444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe concentrated solar power market represents a pivotal segment within the continent’s renewable energy landscape, demonstrating remarkable growth momentum as nations accelerate their transition toward sustainable energy solutions. Concentrated solar power (CSP) technology harnesses solar thermal energy through sophisticated mirror systems that concentrate sunlight to generate electricity, offering unique advantages including energy storage capabilities and grid stability enhancement.

European countries are increasingly recognizing CSP technology as a critical component of their energy diversification strategies, particularly in southern regions with abundant solar irradiation. The market encompasses various technological approaches including parabolic trough systems, solar power towers, dish/engine systems, and linear Fresnel reflectors, each offering distinct operational characteristics and efficiency profiles.

Market dynamics indicate robust expansion driven by supportive regulatory frameworks, declining technology costs, and growing emphasis on energy security. The sector is experiencing a compound annual growth rate of 8.2%, reflecting strong investor confidence and technological advancement. Spain, Italy, and Greece emerge as leading markets, leveraging their favorable climatic conditions and established renewable energy infrastructure.

Industrial applications are expanding beyond traditional electricity generation to include process heat for manufacturing, desalination, and enhanced oil recovery. This diversification strengthens the market’s resilience and opens new revenue streams for CSP developers and operators across Europe.

The Europe concentrated solar power market refers to the comprehensive ecosystem encompassing the development, manufacturing, installation, and operation of concentrated solar power systems across European territories. CSP technology utilizes mirrors or lenses to concentrate solar radiation onto receivers, converting thermal energy into electricity through conventional steam turbines or alternative thermodynamic cycles.

This market definition includes all stakeholder activities from component manufacturing and system integration to project financing and long-term operation and maintenance services. The scope encompasses various CSP technologies, supporting infrastructure, energy storage systems, and associated services that enable efficient solar thermal power generation.

Market participants range from technology developers and equipment manufacturers to project developers, utilities, and financial institutions. The ecosystem also includes research institutions, regulatory bodies, and policy makers who shape the market environment through standards, incentives, and strategic frameworks.

Geographic coverage spans all European Union member states plus associated countries, with particular concentration in Mediterranean regions where solar irradiation levels optimize CSP system performance and economic viability.

Europe’s concentrated solar power market stands at a transformative juncture, characterized by accelerating deployment, technological innovation, and strengthening policy support. The sector demonstrates exceptional resilience and growth potential as European nations intensify their commitment to carbon neutrality and energy independence.

Key market drivers include the European Green Deal initiatives, national renewable energy targets, and increasing recognition of CSP’s unique value proposition in providing dispatchable renewable energy. Technology costs have declined by approximately 47% over the past decade, significantly improving project economics and market competitiveness.

Regional leadership remains concentrated in southern European countries, with Spain maintaining its position as the dominant market, accounting for 62% of European CSP capacity. However, emerging opportunities in Eastern European markets and innovative applications in industrial processes are expanding the geographic footprint.

Investment flows continue strengthening, supported by green finance initiatives and institutional investor interest in long-term renewable energy assets. The market benefits from established supply chains, experienced developers, and proven technology performance across diverse operating conditions.

Future prospects appear highly favorable, with project pipelines expanding and new market segments emerging. Integration with energy storage systems and hybrid renewable configurations positions CSP as a cornerstone technology for Europe’s sustainable energy future.

Strategic market insights reveal several critical trends shaping the European concentrated solar power landscape. The following key observations provide essential understanding for stakeholders navigating this dynamic market environment:

These insights collectively indicate a maturing market with expanding applications and strengthening fundamentals, positioning CSP as an integral component of Europe’s renewable energy transition.

Primary market drivers propelling the European concentrated solar power sector encompass regulatory, economic, and technological factors that create favorable conditions for sustained growth and market expansion.

Regulatory support represents the most significant driver, with the European Green Deal establishing ambitious climate targets requiring massive renewable energy deployment. National governments are implementing supportive policies including feed-in tariffs, renewable energy certificates, and capacity mechanisms that specifically value CSP’s dispatchable characteristics.

