444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe automotive finance market represents a dynamic and rapidly evolving sector that plays a crucial role in facilitating vehicle ownership and mobility across the continent. This comprehensive market encompasses various financing solutions including traditional auto loans, leasing arrangements, hire purchase agreements, and innovative subscription-based models that cater to diverse consumer preferences and business requirements.

Market dynamics in Europe are characterized by increasing digitalization, changing consumer behaviors, and evolving regulatory frameworks that shape the automotive financing landscape. The market demonstrates robust growth potential, driven by rising vehicle sales, expanding electric vehicle adoption, and growing demand for flexible financing solutions. European consumers are increasingly seeking personalized financing options that align with their financial capabilities and lifestyle preferences.

Regional variations across European markets reflect different economic conditions, regulatory environments, and consumer preferences. Western European markets typically exhibit higher penetration rates of automotive financing, while Eastern European markets show significant growth potential as economic development accelerates. The market is experiencing a compound annual growth rate (CAGR) of approximately 6.2%, indicating strong momentum and sustained expansion across multiple segments.

Technology integration has become a defining characteristic of the modern European automotive finance market, with digital platforms, artificial intelligence, and data analytics transforming traditional lending processes. Financial institutions and automotive manufacturers are investing heavily in technological infrastructure to enhance customer experience, streamline operations, and improve risk assessment capabilities.

The Europe automotive finance market refers to the comprehensive ecosystem of financial products, services, and institutions that facilitate the purchase, lease, or rental of vehicles across European countries. This market encompasses traditional banking institutions, specialized automotive finance companies, captive finance arms of vehicle manufacturers, and emerging fintech platforms that provide innovative financing solutions.

Automotive finance includes various financial instruments designed to make vehicle ownership accessible to consumers and businesses. These solutions range from conventional auto loans with fixed or variable interest rates to sophisticated leasing arrangements that offer flexibility and lower monthly payments. The market also includes hire purchase agreements, personal contract purchases, and emerging subscription models that provide alternative pathways to vehicle access.

Market participants include banks, credit unions, automotive manufacturers’ finance divisions, independent finance companies, and technology-driven platforms that leverage digital capabilities to deliver streamlined financing experiences. The interconnected nature of this market creates a complex web of relationships between lenders, dealers, manufacturers, and consumers, all working together to facilitate vehicle transactions across Europe.

The European automotive finance market stands as a cornerstone of the continent’s mobility ecosystem, demonstrating remarkable resilience and adaptability in response to changing economic conditions and consumer preferences. The market has evolved significantly over recent years, embracing digital transformation while maintaining strong fundamentals that support sustained growth across diverse European economies.

Key market drivers include increasing vehicle electrification, rising consumer demand for flexible financing options, and growing acceptance of alternative mobility solutions. The market benefits from supportive regulatory frameworks that promote fair lending practices while encouraging innovation in financial services. Digital adoption rates have accelerated dramatically, with approximately 78% of consumers now preferring online or mobile-first financing applications.

Competitive dynamics reflect a healthy balance between traditional financial institutions and innovative fintech companies, creating an environment that fosters competition and drives continuous improvement in service delivery. The market demonstrates strong fundamentals with manageable risk profiles and robust credit quality metrics across most European regions.

Future prospects remain highly favorable, supported by ongoing economic recovery, increasing vehicle replacement cycles, and growing consumer confidence in automotive financing solutions. The market is well-positioned to capitalize on emerging trends including electric vehicle adoption, shared mobility concepts, and evolving consumer preferences for flexible ownership models.

Market penetration across European countries varies significantly, reflecting different economic development levels, regulatory environments, and cultural attitudes toward financing. The following insights highlight critical market characteristics:

Economic recovery across European markets has created favorable conditions for automotive finance growth, with improving employment rates and increasing consumer confidence driving demand for vehicle financing solutions. The gradual stabilization of economic conditions following recent global challenges has restored consumer willingness to make significant financial commitments, particularly for essential transportation needs.

Digital transformation initiatives have revolutionized the automotive finance experience, making it more accessible, efficient, and user-friendly. Financial institutions are investing heavily in digital platforms that enable instant credit decisions, streamlined application processes, and enhanced customer engagement throughout the financing journey. These technological advances have significantly reduced processing times and improved customer satisfaction rates.

