444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe automotive LED lighting market represents a dynamic and rapidly evolving sector within the broader automotive components industry. This market encompasses the design, manufacturing, and integration of light-emitting diode technology across various automotive lighting applications, including headlights, taillights, interior lighting, and specialized automotive illumination systems. European automotive manufacturers have increasingly adopted LED lighting solutions due to their superior energy efficiency, extended lifespan, and enhanced design flexibility compared to traditional halogen and xenon lighting technologies.

Market dynamics indicate that the European region has emerged as a significant hub for automotive LED innovation, with countries like Germany, France, and the United Kingdom leading technological advancement initiatives. The market is experiencing robust growth driven by stringent regulatory requirements for vehicle safety, increasing consumer demand for premium lighting features, and the automotive industry’s transition toward electric and hybrid vehicles. MarkWide Research analysis suggests that the adoption rate of LED lighting in new vehicle models has reached approximately 78% across European markets, demonstrating the technology’s widespread acceptance.

Technological advancements in LED manufacturing have enabled automotive suppliers to develop more sophisticated lighting solutions, including adaptive headlights, matrix LED systems, and intelligent lighting controls. The market benefits from Europe’s strong automotive manufacturing base, which includes major OEMs such as Volkswagen Group, BMW, Mercedes-Benz, and Stellantis, all of whom have integrated advanced LED lighting systems across their vehicle portfolios.

The Europe automotive LED lighting market refers to the comprehensive ecosystem encompassing the development, production, distribution, and integration of light-emitting diode technology specifically designed for automotive applications within European countries. This market includes various lighting components such as headlamps, fog lights, daytime running lights, turn signals, brake lights, interior ambient lighting, and dashboard illumination systems that utilize LED technology to provide enhanced visibility, safety, and aesthetic appeal in vehicles.

LED automotive lighting represents a significant technological advancement over conventional lighting solutions, offering superior luminous efficiency, reduced power consumption, longer operational lifespan, and greater design flexibility. The market encompasses both original equipment manufacturer (OEM) installations in new vehicles and aftermarket replacement components for existing vehicles across the European automotive landscape.

The European automotive LED lighting market demonstrates exceptional growth momentum, driven by regulatory mandates, technological innovation, and evolving consumer preferences for advanced vehicle lighting systems. The market has experienced significant transformation as automotive manufacturers increasingly prioritize energy-efficient lighting solutions that align with broader sustainability initiatives and electric vehicle development programs.

Key market drivers include the European Union’s stringent vehicle safety regulations, which mandate advanced lighting systems for improved road safety, and the growing consumer demand for premium vehicle features. The market benefits from approximately 12.3% annual growth in LED adoption rates across European vehicle segments, with luxury and premium vehicle categories leading the adoption curve.

Competitive landscape analysis reveals that established automotive lighting suppliers such as Osram, Philips Automotive, Hella, and Valeo maintain strong market positions through continuous innovation and strategic partnerships with major automotive manufacturers. The market also witnesses increasing participation from specialized LED technology companies and emerging players focusing on next-generation automotive lighting solutions.

Strategic market analysis reveals several critical insights that define the current state and future trajectory of the European automotive LED lighting market:

The European automotive LED lighting market benefits from multiple compelling drivers that accelerate adoption and market expansion across the region. Regulatory requirements represent the primary catalyst, as European Union safety standards increasingly mandate advanced lighting systems for new vehicle approvals. These regulations focus on improving road safety through enhanced visibility and reduced accident rates.

Consumer preferences have shifted significantly toward vehicles equipped with premium lighting features, driving automotive manufacturers to incorporate LED technology as standard equipment rather than optional upgrades. The growing popularity of electric and hybrid vehicles further accelerates LED adoption, as these vehicles require energy-efficient components to maximize battery range and performance.

Technological advancement in LED manufacturing has enabled the development of more sophisticated automotive lighting solutions, including matrix LED headlights, dynamic turn signals, and adaptive lighting systems that adjust to driving conditions. These innovations provide competitive advantages for automotive manufacturers seeking to differentiate their products in the European market.

Cost reduction trends in LED production have made these lighting systems more accessible across vehicle segments, expanding beyond luxury vehicles to mainstream automotive categories. The automotive industry’s focus on sustainability and environmental responsibility also drives LED adoption, as these systems contribute to reduced vehicle energy consumption and lower carbon emissions.