Energy security concerns have intensified following recent geopolitical developments, driving European nations to accelerate domestic renewable energy development. CSP technology offers strategic advantages through its ability to provide firm capacity and reduce dependence on fossil fuel imports, aligning with energy independence objectives.

Technological advancement continues reducing costs and improving performance across all CSP system components. Innovations in receiver technology, heat transfer fluids, and thermal storage systems enhance efficiency while extending operational lifespans, improving project economics and investor returns.

Climate commitments under the Paris Agreement and national carbon neutrality pledges create long-term demand certainty for renewable energy technologies. CSP’s ability to provide clean electricity with storage capabilities positions it as a preferred solution for meeting these commitments.

Industrial decarbonization requirements are driving demand for renewable process heat solutions. CSP systems can deliver high-temperature thermal energy for manufacturing processes, cement production, and chemical industries, opening substantial new market segments beyond electricity generation.

Market restraints present challenges that stakeholders must navigate to realize the full potential of Europe’s concentrated solar power sector. Understanding these limitations enables more effective strategic planning and risk mitigation.

High capital requirements remain a significant barrier, as CSP projects typically require substantial upfront investments compared to other renewable technologies. This characteristic can limit project development in markets with constrained financing availability or unfavorable investment conditions.

Geographic limitations restrict CSP deployment to regions with adequate direct normal irradiation levels, primarily concentrating opportunities in southern European countries. Northern European markets face natural resource constraints that limit CSP technology applicability and economic viability.

Competition from alternatives intensifies as photovoltaic and wind technologies continue achieving cost reductions and performance improvements. Battery storage systems increasingly complement these technologies, potentially reducing CSP’s competitive advantages in some applications.

Grid integration challenges can complicate CSP project development, particularly in regions with limited transmission infrastructure or grid flexibility. Upgrading electrical networks to accommodate large-scale CSP installations requires coordination and additional investment.

Permitting complexities and lengthy approval processes can delay project development and increase costs. Environmental assessments, land use approvals, and grid connection permits often require extensive documentation and stakeholder consultation, extending development timelines.

Water availability concerns affect certain CSP technologies that require cooling water for steam condensation. Regions with water scarcity may face limitations in deploying wet-cooled CSP systems, necessitating more expensive dry-cooling alternatives.

Emerging opportunities within the European concentrated solar power market present significant potential for growth, innovation, and market expansion across diverse applications and geographic regions.

Industrial process heat represents the most promising opportunity, with European manufacturing industries seeking renewable alternatives for high-temperature thermal requirements. CSP systems can supply process heat for cement production, steel manufacturing, chemical processing, and food production, creating substantial new market segments.

Hybrid renewable systems offer compelling opportunities for optimizing resource utilization and improving project economics. Combining CSP with photovoltaic installations creates complementary generation profiles, while integration with wind power can provide more consistent renewable energy output.

Energy storage services present lucrative opportunities as European electricity markets increasingly value grid stability and flexibility services. CSP plants with thermal storage can provide ancillary services, peak shaving, and load balancing capabilities that command premium pricing.

Desalination applications are gaining attention in water-stressed Mediterranean regions, where CSP systems can provide both electricity and thermal energy for seawater desalination processes. This dual-purpose approach improves project economics while addressing critical water security challenges.

Eastern European expansion offers growth opportunities as countries like Romania, Bulgaria, and Hungary develop renewable energy strategies. These markets present favorable solar resources and growing energy demand, creating conditions for CSP market development.

Technology export potential enables European CSP companies to leverage domestic experience for international market expansion, particularly in Middle Eastern, North African, and Latin American markets with excellent solar resources.

Market dynamics within the European concentrated solar power sector reflect complex interactions between technological, economic, regulatory, and competitive forces that shape industry evolution and strategic decision-making.

Supply-demand equilibrium is evolving as European electricity markets adapt to increasing renewable energy penetration. CSP technology’s dispatchable characteristics create unique value propositions in markets requiring grid stability and firm capacity, influencing pricing mechanisms and contract structures.

