444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe bottled water processing market represents a dynamic and rapidly evolving sector within the broader beverage industry, characterized by sophisticated processing technologies and stringent quality standards. European consumers increasingly prioritize premium water products, driving demand for advanced processing solutions that ensure purity, safety, and enhanced mineral content. The market encompasses various processing technologies including filtration, purification, ozonation, and UV treatment systems specifically designed for bottled water production.

Market dynamics indicate robust growth driven by rising health consciousness, urbanization, and the expansion of premium water brands across European markets. The processing infrastructure supports both still and sparkling water production, with technological innovations focusing on energy efficiency and environmental sustainability. Growth projections suggest the market will expand at a compound annual growth rate of 6.2% through the forecast period, supported by increasing consumer demand for high-quality bottled water products.

Regional variations across Europe reflect different consumer preferences and regulatory frameworks, with Western European markets emphasizing premium processing technologies while Eastern European regions focus on capacity expansion and modernization. The market serves diverse applications from basic purification to specialized mineral enhancement, supporting the production of various water categories including natural mineral water, spring water, and purified water products.

The Europe bottled water processing market refers to the comprehensive ecosystem of technologies, equipment, and services utilized in the treatment, purification, and preparation of water for commercial bottling operations across European countries. This market encompasses all stages of water processing from source treatment to final packaging preparation, including advanced filtration systems, disinfection technologies, mineral adjustment processes, and quality control mechanisms.

Processing technologies within this market include reverse osmosis systems, activated carbon filtration, ozonation equipment, ultraviolet sterilization units, and specialized mineral dosing systems. The market also covers supporting infrastructure such as storage tanks, pumping systems, automated control systems, and quality monitoring equipment essential for maintaining consistent product quality and regulatory compliance.

Market participants include equipment manufacturers, technology providers, system integrators, and service companies that collectively support the bottled water industry’s processing requirements. The market serves various customer segments from large multinational beverage companies to regional bottlers and emerging premium water brands seeking advanced processing capabilities.

Market fundamentals demonstrate strong growth momentum driven by evolving consumer preferences toward premium bottled water products and increasing regulatory requirements for water quality and safety. The European market benefits from advanced technological infrastructure and high consumer purchasing power, creating favorable conditions for sophisticated processing equipment adoption.

Key growth drivers include rising health awareness, urbanization trends, and the premiumization of bottled water products. Consumer preferences increasingly favor enhanced water products with specific mineral profiles, functional additives, and superior taste characteristics, driving demand for advanced processing technologies. The market experiences adoption rates of 78% for automated processing systems among major bottlers, reflecting the industry’s commitment to operational efficiency and quality consistency.

Technological advancement remains a critical market differentiator, with innovations in energy-efficient processing, smart monitoring systems, and sustainable treatment methods gaining prominence. The integration of Internet of Things (IoT) technologies and artificial intelligence in processing equipment enables real-time optimization and predictive maintenance, reducing operational costs and improving product quality.

Market challenges include increasing environmental regulations, rising energy costs, and the need for continuous technological upgrades to meet evolving quality standards. However, these challenges also create opportunities for innovative processing solutions that address sustainability concerns while maintaining high processing efficiency and product quality.

Strategic insights reveal several critical factors shaping the Europe bottled water processing market landscape:

Primary market drivers propelling growth in the Europe bottled water processing market stem from multiple interconnected factors that create sustained demand for advanced processing technologies and equipment.

Health consciousness trends represent the most significant driver, as European consumers increasingly prioritize water quality and purity. This trend drives demand for sophisticated processing systems capable of removing contaminants while preserving beneficial minerals. Consumer awareness of water quality issues and health benefits associated with premium bottled water products creates sustained market demand for advanced processing capabilities.

Regulatory requirements continue to evolve, mandating higher quality standards and more comprehensive testing protocols. European Union directives on drinking water quality necessitate investment in advanced processing technologies that can consistently meet stringent purity and safety requirements. Compliance costs drive bottlers to invest in automated systems that ensure consistent regulatory adherence while reducing operational risks.

