444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe advanced wound therapy devices market represents a rapidly evolving healthcare sector that addresses the growing demand for sophisticated wound care solutions across the continent. This dynamic market encompasses innovative technologies designed to accelerate healing processes, reduce infection risks, and improve patient outcomes for both acute and chronic wounds. European healthcare systems are increasingly adopting advanced wound therapy devices as they demonstrate superior efficacy compared to traditional wound care methods.

Market growth is driven by several key factors including an aging population, rising prevalence of diabetes and cardiovascular diseases, and increasing awareness about advanced wound care benefits. The market experiences particularly strong demand in countries with well-established healthcare infrastructure such as Germany, France, and the United Kingdom. Advanced wound therapy devices include negative pressure wound therapy systems, bioactive wound care products, oxygen and hyperbaric oxygen equipment, electromagnetic therapy devices, and ultrasonic therapy systems.

Healthcare providers across Europe are recognizing the cost-effectiveness of advanced wound therapy devices despite higher initial investments. These technologies significantly reduce healing time, minimize complications, and decrease overall treatment costs. The market demonstrates robust growth potential with a projected CAGR of 6.2% over the forecast period, reflecting strong adoption rates and continuous technological innovations in wound care management.

The Europe advanced wound therapy devices market refers to the comprehensive ecosystem of sophisticated medical devices and technologies specifically designed to treat complex, chronic, and difficult-to-heal wounds across European healthcare systems. These devices utilize cutting-edge therapeutic approaches that go beyond conventional wound dressings and basic care methods to actively promote healing through various mechanisms including negative pressure, bioactive compounds, electromagnetic fields, ultrasonic waves, and oxygen therapy.

Advanced wound therapy encompasses a broad spectrum of innovative treatment modalities that address the underlying pathophysiology of wound healing. These devices are engineered to create optimal healing environments by managing moisture levels, reducing bacterial load, promoting cellular regeneration, and enhancing blood circulation to affected areas. The market includes both disposable and reusable devices, ranging from portable home-care units to sophisticated hospital-based systems.

European regulatory frameworks ensure that these devices meet stringent safety and efficacy standards before market introduction. The market serves diverse patient populations including diabetic patients with foot ulcers, surgical patients with post-operative wounds, elderly patients with pressure ulcers, and trauma patients with complex injuries requiring specialized care interventions.

Europe’s advanced wound therapy devices market demonstrates exceptional growth momentum driven by demographic shifts, technological innovations, and evolving healthcare delivery models. The market benefits from strong government support for healthcare modernization initiatives and increasing reimbursement coverage for advanced wound care treatments. Key market segments include negative pressure wound therapy, bioactive wound care, and electromagnetic therapy devices, each contributing significantly to overall market expansion.

Market dynamics reveal increasing adoption rates across both hospital and home-care settings, with approximately 42% of treatments now occurring in outpatient environments. This shift reflects improved device portability, user-friendly interfaces, and enhanced patient education programs. Healthcare cost containment initiatives paradoxically drive demand for advanced wound therapy devices as they demonstrate superior cost-effectiveness compared to prolonged conventional treatments.

Competitive landscape features established medical device manufacturers alongside innovative startups developing next-generation wound care technologies. The market experiences continuous product launches, strategic partnerships, and merger and acquisition activities that reshape competitive dynamics. Regional variations exist in adoption patterns, with Northern and Western European countries leading in market penetration while Eastern European markets show rapid growth potential.

Strategic market insights reveal several critical trends shaping the Europe advanced wound therapy devices landscape. The following key insights provide comprehensive understanding of market dynamics:

Healthcare transformation initiatives across Europe emphasize value-based care models that align perfectly with advanced wound therapy device benefits. These insights indicate strong market fundamentals supporting continued growth and innovation in the wound care sector.

Primary market drivers propelling the Europe advanced wound therapy devices market include demographic, clinical, and economic factors that create sustained demand for innovative wound care solutions. The aging European population represents the most significant driver, with individuals over 65 years experiencing higher incidence rates of chronic wounds, pressure ulcers, and delayed healing complications.

Diabetes prevalence continues rising across Europe, with approximately 32 million adults currently diagnosed with diabetes, creating substantial demand for diabetic foot ulcer treatments. Advanced wound therapy devices demonstrate superior efficacy in managing diabetic complications, reducing amputation risks, and improving quality of life for affected patients. Cardiovascular disease prevalence similarly drives demand as poor circulation contributes to wound healing challenges requiring specialized therapeutic interventions.

Healthcare cost pressures paradoxically drive adoption of advanced wound therapy devices as they reduce overall treatment costs through faster healing times, fewer complications, and reduced hospital readmissions. Clinical evidence increasingly demonstrates that initial investments in advanced wound therapy technologies generate significant long-term savings through improved patient outcomes and reduced resource utilization.

Technological advancement creates new treatment possibilities and expands addressable patient populations. Innovation in device portability, battery life, and user interfaces enables home-based care delivery, reducing healthcare system burden while improving patient convenience and satisfaction.