Electric vehicle adoption represents a major growth driver, with governments across Europe implementing supportive policies and incentives that encourage EV purchases. Automotive finance companies are developing specialized products tailored to electric vehicle characteristics, including longer loan terms that account for higher purchase prices and innovative financing structures that incorporate government incentives and subsidies.

Changing consumer preferences toward flexible ownership models have created new opportunities for innovative financing solutions. Consumers increasingly value access over ownership, driving demand for subscription services, short-term leasing arrangements, and other alternative financing structures that provide greater flexibility and lower financial commitment.

Regulatory support from European authorities has created a stable and predictable operating environment that encourages investment and innovation in automotive finance. Clear regulatory frameworks provide certainty for market participants while protecting consumer interests and promoting fair competition across the sector.

Economic uncertainty continues to pose challenges for the European automotive finance market, with fluctuating interest rates, inflation concerns, and geopolitical tensions creating volatility that affects both lenders and borrowers. These macroeconomic factors can impact consumer confidence and willingness to take on long-term financial commitments, potentially slowing market growth.

Regulatory complexity across different European jurisdictions creates operational challenges for financial institutions operating in multiple markets. Varying compliance requirements, consumer protection standards, and reporting obligations increase operational costs and complexity, particularly for smaller market participants with limited resources.

Credit risk management remains a persistent challenge, particularly in emerging European markets where credit histories may be limited and economic volatility higher. Financial institutions must balance growth objectives with prudent risk management practices, which can constrain lending in certain segments or geographic regions.

Technology infrastructure requirements demand significant ongoing investment, creating barriers for smaller financial institutions that may lack the resources to compete effectively with larger, well-capitalized competitors. The rapid pace of technological change requires continuous adaptation and investment in new systems and capabilities.

Competition intensity has increased significantly as new market entrants, including fintech companies and technology platforms, challenge traditional business models and pricing structures. This competitive pressure can compress margins and require increased investment in customer acquisition and retention strategies.

Electric vehicle financing presents substantial growth opportunities as European governments accelerate efforts to achieve carbon neutrality goals. The expanding EV market requires specialized financing solutions that address unique characteristics such as higher upfront costs, battery leasing options, and integration with charging infrastructure financing. Financial institutions that develop comprehensive EV financing ecosystems can capture significant market share in this rapidly growing segment.

Digital-first business models offer opportunities to reach underserved customer segments and improve operational efficiency through automation and artificial intelligence. Companies that successfully implement end-to-end digital financing platforms can reduce costs, improve customer experience, and scale operations more effectively than traditional competitors.

Partnership strategies with automotive manufacturers, dealers, and technology companies create opportunities for integrated service offerings that provide enhanced value to customers. Strategic alliances can enable access to new customer bases, shared technology investments, and innovative product development that differentiates market participants from competitors.

Emerging market expansion in Eastern European countries offers significant growth potential as economic development accelerates and automotive finance penetration rates increase. These markets typically exhibit lower competition levels and higher growth rates, providing attractive opportunities for established financial institutions with appropriate risk management capabilities.

Sustainable finance initiatives align with growing environmental consciousness and regulatory requirements, creating opportunities for green financing products that support sustainable mobility solutions. Financial institutions that develop comprehensive sustainability frameworks can attract environmentally conscious consumers and access favorable regulatory treatment.

Supply and demand dynamics in the European automotive finance market reflect complex interactions between economic conditions, consumer preferences, regulatory requirements, and competitive forces. The market demonstrates cyclical characteristics that correlate with broader economic trends, while also exhibiting structural changes driven by technological innovation and evolving mobility concepts.

Interest rate environments significantly influence market dynamics, affecting both the cost of funding for financial institutions and the attractiveness of financing options for consumers. Recent monetary policy changes across European central banks have created varying conditions across different markets, requiring adaptive strategies from market participants.

Consumer behavior evolution continues to reshape market dynamics, with younger demographics showing different preferences for vehicle ownership, financing terms, and service delivery channels. Millennial and Generation Z consumers demonstrate higher comfort levels with digital processes and greater interest in flexible, subscription-based models that align with their lifestyle preferences.

