444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe car insurance market represents one of the most mature and sophisticated automotive insurance landscapes globally, characterized by stringent regulatory frameworks, diverse consumer preferences, and rapidly evolving technological integration. European car insurance providers are experiencing significant transformation driven by digitalization, changing mobility patterns, and increased focus on personalized coverage solutions. The market demonstrates robust growth potential with annual growth rates of 4.2% across major European economies, reflecting both regulatory compliance requirements and evolving consumer expectations.

Market dynamics in Europe are heavily influenced by the European Union’s regulatory harmonization efforts, which have created standardized minimum coverage requirements while allowing individual member states to implement additional protections. The region’s car insurance penetration rate exceeds 85% of registered vehicles, making it one of the highest globally. Digital transformation initiatives are reshaping traditional insurance models, with telematics-based policies gaining 23% adoption rates among younger demographics seeking usage-based insurance solutions.

Competitive landscape features established multinational insurers alongside emerging insurtech companies, creating dynamic pricing strategies and innovative product offerings. The market’s maturity is evidenced by sophisticated risk assessment methodologies, comprehensive claims processing systems, and advanced fraud detection capabilities that collectively enhance operational efficiency and customer satisfaction across diverse European markets.

The Europe car insurance market refers to the comprehensive ecosystem of automotive insurance products, services, and regulatory frameworks operating across European Union member states and associated territories. This market encompasses mandatory third-party liability coverage, comprehensive insurance policies, and specialized automotive protection products designed to meet diverse consumer needs while complying with varying national and EU-wide regulatory requirements.

Car insurance in the European context includes multiple coverage types ranging from basic legal compliance policies to comprehensive protection packages covering vehicle damage, theft, personal injury, and third-party liabilities. The market structure reflects Europe’s diverse economic landscape, with premium pricing, coverage options, and regulatory requirements varying significantly between countries while maintaining fundamental EU directive compliance standards.

Market participants include traditional insurance companies, digital-first insurers, comparison platforms, and emerging insurtech solutions that collectively serve over 250 million registered vehicles across European markets. The ecosystem supports various distribution channels including direct sales, broker networks, online platforms, and mobile applications that facilitate policy management and claims processing.

Europe’s car insurance market demonstrates remarkable resilience and adaptability, positioning itself as a global leader in insurance innovation and regulatory compliance. The market benefits from strong regulatory foundations established through EU directives while accommodating diverse national preferences and economic conditions across member states. Digital adoption rates have accelerated significantly, with 67% of new policies now initiated through digital channels, reflecting changing consumer behaviors and technological capabilities.

Key market drivers include mandatory insurance requirements, increasing vehicle ownership, growing awareness of comprehensive coverage benefits, and technological advancements enabling personalized pricing models. The market faces challenges from economic uncertainties, changing mobility patterns including car-sharing and electric vehicle adoption, and intensifying competition from insurtech startups offering streamlined digital experiences.

Strategic opportunities emerge from electric vehicle insurance specialization, telematics-based pricing models, cross-border policy harmonization, and integration with emerging mobility services. The market’s future trajectory indicates continued growth supported by regulatory stability, technological innovation, and evolving consumer expectations for personalized, digitally-enabled insurance solutions.

Market intelligence reveals several critical insights shaping the European car insurance landscape:

Market segmentation reflects diverse consumer needs, vehicle types, and usage patterns across European markets, with comprehensive policies gaining preference over basic coverage options as disposable income increases and awareness of protection benefits grows.

Regulatory compliance serves as the primary market driver, with EU directives mandating minimum third-party liability coverage for all registered vehicles. This regulatory foundation creates a stable demand base while encouraging additional coverage adoption through consumer education and awareness campaigns. Mandatory insurance requirements ensure consistent market participation across all demographic segments and geographic regions.

Economic prosperity in major European markets drives increased vehicle ownership and preference for comprehensive coverage options. Rising disposable incomes enable consumers to invest in enhanced protection, including comprehensive, collision, and specialized coverage for high-value vehicles. Vehicle financing requirements from banks and leasing companies further stimulate demand for full coverage policies.

Technological advancement creates new opportunities for personalized insurance products, usage-based pricing, and enhanced customer experiences. Telematics systems, mobile applications, and digital claims processing reduce operational costs while improving service quality. Data analytics capabilities enable more accurate risk assessment and competitive pricing strategies that benefit both insurers and consumers.

