444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe construction repair and rehabilitation chemicals market represents a dynamic and rapidly evolving sector within the broader construction industry. This specialized market encompasses a comprehensive range of chemical solutions designed to restore, strengthen, and extend the lifespan of existing infrastructure across European nations. Construction repair chemicals have become increasingly critical as aging infrastructure demands innovative solutions for maintenance and enhancement.

Market dynamics in Europe are driven by the continent’s extensive legacy infrastructure, much of which was constructed in the post-war reconstruction period and now requires significant rehabilitation. The market encompasses various chemical formulations including concrete repair mortars, protective coatings, sealants, adhesives, and specialized treatment compounds. European construction professionals increasingly rely on these advanced chemical solutions to address structural deterioration, environmental damage, and performance enhancement requirements.

Regional growth patterns indicate that the market is experiencing robust expansion, with growth rates reaching approximately 6.2% CAGR across key European markets. This growth trajectory reflects the increasing recognition of repair and rehabilitation as cost-effective alternatives to complete reconstruction. Infrastructure investment policies across European Union member states have further accelerated market development, with particular emphasis on sustainable construction practices and long-term asset preservation.

Technology advancement continues to reshape the European market landscape, with manufacturers developing increasingly sophisticated chemical formulations that offer enhanced durability, environmental compatibility, and application efficiency. The integration of nanotechnology, polymer science, and sustainable chemistry principles has resulted in next-generation repair solutions that deliver superior performance while meeting stringent European environmental regulations.

The Europe construction repair and rehabilitation chemicals market refers to the comprehensive ecosystem of specialized chemical products, technologies, and services designed to restore, enhance, and extend the operational lifespan of existing construction infrastructure across European territories. This market encompasses a diverse portfolio of chemical solutions specifically formulated to address structural deficiencies, environmental damage, and performance optimization requirements in buildings, bridges, tunnels, and other critical infrastructure assets.

Construction repair chemicals represent advanced formulations that go beyond traditional construction materials, offering targeted solutions for specific rehabilitation challenges. These products include structural repair mortars, crack injection systems, protective coatings, waterproofing compounds, corrosion inhibitors, and strengthening adhesives. Market participants range from multinational chemical manufacturers to specialized regional suppliers, all contributing to a complex value chain that serves diverse construction and infrastructure maintenance needs.

Rehabilitation chemicals specifically focus on restoring structural integrity and functionality to deteriorated construction elements. Unlike new construction materials, these specialized formulations must demonstrate compatibility with existing substrates while providing enhanced performance characteristics. The market definition encompasses both reactive repair solutions that address immediate structural issues and preventive treatments that extend asset lifecycles through proactive maintenance strategies.

Market leadership in the European construction repair and rehabilitation chemicals sector is characterized by strong technological innovation, comprehensive product portfolios, and strategic regional presence. The market demonstrates remarkable resilience and growth potential, driven by aging infrastructure, regulatory requirements, and increasing awareness of lifecycle cost optimization. Key market drivers include the need to address deteriorating post-war infrastructure, growing emphasis on sustainable construction practices, and advancing chemical technologies that offer superior performance characteristics.

Competitive dynamics reveal a market structure dominated by established multinational corporations alongside innovative regional specialists. Major players have invested significantly in research and development, resulting in breakthrough formulations that address complex rehabilitation challenges. Market penetration strategies focus on technical expertise, comprehensive service offerings, and strong distribution networks that ensure product availability across diverse European markets.

Growth trajectories indicate sustained expansion across all major European regions, with particularly strong performance in Western European markets where infrastructure renewal programs are most advanced. Eastern European markets represent significant growth opportunities as these regions modernize their infrastructure and adopt advanced repair technologies. Market analysis suggests that approximately 42% of market growth is attributed to increased infrastructure investment, while 35% stems from technological advancement and improved product performance.

Strategic outlook points toward continued market evolution driven by sustainability requirements, digitalization of construction processes, and increasing integration of smart technologies. The market is expected to benefit from European Union infrastructure initiatives and national programs focused on climate resilience and energy efficiency improvements.

