444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe arts promoter market represents a dynamic and culturally significant sector that serves as the backbone of the continent’s vibrant creative economy. Arts promoters across European nations play a crucial role in connecting artists with audiences, facilitating cultural exchanges, and driving the commercial success of various artistic endeavors. This market encompasses a diverse range of activities including concert promotion, theater production, art exhibition organization, festival management, and digital content distribution.

Market dynamics in Europe reflect the region’s rich cultural heritage combined with modern technological innovations. The sector has experienced remarkable resilience and adaptation, particularly following recent global challenges that reshaped how cultural content is consumed and promoted. Digital transformation has become a key driver, with promoters increasingly leveraging online platforms, virtual reality experiences, and hybrid event formats to reach broader audiences.

The European market demonstrates significant growth potential with an estimated compound annual growth rate of 6.2% CAGR projected through the forecast period. This growth is supported by increasing consumer spending on entertainment, government initiatives supporting cultural industries, and the rising popularity of experiential entertainment among younger demographics. Regional diversity remains a defining characteristic, with different countries showing varying preferences for art forms, promotional strategies, and consumption patterns.

The Europe arts promoter market refers to the comprehensive ecosystem of businesses, organizations, and individuals engaged in the promotion, marketing, and commercial facilitation of artistic and cultural content across European territories. This market encompasses traditional promotional activities such as concert booking, venue management, and artist representation, as well as modern digital marketing strategies, content creation, and audience engagement platforms.

Arts promoters serve as intermediaries between creative talent and consumers, utilizing their expertise in marketing, event management, and industry relationships to maximize the reach and commercial success of artistic works. The market includes independent promoters, large-scale entertainment corporations, government-supported cultural organizations, and emerging digital platforms that facilitate direct artist-to-audience connections.

Scope of services within this market extends beyond simple event organization to include strategic career development for artists, cross-cultural collaboration facilitation, intellectual property management, and the creation of sustainable revenue models for creative professionals. The market’s definition continues to evolve as technology reshapes how art is consumed and promoted across Europe.

Strategic positioning of the Europe arts promoter market reveals a sector undergoing significant transformation while maintaining its cultural significance. The market benefits from Europe’s position as a global cultural hub, with cities like London, Paris, Berlin, and Amsterdam serving as major centers for artistic innovation and promotion. Market participants range from established multinational entertainment companies to innovative startups leveraging technology to democratize arts promotion.

Key performance indicators suggest robust market health, with digital engagement rates increasing by approximately 78% year-over-year and hybrid event formats gaining 45% adoption rates among European promoters. The market demonstrates particular strength in music promotion, visual arts, and performing arts, with emerging growth in digital art forms and immersive experiences.

Competitive landscape features both consolidation trends among major players and the emergence of niche specialists focusing on specific art forms or demographic segments. Technology integration has become essential, with successful promoters investing heavily in data analytics, customer relationship management systems, and digital marketing capabilities to enhance their promotional effectiveness and audience reach.

Market intelligence reveals several critical insights shaping the Europe arts promoter landscape:

Primary growth drivers propelling the Europe arts promoter market include increasing consumer disposable income dedicated to entertainment and cultural experiences. Urbanization trends across European cities have created concentrated populations with strong appetites for diverse artistic content, providing promoters with substantial target markets for their promotional activities.

Technological advancement serves as a fundamental driver, enabling promoters to reach audiences more effectively through sophisticated digital marketing tools, social media platforms, and data analytics systems. The proliferation of streaming services and digital content platforms has created new promotional opportunities while also expanding the definition of what constitutes arts promotion in the modern marketplace.

Government initiatives supporting cultural industries provide significant market stimulus through funding programs, tax incentives, and policy frameworks that encourage artistic development and promotion. European Union cultural programs facilitate cross-border collaboration and provide resources for promoters to expand their operations internationally within the European market.

Demographic shifts toward experiential consumption, particularly among millennials and Generation Z consumers, drive demand for unique, Instagram-worthy cultural experiences that promoters can leverage for marketing and audience engagement. The growing recognition of arts and culture as essential components of quality of life continues to support market expansion across European territories.

Regulatory complexity presents significant challenges for arts promoters operating across multiple European jurisdictions, with varying licensing requirements, taxation structures, and cultural policies creating operational difficulties and increased compliance costs. Brexit implications have particularly impacted UK-EU cultural exchanges, requiring promoters to navigate new bureaucratic processes and potential barriers to artist mobility.