Despite strong growth prospects, the European automotive LED lighting market faces several constraints that may impact expansion rates and market penetration. High initial costs associated with advanced LED lighting systems continue to present challenges, particularly for budget-conscious consumers and entry-level vehicle segments where cost sensitivity remains significant.

Technical complexity in LED system integration requires specialized expertise and sophisticated manufacturing capabilities, creating barriers for smaller suppliers and potentially limiting competition within the market. The need for advanced thermal management systems to ensure LED longevity and performance adds additional complexity and cost to automotive lighting designs.

Supply chain challenges occasionally impact LED component availability, particularly for specialized automotive-grade LEDs that must meet stringent quality and reliability standards. These supply constraints can affect production schedules and increase costs for automotive manufacturers.

Regulatory variations across different European countries can create complexity for manufacturers seeking to develop standardized LED lighting solutions for the broader European market. Additionally, the rapid pace of technological change in LED technology can lead to shorter product lifecycles and increased development costs for automotive lighting suppliers.

The European automotive LED lighting market presents numerous opportunities for growth and innovation across multiple dimensions. Electric vehicle expansion creates substantial opportunities, as these vehicles require energy-efficient lighting systems to optimize battery performance and extend driving range. The growing electric vehicle market in Europe provides a natural fit for LED lighting technology.

Smart lighting integration represents a significant opportunity area, with potential for LED systems to incorporate connectivity features, vehicle-to-infrastructure communication, and adaptive lighting algorithms that respond to real-time driving conditions. These advanced features can command premium pricing and enhance vehicle differentiation.

Aftermarket expansion offers substantial growth potential as older vehicles are retrofitted with LED lighting systems. European consumers increasingly seek to upgrade their vehicles with modern lighting technology, creating opportunities for specialized aftermarket suppliers and installation services.

Emerging applications such as interior ambient lighting, projection systems, and decorative lighting elements provide additional revenue streams for LED lighting suppliers. The trend toward vehicle personalization and premium interior experiences drives demand for innovative LED lighting solutions beyond traditional functional applications.

The European automotive LED lighting market operates within a complex ecosystem of interconnected factors that influence supply, demand, and competitive positioning. Technology evolution continues to drive market dynamics, with ongoing improvements in LED efficiency, color quality, and integration capabilities creating new possibilities for automotive applications.

Competitive pressures among automotive manufacturers to offer distinctive lighting signatures and advanced safety features intensify the demand for innovative LED solutions. This competition drives continuous investment in research and development, leading to rapid technological advancement and market differentiation opportunities.

Supply chain relationships between LED manufacturers, automotive lighting suppliers, and vehicle manufacturers create complex interdependencies that influence market dynamics. Strategic partnerships and vertical integration initiatives shape competitive positioning and market access for various participants.

Economic factors including raw material costs, energy prices, and manufacturing capacity utilization impact LED pricing and availability. The market demonstrates resilience through economic cycles, supported by the essential nature of automotive lighting and ongoing regulatory requirements that sustain demand levels.

Comprehensive market analysis for the European automotive LED lighting market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes extensive interviews with industry executives, automotive manufacturers, LED suppliers, and technology experts across major European markets to gather firsthand insights into market trends and competitive dynamics.

Secondary research encompasses analysis of industry reports, regulatory documents, patent filings, and financial statements from publicly traded companies operating in the automotive LED lighting sector. This approach provides quantitative data and historical trends that support market projections and analysis.

Market modeling techniques incorporate statistical analysis, trend extrapolation, and scenario planning to develop robust market forecasts and identify key growth drivers. The methodology includes validation through multiple data sources and expert consultation to ensure accuracy and reliability of market insights.

Regional analysis focuses on country-specific market conditions, regulatory environments, and competitive landscapes across major European automotive markets including Germany, France, United Kingdom, Italy, and Spain. This granular approach enables identification of regional variations and opportunities within the broader European market context.

Germany dominates the European automotive LED lighting market, accounting for approximately 32% of regional market share, driven by the presence of major automotive manufacturers such as BMW, Mercedes-Benz, and Volkswagen Group. The German market benefits from strong engineering expertise, advanced manufacturing capabilities, and significant investment in automotive innovation and technology development.

France represents the second-largest market segment, with Stellantis (formerly PSA Group) and Renault driving LED adoption across their vehicle portfolios. The French market demonstrates strong growth in electric vehicle adoption, creating additional demand for energy-efficient LED lighting systems that support battery optimization and vehicle range extension.