Competitive intensity has increased as traditional boundaries between automotive finance, banking, and technology sectors blur. New entrants bring innovative approaches and disruptive technologies that challenge established business models, forcing all market participants to continuously evolve their value propositions and operational capabilities.

Risk management practices have become increasingly sophisticated, incorporating advanced analytics, machine learning, and alternative data sources to improve credit assessment accuracy and portfolio performance. These enhanced capabilities enable more precise pricing and risk-adjusted returns while supporting responsible lending practices.

Comprehensive market analysis for the European automotive finance market employs multiple research methodologies to ensure accuracy, reliability, and depth of insights. The research approach combines quantitative data analysis with qualitative assessments to provide a complete understanding of market dynamics, trends, and future prospects.

Primary research activities include extensive interviews with industry executives, financial institution leaders, automotive manufacturers, regulatory officials, and consumer representatives across major European markets. These discussions provide valuable insights into market trends, competitive dynamics, regulatory developments, and strategic priorities that shape the automotive finance landscape.

Secondary research sources encompass industry reports, regulatory filings, financial statements, academic studies, and government publications that provide quantitative data and analytical perspectives on market performance and trends. This comprehensive data collection ensures broad coverage of market segments, geographic regions, and stakeholder perspectives.

Data validation processes include cross-referencing multiple sources, statistical analysis of data consistency, and expert review of findings to ensure accuracy and reliability. The research methodology incorporates feedback loops that allow for continuous refinement of analysis and conclusions based on new information and market developments.

Market modeling techniques utilize advanced statistical methods and forecasting models to project future market trends and identify key growth drivers. These analytical approaches provide quantitative foundations for strategic recommendations and market outlook assessments.

Western European markets dominate the automotive finance landscape, with Germany, France, and the United Kingdom representing the largest and most mature markets. These regions demonstrate high financing penetration rates, sophisticated product offerings, and well-developed regulatory frameworks that support market stability and growth. Germany accounts for approximately 28% of total European automotive finance activity, reflecting its strong automotive industry and robust consumer demand.

Nordic countries including Sweden, Norway, and Denmark exhibit unique market characteristics driven by high environmental consciousness, strong economic conditions, and progressive regulatory approaches. These markets show particularly high adoption rates of electric vehicle financing and innovative sustainability-focused products that align with regional environmental priorities.

Southern European markets including Italy, Spain, and Portugal demonstrate recovering growth following economic challenges, with increasing consumer confidence and improving credit conditions supporting market expansion. These regions show strong potential for growth as economic recovery continues and automotive finance penetration rates increase from current levels.

Eastern European markets represent the highest growth potential within the region, with countries like Poland, Czech Republic, and Hungary showing rapid expansion in automotive finance adoption. Eastern European markets are growing at approximately 12% annually, significantly outpacing Western European growth rates as economic development accelerates and consumer access to financing improves.

Market integration across European Union countries continues to progress, with harmonized regulatory frameworks and cross-border financial services creating opportunities for pan-European market participants. This integration facilitates economies of scale and enables more efficient capital allocation across different regional markets.