Urbanization trends and changing mobility patterns influence insurance demand, with city dwellers seeking flexible coverage options that accommodate car-sharing, public transportation integration, and occasional vehicle use. Cross-border mobility within the EU creates demand for portable insurance solutions that provide consistent coverage across multiple countries.

Economic uncertainties and periodic financial crises impact consumer spending on discretionary insurance coverage beyond mandatory minimums. During economic downturns, consumers often reduce coverage levels or seek lower-cost alternatives, affecting premium revenues and market growth rates. Unemployment fluctuations directly correlate with insurance policy lapses and reduced coverage selections.

Regulatory complexity across different European markets creates operational challenges for insurers seeking to expand internationally. Varying national requirements, tax structures, and consumer protection laws increase compliance costs and limit standardization benefits. Brexit implications continue affecting UK-EU insurance relationships and cross-border policy arrangements.

Intense competition from both traditional insurers and emerging insurtech companies pressures profit margins and requires continuous innovation investments. Price-based competition can lead to unsustainable pricing practices that affect long-term market stability. Customer acquisition costs continue rising as digital marketing channels become more expensive and competitive.

Changing mobility patterns including increased public transportation use, car-sharing adoption, and remote work arrangements reduce vehicle usage and traditional insurance demand. Autonomous vehicle development creates uncertainty about future liability structures and insurance requirements, affecting long-term strategic planning.

Electric vehicle adoption presents significant opportunities for specialized insurance products addressing unique EV characteristics including battery coverage, charging infrastructure protection, and environmental benefits recognition. EV insurance market growth is projected at 18% annually as adoption accelerates across European markets, creating new revenue streams and competitive advantages for early movers.

Telematics integration enables usage-based insurance models that appeal to safety-conscious drivers and those with limited vehicle usage. These programs offer premium discounts of 15-30% for safe driving behaviors while providing valuable data for risk assessment and customer engagement. IoT connectivity expands beyond basic telematics to include comprehensive vehicle monitoring and predictive maintenance alerts.

Digital ecosystem expansion creates opportunities for integrated financial services, including insurance bundling with banking, investment, and lifestyle products. Cross-selling potential increases customer lifetime value while improving retention rates through comprehensive relationship building. API integrations with automotive manufacturers, dealerships, and mobility service providers streamline customer acquisition and policy management.

Sustainability initiatives align with European environmental goals and consumer preferences, creating opportunities for green insurance products that reward eco-friendly behaviors and vehicle choices. Carbon offset programs and environmental impact tracking add value beyond traditional coverage while supporting corporate social responsibility objectives.

Supply and demand dynamics in the European car insurance market reflect the balance between regulatory requirements, consumer preferences, and competitive pressures. Market saturation in mature segments drives innovation and service differentiation as primary growth strategies. Insurers focus on customer retention and cross-selling rather than pure market share expansion, leading to enhanced service quality and personalized offerings.

Pricing dynamics are influenced by regulatory constraints, competitive pressures, and risk assessment accuracy. Premium optimization through advanced analytics enables more precise risk-based pricing while maintaining regulatory compliance and competitive positioning. Claims inflation affects pricing strategies, with repair costs and medical expenses driving premium adjustments across different coverage categories.

Distribution channel evolution reflects changing consumer preferences for digital interactions and self-service capabilities. Online channel adoption reaches 58% of policy renewals, while traditional broker relationships remain important for complex coverage decisions and claims support. Omnichannel strategies integrate multiple touchpoints to provide seamless customer experiences.

Technological disruption continues reshaping market dynamics through artificial intelligence, machine learning, and blockchain applications. These technologies improve fraud detection, streamline claims processing, and enable new product innovations that differentiate market participants and enhance operational efficiency.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the European car insurance market. Primary research includes structured interviews with industry executives, regulatory officials, consumer focus groups, and technology providers to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research encompasses analysis of regulatory filings, industry reports, financial statements, and academic studies to validate primary findings and provide historical context. Data triangulation methods ensure consistency across multiple information sources and reduce potential biases in market assessment and forecasting.

