444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe cat food market represents one of the most dynamic and rapidly evolving segments within the global pet food industry. European consumers are increasingly prioritizing premium nutrition for their feline companions, driving substantial growth across multiple product categories. The market encompasses a diverse range of offerings, from traditional dry kibble to innovative wet formulations, organic options, and specialized dietary solutions.

Market dynamics indicate robust expansion driven by rising pet ownership rates, increasing disposable income, and growing awareness of feline nutritional requirements. The region’s mature pet food infrastructure supports both established multinational brands and emerging artisanal producers, creating a competitive landscape that benefits consumers through innovation and quality improvements.

Consumer preferences across European markets show distinct regional variations, with Northern European countries favoring premium and super-premium products, while Southern and Eastern European markets demonstrate growing adoption of higher-quality formulations. The market is experiencing a compound annual growth rate of 4.2%, reflecting sustained demand for enhanced pet nutrition solutions.

Distribution channels have evolved significantly, with traditional pet specialty stores maintaining strong positions alongside expanding e-commerce platforms and hypermarket chains. This multi-channel approach ensures broad accessibility while supporting diverse consumer shopping preferences and purchasing behaviors.

The Europe cat food market refers to the comprehensive ecosystem of manufactured nutritional products specifically formulated for domestic cats across European Union member states, the United Kingdom, and associated territories. This market encompasses all commercial cat food categories, including dry food, wet food, treats, and specialized dietary formulations designed to meet various life stages and health requirements of feline companions.

Market scope includes products distributed through retail channels, veterinary clinics, online platforms, and specialty pet stores. The definition encompasses both mass-market and premium segments, covering everything from basic nutritional maintenance products to therapeutic diets prescribed for specific medical conditions.

Geographic coverage spans major European economies including Germany, France, United Kingdom, Italy, Spain, Netherlands, and emerging markets in Eastern Europe. Each regional market demonstrates unique characteristics influenced by local consumer preferences, regulatory frameworks, and cultural attitudes toward pet ownership and animal welfare.

Strategic analysis reveals the Europe cat food market as a mature yet continuously evolving sector characterized by premiumization trends and innovation-driven growth. Key market drivers include humanization of pets, increasing awareness of feline health requirements, and growing demand for natural and organic ingredients.

Market segmentation shows wet food categories maintaining the largest share at approximately 52% of total volume, followed by dry food formulations and specialty treats. Premium and super-premium segments demonstrate the strongest growth trajectories, reflecting consumer willingness to invest in higher-quality nutrition for their pets.

Competitive landscape features established multinational corporations alongside innovative smaller brands, creating a dynamic environment that fosters continuous product development and marketing innovation. Private label products are gaining traction, particularly in cost-conscious market segments.

Future projections indicate sustained growth driven by demographic trends, urbanization, and evolving consumer attitudes toward pet care. The market is expected to maintain steady expansion while adapting to emerging trends such as sustainability, transparency, and personalized nutrition solutions.

Consumer behavior analysis reveals several critical insights shaping market development across European territories:

Market intelligence indicates that European consumers demonstrate higher price tolerance for products perceived as beneficial to their cats’ health and wellbeing, supporting continued premiumization trends across the region.

Demographic trends serve as primary catalysts for market expansion across European territories. Aging populations and declining birth rates contribute to increased pet adoption as companion animals fulfill emotional and social needs traditionally met by larger family structures.

Urbanization patterns significantly influence market dynamics, with city-dwelling consumers demonstrating higher propensity for premium pet food purchases. Urban lifestyles often correlate with higher disposable incomes and greater emphasis on convenience and quality in pet care products.

Health awareness represents a fundamental driver, as European consumers increasingly recognize the connection between nutrition and feline health outcomes. This awareness translates into demand for specialized formulations addressing specific health concerns such as urinary tract health, weight management, and digestive wellness.

Humanization trends continue strengthening, with pet owners viewing cats as family members deserving high-quality nutrition comparable to human food standards. This perspective drives acceptance of premium pricing and interest in natural, organic, and minimally processed options.

Regulatory support through European Union pet food regulations ensures product safety and quality standards, building consumer confidence and supporting market growth. Clear labeling requirements and nutritional standards facilitate informed purchasing decisions.

Innovation momentum from manufacturers introduces novel ingredients, formulations, and packaging solutions that attract consumer interest and drive category expansion. Research and development investments yield products addressing previously unmet nutritional needs.

Economic pressures pose significant challenges to market growth, particularly during periods of inflation or economic uncertainty. Rising costs of raw materials, energy, and transportation impact both manufacturer margins and consumer purchasing power, potentially limiting premium product adoption.