Infrastructure aging across Europe presents both challenges and opportunities for the construction repair and rehabilitation chemicals market. Analysis reveals that approximately 60% of European infrastructure was constructed more than 30 years ago, creating substantial demand for specialized repair solutions. This demographic reality drives consistent market demand and supports long-term growth projections across the region.

Market maturation patterns indicate that Western European markets are transitioning toward high-value, specialized applications while Eastern European markets continue to expand in volume-based segments. This regional differentiation creates diverse opportunities for market participants with varying strategic approaches and product portfolios.

Infrastructure deterioration stands as the primary driver propelling the European construction repair and rehabilitation chemicals market forward. The continent’s extensive infrastructure network, much of which was constructed during the rapid expansion periods of the 20th century, now faces significant maintenance challenges. Structural aging manifests through concrete carbonation, steel corrosion, foundation settlement, and environmental weathering, creating consistent demand for specialized repair solutions.

Regulatory frameworks across European nations increasingly mandate proactive infrastructure maintenance and safety compliance. These regulations require regular assessment and remediation of structural deficiencies, driving systematic adoption of repair chemicals. Building codes and safety standards continue to evolve, often requiring upgrades to existing structures that rely heavily on advanced chemical solutions for compliance achievement.

Economic considerations strongly favor repair and rehabilitation over complete reconstruction in many scenarios. Cost analysis demonstrates that strategic application of repair chemicals can extend infrastructure lifespan by decades while requiring significantly lower capital investment than replacement. Lifecycle cost optimization has become a critical factor in infrastructure management decisions, supporting sustained market growth.

Environmental sustainability requirements are reshaping construction practices across Europe, with repair and rehabilitation recognized as inherently more sustainable than demolition and reconstruction. Carbon footprint reduction initiatives favor chemical repair solutions that minimize material waste and energy consumption while extending existing asset lifecycles.

Technological advancement in chemical formulations continues to expand application possibilities and improve performance outcomes. Modern repair chemicals offer enhanced durability, faster curing times, and superior compatibility with existing materials. Innovation cycles regularly introduce new solutions that address previously challenging repair scenarios, expanding market opportunities and driving adoption rates.

High initial costs associated with premium repair chemical solutions can present barriers to adoption, particularly in price-sensitive market segments. While lifecycle cost analysis often favors chemical repair solutions, the upfront investment requirements may challenge budget-constrained projects. Cost considerations become particularly significant in large-scale infrastructure rehabilitation programs where chemical costs can represent substantial budget allocations.

Technical complexity in application procedures requires specialized knowledge and training, potentially limiting market accessibility. Many advanced repair chemicals demand precise mixing ratios, specific environmental conditions, and expert application techniques. Skill requirements can create bottlenecks in market adoption, particularly in regions where technical expertise is limited or training programs are underdeveloped.

Regulatory compliance challenges arise from varying national standards and certification requirements across European markets. Manufacturers must navigate complex approval processes and maintain compliance with diverse regulatory frameworks. Certification costs and time requirements can delay product introductions and increase market entry barriers for innovative solutions.

Performance variability in real-world applications can impact market confidence, particularly when repair solutions fail to meet expected durability or performance standards. Quality control challenges in field applications may result in suboptimal outcomes that affect overall market perception and adoption rates.

Competition from alternative repair methods, including mechanical solutions and traditional construction approaches, continues to challenge chemical repair market share. Market education remains necessary to demonstrate the advantages of chemical solutions over conventional repair methods in many application scenarios.

Infrastructure modernization programs across Europe present substantial opportunities for construction repair and rehabilitation chemicals market expansion. European Union initiatives focused on digital infrastructure, climate resilience, and energy efficiency create demand for advanced repair solutions that support modernization objectives. Smart city development projects increasingly incorporate sophisticated repair and maintenance strategies that rely heavily on specialized chemical solutions.

