444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe aramid fibers market represents a dynamic and rapidly evolving sector within the advanced materials industry, characterized by exceptional growth potential and diverse application opportunities. Aramid fibers, known for their outstanding strength-to-weight ratio, heat resistance, and chemical stability, have become indispensable materials across multiple industries including aerospace, automotive, defense, and protective equipment manufacturing. The European market demonstrates robust expansion driven by increasing demand for lightweight, high-performance materials that meet stringent safety and performance standards.

Market dynamics indicate substantial growth momentum, with the region experiencing a 6.8% CAGR over recent years as industries increasingly adopt advanced fiber technologies. Germany, France, and the United Kingdom emerge as leading markets, collectively accounting for approximately 62% of regional consumption. The market’s evolution reflects Europe’s commitment to technological innovation and sustainable manufacturing practices, positioning aramid fibers as critical components in next-generation applications.

Industrial applications continue expanding beyond traditional uses, with emerging sectors such as renewable energy, electronics, and infrastructure development driving new demand patterns. The region’s strong manufacturing base, coupled with stringent regulatory frameworks emphasizing safety and performance, creates favorable conditions for aramid fiber adoption across diverse end-use industries.

The Europe aramid fibers market refers to the comprehensive ecosystem encompassing the production, distribution, and consumption of synthetic aromatic polyamide fibers characterized by exceptional mechanical properties and thermal stability across European territories. Aramid fibers represent a specialized class of high-performance synthetic materials distinguished by their unique molecular structure, which provides outstanding tensile strength, chemical resistance, and dimensional stability under extreme conditions.

These advanced materials are manufactured through complex polymerization processes that create long-chain molecules with aromatic rings, resulting in fibers that maintain their structural integrity across wide temperature ranges while offering superior protection against cuts, abrasion, and impact. The European market encompasses both para-aramid and meta-aramid fiber segments, each serving distinct application requirements and performance specifications.

Market participants include fiber manufacturers, converters, distributors, and end-users across industries ranging from personal protective equipment to aerospace components. The ecosystem supports innovation in fiber technology, processing techniques, and application development, contributing to Europe’s position as a global leader in advanced materials technology and sustainable manufacturing practices.

The European aramid fibers market demonstrates exceptional growth trajectory driven by increasing demand for high-performance materials across critical industries. Key market drivers include stringent safety regulations, growing emphasis on lightweight materials, and expanding applications in emerging technologies. The market benefits from Europe’s strong industrial base, advanced manufacturing capabilities, and commitment to innovation in materials science.

Regional leadership is evident through significant investments in research and development, with European companies maintaining competitive advantages in specialized applications and premium product segments. Automotive and aerospace sectors represent the largest consumption areas, accounting for approximately 45% of total demand, while protective equipment and industrial applications contribute substantial market share.

Technological advancement remains a cornerstone of market development, with manufacturers focusing on enhanced fiber properties, improved processing techniques, and sustainable production methods. The market exhibits strong resilience and adaptability, successfully navigating global challenges while maintaining growth momentum through strategic partnerships and innovation initiatives.

Future prospects indicate continued expansion supported by emerging applications in renewable energy, electronics, and infrastructure development. The market’s evolution reflects broader trends toward high-performance, sustainable materials that meet increasingly demanding performance requirements across diverse industrial applications.

Strategic market analysis reveals several critical insights that define the European aramid fibers landscape and its future trajectory:

The European aramid fibers market experiences robust growth driven by multiple interconnected factors that create sustained demand across diverse industries. Primary drivers include the region’s commitment to advanced manufacturing, stringent safety regulations, and increasing emphasis on lightweight, high-performance materials.

Automotive industry transformation represents a significant growth catalyst, with manufacturers increasingly adopting aramid fibers for lightweight components, brake systems, and safety applications. The shift toward electric vehicles creates new opportunities for thermal management and structural applications, where aramid fibers provide essential performance characteristics while reducing overall vehicle weight.

Aerospace sector expansion continues driving demand for advanced composite materials incorporating aramid fibers. European aerospace manufacturers require materials that meet strict performance standards while offering weight reduction benefits, making aramid fibers essential components in aircraft structures, interior systems, and safety equipment.

Safety regulation enforcement across industries creates mandatory demand for protective equipment incorporating aramid fibers. European workplace safety standards require high-performance materials that provide reliable protection against cuts, heat, and chemical exposure, establishing aramid fibers as preferred solutions for personal protective equipment manufacturing.

Infrastructure development projects throughout Europe generate demand for durable, high-strength materials in construction and civil engineering applications. Aramid fibers offer superior performance in reinforcement applications, contributing to longer-lasting, more resilient infrastructure systems that meet European quality and safety standards.

