444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe air quality monitoring market represents a critical component of the continent’s environmental protection infrastructure, encompassing sophisticated technologies and systems designed to measure, analyze, and report atmospheric pollutant levels across diverse geographical regions. This comprehensive market includes ambient air quality monitoring stations, indoor air quality sensors, portable monitoring devices, and advanced data analytics platforms that collectively support regulatory compliance, public health protection, and environmental sustainability initiatives.

European nations have established themselves as global leaders in environmental monitoring technologies, driven by stringent regulatory frameworks such as the EU Air Quality Directive and the European Green Deal. The market demonstrates robust growth potential, with adoption rates increasing by approximately 12.5% annually across industrial, governmental, and commercial sectors. Germany, France, and the United Kingdom represent the largest market segments, collectively accounting for over 55% of regional demand for air quality monitoring solutions.

Technological advancement continues to reshape the European air quality monitoring landscape, with Internet of Things (IoT) integration, artificial intelligence-powered analytics, and real-time data transmission capabilities becoming standard features. The market encompasses various monitoring parameters including particulate matter (PM2.5 and PM10), nitrogen dioxide, sulfur dioxide, ozone, carbon monoxide, and volatile organic compounds, addressing both regulatory requirements and emerging health concerns.

The Europe air quality monitoring market refers to the comprehensive ecosystem of technologies, services, and solutions designed to measure, analyze, and report atmospheric pollution levels across European territories. This market encompasses hardware components such as monitoring stations and sensors, software platforms for data management and analysis, and professional services including installation, calibration, and maintenance of monitoring equipment.

Air quality monitoring systems serve multiple critical functions within European environmental management frameworks. These solutions enable regulatory compliance with European Union directives, support public health protection initiatives, facilitate industrial emission control, and provide essential data for climate change research and policy development. The market includes both fixed monitoring installations and portable devices, catering to diverse application requirements across urban, industrial, and rural environments.

Market participants include equipment manufacturers, software developers, system integrators, and service providers who collectively deliver comprehensive air quality monitoring solutions. The European market emphasizes high-precision measurements, long-term reliability, and seamless integration with existing environmental management systems, reflecting the region’s commitment to environmental excellence and public health protection.

Europe’s air quality monitoring market demonstrates exceptional growth momentum, driven by increasingly stringent environmental regulations, growing public awareness of air pollution health impacts, and technological innovations in sensor technology and data analytics. The market benefits from substantial government investments in environmental infrastructure, with public sector procurement representing approximately 68% of total market demand.

Key market drivers include the European Union’s ambitious climate neutrality goals, urbanization trends requiring enhanced pollution monitoring, and industrial digitalization initiatives incorporating environmental compliance systems. The market exhibits strong regional variations, with Northern and Western European countries leading in adoption rates and technological sophistication, while Eastern European markets show rapid growth potential as regulatory frameworks align with EU standards.

Competitive dynamics feature a mix of established European manufacturers, innovative technology startups, and global environmental monitoring specialists. Market consolidation trends are evident, with larger players acquiring specialized technology companies to expand their solution portfolios and geographical reach. The market increasingly favors integrated solutions that combine hardware, software, and services, reflecting customer preferences for comprehensive monitoring ecosystems rather than standalone products.

Strategic market analysis reveals several critical insights shaping the European air quality monitoring landscape. The market demonstrates strong correlation between regulatory enforcement intensity and adoption rates, with countries implementing stricter air quality standards experiencing accelerated market growth.

Regulatory framework evolution serves as the primary market driver, with European Union environmental directives establishing mandatory air quality monitoring requirements across member states. The EU Air Quality Directive, combined with national implementation regulations, creates consistent demand for monitoring infrastructure upgrades and expansions. Compliance deadlines and penalty structures provide strong incentives for timely adoption of advanced monitoring technologies.

Public health awareness continues to drive market growth, as scientific research increasingly demonstrates the correlation between air pollution exposure and respiratory diseases, cardiovascular conditions, and premature mortality. European health authorities actively promote air quality monitoring as a preventive health measure, leading to increased funding for monitoring infrastructure in urban areas and near industrial facilities.

Technological advancement enables more cost-effective and comprehensive monitoring solutions, making air quality monitoring accessible to smaller municipalities and private organizations. Sensor miniaturization, wireless connectivity, and cloud-based data management reduce implementation barriers while improving monitoring accuracy and reliability. Smart city initiatives across European cities integrate air quality monitoring into broader urban management platforms, creating synergies with traffic management, energy systems, and public health programs.

