444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe capital exchange ecosystem market represents a sophisticated network of financial institutions, trading platforms, regulatory frameworks, and technological infrastructure that facilitates the exchange of capital across European markets. This comprehensive ecosystem encompasses traditional stock exchanges, alternative trading systems, electronic communication networks, and emerging digital asset platforms that collectively form the backbone of European financial markets.

Market dynamics within the European capital exchange ecosystem have experienced significant transformation over the past decade, driven by regulatory harmonization through MiFID II, technological advancement, and increasing demand for cross-border investment opportunities. The ecosystem demonstrates robust growth with annual trading volumes increasing by 12.5% across major European exchanges, reflecting enhanced market liquidity and investor confidence.

Digital transformation continues to reshape the landscape, with electronic trading now accounting for over 85% of total trading activity across European capital markets. This shift toward automation and algorithmic trading has enhanced market efficiency while creating new opportunities for fintech innovation and regulatory technology solutions.

Regulatory convergence across European Union member states has strengthened market integration, with harmonized trading rules and transparency requirements fostering increased cross-border capital flows. The ecosystem benefits from standardized reporting mechanisms and unified market surveillance systems that enhance investor protection and market integrity.

The Europe capital exchange ecosystem market refers to the interconnected network of financial market infrastructure, trading venues, intermediaries, and supporting services that enable the efficient exchange of capital instruments across European jurisdictions. This ecosystem encompasses primary and secondary markets for equities, bonds, derivatives, and alternative investments, supported by clearing and settlement systems, market data providers, and regulatory oversight mechanisms.

Core components of this ecosystem include regulated exchanges, multilateral trading facilities, systematic internalisers, and over-the-counter markets that collectively provide diverse trading venues for institutional and retail investors. The ecosystem operates under unified European regulatory frameworks while accommodating local market characteristics and investor preferences across different member states.

Technological infrastructure forms the foundation of modern capital exchange operations, incorporating high-frequency trading systems, blockchain technology, artificial intelligence, and cloud computing solutions that enhance market efficiency, reduce transaction costs, and improve risk management capabilities throughout the ecosystem.

Strategic positioning of the European capital exchange ecosystem reflects its role as a global financial hub, competing effectively with other major markets while maintaining distinct advantages in regulatory stability, market depth, and technological innovation. The ecosystem demonstrates resilience through diverse revenue streams and adaptive business models that respond effectively to changing market conditions.

Growth trajectories indicate sustained expansion across multiple segments, with particular strength in sustainable finance products, digital asset integration, and cross-border trading services. MarkWide Research analysis reveals that environmental, social, and governance focused trading products have experienced growth rates exceeding 18% annually, reflecting evolving investor priorities and regulatory support for sustainable finance initiatives.

Competitive advantages of the European ecosystem include comprehensive regulatory frameworks, advanced technological infrastructure, deep liquidity pools, and strong institutional investor base. These factors combine to create a robust trading environment that attracts both domestic and international capital flows while maintaining high standards of market integrity and investor protection.

Innovation drivers continue to reshape market structure through fintech integration, regulatory technology adoption, and emerging asset class development. The ecosystem demonstrates strong adaptability to technological change while maintaining stability and reliability that institutional investors require for long-term capital allocation decisions.

Market structure evolution reveals several critical insights that define the current landscape and future trajectory of European capital exchange ecosystems:

Technological advancement serves as the primary catalyst for ecosystem growth, with artificial intelligence, machine learning, and blockchain technologies revolutionizing trading operations, settlement processes, and regulatory compliance mechanisms. These innovations reduce operational costs while enhancing market transparency and efficiency.

Regulatory support through initiatives such as the Capital Markets Union and MiFID II implementation has created favorable conditions for market development, cross-border integration, and innovation adoption. Harmonized regulations reduce compliance costs while maintaining high standards of market integrity and investor protection.

