444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe construction equipment rental market represents a dynamic and rapidly evolving sector that has transformed the construction landscape across the continent. This market encompasses the rental and leasing of various construction machinery, tools, and equipment to contractors, construction companies, and infrastructure developers. Market dynamics indicate substantial growth driven by increasing infrastructure investments, urbanization trends, and the growing preference for rental solutions over equipment ownership.

European construction companies are increasingly recognizing the strategic advantages of equipment rental, including reduced capital expenditure, access to latest technology, and improved operational flexibility. The market spans across major European economies including Germany, France, United Kingdom, Italy, Spain, and the Nordic countries, each contributing significantly to the overall market expansion. Growth projections suggest the market will experience a robust 6.2% CAGR over the forecast period, reflecting strong demand fundamentals and evolving industry practices.

Infrastructure development initiatives across Europe, coupled with increasing construction activities in residential, commercial, and industrial sectors, continue to drive demand for rental equipment. The market benefits from favorable regulatory environments, technological advancements in equipment design, and the growing emphasis on sustainable construction practices that favor rental over ownership models.

The Europe construction equipment rental market refers to the comprehensive ecosystem of businesses and services that provide temporary access to construction machinery, tools, and equipment through rental agreements rather than direct purchase. This market encompasses a wide range of equipment categories including excavators, bulldozers, cranes, concrete mixers, scaffolding systems, power tools, and specialized construction machinery.

Rental services in this context involve short-term, medium-term, and long-term leasing arrangements where construction companies and contractors can access necessary equipment without the substantial capital investment required for outright purchase. The model provides flexibility, reduces maintenance responsibilities, and ensures access to the latest technology and equipment innovations.

Market participants include equipment rental companies, construction contractors, infrastructure developers, and specialized service providers who facilitate the efficient allocation and utilization of construction equipment across various projects and geographic regions throughout Europe.

Strategic analysis of the Europe construction equipment rental market reveals a sector experiencing unprecedented growth and transformation. The market is characterized by increasing adoption of rental solutions, driven by economic efficiency considerations and the need for operational flexibility in an increasingly competitive construction environment.

Key market drivers include rising construction activities, infrastructure modernization projects, and the growing preference for asset-light business models among construction companies. The market benefits from technological integration with approximately 78% of rental companies now incorporating digital platforms for equipment tracking and customer service enhancement.

Regional dynamics show strong performance across Western Europe, with emerging opportunities in Eastern European markets. The market demonstrates resilience through economic cycles, with rental penetration rates reaching 42% in mature markets such as the United Kingdom and Germany, while showing significant growth potential in developing regions.

Competitive landscape features both international players and regional specialists, creating a diverse ecosystem that serves various customer segments from large infrastructure projects to small-scale construction activities. Market consolidation trends continue to shape the industry structure while maintaining healthy competition levels.

Market intelligence reveals several critical insights that define the current state and future trajectory of the Europe construction equipment rental market:

Industry trends indicate that the market is evolving beyond traditional equipment provision to become a comprehensive solution provider, offering maintenance, training, and project support services that enhance customer value propositions.

Primary growth drivers propelling the Europe construction equipment rental market include several interconnected factors that create favorable conditions for market expansion and development.

Infrastructure investment across European countries continues to drive substantial demand for construction equipment rental services. Government initiatives focusing on transportation infrastructure, renewable energy projects, and urban development create consistent demand for specialized equipment that contractors prefer to rent rather than purchase.

Economic efficiency considerations play a crucial role in driving rental adoption. Construction companies increasingly recognize that rental solutions offer superior return on investment compared to equipment ownership, particularly for projects with varying equipment requirements or seasonal demand patterns. Cost optimization strategies favor rental models that eliminate depreciation concerns and reduce maintenance overhead.

Technological advancement in construction equipment encourages rental adoption as companies can access the latest innovations without significant capital commitments. The rapid pace of technological development makes equipment ownership less attractive, as newer models offer improved efficiency, safety features, and environmental compliance.

Regulatory compliance requirements across European markets favor rental solutions, as rental companies maintain equipment to the highest standards and ensure compliance with evolving safety and environmental regulations. This reduces compliance burden on construction companies while ensuring project adherence to regulatory requirements.

Market challenges facing the Europe construction equipment rental market include several factors that may limit growth potential or create operational difficulties for market participants.