Regulatory complexity across different European markets creates operational challenges for manufacturers seeking to expand distribution. Varying national requirements for product registration, labeling, and marketing claims necessitate substantial compliance investments.

Supply chain vulnerabilities became apparent during recent global disruptions, highlighting dependencies on international ingredient sourcing and manufacturing networks. These vulnerabilities can impact product availability and pricing stability.

Market saturation in mature European markets limits opportunities for dramatic growth, requiring companies to compete intensively for market share rather than benefiting from overall category expansion.

Consumer skepticism regarding marketing claims and ingredient quality creates challenges for new product launches and brand building efforts. Increasing sophistication among pet owners demands greater transparency and substantiation of product benefits.

Private label competition from major retailers pressures branded manufacturers through aggressive pricing strategies and improved product quality, potentially eroding market share and profit margins for established brands.

Digital transformation presents substantial opportunities for market expansion through e-commerce platforms, subscription services, and direct-to-consumer marketing strategies. Online sales channels demonstrate growth rates exceeding 15% annually, indicating significant potential for companies investing in digital capabilities.

Personalization trends create opportunities for customized nutrition solutions based on individual cat characteristics, health status, and preferences. Advanced data analytics and artificial intelligence enable development of tailored feeding recommendations and product formulations.

Sustainability initiatives offer differentiation opportunities as environmentally conscious consumers seek products with reduced environmental impact. Sustainable packaging, ethical sourcing, and carbon-neutral manufacturing processes appeal to growing segments of European consumers.

Emerging markets within Eastern Europe demonstrate substantial growth potential as economic development increases pet ownership rates and disposable income levels. These markets offer opportunities for both premium and value-oriented product positioning.

Functional nutrition represents a rapidly expanding opportunity as consumers seek products delivering specific health benefits beyond basic nutrition. Formulations targeting cognitive health, joint mobility, and immune system support address aging cat populations.

Alternative proteins including insect-based and plant-derived ingredients present innovation opportunities addressing sustainability concerns while potentially reducing production costs and environmental impact.

Competitive intensity continues escalating as established players defend market positions while new entrants seek to capture share through innovation and differentiation. This dynamic environment benefits consumers through improved product quality and expanded choice options.

Pricing pressures reflect complex interactions between raw material costs, manufacturing expenses, and consumer price sensitivity. Premium segments demonstrate greater pricing flexibility, while mass-market categories face intense price competition.

Innovation cycles accelerate as companies invest in research and development to maintain competitive advantages. Product development focuses on addressing specific consumer needs while incorporating trending ingredients and formulation approaches.

Distribution evolution transforms traditional retail relationships as online channels gain prominence and direct-to-consumer models emerge. This shift requires manufacturers to develop multi-channel strategies while managing potential channel conflicts.

Consumer education becomes increasingly important as product complexity grows and nutritional claims multiply. Companies investing in educational content and transparent communication build stronger customer relationships and brand loyalty.

Regulatory developments continue shaping market dynamics through evolving standards for ingredient approval, labeling requirements, and marketing claims substantiation. Proactive compliance strategies provide competitive advantages in rapidly changing regulatory environments.

Comprehensive analysis of the Europe cat food market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes structured interviews with industry executives, retail buyers, veterinarians, and consumer focus groups across major European markets.

Secondary research incorporates analysis of industry reports, company financial statements, regulatory filings, and trade association data. This approach provides historical context and validates primary research findings through triangulation of multiple data sources.

Market modeling utilizes statistical analysis techniques to project future market trends and quantify growth opportunities. Econometric models incorporate macroeconomic indicators, demographic trends, and industry-specific variables to generate reliable forecasts.

Consumer surveys conducted across representative samples in major European markets provide insights into purchasing behavior, brand preferences, and emerging trends. Survey methodologies ensure statistical significance while capturing regional variations in consumer attitudes.

Retail audits track product availability, pricing trends, and promotional activities across multiple distribution channels. This data provides real-time market intelligence and validates reported sales figures from manufacturer sources.

Expert consultations with veterinary nutritionists, pet food technologists, and industry analysts provide specialized insights into technical developments and regulatory changes affecting market dynamics.

Western Europe dominates the regional market landscape, with Germany, France, and the United Kingdom representing the largest individual markets. These mature economies demonstrate high pet ownership rates and strong consumer spending on premium pet food products. Market penetration in Western European countries averages 68% of households owning pets, with cats representing approximately 42% of total pet population.

Germany leads European markets in terms of both volume and value, driven by strong consumer preferences for high-quality nutrition and willingness to pay premium prices for perceived health benefits. German consumers demonstrate particular interest in organic and natural formulations.

