444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe automotive infotainment systems market represents a dynamic and rapidly evolving sector within the broader automotive technology landscape. This market encompasses sophisticated in-vehicle entertainment, information, and communication systems that integrate multimedia content, navigation services, connectivity features, and vehicle control functions into unified platforms. European automotive manufacturers and technology providers are at the forefront of developing advanced infotainment solutions that enhance driver experience while maintaining safety standards.

Market dynamics in Europe are driven by increasing consumer demand for connected vehicle experiences, stringent safety regulations, and the growing adoption of electric and autonomous vehicles. The region’s automotive infotainment sector is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of 8.2% through the forecast period. Premium automotive brands based in Germany, Italy, and the United Kingdom are leading innovation in this space, incorporating artificial intelligence, voice recognition, and advanced human-machine interfaces.

Technological advancement remains a key differentiator in the European market, with manufacturers focusing on seamless smartphone integration, over-the-air updates, and enhanced user interfaces. The integration of 5G connectivity is expected to revolutionize infotainment capabilities, enabling real-time data processing and cloud-based services. According to MarkWide Research, the adoption rate of advanced infotainment systems in new vehicles across Europe has reached 78% in premium segments and continues to expand into mid-range vehicle categories.

The Europe automotive infotainment systems market refers to the comprehensive ecosystem of in-vehicle technology solutions that combine entertainment, information, navigation, and communication functionalities within European automotive applications. These systems serve as the central hub for driver and passenger interaction with vehicle features, external connectivity, and multimedia content delivery.

Modern infotainment systems encompass touchscreen displays, voice control interfaces, smartphone connectivity protocols, navigation systems, audio entertainment platforms, and vehicle diagnostic information displays. The European market specifically focuses on solutions that comply with regional safety standards, data privacy regulations, and consumer preferences for premium user experiences. Integration capabilities with European telecommunications infrastructure and local service providers distinguish this market from global counterparts.

Key components include hardware elements such as display units, processors, memory systems, and connectivity modules, alongside software platforms that manage user interfaces, application ecosystems, and data processing functions. The market also encompasses aftermarket solutions, original equipment manufacturer (OEM) integrated systems, and retrofit technologies designed for existing vehicle fleets throughout Europe.

Strategic market positioning within Europe’s automotive infotainment sector reveals significant opportunities for growth and innovation across multiple vehicle segments and geographic regions. The market demonstrates strong momentum driven by consumer demand for connected experiences, regulatory support for advanced safety features, and technological breakthroughs in artificial intelligence and connectivity solutions.

Key market drivers include the increasing penetration of electric vehicles, which require sophisticated energy management interfaces, and the growing importance of software-defined vehicles that rely heavily on infotainment platforms for core functionality. European consumers show particularly strong preference for premium infotainment features, with adoption rates exceeding 65% for advanced connectivity features in new vehicle purchases.

Competitive landscape analysis reveals intense competition among traditional automotive suppliers, technology companies, and emerging startups specializing in automotive software solutions. The market is characterized by strategic partnerships between automotive manufacturers and technology providers, creating integrated ecosystems that deliver comprehensive user experiences. Innovation cycles are accelerating, with new feature releases occurring annually rather than following traditional automotive development timelines.

Regional market dynamics show varying adoption patterns across European countries, with Northern and Western European markets leading in premium feature adoption, while Eastern European markets focus on cost-effective solutions with essential connectivity features. The market outlook remains positive, supported by favorable regulatory environments and increasing consumer willingness to invest in advanced automotive technologies.

Critical market insights reveal several transformative trends shaping the European automotive infotainment landscape:

Market maturation is evident in the shift from basic entertainment systems to comprehensive digital cockpit solutions that integrate infotainment with instrument clusters, climate controls, and vehicle management systems. Consumer expectations continue to evolve, demanding smartphone-like user experiences with intuitive interfaces and rapid response times.

Primary market drivers propelling growth in the European automotive infotainment systems sector encompass technological, regulatory, and consumer-driven factors that create sustained demand for advanced solutions.

Technological advancement serves as a fundamental driver, with improvements in processing power, display technology, and connectivity infrastructure enabling more sophisticated infotainment capabilities. The rollout of 5G networks across Europe provides the foundation for real-time data services, cloud computing integration, and enhanced multimedia streaming capabilities. Semiconductor innovations continue to reduce costs while improving performance, making advanced features accessible across broader vehicle segments.

