444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe cargo and vehicle screening market represents a critical component of the continent’s comprehensive security infrastructure, encompassing advanced technologies and systems designed to detect threats, contraband, and hazardous materials in commercial vehicles, cargo containers, and transportation hubs. This sophisticated market has experienced remarkable growth driven by increasing security concerns, stringent regulatory requirements, and the need for efficient border control mechanisms across European Union member states.

European security agencies and transportation authorities have significantly expanded their screening capabilities, implementing state-of-the-art detection technologies including X-ray imaging systems, gamma-ray scanners, neutron activation analysis, and advanced explosive detection systems. The market encompasses various screening modalities ranging from stationary portal systems at border crossings to mobile screening units capable of rapid deployment at temporary checkpoints.

Growth dynamics in the European market reflect the region’s commitment to maintaining secure trade corridors while facilitating legitimate commerce. The market has demonstrated consistent expansion with a projected CAGR of 6.8% through the forecast period, driven by technological advancements, increased threat awareness, and substantial investments in critical infrastructure protection. Border security modernization initiatives across European nations have created substantial demand for integrated screening solutions that can process high volumes of cargo while maintaining operational efficiency.

Regional variations in screening requirements reflect diverse security priorities, with Western European nations focusing on sophisticated detection capabilities for established trade routes, while Eastern European countries emphasize rapid deployment systems for emerging transportation corridors. The market’s evolution continues to be shaped by evolving threat landscapes, technological innovations, and the imperative to balance security effectiveness with trade facilitation requirements.

The Europe cargo and vehicle screening market refers to the comprehensive ecosystem of technologies, systems, and services designed to inspect, analyze, and clear commercial vehicles, cargo containers, and transportation assets for security threats, contraband materials, and regulatory compliance across European territories. This market encompasses the entire spectrum of screening solutions from initial threat detection to final clearance authorization.

Screening technologies within this market include non-intrusive inspection systems, radiation detection portals, chemical analysis equipment, biometric verification systems, and integrated command and control platforms that enable real-time threat assessment and response coordination. The market serves multiple stakeholders including customs authorities, border security agencies, port operators, logistics companies, and transportation security organizations.

Operational scope extends beyond traditional border crossings to include inland screening facilities, distribution centers, critical infrastructure protection points, and mobile screening capabilities for special events or emergency response situations. The market encompasses both hardware components such as scanning equipment and software solutions including threat analysis algorithms, database management systems, and automated reporting platforms.

Integration capabilities represent a fundamental aspect of modern screening solutions, enabling seamless data sharing between different agencies, automated threat correlation, and coordinated response protocols that enhance overall security effectiveness while minimizing disruption to legitimate trade and transportation activities.

Market dynamics in the European cargo and vehicle screening sector reflect a mature yet rapidly evolving landscape characterized by technological sophistication, regulatory complexity, and increasing operational demands. The market has established itself as an essential component of European security infrastructure, with comprehensive screening capabilities deployed across major transportation hubs, border crossings, and critical infrastructure facilities.

Technology advancement continues to drive market evolution, with artificial intelligence integration, machine learning algorithms, and automated threat detection capabilities representing key growth areas. European screening systems increasingly incorporate advanced analytics that can identify subtle threat indicators, reduce false alarm rates by 35%, and enhance overall operational efficiency through intelligent automation.

Regulatory frameworks across European Union member states have created standardized screening requirements while allowing flexibility for national security priorities. This regulatory environment has fostered market growth by establishing clear performance standards, certification requirements, and interoperability specifications that enable seamless cross-border operations and technology sharing initiatives.

Investment patterns demonstrate strong commitment to screening infrastructure modernization, with public sector funding complemented by private sector innovation and partnership arrangements. The market benefits from substantial European Union security funding programs, national defense budgets, and commercial investments in supply chain security that collectively support continued market expansion and technological advancement.

Technological convergence represents a defining characteristic of the European screening market, with traditional detection technologies increasingly integrated with advanced analytics, artificial intelligence, and automated decision-making capabilities that enhance threat detection accuracy while reducing operational complexity.