France maintains a sophisticated market characterized by diverse product offerings and strong retail infrastructure. French consumers show preferences for wet food formulations and demonstrate loyalty to established brands with long market presence.

United Kingdom represents a unique market dynamic following Brexit, with evolving regulatory frameworks and supply chain adjustments. British consumers maintain strong preferences for premium products and demonstrate high adoption rates of online purchasing channels.

Southern Europe including Italy and Spain shows rapid growth in premium segment adoption, driven by increasing urbanization and rising disposable incomes. These markets demonstrate growing sophistication in pet care attitudes and spending patterns.

Eastern Europe presents the highest growth potential, with countries like Poland, Czech Republic, and Hungary experiencing rapid market development. Growth rates in Eastern European markets exceed 8% annually, reflecting economic development and changing consumer attitudes toward pet ownership.

Market leadership remains concentrated among several multinational corporations with extensive European operations and established brand portfolios. The competitive environment features both global players and regional specialists competing across different market segments.

Competitive strategies focus on product innovation, brand building, and distribution expansion. Companies invest heavily in research and development to create differentiated products addressing specific consumer needs and preferences.

Private label growth presents challenges to branded manufacturers as major retailers develop high-quality store brands. Private label products now represent approximately 23% of total market volume, with continued growth expected across multiple categories.

Product type segmentation reveals distinct market dynamics across different cat food categories:

By Product Type:

By Price Segment:

By Life Stage:

By Distribution Channel:

Wet food dominance continues across European markets, with consumers valuing the palatability, moisture content, and perceived freshness of canned and pouch formats. Innovation focus in wet food categories emphasizes texture variety, flavor combinations, and convenient packaging solutions.

Dry food evolution incorporates advanced nutrition science with improved digestibility, enhanced palatability, and functional ingredients targeting specific health benefits. Premium dry food formulations compete effectively with wet alternatives through superior convenience and cost-effectiveness.

Treats segment expansion reflects humanization trends as pet owners seek products for training, bonding, and reward purposes. Functional treats incorporating health benefits such as dental care, hairball control, and joint support demonstrate particular growth potential.

Prescription diet growth benefits from increasing veterinary awareness of nutrition’s role in disease management and prevention. These specialized products command premium pricing while requiring professional recommendation and monitoring.

Organic and natural categories show robust growth as consumers seek products with minimal processing and recognizable ingredients. Organic segment growth exceeds 12% annually, reflecting strong consumer demand for transparency and quality assurance.

Grain-free formulations maintain popularity despite regulatory scrutiny, as consumers associate these products with natural feeding patterns and reduced allergen potential. Manufacturers continue developing grain-free options while ensuring nutritional completeness.

Manufacturers benefit from growing market demand and consumer willingness to pay premium prices for perceived quality and health benefits. The expanding market provides opportunities for product line extensions, geographic expansion, and acquisition of smaller innovative brands.

Retailers gain from strong category performance and high inventory turnover rates in pet food sections. The category’s resilience during economic downturns provides stability while premium segments offer attractive profit margins.

Distributors capitalize on growing e-commerce demand and subscription service opportunities. The shift toward online purchasing creates new revenue streams while traditional distribution maintains importance for immediate needs fulfillment.

Consumers receive improved product quality, expanded choice options, and better nutritional outcomes for their pets. Increased competition drives innovation and value improvements across all price segments.

Veterinarians benefit from growing awareness of nutrition’s importance in pet health, creating opportunities for professional consultation services and therapeutic diet recommendations. The expanding prescription diet segment provides additional revenue streams.

Ingredient suppliers experience increased demand for high-quality raw materials, functional ingredients, and innovative protein sources. The premiumization trend supports higher-value ingredient sales and long-term supply relationships.

Pet owners enjoy access to scientifically formulated products that support their cats’ health, longevity, and quality of life. Improved nutrition contributes to reduced veterinary costs and enhanced human-animal bonds.

Strengths:

Weaknesses:

Opportunities:

Threats:

Premiumization acceleration continues driving market evolution as European consumers increasingly prioritize quality over price considerations. This trend supports margin expansion while encouraging innovation in ingredients, formulations, and packaging solutions.

Sustainability integration becomes essential for brand differentiation and consumer appeal. Companies invest in sustainable sourcing, eco-friendly packaging, and carbon-neutral manufacturing processes to meet growing environmental consciousness among pet owners.

Personalization advancement leverages technology to create customized nutrition solutions based on individual cat characteristics, health status, and preferences. MarkWide Research indicates that personalized pet food services demonstrate growth rates exceeding 25% annually in early-adopter markets.