Premiumization trends in the bottled water industry create demand for specialized processing equipment capable of producing enhanced water products. Market differentiation through unique mineral profiles, pH adjustment, and functional additives requires sophisticated processing technologies that can precisely control water composition and characteristics.

Operational efficiency demands drive adoption of automated processing systems that reduce labor costs, minimize human error, and optimize resource utilization. Cost pressures in competitive markets necessitate investments in efficient processing technologies that can maintain quality while reducing per-unit production costs.

Market constraints present significant challenges that may limit growth potential and create barriers to market expansion in the Europe bottled water processing sector.

High capital requirements for advanced processing equipment represent a primary restraint, particularly for smaller bottlers and new market entrants. Investment costs for comprehensive processing systems can be substantial, requiring significant financial resources and long-term commitment to technology adoption. This financial barrier limits market accessibility and may slow adoption rates among smaller operators.

Environmental regulations increasingly restrict processing methods and waste disposal practices, requiring additional investments in compliance systems and sustainable technologies. Regulatory complexity across different European markets creates challenges for equipment standardization and may increase operational costs for multi-market operators.

Technical complexity of modern processing systems requires specialized expertise for operation and maintenance, creating workforce challenges and increasing operational costs. Skills shortages in technical fields may limit the effective utilization of advanced processing equipment and increase dependency on external service providers.

Energy costs continue to rise across European markets, impacting the operational economics of energy-intensive processing technologies. Utility expenses represent a significant portion of processing costs, potentially limiting the adoption of certain treatment methods and affecting overall market profitability.

Market saturation in mature European markets may limit growth opportunities for processing equipment suppliers, requiring focus on replacement cycles and technological upgrades rather than capacity expansion projects.

Emerging opportunities in the Europe bottled water processing market present substantial potential for growth and innovation across multiple dimensions of the industry.

Sustainability initiatives create significant opportunities for eco-friendly processing technologies that reduce environmental impact while maintaining processing efficiency. Green technology adoption enables bottlers to meet corporate sustainability goals while potentially reducing operational costs through improved resource efficiency and waste reduction.

Smart technology integration offers opportunities for advanced monitoring and control systems that optimize processing parameters in real-time. Digital transformation initiatives enable predictive maintenance, automated quality control, and remote monitoring capabilities that improve operational efficiency and reduce downtime.

Premium product development creates opportunities for specialized processing equipment that can produce enhanced water products with specific functional properties. Market differentiation through unique processing capabilities enables bottlers to command premium pricing and expand market share in high-value segments.

Eastern European expansion presents growth opportunities as these markets modernize their bottled water industries and invest in advanced processing technologies. Infrastructure development in emerging European markets creates demand for comprehensive processing solutions and technology transfer opportunities.

Circular economy principles drive opportunities for processing systems that enable water recycling and waste minimization, supporting both environmental goals and cost reduction objectives. Resource efficiency improvements create competitive advantages while addressing regulatory requirements and consumer expectations.

Market dynamics in the Europe bottled water processing sector reflect complex interactions between technological advancement, regulatory evolution, and changing consumer preferences that collectively shape industry development patterns.

Technological evolution drives continuous improvement in processing efficiency and capability, with innovations in membrane technology, disinfection methods, and automation systems creating new possibilities for water treatment and quality enhancement. Processing efficiency improvements of 30% in recent years demonstrate the impact of technological advancement on operational performance.

Competitive pressures intensify as bottled water markets mature, driving demand for processing technologies that enable cost reduction and product differentiation. Market consolidation trends create opportunities for larger-scale processing installations while potentially reducing the number of individual processing sites.

Regulatory dynamics continue to evolve with increasing emphasis on environmental protection, water source sustainability, and product safety. Compliance requirements drive investment in advanced monitoring and treatment technologies that ensure consistent regulatory adherence across diverse European markets.