The United Kingdom maintains a significant market presence despite Brexit-related challenges, with luxury automotive brands such as Jaguar Land Rover, Bentley, and Aston Martin incorporating advanced LED lighting systems as standard features. The UK market shows particular strength in premium and luxury vehicle segments where LED adoption rates exceed 90%.

Italy and Spain represent growing markets with increasing LED adoption driven by European Union safety regulations and consumer demand for modern vehicle features. These markets benefit from the presence of automotive manufacturing facilities and growing awareness of LED lighting benefits among consumers and fleet operators.

The European automotive LED lighting market features a competitive landscape dominated by established automotive lighting suppliers and emerging LED technology specialists. Market leadership is characterized by companies that combine automotive industry expertise with advanced LED technology capabilities and strong relationships with major vehicle manufacturers.

Competitive strategies focus on technological innovation, strategic partnerships with automotive manufacturers, and expansion of manufacturing capabilities to meet growing demand. Companies invest heavily in research and development to maintain technological leadership and develop next-generation LED lighting solutions.

The European automotive LED lighting market can be segmented across multiple dimensions to provide detailed analysis of market structure and opportunities. By application, the market includes exterior lighting systems such as headlights, taillights, and turn signals, as well as interior lighting applications including dashboard illumination and ambient lighting systems.

By vehicle type, segmentation encompasses passenger cars, commercial vehicles, and specialty vehicles, with passenger cars representing the largest market segment due to volume production and increasing LED adoption rates. Commercial vehicles show growing LED adoption driven by fleet efficiency requirements and regulatory compliance needs.

By technology, the market includes various LED configurations such as single LED units, LED arrays, and advanced matrix LED systems that offer adaptive lighting capabilities. Matrix LED technology represents a premium segment with high growth potential and significant technological differentiation opportunities.

By sales channel, the market divides between original equipment manufacturer (OEM) installations and aftermarket sales, with OEM representing the dominant channel but aftermarket showing strong growth potential as LED awareness increases among vehicle owners.

Headlight systems represent the largest category within the European automotive LED lighting market, driven by safety regulations and consumer demand for improved visibility. LED headlights offer superior illumination compared to traditional halogen systems, with energy consumption reduced by approximately 60% compared to conventional lighting. Advanced features such as adaptive beam patterns and automatic high-beam control enhance safety and driving comfort.

Taillight applications demonstrate strong growth as automotive manufacturers seek to create distinctive rear lighting signatures that enhance brand recognition and vehicle aesthetics. LED taillights provide faster illumination response times compared to traditional bulbs, improving safety through quicker brake light activation and enhanced visibility for following vehicles.

Interior lighting represents an emerging high-growth category, with LED technology enabling sophisticated ambient lighting systems that enhance passenger comfort and vehicle premium appeal. Customizable LED interior lighting allows drivers to personalize their vehicle environment and creates opportunities for automotive manufacturers to differentiate their products.

Daytime running lights (DRL) have become mandatory in European markets, creating a substantial market opportunity for LED suppliers. LED DRL systems provide energy-efficient compliance with regulatory requirements while offering design flexibility for automotive styling and brand differentiation.

Automotive manufacturers benefit significantly from LED lighting adoption through enhanced product differentiation, improved energy efficiency, and compliance with European safety regulations. LED technology enables distinctive lighting signatures that strengthen brand identity and create premium vehicle positioning opportunities in competitive markets.

Suppliers and component manufacturers gain access to a growing market with strong demand fundamentals and opportunities for technological innovation. The LED lighting market offers higher profit margins compared to traditional automotive components, supporting business growth and investment in advanced manufacturing capabilities.

Consumers benefit from improved vehicle safety through enhanced visibility, reduced energy consumption that supports fuel economy and electric vehicle range, and longer component lifespan that reduces maintenance requirements. LED lighting systems typically last significantly longer than traditional bulbs, reducing replacement frequency and associated costs.

Fleet operators realize operational benefits through reduced maintenance costs, improved vehicle safety ratings, and enhanced energy efficiency that supports total cost of ownership optimization. Commercial vehicle LED adoption contributes to fleet sustainability goals and regulatory compliance requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Adaptive lighting systems represent a major trend in the European automotive LED market, with manufacturers developing intelligent lighting solutions that automatically adjust beam patterns, intensity, and direction based on driving conditions. These systems enhance safety while providing premium features that justify higher vehicle pricing and improved profit margins.

