444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe air fryers market represents a dynamic and rapidly expanding segment within the broader kitchen appliances industry, driven by evolving consumer preferences toward healthier cooking methods and convenience-oriented lifestyle choices. European consumers are increasingly embracing air frying technology as a versatile alternative to traditional cooking methods, with the market experiencing robust growth across multiple countries including Germany, France, the United Kingdom, Italy, and Spain.

Market dynamics indicate that the European air fryers sector is characterized by intense innovation, with manufacturers continuously introducing advanced features such as smart connectivity, multi-functionality, and energy-efficient designs. The market demonstrates strong penetration rates, with household adoption reaching approximately 28% across major European markets, reflecting the growing acceptance of this cooking technology among diverse demographic segments.

Regional variations within Europe showcase distinct preferences, with Northern European countries showing higher adoption rates for premium, feature-rich models, while Southern European markets demonstrate strong demand for compact, space-efficient designs. The market landscape encompasses various product categories, from basic single-function units to sophisticated multi-cooking appliances that combine air frying with other cooking methods.

The Europe air fryers market refers to the comprehensive ecosystem of manufacturers, distributors, retailers, and consumers involved in the production, marketing, and consumption of air frying appliances across European countries. This market encompasses various product segments, distribution channels, and consumer applications, representing a significant portion of the small kitchen appliances category.

Air fryers utilize rapid air circulation technology to cook food with minimal or no oil, creating a crispy exterior while maintaining moisture inside. The European market specifically addresses regional preferences, regulatory requirements, and cultural cooking traditions that influence product design, marketing strategies, and consumer adoption patterns across different European nations.

Strategic analysis reveals that the Europe air fryers market is experiencing unprecedented growth momentum, driven by health-conscious consumer behavior and technological advancements in cooking appliance design. The market demonstrates strong fundamentals with increasing penetration rates across both urban and suburban households, supported by effective marketing campaigns and positive word-of-mouth recommendations.

Key market drivers include rising awareness of healthy cooking methods, busy lifestyles demanding convenient meal preparation solutions, and growing interest in energy-efficient appliances. The market benefits from strong retail presence across multiple channels, including traditional appliance stores, online marketplaces, and specialty kitchen retailers, with e-commerce sales accounting for approximately 42% of total market volume.

Competitive landscape features both established kitchen appliance manufacturers and emerging specialized brands, creating a diverse product portfolio that caters to various price points and feature preferences. Market leaders focus on innovation, brand building, and strategic partnerships to maintain competitive advantages in this rapidly evolving sector.

Consumer behavior analysis reveals several critical insights that shape the European air fryers market dynamics. The following key insights demonstrate the market’s current state and future potential:

Health and wellness trends serve as the primary catalyst driving European air fryer adoption, with consumers increasingly seeking cooking methods that reduce oil consumption while maintaining food taste and texture. The growing awareness of diet-related health issues and the desire for healthier meal preparation options create sustained demand for air frying technology across all demographic segments.

Lifestyle convenience factors significantly influence market growth, as busy European consumers value appliances that reduce cooking time and simplify meal preparation processes. Air fryers address multiple convenience needs, including faster cooking times, easy cleanup, and versatile cooking capabilities that eliminate the need for multiple appliances.

Technological advancement in air fryer design and functionality continues to attract new consumers and encourage existing users to upgrade their appliances. Innovations such as smart connectivity, improved heating elements, and enhanced air circulation systems create compelling value propositions that drive market expansion.

Marketing and awareness campaigns by manufacturers and retailers have successfully educated European consumers about air fryer benefits, cooking techniques, and recipe possibilities. Social media influence, cooking demonstrations, and celebrity endorsements contribute to increased market visibility and consumer interest.

High initial investment costs for premium air fryer models can limit adoption among price-sensitive consumer segments, particularly in markets where traditional cooking methods remain deeply ingrained in cultural practices. The perception of air fryers as luxury appliances rather than essential kitchen tools creates barriers for mass market penetration in certain European regions.