High capital requirements for rental companies represent a significant barrier to entry and expansion. Maintaining diverse, modern equipment fleets requires substantial ongoing investment, particularly as equipment technology advances and customer expectations increase. This capital intensity can limit the ability of smaller players to compete effectively with established market leaders.

Economic volatility in construction markets can create demand fluctuations that impact rental company profitability. Construction activity levels are sensitive to economic conditions, interest rates, and government spending patterns, creating revenue uncertainty for rental service providers.

Equipment utilization challenges arise when demand patterns don’t align with fleet capacity, leading to periods of underutilization that impact profitability. Seasonal variations in construction activity and project timing can create imbalances between equipment availability and demand.

Maintenance complexity increases as equipment becomes more sophisticated, requiring specialized technical expertise and higher maintenance costs. The integration of advanced electronics and software systems in modern construction equipment demands skilled technicians and specialized diagnostic equipment.

Emerging opportunities in the Europe construction equipment rental market present significant potential for growth and market expansion across various segments and geographic regions.

Digital platform development offers substantial opportunities for rental companies to enhance customer experience and operational efficiency. Advanced booking systems, real-time equipment tracking, and predictive maintenance capabilities can differentiate service providers and create competitive advantages in an increasingly digital marketplace.

Sustainability initiatives create opportunities for rental companies to lead in environmental responsibility by offering electric and hybrid equipment options. As construction companies face increasing pressure to reduce carbon footprints, rental providers can capture market share by maintaining environmentally friendly equipment fleets.

Eastern European expansion presents significant growth opportunities as these markets develop infrastructure and construction sectors. Countries such as Poland, Czech Republic, and Hungary show increasing construction activity and growing acceptance of rental business models, representing untapped market potential.

Specialized equipment segments offer opportunities for niche market development. High-value, specialized equipment such as tunnel boring machines, large cranes, and specialized demolition equipment represent attractive rental opportunities due to their high purchase costs and infrequent usage patterns.

Market dynamics in the Europe construction equipment rental sector reflect complex interactions between supply and demand factors, competitive pressures, and evolving customer requirements that shape market behavior and growth patterns.

Supply chain optimization has become increasingly important as rental companies seek to maximize equipment utilization and minimize operational costs. Advanced logistics systems and strategic depot locations enable efficient equipment deployment and reduce transportation costs, improving overall service delivery and profitability.

Customer relationship management evolution shows rental companies developing deeper partnerships with construction contractors, moving beyond transactional relationships to strategic collaborations. These partnerships often include equipment consulting, project planning support, and customized rental packages that address specific customer needs.

Technology integration continues to reshape market dynamics, with 85% of leading rental companies now utilizing telematics systems for fleet management and customer service enhancement. These systems provide real-time equipment monitoring, usage optimization, and predictive maintenance capabilities that improve operational efficiency.

Competitive intensity varies across different market segments and geographic regions, with mature markets experiencing price competition while emerging markets offer growth opportunities with higher margins. Market dynamics favor companies that can balance competitive pricing with superior service quality and equipment availability.

Comprehensive research methodology employed in analyzing the Europe construction equipment rental market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability of market insights and projections.

Primary research activities include extensive interviews with industry executives, rental company operators, construction contractors, and equipment manufacturers across major European markets. These interviews provide qualitative insights into market trends, customer preferences, and competitive dynamics that quantitative data alone cannot capture.

Secondary research encompasses analysis of industry reports, company financial statements, government statistics, and trade association data to establish market baselines and validate primary research findings. This approach ensures comprehensive coverage of market segments and geographic regions.

Data validation processes involve cross-referencing multiple sources and employing statistical analysis techniques to ensure data accuracy and reliability. Market projections utilize econometric modeling that considers historical trends, economic indicators, and industry-specific factors to generate realistic growth scenarios.

Market segmentation analysis employs both top-down and bottom-up approaches to ensure comprehensive coverage of all market segments and accurate representation of market dynamics across different equipment categories and geographic regions.

Regional market analysis reveals significant variations in market development, growth patterns, and competitive dynamics across different European countries and regions, reflecting diverse economic conditions and construction market characteristics.

Western Europe represents the most mature segment of the market, with countries such as Germany, France, and the United Kingdom showing high rental penetration rates and sophisticated market structures. Germany leads with approximately 38% market share in the regional market, driven by strong construction activity and well-established rental infrastructure.