Institutional demand for sophisticated trading solutions drives continuous innovation in execution algorithms, risk management systems, and market data analytics. Large asset managers and pension funds require advanced capabilities for portfolio optimization and regulatory reporting, creating opportunities for technology providers and service vendors.

Sustainable finance momentum reflects growing investor focus on environmental, social, and governance factors, driving demand for green bonds, sustainability-linked securities, and ESG-compliant investment products. This trend creates new market segments and revenue opportunities for exchange operators and intermediaries.

Digital transformation across financial services accelerates adoption of cloud computing, application programming interfaces, and automated trading systems that enhance operational efficiency while reducing manual intervention and associated risks.

Regulatory complexity presents ongoing challenges as market participants navigate evolving compliance requirements, reporting obligations, and cross-border regulatory differences that increase operational costs and implementation timelines for new products and services.

Cybersecurity threats pose significant risks to market infrastructure, requiring substantial investments in security systems, monitoring capabilities, and incident response procedures. The interconnected nature of capital exchange ecosystems amplifies potential impact from security breaches or system failures.

Market volatility during economic uncertainty can reduce trading volumes, impact revenue streams, and create operational challenges for exchange operators and intermediaries. Extreme market conditions may strain system capacity and risk management capabilities.

Competition intensity from alternative trading systems, dark pools, and international exchanges creates pressure on traditional revenue models while requiring continuous investment in technology and service enhancement to maintain market share.

Implementation costs for new technologies, regulatory compliance systems, and infrastructure upgrades require significant capital investments that may strain resources, particularly for smaller market participants and emerging trading venues.

Digital asset integration presents substantial growth opportunities as traditional exchanges develop capabilities for cryptocurrency trading, digital securities, and tokenized assets. This convergence creates new revenue streams while attracting technology-focused investors and trading firms.

Artificial intelligence applications offer potential for enhanced market surveillance, predictive analytics, and automated compliance monitoring that improve operational efficiency while reducing regulatory risks and compliance costs.

Cross-border expansion through strategic partnerships, technology sharing agreements, and regulatory cooperation enables European exchanges to access international markets while offering global investors enhanced access to European capital markets.

Sustainable finance products continue expanding as regulatory support and investor demand drive development of green bonds, carbon credits, and ESG-focused investment vehicles that create new trading opportunities and market segments.

Data analytics services represent growing revenue potential as market participants seek sophisticated insights for investment decisions, risk management, and regulatory compliance. Advanced analytics capabilities create competitive advantages and additional income streams.

Competitive forces within the European capital exchange ecosystem reflect ongoing tension between collaboration and competition as market participants balance the benefits of standardization and interoperability against the need for differentiation and competitive advantage.

Technology adoption cycles demonstrate accelerating pace of innovation as exchanges and trading venues invest heavily in next-generation systems that support high-frequency trading, real-time risk management, and automated compliance monitoring. These investments enhance market quality while creating barriers to entry for smaller competitors.

Regulatory evolution continues shaping market structure through ongoing policy development, enforcement actions, and international coordination efforts that influence trading patterns, market access, and operational requirements across the ecosystem.

Investor behavior patterns show increasing sophistication in trading strategies, risk management approaches, and technology utilization that drive demand for advanced execution capabilities and comprehensive market data services.

Revenue diversification strategies among exchange operators include expansion into data services, technology licensing, regulatory reporting solutions, and value-added services that reduce dependence on traditional trading fees while creating sustainable growth opportunities.

Comprehensive analysis of the European capital exchange ecosystem market employs multiple research methodologies to ensure accuracy, completeness, and reliability of findings. Primary research includes extensive interviews with exchange executives, technology providers, regulatory officials, and institutional investors across major European financial centers.

Secondary research incorporates analysis of regulatory filings, exchange statistics, industry reports, and academic studies that provide quantitative data and qualitative insights into market trends, competitive dynamics, and technological developments affecting the ecosystem.

Data validation processes include cross-referencing multiple sources, statistical analysis of trading volumes and market share data, and verification of findings through expert consultations and industry feedback sessions.