Despite strong growth potential, the European aramid fibers market faces several challenges that may limit expansion or create operational difficulties for market participants. High production costs represent the most significant constraint, as aramid fiber manufacturing requires specialized equipment, complex processes, and substantial energy consumption, resulting in premium pricing that may limit adoption in cost-sensitive applications.

Raw material availability and price volatility create supply chain uncertainties that affect production planning and cost management. The specialized chemicals required for aramid fiber production are subject to supply disruptions and price fluctuations, impacting manufacturer profitability and market stability.

Technical processing challenges limit the adoption of aramid fibers in certain applications where conventional materials offer easier handling and processing characteristics. The unique properties that make aramid fibers valuable also create difficulties in cutting, machining, and bonding operations, requiring specialized equipment and expertise.

Competition from alternative materials poses ongoing challenges as manufacturers develop new high-performance fibers and composite materials that may offer similar properties at lower costs or with improved processing characteristics. Carbon fibers, ultra-high molecular weight polyethylene, and advanced glass fibers compete directly with aramid fibers in various applications.

Environmental concerns related to aramid fiber production and disposal create regulatory pressures and market perception challenges. The complex chemistry involved in aramid fiber manufacturing raises questions about environmental impact and sustainability, requiring ongoing investment in cleaner production technologies and recycling solutions.

The European aramid fibers market presents numerous growth opportunities driven by technological advancement, emerging applications, and evolving industry requirements. Renewable energy sector expansion creates substantial demand for high-performance materials in wind turbine blades, solar panel components, and energy storage systems, where aramid fibers provide essential durability and performance characteristics.

Electric vehicle proliferation throughout Europe generates new application opportunities in battery protection, thermal management, and lightweight structural components. As European automotive manufacturers accelerate electric vehicle production, demand for specialized materials that enhance safety and performance while reducing weight continues expanding.

Advanced electronics applications represent emerging opportunities as miniaturization and performance requirements drive demand for high-performance insulation and structural materials. Aramid fibers offer unique properties for flexible electronics, 5G infrastructure, and advanced computing applications that require exceptional thermal and mechanical stability.

Sustainable manufacturing initiatives create opportunities for developing recycled aramid fiber products and circular economy solutions. European companies investing in recycling technologies and sustainable production methods can capture growing demand from environmentally conscious customers while meeting regulatory requirements.

Defense and security applications continue expanding as European nations invest in advanced protective equipment and military technologies. Aramid fibers play critical roles in ballistic protection, vehicle armor, and specialized equipment that meets evolving security requirements while providing enhanced performance and comfort.

The European aramid fibers market operates within a complex ecosystem of interconnected forces that shape industry development and competitive positioning. Supply-demand dynamics reflect the balance between specialized production capabilities and diverse application requirements across multiple industries, creating market conditions that favor innovation and strategic partnerships.

Technological evolution drives continuous market transformation as manufacturers develop enhanced fiber properties, improved processing techniques, and novel applications. Innovation cycles typically span 3-5 years, with successful developments creating competitive advantages and market differentiation opportunities for leading companies.

Competitive intensity varies across market segments, with specialized applications offering higher margins and greater differentiation potential compared to commodity-oriented segments. Market leaders maintain positions through technological expertise, customer relationships, and operational efficiency rather than price competition alone.

Regulatory influences significantly impact market dynamics through safety standards, environmental requirements, and trade policies. European regulations often set global standards for aramid fiber applications, creating both compliance challenges and competitive advantages for regional manufacturers.

Customer concentration in key industries creates both opportunities and risks, as major customers drive substantial demand volumes while also possessing significant negotiating power. Successful market participants develop diversified customer bases and application portfolios to reduce dependency risks while maximizing growth opportunities.

Comprehensive market analysis employs multiple research methodologies to ensure accurate, reliable insights into the European aramid fibers market landscape. Primary research involves extensive interviews with industry executives, technical experts, and key stakeholders across the value chain, providing firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses detailed analysis of industry publications, company reports, regulatory documents, and technical literature to establish market context and validate primary findings. This approach ensures comprehensive coverage of market dynamics, competitive positioning, and technological developments.

Quantitative analysis utilizes statistical modeling and data analytics to identify market patterns, growth trends, and correlation factors that influence market development. Advanced analytical techniques help distinguish between short-term fluctuations and long-term structural changes in market behavior.

Qualitative assessment focuses on understanding market drivers, barriers, and strategic considerations that shape industry evolution. Expert interviews and industry workshops provide insights into future trends, technological developments, and competitive strategies that quantitative data alone cannot capture.