Regulatory support for connected vehicle technologies and safety features creates market demand through mandatory implementation requirements. European Union regulations promoting vehicle connectivity for emergency services, traffic management, and environmental monitoring drive adoption of advanced infotainment platforms. Safety standards requiring hands-free operation and driver distraction minimization favor sophisticated voice control and automated systems.

Consumer behavior shifts toward digital lifestyle integration create expectations for seamless connectivity between personal devices and vehicle systems. Millennial and Gen Z consumers prioritize technology features in vehicle purchasing decisions, with infotainment capabilities often ranking among top considerations. The growing importance of vehicle personalization drives demand for customizable interfaces and user profile management systems.

Electric vehicle adoption creates unique opportunities for infotainment system integration, as these vehicles require sophisticated energy management interfaces and charging infrastructure connectivity. The transition toward autonomous driving capabilities positions infotainment systems as central platforms for passenger entertainment and productivity during automated travel periods.

Significant market restraints present challenges to the widespread adoption and development of automotive infotainment systems across the European market, requiring strategic approaches to overcome implementation barriers.

High development costs associated with advanced infotainment systems create financial pressures for automotive manufacturers, particularly in competitive mid-market segments where cost sensitivity remains high. The complexity of integrating multiple technologies, ensuring compatibility across vehicle platforms, and maintaining quality standards requires substantial investment in research and development. Certification processes for automotive-grade components add time and expense to product development cycles.

Technical complexity in system integration poses ongoing challenges, as infotainment platforms must interface with numerous vehicle systems while maintaining reliability and safety standards. Software compatibility issues between different operating systems, applications, and hardware configurations can create user experience problems and increase maintenance requirements. The rapid pace of technology evolution can render systems obsolete quickly, creating concerns about long-term value and support.

Privacy and security concerns related to data collection, storage, and transmission create consumer hesitation and regulatory compliance challenges. European data protection regulations require sophisticated privacy management systems, adding complexity and cost to infotainment platform development. Cybersecurity threats targeting connected vehicles raise concerns about system vulnerability and potential safety implications.

Infrastructure limitations in certain European regions, particularly regarding cellular network coverage and bandwidth availability, can limit the effectiveness of connected infotainment features. Standardization challenges across different countries and automotive manufacturers create fragmentation that complicates system development and user experience consistency.

Substantial market opportunities exist within the European automotive infotainment systems sector, driven by emerging technologies, evolving consumer preferences, and supportive regulatory environments that create favorable conditions for innovation and growth.

Artificial intelligence integration presents significant opportunities for creating personalized user experiences, predictive maintenance capabilities, and intelligent content curation. Machine learning algorithms can analyze driver behavior patterns to optimize interface layouts, suggest relevant services, and enhance safety through proactive alerts. The development of natural language processing capabilities enables more intuitive voice interactions and multilingual support across diverse European markets.

Augmented reality applications offer innovative opportunities for navigation enhancement, safety information display, and interactive entertainment experiences. Head-up display integration with infotainment systems can provide contextual information without requiring driver attention diversion. The growing interest in mixed reality experiences creates potential for immersive passenger entertainment during autonomous driving scenarios.

Subscription-based services represent a growing revenue opportunity, allowing manufacturers to generate ongoing income through premium content, advanced features, and personalized services. Over-the-air monetization enables new business models based on feature activation, temporary access, and usage-based pricing. The development of marketplace platforms within infotainment systems can create ecosystems for third-party applications and services.

Electric vehicle market expansion creates specialized opportunities for infotainment systems that integrate energy management, charging optimization, and environmental impact tracking. Smart city integration opportunities emerge as urban areas develop connected infrastructure that can interface with vehicle infotainment systems for traffic optimization, parking management, and environmental monitoring.

Complex market dynamics shape the European automotive infotainment systems landscape through interconnected technological, economic, and social factors that influence development priorities, competitive positioning, and growth trajectories across the region.