Limited cooking capacity in standard air fryer models may not meet the needs of larger European households or families who require cooking solutions for multiple servings simultaneously. This limitation can restrict market appeal among demographic segments that prioritize cooking efficiency for larger groups.

Consumer skepticism regarding cooking quality and taste compared to traditional frying methods persists among certain consumer segments, particularly those with strong culinary traditions. Overcoming these perceptions requires continued education and demonstration of air fryer capabilities.

Market saturation concerns in mature European markets may limit future growth potential as household penetration rates increase and replacement cycles extend. Competition from alternative healthy cooking appliances also creates challenges for sustained market expansion.

Emerging market segments present significant growth opportunities, particularly among younger European consumers who are more receptive to new cooking technologies and health-conscious lifestyle choices. The millennial and Gen Z demographics represent untapped potential for air fryer adoption, driven by social media influence and convenience preferences.

Product innovation opportunities exist in developing specialized air fryer models for specific European culinary traditions, dietary requirements, and kitchen configurations. Customization for regional preferences, such as compact designs for urban apartments or larger capacity models for family households, can drive market expansion.

Smart home integration represents a growing opportunity as European consumers increasingly adopt connected home technologies. Air fryers with IoT capabilities, voice control, and integration with smart home ecosystems can capture tech-savvy consumer segments and command premium pricing.

Commercial and institutional markets offer expansion opportunities beyond residential applications, including restaurants, cafeterias, and food service establishments seeking healthier cooking alternatives and operational efficiency improvements.

Supply chain dynamics in the European air fryers market reflect a complex network of global manufacturing, regional distribution, and local retail operations. MarkWide Research analysis indicates that supply chain efficiency improvements have contributed to reduced product costs by approximately 15% over the past three years, enabling manufacturers to offer competitive pricing while maintaining profit margins.

Competitive intensity continues to increase as new entrants join established players in pursuing market share growth. This competition drives innovation, improves product quality, and benefits consumers through expanded choice and competitive pricing. Market leaders maintain advantages through brand recognition, distribution networks, and research and development capabilities.

Regulatory environment in Europe influences product design, safety standards, and energy efficiency requirements, creating both challenges and opportunities for manufacturers. Compliance with European Union regulations regarding electrical appliances, environmental standards, and consumer protection shapes product development strategies and market entry approaches.

Economic factors including disposable income levels, consumer confidence, and housing market trends impact air fryer demand patterns across different European countries. Economic stability and growth support sustained market expansion, while economic uncertainties may influence consumer purchasing decisions and brand preferences.

Comprehensive market research methodology encompasses multiple data collection and analysis approaches to ensure accurate and reliable insights into the European air fryers market. Primary research includes consumer surveys, retailer interviews, and manufacturer consultations across major European markets to gather firsthand insights into market trends, consumer preferences, and industry dynamics.

Secondary research incorporates analysis of industry reports, trade publications, regulatory filings, and company financial statements to validate primary research findings and provide comprehensive market context. Data triangulation methods ensure accuracy and reliability of market insights and projections.

Quantitative analysis utilizes statistical modeling, trend analysis, and forecasting techniques to project market growth, segment performance, and regional variations. Advanced analytics tools process large datasets to identify patterns, correlations, and market opportunities that inform strategic recommendations.

Qualitative research includes focus groups, expert interviews, and observational studies to understand consumer behavior, purchase decision factors, and brand perception dynamics that influence market development and competitive positioning strategies.

Germany represents the largest European air fryer market, characterized by strong consumer adoption rates and preference for premium, feature-rich models. German consumers demonstrate high brand loyalty and willingness to invest in quality appliances, with market penetration rates reaching approximately 35% among urban households. The market benefits from well-established retail networks and strong e-commerce infrastructure.

France shows robust market growth driven by culinary culture adaptation and health-conscious consumer trends. French consumers appreciate air fryers that complement traditional cooking methods while offering healthier alternatives. The market demonstrates strong seasonal demand patterns and preference for aesthetically appealing designs that complement modern kitchen environments.