Consumer behavior shifts toward premium and functional water products create demand for flexible processing systems capable of producing diverse product portfolios. Product innovation cycles require processing equipment that can adapt to changing formulations and quality specifications without significant capital investment.

Supply chain considerations influence processing equipment selection and installation strategies, with emphasis on local service support and rapid response capabilities for maintenance and technical support requirements.

Research approach for analyzing the Europe bottled water processing market employed comprehensive methodologies combining primary research, secondary data analysis, and industry expert consultations to ensure accuracy and reliability of market insights.

Primary research activities included structured interviews with industry executives, equipment manufacturers, bottled water producers, and technology providers across major European markets. Survey methodologies captured quantitative data on market trends, technology adoption rates, and investment priorities from a representative sample of market participants.

Secondary research encompassed analysis of industry reports, regulatory documents, company financial statements, and trade publications to establish market context and validate primary research findings. Data triangulation methods ensured consistency and accuracy across multiple information sources.

Market modeling techniques incorporated statistical analysis, trend extrapolation, and scenario planning to develop growth projections and market size estimates. Analytical frameworks considered multiple variables including economic indicators, regulatory changes, and technological advancement rates.

Expert validation processes involved review of research findings by industry specialists and academic researchers to ensure methodological rigor and practical relevance. Quality assurance protocols maintained data integrity throughout the research process and analysis phases.

Geographic coverage included comprehensive analysis of major European markets with detailed examination of regional variations in market dynamics, regulatory requirements, and competitive landscapes across Western, Central, and Eastern European regions.

Regional market dynamics across Europe reveal distinct patterns influenced by economic development levels, regulatory frameworks, and consumer preferences that shape bottled water processing market characteristics.

Western European markets including Germany, France, and the United Kingdom represent mature segments with emphasis on premium processing technologies and sustainable operations. These markets demonstrate 85% adoption rates for advanced filtration systems and show strong demand for energy-efficient processing equipment. Innovation focus in Western Europe centers on smart technology integration and environmental compliance solutions.

Southern European regions encompassing Italy, Spain, and Greece benefit from abundant natural water sources and strong bottled water consumption traditions. Market characteristics include emphasis on mineral water processing and traditional quality preservation methods, with growing adoption of 65% for modern processing technologies among established bottlers.

Central European markets including Poland, Czech Republic, and Hungary experience rapid modernization and capacity expansion in bottled water processing infrastructure. Investment trends focus on comprehensive processing system upgrades and automation implementation, with annual growth rates of 8.5% in processing equipment installations.

Eastern European regions present significant growth opportunities as markets develop and modernize their bottled water industries. Infrastructure development drives demand for complete processing solutions, with emphasis on cost-effective technologies that meet European quality standards while maintaining operational efficiency.

Nordic countries demonstrate leadership in sustainable processing technologies and environmental compliance, with 90% adoption rates for eco-friendly treatment methods and strong emphasis on energy efficiency and waste reduction in processing operations.

Competitive dynamics in the Europe bottled water processing market feature a diverse ecosystem of equipment manufacturers, technology providers, and system integrators competing across multiple market segments and geographic regions.

Market leaders include established equipment manufacturers with comprehensive product portfolios and strong European market presence:

Competitive strategies focus on technological innovation, comprehensive service offerings, and regional market expansion. Market differentiation occurs through specialized processing capabilities, energy efficiency improvements, and integrated automation solutions that address specific customer requirements and operational challenges.

Partnership strategies enable companies to expand market reach and combine complementary technologies, creating comprehensive solutions that address complete processing requirements from water treatment through final packaging preparation.

Market segmentation analysis reveals distinct categories based on technology type, application, and end-user requirements that define specific market opportunities and competitive dynamics within the Europe bottled water processing sector.

By Technology:

By Application:

By End User:

Technology category analysis provides detailed insights into specific market segments and their unique characteristics, growth patterns, and competitive dynamics within the Europe bottled water processing market.