Technology convergence between automotive, telecommunications, and consumer electronics industries creates dynamic competitive environments where traditional boundaries blur. Software-defined vehicle architectures position infotainment systems as central computing platforms that manage multiple vehicle functions beyond entertainment and navigation. This convergence drives efficiency improvements of up to 35% in system integration and reduces overall vehicle complexity.

Supply chain evolution reflects the shift toward software-centric solutions, with traditional automotive suppliers partnering with technology companies to develop integrated offerings. Vertical integration strategies among major automotive manufacturers aim to control critical software development while maintaining flexibility through strategic partnerships. The emergence of specialized automotive software companies creates new competitive dynamics and innovation opportunities.

Consumer adoption patterns vary significantly across European markets, with premium segments showing adoption rates exceeding 85% for advanced connectivity features, while mass-market segments focus on essential functionality and cost-effectiveness. Generational differences in technology acceptance influence feature prioritization and interface design approaches. The growing importance of user experience consistency across different touchpoints drives standardization efforts.

Regulatory landscape evolution continues to shape market dynamics through safety requirements, environmental standards, and data protection mandates. MWR analysis indicates that regulatory compliance costs represent approximately 12% of total development expenses for advanced infotainment systems, influencing design decisions and market entry strategies.

Comprehensive research methodology employed in analyzing the European automotive infotainment systems market incorporates multiple data collection approaches, analytical frameworks, and validation processes to ensure accuracy and reliability of market insights and projections.

Primary research activities include extensive interviews with industry executives, automotive manufacturers, technology suppliers, and end-users across major European markets. Survey methodologies capture quantitative data on adoption rates, feature preferences, purchasing behaviors, and satisfaction levels among diverse consumer segments. Expert consultations with automotive engineers, software developers, and market analysts provide technical insights and trend validation.

Secondary research sources encompass industry reports, regulatory filings, patent databases, and academic publications that provide historical context and technical specifications. Market intelligence platforms offer real-time data on competitive activities, product launches, and strategic partnerships. Financial analysis of public companies provides insights into investment priorities and market performance indicators.

Analytical frameworks combine quantitative modeling with qualitative assessment to develop comprehensive market understanding. Statistical analysis techniques identify correlation patterns, growth trends, and market segment dynamics. Scenario modeling explores potential future developments under different technological and regulatory assumptions. Cross-validation processes ensure consistency between different data sources and analytical approaches.

Geographic coverage spans major European automotive markets including Germany, France, United Kingdom, Italy, Spain, and emerging markets in Eastern Europe. Temporal analysis examines historical trends, current market conditions, and future projections to provide comprehensive market perspective. Technology assessment evaluates emerging innovations and their potential market impact through expert evaluation and pilot program analysis.

Regional market analysis reveals distinct patterns and opportunities across European automotive infotainment systems markets, with varying adoption rates, regulatory environments, and consumer preferences shaping development strategies and competitive positioning.

Germany dominates the European automotive infotainment market, accounting for approximately 28% of regional market share due to its strong automotive manufacturing base and consumer preference for premium technology features. German automotive brands including BMW, Mercedes-Benz, and Audi lead innovation in luxury infotainment systems, incorporating advanced artificial intelligence and connectivity features. The country’s robust telecommunications infrastructure supports sophisticated connected vehicle services and over-the-air update capabilities.

France represents the second-largest market with 18% market share, characterized by strong government support for automotive technology development and electric vehicle adoption. French manufacturers focus on user-friendly interfaces and integration with local service providers. The market shows particular strength in voice control systems and multilingual support capabilities that serve diverse European markets.

United Kingdom maintains significant market presence despite Brexit-related uncertainties, with 15% market share driven by premium automotive brands and advanced technology adoption. British automotive companies emphasize luxury infotainment experiences and integration with global connectivity services. The market demonstrates strong adoption of subscription-based services and over-the-air feature updates.

Italy and Spain collectively represent 22% of market share, with growing adoption of infotainment systems in both premium and mass-market vehicle segments. Southern European markets show increasing interest in smartphone integration and navigation services tailored to regional driving patterns. The emphasis on design aesthetics and user experience aligns with regional automotive traditions.

Eastern European markets including Poland, Czech Republic, and Hungary account for 17% of market share with rapid growth driven by increasing vehicle ownership and technology adoption. These markets focus on cost-effective solutions with essential connectivity features while gradually adopting more advanced capabilities as economic conditions improve.