United Kingdom maintains significant market presence despite economic uncertainties, with consumers valuing convenience and energy efficiency features. The UK market shows strong online sales growth and preference for compact, multi-functional models suitable for smaller living spaces common in urban areas.

Italy and Spain represent emerging growth markets with increasing adoption rates among younger consumers and urban households. These markets show preference for models that accommodate traditional Mediterranean cooking styles while providing healthier preparation methods for popular regional dishes.

Nordic countries including Sweden, Norway, and Denmark demonstrate high adoption rates for premium air fryer models with advanced features and energy efficiency capabilities. These markets show strong environmental consciousness and willingness to invest in sustainable cooking appliances.

Market leadership in the European air fryers sector is characterized by intense competition among established kitchen appliance manufacturers and emerging specialized brands. The competitive landscape features diverse strategies including innovation focus, brand building, distribution expansion, and pricing optimization to capture market share and maintain competitive advantages.

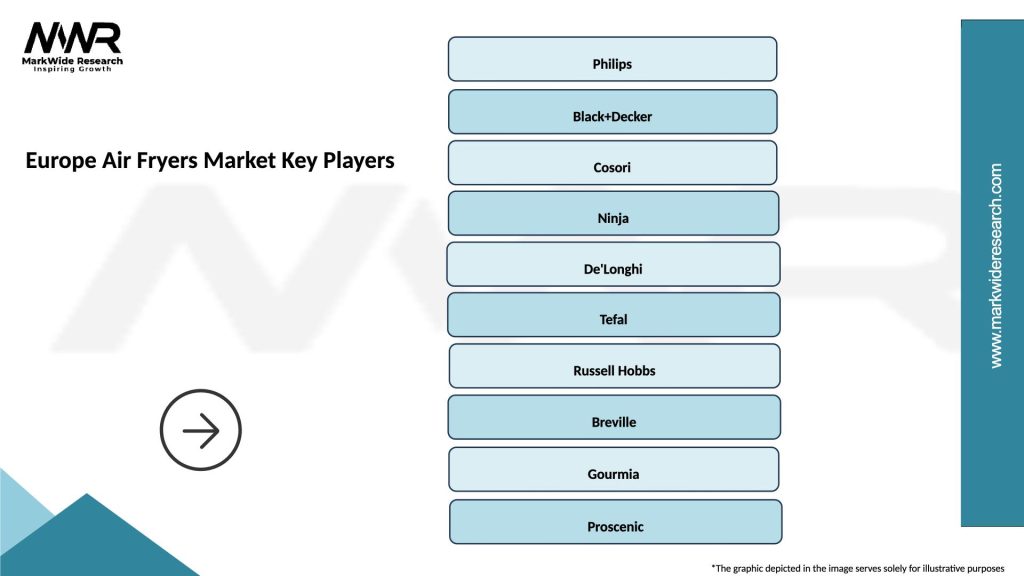

Key market players include:

Competitive strategies focus on product differentiation through innovative features, design aesthetics, and cooking performance improvements. Companies invest heavily in research and development, marketing campaigns, and retail partnerships to maintain market position and drive growth in this dynamic sector.

By Product Type:

By Capacity:

By Distribution Channel:

Premium Segment Analysis reveals strong growth potential among European consumers willing to invest in high-quality air fryers with advanced features. This segment demonstrates annual growth rates of approximately 12% across major European markets, driven by increasing disposable income and preference for durable, feature-rich appliances that offer superior cooking performance and convenience.

Mid-Range Category represents the largest market segment, balancing affordability with essential features that meet mainstream consumer needs. This category benefits from competitive pricing, reliable performance, and broad retail availability, making air fryer technology accessible to diverse European household demographics.

Budget Segment serves price-sensitive consumers and first-time air fryer buyers, offering basic functionality at attractive price points. While margins are lower, this segment drives market penetration and introduces new consumers to air frying technology, creating potential for future upgrades to higher-value products.

Smart Technology Category emerges as a high-growth segment appealing to tech-savvy European consumers who value connectivity, automation, and integration with smart home ecosystems. This category commands premium pricing while offering manufacturers opportunities for recurring revenue through app-based services and content.

