444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe Commercial HVAC Market represents a dynamic and rapidly evolving sector that encompasses heating, ventilation, and air conditioning systems designed specifically for commercial applications across the European continent. This comprehensive market serves diverse commercial establishments including office buildings, retail spaces, healthcare facilities, educational institutions, hospitality venues, and industrial complexes. Market dynamics indicate robust growth driven by stringent energy efficiency regulations, increasing focus on indoor air quality, and the ongoing digital transformation of building management systems.

European commercial HVAC systems are experiencing unprecedented demand as businesses prioritize sustainable operations and employee wellness. The market demonstrates significant technological advancement with the integration of smart controls, IoT connectivity, and energy-efficient components. Growth projections suggest the sector will expand at a compound annual growth rate of 6.2% through the forecast period, driven by replacement of aging infrastructure and new construction activities across key European markets.

Regional variations within Europe showcase distinct market characteristics, with Western European countries leading in premium system adoption while Eastern European markets demonstrate rapid growth in basic and mid-tier HVAC solutions. The market’s evolution reflects broader European Union initiatives toward carbon neutrality and enhanced building performance standards.

The Europe Commercial HVAC Market refers to the comprehensive ecosystem of heating, ventilation, and air conditioning systems, components, and services specifically designed for non-residential applications across European countries. This market encompasses equipment manufacturing, system installation, maintenance services, and technological innovations that ensure optimal indoor climate control for commercial spaces.

Commercial HVAC systems differ significantly from residential applications in terms of scale, complexity, and performance requirements. These systems must accommodate larger spaces, higher occupancy levels, diverse usage patterns, and stringent regulatory compliance standards. The market includes various system types such as centralized air handling units, variable refrigerant flow systems, packaged rooftop units, and specialized ventilation solutions.

Market participants include equipment manufacturers, system integrators, installation contractors, maintenance service providers, and technology solution developers. The ecosystem also encompasses component suppliers, control system manufacturers, and energy management solution providers who collectively contribute to the market’s comprehensive value chain.

Market leadership in the Europe Commercial HVAC sector is characterized by intense competition among established global manufacturers and emerging technology innovators. The market demonstrates strong resilience with consistent growth patterns driven by regulatory mandates, technological advancement, and increasing awareness of indoor environmental quality importance.

Key growth drivers include the European Union’s ambitious climate targets, which mandate 55% reduction in greenhouse gas emissions by 2030, directly impacting commercial building energy consumption requirements. Additionally, the post-pandemic focus on indoor air quality has accelerated demand for advanced ventilation and air purification systems across commercial establishments.

Technology integration represents a fundamental market transformation with smart HVAC systems gaining significant market penetration of 42% in premium commercial segments. These systems offer predictive maintenance capabilities, energy optimization algorithms, and seamless integration with building management platforms.

Regional market dynamics reveal Germany, France, and the United Kingdom as primary revenue contributors, collectively representing substantial market share. However, emerging markets in Eastern Europe demonstrate the highest growth rates as infrastructure development accelerates and energy efficiency standards align with EU directives.

Strategic market insights reveal several critical trends shaping the Europe Commercial HVAC landscape:

Market maturity levels vary significantly across European regions, with Nordic countries leading in advanced system adoption while Mediterranean markets focus on cooling-centric solutions. This diversity creates opportunities for specialized product development and targeted market strategies.

Regulatory compliance serves as the primary market driver, with the European Union’s Energy Performance of Buildings Directive mandating significant improvements in commercial building energy efficiency. These regulations require building owners to implement advanced HVAC systems capable of meeting stringent performance standards.

Economic incentives provided by national governments accelerate market adoption through tax credits, rebates, and financing programs for energy-efficient HVAC installations. These programs particularly benefit small and medium enterprises seeking to upgrade their commercial facilities while managing capital expenditure constraints.