Competitive landscape analysis reveals a dynamic ecosystem of established automotive suppliers, technology companies, and emerging software specialists competing for market share in the European automotive infotainment systems sector.

Leading market participants include:

Strategic partnerships characterize the competitive landscape, with automotive manufacturers collaborating with technology companies to develop integrated solutions. Software companies including Google, Apple, and Microsoft play increasingly important roles through platform provision and application development. Emerging startups focus on specialized applications such as voice recognition, artificial intelligence, and user interface innovation.

Competitive strategies emphasize differentiation through user experience, integration capabilities, and feature innovation. Market consolidation continues through acquisitions and strategic alliances that combine automotive expertise with technology capabilities. Innovation cycles accelerate as companies compete to introduce new features and maintain technological leadership.

Market segmentation analysis provides detailed insights into the diverse components and applications within the European automotive infotainment systems market, enabling targeted strategies for different customer segments and use cases.

By Product Type:

By Technology:

By Vehicle Type:

By Sales Channel:

Detailed category analysis reveals specific trends, opportunities, and challenges within major segments of the European automotive infotainment systems market, providing strategic insights for market participants and stakeholders.

Audio Systems Category: Premium audio experiences drive significant value creation, with high-end audio systems showing adoption rates of 42% in luxury vehicles. Digital signal processing and multi-channel audio configurations create differentiation opportunities. Streaming service integration becomes increasingly important as consumers expect seamless access to personal music libraries and subscription services. Noise cancellation technology and acoustic optimization for electric vehicles present emerging opportunities.

Display Systems Category: Large touchscreen displays dominate new vehicle designs, with screen sizes averaging 10.4 inches in premium segments. Multi-display configurations combining instrument clusters with infotainment screens create immersive user experiences. Curved and flexible displays enable innovative interior designs while maintaining functionality. Haptic feedback technology improves user interaction safety by providing tactile confirmation without visual attention requirements.

Navigation Systems Category: Real-time traffic integration and predictive routing algorithms enhance user value and differentiate offerings. Augmented reality navigation overlays digital information on camera feeds for intuitive direction guidance. Electric vehicle routing incorporates charging station availability and energy consumption optimization. Integration with smart city infrastructure enables advanced traffic management and parking assistance features.

Communication Systems Category: Voice control adoption accelerates driven by safety regulations and user convenience preferences. Natural language processing improvements enable more intuitive interactions and reduce learning curves. Multi-language support becomes essential for European market success. Emergency communication features integrate with regional emergency services and provide automatic crash notification capabilities.

Substantial benefits accrue to various industry participants and stakeholders within the European automotive infotainment systems market, creating value through improved efficiency, enhanced user experiences, and new revenue opportunities.

Automotive Manufacturers benefit from differentiation opportunities that justify premium pricing and enhance brand positioning. Advanced infotainment systems serve as key selling points that influence consumer purchasing decisions and create competitive advantages. Software-defined vehicle architectures enable ongoing revenue generation through over-the-air updates and subscription services. Data collection capabilities provide insights into user behavior and preferences that inform future product development and marketing strategies.

Technology Suppliers gain access to the large and growing automotive market while leveraging existing expertise in consumer electronics and software development. Long-term partnerships with automotive manufacturers provide stable revenue streams and opportunities for innovation collaboration. Automotive-grade requirements create barriers to entry that protect market positions once established. Cross-industry knowledge transfer accelerates innovation and creates competitive advantages.

Consumers experience enhanced safety through hands-free operation, voice control, and integrated emergency services. Connectivity features provide seamless integration between personal devices and vehicle systems, maintaining digital lifestyle continuity. Personalization capabilities adapt to individual preferences and usage patterns, improving user satisfaction. Over-the-air updates ensure systems remain current with latest features and security improvements without requiring service visits.

Fleet Operators benefit from integrated management systems that monitor vehicle performance, driver behavior, and maintenance requirements. Connectivity features enable real-time tracking, route optimization, and communication with drivers. Data analytics capabilities support operational efficiency improvements and cost reduction initiatives. Safety features reduce accident risks and associated insurance costs.