Climate change commitments under the European Green Deal and Paris Agreement require detailed environmental monitoring to track progress toward emission reduction targets. Air quality monitoring provides essential data for policy evaluation and adjustment, supporting evidence-based environmental management decisions at local, national, and EU levels.

High implementation costs represent a significant market restraint, particularly for smaller municipalities and organizations with limited environmental budgets. Comprehensive air quality monitoring systems require substantial initial investments in equipment, installation, and ongoing maintenance, creating financial barriers for widespread adoption. Budget constraints in public sector organizations often delay or limit monitoring network expansions, despite regulatory requirements.

Technical complexity challenges organizations lacking specialized environmental monitoring expertise. Air quality monitoring systems require proper calibration, regular maintenance, and skilled interpretation of data to ensure accuracy and regulatory compliance. The shortage of qualified technicians and environmental specialists in some European regions limits market growth potential and increases operational costs.

Data management challenges emerge as monitoring networks generate vast amounts of environmental data requiring sophisticated storage, processing, and analysis capabilities. Organizations struggle with data integration, quality assurance, and meaningful interpretation of monitoring results, particularly when managing multiple monitoring locations and parameters simultaneously.

Standardization issues across different European countries create compatibility challenges for monitoring equipment and data sharing initiatives. Varying national regulations, measurement protocols, and reporting requirements complicate market entry for manufacturers and increase costs for organizations operating across multiple jurisdictions.

Digital transformation initiatives across European organizations create substantial opportunities for advanced air quality monitoring solutions incorporating artificial intelligence, machine learning, and predictive analytics capabilities. Organizations seek monitoring systems that provide actionable insights rather than raw data, opening markets for value-added services and intelligent monitoring platforms.

Indoor air quality monitoring represents a rapidly expanding opportunity segment, driven by increased awareness of indoor pollution sources and their health impacts. Commercial buildings, educational institutions, healthcare facilities, and residential developments increasingly adopt indoor monitoring systems, creating new market channels beyond traditional outdoor ambient monitoring applications.

Industrial digitalization trends offer significant growth potential as manufacturing companies integrate air quality monitoring into broader Industry 4.0 initiatives. Smart factories require real-time environmental monitoring to optimize production processes, ensure worker safety, and maintain regulatory compliance, creating demand for integrated monitoring solutions.

Cross-border collaboration initiatives among European countries create opportunities for standardized monitoring networks and data sharing platforms. Regional air quality management programs require coordinated monitoring approaches, potentially leading to large-scale procurement opportunities and technology standardization benefits.

Supply chain dynamics in the European air quality monitoring market reflect a complex ecosystem of component manufacturers, system integrators, and service providers. The market benefits from strong local manufacturing capabilities in countries like Germany and Switzerland, reducing dependence on imports and ensuring rapid response to customer requirements. Component availability and pricing stability support consistent market growth, though global semiconductor shortages occasionally impact production schedules.

Competitive intensity varies significantly across market segments, with established players dominating traditional monitoring station markets while innovative startups capture emerging opportunities in IoT-enabled sensors and data analytics platforms. Market consolidation trends create opportunities for strategic partnerships and acquisitions, as companies seek to expand their technological capabilities and geographical reach.

Customer behavior patterns show increasing preference for comprehensive monitoring solutions that combine hardware, software, and services rather than standalone products. Organizations value long-term partnerships with monitoring solution providers who can support their evolving environmental management requirements. Procurement cycles typically range from 18 to 36 months for large installations, requiring sustained sales and marketing efforts.

Innovation cycles accelerate as technological advancement enables new monitoring capabilities and applications. The market demonstrates strong receptivity to innovative solutions that improve measurement accuracy, reduce operational costs, or provide enhanced data insights. Research and development investments by leading market participants drive continuous improvement in monitoring technologies and analytical capabilities.

Comprehensive market research for the European air quality monitoring market employs multiple data collection and analysis methodologies to ensure accuracy and reliability of findings. Primary research activities include structured interviews with industry executives, government officials, and end-user organizations across major European markets to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of government publications, regulatory documents, industry reports, and company financial statements to establish market size estimates and growth projections. MarkWide Research analysts utilize proprietary databases and analytical frameworks to synthesize information from diverse sources and validate market intelligence through triangulation methods.

Quantitative analysis techniques include statistical modeling, trend analysis, and market segmentation studies to identify growth patterns and forecast future market developments. Data validation processes ensure consistency and accuracy across different information sources, while sensitivity analysis tests the robustness of market projections under various scenario assumptions.

Expert consultation with technology specialists, regulatory experts, and industry veterans provides qualitative insights that complement quantitative findings. Focus group discussions with end-user organizations reveal practical implementation challenges and solution preferences that inform market opportunity assessments and competitive positioning analysis.