United Kingdom demonstrates the highest rental penetration rates in Europe, with rental solutions accounting for 45% of construction equipment usage. This mature market benefits from established customer relationships, comprehensive service networks, and strong regulatory frameworks that support rental business models.

Nordic countries including Sweden, Norway, and Denmark show strong market performance driven by infrastructure investments and environmental consciousness that favors rental over ownership. These markets demonstrate annual growth rates of 7.1%, reflecting robust construction activity and increasing rental adoption.

Eastern Europe presents the highest growth potential, with countries such as Poland, Czech Republic, and Hungary experiencing rapid market development. These emerging markets show growth rates exceeding 9.2% annually as construction sectors modernize and adopt rental business models.

Southern Europe including Italy and Spain shows recovery from previous economic challenges, with increasing construction activity driving renewed demand for rental services. These markets benefit from tourism-related construction projects and infrastructure modernization initiatives.

Competitive dynamics in the Europe construction equipment rental market feature a diverse mix of international corporations, regional specialists, and local service providers that create a complex but dynamic competitive environment.

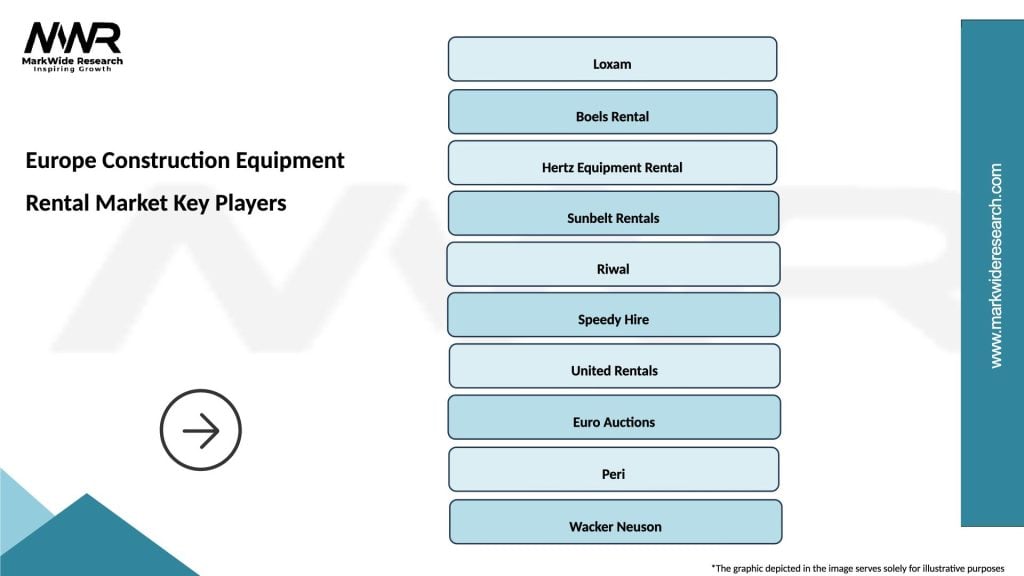

Market leaders include several key players that have established strong positions through strategic acquisitions, comprehensive service offerings, and extensive geographic coverage:

Regional specialists maintain competitive positions through local market knowledge, specialized equipment offerings, and customer relationship advantages. These companies often focus on specific geographic regions or equipment categories where they can achieve competitive advantages.

Competitive strategies vary across market participants, with larger companies focusing on scale advantages and comprehensive service offerings, while smaller players emphasize specialized expertise and superior customer service in niche markets.

Market segmentation analysis reveals distinct categories based on equipment type, application, and customer segments that demonstrate varying growth patterns and competitive dynamics.

By Equipment Type:

By Application:

By Customer Type:

Equipment category analysis provides detailed insights into performance patterns, growth drivers, and market dynamics across different construction equipment segments within the European rental market.

Earthmoving equipment represents the largest and most stable segment, accounting for approximately 35% of total rental revenue. This category benefits from consistent demand across all construction applications and relatively standardized equipment specifications that facilitate efficient fleet management and utilization.

Aerial work platforms demonstrate the highest growth rates within the market, driven by increasing safety regulations and the growing complexity of construction projects that require elevated access solutions. This segment shows annual growth of 8.7%, reflecting strong demand fundamentals and expanding application areas.