Market modeling techniques utilize econometric analysis, scenario planning, and trend extrapolation to develop projections and identify key factors influencing future market development and competitive positioning.

Stakeholder engagement through surveys, focus groups, and expert panels provides insights into market participant perspectives, technology adoption patterns, and strategic priorities that inform analysis and recommendations.

United Kingdom maintains its position as a leading European financial center despite Brexit implications, with London-based exchanges and trading venues continuing to attract international capital flows. The region demonstrates market share of approximately 35% in European equity trading volumes, supported by advanced technology infrastructure and deep institutional investor base.

Germany represents the largest continental European market, with Frankfurt serving as a major trading hub for both domestic and international securities. German exchanges benefit from strong industrial base, robust regulatory framework, and growing sustainable finance sector that attracts environmentally conscious investors.

France demonstrates significant market presence through Euronext operations and strong government bond trading activities. The French market shows particular strength in derivatives trading and sustainable finance products, with green bond issuance growing at 22% annually.

Netherlands serves as a key European trading center through Amsterdam-based operations, benefiting from favorable regulatory environment and strategic location for international market access. The Dutch market shows strong performance in technology sector listings and cross-border trading activities.

Nordic region including Sweden, Denmark, and Finland demonstrates innovation leadership in sustainable finance and technology adoption, with ESG-focused products representing over 40% of new listings in recent periods.

Southern Europe markets including Italy and Spain show growing integration with broader European ecosystem while maintaining distinct characteristics in government bond trading and retail investor participation patterns.

Market leadership in the European capital exchange ecosystem reflects diverse competitive dynamics across different segments and geographic regions:

Strategic positioning among competitors emphasizes technology innovation, regulatory compliance capabilities, and value-added services that differentiate offerings while maintaining cost competitiveness in core trading services.

By Trading Venue Type:

By Asset Class:

By Technology Platform:

Equity Trading Segment demonstrates robust growth driven by increased retail investor participation and institutional portfolio rebalancing activities. Electronic trading platforms have captured over 90% market share in equity transactions, with algorithmic trading strategies becoming increasingly sophisticated and prevalent among professional investors.

Fixed Income Markets show gradual transition toward electronic trading, though voice-based transactions remain significant for large institutional trades and complex securities. Government bond trading benefits from central bank policies and increased transparency requirements that enhance market liquidity and price discovery mechanisms.

Derivatives Trading experiences strong growth in both exchange-traded and over-the-counter segments, with particular strength in interest rate and equity index products. Risk management applications drive institutional demand while regulatory requirements favor centrally cleared derivatives over bilateral arrangements.

Sustainable Finance Category emerges as fastest-growing segment with MWR data indicating annual growth rates exceeding 25% for green bonds and ESG-focused investment products. This category benefits from regulatory support, institutional mandates, and growing retail investor awareness of environmental and social issues.

Technology Services Segment provides critical infrastructure supporting trading operations, including market data distribution, connectivity services, and regulatory reporting solutions. This segment demonstrates stable revenue growth and high barriers to entry due to technical complexity and regulatory requirements.

Exchange Operators benefit from diversified revenue streams, economies of scale in technology investments, and opportunities for international expansion through strategic partnerships and cross-border listings. Advanced technology platforms enable cost-effective operations while supporting innovative product development.

Institutional Investors gain access to deep liquidity pools, sophisticated execution algorithms, and comprehensive risk management tools that enhance portfolio performance while reducing transaction costs. Regulatory transparency requirements provide improved market surveillance and investor protection.

Technology Providers experience growing demand for trading systems, market data solutions, and regulatory compliance tools that support ecosystem operations. Cloud computing adoption creates opportunities for scalable, cost-effective service delivery models.

Retail Investors benefit from improved market access through digital platforms, reduced trading costs, and enhanced transparency in pricing and execution quality. Educational resources and analytical tools support informed investment decision-making.