Quantitative analysis utilizes statistical modeling, trend analysis, and comparative studies across different European markets to identify patterns and project future developments. Market segmentation analysis examines consumer behavior, demographic trends, and purchasing patterns to understand market dynamics and growth drivers.

Qualitative assessment includes expert opinions, industry best practices evaluation, and competitive intelligence gathering to provide strategic insights beyond numerical data. Scenario analysis considers multiple potential futures based on regulatory changes, technological developments, and economic conditions affecting market evolution.

Western European markets including Germany, France, and the United Kingdom represent the largest and most mature segments of the European car insurance landscape. Germany commands approximately 28% market share across European car insurance premiums, driven by high vehicle ownership rates, comprehensive coverage preferences, and strong regulatory frameworks. German market characteristics include sophisticated risk assessment, extensive broker networks, and growing digital adoption among younger demographics.

France demonstrates unique market dynamics with strong state involvement and consumer protection emphasis. French insurance penetration exceeds 92% of registered vehicles, with comprehensive coverage gaining popularity among middle-class consumers. The market benefits from established distribution networks and increasing integration with banking services.

Nordic countries including Sweden, Norway, and Denmark showcase advanced digital adoption and environmental consciousness in insurance purchasing decisions. Nordic market growth is driven by high disposable incomes, extensive vehicle ownership, and preference for comprehensive coverage options. Telematics adoption rates in Nordic markets reach 34%, significantly above European averages.

Eastern European markets present significant growth opportunities with expanding middle classes, increasing vehicle ownership, and evolving regulatory frameworks. Poland and Czech Republic lead regional growth with annual expansion rates of 6.8%, driven by economic development and EU integration benefits. These markets show strong potential for digital insurance solutions and international insurer expansion.

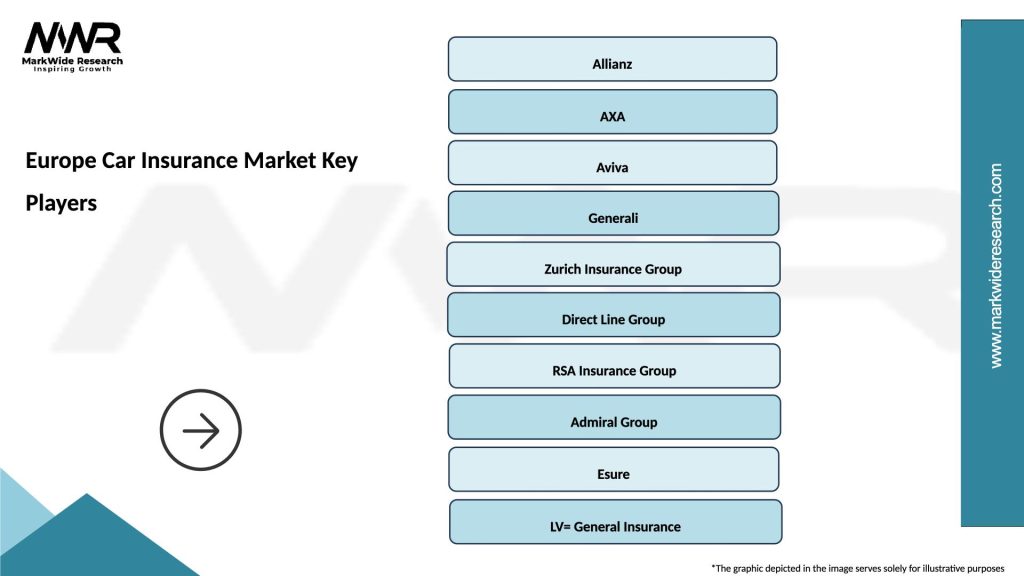

Market leadership in European car insurance is distributed among several major players, each with distinct competitive advantages and regional strengths:

Competitive strategies focus on digital transformation, customer experience enhancement, and product innovation rather than pure price competition. Market consolidation continues through strategic acquisitions and partnerships that expand geographic reach and technological capabilities.

Insurtech companies challenge traditional players with streamlined digital experiences, usage-based pricing models, and innovative product offerings. These emerging competitors force established insurers to accelerate digital transformation and improve customer engagement strategies.