Matrix LED technology continues gaining traction as automotive manufacturers seek to offer advanced lighting capabilities that provide competitive differentiation. Matrix systems enable precise light distribution control, allowing high-beam operation without glare for oncoming traffic, significantly improving nighttime driving safety and comfort.

Sustainable manufacturing practices are becoming increasingly important as automotive suppliers focus on environmental responsibility and circular economy principles. LED lighting systems support sustainability goals through reduced energy consumption and longer operational lifespans compared to traditional automotive lighting technologies.

Integration with vehicle systems represents an emerging trend where LED lighting connects with advanced driver assistance systems (ADAS), navigation systems, and vehicle connectivity platforms. This integration enables features such as turn signal projection, hazard warning enhancement, and communication with other vehicles or infrastructure systems.

Recent industry developments demonstrate the dynamic nature of the European automotive LED lighting market and the continuous innovation driving market evolution. Major automotive manufacturers have announced significant investments in LED technology development and manufacturing capacity expansion to meet growing demand and maintain competitive positioning.

Strategic partnerships between LED technology companies and automotive suppliers have accelerated product development and market introduction of advanced lighting solutions. These collaborations combine LED expertise with automotive industry knowledge to develop solutions that meet stringent automotive requirements and performance standards.

Regulatory developments continue shaping market dynamics, with European authorities implementing new safety standards that mandate advanced lighting systems for specific vehicle categories. MWR analysis indicates that regulatory compliance drives approximately 40% of LED adoption in commercial vehicle segments across European markets.

Technology breakthroughs in LED efficiency, color quality, and miniaturization enable new automotive applications and improved performance characteristics. These advances support the development of more sophisticated lighting systems that enhance vehicle safety, aesthetics, and functionality while reducing power consumption and system complexity.

Industry analysts recommend that automotive LED lighting suppliers focus on developing comprehensive technology platforms that can serve multiple vehicle segments and applications. Platform strategies enable cost optimization through economies of scale while providing flexibility to meet diverse customer requirements across the European automotive market.

Investment in research and development remains critical for maintaining competitive positioning in the rapidly evolving LED technology landscape. Companies should prioritize development of next-generation features such as smart lighting integration, adaptive systems, and connectivity capabilities that align with broader automotive industry trends.

Strategic partnerships with automotive manufacturers provide essential market access and development collaboration opportunities. Suppliers should focus on building long-term relationships that support joint technology development and ensure alignment with automotive manufacturer product roadmaps and strategic priorities.

Geographic expansion within Europe presents opportunities for market share growth, particularly in emerging markets where LED adoption rates remain below regional averages. Companies should consider localized manufacturing and distribution strategies to optimize cost structures and improve customer service capabilities.

The European automotive LED lighting market demonstrates strong growth prospects driven by continuing technological advancement, regulatory support, and expanding electric vehicle adoption. Market projections indicate sustained growth momentum with LED penetration rates expected to reach 85% across all vehicle segments within the next five years.

Technology evolution will continue driving market expansion as LED systems become more sophisticated and integrate with broader vehicle systems. Smart lighting capabilities including connectivity, adaptive algorithms, and integration with autonomous driving systems represent significant growth opportunities for innovative suppliers and manufacturers.

Electric vehicle growth provides a natural catalyst for LED adoption, as these vehicles require energy-efficient components to maximize battery performance and driving range. The expanding European electric vehicle market creates substantial opportunities for LED lighting suppliers focused on energy optimization and system integration.

Market consolidation may occur as smaller suppliers face challenges meeting automotive industry requirements and investment needs for advanced LED technology development. This consolidation could create opportunities for well-positioned companies to gain market share and expand their customer base across European automotive markets.

The Europe automotive LED lighting market represents a dynamic and rapidly growing sector within the broader automotive components industry, driven by regulatory requirements, technological innovation, and evolving consumer preferences for advanced vehicle features. The market benefits from strong fundamentals including European Union safety standards, growing electric vehicle adoption, and the region’s established automotive manufacturing base.

Key success factors for market participants include technological innovation capabilities, strong relationships with automotive manufacturers, and the ability to scale production to meet growing demand while maintaining quality standards. The market offers substantial opportunities for companies that can develop advanced LED solutions that meet automotive industry requirements for reliability, performance, and cost-effectiveness.