Market restraints present challenges to widespread adoption of advanced wound therapy devices across European healthcare systems. High initial device costs represent the primary barrier, particularly for smaller healthcare facilities and resource-constrained regions. Capital investment requirements for advanced wound therapy systems can strain healthcare budgets, especially when competing with other medical equipment priorities.

Reimbursement limitations in certain European countries restrict patient access to advanced wound therapy devices. While coverage is expanding, inconsistent reimbursement policies across different regions create market access challenges for manufacturers and affordability concerns for patients. Administrative complexity associated with reimbursement processes can delay treatment initiation and discourage healthcare provider adoption.

Training requirements for healthcare professionals represent another significant restraint. Advanced wound therapy devices often require specialized knowledge and skills for optimal utilization, necessitating comprehensive training programs that require time and resource investments. Staff turnover in healthcare settings can disrupt continuity of expertise and require ongoing training initiatives.

Regulatory complexity can slow product development and market introduction timelines. While European regulatory frameworks ensure safety and efficacy, the approval process can be lengthy and expensive, particularly for innovative technologies requiring extensive clinical validation. Market fragmentation across different European countries with varying regulatory requirements adds complexity for manufacturers seeking broad market access.

Significant market opportunities exist within the Europe advanced wound therapy devices sector, driven by unmet clinical needs, technological innovations, and evolving healthcare delivery models. The expanding home healthcare market presents substantial growth potential as patients increasingly prefer receiving care in comfortable, familiar environments while reducing healthcare system costs.

Digital health integration offers transformative opportunities for advanced wound therapy devices. Incorporating telemedicine capabilities, remote monitoring systems, and artificial intelligence-driven treatment optimization can significantly enhance patient outcomes while reducing healthcare provider workload. Data analytics applications enable personalized treatment protocols and predictive healing assessments that improve clinical decision-making.

Emerging markets within Eastern Europe demonstrate rapid growth potential as healthcare infrastructure modernization accelerates and economic conditions improve. Countries such as Poland, Czech Republic, and Hungary show increasing adoption rates for advanced medical technologies, creating expansion opportunities for established manufacturers.

Combination therapies represent innovative opportunities where advanced wound therapy devices integrate with pharmaceutical treatments, biologics, or other medical technologies to create synergistic healing effects. Personalized medicine approaches utilizing genetic testing and biomarker analysis can optimize device selection and treatment protocols for individual patients, improving outcomes and cost-effectiveness.

Preventive care applications extend market opportunities beyond treatment to include wound prevention in high-risk patient populations, potentially expanding addressable markets significantly.

Market dynamics within the Europe advanced wound therapy devices sector reflect complex interactions between technological innovation, healthcare policy changes, demographic trends, and competitive forces. The market demonstrates strong resilience and adaptability, with manufacturers continuously evolving products and strategies to address changing healthcare needs and regulatory requirements.

Supply chain dynamics have evolved significantly, with manufacturers establishing regional production facilities and distribution networks to ensure reliable product availability and reduce logistics costs. Brexit implications created temporary market disruptions but led to supply chain diversification and strengthened European Union manufacturing capabilities.

Competitive dynamics intensify as established medical device companies face competition from innovative startups and technology companies entering the wound care market. This competition drives continuous innovation, price optimization, and enhanced customer service offerings. Partnership strategies become increasingly important as companies seek to combine complementary technologies and market access capabilities.

Regulatory dynamics continue evolving with new European Medical Device Regulation requirements that emphasize post-market surveillance, clinical evidence generation, and enhanced safety monitoring. These changes create both challenges and opportunities for manufacturers committed to quality and innovation.

Healthcare delivery dynamics shift toward value-based care models that reward improved patient outcomes rather than treatment volume, aligning perfectly with advanced wound therapy device benefits and creating favorable market conditions for continued growth.

Comprehensive research methodology employed for analyzing the Europe advanced wound therapy devices market incorporates multiple data sources, analytical approaches, and validation techniques to ensure accuracy and reliability of market insights. The research framework combines primary and secondary research methodologies to provide holistic market understanding and strategic intelligence.

Primary research activities include extensive interviews with key industry stakeholders including medical device manufacturers, healthcare providers, regulatory experts, and clinical specialists. These interviews provide firsthand insights into market trends, challenges, opportunities, and competitive dynamics. Healthcare facility surveys across different European countries capture adoption patterns, usage experiences, and future procurement intentions.

Secondary research encompasses analysis of published clinical studies, regulatory filings, company financial reports, industry publications, and government healthcare statistics. This comprehensive data collection ensures thorough market coverage and validates primary research findings. Market modeling techniques utilize statistical analysis and forecasting methodologies to project future market trends and growth patterns.

Data validation processes include triangulation of information sources, expert review panels, and cross-referencing with established market databases. Quality assurance measures ensure research accuracy and eliminate potential biases or inconsistencies in data interpretation and analysis.