Competitive positioning continues shifting as CSP technology competes with other renewable sources while carving out distinct market niches. The technology’s ability to provide thermal energy storage and grid services differentiates it from variable renewable sources, creating specialized market segments.

Innovation cycles are accelerating through increased research and development investment, collaborative projects, and technology transfer initiatives. MarkWide Research analysis indicates that innovation focus areas include advanced materials, improved heat transfer systems, and enhanced storage technologies.

Investment patterns reflect growing institutional investor interest in long-term renewable energy assets with predictable cash flows. CSP projects benefit from their operational characteristics that provide stable returns over extended periods, attracting pension funds and infrastructure investors.

Regulatory evolution continues shaping market conditions through policy refinements, market mechanism updates, and international cooperation frameworks. European Union initiatives promote technology development while national policies address specific market conditions and strategic objectives.

Value chain integration is strengthening as companies pursue vertical integration strategies to capture greater value and improve project economics. This trend includes manufacturing, development, construction, and operation activities within single organizational structures.

Comprehensive research methodology underpins this analysis of the European concentrated solar power market, employing multiple data sources and analytical approaches to ensure accuracy, reliability, and strategic relevance.

Primary research activities include structured interviews with industry executives, technology developers, project developers, and policy makers across key European markets. These discussions provide insights into market trends, challenges, opportunities, and strategic priorities that shape industry development.

Secondary research encompasses analysis of government publications, industry reports, academic studies, and company financial disclosures. This information provides quantitative data on market size, growth rates, technology performance, and competitive positioning across different market segments.

Data validation processes ensure information accuracy through cross-referencing multiple sources, expert review, and statistical analysis. Market data undergoes rigorous verification to eliminate inconsistencies and provide reliable foundations for strategic analysis and forecasting.

Analytical frameworks include market segmentation analysis, competitive benchmarking, technology assessment, and regulatory impact evaluation. These approaches provide comprehensive understanding of market structure, dynamics, and evolution patterns.

Forecasting methodologies combine historical trend analysis, scenario modeling, and expert judgment to project future market development. Multiple scenarios account for different policy environments, technology advancement rates, and economic conditions that could influence market outcomes.

Quality assurance measures include peer review, data auditing, and methodology validation to ensure research standards and analytical rigor throughout the study process.

Regional market analysis reveals significant variations in CSP development across European territories, reflecting differences in solar resources, policy frameworks, economic conditions, and industrial requirements.

Southern Europe dominates the regional landscape, with Spain maintaining its position as the leading CSP market, representing approximately 68% of total European capacity. The country benefits from excellent solar irradiation, supportive policies, and established industrial infrastructure that facilitates project development and operation.

Italy emerges as the second-largest market, leveraging its Mediterranean climate and growing renewable energy commitments. Recent policy developments and industrial decarbonization initiatives are driving increased CSP adoption, particularly for process heat applications in manufacturing sectors.

Greece demonstrates strong growth potential, with government initiatives promoting renewable energy development and energy independence. The country’s strategic location and abundant solar resources create favorable conditions for CSP deployment, supported by European Union funding programs.

France represents an emerging opportunity, with research institutions and technology companies developing advanced CSP solutions. While northern regions face resource limitations, southern French territories offer suitable conditions for CSP development, particularly for industrial applications.

Portugal is expanding its renewable energy portfolio through CSP integration, focusing on hybrid systems and energy storage applications. The country’s Atlantic location provides unique opportunities for offshore wind-CSP combinations and grid stability services.

Eastern European markets including Romania, Bulgaria, and Hungary are beginning to explore CSP opportunities as part of their renewable energy strategies. These markets offer growth potential as policy frameworks develop and financing mechanisms mature.

Competitive landscape within the European concentrated solar power market encompasses diverse stakeholders ranging from global technology leaders to specialized regional developers, creating a dynamic ecosystem of innovation and market development.

Leading market participants include established companies with proven track records in CSP technology development, project implementation, and long-term operations:

Competitive strategies focus on technology differentiation, cost optimization, and market expansion through strategic partnerships and vertical integration. Companies are investing in research and development to improve system efficiency while reducing capital and operational costs.