Western Europe dominates the regional air quality monitoring market, with Germany accounting for approximately 22% of total demand, followed by France and the United Kingdom. These markets benefit from mature regulatory frameworks, substantial environmental budgets, and advanced technological infrastructure supporting comprehensive monitoring networks. Industrial concentration in the Rhine Valley and other manufacturing regions drives consistent demand for emission monitoring systems.

Northern European countries including Sweden, Denmark, and Norway demonstrate high adoption rates of advanced monitoring technologies, reflecting strong environmental consciousness and government support for clean air initiatives. These markets favor premium monitoring solutions with enhanced accuracy and reliability, creating opportunities for high-value technology providers.

Southern Europe shows growing market potential, with Italy and Spain implementing expanded monitoring networks to address urban air quality challenges. Mediterranean countries increasingly focus on ozone and particulate matter monitoring due to specific climatic conditions and pollution patterns. Tourism considerations in coastal regions drive municipal investments in air quality monitoring infrastructure.

Eastern Europe represents the fastest-growing regional segment, with market expansion rates exceeding 15% annually as countries align their environmental regulations with EU standards. Poland, Czech Republic, and Romania lead regional adoption, supported by EU funding programs for environmental infrastructure development. These markets prioritize cost-effective monitoring solutions while building technical expertise and regulatory compliance capabilities.

Market leadership in the European air quality monitoring sector features a diverse mix of established environmental monitoring specialists, technology innovators, and integrated solution providers. The competitive landscape reflects regional preferences for local suppliers combined with demand for global technology leadership and innovation capabilities.

Competitive strategies emphasize technological differentiation, comprehensive service offerings, and strategic partnerships with system integrators and government agencies. Market leaders invest heavily in research and development to maintain technological advantages while building local presence through acquisitions and joint ventures.

Technology-based segmentation reveals distinct market segments with varying growth trajectories and customer requirements. Traditional monitoring technologies maintain strong market positions while emerging sensor technologies capture increasing market share through cost advantages and deployment flexibility.

By Technology:

By Application:

Continuous Emission Monitoring Systems represent the largest market category, driven by stringent industrial emission regulations and the need for real-time compliance verification. These systems demonstrate strong growth in power generation, cement manufacturing, and chemical processing sectors, with adoption rates increasing by 8.5% annually across European industrial facilities.

Ambient air quality monitoring maintains steady growth supported by urban expansion and regulatory requirements for monitoring station density. Municipal governments prioritize network expansion to meet EU directive requirements, while technological upgrades improve measurement accuracy and data reliability. Smart city integration creates additional value propositions beyond regulatory compliance.

Indoor air quality monitoring emerges as the fastest-growing category, with commercial building applications leading adoption. Healthcare facilities, educational institutions, and office buildings increasingly recognize indoor air quality impacts on occupant health and productivity. COVID-19 pandemic effects accelerated awareness of indoor air quality importance, creating sustained demand growth.

Portable monitoring devices serve specialized applications including emergency response, environmental consulting, and research projects. These systems provide flexibility for temporary monitoring requirements and complement fixed monitoring networks. Technological miniaturization enables more sophisticated portable solutions with laboratory-grade accuracy.

Regulatory compliance benefits provide fundamental value for organizations subject to air quality regulations. Comprehensive monitoring systems ensure consistent compliance with EU directives and national standards, reducing regulatory risks and potential penalties. Automated reporting capabilities streamline compliance processes while maintaining audit trails for regulatory inspections.

Operational efficiency improvements result from integrated monitoring systems that optimize industrial processes and building management operations. Real-time air quality data enables proactive responses to pollution events, reducing environmental impacts and operational disruptions. Predictive analytics capabilities help organizations anticipate and prevent air quality issues before they occur.

Public health protection benefits extend to communities surrounding monitoring installations, with early warning systems enabling protective actions during pollution episodes. Healthcare organizations utilize air quality data to inform patient care decisions and public health recommendations. Community engagement through public data sharing builds trust and environmental awareness.

Research and development advantages emerge from comprehensive environmental datasets supporting climate research, policy development, and technology innovation. Academic institutions and research organizations access high-quality environmental data for scientific studies and model validation. Data sharing initiatives create collaborative research opportunities across European institutions.

Strengths:

Weaknesses:

Opportunities:

Threats:

IoT integration transforms traditional air quality monitoring through connected sensor networks that provide real-time data transmission and remote monitoring capabilities. This trend enables more cost-effective monitoring deployments while improving data accessibility and system management efficiency. Cloud-based platforms support scalable data storage and advanced analytics capabilities.