Economic uncertainty in various European markets affects consumer spending on discretionary cultural activities, forcing promoters to adapt their strategies and pricing models to maintain audience engagement during periods of financial constraint. Competition from digital entertainment platforms and streaming services continues to challenge traditional promotional models, requiring significant investment in technology and digital capabilities.

Venue availability and rising real estate costs in major European cities limit promotional opportunities and increase operational expenses for arts promoters. The concentration of cultural activities in major urban centers creates intense competition for premium venues while potentially limiting market expansion into smaller markets.

Talent acquisition challenges affect the market as skilled professionals in arts promotion, digital marketing, and event management command premium salaries, particularly in competitive markets like London, Paris, and Berlin. The specialized nature of arts promotion requires industry-specific expertise that can be difficult to source and retain.

Digital transformation presents unprecedented opportunities for European arts promoters to expand their reach and develop innovative promotional strategies. Virtual and augmented reality technologies offer potential for creating immersive promotional experiences that can transcend geographical boundaries and provide new revenue streams through digital ticketing and virtual event access.

Emerging markets within Eastern European countries provide growth opportunities as these economies develop stronger cultural sectors and consumer bases with increasing disposable income for arts and entertainment. Cultural tourism integration offers promoters opportunities to collaborate with tourism boards and hospitality sectors to create comprehensive cultural experiences for international visitors.

Corporate partnerships represent significant opportunity areas, with businesses increasingly recognizing the value of cultural sponsorship and employee engagement through arts programming. Educational sector collaboration provides opportunities for promoters to develop programs targeting students and academic institutions, creating long-term audience development strategies.

Sustainability initiatives offer differentiation opportunities for promoters who can develop and market environmentally conscious promotional strategies and events. The growing consumer preference for sustainable and socially responsible entertainment options creates market space for innovative promotional approaches that align with these values.

Market forces shaping the Europe arts promoter sector reflect the complex interplay between traditional cultural values and modern technological capabilities. Supply chain dynamics have evolved to include digital content distribution, online ticketing systems, and virtual venue management, requiring promoters to develop new competencies and operational frameworks.

Competitive dynamics demonstrate increasing consolidation among major players while simultaneously showing growth in niche specialists and technology-enabled startups. Market entry barriers have both lowered and heightened – digital tools make basic promotion more accessible, but sophisticated market success requires substantial investment in technology, talent, and market knowledge.

Consumer behavior patterns show increasing demand for personalized experiences, with successful promoters leveraging data analytics to provide targeted content recommendations and customized promotional approaches. Seasonal fluctuations remain significant, with promoters developing strategies to maintain revenue during traditionally slower periods through digital content and off-season programming.

Innovation cycles in the market have accelerated, with new promotional technologies, platforms, and strategies emerging regularly. Promoters must balance investment in emerging technologies with maintaining proven promotional methods that continue to deliver results for their artist clients and audience engagement objectives.

Comprehensive research approach employed for analyzing the Europe arts promoter market combines quantitative data analysis with qualitative insights from industry stakeholders. Primary research includes structured interviews with arts promoters, venue operators, artists, and cultural policy makers across major European markets to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, government cultural statistics, trade association data, and academic studies focusing on European cultural industries. Market sizing methodologies utilize multiple data sources including industry surveys, government economic data, and trade organization statistics to develop comprehensive market understanding.

Regional analysis methodology involves country-specific research across major European markets including the United Kingdom, Germany, France, Italy, Spain, Netherlands, and emerging Eastern European markets. Segmentation analysis examines market performance across different art forms, promotional channels, and target demographics to provide detailed market insights.

Data validation processes include cross-referencing multiple sources, expert review panels, and statistical verification methods to ensure research accuracy and reliability. Trend analysis incorporates historical data spanning multiple years to identify sustainable market patterns and distinguish temporary fluctuations from long-term structural changes in the European arts promotion landscape.

Western European markets dominate the regional landscape, with the United Kingdom, Germany, and France representing approximately 62% of total market activity. London maintains its position as a leading global arts promotion hub, despite Brexit-related challenges, with its diverse cultural scene and international connectivity continuing to attract major promotional investments and activities.

German market demonstrates particular strength in music promotion and festival organization, with cities like Berlin, Munich, and Hamburg serving as key centers for both domestic and international arts promotion. France shows robust performance in visual arts promotion and cultural tourism integration, leveraging its rich artistic heritage and government support for cultural industries.

Southern European markets including Italy and Spain show growing significance, with approximately 23% market share driven by increased cultural tourism and government initiatives supporting creative industries. Nordic countries demonstrate innovation in digital arts promotion and sustainable event practices, influencing broader European market trends.