Comprehensive SWOT analysis evaluates the strategic position of the European automotive infotainment systems market, identifying internal strengths and weaknesses alongside external opportunities and threats that influence market development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging market trends shape the evolution of European automotive infotainment systems, reflecting technological advancement, changing consumer preferences, and industry transformation toward connected and autonomous vehicles.

Voice-First Interfaces gain prominence as primary interaction methods, driven by safety requirements and user convenience preferences. Natural language processing improvements enable more intuitive conversations with vehicle systems, while multilingual capabilities serve diverse European markets. Voice biometrics add security features and enable personalized experiences for multiple users. Contextual awareness allows systems to understand user intent and provide relevant responses based on driving conditions and historical patterns.

Augmented Reality Integration transforms navigation and information display through overlay technologies that enhance real-world views with digital content. Head-up displays project navigation instructions and safety information directly onto windshields, reducing driver distraction. Camera-based AR systems identify landmarks, traffic signs, and hazards while providing contextual information. Mixed reality applications create immersive experiences for passengers during autonomous driving scenarios.

Ecosystem Integration extends beyond individual vehicles to encompass smart homes, mobile devices, and urban infrastructure. Cross-platform synchronization maintains user preferences and data across different touchpoints. Smart city connectivity enables vehicles to interact with traffic management systems, parking infrastructure, and environmental monitoring networks. IoT integration creates comprehensive connected experiences that anticipate user needs and optimize daily routines.

Sustainability Focus influences infotainment system design through energy efficiency optimization and environmental impact tracking. Eco-driving features provide real-time feedback on energy consumption and suggest optimization strategies. Carbon footprint monitoring appeals to environmentally conscious consumers and supports corporate sustainability goals. Lifecycle management considerations drive design decisions that extend system longevity and reduce electronic waste.

Significant industry developments demonstrate the dynamic nature of the European automotive infotainment systems market, with major announcements, technological breakthroughs, and strategic initiatives shaping competitive positioning and market evolution.

Partnership Announcements between traditional automotive manufacturers and technology companies create integrated solution offerings that combine automotive expertise with software innovation. BMW and Microsoft collaboration on cloud-based services exemplifies the trend toward strategic technology partnerships. Volkswagen Group investments in software development capabilities through dedicated subsidiaries demonstrate the industry shift toward software-defined vehicles. Stellantis partnerships with Amazon and Google showcase the importance of ecosystem integration for competitive differentiation.

Product Launch Activities reveal accelerating innovation cycles with new infotainment platforms introduced annually rather than following traditional automotive development timelines. Mercedes-Benz MBUX system updates demonstrate continuous improvement through over-the-air capabilities. Audi Virtual Cockpit evolution showcases the integration of instrument clusters with infotainment functionality. Tesla’s approach to software-first design influences traditional manufacturers to adopt similar strategies.

Regulatory Developments including European Union mandates for emergency calling systems and connectivity requirements drive market adoption of advanced infotainment features. Data protection regulations influence system design and privacy management capabilities. Safety standards for driver distraction and hands-free operation create opportunities for voice control and automated systems. Environmental regulations promoting electric vehicle adoption create demand for specialized infotainment features.

Investment Activities in automotive software startups and technology development demonstrate industry commitment to innovation and competitive positioning. Venture capital funding for automotive AI companies reaches record levels, supporting development of advanced infotainment capabilities. Acquisition activities consolidate expertise and accelerate technology integration timelines. Research and development spending increases across the industry as companies compete for technological leadership.

Strategic recommendations for market participants in the European automotive infotainment systems sector focus on positioning for long-term success while addressing immediate competitive challenges and market opportunities.

Technology Investment Priorities should emphasize artificial intelligence capabilities, voice recognition systems, and over-the-air update infrastructure that enable continuous improvement and feature enhancement. Cloud computing integration becomes essential for delivering advanced services and managing system complexity. Cybersecurity investments must keep pace with connectivity expansion to maintain consumer trust and regulatory compliance. User experience design requires dedicated resources to create intuitive interfaces that meet diverse European market preferences.

Partnership Strategy Development should focus on creating comprehensive ecosystems that combine automotive expertise with technology innovation capabilities. Strategic alliances with telecommunications providers enable advanced connectivity services and 5G integration. Content partnerships with streaming services and application developers create value-added offerings that differentiate products. Academic collaborations support research and development while accessing emerging talent and technologies.