By Coverage Type:

By Vehicle Type:

By Distribution Channel:

Comprehensive coverage demonstrates the strongest growth trajectory across European markets, driven by increasing consumer awareness of protection benefits and rising vehicle values. Premium comprehensive policies show annual growth rates of 5.7%, outpacing basic coverage segments as disposable incomes increase and consumers prioritize financial protection.

Usage-based insurance emerges as a high-growth category, particularly appealing to younger demographics and environmentally conscious consumers. Telematics-based policies offer significant premium savings for safe drivers while providing valuable data for risk assessment and customer engagement. This category benefits from advancing IoT technology and increasing consumer acceptance of data sharing for insurance benefits.

Electric vehicle insurance represents the fastest-growing specialty segment, with annual expansion rates exceeding 22% as EV adoption accelerates across European markets. These policies require specialized knowledge of electric vehicle technology, battery systems, and charging infrastructure, creating competitive advantages for insurers developing EV expertise.

Commercial vehicle insurance shows steady growth driven by e-commerce expansion, last-mile delivery services, and increasing business vehicle utilization. Fleet management integration becomes increasingly important as businesses seek comprehensive solutions combining insurance, telematics, and operational efficiency tools.

Cross-border coverage gains importance as European mobility increases and temporary relocations become more common. Policies offering seamless coverage across multiple EU countries appeal to international professionals, frequent travelers, and businesses with multi-country operations.

Insurance Companies benefit from stable regulatory frameworks, diverse market opportunities, and technological advancement possibilities. Market maturity provides predictable demand patterns while digital transformation enables operational efficiency improvements and enhanced customer experiences. Risk diversification across multiple European markets reduces exposure to localized economic fluctuations and regulatory changes.

Consumers gain access to competitive pricing, comprehensive coverage options, and improved service quality through digital innovation. Regulatory protection ensures fair treatment, transparent pricing, and standardized minimum coverage requirements across EU markets. Product innovation provides personalized solutions matching individual needs and preferences while maintaining affordability.

Regulatory Authorities achieve consumer protection objectives while promoting market competition and innovation. Standardization efforts reduce regulatory complexity and enable cross-border mobility while preserving national market characteristics. Digital transformation improves market transparency and reduces fraudulent activities through enhanced monitoring capabilities.

Technology Providers find expanding opportunities in telematics, artificial intelligence, blockchain, and mobile application development. Insurance industry digitalization creates demand for innovative solutions that improve operational efficiency, customer experience, and risk assessment accuracy. Partnership opportunities with established insurers provide market access and scaling potential for technology companies.

Automotive Industry benefits from integrated insurance solutions that enhance vehicle sales and customer relationships. Manufacturer partnerships with insurers create value-added services and competitive differentiation in crowded automotive markets. Connected vehicle technology enables new insurance products and services that leverage vehicle data for improved risk assessment and customer engagement.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-first customer experience becomes the standard expectation across all demographic segments, with mobile applications and online platforms handling 72% of customer interactions. Self-service capabilities expand beyond basic policy management to include claims reporting, document submission, and real-time claim status tracking through intuitive digital interfaces.

Artificial intelligence integration transforms underwriting, claims processing, and fraud detection capabilities. Machine learning algorithms analyze vast datasets to improve risk assessment accuracy and enable dynamic pricing adjustments based on real-time risk factors. Chatbot technology handles routine customer inquiries while freeing human agents for complex problem resolution.

Sustainability initiatives influence product development, operational practices, and customer engagement strategies. Carbon-neutral insurance products appeal to environmentally conscious consumers while supporting corporate social responsibility objectives. Green vehicle discounts and eco-friendly claims processing reduce environmental impact while attracting sustainability-focused customers.

Personalization advancement through data analytics enables customized coverage recommendations, pricing optimization, and targeted marketing communications. Behavioral analytics identify customer preferences and risk profiles to deliver relevant product suggestions and proactive service interventions that enhance satisfaction and retention rates.

Ecosystem partnerships expand beyond traditional insurance boundaries to include automotive manufacturers, technology companies, and mobility service providers. These collaborations create integrated solutions that address comprehensive customer needs while generating new revenue streams and competitive advantages.

Regulatory harmonization continues advancing through EU initiatives aimed at standardizing insurance requirements and facilitating cross-border coverage. Digital insurance directives promote electronic policy management and claims processing while maintaining consumer protection standards across member states.