Eastern European markets represent the fastest-growing segment with projected growth rates of 8.4% annually, driven by economic development, EU integration, and increasing consumer spending on cultural activities. Countries like Poland, Czech Republic, and Hungary are emerging as significant markets for both domestic and international arts promotion activities.

Market leadership in the Europe arts promoter sector features a diverse mix of multinational entertainment corporations, regional specialists, and innovative technology-enabled platforms. Major players have established comprehensive service offerings spanning multiple art forms and geographical markets:

Competitive strategies increasingly focus on technology integration, data analytics capabilities, and cross-platform promotional approaches. Market consolidation continues alongside the emergence of specialized niche players targeting specific art forms or demographic segments.

Market segmentation analysis reveals distinct categories within the Europe arts promoter market based on art form specialization, target audience, and promotional approach:

By Art Form:

By Target Audience:

By Promotional Channel:

Music promotion represents the dominant category, accounting for approximately 58% of total market activity. This segment benefits from strong consumer demand, established promotional infrastructure, and successful integration of digital marketing strategies. Festival promotion within this category shows particular strength, with European music festivals attracting international audiences and generating significant economic impact.

Visual arts promotion demonstrates steady growth driven by cultural tourism and increasing collector interest in contemporary art. Gallery partnerships and art fair participation provide key promotional channels, while digital platforms enable broader audience reach and online sales integration. The segment benefits from government support and cultural institution collaboration.

Performing arts promotion faces unique challenges related to venue capacity and production costs but maintains strong audience loyalty and cultural significance. Theater promotion shows resilience through subscription models and season ticket sales, while dance promotion benefits from international touring opportunities and cultural exchange programs.

Digital arts promotion represents the fastest-growing category, with virtual reality experiences and interactive installations gaining commercial viability. This emerging segment attracts younger demographics and technology-savvy audiences, creating new promotional opportunities and revenue models for innovative promoters.

Artists and creative professionals benefit from professional promotional services that expand their audience reach, increase revenue opportunities, and provide strategic career development support. Market access through established promotional networks enables artists to focus on creative work while promoters handle marketing, logistics, and audience development activities.

Venue operators gain from partnerships with arts promoters through increased booking activity, professional event management, and access to diverse programming that attracts varied audiences. Risk sharing arrangements allow venues to host ambitious programming while minimizing financial exposure through promoter expertise and market knowledge.

Audiences and consumers benefit from curated cultural experiences, professional event organization, and access to diverse artistic content that might not otherwise be available in their local markets. Quality assurance provided by professional promoters ensures high standards in event production and customer service.

Government and cultural institutions achieve policy objectives related to cultural development, tourism promotion, and creative economy growth through collaboration with professional arts promoters. Economic impact generated by promotional activities supports broader economic development goals and cultural sector sustainability.

Corporate sponsors and partners access targeted marketing opportunities and brand association with cultural activities that enhance their reputation and customer engagement. Employee engagement programs developed through arts promotion partnerships provide valuable human resources benefits and corporate social responsibility achievements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-first strategies have become essential for successful arts promotion, with social media marketing, influencer partnerships, and data-driven audience targeting representing standard practices rather than innovative approaches. Hybrid event models combining physical and digital experiences show sustained adoption rates of 67% among European promoters, creating new revenue opportunities and expanded audience reach.

Sustainability initiatives are increasingly important, with environmentally conscious event practices and carbon-neutral promotional strategies becoming competitive differentiators. Consumer demand for sustainable entertainment options drives promoter investment in green technologies, renewable energy, and waste reduction programs.

Personalization technology enables promoters to deliver customized experiences and targeted marketing messages based on individual consumer preferences and behavior patterns. Artificial intelligence and machine learning applications support improved audience segmentation, content recommendation, and promotional timing optimization.

Cross-cultural collaboration trends show increased international partnerships and touring activities, facilitated by digital communication tools and streamlined logistics solutions. Cultural exchange programs supported by government initiatives create opportunities for promoters to develop international markets and artist career development services.

Technology partnerships between traditional promoters and digital platforms have accelerated, with major promotional companies investing in streaming capabilities, virtual event technologies, and customer relationship management systems. MarkWide Research analysis indicates that technology investment among European promoters has increased by 43% over the past two years.

Merger and acquisition activity continues to reshape the competitive landscape, with larger promotional companies acquiring specialized firms to expand their service offerings and geographical reach. Independent promoter consolidation provides economies of scale while maintaining specialized market knowledge and artist relationships.