Sustainability mandates are driving demand for environmentally friendly repair chemicals that support green building certifications and carbon reduction goals. Bio-based formulations and low-emission products represent growing market segments with significant expansion potential. The increasing emphasis on circular economy principles creates opportunities for repair solutions that extend asset lifecycles and reduce waste generation.

Preventive maintenance market segments offer substantial growth opportunities as infrastructure owners recognize the cost benefits of proactive treatment strategies. Protective coatings and preventive chemical treatments can significantly extend infrastructure lifecycles while reducing long-term maintenance costs. This shift from reactive to preventive approaches represents a fundamental market evolution with sustained growth potential.

Emerging applications in renewable energy infrastructure, including wind turbine foundations and solar installation structures, create new market opportunities. Specialized formulations for extreme environmental conditions and unique structural requirements expand the addressable market and support premium pricing strategies.

Digital integration opportunities include smart repair chemicals with embedded sensors, self-healing formulations, and IoT-enabled monitoring systems. Technology convergence between construction chemicals and digital technologies opens new market segments and value propositions that differentiate advanced solutions from raditional products.

Supply chain evolution in the European construction repair and rehabilitation chemicals market reflects increasing sophistication and regional specialization. Manufacturing networks have adapted to serve diverse European markets while maintaining quality consistency and regulatory compliance. Local production facilities enable rapid response to regional demand fluctuations while reducing transportation costs and environmental impact.

Demand patterns exhibit seasonal variations influenced by weather conditions and construction activity cycles. Peak demand periods typically occur during favorable weather months when outdoor repair work is most feasible. Market participants have developed strategies to manage seasonal fluctuations through product diversification and geographic market expansion.

Innovation cycles drive continuous market evolution as manufacturers invest in research and development to address emerging challenges and opportunities. Product development focuses on enhanced performance characteristics, environmental compatibility, and application efficiency. The typical innovation cycle spans 3-5 years from concept to market introduction, requiring sustained investment and technical expertise.

Price dynamics reflect raw material costs, regulatory compliance expenses, and competitive pressures. Premium segments command higher margins through superior performance and specialized applications, while commodity segments face price pressure from competitive alternatives. Market analysis indicates that approximately 28% of price variation is attributed to raw material fluctuations, while 22% relates to regulatory compliance costs.

Distribution channels have evolved to support diverse customer requirements and geographic coverage. Multi-channel strategies combine direct sales, distributor networks, and digital platforms to optimize market reach and customer service. The integration of technical support services with product distribution has become a key competitive differentiator in the market.

Comprehensive market analysis for the European construction repair and rehabilitation chemicals market employs multiple research methodologies to ensure accuracy and reliability. Primary research involves extensive interviews with industry executives, technical specialists, and end-users across major European markets. These interviews provide insights into market trends, competitive dynamics, and emerging opportunities that quantitative data alone cannot capture.

Secondary research encompasses analysis of industry publications, regulatory documents, company financial reports, and technical literature. Data triangulation methods validate findings across multiple sources to ensure consistency and accuracy. Government statistics, trade association reports, and academic research contribute to comprehensive market understanding.

Market sizing methodologies utilize both top-down and bottom-up approaches to validate market scope and growth projections. Top-down analysis begins with overall construction market data and applies segmentation ratios to estimate repair chemical market size. Bottom-up analysis aggregates company-level data and regional market estimates to build comprehensive market models.

Qualitative analysis techniques include expert interviews, focus groups, and case study development to understand market dynamics and competitive positioning. Quantitative analysis employs statistical modeling, trend analysis, and forecasting methodologies to project market evolution and identify growth opportunities.

Data validation processes ensure research accuracy through cross-referencing multiple sources and expert review. MarkWide Research analysts apply rigorous quality control procedures to verify data consistency and eliminate potential biases in market analysis and projections.