Regulatory Authorities utilize advanced surveillance systems and standardized reporting mechanisms that enhance market oversight capabilities while reducing regulatory burden through harmonized requirements across jurisdictions.

Fintech Companies find opportunities to integrate innovative solutions into established market infrastructure, creating value-added services and improving operational efficiency across the ecosystem.

Strengths:

Weaknesses:

Opportunities:

Threats:

Algorithmic Trading Dominance continues expanding as institutional investors adopt sophisticated execution strategies that optimize trade timing, minimize market impact, and reduce transaction costs. Machine learning applications enhance algorithm performance while regulatory requirements ensure appropriate risk controls.

Sustainable Finance Integration accelerates across all market segments, with exchanges developing specialized platforms for green bonds, carbon credits, and ESG-compliant securities. This trend reflects both regulatory requirements and evolving investor preferences toward responsible investing.

Real-time Risk Management becomes increasingly critical as trading volumes and market volatility create potential for rapid loss accumulation. Advanced monitoring systems provide immediate alerts and automated risk controls that protect both individual participants and overall market stability.

Data Monetization Strategies expand beyond traditional market data sales to include analytics services, research products, and customized information solutions that serve diverse client needs while creating additional revenue streams for exchange operators.

Cloud Computing Adoption accelerates as market participants seek scalable, cost-effective technology solutions that support business growth while maintaining security and regulatory compliance requirements.

Cross-border Collaboration increases through strategic partnerships, technology sharing agreements, and regulatory cooperation initiatives that enhance market integration while preserving local market characteristics and investor preferences.

Regulatory Evolution through MiFID II implementation and ongoing Capital Markets Union initiatives has fundamentally reshaped market structure, transparency requirements, and investor protection mechanisms across European capital markets.

Technology Partnerships between traditional exchanges and fintech companies have accelerated innovation in trading systems, market data analytics, and regulatory compliance solutions that enhance operational efficiency and competitive positioning.

Sustainable Finance Initiatives including dedicated green bond segments, ESG data integration, and sustainability-linked derivatives have created new market categories while supporting environmental and social policy objectives.

Digital Asset Exploration by major exchanges reflects growing institutional interest in cryptocurrency trading and digital securities, with pilot programs and regulatory discussions paving the way for broader adoption.

Consolidation Activities among exchange operators and technology providers have created larger, more diversified organizations capable of competing effectively in global markets while achieving operational efficiencies.

Cybersecurity Enhancements across market infrastructure include advanced threat detection systems, incident response protocols, and industry-wide information sharing initiatives that strengthen overall ecosystem resilience.

Technology Investment Priorities should focus on artificial intelligence applications, cloud computing migration, and cybersecurity enhancements that improve operational efficiency while maintaining regulatory compliance and market integrity standards.

Strategic Partnerships with fintech companies, data providers, and international exchanges can accelerate innovation adoption while expanding market reach and service capabilities beyond traditional trading venue operations.

Sustainable Finance Development represents critical growth opportunity requiring dedicated resources for product development, market education, and regulatory engagement to capture increasing investor demand for ESG-compliant investment options.

Risk Management Enhancement through real-time monitoring systems, stress testing capabilities, and scenario analysis tools becomes increasingly important as market complexity and interconnectedness continue expanding.

Regulatory Engagement with policymakers and industry associations helps shape future regulatory development while ensuring compliance requirements support rather than hinder innovation and market development objectives.

Client Experience Improvement through user interface enhancements, educational resources, and personalized service offerings can differentiate market participants while building stronger, more sustainable client relationships.

Growth projections for the European capital exchange ecosystem indicate continued expansion driven by technology adoption, sustainable finance development, and increasing cross-border investment flows. MarkWide Research analysis suggests the ecosystem will experience compound annual growth rates of 8-10% over the next five years, supported by regulatory stability and ongoing innovation initiatives.

Technology transformation will accelerate through artificial intelligence integration, blockchain adoption, and cloud computing migration that enhance operational efficiency while reducing costs and improving service quality. These developments create competitive advantages for early adopters while establishing new industry standards.