Market segmentation reveals diverse application areas ranging from high-volume commercial screening at major ports to specialized screening for sensitive cargo categories. The market demonstrates particular strength in container screening technologies, with European ports handling significant cargo volumes requiring sophisticated inspection capabilities that can process containers efficiently while maintaining thorough security coverage.

Security threat evolution continues to drive demand for advanced screening capabilities, with European authorities responding to changing threat landscapes through enhanced detection technologies and expanded screening coverage. The persistent threat of terrorism, smuggling activities, and illegal trafficking has created sustained demand for sophisticated screening solutions capable of detecting diverse threat categories.

Regulatory compliance requirements across European Union member states mandate comprehensive screening protocols for international trade, creating consistent demand for certified screening technologies. These regulations establish minimum performance standards, operational procedures, and documentation requirements that drive technology adoption and system upgrades across the screening infrastructure.

Trade volume growth throughout European transportation networks necessitates efficient screening solutions that can process increased cargo volumes without creating bottlenecks or delays. The expansion of e-commerce, international trade agreements, and supply chain globalization has created demand for high-throughput screening systems capable of maintaining security effectiveness at scale.

Technology advancement in detection capabilities, data analytics, and system integration continues to create opportunities for screening system enhancement and modernization. European screening operators increasingly seek solutions that can improve detection accuracy, reduce false alarms, and provide comprehensive threat analysis capabilities that support informed decision-making.

Critical infrastructure protection initiatives across European nations emphasize the importance of comprehensive screening coverage for transportation hubs, logistics facilities, and strategic assets. These protection programs drive demand for integrated screening solutions that can provide layered security coverage while maintaining operational efficiency and minimizing disruption to legitimate activities.

Implementation costs associated with advanced screening technologies represent a significant barrier for many organizations, particularly smaller operators and developing transportation hubs. The substantial capital investment required for comprehensive screening systems, including equipment procurement, installation, training, and ongoing maintenance, can limit adoption rates and delay modernization initiatives.

Operational complexity of modern screening systems requires specialized training, technical expertise, and ongoing support that may strain organizational resources. The integration of multiple detection technologies, data management systems, and automated analysis capabilities creates operational challenges that require significant investment in human resources and technical infrastructure.

Regulatory variations across European nations can create compliance challenges for screening system operators, particularly those managing cross-border operations or multi-national screening networks. Differences in certification requirements, operational procedures, and performance standards can complicate system deployment and increase operational costs.

Privacy concerns related to screening technologies and data collection practices continue to influence market development, with European data protection regulations requiring careful consideration of privacy implications in screening system design and operation. These concerns can limit the deployment of certain technologies and require additional safeguards that increase system complexity.

Technology limitations in current screening systems may restrict detection capabilities for certain threat categories or create operational constraints that impact screening effectiveness. The ongoing evolution of threat techniques requires continuous technology development and system updates that can strain operational budgets and resources.

Artificial intelligence integration presents substantial opportunities for screening system enhancement, with machine learning algorithms capable of improving threat detection accuracy, reducing false alarm rates, and enabling automated analysis of complex screening data. European screening operators increasingly recognize the potential for AI-powered systems to enhance operational efficiency while maintaining high security standards.

Mobile screening solutions represent a growing opportunity segment, with demand increasing for portable and deployable screening systems that can provide flexible security coverage for temporary events, emergency response situations, or remote locations. These solutions offer operational flexibility that complements fixed screening installations and extends security coverage to previously unprotected areas.

Integration services for existing screening infrastructure create opportunities for technology providers to enhance system capabilities through software upgrades, sensor integration, and connectivity improvements. Many European screening facilities seek to modernize existing systems rather than complete replacements, creating demand for integration solutions that can extend system life and improve performance.

Data analytics services represent an emerging opportunity area, with screening operators seeking advanced analysis capabilities that can identify patterns, predict threats, and optimize operational procedures. The growing volume of screening data creates opportunities for specialized analytics services that can extract actionable intelligence from screening operations.

Cross-border cooperation initiatives among European nations create opportunities for standardized screening solutions, shared intelligence platforms, and coordinated threat response capabilities. These cooperation programs drive demand for interoperable screening technologies that can support seamless information sharing and coordinated security operations across national boundaries.