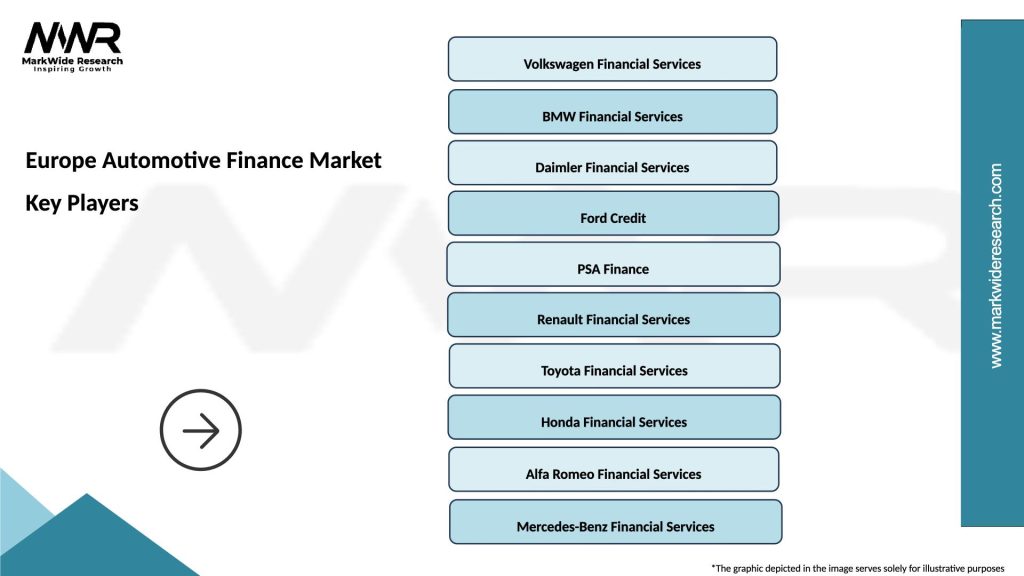

Market leadership in the European automotive finance sector is distributed among several categories of participants, each bringing distinct competitive advantages and strategic approaches. The competitive environment reflects a healthy balance between established financial institutions, automotive manufacturer captive finance companies, and innovative technology-driven entrants.

Traditional banking institutions maintain strong market positions through established customer relationships, comprehensive financial service offerings, and robust risk management capabilities. Major players include:

Captive finance companies operated by automotive manufacturers leverage brand relationships and integrated sales processes to capture significant market share:

Fintech and technology companies are increasingly challenging traditional market participants through innovative digital platforms and alternative financing models that appeal to tech-savvy consumers seeking streamlined experiences.

Product segmentation within the European automotive finance market reflects diverse consumer needs and preferences, with each segment demonstrating distinct characteristics and growth patterns:

By Product Type:

By Vehicle Type:

By Customer Type:

Passenger vehicle financing represents the largest and most established category within the European automotive finance market, accounting for the majority of transaction volume and revenue generation. This segment demonstrates steady growth driven by vehicle replacement cycles, changing consumer preferences, and expanding product innovation. New vehicle financing comprises approximately 58% of passenger car financing activity, while used vehicle financing shows stronger growth rates as consumers seek value-oriented options.

Commercial vehicle financing exhibits distinct characteristics reflecting business customer needs for operational efficiency, tax optimization, and cash flow management. This category includes light commercial vehicles popular among small businesses, medium-duty trucks for regional distribution, and heavy-duty vehicles for long-haul transportation. The segment benefits from economic recovery and increasing e-commerce activity that drives demand for delivery and logistics vehicles.

Electric vehicle financing has emerged as a high-growth category with unique requirements and opportunities. Financial institutions are developing specialized products that address EV-specific considerations including higher purchase prices, government incentives, charging infrastructure, and battery technology evolution. This category demonstrates the strongest growth rates within the market, supported by regulatory mandates and increasing consumer acceptance.

Luxury vehicle financing caters to affluent consumers seeking premium automotive experiences with sophisticated financing arrangements. This segment typically involves higher transaction values, longer loan terms, and enhanced service levels that reflect customer expectations. Luxury financing often incorporates additional services such as insurance, maintenance, and concierge services that create comprehensive ownership experiences.

Fleet and corporate financing serves business customers with complex requirements for multiple vehicle acquisitions, specialized equipment, and integrated service packages. This category requires sophisticated risk assessment, flexible terms, and comprehensive account management that addresses diverse business needs across different industries and company sizes.

Financial institutions benefit from automotive finance through diversified revenue streams, stable asset-backed lending, and opportunities for cross-selling additional financial products. The automotive finance business provides predictable cash flows, manageable risk profiles, and strong customer relationships that support long-term profitability and growth.

Automotive manufacturers leverage captive finance companies to support vehicle sales, enhance dealer relationships, and improve customer loyalty. Integrated financing solutions enable manufacturers to offer competitive terms, accelerate sales cycles, and maintain ongoing relationships with customers throughout the ownership experience.

Automotive dealers benefit from financing partnerships through improved sales conversion rates, enhanced customer service capabilities, and additional revenue opportunities. Access to diverse financing options enables dealers to serve broader customer segments and close more transactions by addressing various financial needs and preferences.

Consumers gain access to vehicle ownership through affordable monthly payments, flexible terms, and competitive interest rates that make transportation accessible across different income levels. Financing options enable consumers to purchase newer, safer, and more efficient vehicles while preserving cash for other financial priorities.