Future growth prospects remain positive, supported by continuing LED technology advancement, expanding electric vehicle market, and ongoing regulatory developments that favor energy-efficient automotive components. The market is positioned for sustained expansion as LED lighting becomes standard equipment across all vehicle segments and applications within the European automotive industry.

What is Automotive LED Lighting?

Automotive LED Lighting refers to the use of light-emitting diodes (LEDs) in vehicles for various lighting applications, including headlights, taillights, and interior lighting. This technology is known for its energy efficiency, longevity, and ability to produce bright, high-quality light.

What are the key companies in the Europe Automotive LED Lighting Market?

Key companies in the Europe Automotive LED Lighting Market include Osram, Philips, and Valeo, which are known for their innovative lighting solutions and extensive product ranges. These companies focus on enhancing vehicle safety and aesthetics through advanced LED technologies, among others.

What are the drivers of growth in the Europe Automotive LED Lighting Market?

The growth of the Europe Automotive LED Lighting Market is driven by increasing consumer demand for energy-efficient lighting solutions, advancements in automotive technology, and stricter regulations on vehicle emissions. Additionally, the rising trend of electric vehicles is further propelling the adoption of LED lighting.

What challenges does the Europe Automotive LED Lighting Market face?

The Europe Automotive LED Lighting Market faces challenges such as high initial costs of LED technology compared to traditional lighting and the need for continuous innovation to meet evolving consumer preferences. Additionally, competition from alternative lighting technologies can hinder market growth.

What opportunities exist in the Europe Automotive LED Lighting Market?

Opportunities in the Europe Automotive LED Lighting Market include the growing trend of smart lighting systems and the integration of LED technology in autonomous vehicles. Furthermore, increasing investments in research and development for innovative lighting solutions present significant growth potential.

What trends are shaping the Europe Automotive LED Lighting Market?

Trends shaping the Europe Automotive LED Lighting Market include the shift towards adaptive lighting systems that enhance visibility and safety, as well as the increasing use of customizable lighting features in vehicles. Additionally, sustainability initiatives are driving the development of eco-friendly LED lighting solutions.

Europe Automotive LED Lighting Market

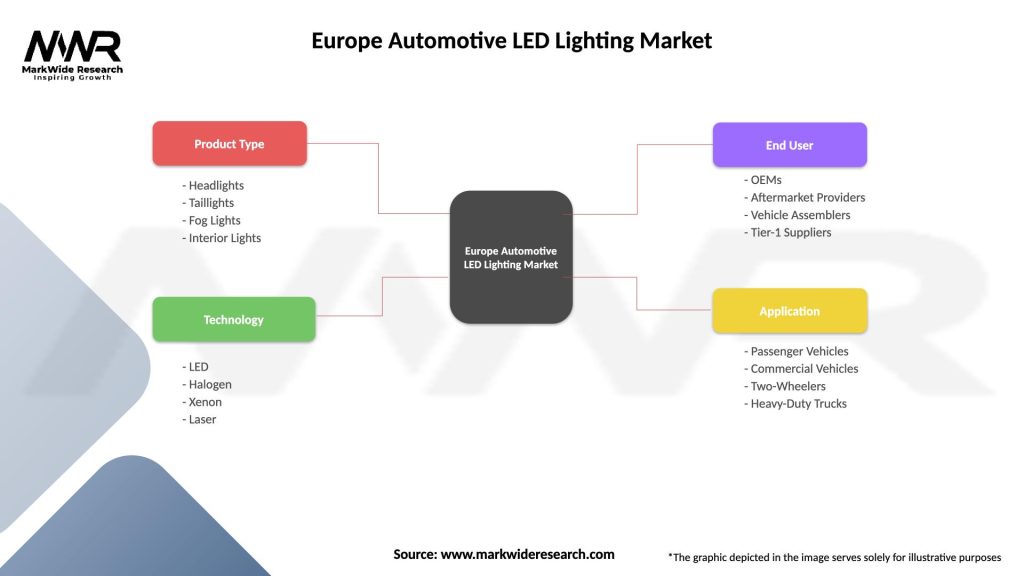

| Segmentation Details | Description |

|---|---|

| Product Type | Headlights, Taillights, Fog Lights, Interior Lights |

| Technology | LED, Halogen, Xenon, Laser |

| End User | OEMs, Aftermarket Providers, Vehicle Assemblers, Tier-1 Suppliers |

| Application | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Heavy-Duty Trucks |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Automotive LED Lighting Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at