Specialized equipment categories including tunnel boring machines, large cranes, and demolition equipment offer attractive rental opportunities due to high purchase costs and infrequent usage patterns. These categories typically command premium rental rates and longer-term contracts that provide stable revenue streams.

Power tools and small equipment represent a growing segment as rental companies expand service offerings to capture additional customer spending. This category benefits from low capital requirements and high utilization rates, though it faces increased competition from retail channels.

Technology-enhanced equipment including GPS-enabled machines and telematics-equipped tools are gaining market share as customers recognize the operational benefits of advanced monitoring and control capabilities.

Industry participants and stakeholders in the Europe construction equipment rental market realize numerous strategic and operational benefits that contribute to improved business performance and competitive positioning.

For Construction Companies:

For Rental Companies:

For Equipment Manufacturers:

Strategic analysis of the Europe construction equipment rental market reveals key strengths, weaknesses, opportunities, and threats that influence market development and competitive dynamics.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends in the Europe construction equipment rental market reflect evolving customer needs, technological advancement, and changing business models that shape future market development.

Digital platform adoption continues to accelerate, with rental companies investing in comprehensive digital solutions that enhance customer experience and operational efficiency. These platforms integrate equipment booking, tracking, maintenance scheduling, and customer communication in unified systems that improve service delivery.

Sustainability initiatives are becoming increasingly important as construction companies face pressure to reduce environmental impact. Rental companies are responding by expanding electric and hybrid equipment offerings, with electric equipment representing 12% of new fleet additions in leading markets.

Service integration trends show rental companies expanding beyond equipment provision to offer comprehensive project support services. These integrated offerings include equipment consulting, operator training, maintenance services, and project management support that create deeper customer relationships.

Fleet optimization through advanced analytics and artificial intelligence enables rental companies to improve equipment utilization and reduce operational costs. Predictive maintenance systems and demand forecasting tools help optimize fleet composition and deployment strategies.

Market consolidation continues as larger companies acquire regional specialists and smaller operators to expand geographic coverage and service capabilities. This trend creates opportunities for improved operational efficiency while maintaining competitive market dynamics.

Recent industry developments highlight the dynamic nature of the Europe construction equipment rental market and indicate future direction of market evolution and competitive positioning.

Strategic acquisitions have reshaped the competitive landscape, with major rental companies expanding European operations through targeted acquisitions of regional specialists. These transactions enable rapid market entry and customer base expansion while leveraging existing operational infrastructure.

Technology partnerships between rental companies and equipment manufacturers are creating innovative solutions that enhance equipment performance and customer value. These collaborations focus on telematics integration, predictive maintenance, and operational optimization capabilities.

Sustainability investments by leading rental companies include significant fleet modernization programs that prioritize low-emission and electric equipment. According to MarkWide Research analysis, these investments are driving equipment fleet renewal rates of 15% annually in leading markets.

Digital transformation initiatives across the industry include development of mobile applications, online booking platforms, and integrated customer management systems that improve service accessibility and operational efficiency.

Market expansion activities focus on Eastern European countries where construction markets are developing and rental penetration rates remain low. These expansion efforts typically involve strategic partnerships with local companies or direct investment in operational infrastructure.

Strategic recommendations for market participants in the Europe construction equipment rental market focus on key areas that will determine competitive success and sustainable growth in evolving market conditions.

Technology investment should be prioritized to enhance operational efficiency and customer service capabilities. Rental companies should focus on integrated digital platforms that provide seamless customer experience while optimizing internal operations through advanced analytics and automation.

Geographic expansion strategies should target Eastern European markets where construction activity is increasing and rental penetration rates offer significant growth potential. Market entry should be supported by local partnerships or strategic acquisitions that provide market knowledge and operational infrastructure.

Service diversification beyond basic equipment rental can create competitive advantages and improve customer retention. Companies should consider expanding into related services such as equipment consulting, operator training, and project management support that add value for customers.

Sustainability initiatives will become increasingly important as environmental regulations tighten and customer preferences shift toward eco-friendly solutions. Fleet modernization programs should prioritize low-emission and electric equipment to meet evolving market demands.

Partnership development with equipment manufacturers, technology providers, and construction companies can create synergies that enhance competitive positioning and market reach. Strategic alliances should focus on innovation, market access, and operational efficiency improvements.

Future market prospects for the Europe construction equipment rental market indicate continued growth and evolution driven by favorable industry trends, technological advancement, and changing customer preferences that support rental business models.