Manufacturers benefit from expanding market opportunities, premium pricing potential for innovative products, and growing consumer acceptance of air fryer technology. The market offers opportunities for brand differentiation, customer loyalty development, and expansion into adjacent product categories through multi-functional appliance development.

Retailers gain from strong consumer demand, attractive profit margins, and opportunities for cross-selling complementary products such as accessories, cookbooks, and specialty ingredients. The air fryer category drives foot traffic and online engagement while supporting broader kitchen appliance sales strategies.

Consumers receive significant value through healthier cooking options, convenience improvements, energy efficiency benefits, and versatile meal preparation capabilities. Air fryers enable European households to maintain culinary traditions while adopting healthier cooking practices and reducing meal preparation time.

Supply Chain Partners including component suppliers, logistics providers, and service organizations benefit from sustained market growth, long-term partnership opportunities, and involvement in innovative product development initiatives that drive industry advancement and competitive differentiation.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart Connectivity Integration represents a dominant trend as European consumers increasingly demand appliances that connect to smartphones and smart home systems. This trend drives development of air fryers with Wi-Fi connectivity, mobile app control, and integration with voice assistants, enabling remote monitoring and automated cooking programs.

Multi-Functionality Emphasis continues gaining momentum as consumers prefer appliances that combine air frying with other cooking methods such as baking, roasting, dehydrating, and reheating. This trend reduces kitchen clutter while maximizing appliance utility and value proposition for European households.

Sustainable Design Focus reflects growing environmental consciousness among European consumers, driving demand for energy-efficient models, recyclable materials, and durable construction that extends product lifespan. Manufacturers respond with eco-friendly packaging, reduced energy consumption, and sustainable manufacturing practices.

Aesthetic Design Evolution emphasizes visual appeal and kitchen integration, with manufacturers developing air fryers in various colors, finishes, and styles that complement modern European kitchen designs. This trend supports premium positioning and appeals to design-conscious consumers.

Health and Wellness Positioning strengthens as manufacturers emphasize nutritional benefits, reduced oil consumption, and support for healthy lifestyle choices. Marketing strategies increasingly focus on wellness outcomes rather than just cooking convenience, appealing to health-conscious European consumers.

Product Launch Innovations continue driving market evolution, with manufacturers introducing advanced models featuring improved heating technology, enhanced air circulation systems, and intuitive user interfaces. Recent developments include dual-zone cooking capabilities, automatic food recognition, and precision temperature control systems that optimize cooking results.

Strategic Partnerships between appliance manufacturers and food brands create synergistic opportunities for market expansion. Collaborations include recipe development, ingredient partnerships, and co-marketing initiatives that enhance consumer value and drive adoption across European markets.

Retail Channel Expansion encompasses both traditional and digital platforms, with manufacturers investing in omnichannel strategies that combine online presence with physical retail experiences. Pop-up demonstrations, cooking classes, and interactive displays enhance consumer education and purchase confidence.

Technology Advancement focuses on artificial intelligence integration, machine learning capabilities, and predictive cooking algorithms that automatically adjust cooking parameters based on food type, quantity, and desired results. These developments position air fryers as intelligent cooking assistants rather than simple appliances.

Market Entry Strategies for new participants should focus on differentiation through innovative features, competitive pricing, and targeted marketing to specific European consumer segments. MWR analysis suggests that success requires understanding regional preferences, regulatory requirements, and distribution channel dynamics across different European markets.

Product Development Priorities should emphasize smart connectivity, multi-functionality, and energy efficiency to meet evolving consumer expectations. Companies should invest in user experience design, mobile app development, and integration with popular smart home platforms to maintain competitive relevance.

Marketing Approach Optimization requires emphasis on health benefits, convenience advantages, and lifestyle integration rather than purely technical specifications. Successful marketing strategies combine digital channels with experiential marketing, influencer partnerships, and user-generated content that demonstrates real-world applications.