Market consolidation trends are emerging as larger players acquire specialized technology companies and project developers to strengthen their competitive positions and expand market reach.

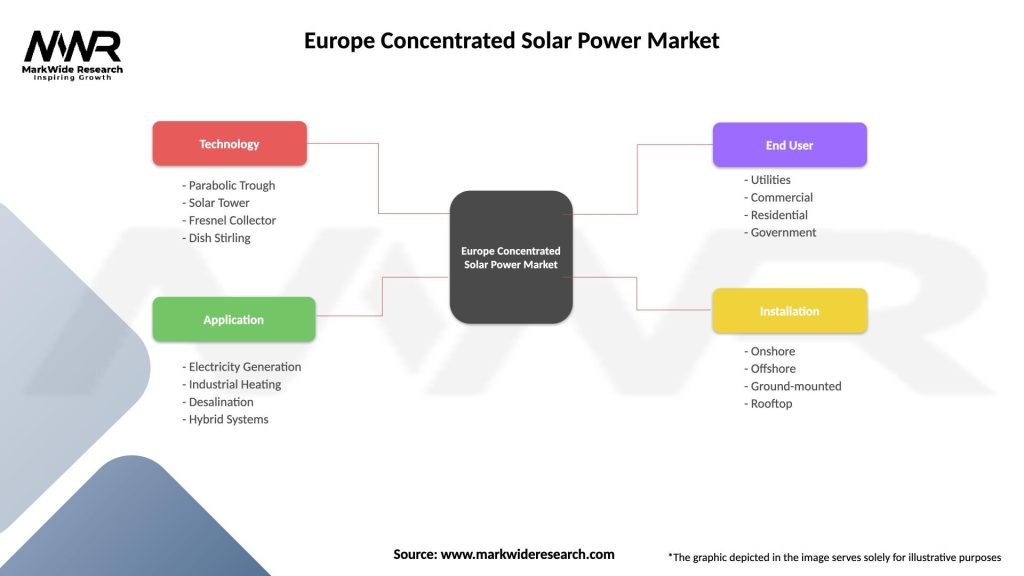

Market segmentation analysis provides detailed understanding of the European concentrated solar power market structure, revealing distinct segments with unique characteristics, growth patterns, and strategic implications.

By Technology:

By Application:

By Capacity:

Category-wise analysis reveals distinct market dynamics and opportunities across different CSP technology segments and application areas within the European market context.

Parabolic Trough Technology maintains market leadership through proven reliability and established manufacturing capabilities. This category benefits from extensive operational experience, mature supply chains, and continuous performance improvements. Recent innovations focus on advanced heat transfer fluids and enhanced receiver designs that improve efficiency and reduce maintenance requirements.

Solar Power Tower Systems demonstrate superior performance characteristics including higher operating temperatures and more efficient thermal storage integration. This category attracts significant investment in research and development, with European companies leading innovations in receiver technology, heliostat control systems, and molten salt storage solutions.

Industrial Process Heat Applications represent the fastest-growing category, driven by European manufacturing industries’ decarbonization requirements. This segment offers attractive opportunities for CSP deployment in cement production, steel manufacturing, chemical processing, and food production, where high-temperature thermal energy replaces fossil fuel combustion.

Utility-Scale Power Generation remains the dominant application category, benefiting from supportive renewable energy policies and grid integration requirements. Large-scale CSP plants provide grid stability services and firm capacity that complement variable renewable sources, creating unique value propositions in European electricity markets.

Hybrid System Configurations emerge as an innovative category combining CSP with photovoltaic or wind technologies. These integrated systems optimize resource utilization, improve capacity factors, and provide enhanced grid services that command premium pricing in sophisticated European energy markets.

Industry participants and stakeholders across the European concentrated solar power value chain realize substantial benefits from market participation, technological advancement, and strategic positioning within this growing sector.

Technology Developers benefit from expanding market opportunities, increasing demand for innovative solutions, and growing investment in research and development. European CSP companies leverage domestic market experience to compete internationally while developing next-generation technologies that maintain competitive advantages.