Merger and acquisition activity intensifies as traditional insurers acquire insurtech companies to accelerate digital transformation and access innovative technologies. Strategic partnerships between established insurers and technology providers create hybrid solutions combining traditional expertise with digital innovation capabilities.

Telematics program expansion accelerates across European markets, with major insurers launching usage-based insurance options targeting safety-conscious drivers and limited-use vehicle owners. MarkWide Research analysis indicates telematics adoption growing at 28% annually as consumer acceptance increases and technology costs decrease.

Electric vehicle insurance specialization emerges as a key differentiator, with insurers developing expertise in EV technology, battery systems, and charging infrastructure coverage. Manufacturer partnerships create integrated insurance solutions offered at point of vehicle purchase, streamlining customer acquisition and improving coverage adoption rates.

Blockchain pilot programs explore applications in claims processing, fraud prevention, and cross-border policy management. These initiatives aim to reduce administrative costs, improve transparency, and enable automated claims settlement for routine incidents through smart contract technology.

Digital transformation acceleration should remain the top strategic priority for European car insurers seeking competitive advantage and operational efficiency. Mobile-first development and artificial intelligence integration will become essential capabilities rather than optional enhancements as customer expectations continue evolving toward seamless digital experiences.

Electric vehicle expertise development presents immediate opportunities for market differentiation and revenue growth. Insurers should invest in EV technology training, specialized coverage development, and manufacturer partnerships to capture this rapidly expanding market segment before competitors establish dominant positions.

Data analytics capabilities require continuous investment and enhancement to support personalized pricing, improved risk assessment, and predictive customer service. Advanced analytics platforms enable competitive advantages through more accurate underwriting and targeted product development that meets specific customer needs.

Cross-border expansion strategies should focus on Eastern European markets showing strong growth potential and increasing insurance penetration rates. Market entry approaches should consider local partnerships, regulatory compliance requirements, and cultural preferences to ensure successful expansion initiatives.

Sustainability integration will become increasingly important for brand positioning and customer attraction, particularly among younger demographics prioritizing environmental responsibility. Green insurance products and carbon-neutral operations should be developed as core business strategies rather than peripheral marketing initiatives.

Market evolution over the next decade will be characterized by continued digital transformation, regulatory harmonization, and technological innovation that reshapes traditional insurance models. Growth projections indicate sustained expansion at 4.5% annually driven by increasing vehicle ownership, comprehensive coverage adoption, and emerging market segments including electric vehicles and usage-based insurance.

Technology integration will accelerate through artificial intelligence, Internet of Things connectivity, and blockchain applications that improve operational efficiency and customer experience. Autonomous vehicle development will gradually influence liability structures and coverage requirements, though significant impact remains several years away as regulatory frameworks and technology adoption evolve.

Regulatory development will continue promoting consumer protection while enabling innovation and cross-border mobility within European markets. Digital insurance regulations will standardize electronic processes and data protection requirements while maintaining competitive market dynamics and consumer choice.

Competitive landscape will feature continued consolidation among traditional insurers alongside growing influence of insurtech companies offering specialized solutions and digital-native experiences. MWR analysis suggests successful market participants will combine traditional insurance expertise with advanced technology capabilities and customer-centric service delivery.

Sustainability focus will intensify as environmental regulations tighten and consumer preferences shift toward eco-friendly products and services. Insurance companies integrating sustainability into core business strategies will gain competitive advantages and appeal to increasingly environmentally conscious customer segments across European markets.

The Europe car insurance market stands at a pivotal transformation point, balancing traditional strengths with innovative technologies and evolving consumer expectations. Market maturity provides stability and predictable demand patterns while creating opportunities for differentiation through digital innovation, personalized products, and enhanced customer experiences that set new industry standards.

Regulatory frameworks continue supporting market growth through consumer protection standards and cross-border harmonization efforts that facilitate expansion and competition. The combination of mandatory coverage requirements and increasing preference for comprehensive protection ensures sustained demand growth across diverse European markets with varying economic conditions and consumer preferences.

Technology adoption will remain the primary driver of competitive advantage, with successful insurers investing in artificial intelligence, telematics, mobile platforms, and data analytics capabilities that improve operational efficiency and customer satisfaction. Digital transformation initiatives must balance innovation with regulatory compliance and consumer trust to achieve sustainable competitive positioning.