Technological advancement drives market expansion through the development of innovative solutions that offer superior performance, reduced energy consumption, and enhanced user comfort. Smart thermostats, variable speed drives, and advanced heat pump technologies provide compelling value propositions for commercial building owners.

Corporate sustainability initiatives increasingly influence HVAC purchasing decisions as companies strive to achieve carbon neutrality goals and enhance their environmental credentials. This trend particularly impacts large corporate facilities and multinational organizations with comprehensive sustainability mandates.

Indoor environmental quality awareness has intensified following global health concerns, driving demand for advanced air filtration, UV disinfection systems, and enhanced ventilation capabilities. Commercial establishments prioritize occupant health and wellness as competitive differentiators.

High initial investment costs represent a significant barrier for many commercial establishments, particularly small businesses and budget-conscious organizations. Advanced HVAC systems require substantial capital expenditure that may strain financial resources and delay implementation timelines.

Technical complexity of modern commercial HVAC systems creates challenges for installation, operation, and maintenance. The integration of multiple technologies, control systems, and communication protocols requires specialized expertise that may not be readily available in all markets.

Skilled labor shortage affects the industry across multiple European countries, limiting installation capacity and increasing project costs. The technical nature of modern HVAC systems demands highly trained technicians capable of handling sophisticated equipment and control systems.

Economic uncertainty in certain European regions impacts commercial construction activities and building upgrade projects. Economic volatility can delay capital investment decisions and reduce demand for premium HVAC solutions.

Regulatory complexity varies across European countries, creating challenges for manufacturers and contractors operating in multiple markets. Compliance with diverse national standards, certification requirements, and installation codes increases operational complexity and costs.

Retrofit market potential presents substantial opportunities as millions of European commercial buildings require HVAC system upgrades to meet current energy efficiency standards. This market segment offers consistent demand and attractive profit margins for service providers and equipment manufacturers.

Smart building integration creates new revenue streams through the development of comprehensive building automation solutions that combine HVAC control with lighting, security, and energy management systems. These integrated platforms offer enhanced value propositions and recurring revenue opportunities.

Emerging market expansion in Eastern European countries provides growth opportunities as these markets develop modern commercial infrastructure and align with EU energy efficiency standards. Early market entry can establish competitive advantages and long-term customer relationships.

Service sector growth offers opportunities for companies to develop comprehensive maintenance, monitoring, and optimization services. Performance-based contracts and energy-as-a-service models create recurring revenue streams while providing customer value through guaranteed performance outcomes.

Technology innovation in areas such as artificial intelligence, machine learning, and advanced materials creates opportunities for differentiated product offerings. Companies investing in research and development can capture premium market segments and establish technology leadership positions.

Supply chain dynamics in the Europe Commercial HVAC Market reflect complex interactions between global component manufacturers, regional system integrators, and local installation contractors. Recent supply chain disruptions have highlighted the importance of diversified sourcing strategies and regional manufacturing capabilities.

Competitive intensity continues to increase as traditional HVAC manufacturers face competition from technology companies entering the smart building space. This convergence creates both challenges and opportunities for established market participants seeking to maintain competitive positions.

Customer behavior evolution demonstrates increasing sophistication in HVAC system selection criteria, with buyers prioritizing total cost of ownership, energy performance, and digital capabilities over initial purchase price. This shift rewards manufacturers offering comprehensive value propositions and superior technology integration.

Innovation cycles are accelerating as digitalization transforms traditional HVAC equipment into connected, intelligent systems. Companies must balance investment in emerging technologies while maintaining profitability in existing product lines.

Market consolidation trends reflect the industry’s maturation as larger companies acquire specialized technology providers and regional service companies to expand capabilities and market reach. This consolidation creates opportunities for remaining independent companies to serve niche markets and specialized applications.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes extensive interviews with industry executives, technical specialists, and end-user organizations across major European markets.

Secondary research encompasses analysis of industry publications, regulatory documents, company financial reports, and technical specifications from leading manufacturers. This approach provides comprehensive market understanding and validates primary research findings.