Western European markets dominate the construction repair and rehabilitation chemicals sector, accounting for approximately 65% of regional market share. Countries including Germany, France, United Kingdom, and Italy represent mature markets with sophisticated infrastructure maintenance programs and high adoption rates of advanced repair technologies. Market characteristics in these regions emphasize premium products, technical innovation, and comprehensive service offerings.

Germany leads the European market through extensive infrastructure networks and proactive maintenance strategies. German market dynamics favor high-performance repair solutions that meet stringent quality standards and environmental regulations. The country’s strong manufacturing base and technical expertise support both domestic consumption and export activities across Europe.

Nordic countries including Sweden, Norway, and Denmark represent specialized market segments driven by extreme weather conditions and sustainability requirements. Cold climate applications demand specialized formulations that maintain performance in harsh environmental conditions. These markets command premium pricing for products that address unique regional challenges.

Eastern European markets demonstrate the highest growth rates, with expansion reaching approximately 8.5% annually as infrastructure modernization accelerates. Countries including Poland, Czech Republic, and Hungary are investing heavily in infrastructure upgrades that drive demand for repair and rehabilitation chemicals. Market development in these regions focuses on volume growth and technology adoption.

Southern European markets including Spain, Italy, and Greece face unique challenges related to seismic activity and coastal environmental conditions. Specialized applications for earthquake resistance and marine environment protection create niche market opportunities with specific technical requirements and performance standards.

Market leadership in the European construction repair and rehabilitation chemicals sector is characterized by a combination of multinational corporations and specialized regional players. Competitive positioning depends on factors including product portfolio breadth, technical expertise, distribution network strength, and regional market presence.

Competitive strategies emphasize innovation, technical service, and market-specific product development. Leading companies invest heavily in research and development to maintain technological advantages and address evolving market requirements. Strategic partnerships with distributors, contractors, and engineering firms enhance market reach and customer relationships.

Market consolidation trends include strategic acquisitions and partnerships that strengthen regional presence and expand product portfolios. Merger and acquisition activity focuses on accessing specialized technologies, entering new geographic markets, and achieving operational synergies.

Product segmentation in the European construction repair and rehabilitation chemicals market encompasses diverse chemical formulations designed for specific applications and performance requirements. Major product categories include structural repair mortars, protective coatings, sealants and adhesives, waterproofing compounds, and specialized treatment chemicals.

By Product Type:

By Application:

By End-User:

Structural repair mortars represent the largest product category, driven by widespread concrete infrastructure deterioration across Europe. High-performance mortars incorporating polymer modifications and fiber reinforcement offer superior durability and application characteristics. Market growth in this category reaches approximately 5.8% annually, supported by increasing infrastructure maintenance requirements.

Protective coatings demonstrate strong growth potential as preventive maintenance strategies gain adoption. Advanced coating systems provide long-term protection against environmental factors while offering aesthetic enhancement. The category benefits from increasing awareness of lifecycle cost optimization and proactive asset management approaches.

Waterproofing compounds address critical moisture protection requirements in European climates. Membrane systems and liquid-applied waterproofing solutions offer versatile application methods and reliable performance. Climate change impacts and extreme weather events drive demand for robust waterproofing solutions across diverse applications.

Injection systems serve specialized repair applications requiring precision and minimal disruption. Crack injection and void filling technologies enable targeted repairs that restore structural integrity without extensive demolition. This category commands premium pricing through specialized application requirements and technical expertise.

Sealants and adhesives support diverse construction repair applications from joint sealing to structural bonding. Hybrid technologies combining multiple performance characteristics expand application possibilities and market opportunities. The category benefits from increasing construction complexity and performance requirements.

Infrastructure owners benefit significantly from advanced repair and rehabilitation chemicals through extended asset lifecycles and reduced maintenance costs. Lifecycle optimization strategies utilizing specialized chemicals can extend infrastructure service life by decades while maintaining safety and performance standards. Cost analysis demonstrates that strategic chemical repair applications can reduce total ownership costs by approximately 30-40% compared to traditional replacement approaches.