Economic development benefits from automotive finance through increased vehicle sales, job creation in financial services, and enhanced mobility that supports economic activity. The automotive finance sector contributes to economic growth by facilitating transportation access that enables employment, commerce, and social participation.

Environmental benefits emerge as automotive finance supports the transition to cleaner vehicles through specialized EV financing, incentive integration, and sustainable mobility solutions. Financial institutions play crucial roles in accelerating environmental progress by making clean transportation technologies more accessible and affordable.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation continues to reshape the European automotive finance landscape, with artificial intelligence, machine learning, and automation revolutionizing traditional processes. Financial institutions are implementing end-to-end digital platforms that enable instant credit decisions, streamlined documentation, and enhanced customer engagement throughout the financing journey.

Sustainability integration has become a central theme, with financial institutions developing green financing products that support electric vehicle adoption and sustainable mobility solutions. MarkWide Research indicates that sustainability-focused financing products have grown by 73% over the past two years, reflecting increasing environmental consciousness among consumers and regulatory requirements.

Subscription and mobility-as-a-service models are gaining traction as consumers seek flexible alternatives to traditional ownership. These innovative approaches combine financing, insurance, maintenance, and other services into comprehensive packages that provide hassle-free vehicle access without long-term ownership commitments.

Data analytics and personalization enable more sophisticated customer segmentation, risk assessment, and product customization. Financial institutions are leveraging big data and advanced analytics to develop personalized financing offers, improve credit decisions, and enhance customer experiences through tailored solutions.

Partnership ecosystems are expanding as automotive finance companies collaborate with technology providers, automotive manufacturers, dealers, and service providers to create integrated value propositions. These strategic alliances enable comprehensive solutions that address multiple customer needs while sharing costs and risks among partners.

Regulatory evolution across European markets continues to shape industry practices, with new consumer protection measures, data privacy requirements, and sustainability mandates influencing business strategies. Recent developments include enhanced disclosure requirements, standardized comparison tools, and strengthened consumer rights that promote market transparency and fair competition.

Technology partnerships between traditional financial institutions and fintech companies are accelerating innovation and improving operational efficiency. Major automotive finance providers are investing in or acquiring technology companies to enhance digital capabilities, streamline processes, and develop next-generation customer experiences.

Electric vehicle initiatives have expanded significantly, with financial institutions launching specialized EV financing programs that integrate government incentives, charging infrastructure support, and battery leasing options. These comprehensive solutions address unique EV characteristics while supporting the transition to sustainable transportation.

Cross-border expansion strategies are enabling market participants to leverage economies of scale and access new growth opportunities across European markets. Successful expansion requires understanding local market conditions, regulatory requirements, and consumer preferences while maintaining operational efficiency.

Sustainable finance commitments from major market participants demonstrate growing focus on environmental, social, and governance considerations. Financial institutions are setting ambitious targets for green financing, implementing sustainability frameworks, and developing products that support climate objectives.

Strategic positioning recommendations emphasize the importance of developing comprehensive digital capabilities while maintaining strong risk management practices. Market participants should invest in technology infrastructure that enables seamless customer experiences, efficient operations, and data-driven decision making while preserving the fundamental credit discipline that ensures portfolio quality.

Product innovation should focus on addressing evolving customer needs through flexible financing solutions, integrated service offerings, and sustainability-focused products. MWR analysis suggests that companies developing comprehensive EV financing ecosystems and subscription-based models will capture disproportionate market share as consumer preferences continue evolving.

Partnership strategies offer opportunities to enhance competitive positioning through strategic alliances with automotive manufacturers, technology providers, and service companies. Successful partnerships require clear value propositions, aligned incentives, and effective governance structures that enable mutual benefit while maintaining operational independence.

Market expansion into emerging European markets presents attractive growth opportunities for established participants with appropriate risk management capabilities. Success requires understanding local market conditions, developing culturally appropriate products, and building effective distribution networks while maintaining prudent credit standards.

Regulatory compliance should be viewed as a competitive advantage rather than merely a cost of doing business. Companies that proactively implement robust compliance frameworks and exceed minimum requirements can build stronger customer trust, reduce regulatory risk, and position themselves favorably for future regulatory developments.