Quantitative analysis utilizes statistical modeling techniques to project market trends, segment performance, and regional growth patterns. MarkWide Research employs sophisticated analytical tools to process large datasets and identify meaningful market patterns.

Qualitative assessment includes expert interviews, focus groups, and case study analysis to understand market dynamics, competitive positioning, and technology adoption patterns. This methodology provides context for quantitative findings and reveals underlying market drivers.

Data validation processes ensure research accuracy through triangulation of multiple sources, expert review panels, and statistical verification techniques. This rigorous approach maintains high standards for market intelligence and strategic recommendations.

Western Europe dominates the commercial HVAC market with mature infrastructure and high adoption rates of advanced technologies. Germany leads regional demand with approximately 28% market share, driven by stringent energy efficiency regulations and strong industrial base. France and the United Kingdom follow as significant markets with emphasis on smart building technologies and retrofit applications.

Nordic countries demonstrate exceptional market sophistication with widespread adoption of heat pump technologies and integrated building management systems. These markets prioritize energy efficiency and environmental sustainability, creating demand for premium HVAC solutions with advanced control capabilities.

Southern Europe focuses primarily on cooling applications due to climate conditions, with Spain and Italy representing major markets for commercial air conditioning systems. These regions show increasing interest in energy-efficient solutions as utility costs rise and environmental regulations tighten.

Eastern Europe exhibits the highest growth rates as commercial infrastructure development accelerates and EU membership drives regulatory alignment. Poland, Czech Republic, and Hungary lead regional growth with combined annual growth rates exceeding 8.5% in commercial HVAC installations.

Market penetration rates vary significantly across regions, with Western European countries achieving advanced system penetration of 65% while Eastern European markets demonstrate substantial growth potential with current penetration levels around 35% in commercial segments.

Market leadership is distributed among several global manufacturers with strong European presence and specialized regional players serving local markets. The competitive environment reflects diverse strategies ranging from technology innovation to service excellence and cost optimization.

Competitive strategies increasingly focus on digital transformation, service capabilities, and sustainability credentials. Companies invest heavily in IoT platforms, artificial intelligence, and predictive analytics to differentiate their offerings and create customer value.

By System Type:

By Application:

By Technology:

Smart HVAC Systems represent the fastest-growing category with annual growth rates of 12.3% driven by increasing demand for building automation and energy optimization. These systems offer predictive maintenance, remote monitoring, and integration with broader building management platforms.

Heat Pump Technologies gain significant traction across European markets as governments promote electrification and renewable energy integration. Air-source and ground-source heat pumps demonstrate strong adoption rates in both new construction and retrofit applications.

Variable Refrigerant Flow Systems capture increasing market share due to their flexibility, energy efficiency, and ability to provide simultaneous heating and cooling in different building zones. These systems particularly appeal to modern office buildings and mixed-use developments.

Service and Maintenance categories show robust growth as building owners prioritize system reliability and performance optimization. Comprehensive service agreements and performance-based contracts create recurring revenue opportunities for service providers.

Control Systems Integration becomes increasingly important as buildings adopt comprehensive automation platforms. HVAC systems must seamlessly integrate with lighting, security, and energy management systems to provide optimal building performance.

Building Owners benefit from reduced energy costs, improved occupant comfort, and enhanced property values through advanced HVAC system implementation. Modern systems offer energy savings of 25-40% compared to older installations while providing superior environmental control.

Facility Managers gain operational advantages through predictive maintenance capabilities, remote monitoring, and automated system optimization. These features reduce maintenance costs, minimize downtime, and improve overall building performance.

Occupants experience enhanced comfort, improved indoor air quality, and healthier work environments. Advanced HVAC systems maintain optimal temperature, humidity, and air quality conditions that support productivity and well-being.

Equipment Manufacturers access expanding market opportunities through technology innovation, service offerings, and geographic expansion. The shift toward smart systems creates premium pricing opportunities and recurring revenue streams.

