444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe and Asia Pacific digital motor claims management market is witnessing significant growth as insurers and automotive companies increasingly adopt digital solutions to streamline their claims processes. Digital motor claims management involves leveraging technology, such as artificial intelligence (AI), machine learning (ML), and automation, to enhance the efficiency, accuracy, and speed of handling motor insurance claims.

Meaning

Digital motor claims management refers to the use of advanced technologies and digital tools to automate and optimize the motor insurance claims process. These technologies enable insurers and automotive companies to efficiently manage and process claims, reducing manual intervention and improving customer satisfaction.

Executive Summary

The Europe and Asia Pacific digital motor claims management market is experiencing rapid growth due to the increasing demand for streamlined claims processes and enhanced customer experience. Digital solutions offer benefits such as faster claims settlement, reduced fraud, improved accuracy, and enhanced customer engagement. Insurers and automotive companies are investing in digital motor claims management solutions to gain a competitive edge in the market.

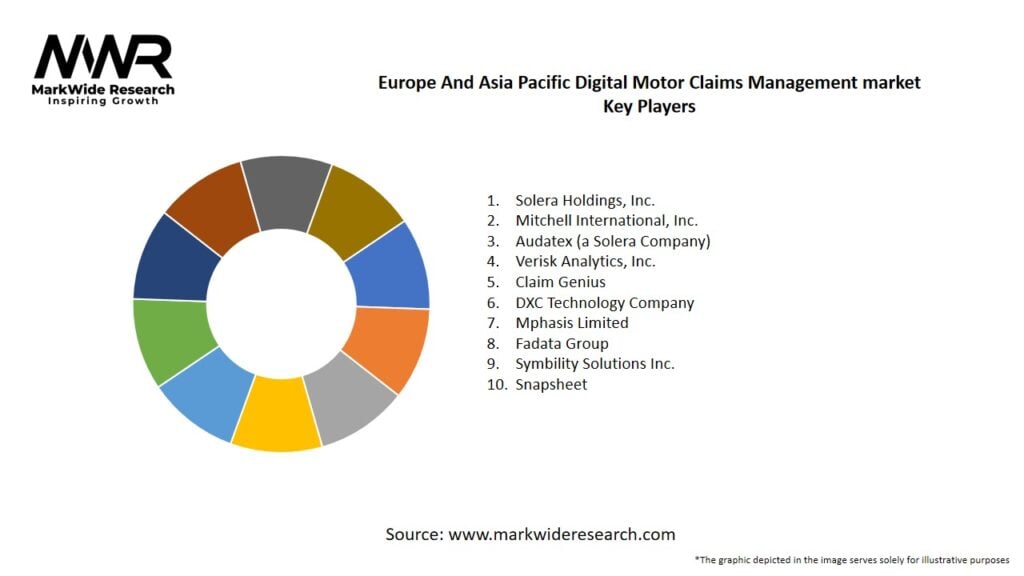

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

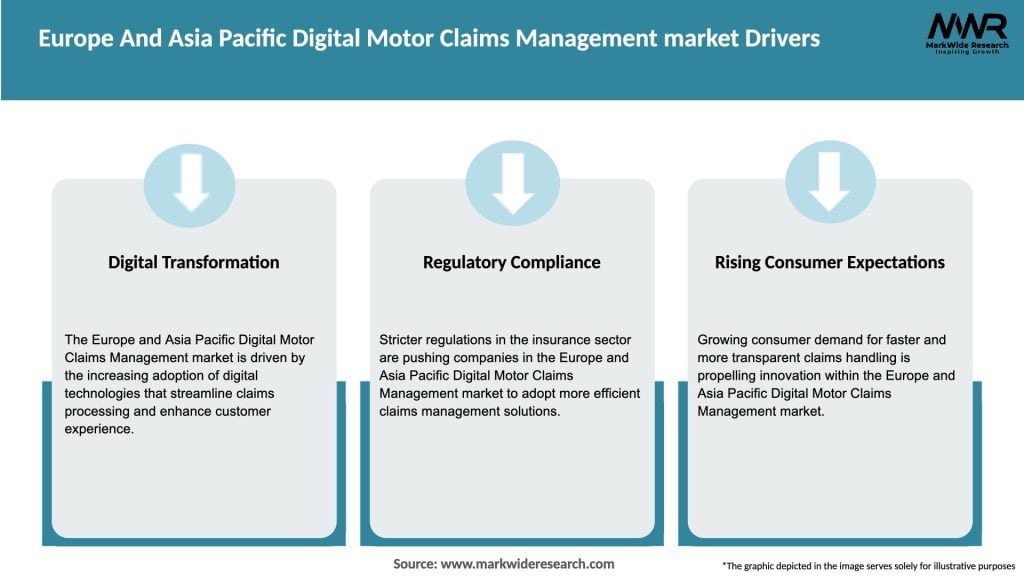

The Europe and Asia Pacific digital motor claims management market is driven by the convergence of various factors, including technological advancements, evolving customer expectations, regulatory reforms, and the need for operational efficiency. The market is characterized by intense competition, with both established players and emerging startups vying for market share by offering innovative solutions.