Project Developers realize benefits through diversified revenue streams, long-term contract opportunities, and access to favorable financing conditions. CSP projects offer stable cash flows over extended operational periods, attracting institutional investors and enabling attractive project economics.

Utilities and Power Producers gain access to dispatchable renewable energy that provides grid stability services and firm capacity. CSP technology enables utilities to meet renewable energy targets while maintaining system reliability and operational flexibility.

Industrial Companies benefit from renewable process heat solutions that reduce carbon emissions, improve energy security, and potentially lower long-term energy costs. CSP systems enable industrial decarbonization while maintaining production efficiency and competitiveness.

Financial Institutions access attractive investment opportunities with predictable returns, long-term cash flows, and positive environmental impact. CSP projects align with sustainable finance objectives while providing portfolio diversification and stable yield characteristics.

Government Entities achieve multiple policy objectives including renewable energy targets, industrial competitiveness, energy security, and climate commitments through CSP market development and supportive policy frameworks.

SWOT Analysis provides comprehensive evaluation of the European concentrated solar power market’s internal capabilities and external environment, revealing strategic insights for stakeholder decision-making.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the European concentrated solar power landscape reflect technological evolution, changing market dynamics, and emerging applications that influence strategic planning and investment decisions.

Thermal Storage Innovation represents a dominant trend, with companies developing advanced molten salt systems, phase change materials, and thermochemical storage solutions. These innovations extend CSP plant operating hours and improve capacity factors, with some facilities achieving storage durations exceeding 15 hours.

Hybrid System Development gains momentum as developers combine CSP with photovoltaic installations, wind farms, and battery storage systems. These integrated configurations optimize resource utilization and provide more consistent renewable energy output, improving project economics and grid integration characteristics.

Industrial Process Integration emerges as a transformative trend, with CSP systems increasingly deployed for manufacturing applications requiring high-temperature thermal energy. European industries are adopting CSP for cement production, steel manufacturing, and chemical processing, driving market diversification beyond electricity generation.

Digitalization and Smart Operations enhance CSP plant performance through advanced control systems, predictive maintenance, and artificial intelligence applications. These technologies improve operational efficiency, reduce maintenance costs, and optimize energy production based on weather forecasting and grid demand patterns.

Financing Innovation includes green bonds, sustainability-linked loans, and blended finance mechanisms that reduce capital costs and improve project viability. MWR analysis indicates that innovative financing structures are enabling CSP projects to achieve more competitive economics.

Circular Economy Principles influence CSP development through component recycling, sustainable materials selection, and end-of-life planning. European companies are implementing circular economy approaches that reduce environmental impact and improve long-term sustainability.

Recent industry developments demonstrate the dynamic nature of the European concentrated solar power market, with significant advances in technology, policy, and commercial deployment shaping future market evolution.

Technology Breakthroughs include next-generation receiver designs that achieve higher operating temperatures and improved efficiency. European research institutions and companies are developing advanced materials and heat transfer systems that enhance CSP performance while reducing costs.

Major Project Announcements across southern European markets signal continued market expansion and investor confidence. Several large-scale CSP facilities with advanced thermal storage systems have received final investment decisions, indicating strong project pipelines and market momentum.

Policy Developments include updated renewable energy frameworks that specifically recognize CSP’s grid stability benefits and dispatchable characteristics. National governments are implementing support mechanisms that value CSP’s unique attributes in maintaining electrical grid reliability.

Strategic Partnerships between European CSP companies and international developers are expanding market reach and technology transfer opportunities. These collaborations enable knowledge sharing, risk mitigation, and access to global markets with excellent solar resources.

Research Initiatives supported by European Union funding programs are advancing CSP technology development and reducing costs. Collaborative projects focus on materials science, system integration, and performance optimization that strengthen European technological leadership.

Industrial Applications are expanding rapidly, with major European manufacturers announcing CSP adoption for process heat requirements. These developments demonstrate CSP’s versatility and create new market segments beyond traditional electricity generation.