Artificial intelligence adoption enhances monitoring system capabilities through predictive analytics, automated calibration, and intelligent data interpretation. Machine learning algorithms identify pollution patterns, predict air quality trends, and optimize monitoring network operations. AI-powered insights transform raw monitoring data into actionable environmental intelligence.

Miniaturization trends enable deployment of monitoring sensors in previously inaccessible locations, creating opportunities for high-resolution spatial monitoring networks. Smaller, more affordable sensors democratize air quality monitoring while maintaining measurement accuracy and reliability. Sensor fusion technologies combine multiple measurement techniques for enhanced accuracy.

Data democratization initiatives make air quality information more accessible to citizens, researchers, and policymakers through open data platforms and mobile applications. Public access to environmental data increases awareness and supports community engagement in air quality improvement efforts. Citizen science programs incorporate community-based monitoring into official networks.

Regulatory evolution continues with the European Commission’s revision of ambient air quality standards to align with World Health Organization guidelines, creating demand for more sensitive monitoring equipment and expanded monitoring networks. New regulations emphasize ultrafine particle monitoring and improved spatial coverage requirements.

Technology partnerships between traditional monitoring equipment manufacturers and technology companies accelerate innovation in sensor technologies, data analytics, and system integration. Strategic alliances combine domain expertise with technological capabilities to deliver comprehensive monitoring solutions.

Funding initiatives through EU environmental programs and national green recovery plans provide substantial resources for air quality monitoring infrastructure development. MWR analysis indicates that public funding represents approximately 45% of total market investment, supporting widespread adoption of advanced monitoring technologies.

Standardization efforts through European standards organizations work to harmonize monitoring protocols, data formats, and quality assurance procedures across member states. These initiatives aim to improve data comparability and facilitate cross-border environmental management cooperation.

Market participants should prioritize development of integrated monitoring solutions that combine hardware, software, and services to meet evolving customer preferences for comprehensive environmental management platforms. Organizations seeking competitive advantages should invest in IoT connectivity, cloud-based analytics, and artificial intelligence capabilities that differentiate their offerings from traditional monitoring systems.

Geographic expansion strategies should focus on Eastern European markets where regulatory alignment with EU standards creates substantial growth opportunities. Companies should establish local partnerships and service capabilities to support market entry while building relationships with government agencies and system integrators.

Technology investment priorities should emphasize sensor miniaturization, wireless connectivity, and advanced data analytics capabilities that enable cost-effective monitoring deployments. Organizations should also consider indoor air quality monitoring as a high-growth opportunity segment with less competitive intensity than traditional outdoor monitoring markets.

Strategic partnerships with smart city platform providers, building management system integrators, and environmental consulting firms can accelerate market penetration and create new distribution channels. Collaboration with research institutions and universities supports technology development while building market credibility and thought leadership.

Market growth prospects remain robust through 2030, supported by continued regulatory strengthening, technological advancement, and increasing environmental awareness across European societies. MarkWide Research projects sustained growth momentum with particular strength in IoT-enabled monitoring systems and indoor air quality applications.

Technology evolution will continue toward more intelligent, connected, and cost-effective monitoring solutions that provide actionable insights rather than raw data. Integration with broader environmental management platforms and smart city infrastructures will create new value propositions and market opportunities. Sensor technology advancement will enable monitoring of additional pollutants and improved measurement accuracy.

Market consolidation trends are expected to continue as larger companies acquire specialized technology providers and expand their solution portfolios. This consolidation will create more comprehensive solution providers while potentially reducing competitive intensity in certain market segments. Innovation cycles will accelerate as companies invest in research and development to maintain competitive positions.

Regulatory developments will drive continued market expansion, with potential new requirements for ultrafine particle monitoring, greenhouse gas measurements, and enhanced spatial coverage. Climate change commitments under the European Green Deal will sustain long-term demand for comprehensive environmental monitoring capabilities supporting policy development and implementation tracking.

The Europe air quality monitoring market demonstrates exceptional growth potential driven by strong regulatory frameworks, technological innovation, and increasing environmental consciousness across the continent. Market participants benefit from stable demand patterns supported by EU environmental directives while capturing emerging opportunities in IoT integration, indoor monitoring, and smart city applications.

Competitive dynamics favor companies that combine technological leadership with comprehensive service capabilities and strong local market presence. The market rewards innovation in sensor technologies, data analytics, and system integration while maintaining emphasis on measurement accuracy, reliability, and regulatory compliance. Strategic positioning requires balancing traditional monitoring excellence with emerging technology capabilities.