Construction contractors gain competitive advantages through access to advanced repair technologies that enable complex project execution and differentiated service offerings. Technical expertise in chemical repair applications creates market positioning opportunities and supports premium pricing strategies. Contractors benefit from faster project completion times and reduced labor requirements associated with modern chemical repair systems.

Chemical manufacturers participate in a growing market with strong demand fundamentals and opportunities for innovation-driven growth. Product development investments yield competitive advantages through superior performance characteristics and expanded application possibilities. The market supports sustainable revenue growth through recurring maintenance requirements and technology advancement cycles.

Engineering consultants benefit from expanding opportunities to provide specialized technical services related to repair system design and implementation. Technical consulting services command premium fees while supporting overall project success and client satisfaction. The complexity of modern repair systems creates ongoing demand for specialized engineering expertise.

End-users including building owners and facility managers achieve improved asset performance and reduced operational disruptions through effective chemical repair solutions. Maintenance efficiency improvements reduce downtime and operational costs while maintaining safety and functionality standards. Users benefit from extended asset lifecycles and improved environmental performance through sustainable repair practices.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration represents a fundamental trend reshaping the European construction repair and rehabilitation chemicals market. Green formulations utilizing bio-based raw materials and low-emission technologies are gaining market acceptance as environmental regulations become more stringent. Manufacturers are investing heavily in sustainable product development to meet evolving regulatory requirements and customer preferences.

Digital transformation is revolutionizing how repair chemicals are specified, applied, and monitored. Smart materials incorporating sensors and self-monitoring capabilities enable real-time performance assessment and predictive maintenance strategies. Digital platforms for product selection, application guidance, and performance tracking are becoming standard tools in the industry.

Preventive maintenance strategies are gaining prominence as infrastructure owners recognize the cost benefits of proactive treatment approaches. Protective systems applied before significant deterioration occurs can extend asset lifecycles dramatically while reducing long-term maintenance costs. This trend is driving demand for specialized protective coatings and treatment systems.

Customization trends reflect increasing demand for application-specific solutions that address unique environmental conditions and performance requirements. Tailored formulations for specific climate conditions, substrate types, and performance criteria are becoming more common as market sophistication increases.

Nanotechnology integration is enabling breakthrough performance improvements in repair chemical formulations. Nano-enhanced products offer superior durability, self-healing properties, and enhanced compatibility with existing substrates. This technology trend is driving premium market segments and supporting innovation-based competitive strategies.

Product innovation continues to drive market evolution with manufacturers introducing advanced formulations that address emerging challenges and opportunities. Recent developments include self-healing concrete repair systems, ultra-rapid setting mortars, and environmentally friendly protective coatings. These innovations expand application possibilities while improving performance outcomes and user experience.

Strategic partnerships between chemical manufacturers and technology companies are accelerating digital integration and smart material development. Collaboration initiatives focus on combining chemical expertise with digital technologies to create next-generation repair solutions. These partnerships enable faster innovation cycles and expanded market reach.

Regulatory developments across European markets continue to influence product formulations and market strategies. New standards for environmental performance, safety, and quality are driving product reformulation and compliance investments. Manufacturers are adapting to evolving regulatory landscapes while maintaining performance and cost competitiveness.

Market consolidation activities include strategic acquisitions and mergers that strengthen competitive positions and expand geographic coverage. Industry consolidation enables companies to achieve economies of scale while investing in research and development capabilities. These activities reshape competitive dynamics and market structure.

Sustainability initiatives are driving industry-wide efforts to reduce environmental impact and support circular economy principles. Green chemistry developments focus on renewable raw materials, reduced emissions, and improved recyclability. These initiatives align with European environmental policies and customer sustainability requirements.

Market participants should prioritize sustainability integration in product development and marketing strategies to align with European environmental regulations and customer preferences. Investment priorities should focus on bio-based formulations, reduced emission products, and circular economy principles. Companies that successfully integrate sustainability into their value propositions will gain competitive advantages in the evolving market landscape.