Government policy developments including cultural funding programs, visa facilitation for artists, and digital taxation frameworks significantly impact promotional operations and strategic planning. European Union initiatives supporting cultural mobility and cross-border collaboration create new opportunities for promotional expansion.

Venue innovation including flexible spaces, technology integration, and sustainable design influences promotional strategies and event programming possibilities. Pop-up venues and alternative spaces provide promoters with cost-effective options for experimental programming and emerging artist development.

Strategic recommendations for arts promoters operating in the European market emphasize the critical importance of digital transformation and data analytics capabilities. Investment priorities should focus on customer relationship management systems, social media marketing expertise, and hybrid event production capabilities to remain competitive in the evolving marketplace.

Market expansion strategies should consider emerging Eastern European markets while maintaining strong positions in established Western European territories. Partnership development with technology companies, venue operators, and cultural institutions provides opportunities for service enhancement and market reach expansion.

Risk management approaches should address regulatory compliance across multiple jurisdictions, economic sensitivity mitigation, and operational flexibility to adapt to changing market conditions. Diversification strategies across art forms, audience segments, and revenue streams provide stability and growth opportunities.

Innovation investment in emerging technologies such as virtual reality, artificial intelligence, and blockchain applications for ticketing and rights management positions promoters for future market leadership. Sustainability initiatives should be integrated into core business strategies rather than treated as optional add-ons to meet evolving consumer expectations.

Market projections indicate continued growth for the Europe arts promoter sector, with digital integration and international collaboration driving expansion opportunities. Technology adoption will accelerate, with successful promoters leveraging artificial intelligence, virtual reality, and advanced analytics to enhance their promotional effectiveness and audience engagement capabilities.

Demographic shifts toward younger, digitally native audiences will require promoters to adapt their strategies and embrace new promotional channels and content formats. MWR projections suggest that promoters focusing on digital-first strategies will capture 75% of new market growth over the next five years.

Regulatory environment evolution will continue to impact cross-border operations, with promoters needing to maintain flexibility and compliance capabilities across multiple jurisdictions. Brexit implications will stabilize as new operational frameworks become established, potentially creating opportunities for promoters who successfully navigate the transition.

Sustainability requirements will become increasingly important, with consumer preferences and regulatory pressures driving adoption of environmentally responsible promotional practices. Innovation cycles will accelerate, requiring promoters to maintain continuous learning and adaptation capabilities to remain competitive in the dynamic European marketplace.

The Europe arts promoter market represents a dynamic and culturally significant sector positioned for continued growth and evolution. Digital transformation has emerged as the defining trend, reshaping how promoters connect artists with audiences and creating new opportunities for market expansion and revenue generation.

Regional diversity across European markets provides both opportunities and challenges, with successful promoters developing strategies that leverage local cultural preferences while maintaining operational efficiency across multiple jurisdictions. Technology integration will continue to drive competitive advantage, with data analytics, social media marketing, and hybrid event capabilities becoming essential operational requirements.

Market outlook remains positive despite ongoing challenges related to regulatory complexity and economic uncertainty. The sector’s resilience and adaptability, demonstrated through recent global disruptions, positions European arts promoters for sustained growth and continued cultural impact. Innovation investment and strategic partnerships will determine market leadership as the sector continues to evolve and expand its influence on Europe’s creative economy.

What is Arts Promoter?

Arts Promoters are individuals or organizations that facilitate the promotion and marketing of artistic events, performances, and exhibitions. They play a crucial role in connecting artists with audiences and ensuring that cultural events reach their potential attendees.