Market validation processes ensure research accuracy through cross-referencing multiple data sources, expert review, and industry feedback. This rigorous approach maintains research credibility while providing actionable insights for strategic decision-making across the aramid fibers value chain.

Germany dominates the European aramid fibers market, accounting for approximately 28% of regional consumption, driven by its strong automotive and industrial manufacturing sectors. German manufacturers lead in automotive applications, aerospace components, and industrial textiles, benefiting from advanced manufacturing capabilities and strong customer relationships with major OEMs.

France represents the second-largest market with significant consumption in aerospace, defense, and protective equipment applications. French companies maintain leadership positions in specialized applications requiring high-performance materials, particularly in aerospace and military sectors where technical expertise and quality standards are paramount.

The United Kingdom demonstrates strong market presence despite Brexit-related challenges, with continued growth in automotive, aerospace, and industrial applications. UK manufacturers focus on high-value applications and maintain competitive positions through innovation and specialized expertise in niche market segments.

Italy and Spain show growing market importance, particularly in automotive and industrial applications, with increasing adoption of aramid fibers in manufacturing processes. These markets benefit from expanding industrial capabilities and growing emphasis on high-performance materials in traditional manufacturing sectors.

Eastern European markets including Poland, Czech Republic, and Hungary demonstrate rapid growth potential as industrial capabilities expand and foreign investment increases. These regions offer cost advantages while developing technical expertise, creating opportunities for market expansion and supply chain optimization.

The European aramid fibers market features a concentrated competitive structure dominated by several key players who maintain market leadership through technological innovation, operational excellence, and strategic customer relationships. Market competition focuses on product performance, technical support, and application development rather than price alone.

Strategic partnerships and vertical integration characterize competitive strategies, with leading companies developing close relationships with key customers and investing in application development capabilities. Innovation leadership remains critical for maintaining competitive advantages in premium market segments.

The European aramid fibers market exhibits clear segmentation patterns based on product type, application, and end-use industry, each demonstrating distinct growth characteristics and competitive dynamics.

By Product Type:

By Application:

By End-Use Industry:

Para-aramid fibers dominate the European market through exceptional strength-to-weight ratios and versatile application potential. These high-performance materials excel in demanding applications where mechanical properties are critical, including ballistic protection, automotive reinforcement, and aerospace components. Market growth reflects increasing adoption in lightweight automotive applications and expanding use in renewable energy infrastructure.

Meta-aramid fibers serve specialized thermal protection and electrical insulation markets with steady growth driven by safety regulations and industrial applications. Flame-resistant properties make these materials essential for protective clothing, industrial filtration, and electrical insulation applications where thermal stability is paramount.

Automotive applications represent the largest consumption category, benefiting from European automotive industry leadership and increasing emphasis on lightweight materials. Electric vehicle development creates new opportunities for aramid fibers in battery protection, thermal management, and structural applications that require exceptional performance characteristics.

Protective equipment applications demonstrate consistent growth driven by workplace safety regulations and security requirements. European safety standards mandate high-performance materials in personal protective equipment, creating stable demand for aramid fibers in cut-resistant, ballistic, and flame-resistant applications.

Aerospace applications maintain premium market positioning through stringent performance requirements and long product lifecycles. Commercial aircraft production and defense spending support continued demand for specialized aramid fiber products that meet exacting aerospace industry standards.

Manufacturers benefit from the European aramid fibers market through access to advanced technologies, skilled workforce, and sophisticated customer base that drives innovation and product development. European manufacturing capabilities enable production of high-quality, specialized products that command premium pricing in global markets.

End-users gain significant advantages through improved product performance, enhanced safety characteristics, and reduced lifecycle costs when incorporating aramid fibers into their applications. Performance benefits include weight reduction, durability improvement, and enhanced protection capabilities that justify premium material costs.

Supply chain participants benefit from stable, long-term relationships with established customers and predictable demand patterns in key application areas. Value-added services including technical support, application development, and customized solutions create differentiation opportunities and enhanced profitability.

Research institutions and technology developers gain access to collaborative opportunities with industry leaders, funding for advanced research projects, and pathways for commercializing innovative technologies. European research infrastructure supports continued innovation in aramid fiber technology and applications.

Investors benefit from market stability, growth potential, and strong competitive positions of European companies in global aramid fiber markets. Market fundamentals including regulatory support, technological leadership, and diverse application base provide attractive investment opportunities with sustainable competitive advantages.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as a dominant trend shaping the European aramid fibers market, with manufacturers investing heavily in recycling technologies and circular economy solutions. Environmental responsibility drives innovation in production processes, waste reduction, and end-of-life fiber recovery, creating competitive advantages for companies that successfully implement sustainable practices.

