444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe automated material handling (AMH) market represents a dynamic and rapidly evolving sector that encompasses sophisticated technologies designed to streamline warehouse operations, manufacturing processes, and distribution centers across the continent. European industries are increasingly adopting automated solutions to address labor shortages, enhance operational efficiency, and meet growing consumer demands for faster delivery times. The market demonstrates robust growth potential, driven by the region’s strong manufacturing base and advanced technological infrastructure.

Market expansion is particularly pronounced in countries such as Germany, the United Kingdom, France, and the Netherlands, where industrial automation has become a strategic priority. The sector encompasses various technologies including automated storage and retrieval systems, conveyor systems, robotic solutions, and warehouse management software. Growth projections indicate the market is expanding at a compound annual growth rate of 8.2%, reflecting the increasing adoption of Industry 4.0 principles across European manufacturing and logistics sectors.

Technological advancement continues to shape market dynamics, with artificial intelligence, machine learning, and Internet of Things (IoT) integration becoming standard features in modern AMH systems. European companies are investing heavily in these technologies to maintain competitive advantages and comply with stringent regulatory requirements regarding workplace safety and environmental sustainability.

The automated material handling market refers to the comprehensive ecosystem of technologies, equipment, and systems designed to move, store, control, and protect materials throughout manufacturing, warehousing, and distribution processes without direct human intervention. AMH systems integrate mechanical, electrical, and software components to create seamless workflows that optimize material flow from raw material receipt through finished product shipment.

Core components of automated material handling include conveyor systems, automated guided vehicles (AGVs), robotic picking systems, automated storage and retrieval systems (AS/RS), and sophisticated warehouse management software. These technologies work in concert to eliminate manual handling processes, reduce operational costs, and improve accuracy in material movement and inventory management.

European implementation of AMH systems typically focuses on enhancing productivity while maintaining strict quality standards and regulatory compliance. The technology encompasses both hardware solutions such as mechanical handling equipment and software platforms that provide real-time visibility, predictive analytics, and optimization capabilities for complex supply chain operations.

Market dynamics in the European automated material handling sector reflect a convergence of technological innovation, economic pressures, and evolving consumer expectations. The region’s mature industrial base provides a solid foundation for AMH adoption, while emerging technologies continue to expand the scope and capabilities of automated solutions. Key market drivers include labor cost optimization, operational efficiency improvements, and the need for enhanced supply chain resilience.

Competitive landscape features a mix of established European manufacturers and innovative technology providers, creating a diverse ecosystem of solutions tailored to specific industry requirements. The market demonstrates strong growth momentum, with adoption rates increasing by 12% annually across key industrial sectors including automotive, food and beverage, pharmaceuticals, and e-commerce fulfillment.

Regional variations in market development reflect different industrial priorities and economic conditions, with Western European countries leading in advanced automation adoption while Eastern European markets show rapid growth in basic AMH implementations. Investment trends indicate continued expansion in both greenfield facilities and brownfield retrofits, supported by favorable financing conditions and government incentives for industrial modernization.

Strategic insights reveal several critical factors shaping the European AMH market landscape. The following key observations provide essential understanding of market dynamics and growth opportunities:

Primary drivers propelling the European AMH market forward encompass both economic and technological factors that create compelling business cases for automation adoption. Labor market dynamics represent perhaps the most significant driver, as European industries face persistent challenges in recruiting and retaining skilled warehouse and manufacturing workers. This shortage has intensified following demographic shifts and changing workforce preferences, making automated solutions increasingly attractive.

E-commerce expansion continues to drive demand for sophisticated AMH systems capable of handling high-volume, small-batch orders with rapid turnaround times. The growth of online retail has fundamentally changed fulfillment requirements, necessitating flexible automation solutions that can process diverse product mixes efficiently. Consumer expectations for same-day and next-day delivery have created pressure on logistics providers to invest in advanced material handling technologies.

Operational efficiency requirements push companies toward AMH adoption as organizations seek to optimize space utilization, reduce operational costs, and improve inventory accuracy. Modern AMH systems offer significant advantages in terms of throughput capacity, error reduction, and real-time visibility into material flows. Regulatory compliance also drives adoption, particularly in industries such as pharmaceuticals and food processing where traceability and quality control requirements favor automated solutions over manual processes.