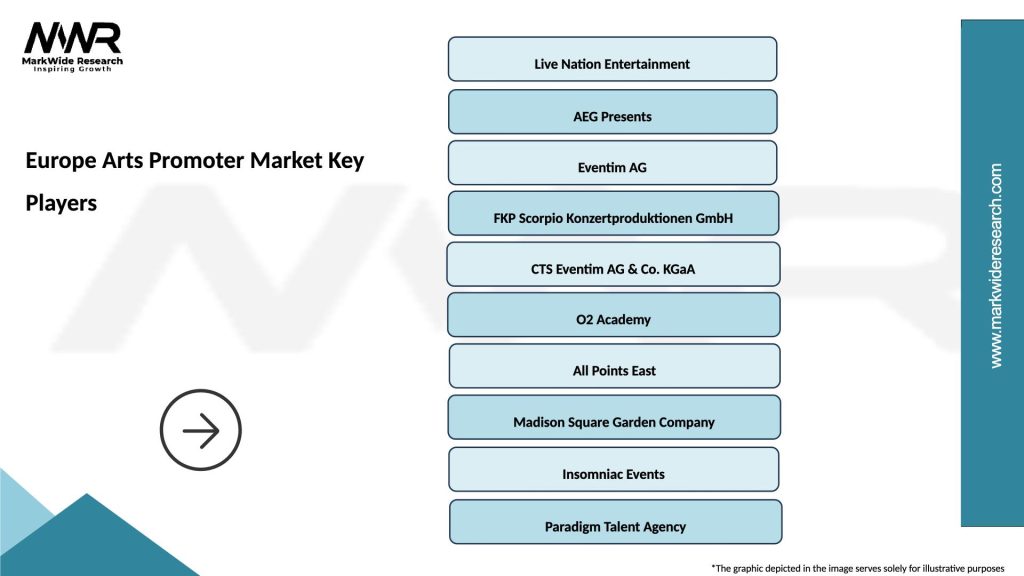

What are the key players in the Europe Arts Promoter Market?

Key players in the Europe Arts Promoter Market include companies like Live Nation, AEG Presents, and Eventim, which specialize in organizing and promoting live events. These companies often collaborate with artists, venues, and sponsors to enhance the visibility of cultural events, among others.

What are the main drivers of growth in the Europe Arts Promoter Market?

The growth of the Europe Arts Promoter Market is driven by increasing consumer interest in live performances, the rise of digital marketing strategies, and the expansion of cultural festivals. Additionally, government support for the arts and a growing emphasis on cultural tourism contribute to this growth.

What challenges does the Europe Arts Promoter Market face?

The Europe Arts Promoter Market faces challenges such as fluctuating audience attendance, competition from digital entertainment platforms, and funding limitations for arts organizations. These factors can impact the sustainability and profitability of live events.

What opportunities exist in the Europe Arts Promoter Market?

Opportunities in the Europe Arts Promoter Market include the integration of technology in event promotion, such as virtual reality experiences and online ticketing solutions. Additionally, the growing trend of experiential marketing offers new avenues for engaging audiences.

What trends are shaping the Europe Arts Promoter Market?

Trends shaping the Europe Arts Promoter Market include the increasing use of social media for event promotion, a focus on sustainability in event planning, and the rise of hybrid events that combine in-person and virtual experiences. These trends reflect changing consumer preferences and technological advancements.

Europe Arts Promoter Market

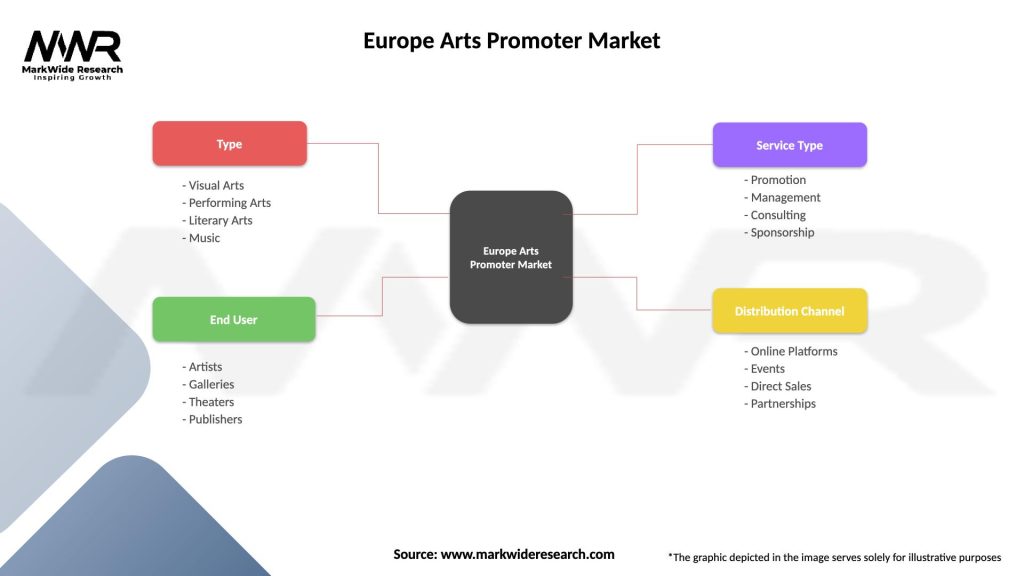

| Segmentation Details | Description |

|---|---|

| Type | Visual Arts, Performing Arts, Literary Arts, Music |

| End User | Artists, Galleries, Theaters, Publishers |

| Service Type | Promotion, Management, Consulting, Sponsorship |

| Distribution Channel | Online Platforms, Events, Direct Sales, Partnerships |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Arts Promoter Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at