Technology investment in digital integration and smart materials represents a critical success factor for long-term market leadership. Digital capabilities including IoT integration, predictive analytics, and automated application systems will differentiate advanced solutions from traditional products. Companies should develop comprehensive digital strategies that enhance product performance and customer experience.

Geographic expansion strategies should prioritize Eastern European markets where infrastructure modernization is driving rapid growth. Market entry approaches should consider local partnerships, regulatory requirements, and customer preferences. Successful expansion requires understanding regional market dynamics and adapting products and services accordingly.

Service integration opportunities include technical consulting, application training, and performance monitoring services that enhance customer relationships and support premium pricing. Value-added services create differentiation opportunities while building customer loyalty and recurring revenue streams. Companies should develop comprehensive service capabilities that complement product offerings.

MarkWide Research analysis suggests that companies should focus on preventive maintenance market segments where growth potential is highest and customer value propositions are strongest. Market positioning strategies should emphasize lifecycle cost benefits and performance advantages of advanced chemical repair solutions compared to traditional alternatives.

Long-term growth prospects for the European construction repair and rehabilitation chemicals market remain highly positive, driven by fundamental demographic and infrastructure trends. Market expansion is expected to continue at robust rates, with growth projections indicating sustained expansion reaching approximately 6.8% annually over the next decade. This growth trajectory reflects the ongoing need for infrastructure maintenance and the increasing adoption of advanced repair technologies.

Technology evolution will continue to reshape market dynamics through breakthrough innovations in materials science, digital integration, and application technologies. Future developments are expected to include fully autonomous repair systems, self-diagnosing materials, and AI-driven application optimization. These technological advances will expand market opportunities while improving performance outcomes and cost effectiveness.

Sustainability requirements will become increasingly important in product development and market positioning strategies. Environmental regulations are expected to become more stringent, driving demand for eco-friendly formulations and sustainable application practices. Companies that successfully integrate sustainability into their core strategies will achieve competitive advantages and market leadership positions.

Market structure evolution is likely to include continued consolidation among major players while creating opportunities for specialized niche providers. Competitive dynamics will increasingly favor companies with strong technical capabilities, comprehensive service offerings, and sustainable product portfolios. Innovation and customer service excellence will become primary competitive differentiators.

Regional development patterns suggest that Eastern European markets will continue to exhibit the highest growth rates as infrastructure modernization accelerates. Western European markets will focus on high-value applications and premium products as market maturity increases. This regional differentiation will create diverse opportunities for companies with appropriate strategic positioning and capabilities.

The Europe construction repair and rehabilitation chemicals market represents a dynamic and rapidly evolving sector with strong growth fundamentals and significant expansion opportunities. Market drivers including aging infrastructure, regulatory requirements, and sustainability mandates create consistent demand for advanced chemical repair solutions across diverse European markets.

Competitive positioning in this market requires comprehensive strategies that combine product innovation, technical expertise, and customer service excellence. Successful companies will be those that effectively integrate sustainability principles, digital technologies, and specialized application capabilities into their value propositions. The market rewards innovation and technical leadership while supporting sustainable business models.

Future success in the European construction repair and rehabilitation chemicals market will depend on companies’ ability to adapt to evolving customer requirements, regulatory frameworks, and technological possibilities. Strategic priorities should include sustainability integration, digital transformation, geographic expansion, and service enhancement initiatives that create competitive advantages and support long-term growth.

Market outlook remains highly positive with sustained growth expected across all major European regions. The combination of infrastructure investment programs, technological advancement, and increasing awareness of lifecycle cost optimization creates a favorable environment for continued market expansion and innovation-driven success in the construction repair and rehabilitation chemicals sector.

What is Construction Repair and Rehabilitation Chemicals?

Construction Repair and Rehabilitation Chemicals refer to a range of products used to restore, protect, and enhance the durability of structures. These chemicals are essential in various applications, including concrete repair, waterproofing, and surface protection.