Strategic recommendations for stakeholders navigating the European concentrated solar power market emphasize positioning for long-term success while capitalizing on emerging opportunities and managing inherent risks.

Technology Investment should prioritize thermal storage advancement, system integration capabilities, and hybrid configuration development. Companies investing in next-generation CSP technologies will maintain competitive advantages as market demand expands and performance requirements increase.

Market Diversification beyond traditional electricity generation offers substantial growth opportunities. Stakeholders should explore industrial process heat applications, desalination projects, and specialized thermal energy services that leverage CSP’s unique capabilities and create differentiated value propositions.

Geographic Expansion into emerging European markets provides growth potential as Eastern European countries develop renewable energy strategies. Early market entry and strategic partnerships can establish competitive positions in these developing markets.

Financial Innovation through green finance mechanisms, risk-sharing arrangements, and innovative contract structures can improve project economics and attract institutional investment. Stakeholders should leverage sustainability-focused financing to reduce capital costs and enhance returns.

Supply Chain Optimization including component localization, strategic partnerships, and vertical integration can improve cost competitiveness and reduce supply chain risks. European companies should strengthen domestic manufacturing capabilities while maintaining global market access.

Policy Engagement with regulatory authorities and industry associations ensures favorable policy development and market mechanism design. Active participation in policy discussions helps shape supportive frameworks that recognize CSP’s unique value proposition.

Future market outlook for the European concentrated solar power sector appears highly favorable, with multiple growth drivers converging to create sustained expansion opportunities and technological advancement.

Market expansion is projected to accelerate through the next decade, driven by strengthening policy support, improving technology economics, and growing recognition of CSP’s strategic value in renewable energy systems. MarkWide Research projects continued robust growth as European nations intensify their climate commitments and energy security initiatives.

Technology evolution will focus on efficiency improvements, cost reductions, and enhanced storage capabilities. Advanced materials, improved heat transfer systems, and innovative storage solutions will strengthen CSP’s competitive position relative to alternative renewable technologies.

Application diversification beyond electricity generation will create substantial new market segments, particularly in industrial process heat and hybrid system configurations. These applications offer higher value propositions and reduced competition from alternative technologies.

Geographic expansion into previously underserved European markets will broaden the industry’s foundation and reduce concentration risks. Eastern European countries and emerging applications in northern regions will contribute to market growth and diversification.

Investment flows are expected to strengthen as institutional investors increasingly recognize CSP’s attractive risk-return characteristics and alignment with sustainable investment objectives. Green finance mechanisms will continue improving project economics and accessibility.

Integration opportunities with other renewable technologies, energy storage systems, and smart grid infrastructure will enhance CSP’s value proposition and market positioning. These integrated approaches will optimize resource utilization and improve overall system performance.

The Europe concentrated solar power market represents a dynamic and rapidly evolving sector within the continent’s renewable energy landscape, characterized by strong growth fundamentals, technological innovation, and expanding application opportunities. The market demonstrates resilience and adaptability while contributing significantly to European climate objectives and energy security goals.

Strategic positioning of CSP technology as a dispatchable renewable energy source with thermal storage capabilities creates unique value propositions that differentiate it from variable renewable alternatives. This positioning becomes increasingly valuable as European electricity systems require greater flexibility and grid stability services.

Market participants benefit from supportive policy frameworks, improving technology economics, and growing investor interest in sustainable energy infrastructure. The combination of proven technology performance, expanding applications, and favorable regulatory environment creates attractive opportunities for stakeholders across the value chain.

Future prospects remain highly favorable, with multiple growth drivers including industrial decarbonization requirements, hybrid system development, and geographic market expansion supporting sustained market development. The sector’s evolution toward greater cost competitiveness and technological sophistication positions it as a cornerstone of Europe’s renewable energy future.

Success in this market requires strategic focus on technology innovation, market diversification, and stakeholder collaboration to capitalize on emerging opportunities while navigating competitive challenges and regulatory evolution. The Europe concentrated solar power market offers substantial potential for companies and investors committed to long-term sustainable energy development.

What is Concentrated Solar Power?