Filtration Systems Category: Represents the largest market segment with 45% market share, driven by fundamental requirements for contaminant removal and water purification. Reverse osmosis technology dominates this category due to its effectiveness in removing dissolved solids and ensuring consistent water quality. Advanced membrane technologies continue to evolve with improved efficiency and reduced energy consumption.

Disinfection Equipment Category: Experiences rapid growth due to increasing emphasis on microbial safety and regulatory compliance. UV sterilization systems gain popularity due to chemical-free disinfection and minimal impact on water taste and composition. Ozonation technology maintains strong market presence for comprehensive disinfection and oxidation applications.

Automation and Control Category: Emerges as a high-growth segment with 12% annual growth rate driven by operational efficiency requirements and quality consistency demands. Smart monitoring systems enable real-time optimization and predictive maintenance, reducing operational costs and improving system reliability.

Sustainable Processing Category: Gains momentum as environmental regulations tighten and corporate sustainability initiatives expand. Energy-efficient technologies and waste reduction systems become increasingly important for competitive positioning and regulatory compliance.

Premium Processing Category: Shows strong growth potential as bottlers seek differentiation through unique water characteristics and enhanced quality profiles. Specialized treatment systems enable production of functional waters and premium products with specific mineral compositions and health benefits.

Industry participants and stakeholders in the Europe bottled water processing market realize significant benefits from advanced processing technologies and comprehensive market development.

For Bottled Water Producers:

For Equipment Manufacturers:

For Consumers:

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends in the Europe bottled water processing market reflect evolving industry dynamics and technological advancement that shape future market development and competitive positioning.

Sustainability Integration emerges as a dominant trend with bottlers increasingly adopting eco-friendly processing technologies that reduce environmental impact. Green processing methods focus on energy efficiency, waste reduction, and resource conservation while maintaining high quality standards. Circular economy principles drive adoption of water recycling systems and waste minimization technologies.

Smart Technology Adoption accelerates across the industry with IoT integration enabling real-time monitoring, predictive maintenance, and automated optimization of processing parameters. Artificial intelligence applications improve quality control and operational efficiency through advanced data analysis and pattern recognition capabilities.

Premium Product Focus intensifies as bottlers seek differentiation through unique water characteristics and enhanced quality profiles. Functional water processing technologies enable addition of minerals, vitamins, and other beneficial compounds while maintaining water purity and taste quality.

Modular System Design gains popularity as bottlers require flexible processing capabilities that can adapt to changing product requirements and production volumes. Scalable solutions enable capacity adjustments without significant capital investment or operational disruption.

Energy Efficiency Emphasis drives development of processing technologies that minimize energy consumption while maintaining processing effectiveness. Heat recovery systems and optimized process design reduce operational costs and environmental impact.

Quality Monitoring Enhancement through advanced sensor technologies and real-time analysis systems ensures consistent product quality and immediate detection of any processing deviations or quality issues.

Recent industry developments demonstrate significant advancement in processing technologies and market expansion activities that influence competitive dynamics and growth opportunities.

Technology Innovation continues with introduction of next-generation membrane technologies that improve filtration efficiency while reducing energy consumption. Advanced materials in membrane construction enhance durability and performance while reducing maintenance requirements and operational costs.

Automation Advancement includes development of fully integrated processing systems with minimal human intervention requirements. Machine learning algorithms optimize processing parameters automatically based on water source characteristics and product specifications.

Sustainability Initiatives drive development of processing systems that achieve zero liquid discharge and minimize environmental impact through advanced water recovery and waste treatment technologies. Energy recovery systems capture and reuse process energy to improve overall system efficiency.

Market Expansion activities include strategic partnerships between equipment manufacturers and bottled water producers to develop customized processing solutions. Technology transfer initiatives facilitate adoption of advanced processing methods in emerging European markets.