Digital transformation revolutionizes manufacturing processes through advanced automation, artificial intelligence, and data analytics that optimize production efficiency and quality control. Industry 4.0 technologies enable real-time monitoring, predictive maintenance, and customized production capabilities that enhance competitiveness and customer satisfaction.

Application diversification continues expanding beyond traditional uses as manufacturers develop specialized products for emerging technologies including flexible electronics, advanced composites, and smart textiles. Innovation partnerships with technology companies and research institutions accelerate development of novel applications that create new market opportunities.

Supply chain localization gains importance as companies seek to reduce dependency on global supply chains and improve responsiveness to customer requirements. Regional manufacturing strategies enhance supply security while reducing transportation costs and environmental impact.

Performance enhancement through advanced fiber modifications and hybrid material development creates opportunities for premium product positioning. Nanotechnology integration and surface treatments enable enhanced properties that justify premium pricing in specialized applications requiring exceptional performance characteristics.

Recent industry developments demonstrate the dynamic nature of the European aramid fibers market and the continuous evolution of technology, applications, and competitive positioning. Strategic investments in production capacity expansion reflect confidence in long-term market growth and commitment to meeting increasing demand across diverse applications.

Technology partnerships between aramid fiber manufacturers and end-use industries accelerate innovation in product development and application optimization. Collaborative research programs focus on developing next-generation materials that meet evolving performance requirements while addressing sustainability concerns.

Acquisition activities reshape the competitive landscape as companies seek to enhance technological capabilities, expand market reach, and achieve operational synergies. Strategic consolidation enables companies to leverage complementary strengths while improving cost competitiveness and customer service capabilities.

Regulatory developments including updated safety standards and environmental requirements influence product development priorities and market positioning strategies. Compliance initiatives drive investment in cleaner production technologies and enhanced quality management systems that meet evolving regulatory expectations.

Market expansion initiatives target emerging applications and geographic regions where aramid fibers can provide unique value propositions. Application development programs focus on demonstrating performance benefits and cost-effectiveness in new market segments that offer growth potential.

MarkWide Research recommends that European aramid fiber manufacturers prioritize sustainability initiatives and circular economy solutions to address growing environmental concerns while creating competitive differentiation. Investment in recycling technologies and sustainable production methods will become increasingly important for maintaining market leadership and customer relationships.

Strategic partnerships with key customers in automotive and aerospace industries should focus on collaborative innovation and long-term supply agreements that provide mutual benefits and market stability. Technical support capabilities and application development expertise will become critical differentiators in competitive markets.

Geographic expansion into Eastern European markets offers growth opportunities as industrial capabilities develop and foreign investment increases. Market entry strategies should emphasize local partnerships and technical support to establish competitive positions in emerging markets.

Digital transformation investments in manufacturing processes, customer service, and supply chain management will enhance operational efficiency and competitive positioning. Advanced analytics and automation technologies can improve quality control while reducing production costs.

Product portfolio diversification toward emerging applications in renewable energy, electronics, and advanced composites will reduce dependency on traditional markets while capturing growth opportunities. Innovation investments should focus on developing specialized products that meet unique performance requirements in high-growth market segments.

The European aramid fibers market demonstrates exceptional long-term growth potential driven by technological advancement, application diversification, and increasing emphasis on high-performance materials across key industries. Market projections indicate sustained expansion at a 7.2% CAGR through the forecast period, supported by robust demand from automotive, aerospace, and emerging technology sectors.

Electric vehicle proliferation throughout Europe will create substantial new demand for aramid fibers in battery protection, thermal management, and lightweight structural applications. Automotive industry transformation toward electrification and autonomous systems generates opportunities for specialized materials that enhance safety and performance while reducing vehicle weight.

Renewable energy infrastructure development will drive significant demand for durable, high-performance materials in wind turbine blades, solar panel components, and energy storage systems. European climate goals and renewable energy targets create favorable conditions for aramid fiber adoption in sustainable energy applications.

Advanced manufacturing technologies including additive manufacturing, smart textiles, and flexible electronics will create new application opportunities that leverage aramid fibers’ unique properties. Innovation cycles in emerging technologies will generate demand for specialized materials that meet evolving performance requirements.

Sustainability initiatives will reshape market dynamics as customers increasingly prioritize environmentally responsible materials and suppliers. Circular economy solutions and recycling technologies will become competitive advantages for companies that successfully implement sustainable practices while maintaining performance standards.