Concentrated Solar Power (CSP) refers to a technology that uses mirrors or lenses to concentrate a large area of sunlight, or solar thermal energy, onto a small area. This concentrated energy is then used to produce electricity, typically through a steam turbine or heat engine.

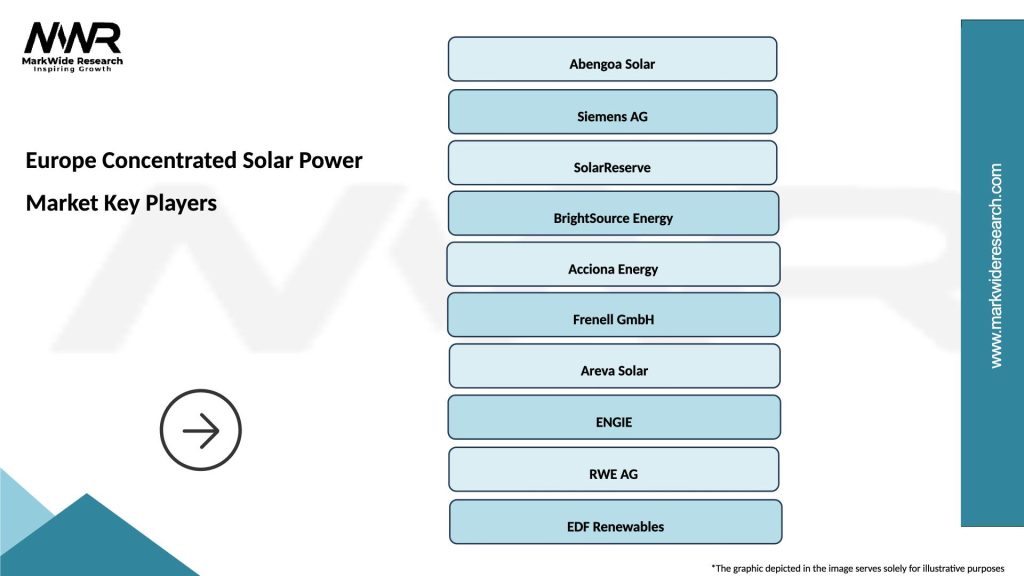

What are the key players in the Europe Concentrated Solar Power Market?

Key players in the Europe Concentrated Solar Power Market include Abengoa Solar, SolarReserve, and BrightSource Energy, among others. These companies are involved in the development and operation of CSP plants across various European countries.

What are the growth factors driving the Europe Concentrated Solar Power Market?

The growth of the Europe Concentrated Solar Power Market is driven by increasing demand for renewable energy, government incentives for clean energy projects, and advancements in CSP technology. Additionally, the need for energy security and reduction of greenhouse gas emissions further supports market expansion.

What challenges does the Europe Concentrated Solar Power Market face?

The Europe Concentrated Solar Power Market faces challenges such as high initial investment costs, competition from other renewable energy sources, and the need for large land areas for CSP installations. Additionally, variability in sunlight can affect energy production efficiency.

What opportunities exist in the Europe Concentrated Solar Power Market?

Opportunities in the Europe Concentrated Solar Power Market include the potential for hybrid systems that combine CSP with other renewable technologies, increased investment in energy storage solutions, and the expansion of CSP projects in regions with high solar irradiance. These factors can enhance the viability and efficiency of CSP.

What trends are shaping the Europe Concentrated Solar Power Market?

Trends shaping the Europe Concentrated Solar Power Market include the integration of advanced thermal storage systems, the development of smaller-scale CSP plants, and innovations in mirror and receiver technologies. These trends aim to improve efficiency and reduce costs associated with CSP systems.

Europe Concentrated Solar Power Market

| Segmentation Details | Description |

|---|---|

| Technology | Parabolic Trough, Solar Tower, Fresnel Collector, Dish Stirling |

| Application | Electricity Generation, Industrial Heating, Desalination, Hybrid Systems |

| End User | Utilities, Commercial, Residential, Government |

| Installation | Onshore, Offshore, Ground-mounted, Rooftop |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Concentrated Solar Power Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at