Market Entry Approaches for new participants should consider regional variations in consumer preferences, regulatory requirements, and competitive dynamics across European markets. Pilot program strategies enable testing and refinement before full market launch. Niche market focus can provide entry opportunities in specialized applications or underserved segments. Acquisition strategies may offer faster market access and established customer relationships.

Future Preparation Initiatives should address autonomous vehicle requirements, electric vehicle integration, and evolving consumer expectations for connected experiences. Scalable architecture development enables adaptation to changing requirements and technology evolution. Data analytics capabilities support personalization and predictive maintenance features. Sustainability considerations align with environmental regulations and consumer preferences for responsible technology.

Future market outlook for European automotive infotainment systems indicates continued growth and transformation driven by technological advancement, changing mobility patterns, and evolving consumer expectations for connected vehicle experiences.

Technology Evolution will accelerate with artificial intelligence becoming central to infotainment system functionality, enabling predictive features, natural language interactions, and personalized experiences. 5G network deployment across Europe will unlock real-time data processing capabilities and cloud-based services that transform vehicle functionality. Augmented reality integration will become standard in premium vehicles, providing enhanced navigation and safety information. Quantum computing applications may emerge for complex optimization problems in traffic management and route planning.

Market Growth Projections indicate sustained expansion with compound annual growth rates exceeding 8% driven by electric vehicle adoption, autonomous driving development, and consumer demand for connected experiences. Premium segment growth will outpace mass market adoption as advanced features become differentiating factors. Subscription service revenues are projected to represent 25% of total market value by the end of the forecast period. Aftermarket opportunities will expand as retrofit solutions become more sophisticated and cost-effective.

Industry Transformation toward software-defined vehicles will position infotainment systems as central computing platforms that manage multiple vehicle functions beyond entertainment and navigation. Ecosystem integration will extend to smart homes, urban infrastructure, and personal devices, creating comprehensive connected experiences. Business model evolution will emphasize service-based revenues and ongoing customer relationships rather than one-time hardware sales. MarkWide Research projections suggest that software revenues will account for 60% of total infotainment system value by 2030.

Regulatory Environment will continue evolving to address privacy, security, and safety concerns while promoting innovation and competition. Standardization efforts may reduce fragmentation and improve interoperability across different systems and regions. Environmental regulations will drive efficiency improvements and sustainable design practices. Data governance frameworks will balance innovation opportunities with privacy protection requirements.

The Europe automotive infotainment systems market stands at the forefront of automotive technology innovation, driven by advancing connectivity standards, consumer demand for seamless digital experiences, and regulatory support for intelligent transportation systems across the region. Market dynamics across key European automotive markets including Germany, France, United Kingdom, Italy, Spain, and Sweden demonstrate exceptional growth potential supported by premium vehicle production, 5G network deployment, and increasing integration of artificial intelligence in automotive applications. Digital transformation initiatives and smart mobility concepts continue reshaping industry standards and consumer expectations throughout European automotive markets.

Strategic positioning in this technologically advanced market requires deep understanding of diverse automotive regulations, consumer preferences, and integration requirements across European vehicle manufacturers and suppliers. Companies that prioritize seamless smartphone integration, advanced driver assistance connectivity, and intuitive user interface design will be best positioned to capture opportunities in this competitive sector. Software-defined vehicle architectures and over-the-air update capabilities have become essential features for maintaining competitive advantage and customer satisfaction in modern automotive applications.

Innovation leadership in autonomous driving integration, augmented reality displays, and voice recognition technologies positions Europe as a global hub for next-generation automotive infotainment development. Manufacturing excellence and supplier ecosystem collaboration ensure high-quality system integration and reliability standards expected by European automotive brands. Sustainability focus including energy-efficient processors, recyclable materials, and carbon-neutral production aligns with European environmental regulations and corporate responsibility mandates.

The competitive landscape will continue evolving as both established automotive suppliers and innovative technology companies compete for market leadership in this rapidly advancing sector. Long-term success will require ongoing investment in research and development, cybersecurity solutions, and platform scalability to meet increasingly sophisticated automotive integration requirements and consumer expectations. Consumer-centric approaches emphasizing safety, usability, and seamless connectivity will become increasingly critical differentiators in this dynamic and technologically sophisticated European automotive infotainment systems market.