Implementation challenges present significant barriers to AMH adoption across European markets, with high initial capital requirements representing the primary constraint for many organizations. Cost considerations extend beyond equipment procurement to include system integration, employee training, and ongoing maintenance expenses. Small and medium-sized enterprises often struggle to justify the substantial upfront investments required for comprehensive AMH implementations.

Technical complexity associated with modern AMH systems can overwhelm organizations lacking adequate technical expertise or infrastructure. Integration with existing warehouse management systems, enterprise resource planning platforms, and legacy equipment requires specialized knowledge and careful planning. Change management challenges arise when implementing AMH solutions, as organizations must adapt established processes and retrain workforce members to work effectively with automated systems.

Market fragmentation creates additional complications, as the diversity of available technologies and vendors makes solution selection challenging for potential adopters. Standardization issues across different AMH platforms can limit flexibility and increase long-term operational costs. Additionally, concerns about technology obsolescence and the rapid pace of innovation create hesitation among potential investors who worry about making premature commitments to specific technological approaches.

Emerging opportunities in the European AMH market reflect evolving technological capabilities and changing business requirements across multiple industry sectors. Industry 4.0 integration presents substantial growth potential as manufacturers seek to create smart factories with interconnected automated systems. The convergence of AMH technologies with artificial intelligence, machine learning, and predictive analytics opens new possibilities for optimization and autonomous operation.

Sustainability initiatives create opportunities for AMH providers to develop energy-efficient solutions that help organizations meet environmental targets and regulatory requirements. Green logistics trends favor automated systems that optimize energy consumption, reduce waste, and minimize environmental impact. Companies increasingly view AMH investments as components of broader sustainability strategies that enhance corporate reputation and operational efficiency simultaneously.

Market expansion opportunities exist in Eastern European countries where industrial modernization programs and EU funding support AMH adoption. Retrofitting existing facilities represents a significant opportunity as companies seek to upgrade legacy operations without complete facility reconstruction. The growing importance of supply chain resilience following recent global disruptions creates demand for flexible AMH solutions that can adapt to changing operational requirements and maintain continuity during challenging periods.

Dynamic interactions between technological advancement, economic pressures, and regulatory requirements shape the European AMH market landscape. Competitive forces drive continuous innovation as established players and new entrants compete to offer superior solutions that address evolving customer needs. The market demonstrates cyclical patterns influenced by broader economic conditions, with investment levels fluctuating based on business confidence and capital availability.

Technology evolution accelerates market transformation as new capabilities emerge and mature solutions become more accessible. MarkWide Research analysis indicates that technological convergence between AMH systems and digital technologies creates synergistic effects that enhance overall system performance and value proposition. The integration of cloud computing, edge analytics, and mobile technologies expands AMH capabilities while reducing implementation complexity.

Supply chain disruptions have heightened awareness of AMH benefits, particularly regarding operational resilience and flexibility. Organizations recognize that automated systems can maintain operations during labor shortages, health crises, and other disruptions that affect manual processes. Market maturation brings standardization of interfaces and protocols, reducing integration challenges and enabling more modular approaches to AMH implementation that lower barriers to adoption.

Comprehensive research methodology employed in analyzing the European AMH market combines primary and secondary research approaches to ensure accuracy and completeness of market insights. Primary research includes extensive interviews with industry executives, technology providers, end-users, and market experts across multiple European countries. Survey data collection encompasses quantitative analysis of market trends, adoption patterns, and investment priorities among key stakeholder groups.

Secondary research incorporates analysis of industry publications, company financial reports, government statistics, and trade association data to validate primary findings and provide broader market context. Data triangulation methods ensure reliability by cross-referencing information from multiple sources and identifying potential discrepancies or biases in individual data sets.

Market modeling techniques utilize statistical analysis and forecasting algorithms to project future market developments based on historical trends and identified drivers. Qualitative analysis supplements quantitative data through expert opinion synthesis and scenario planning exercises that explore potential market evolution paths. The methodology incorporates regular updates to reflect changing market conditions and emerging trends that may impact future market dynamics.

Regional market dynamics across Europe reveal distinct patterns of AMH adoption influenced by industrial structure, economic development levels, and regulatory environments. Western European markets including Germany, France, and the United Kingdom lead in advanced AMH implementation, with Germany maintaining approximately 28% market share due to its strong manufacturing base and early automation adoption.