Regulatory Compliance developments include introduction of enhanced monitoring requirements and quality standards that drive adoption of advanced processing and testing equipment. Traceability systems enable comprehensive tracking of water processing from source to final product.

Digital Integration advances include cloud-based monitoring systems that enable remote oversight of processing operations and predictive maintenance scheduling. Data analytics platforms provide insights into processing efficiency and optimization opportunities.

Strategic recommendations for market participants focus on positioning for long-term success in the evolving Europe bottled water processing market landscape.

Technology Investment Priorities should emphasize sustainable processing solutions that address environmental concerns while maintaining operational efficiency. MarkWide Research analysis indicates that companies investing in energy-efficient technologies achieve competitive advantages through reduced operational costs and enhanced market positioning.

Market Entry Strategies for new participants should focus on specialized processing capabilities that address specific market niches or unique customer requirements. Partnership approaches with established bottlers can provide market access and validation for innovative processing technologies.

Capacity Planning should consider modular system designs that enable scalable expansion based on market demand and business growth. Flexible processing capabilities allow adaptation to changing product requirements and market conditions without significant capital reinvestment.

Service Excellence becomes increasingly important as processing systems become more sophisticated and require specialized maintenance and support. Comprehensive service offerings create competitive differentiation and recurring revenue opportunities for equipment manufacturers.

Innovation Focus should prioritize smart technology integration and automation capabilities that improve operational efficiency and quality consistency. Digital transformation initiatives enable competitive advantages through enhanced monitoring and control capabilities.

Regulatory Preparedness requires proactive compliance strategies that anticipate evolving environmental and quality requirements. Advanced monitoring systems ensure consistent regulatory adherence and reduce compliance risks.

Future market prospects for the Europe bottled water processing market indicate sustained growth driven by technological advancement, regulatory evolution, and changing consumer preferences that create long-term opportunities for industry participants.

Growth projections suggest continued market expansion with compound annual growth rates of 6.8% expected through the next decade, supported by increasing demand for premium bottled water products and advanced processing capabilities. Market evolution will be characterized by greater emphasis on sustainability, automation, and product differentiation.

Technology development will focus on integration of artificial intelligence, machine learning, and advanced sensor technologies that enable autonomous processing operations and predictive quality control. Smart processing systems will become standard in new installations, providing enhanced efficiency and reliability.

Sustainability requirements will drive adoption of circular economy principles in processing operations, with emphasis on water recycling, energy recovery, and waste minimization. Environmental compliance will become increasingly important for market competitiveness and regulatory approval.

Market consolidation trends may continue as larger bottlers seek economies of scale and smaller operators face increasing capital requirements for advanced processing technologies. Strategic partnerships between equipment manufacturers and bottlers will become more common to share technology development costs and risks.

Regional development will see continued modernization in Eastern European markets and premium technology adoption in Western European regions. MWR projections indicate that Eastern European markets will achieve processing technology adoption rates of 75% by the end of the forecast period.

Innovation opportunities will emerge in functional water processing, personalized nutrition applications, and sustainable packaging integration that create new market segments and competitive advantages for forward-thinking industry participants.

The Europe bottled water processing market represents a dynamic and evolving sector with substantial growth potential driven by technological innovation, regulatory advancement, and changing consumer preferences. Market fundamentals remain strong with sustained demand for high-quality processing equipment and advanced treatment technologies that ensure product safety, quality, and differentiation.

Key success factors for market participants include strategic technology investment, comprehensive service capabilities, and proactive adaptation to evolving regulatory and environmental requirements. The integration of smart technologies and sustainable processing methods will become increasingly important for competitive positioning and long-term market success.

Future opportunities exist across multiple market segments, from premium product processing to sustainable technology development and digital transformation initiatives. Companies that successfully balance innovation, sustainability, and operational efficiency will be best positioned to capitalize on the market’s growth potential and evolving customer requirements in the European bottled water processing landscape.

What is Bottled Water Processing?