Competitive landscape in the European screening market reflects a combination of established security technology providers, emerging innovation companies, and specialized system integrators. Market dynamics are influenced by technological advancement cycles, regulatory changes, and evolving customer requirements that create both opportunities and challenges for market participants.

Innovation cycles in screening technology continue to accelerate, with new detection capabilities, improved system performance, and enhanced user interfaces driving market evolution. European screening operators increasingly demand solutions that can adapt to changing threat landscapes while providing improved operational efficiency and reduced total cost of ownership.

Partnership arrangements between technology providers, system integrators, and end-users have become increasingly important for market success. These partnerships enable comprehensive solution development, risk sharing, and collaborative innovation that benefits all stakeholders while advancing overall market capabilities.

Market consolidation trends reflect the increasing complexity of screening solutions and the advantages of scale in technology development and system deployment. Larger organizations can invest in research and development, maintain comprehensive service capabilities, and provide integrated solutions that meet diverse customer requirements.

Customer expectations continue to evolve toward more sophisticated, automated, and user-friendly screening solutions that can provide comprehensive security coverage while minimizing operational burden. European screening operators seek systems that can integrate seamlessly with existing infrastructure, provide actionable intelligence, and adapt to changing operational requirements.

Comprehensive analysis of the European cargo and vehicle screening market employs multiple research methodologies to ensure accurate market assessment and reliable forecasting. The research approach combines quantitative data analysis with qualitative insights gathered from industry experts, technology providers, and end-user organizations across European markets.

Primary research activities include structured interviews with key market participants, surveys of screening system operators, and consultations with regulatory authorities and industry associations. These primary sources provide current market insights, technology trends, and operational challenges that inform market analysis and future projections.

Secondary research encompasses analysis of industry reports, regulatory documents, technology specifications, and market data from multiple sources. This secondary research provides historical context, market sizing information, and competitive landscape analysis that supports comprehensive market understanding.

Data validation procedures ensure research accuracy through cross-referencing multiple sources, expert review processes, and statistical analysis techniques. The research methodology emphasizes data quality and reliability to provide actionable insights for market participants and stakeholders.

Market modeling techniques incorporate various factors including technology adoption rates, regulatory impacts, economic conditions, and competitive dynamics to develop realistic market projections. According to MarkWide Research analysis, these modeling approaches provide robust forecasting capabilities that account for market complexity and uncertainty factors.

Western European markets demonstrate mature screening infrastructure with emphasis on technology advancement and system modernization. Countries including Germany, France, and the United Kingdom maintain sophisticated screening capabilities at major transportation hubs, with ongoing investments in next-generation detection technologies and integrated security platforms.

Germany represents the largest European screening market, accounting for approximately 28% market share, driven by extensive transportation networks, major port facilities, and comprehensive border security requirements. German screening operations emphasize technological sophistication, operational efficiency, and integration with broader security infrastructure.

Eastern European markets show rapid growth in screening infrastructure development, with countries including Poland, Czech Republic, and Hungary investing substantially in modern screening capabilities. These markets benefit from European Union funding programs and demonstrate strong growth potential as transportation networks expand and security requirements increase.

Nordic countries maintain specialized screening capabilities adapted to unique geographic and operational requirements, with emphasis on mobile screening solutions and remote monitoring capabilities. These markets demonstrate innovation in screening technology applications and contribute to overall European market development.

Southern European markets including Italy, Spain, and Greece focus on port security and Mediterranean trade route protection, with screening systems designed for high-volume cargo processing and maritime security applications. These markets contribute approximately 22% of regional screening capacity and continue to expand screening infrastructure to support growing trade volumes.

Market leadership in European cargo and vehicle screening reflects a diverse ecosystem of technology providers, system integrators, and specialized service companies. The competitive landscape encompasses both global security technology leaders and regional specialists that serve specific market segments or geographic areas.

Innovation strategies among competitive participants emphasize artificial intelligence integration, improved detection capabilities, and enhanced user interfaces that reduce operational complexity while maintaining security effectiveness. Companies invest substantially in research and development to maintain competitive advantages and address evolving market requirements.

Partnership approaches enable companies to combine complementary capabilities, share development costs, and access new market segments. Strategic alliances between technology providers, system integrators, and service companies create comprehensive solution offerings that meet diverse customer requirements across European markets.