Regional Analysis

The Europe and Asia Pacific region showcases significant potential for digital motor claims management solutions. Europe, with its mature insurance industry and stringent regulations, offers a robust market for digital transformation. Asia Pacific, on the other hand, is experiencing rapid motor vehicle sales growth and increasing insurance penetration, driving the demand for digital claims management solutions.

Competitive Landscape

Leading Companies in the Europe and Asia Pacific Digital Motor Claims Management Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The market can be segmented based on solution type, deployment mode, end-user, and region. Solution types may include automated claims processing, fraud detection, claims estimation, and customer engagement solutions. Deployment modes can range from on-premises solutions to cloud-based platforms. End-users may include insurance companies, automotive manufacturers, and third-party claims administrators.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has accelerated the adoption of digital motor claims management solutions. With lockdowns and social distancing measures in place, insurers and automotive companies turned to digital tools to ensure uninterrupted claims processing, remote collaboration, and enhanced customer engagement. The pandemic underscored the importance of resilient and flexible claims management systems, further driving the demand for digital solutions.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Europe and Asia Pacific digital motor claims management market is poised for significant growth in the coming years. Increasing digitization, advancements in AI and ML technologies, and evolving customer expectations will drive the demand for efficient and seamless claims management processes. The market is likely to witness further innovation, consolidation, and collaboration as industry players strive to meet the evolving needs of insurers, automotive companies, and customers.

Conclusion

The Europe and Asia Pacific digital motor claims management market is undergoing a transformative phase, with technology playing a crucial role in streamlining claims processes and enhancing customer experiences. Digital solutions offer numerous benefits, including improved operational efficiency, cost reduction, accurate claims assessment, and enhanced customer engagement. To stay competitive, industry participants need to embrace digital transformation, leverage advanced technologies, and prioritize customer-centricity. With the right strategies and investments, insurers and automotive companies can navigate the evolving market landscape and drive sustainable growth in the digital motor claims management sector.

What is Digital Motor Claims Management?

Digital Motor Claims Management refers to the use of digital technologies to streamline and enhance the process of managing motor insurance claims. This includes the integration of software solutions, data analytics, and automated workflows to improve efficiency and customer satisfaction.

What are the key players in the Europe And Asia Pacific Digital Motor Claims Management market?

Key players in the Europe And Asia Pacific Digital Motor Claims Management market include companies like Guidewire Software, CCC Information Services, and Solera Holdings, among others.

What are the growth factors driving the Europe And Asia Pacific Digital Motor Claims Management market?

The growth of the Europe And Asia Pacific Digital Motor Claims Management market is driven by increasing demand for efficient claims processing, the rise of digital transformation in the insurance sector, and the need for enhanced customer experiences.

What challenges does the Europe And Asia Pacific Digital Motor Claims Management market face?

Challenges in the Europe And Asia Pacific Digital Motor Claims Management market include data privacy concerns, the complexity of integrating new technologies with legacy systems, and the need for skilled personnel to manage digital tools effectively.

What opportunities exist in the Europe And Asia Pacific Digital Motor Claims Management market?

Opportunities in the Europe And Asia Pacific Digital Motor Claims Management market include the potential for artificial intelligence to improve claims assessment, the growth of telematics in motor insurance, and the increasing adoption of mobile applications for claims reporting.

What trends are shaping the Europe And Asia Pacific Digital Motor Claims Management market?

Trends shaping the Europe And Asia Pacific Digital Motor Claims Management market include the rise of automation in claims processing, the use of big data analytics for fraud detection, and the growing emphasis on customer-centric services.

Europe And Asia Pacific Digital Motor Claims Management market

| Segmentation Details | Description |

|---|---|

| End User | Insurance Companies, Fleet Operators, Repair Shops, Third-Party Administrators |

| Service Type | Claims Processing, Fraud Detection, Customer Support, Data Analytics |

| Technology | Cloud Computing, Machine Learning, Blockchain, Mobile Applications |

| Deployment | On-Premises, Cloud-Based, Hybrid, Managed Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Europe and Asia Pacific Digital Motor Claims Management Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at