Nordic countries demonstrate high per-capita AMH adoption rates, driven by labor costs and technological sophistication. Sweden, Denmark, and Norway show particular strength in sustainable AMH solutions that align with regional environmental priorities. Southern European markets including Italy and Spain focus on AMH applications in automotive and food processing industries, with growth rates of 6-8% annually.

Eastern European expansion represents the fastest-growing regional segment, with countries such as Poland, Czech Republic, and Hungary experiencing rapid AMH adoption as manufacturing operations relocate and modernize. Market penetration rates in Eastern Europe remain lower than Western counterparts but show accelerating growth supported by EU structural funds and foreign direct investment. The Netherlands and Belgium serve as important logistics hubs with high AMH density in distribution and fulfillment operations serving broader European markets.

Competitive dynamics in the European AMH market feature a diverse ecosystem of global technology leaders, regional specialists, and innovative startups competing across different market segments and applications. Market leadership positions vary by technology category and geographic region, creating opportunities for specialized providers to establish strong positions in specific niches.

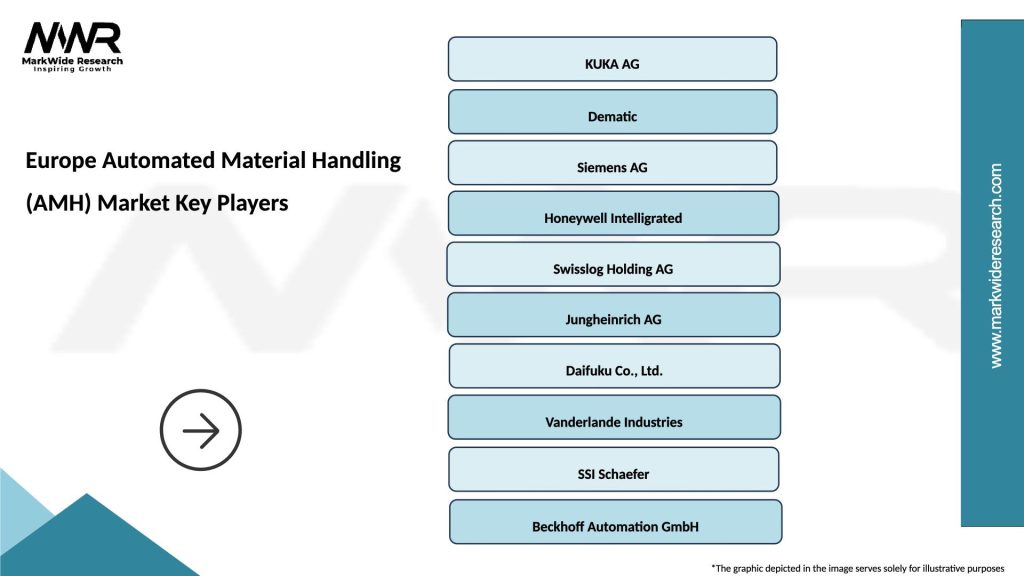

Key market participants include:

Competitive strategies emphasize technological innovation, customer service excellence, and strategic partnerships to expand market reach and capabilities. Market consolidation trends include acquisitions of specialized technology companies and formation of strategic alliances to offer comprehensive solutions addressing complex customer requirements.

Market segmentation analysis reveals distinct categories within the European AMH market, each characterized by specific technologies, applications, and growth patterns. Technology-based segmentation provides insights into the relative importance and growth potential of different AMH solution categories.

By Technology:

By Application:

Automated Storage and Retrieval Systems represent the most mature AMH category, with established market presence across multiple industries. AS/RS adoption continues growing at 7% annually as organizations seek to maximize storage density and improve inventory accuracy. Modern systems incorporate advanced software for predictive maintenance and optimization, extending equipment life and reducing operational costs.

Robotic systems demonstrate the highest growth potential within the AMH market, driven by advancing artificial intelligence and decreasing hardware costs. Collaborative robots gain particular traction in European markets where worker safety and human-machine collaboration receive priority attention. Integration with machine learning algorithms enables robots to adapt to changing operational requirements and improve performance over time.

Conveyor technology evolution focuses on modularity and intelligence, with smart conveyors incorporating sensors, controls, and analytics capabilities. Flexible conveyor systems address the need for adaptable material handling solutions that can accommodate changing product mixes and seasonal demand variations. Energy efficiency improvements in modern conveyor designs align with European sustainability objectives while reducing operational costs.