What is Automotive Infotainment Systems?

Automotive Infotainment Systems refer to integrated multimedia systems in vehicles that provide entertainment, information, and connectivity features. These systems typically include audio and video playback, navigation, and smartphone integration functionalities.

What are the key players in the Europe Automotive Infotainment Systems Market?

Key players in the Europe Automotive Infotainment Systems Market include companies like Bosch, Continental, and Harman International. These companies are known for their innovative solutions and contributions to enhancing in-car entertainment and connectivity, among others.

What are the growth factors driving the Europe Automotive Infotainment Systems Market?

The growth of the Europe Automotive Infotainment Systems Market is driven by increasing consumer demand for advanced connectivity features, the rise of electric vehicles, and the integration of artificial intelligence in infotainment systems. Additionally, the trend towards enhanced user experience in vehicles is a significant factor.

What challenges does the Europe Automotive Infotainment Systems Market face?

The Europe Automotive Infotainment Systems Market faces challenges such as high development costs, cybersecurity concerns, and the rapid pace of technological change. These factors can hinder the timely deployment of new features and systems.

What opportunities exist in the Europe Automotive Infotainment Systems Market?

Opportunities in the Europe Automotive Infotainment Systems Market include the growing demand for connected car technologies, advancements in voice recognition systems, and the potential for integration with smart home devices. These trends are expected to shape the future of automotive infotainment.

What trends are shaping the Europe Automotive Infotainment Systems Market?

Trends shaping the Europe Automotive Infotainment Systems Market include the increasing adoption of over-the-air updates, the rise of augmented reality navigation, and the integration of social media applications. These innovations are enhancing user engagement and functionality in vehicles.

Europe Automotive Infotainment Systems Market

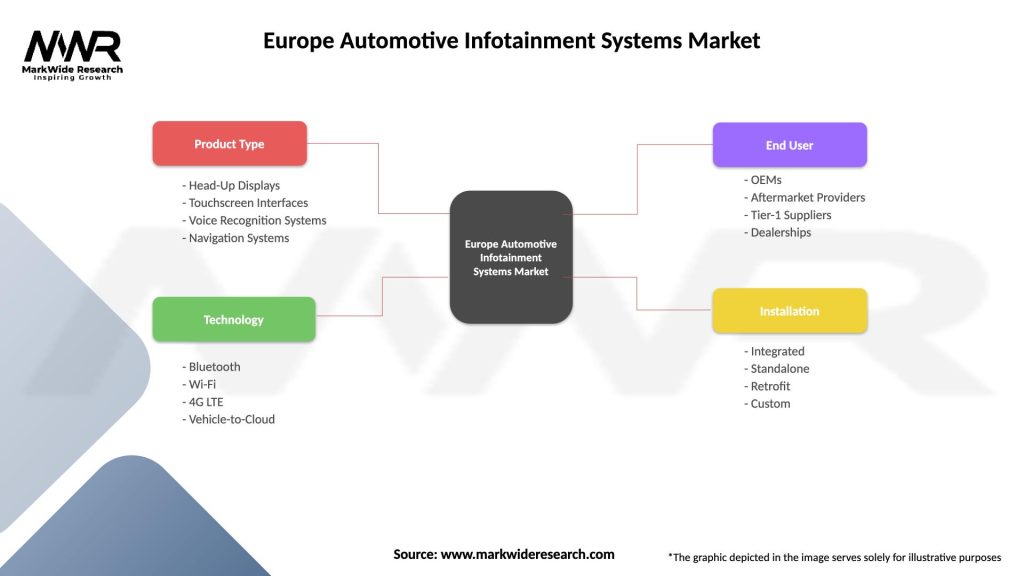

| Segmentation Details | Description |

|---|---|

| Product Type | Head-Up Displays, Touchscreen Interfaces, Voice Recognition Systems, Navigation Systems |

| Technology | Bluetooth, Wi-Fi, 4G LTE, Vehicle-to-Cloud |

| End User | OEMs, Aftermarket Providers, Tier-1 Suppliers, Dealerships |

| Installation | Integrated, Standalone, Retrofit, Custom |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Automotive Infotainment Systems Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at