Technology segmentation of the European screening market encompasses multiple detection modalities, each serving specific applications and operational requirements. The market demonstrates diversity in technology approaches, reflecting the varied nature of screening challenges and operational environments across European transportation networks.

By Technology:

By Application:

By End User:

Container screening systems represent the largest market segment, driven by the substantial volume of containerized cargo moving through European ports and transportation networks. These systems must balance thorough inspection capabilities with high-throughput processing requirements, leading to demand for advanced imaging technologies and automated analysis capabilities.

Vehicle screening applications encompass both commercial truck inspection and passenger vehicle screening at border crossings and security checkpoints. This segment demonstrates growth in mobile screening solutions that can be deployed flexibly to address changing security requirements and operational conditions.

Specialized cargo screening for hazardous materials, high-value goods, and sensitive shipments requires advanced detection capabilities and specialized handling procedures. This segment shows particular growth in chemical detection technologies and integrated analysis platforms that can identify diverse threat categories.

Mobile screening solutions have emerged as a significant growth category, with demand increasing for portable systems that can provide temporary security coverage for special events, emergency response situations, or remote locations. These solutions offer operational flexibility that complements fixed screening installations.

Integration services represent an important market category, with many European screening operators seeking to enhance existing systems through software upgrades, sensor additions, and connectivity improvements. This category demonstrates the market’s focus on maximizing return on existing infrastructure investments while improving screening capabilities.

Enhanced security effectiveness represents the primary benefit of advanced screening systems, with modern technologies providing improved threat detection capabilities, reduced false alarm rates, and comprehensive coverage of diverse threat categories. European screening operators report 45% improvement in threat detection accuracy with advanced screening technologies.

Operational efficiency gains through automated screening processes, streamlined workflows, and integrated data management systems enable screening operators to process higher volumes while maintaining security standards. These efficiency improvements reduce operational costs and minimize delays for legitimate cargo and vehicles.

Regulatory compliance benefits include standardized screening procedures, comprehensive documentation capabilities, and automated reporting systems that ensure adherence to European Union security requirements and national regulations. These compliance benefits reduce regulatory risk and support operational certification requirements.

Cost optimization through improved system reliability, reduced maintenance requirements, and enhanced operational efficiency enables screening operators to achieve better return on investment while maintaining high security standards. Modern screening systems demonstrate 30% reduction in total cost of ownership compared to legacy systems.

Intelligence capabilities provided by advanced screening systems enable threat pattern analysis, predictive security insights, and coordinated response planning that enhance overall security effectiveness. These intelligence benefits support strategic security planning and operational decision-making across European screening networks.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration continues to transform European screening operations, with machine learning algorithms enabling automated threat analysis, pattern recognition, and predictive security capabilities. This trend demonstrates significant potential for improving screening effectiveness while reducing operational complexity and human resource requirements.

Cloud-based management systems are increasingly adopted for screening operations, providing centralized control, remote monitoring, and comprehensive data analysis capabilities. European screening operators report 25% improvement in operational efficiency through cloud-based management platforms that enable real-time system optimization and coordinated response capabilities.

Mobile screening deployment represents a growing trend, with demand increasing for portable and rapidly deployable screening systems that can provide flexible security coverage. These mobile solutions complement fixed screening installations and enable security coverage extension to previously unprotected areas or temporary operational requirements.

Multi-modal detection approaches combine multiple screening technologies in integrated systems that provide comprehensive threat analysis capabilities. This trend reflects the increasing sophistication of threat techniques and the need for layered detection approaches that can identify diverse threat categories through complementary detection modalities.

Automated clearance systems streamline screening processes through intelligent analysis algorithms that can automatically clear low-risk cargo and vehicles while flagging potential threats for detailed inspection. This automation trend enables high-throughput screening operations while maintaining security effectiveness and reducing operational costs.

Technology advancement initiatives across European screening markets focus on next-generation detection capabilities, improved system integration, and enhanced user interfaces that reduce operational complexity. Recent developments include advanced imaging algorithms, improved material discrimination capabilities, and automated threat analysis systems.

Regulatory updates from European Union authorities continue to refine screening requirements, establish new performance standards, and promote interoperability among member state screening systems. These regulatory developments drive technology adoption and create opportunities for standardized screening solutions across European markets.