Service Providers benefit from increasing demand for specialized installation, maintenance, and optimization services. The complexity of modern HVAC systems creates opportunities for value-added services and long-term customer relationships.

Environmental Stakeholders achieve sustainability goals through reduced energy consumption, lower carbon emissions, and improved building efficiency. Advanced HVAC systems contribute significantly to European climate objectives and environmental protection initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Electrification Acceleration represents a fundamental market transformation as European countries phase out fossil fuel heating systems in favor of electric heat pumps and renewable energy integration. This trend creates substantial opportunities for heat pump manufacturers and electrical system integrators.

Artificial Intelligence Integration enables predictive maintenance, energy optimization, and autonomous system operation. AI-powered HVAC systems learn occupancy patterns, weather conditions, and usage preferences to optimize performance automatically while reducing energy consumption.

Indoor Air Quality Focus intensifies following health awareness trends, driving demand for advanced filtration systems, UV disinfection technologies, and enhanced ventilation capabilities. Commercial establishments prioritize occupant health as a competitive advantage and regulatory requirement.

Sustainability Reporting requirements compel commercial building owners to implement systems that support environmental compliance and carbon footprint reduction. HVAC systems play a critical role in achieving sustainability targets and regulatory compliance.

As-a-Service Models gain popularity as building owners seek to minimize capital expenditure while accessing advanced HVAC technologies. Equipment-as-a-service and performance-based contracts transfer operational risk while providing predictable costs and guaranteed performance outcomes.

Modular System Design enables flexible installation and future expansion capabilities. Modular approaches reduce installation complexity, minimize disruption to existing operations, and provide scalability for growing businesses.

Regulatory Evolution continues with the European Union’s implementation of stricter energy performance standards and refrigerant regulations. The F-Gas Regulation phase-down creates opportunities for low-global warming potential refrigerant technologies and natural refrigerant systems.

Technology Partnerships between traditional HVAC manufacturers and technology companies accelerate innovation in smart building solutions. These collaborations combine mechanical expertise with digital capabilities to create comprehensive building automation platforms.

Manufacturing Localization trends reflect supply chain resilience strategies and reduced transportation costs. European manufacturers invest in regional production facilities to serve local markets more effectively and reduce dependency on global supply chains.

Workforce Development initiatives address skilled labor shortages through training programs, certification standards, and educational partnerships. Industry associations collaborate with technical schools and universities to develop qualified technicians for modern HVAC systems.

Sustainability Certifications gain importance as building owners seek third-party validation of environmental performance. HVAC systems contribute significantly to green building certifications such as BREEAM, LEED, and national sustainability standards.

Strategic positioning recommendations emphasize the importance of technology integration and service capability development. Companies should invest in digital platforms, IoT connectivity, and data analytics capabilities to remain competitive in the evolving market landscape.

Market entry strategies for Eastern European markets should focus on partnerships with local distributors and service providers. MWR analysis indicates that successful market penetration requires understanding of local regulations, customer preferences, and competitive dynamics.

Product development priorities should emphasize energy efficiency, smart connectivity, and ease of installation. The market rewards solutions that combine superior performance with simplified deployment and operation, particularly in retrofit applications.

Service model evolution toward comprehensive building solutions creates differentiation opportunities. Companies should develop capabilities in energy management, predictive maintenance, and performance optimization to capture higher-value market segments.

Sustainability leadership becomes increasingly important for competitive positioning. Companies should prioritize low-carbon technologies, circular economy principles, and environmental impact reduction throughout their product lifecycles and operations.

Market evolution toward intelligent, connected HVAC systems will accelerate as building owners seek comprehensive solutions that optimize energy consumption, occupant comfort, and operational efficiency. The integration of artificial intelligence and machine learning will enable autonomous system operation and predictive performance optimization.

Technology convergence between HVAC, lighting, security, and energy management systems will create comprehensive building automation platforms. This convergence offers opportunities for system integrators and technology providers while challenging traditional equipment manufacturers to expand their capabilities.