Distribution Strategy Enhancement should leverage both online and offline channels while providing comprehensive customer support, educational resources, and after-sales service. Companies should consider direct-to-consumer strategies alongside traditional retail partnerships to maximize market reach and customer relationships.

Long-term growth prospects for the European air fryers market remain positive, supported by sustained consumer interest in healthy cooking, technological advancement, and lifestyle convenience trends. The market is expected to maintain steady growth rates of approximately 8-10% annually over the next five years, driven by product innovation and expanding consumer adoption across diverse demographic segments.

Technology evolution will continue shaping market development, with artificial intelligence, machine learning, and IoT integration becoming standard features rather than premium options. Future air fryers will likely offer personalized cooking experiences, nutritional tracking, and seamless integration with broader smart kitchen ecosystems.

Market maturation in established European countries will shift focus toward replacement purchases, premium model upgrades, and specialized applications. Emerging markets within Eastern Europe present growth opportunities as economic development and lifestyle changes drive appliance adoption.

Sustainability considerations will increasingly influence product development, manufacturing processes, and consumer purchase decisions. Companies that successfully integrate environmental responsibility with performance and convenience will gain competitive advantages in environmentally conscious European markets.

The Europe air fryers market demonstrates remarkable resilience and growth potential, driven by fundamental shifts in consumer behavior toward healthier cooking methods and convenience-oriented lifestyle choices. Market dynamics reflect strong underlying demand supported by technological innovation, effective marketing strategies, and expanding retail presence across diverse European countries.

Strategic opportunities exist for both established manufacturers and new market entrants willing to invest in product innovation, brand building, and customer education initiatives. Success requires understanding regional preferences, regulatory environments, and competitive dynamics that shape market development across different European nations.

Future market evolution will likely emphasize smart technology integration, sustainability considerations, and multi-functional capabilities that address evolving consumer needs and preferences. Companies that successfully balance innovation with affordability while maintaining quality and reliability will capture the greatest share of this expanding market opportunity in Europe’s dynamic kitchen appliance sector.

What is Air Fryers?

Air fryers are kitchen appliances that use hot air circulation to cook food, providing a crispy texture similar to frying but with significantly less oil. They are popular for preparing a variety of dishes, including vegetables, meats, and snacks, while promoting healthier cooking methods.

What are the key players in the Europe Air Fryers Market?

Key players in the Europe Air Fryers Market include Philips, Tefal, and Ninja, which are known for their innovative designs and technology in air frying. These companies focus on enhancing user experience and expanding their product lines, among others.

What are the growth factors driving the Europe Air Fryers Market?

The growth of the Europe Air Fryers Market is driven by increasing health consciousness among consumers, the rising demand for convenient cooking solutions, and the popularity of low-fat cooking methods. Additionally, the trend towards home cooking has further boosted air fryer sales.

What challenges does the Europe Air Fryers Market face?

The Europe Air Fryers Market faces challenges such as high competition among manufacturers, potential market saturation, and consumer skepticism regarding the effectiveness of air frying compared to traditional frying methods. These factors can impact market growth and brand loyalty.

What opportunities exist in the Europe Air Fryers Market?

Opportunities in the Europe Air Fryers Market include the introduction of smart air fryers with advanced features, the expansion of product offerings to cater to diverse consumer preferences, and the growing trend of healthy eating. These factors can attract new customers and enhance market penetration.

What trends are shaping the Europe Air Fryers Market?

Trends shaping the Europe Air Fryers Market include the increasing integration of smart technology, such as app connectivity and voice control, as well as a focus on energy efficiency and sustainability. Additionally, the rise of multi-functional appliances that combine air frying with other cooking methods is gaining popularity.

Europe Air Fryers Market

| Segmentation Details | Description |

|---|---|

| Product Type | Countertop, Built-in, Multi-functional, Commercial |

| Technology | Rapid Air, Convection, Infrared, Halogen |

| End User | Households, Restaurants, Cafes, Catering Services |

| Distribution Channel | Online Retail, Supermarkets, Specialty Stores, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Air Fryers Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at