Sustainable finance expansion is expected to continue at rapid pace, with ESG-focused products potentially representing over 50% of new issuance within the next decade. This trend reflects both regulatory requirements and fundamental shifts in investor preferences toward responsible investing approaches.

Digital asset integration will likely progress gradually as regulatory frameworks develop and institutional investor acceptance increases. Traditional exchanges are well-positioned to capture this opportunity through their existing infrastructure and regulatory relationships.

Market consolidation may continue as smaller participants seek scale advantages while larger organizations pursue geographic expansion and service diversification strategies that enhance competitive positioning in global markets.

Innovation acceleration through fintech partnerships, regulatory sandboxes, and technology incubation programs will drive continuous evolution in trading systems, risk management capabilities, and client service offerings that define future market leadership.

The European capital exchange ecosystem market demonstrates remarkable resilience and adaptability in navigating complex regulatory environments, technological disruption, and evolving investor preferences. Strong fundamentals including comprehensive regulatory frameworks, advanced technology infrastructure, and deep institutional investor base position the ecosystem for continued growth and innovation.

Strategic opportunities in sustainable finance, digital asset integration, and technology advancement create multiple pathways for market participants to enhance competitive positioning while contributing to overall ecosystem development. Success requires balanced investment in innovation and operational excellence while maintaining high standards of market integrity and investor protection.

Future success will depend on continued collaboration between market participants, regulators, and technology providers to address emerging challenges while capitalizing on growth opportunities. The ecosystem’s ability to adapt to changing market conditions while preserving core strengths in stability, transparency, and efficiency will determine its long-term competitive position in global capital markets.

What is Europe Capital Exchange Ecosystem?

The Europe Capital Exchange Ecosystem refers to the interconnected network of financial markets, institutions, and participants that facilitate the trading of capital assets in Europe. This ecosystem includes stock exchanges, investment banks, asset managers, and regulatory bodies that work together to ensure efficient capital flow and investment opportunities.

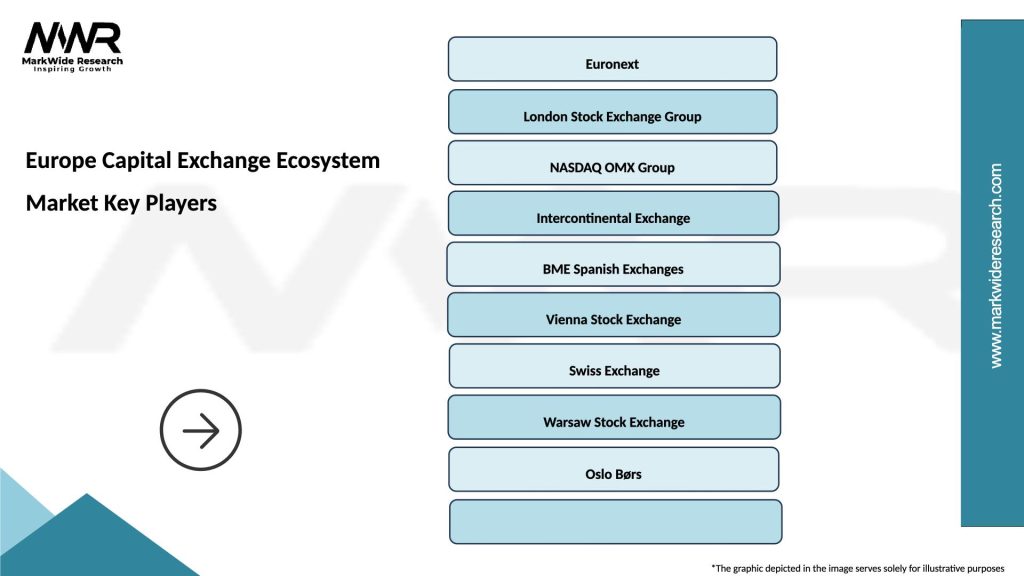

What are the key players in the Europe Capital Exchange Ecosystem Market?