Regulatory landscape will continue evolving toward stricter energy efficiency requirements and carbon reduction mandates. The European Green Deal and national climate policies will drive demand for advanced HVAC technologies and accelerate the phase-out of fossil fuel systems.

Market growth projections indicate sustained expansion with compound annual growth rates of 6.8% expected through the next decade. Growth will be driven by retrofit demand, new construction activities, and technology upgrade cycles as smart building adoption accelerates.

Geographic expansion opportunities in Eastern European markets will provide significant growth potential as these regions develop modern commercial infrastructure and align with EU energy standards. Early market entry and local partnerships will be critical for success in these emerging markets.

The Europe Commercial HVAC Market stands at a transformative juncture characterized by technological innovation, regulatory evolution, and changing customer expectations. The market demonstrates robust growth potential driven by energy efficiency mandates, sustainability initiatives, and the ongoing digital transformation of building management systems.

Strategic opportunities abound for companies that can successfully navigate the complex regulatory landscape while delivering innovative solutions that address customer needs for energy efficiency, indoor air quality, and operational optimization. The shift toward smart, connected systems creates new value propositions and revenue models that reward technology leadership and service excellence.

Market participants must adapt to evolving customer requirements, regulatory changes, and competitive dynamics while investing in technology development and service capabilities. Success in this market requires a comprehensive understanding of regional variations, application requirements, and emerging trends that shape customer purchasing decisions.

The future of the Europe Commercial HVAC Market will be defined by companies that can effectively combine mechanical expertise with digital capabilities, sustainability leadership, and customer-centric service models. As the market continues evolving toward intelligent building solutions, organizations that embrace innovation and strategic positioning will capture the most significant opportunities in this dynamic and growing sector.

What is Commercial HVAC?

Commercial HVAC refers to heating, ventilation, and air conditioning systems specifically designed for commercial buildings, such as offices, retail spaces, and industrial facilities. These systems are essential for maintaining indoor air quality and comfort in large spaces.

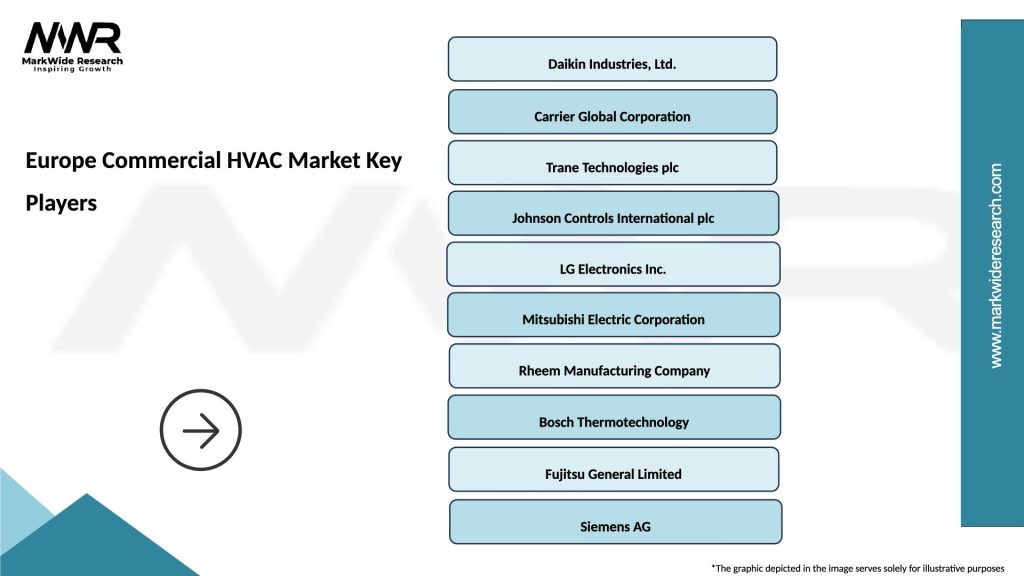

What are the key players in the Europe Commercial HVAC Market?