Digital transformation reshapes customer relationships through e-commerce platforms, subscription services, and direct-to-consumer marketing strategies. Social media influence and online reviews significantly impact purchasing decisions and brand perception.

Functional ingredient adoption incorporates probiotics, omega fatty acids, antioxidants, and other health-promoting compounds into mainstream formulations. These ingredients address specific health concerns while supporting premium positioning and pricing.

Transparency demands require clear ingredient sourcing information, manufacturing process details, and nutritional benefit substantiation. Consumers increasingly research products online before purchasing, making transparency a competitive necessity.

Alternative protein exploration includes insect-based proteins, plant-derived ingredients, and novel protein sources addressing sustainability concerns while potentially reducing production costs and environmental impact.

Acquisition activity intensifies as major players seek to expand product portfolios, geographic reach, and technological capabilities through strategic acquisitions of innovative smaller companies and regional brands.

Manufacturing investments focus on automation, quality control improvements, and capacity expansion to meet growing demand while maintaining cost competitiveness. European manufacturers prioritize local production to reduce supply chain risks.

Research partnerships between pet food companies and academic institutions advance understanding of feline nutrition science, leading to evidence-based product development and marketing claims substantiation.

Regulatory developments include updated European Union guidelines for pet food labeling, ingredient approval processes, and marketing claim substantiation requirements. These changes require industry adaptation and compliance investments.

Technology integration incorporates artificial intelligence, data analytics, and Internet of Things solutions to optimize manufacturing processes, supply chain management, and customer relationship management systems.

Sustainability initiatives encompass renewable energy adoption, waste reduction programs, and circular economy principles in manufacturing operations. These efforts address environmental concerns while potentially reducing operational costs.

Distribution partnerships expand between manufacturers and e-commerce platforms, subscription service providers, and veterinary clinic networks to reach consumers through preferred purchasing channels.

Strategic recommendations for market participants emphasize the importance of balancing innovation investments with operational efficiency improvements. Companies should prioritize digital transformation initiatives while maintaining strong traditional retail relationships.

Product development focus should address emerging consumer demands for transparency, sustainability, and functional health benefits. MWR analysis suggests that companies investing in these areas demonstrate superior long-term growth potential compared to those maintaining traditional approaches.

Geographic expansion strategies should prioritize Eastern European markets where economic development creates substantial growth opportunities. However, companies must adapt products and marketing approaches to local preferences and price sensitivities.

Partnership strategies with veterinary professionals, pet specialty retailers, and e-commerce platforms become increasingly important for market access and credibility building. These relationships provide valuable consumer insights and distribution advantages.

Investment priorities should include manufacturing automation, quality control systems, and supply chain resilience improvements. These investments support long-term competitiveness while addressing current market challenges.

Marketing evolution must incorporate digital channels, social media engagement, and educational content creation to reach and influence modern pet owners. Traditional advertising approaches require integration with digital strategies for maximum effectiveness.

Sustainability integration should extend beyond marketing claims to encompass genuine operational improvements in environmental impact, social responsibility, and governance practices. Authentic sustainability efforts create lasting competitive advantages.

Long-term projections indicate sustained market growth driven by demographic trends, urbanization, and evolving consumer attitudes toward pet care. The market is expected to maintain steady expansion while adapting to emerging trends and technological developments.

Innovation trajectories will likely focus on personalized nutrition solutions, alternative protein sources, and functional health benefits. Companies investing in these areas position themselves advantageously for future market leadership.

Digital integration will continue transforming customer relationships and distribution strategies. E-commerce penetration is projected to reach 35% of total sales within the next five years, requiring manufacturers to develop comprehensive omnichannel strategies.

Regulatory evolution may introduce stricter requirements for ingredient sourcing, environmental impact disclosure, and marketing claim substantiation. Proactive compliance strategies will provide competitive advantages in evolving regulatory environments.

Market consolidation is expected to continue as larger companies acquire innovative smaller brands and regional players seek partnerships with multinational corporations for geographic expansion and resource access.

Sustainability requirements will likely become more stringent as environmental consciousness grows among consumers and regulatory bodies. Companies demonstrating genuine commitment to sustainable practices will benefit from enhanced brand reputation and consumer loyalty.

Technology adoption will accelerate across manufacturing, distribution, and customer engagement processes. Artificial intelligence, data analytics, and automation technologies will become essential for maintaining competitiveness in evolving market conditions.

The Europe cat food market represents a dynamic and evolving sector characterized by strong growth fundamentals, increasing consumer sophistication, and continuous innovation. Market participants benefit from rising pet ownership rates, premiumization trends, and growing awareness of feline nutritional requirements across European territories.