Key players in the Europe Capital Exchange Ecosystem Market include major stock exchanges like Euronext and Deutsche Börse, as well as investment firms such as BlackRock and UBS. These companies play crucial roles in facilitating trading, providing liquidity, and managing investments, among others.

What are the growth factors driving the Europe Capital Exchange Ecosystem Market?

The growth of the Europe Capital Exchange Ecosystem Market is driven by increasing investor participation, advancements in financial technology, and the rising demand for diversified investment products. Additionally, regulatory reforms aimed at enhancing market transparency and efficiency contribute to this growth.

What challenges does the Europe Capital Exchange Ecosystem Market face?

The Europe Capital Exchange Ecosystem Market faces challenges such as regulatory compliance complexities, market volatility, and competition from alternative trading platforms. These factors can impact investor confidence and the overall stability of the market.

What opportunities exist in the Europe Capital Exchange Ecosystem Market?

Opportunities in the Europe Capital Exchange Ecosystem Market include the expansion of digital trading platforms, the integration of sustainable investment practices, and the potential for cross-border trading enhancements. These developments can attract new investors and increase market participation.

What trends are shaping the Europe Capital Exchange Ecosystem Market?

Trends shaping the Europe Capital Exchange Ecosystem Market include the rise of fintech innovations, the growing importance of environmental, social, and governance (ESG) criteria in investment decisions, and the increasing use of blockchain technology for trading and settlement processes. These trends are transforming how capital markets operate.

Europe Capital Exchange Ecosystem Market

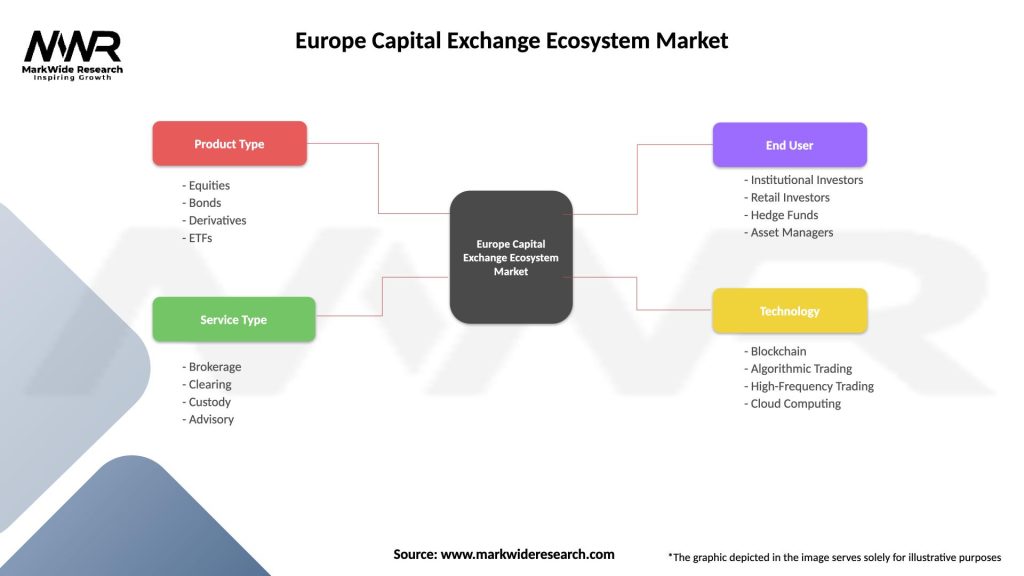

| Segmentation Details | Description |

|---|---|

| Product Type | Equities, Bonds, Derivatives, ETFs |

| Service Type | Brokerage, Clearing, Custody, Advisory |

| End User | Institutional Investors, Retail Investors, Hedge Funds, Asset Managers |

| Technology | Blockchain, Algorithmic Trading, High-Frequency Trading, Cloud Computing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Capital Exchange Ecosystem Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at