Key players in the Europe Commercial HVAC Market include companies like Daikin, Trane Technologies, Carrier, and Johnson Controls, among others. These companies are known for their innovative HVAC solutions and extensive product offerings tailored to commercial applications.

What are the main drivers of the Europe Commercial HVAC Market?

The main drivers of the Europe Commercial HVAC Market include the increasing demand for energy-efficient systems, the growth of smart building technologies, and the rising focus on indoor air quality. Additionally, regulatory requirements for energy efficiency are pushing businesses to upgrade their HVAC systems.

What challenges does the Europe Commercial HVAC Market face?

The Europe Commercial HVAC Market faces challenges such as high installation and maintenance costs, as well as the complexity of integrating new technologies into existing systems. Additionally, fluctuating energy prices can impact operational costs for businesses.

What opportunities exist in the Europe Commercial HVAC Market?

Opportunities in the Europe Commercial HVAC Market include the growing trend towards sustainable building practices and the increasing adoption of IoT-enabled HVAC systems. These advancements can lead to improved energy management and operational efficiency for commercial buildings.

What trends are shaping the Europe Commercial HVAC Market?

Trends shaping the Europe Commercial HVAC Market include the rise of smart HVAC systems that utilize AI and machine learning for optimization, as well as a shift towards environmentally friendly refrigerants. Additionally, there is a growing emphasis on retrofitting existing systems to enhance energy efficiency.

Europe Commercial HVAC Market

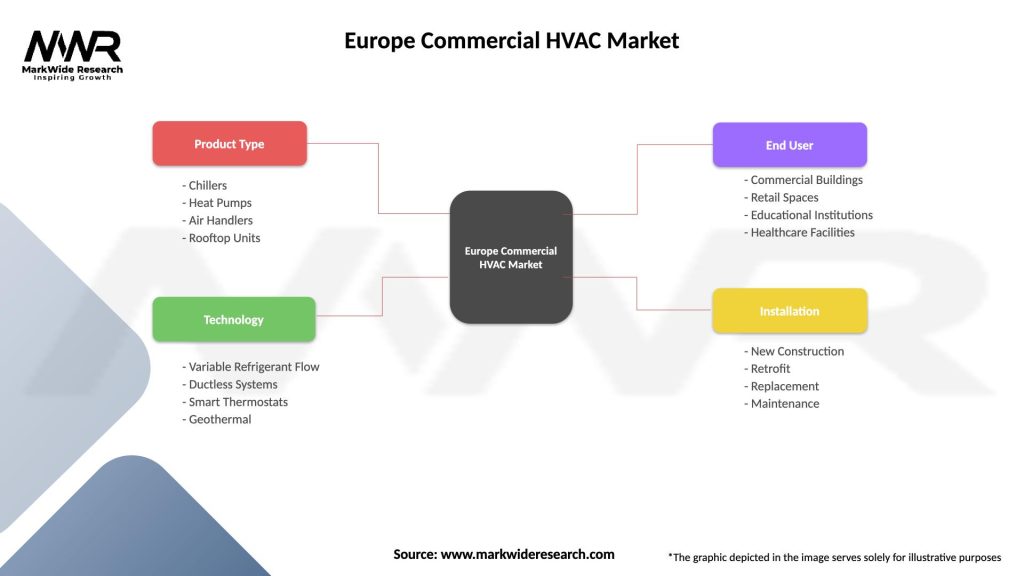

| Segmentation Details | Description |

|---|---|

| Product Type | Chillers, Heat Pumps, Air Handlers, Rooftop Units |

| Technology | Variable Refrigerant Flow, Ductless Systems, Smart Thermostats, Geothermal |

| End User | Commercial Buildings, Retail Spaces, Educational Institutions, Healthcare Facilities |

| Installation | New Construction, Retrofit, Replacement, Maintenance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Commercial HVAC Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at