Future success in the European air quality monitoring market depends on organizations’ ability to adapt to evolving customer requirements, regulatory changes, and technological advancement. Companies that invest in IoT connectivity, artificial intelligence, and comprehensive solution development will capture the greatest share of market growth opportunities while building sustainable competitive advantages in this essential environmental protection sector.

What is Air Quality Monitoring?

Air Quality Monitoring refers to the process of measuring and analyzing the levels of pollutants in the air to assess environmental quality and public health. This includes tracking substances like particulate matter, nitrogen dioxide, and ozone, which can impact human health and ecosystems.

What are the key players in the Europe Air Quality Monitoring Market?

Key players in the Europe Air Quality Monitoring Market include companies like Aeroqual, Thermo Fisher Scientific, and Siemens, which provide advanced air quality monitoring solutions and technologies. These companies focus on developing innovative sensors and data analytics tools to enhance air quality management, among others.

What are the main drivers of the Europe Air Quality Monitoring Market?

The main drivers of the Europe Air Quality Monitoring Market include increasing awareness of air pollution’s health impacts, stringent government regulations on air quality, and the growing demand for real-time monitoring solutions. Additionally, urbanization and industrial activities contribute to the need for effective air quality management.

What challenges does the Europe Air Quality Monitoring Market face?

Challenges in the Europe Air Quality Monitoring Market include high costs associated with advanced monitoring technologies and the complexity of data interpretation. Furthermore, varying regulatory standards across different countries can complicate compliance and implementation efforts.

What opportunities exist in the Europe Air Quality Monitoring Market?

Opportunities in the Europe Air Quality Monitoring Market include the development of smart city initiatives that integrate air quality monitoring with urban planning. Additionally, advancements in IoT and AI technologies present new avenues for enhancing data collection and analysis, improving public health outcomes.

What trends are shaping the Europe Air Quality Monitoring Market?

Trends shaping the Europe Air Quality Monitoring Market include the increasing adoption of low-cost sensors for widespread monitoring and the integration of air quality data with mobile applications. There is also a growing emphasis on public engagement and awareness campaigns to promote air quality improvement initiatives.

Europe Air Quality Monitoring Market

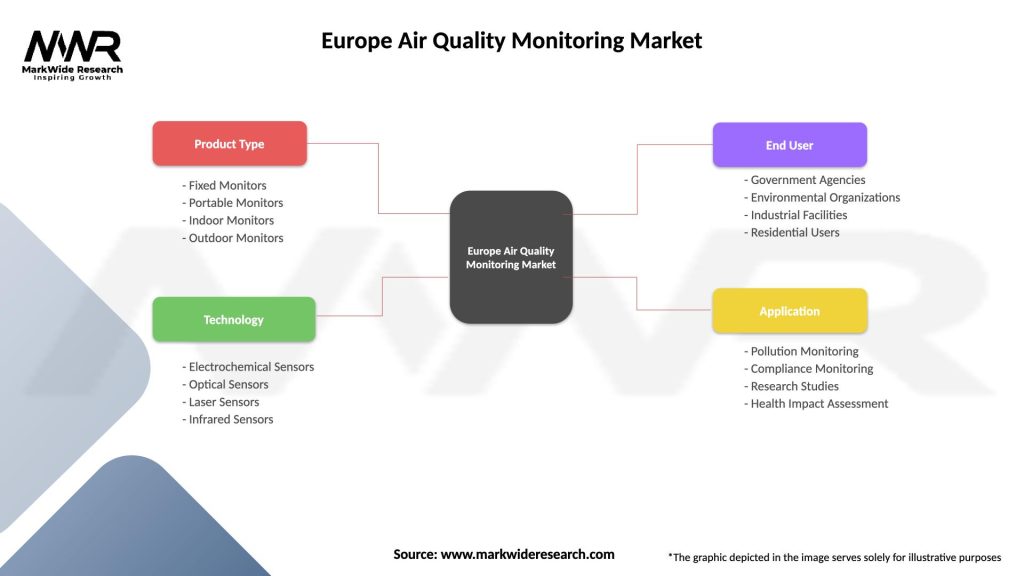

| Segmentation Details | Description |

|---|---|

| Product Type | Fixed Monitors, Portable Monitors, Indoor Monitors, Outdoor Monitors |

| Technology | Electrochemical Sensors, Optical Sensors, Laser Sensors, Infrared Sensors |

| End User | Government Agencies, Environmental Organizations, Industrial Facilities, Residential Users |

| Application | Pollution Monitoring, Compliance Monitoring, Research Studies, Health Impact Assessment |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Air Quality Monitoring Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at