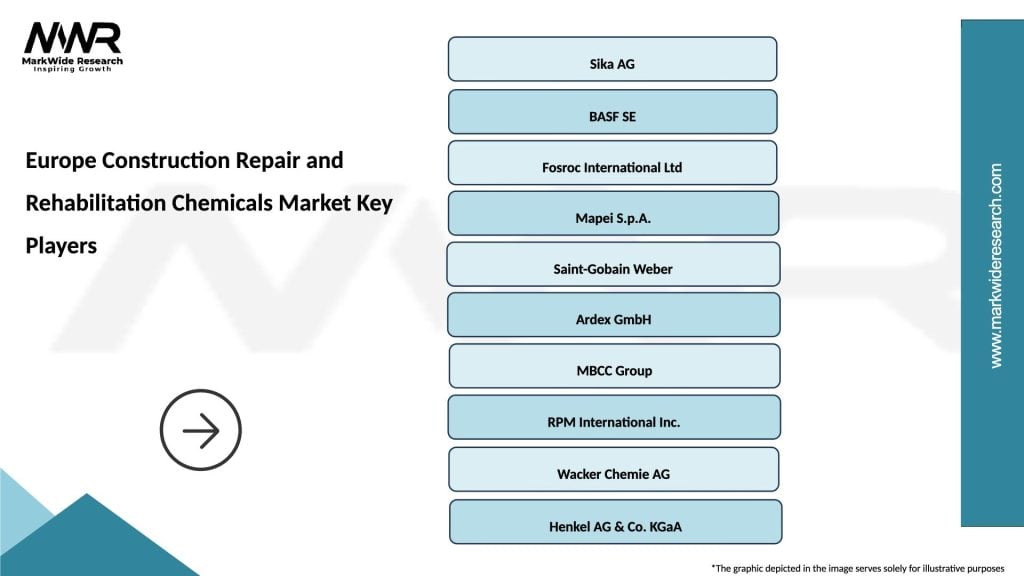

What are the key players in the Europe Construction Repair and Rehabilitation Chemicals Market?

Key players in the Europe Construction Repair and Rehabilitation Chemicals Market include BASF SE, Sika AG, and Mapei S.p.A., among others. These companies are known for their innovative solutions and extensive product portfolios in the construction chemicals sector.

What are the growth factors driving the Europe Construction Repair and Rehabilitation Chemicals Market?

The growth of the Europe Construction Repair and Rehabilitation Chemicals Market is driven by increasing infrastructure development, the need for maintenance of aging structures, and rising awareness of sustainable construction practices. Additionally, advancements in chemical formulations enhance product performance.

What challenges does the Europe Construction Repair and Rehabilitation Chemicals Market face?

The Europe Construction Repair and Rehabilitation Chemicals Market faces challenges such as stringent regulations regarding chemical safety and environmental impact. Additionally, fluctuating raw material prices can affect production costs and market stability.

What opportunities exist in the Europe Construction Repair and Rehabilitation Chemicals Market?

Opportunities in the Europe Construction Repair and Rehabilitation Chemicals Market include the growing demand for eco-friendly products and the expansion of smart construction technologies. The increasing focus on infrastructure resilience also presents avenues for innovation and growth.

What trends are shaping the Europe Construction Repair and Rehabilitation Chemicals Market?

Trends shaping the Europe Construction Repair and Rehabilitation Chemicals Market include the rise of sustainable materials, the integration of digital technologies in construction processes, and the development of high-performance repair solutions. These trends reflect a shift towards more efficient and environmentally friendly construction practices.

Europe Construction Repair and Rehabilitation Chemicals Market

| Segmentation Details | Description |

|---|---|

| Product Type | Adhesives, Sealants, Coatings, Grouts |

| Application | Infrastructure, Residential, Commercial, Industrial |

| End Use Industry | Construction, Renovation, Maintenance, Restoration |

| Packaging Type | Drums, Bags, Containers, Pails |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Construction Repair and Rehabilitation Chemicals Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at