Infrastructure investments by European governments and transportation operators support screening system modernization, capacity expansion, and technology upgrades. Recent investment programs focus on critical infrastructure protection, border security enhancement, and transportation hub security improvements.

Partnership agreements between technology providers, system integrators, and end-users enable collaborative solution development, risk sharing, and comprehensive service delivery. These partnerships facilitate innovation, reduce development costs, and accelerate technology deployment across European screening networks.

Research initiatives supported by European Union funding programs advance screening technology development, threat analysis capabilities, and operational efficiency improvements. MWR analysis indicates these research programs contribute significantly to European screening technology leadership and market competitiveness.

Technology investment strategies should prioritize artificial intelligence integration, automated analysis capabilities, and system interoperability that can provide long-term competitive advantages. European screening operators should focus on solutions that can adapt to evolving threat landscapes while providing operational efficiency improvements.

Partnership development with technology providers, system integrators, and service companies can provide access to advanced capabilities, reduce implementation risks, and enable comprehensive solution deployment. Strategic partnerships should emphasize complementary capabilities, shared risk management, and collaborative innovation approaches.

Training and development programs for screening personnel should emphasize advanced technology operation, threat analysis capabilities, and system integration skills that support effective screening operations. Investment in human resources development ensures optimal system utilization and operational effectiveness.

Regulatory compliance strategies should anticipate evolving European Union requirements, maintain current certification standards, and prepare for future regulatory changes that may impact screening operations. Proactive compliance approaches reduce operational risk and support long-term market participation.

Innovation focus should emphasize user-friendly interfaces, automated operation capabilities, and integrated analysis platforms that can improve screening effectiveness while reducing operational complexity. Innovation investments should address current operational challenges while preparing for future market requirements.

Market evolution in the European cargo and vehicle screening sector will continue to be driven by technological advancement, regulatory development, and evolving security requirements. The market demonstrates strong growth potential with projected expansion at 6.8% CAGR through the forecast period, supported by ongoing infrastructure investment and technology modernization initiatives.

Technology trends indicate continued advancement in artificial intelligence integration, automated analysis capabilities, and system interoperability that will enhance screening effectiveness while reducing operational complexity. European screening systems will increasingly incorporate predictive analytics, machine learning algorithms, and automated decision-making capabilities that improve threat detection accuracy.

Regulatory evolution will continue to shape market development through updated security standards, enhanced interoperability requirements, and expanded screening coverage mandates. European Union initiatives will likely emphasize standardized screening protocols, shared intelligence platforms, and coordinated threat response capabilities that support seamless cross-border security operations.

Investment patterns suggest continued strong support for screening infrastructure modernization, with both public sector funding and private sector investment supporting market growth. European screening operators will increasingly seek integrated solutions that can provide comprehensive security coverage while optimizing operational efficiency and total cost of ownership.

Market opportunities will emerge from artificial intelligence applications, mobile screening solutions, data analytics services, and system integration capabilities that address evolving customer requirements. According to MarkWide Research projections, these opportunity areas will drive market expansion and create new revenue streams for technology providers and service companies operating in European screening markets.

The Europe cargo and vehicle screening market represents a dynamic and essential component of the continent’s security infrastructure, characterized by technological sophistication, regulatory complexity, and continuous evolution in response to changing threat landscapes. The market demonstrates strong growth potential driven by ongoing infrastructure investment, technology advancement, and expanding security requirements across European transportation networks.

Market success will increasingly depend on the ability to integrate advanced technologies, provide comprehensive security coverage, and maintain operational efficiency while adapting to evolving regulatory requirements and threat conditions. European screening operators must balance security effectiveness with operational efficiency, ensuring that screening processes support legitimate trade and transportation while providing robust protection against diverse threat categories.

Future development will be shaped by artificial intelligence integration, automated analysis capabilities, and enhanced system interoperability that can improve screening effectiveness while reducing operational complexity. The market’s continued evolution will require ongoing investment in technology development, human resources, and infrastructure modernization that supports European security objectives while facilitating legitimate commerce and transportation activities across the continent.

What is Cargo And Vehicle Screening?