Bottled Water Processing refers to the methods and technologies used to purify, package, and distribute bottled water for consumer use. This includes filtration, disinfection, and bottling processes that ensure the water is safe and meets quality standards.

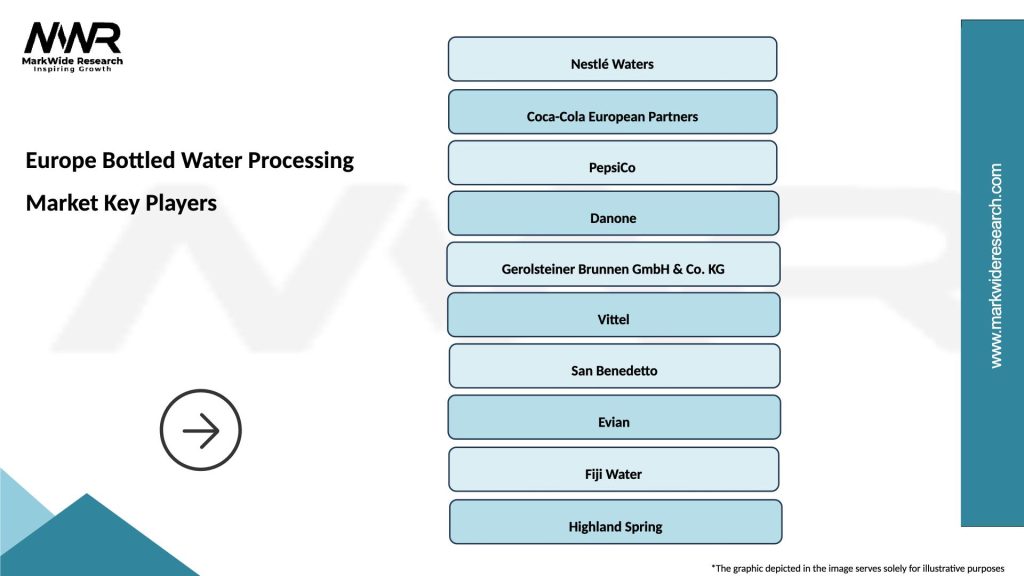

What are the key players in the Europe Bottled Water Processing Market?

Key players in the Europe Bottled Water Processing Market include Nestlé Waters, Danone, and Coca-Cola, which are known for their extensive bottled water brands and processing capabilities. Other notable companies include Perrier Vittel and Highland Spring, among others.

What are the main drivers of the Europe Bottled Water Processing Market?

The main drivers of the Europe Bottled Water Processing Market include the increasing consumer preference for healthy beverages, the rise in health consciousness, and the growing demand for convenient hydration options. Additionally, environmental concerns are pushing for more sustainable packaging solutions.

What challenges does the Europe Bottled Water Processing Market face?

The Europe Bottled Water Processing Market faces challenges such as stringent regulations regarding water quality and packaging, competition from alternative beverages, and environmental concerns related to plastic waste. These factors can impact production costs and market growth.

What opportunities exist in the Europe Bottled Water Processing Market?

Opportunities in the Europe Bottled Water Processing Market include the development of eco-friendly packaging solutions, the introduction of flavored and functional waters, and the expansion into emerging markets. Innovations in processing technology also present avenues for growth.

What trends are shaping the Europe Bottled Water Processing Market?

Trends shaping the Europe Bottled Water Processing Market include a shift towards premium bottled water products, increased focus on sustainability, and the rise of online sales channels. Additionally, health and wellness trends are driving demand for enhanced water products.

Europe Bottled Water Processing Market

| Segmentation Details | Description |

|---|---|

| Product Type | Spring Water, Mineral Water, Purified Water, Sparkling Water |

| Packaging Type | Plastic Bottles, Glass Bottles, Tetra Packs, Pouches |

| Distribution Channel | Supermarkets, Convenience Stores, Online Retail, Vending Machines |

| End User | Households, Restaurants, Hotels, Offices |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Bottled Water Processing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at