Sortation systems benefit from e-commerce growth and increasing complexity of order fulfillment requirements. Advanced sortation technologies incorporate artificial intelligence for improved accuracy and throughput optimization. Cross-belt sorters and tilt-tray systems gain popularity for their ability to handle diverse product types while maintaining high processing speeds.

Operational benefits derived from AMH implementation provide compelling value propositions for European organizations across multiple industry sectors. Efficiency improvements typically range from 20-40% in throughput capacity, while accuracy enhancements reduce error rates and associated costs. Labor optimization allows organizations to redeploy human resources to higher-value activities while maintaining or increasing operational capacity.

Financial advantages include reduced operational costs, improved asset utilization, and enhanced return on investment through optimized space usage and inventory management. AMH systems provide better visibility into material flows and inventory levels, enabling more accurate demand planning and reduced carrying costs. Energy efficiency improvements contribute to cost reduction while supporting sustainability objectives.

Strategic benefits encompass enhanced competitive positioning through improved customer service capabilities and operational flexibility. Scalability advantages allow organizations to adapt capacity to changing business requirements without proportional increases in labor costs. Risk mitigation benefits include reduced dependency on manual labor, improved workplace safety, and enhanced operational resilience during disruptions.

Stakeholder value creation extends beyond immediate operational improvements to include enhanced customer satisfaction, improved employee working conditions, and positive environmental impact. Supply chain partners benefit from improved reliability and visibility, while investors appreciate the operational efficiency and growth potential associated with modern AMH implementations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration represents the most significant trend shaping the European AMH market, with AI-powered systems offering unprecedented optimization capabilities and autonomous decision-making. Machine learning algorithms enable AMH systems to continuously improve performance, predict maintenance requirements, and adapt to changing operational conditions without human intervention.

Collaborative Robotics gains momentum as European organizations prioritize worker safety and human-machine collaboration. Cobots designed to work alongside human operators provide flexibility while maintaining safety standards, making automation accessible to smaller operations that cannot justify fully automated solutions. Advanced safety systems and intuitive programming interfaces reduce implementation barriers and training requirements.

Sustainability Focus drives development of energy-efficient AMH solutions that minimize environmental impact while reducing operational costs. Green automation initiatives incorporate renewable energy sources, energy recovery systems, and optimized routing algorithms to reduce carbon footprints. European companies increasingly view sustainable AMH solutions as essential components of corporate environmental responsibility programs.

Modular System Design addresses the need for flexible, scalable AMH solutions that can evolve with changing business requirements. Plug-and-play components enable organizations to implement AMH systems incrementally, reducing initial investment requirements and allowing for gradual expansion. Standardized interfaces and protocols facilitate integration between different vendors’ equipment and software platforms.

Recent industry developments highlight the dynamic nature of the European AMH market and the continuous evolution of technologies and business models. Strategic acquisitions among major AMH providers consolidate market positions and expand technological capabilities, creating more comprehensive solution portfolios for complex customer requirements.

Technology partnerships between AMH providers and software companies accelerate innovation in areas such as artificial intelligence, predictive analytics, and cloud computing integration. MWR analysis indicates that these collaborations are essential for developing next-generation AMH solutions that meet evolving customer expectations for intelligence and connectivity.

Government initiatives across European countries support AMH adoption through funding programs, tax incentives, and regulatory frameworks that encourage industrial modernization. Digital transformation programs at national and EU levels recognize AMH as critical infrastructure for maintaining industrial competitiveness in the global economy.

Customer-centric innovations focus on improving user experience through intuitive interfaces, remote monitoring capabilities, and predictive maintenance services. Service model evolution includes subscription-based offerings, performance guarantees, and outcome-based contracts that align vendor and customer interests while reducing implementation risks.

Strategic recommendations for AMH market participants emphasize the importance of technological innovation, customer focus, and operational excellence in maintaining competitive advantages. Technology providers should prioritize development of AI-enabled solutions that offer autonomous operation capabilities and predictive analytics for optimized performance.

Market expansion strategies should focus on underserved segments and geographic regions where AMH adoption remains limited. Eastern European markets present particular opportunities for growth, supported by EU funding and industrial modernization programs. Tailored solutions addressing specific regional requirements and cost constraints can accelerate market penetration.