Future success in the European car insurance market will depend on adaptability, customer focus, and strategic technology investments that address evolving mobility patterns, environmental consciousness, and digital service expectations. Companies positioning themselves as comprehensive mobility partners rather than traditional insurers will capture the greatest opportunities in this dynamic and evolving marketplace.

What is Car Insurance?

Car insurance is a contract between a vehicle owner and an insurance company that provides financial protection against physical damage or bodily injury resulting from traffic collisions, theft, and other incidents. It typically covers liability, collision, and comprehensive damages.

What are the key players in the Europe Car Insurance Market?

Key players in the Europe Car Insurance Market include Allianz, AXA, and Zurich Insurance Group, which offer a range of car insurance products tailored to different consumer needs. These companies compete on pricing, coverage options, and customer service, among others.

What are the main drivers of growth in the Europe Car Insurance Market?

The growth of the Europe Car Insurance Market is driven by factors such as increasing vehicle ownership, rising awareness of road safety, and the growing demand for comprehensive coverage options. Additionally, advancements in technology and telematics are enhancing customer engagement and policy customization.

What challenges does the Europe Car Insurance Market face?

The Europe Car Insurance Market faces challenges such as regulatory changes, increasing competition, and the impact of economic fluctuations on consumer spending. Additionally, the rise of alternative mobility solutions may affect traditional car insurance models.

What opportunities exist in the Europe Car Insurance Market?

Opportunities in the Europe Car Insurance Market include the integration of digital technologies for policy management and claims processing, as well as the potential for innovative products catering to electric and autonomous vehicles. Insurers can also explore partnerships with tech companies to enhance service delivery.

What trends are shaping the Europe Car Insurance Market?

Trends shaping the Europe Car Insurance Market include the increasing use of artificial intelligence for risk assessment and claims handling, the rise of usage-based insurance models, and a growing emphasis on sustainability in insurance practices. These trends are influencing how insurers develop products and engage with customers.

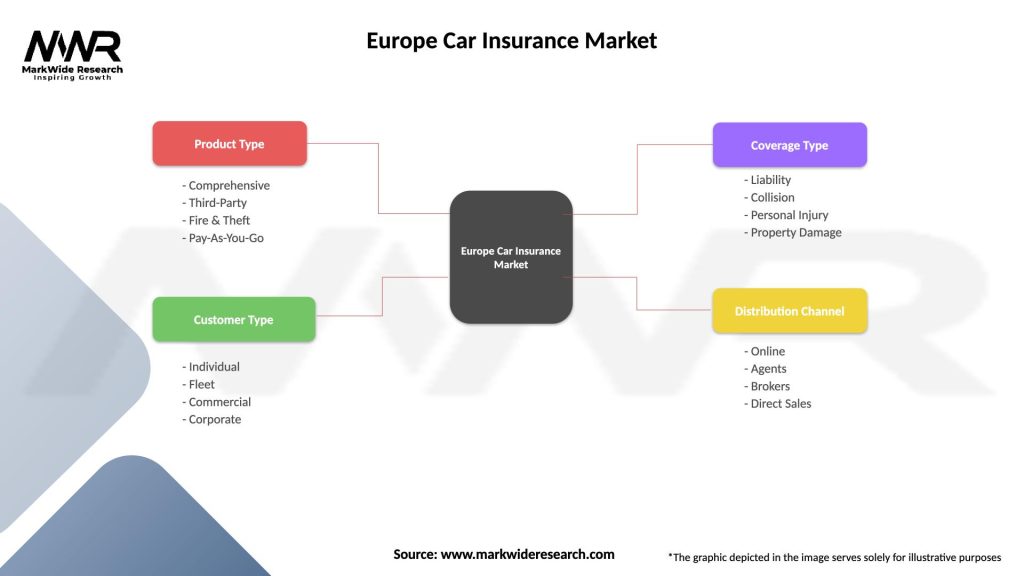

Europe Car Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Comprehensive, Third-Party, Fire & Theft, Pay-As-You-Go |

| Customer Type | Individual, Fleet, Commercial, Corporate |

| Coverage Type | Liability, Collision, Personal Injury, Property Damage |

| Distribution Channel | Online, Agents, Brokers, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Car Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at