The Europe aramid fibers market represents a dynamic and rapidly evolving sector with exceptional growth potential driven by technological innovation, application diversification, and increasing demand for high-performance materials across critical industries. Market fundamentals including strong industrial base, advanced manufacturing capabilities, and stringent quality standards position European companies for continued leadership in global aramid fiber markets.

Strategic opportunities in electric vehicles, renewable energy, and emerging technologies create pathways for sustained growth while reducing dependency on traditional applications. Sustainability initiatives and circular economy solutions will become increasingly important for maintaining competitive advantages and meeting evolving customer expectations.

Competitive success will depend on companies’ ability to innovate continuously, develop strategic partnerships, and invest in advanced manufacturing technologies that enhance efficiency and product quality. Market leaders who successfully balance performance, sustainability, and cost-effectiveness will capture the greatest share of expanding market opportunities while building long-term competitive advantages in this critical advanced materials sector.

What is Aramid Fibers?

Aramid fibers are a class of heat-resistant and strong synthetic fibers used in various applications, including aerospace, automotive, and protective clothing. They are known for their high tensile strength and thermal stability.

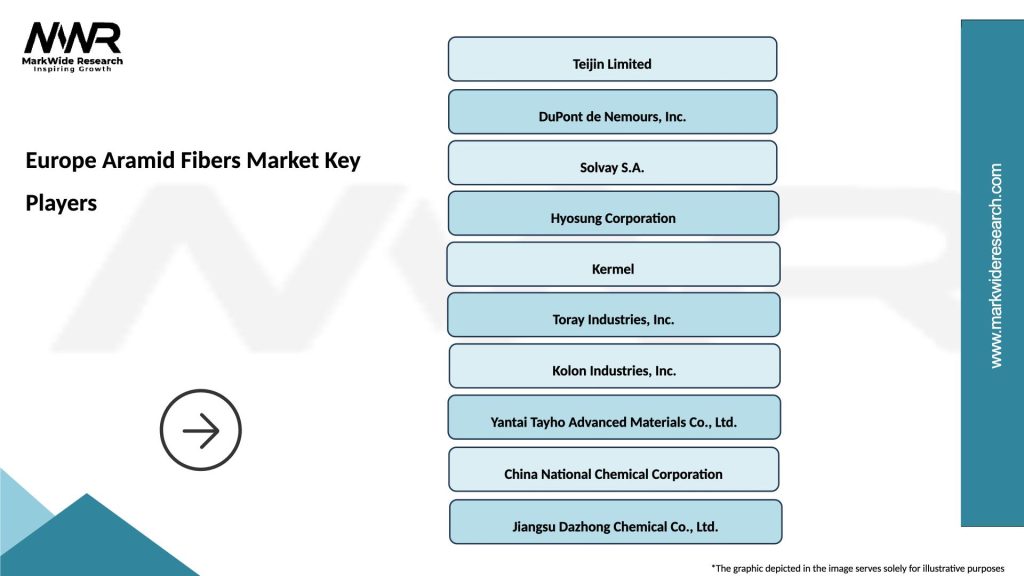

What are the key players in the Europe Aramid Fibers Market?

Key players in the Europe Aramid Fibers Market include DuPont, Teijin, and Solvay, which are known for their innovative products and significant market presence. These companies focus on developing advanced aramid fiber solutions for various industries, among others.

What are the main drivers of the Europe Aramid Fibers Market?

The main drivers of the Europe Aramid Fibers Market include the increasing demand for lightweight and high-strength materials in the automotive and aerospace sectors. Additionally, the growing need for protective gear in industrial applications is also contributing to market growth.

What challenges does the Europe Aramid Fibers Market face?

The Europe Aramid Fibers Market faces challenges such as high production costs and the availability of alternative materials that may offer similar properties. Additionally, fluctuations in raw material prices can impact the overall market dynamics.

What opportunities exist in the Europe Aramid Fibers Market?

Opportunities in the Europe Aramid Fibers Market include the expansion of applications in emerging sectors like renewable energy and electronics. The increasing focus on sustainability and lightweight materials also presents growth potential for aramid fibers.

What trends are shaping the Europe Aramid Fibers Market?

Trends shaping the Europe Aramid Fibers Market include advancements in fiber technology, leading to enhanced performance characteristics. Additionally, there is a growing emphasis on eco-friendly production processes and the development of new composite materials.

Europe Aramid Fibers Market

| Segmentation Details | Description |

|---|---|

| Product Type | Para-Aramid, Meta-Aramid, Blends, Others |

| End Use Industry | Aerospace, Automotive OEMs, Construction, Electrical |

| Form | Fabrics, Papers, Composites, Yarns |

| Grade | Standard, High-Strength, High-Temperature, Specialty |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Aramid Fibers Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at