Market prospects for the European automotive finance sector remain highly favorable, supported by ongoing economic recovery, increasing vehicle electrification, and continued innovation in financing solutions. The market is well-positioned to benefit from structural trends including urbanization, changing mobility preferences, and growing environmental consciousness that drive demand for innovative transportation financing.

Technology evolution will continue transforming the industry, with artificial intelligence, blockchain, and advanced analytics enabling more sophisticated risk management, personalized customer experiences, and operational efficiency. Companies that successfully integrate these technologies while maintaining human touch points will achieve sustainable competitive advantages.

Electric vehicle financing represents the most significant growth opportunity, with projections indicating continued rapid expansion as EV adoption accelerates across European markets. Financial institutions that develop comprehensive EV financing capabilities, including charging infrastructure support and battery leasing options, will capture substantial market share in this high-growth segment.

Regulatory developments will likely focus on consumer protection, sustainability requirements, and digital privacy standards that shape industry practices. Proactive compliance and stakeholder engagement will be essential for navigating evolving regulatory landscapes while maintaining operational flexibility and competitive positioning.

Market consolidation may accelerate as smaller participants seek scale advantages through mergers and acquisitions, while larger companies pursue geographic expansion and capability enhancement through strategic transactions. This consolidation will likely result in stronger, more efficient market participants better positioned to serve evolving customer needs.

The Europe automotive finance market demonstrates remarkable resilience and adaptability, positioning itself as a critical enabler of mobility and economic growth across the continent. The market’s evolution from traditional lending to comprehensive mobility solutions reflects its ability to respond to changing consumer needs, technological advances, and regulatory requirements while maintaining fundamental strengths in risk management and customer service.

Strategic opportunities abound for market participants willing to invest in digital transformation, sustainable financing solutions, and innovative product development. The convergence of electric vehicle adoption, digital technology integration, and evolving consumer preferences creates unprecedented opportunities for companies that can successfully navigate this complex landscape while delivering superior customer value.

Future success will depend on balancing innovation with prudent risk management, embracing technology while maintaining human relationships, and pursuing growth while ensuring sustainable business practices. The European automotive finance market is well-positioned to continue its vital role in supporting mobility, economic development, and the transition to sustainable transportation across the continent.

What is Automotive Finance?

Automotive finance refers to the various financial services and products that facilitate the purchase or leasing of vehicles. This includes loans, leases, and financing options provided by banks, credit unions, and automotive manufacturers.

What are the key players in the Europe Automotive Finance Market?

Key players in the Europe Automotive Finance Market include major financial institutions such as Volkswagen Financial Services, BMW Financial Services, and Daimler Financial Services, among others. These companies provide tailored financing solutions to consumers and dealerships.

What are the growth factors driving the Europe Automotive Finance Market?

The Europe Automotive Finance Market is driven by factors such as increasing vehicle sales, the rise of electric vehicles, and the growing trend of flexible financing options. Additionally, consumer demand for affordable payment plans is influencing market growth.

What challenges does the Europe Automotive Finance Market face?

Challenges in the Europe Automotive Finance Market include regulatory changes, economic fluctuations, and the impact of digital transformation on traditional financing models. These factors can create uncertainty for both consumers and financial institutions.

What opportunities exist in the Europe Automotive Finance Market?

Opportunities in the Europe Automotive Finance Market include the expansion of digital financing platforms and the increasing popularity of subscription-based vehicle services. Additionally, the shift towards sustainable mobility solutions presents new avenues for growth.

What trends are shaping the Europe Automotive Finance Market?

Trends in the Europe Automotive Finance Market include the rise of fintech companies offering innovative financing solutions, the integration of artificial intelligence in credit assessments, and a growing focus on sustainability in financing options. These trends are reshaping how consumers access automotive finance.

Europe Automotive Finance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Leasing, Loans, Insurance, Credit |

| End User | Consumers, Dealerships, Fleet Operators, Corporates |

| Service Type | Retail Financing, Wholesale Financing, Aftermarket Services, Financial Advisory |

| Vehicle Type | Passenger Cars, Commercial Vehicles, Electric Vehicles, Luxury Vehicles |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Automotive Finance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at