Growth projections suggest the market will maintain robust expansion over the forecast period, with MWR projecting sustained growth rates that reflect strong underlying demand fundamentals and increasing rental penetration across European markets. Infrastructure investment programs and urbanization trends will continue to drive equipment demand.

Technology integration will accelerate, with advanced telematics, artificial intelligence, and automation becoming standard features in rental equipment fleets. These technological capabilities will enhance operational efficiency, improve safety performance, and create new service opportunities for rental companies.

Market maturation in Western European countries will drive companies to seek growth opportunities in Eastern Europe and through service diversification. The focus will shift from pure equipment rental to comprehensive construction support services that provide higher value and stronger customer relationships.

Sustainability requirements will reshape fleet composition as environmental regulations become more stringent and customer preferences favor eco-friendly equipment options. Electric and hybrid equipment adoption rates are expected to reach 25% of new fleet additions by the end of the forecast period.

Competitive dynamics will continue to evolve through consolidation activities and new market entrants, creating opportunities for improved operational efficiency while maintaining healthy competition levels that benefit customers through innovation and service improvements.

The Europe construction equipment rental market represents a dynamic and growing sector that has fundamentally transformed how construction companies access and utilize equipment resources. The market demonstrates strong growth potential driven by economic efficiency considerations, technological advancement, and evolving customer preferences that favor flexible rental solutions over traditional equipment ownership models.

Market analysis reveals a sector characterized by increasing sophistication in service delivery, technology integration, and customer relationship management. The combination of mature Western European markets and emerging Eastern European opportunities creates a balanced growth environment that supports both established players and new market entrants.

Strategic success in this market will depend on companies’ ability to adapt to changing customer needs, embrace technological innovation, and develop comprehensive service offerings that extend beyond basic equipment rental. The future belongs to organizations that can combine operational excellence with customer-centric service delivery and sustainable business practices that address environmental concerns and regulatory requirements.

Long-term prospects remain highly favorable as construction activity continues to grow across Europe, infrastructure investment programs expand, and the fundamental advantages of rental business models become increasingly recognized by construction industry participants. The Europe construction equipment rental market is positioned for sustained growth and continued evolution as a critical component of the European construction ecosystem.

What is Construction Equipment Rental?

Construction Equipment Rental refers to the practice of renting machinery and equipment used in construction projects, such as excavators, bulldozers, and cranes, rather than purchasing them outright. This approach allows companies to manage costs and access a wider range of equipment for various projects.

What are the key players in the Europe Construction Equipment Rental Market?

Key players in the Europe Construction Equipment Rental Market include companies like Ashtead Group, Loxam, and Herc Rentals, which provide a variety of construction equipment for rental purposes. These companies compete on factors such as equipment availability, pricing, and customer service, among others.

What are the main drivers of the Europe Construction Equipment Rental Market?

The main drivers of the Europe Construction Equipment Rental Market include the increasing demand for construction activities, the need for cost-effective solutions, and the growing trend of urbanization. Additionally, the rise in infrastructure projects across various countries is fueling market growth.

What challenges does the Europe Construction Equipment Rental Market face?

The Europe Construction Equipment Rental Market faces challenges such as fluctuating demand due to economic conditions and competition from used equipment sales. Additionally, regulatory compliance and the need for regular maintenance of rental equipment can pose operational challenges.

What opportunities exist in the Europe Construction Equipment Rental Market?

Opportunities in the Europe Construction Equipment Rental Market include the expansion of renewable energy projects and the increasing adoption of advanced technologies like telematics and automation in construction equipment. These trends can enhance operational efficiency and attract new customers.

What trends are shaping the Europe Construction Equipment Rental Market?

Trends shaping the Europe Construction Equipment Rental Market include the growing emphasis on sustainability and eco-friendly equipment, as well as the integration of digital solutions for inventory management and customer engagement. Additionally, the shift towards modular construction techniques is influencing rental equipment demand.

Europe Construction Equipment Rental Market

| Segmentation Details | Description |

|---|---|

| Product Type | Excavators, Bulldozers, Cranes, Forklifts |

| Technology | Telematics, Electric, Hybrid, Diesel |

| End User | Construction, Infrastructure, Mining, Landscaping |

| Size | Small, Medium, Large, Extra Large |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Construction Equipment Rental Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at