Cargo and vehicle screening refers to the processes and technologies used to inspect cargo and vehicles for security threats, contraband, and compliance with regulations. This includes the use of X-ray machines, explosive detection systems, and manual inspections in various settings such as airports, seaports, and border crossings.

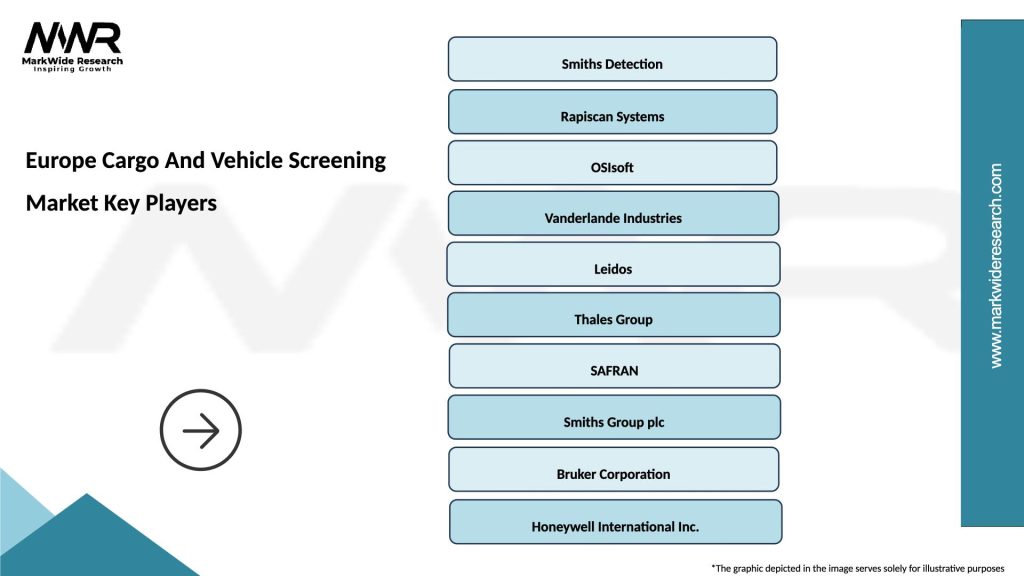

What are the key players in the Europe Cargo And Vehicle Screening Market?

Key players in the Europe Cargo And Vehicle Screening Market include Smiths Detection, Rapiscan Systems, and L3Harris Technologies, among others. These companies provide advanced screening solutions and technologies to enhance security in transportation and logistics.

What are the main drivers of the Europe Cargo And Vehicle Screening Market?

The main drivers of the Europe Cargo And Vehicle Screening Market include increasing security concerns, regulatory requirements for cargo inspections, and the growth of international trade. Additionally, advancements in screening technologies are also contributing to market growth.

What challenges does the Europe Cargo And Vehicle Screening Market face?

Challenges in the Europe Cargo And Vehicle Screening Market include the high costs associated with advanced screening technologies and the need for continuous updates to comply with evolving regulations. Furthermore, the integration of new technologies into existing systems can pose operational difficulties.

What opportunities exist in the Europe Cargo And Vehicle Screening Market?

Opportunities in the Europe Cargo And Vehicle Screening Market include the development of innovative screening technologies, such as AI and machine learning applications, to improve detection rates. Additionally, the increasing focus on supply chain security presents further growth potential for screening solutions.

What trends are shaping the Europe Cargo And Vehicle Screening Market?

Trends shaping the Europe Cargo And Vehicle Screening Market include the adoption of automated screening processes and the integration of advanced imaging technologies. There is also a growing emphasis on sustainability and reducing the environmental impact of screening operations.

Europe Cargo And Vehicle Screening Market

| Segmentation Details | Description |

|---|---|

| Product Type | X-Ray Machines, Explosive Detectors, Metal Detectors, Chemical Analyzers |

| Technology | Computed Tomography, Millimeter Wave, Ion Mobility Spectrometry, Laser Induced Breakdown Spectroscopy |

| End User | Aviation Security, Maritime Security, Customs Authorities, Freight Forwarders |

| Application | Cargo Inspection, Vehicle Inspection, Baggage Screening, Threat Detection |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Cargo And Vehicle Screening Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at