Strategic success in this market requires balancing traditional retail relationships with digital transformation initiatives, while maintaining focus on product quality, innovation, and consumer education. Companies that effectively navigate regulatory complexities, supply chain challenges, and competitive pressures will capture disproportionate value creation opportunities.

Future market development will be shaped by sustainability considerations, personalization trends, and technological integration across all business functions. The most successful organizations will be those that anticipate and adapt to these evolving requirements while maintaining operational excellence and customer focus.

Investment opportunities remain attractive for companies with strong innovation capabilities, established brand portfolios, and adaptive strategic approaches. The market’s resilience and growth potential make it an appealing sector for both established players and new entrants with differentiated value propositions.

What is Cat Food?

Cat food refers to food specifically formulated and intended for consumption by cats. It includes various types such as dry kibble, wet canned food, and raw diets, catering to the nutritional needs of felines.

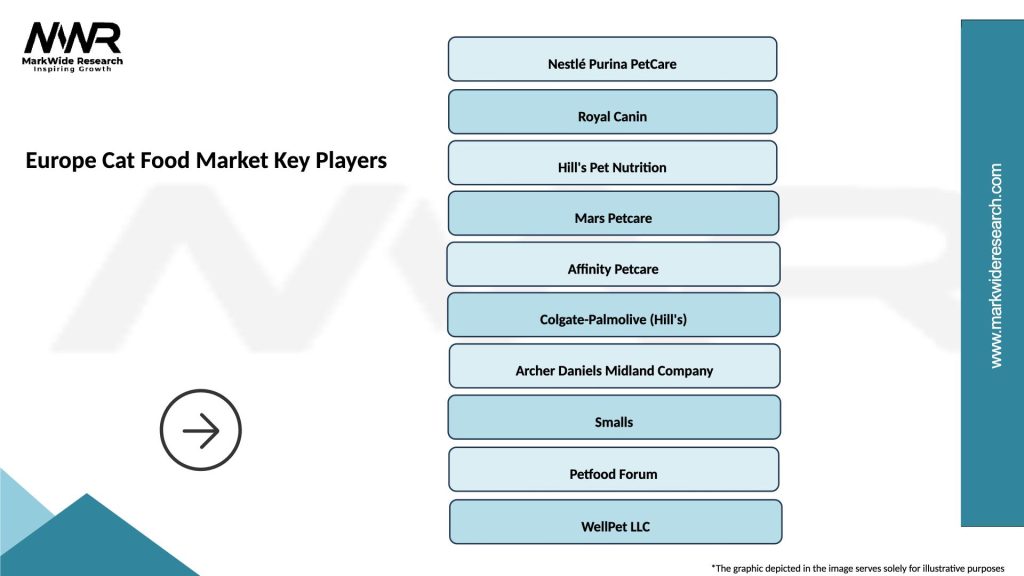

What are the key players in the Europe Cat Food Market?

Key players in the Europe Cat Food Market include Nestlé Purina PetCare, Mars Petcare, and Hill’s Pet Nutrition, among others. These companies dominate the market with a wide range of products tailored to different cat dietary needs.

What are the growth factors driving the Europe Cat Food Market?

The growth of the Europe Cat Food Market is driven by increasing pet ownership, rising awareness of pet nutrition, and the trend towards premium and specialized cat food products. Additionally, the humanization of pets is influencing consumer preferences.

What challenges does the Europe Cat Food Market face?

The Europe Cat Food Market faces challenges such as rising raw material costs, stringent regulations on pet food safety, and competition from private label brands. These factors can impact pricing and product availability.

What opportunities exist in the Europe Cat Food Market?

Opportunities in the Europe Cat Food Market include the growing demand for organic and natural cat food products, innovations in pet food technology, and the expansion of online retail channels. These trends can enhance market reach and consumer engagement.

What trends are shaping the Europe Cat Food Market?

Trends shaping the Europe Cat Food Market include the rise of grain-free and high-protein diets, increased focus on sustainability in packaging, and the incorporation of functional ingredients for health benefits. These trends reflect changing consumer preferences and environmental concerns.

Europe Cat Food Market

| Segmentation Details | Description |

|---|---|

| Product Type | Dry Food, Wet Food, Treats, Raw Food |

| Distribution Channel | Supermarkets, Pet Stores, Online Retail, Specialty Shops |

| Customer Type | Pet Owners, Breeders, Shelters, Veterinarians |

| Packaging Type | Bags, Cans, Pouches, Tubs |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Cat Food Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at