Partnership development represents a critical success factor for AMH providers seeking to offer comprehensive solutions addressing complex customer requirements. Strategic alliances with software providers, system integrators, and industry specialists can expand capabilities while reducing development costs and time-to-market for new solutions.

Customer education initiatives should address knowledge gaps and misconceptions about AMH technologies, particularly among small and medium-sized enterprises. Demonstration facilities and pilot programs can help potential customers understand AMH benefits and develop confidence in automation investments. Flexible financing options and phased implementation approaches can reduce barriers to adoption.

Market projections indicate continued strong growth for the European AMH market, driven by technological advancement, economic pressures, and evolving customer requirements. Growth momentum is expected to accelerate as AI integration matures and costs of advanced technologies continue declining. The market is projected to maintain a compound annual growth rate of 8.2% through the forecast period.

Technology evolution will focus on autonomous systems capable of self-optimization and predictive maintenance, reducing operational complexity and costs. MarkWide Research forecasts that fully autonomous AMH systems will account for 35% of new installations by the end of the decade, representing a significant shift from current manually supervised operations.

Market maturation will bring increased standardization and interoperability between different AMH platforms, reducing integration challenges and enabling more flexible system architectures. Industry consolidation is expected to continue as larger providers acquire specialized technology companies and expand their solution portfolios to address comprehensive customer requirements.

Emerging applications in sectors such as healthcare, pharmaceuticals, and cold storage will drive market diversification and create new growth opportunities. Sustainability requirements will increasingly influence AMH design and selection criteria, favoring energy-efficient solutions that support corporate environmental objectives while delivering operational benefits.

The European automated material handling market stands at a pivotal point in its evolution, characterized by rapid technological advancement, increasing adoption across diverse industries, and growing recognition of AMH as essential infrastructure for competitive operations. Market dynamics reflect the convergence of economic pressures, technological capabilities, and changing business requirements that create compelling drivers for automation investment.

Growth prospects remain robust across the region, supported by strong industrial foundations, technological innovation, and favorable regulatory environments. The market’s evolution toward intelligent, autonomous systems promises to deliver unprecedented levels of operational efficiency and flexibility while addressing persistent challenges such as labor shortages and sustainability requirements.

Success factors for market participants include technological leadership, customer-centric innovation, and strategic partnerships that enable comprehensive solution delivery. Organizations that can effectively combine advanced technologies with deep industry expertise and strong service capabilities are best positioned to capitalize on the substantial opportunities presented by the evolving European AMH market landscape.

What is Automated Material Handling?

Automated Material Handling refers to the use of technology to automate the movement, storage, and control of materials and products throughout the manufacturing, warehousing, and distribution processes.

What are the key players in the Europe Automated Material Handling (AMH) Market?

Key players in the Europe Automated Material Handling (AMH) Market include KION Group, Dematic, and Swisslog, among others.

What are the main drivers of growth in the Europe Automated Material Handling (AMH) Market?

The main drivers of growth in the Europe Automated Material Handling (AMH) Market include the increasing demand for efficiency in supply chain operations, the rise of e-commerce, and advancements in robotics and AI technologies.

What challenges does the Europe Automated Material Handling (AMH) Market face?

Challenges in the Europe Automated Material Handling (AMH) Market include high initial investment costs, the complexity of integrating new systems with existing infrastructure, and the need for skilled labor to manage advanced technologies.

What opportunities exist in the Europe Automated Material Handling (AMH) Market?

Opportunities in the Europe Automated Material Handling (AMH) Market include the growing trend of smart factories, the expansion of logistics and warehousing sectors, and the increasing adoption of IoT technologies for real-time tracking.

What trends are shaping the Europe Automated Material Handling (AMH) Market?

Trends shaping the Europe Automated Material Handling (AMH) Market include the rise of autonomous mobile robots, the integration of AI for predictive analytics, and the focus on sustainability in material handling processes.

Europe Automated Material Handling (AMH) Market

| Segmentation Details | Description |

|---|---|

| Product Type | Automated Guided Vehicles, Conveyor Systems, Robotic Arms, Sortation Systems |

| Technology | IoT, AI, Machine Learning, Robotics |

| End User | Manufacturing, Warehousing, Retail, Logistics |

| Application | Order Fulfillment, Inventory Management, Material Transport, Packaging |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Automated Material Handling (AMH) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at