Analytical frameworks incorporate Porter’s Five Forces analysis, SWOT assessment, and competitive benchmarking to provide strategic insights and actionable recommendations for market participants.

Regional analysis reveals significant variations in advanced wound therapy device adoption patterns, market maturity levels, and growth trajectories across different European regions. Western Europe maintains market leadership with approximately 58% market share, driven by established healthcare infrastructure, favorable reimbursement policies, and high healthcare spending levels.

Germany represents the largest individual country market, accounting for nearly 23% of European demand due to its robust healthcare system, aging population, and strong medical device industry presence. German healthcare providers demonstrate high adoption rates for innovative wound care technologies, supported by comprehensive reimbursement coverage and clinical evidence requirements.

France and United Kingdom follow as significant markets, each contributing approximately 15-18% of regional demand. These countries benefit from national healthcare systems that increasingly recognize the cost-effectiveness of advanced wound therapy devices. Nordic countries including Sweden, Norway, and Denmark show high per-capita adoption rates despite smaller absolute market sizes.

Eastern Europe demonstrates the fastest growth rates, with countries like Poland, Czech Republic, and Hungary experiencing annual growth rates exceeding 8%. These markets benefit from healthcare modernization initiatives, European Union funding support, and increasing medical tourism activities. Southern Europe including Italy and Spain shows steady growth despite economic challenges, with focus on cost-effective wound care solutions.

Market penetration varies significantly by country, with Northern European countries achieving penetration rates above 65% while Eastern European markets remain below 35% penetration, indicating substantial growth potential.

Competitive landscape within the Europe advanced wound therapy devices market features diverse participants ranging from multinational medical device corporations to specialized wound care companies and innovative technology startups. Market leadership positions reflect companies’ ability to combine clinical efficacy, cost-effectiveness, and comprehensive customer support services.

Competitive strategies emphasize product innovation, clinical evidence generation, and strategic partnerships with healthcare providers. Companies invest heavily in research and development to maintain technological leadership and address evolving clinical needs. Market consolidation continues through mergers and acquisitions that combine complementary technologies and expand geographic reach.

Market segmentation analysis provides detailed insights into different product categories, application areas, end-user segments, and distribution channels within the Europe advanced wound therapy devices market. This comprehensive segmentation enables targeted strategies and identifies specific growth opportunities across market subsectors.

By Product Type:

By Application:

By End User:

Category-wise analysis reveals distinct market dynamics, growth patterns, and competitive landscapes across different advanced wound therapy device categories. Each category demonstrates unique characteristics in terms of clinical applications, adoption rates, and future growth potential.

Negative Pressure Wound Therapy maintains market leadership through proven clinical efficacy and broad clinical acceptance. This category benefits from extensive clinical evidence, established reimbursement coverage, and continuous product innovations including portable systems and smart monitoring capabilities. Market penetration reaches approximately 72% in hospital settings while home-care adoption accelerates rapidly.

Bioactive Wound Care represents the fastest-growing category, driven by advances in regenerative medicine and biological therapies. This segment includes growth factor therapies, stem cell treatments, and bioengineered tissue products that actively promote healing processes. Clinical outcomes demonstrate superior healing rates for complex wounds, justifying premium pricing and expanding reimbursement coverage.

Electromagnetic Therapy Devices emerge as innovative treatment options utilizing pulsed electromagnetic fields to stimulate cellular activity and enhance healing. This category shows particular promise for chronic wounds resistant to conventional treatments. Research activities continue expanding clinical evidence and optimizing treatment protocols.

Oxygen Therapy Equipment serves specialized applications requiring enhanced tissue oxygenation. Hyperbaric oxygen therapy demonstrates effectiveness for specific wound types including diabetic foot ulcers and radiation-induced wounds. Treatment centers expand across Europe to improve patient access to these specialized therapies.

Industry participants and stakeholders across the Europe advanced wound therapy devices market realize significant benefits through improved patient outcomes, operational efficiencies, and economic advantages. These benefits create value for manufacturers, healthcare providers, patients, and healthcare systems while supporting continued market growth and innovation.

Healthcare Providers benefit from reduced treatment complexity, shorter healing times, and improved patient satisfaction rates. Advanced wound therapy devices enable more predictable treatment outcomes and reduce resource requirements for wound management. Clinical staff experience reduced workload and enhanced job satisfaction through improved patient outcomes and streamlined care processes.

Patients experience faster healing, reduced pain levels, and improved quality of life through advanced wound therapy treatments. Home-based care options provide convenience and comfort while maintaining clinical effectiveness. Treatment costs often decrease despite higher initial device costs due to reduced healing times and fewer complications.

Healthcare Systems achieve cost savings through reduced hospital stays, fewer readmissions, and decreased long-term care requirements. Advanced wound therapy devices support value-based care initiatives by improving outcomes while controlling costs. Resource optimization enables healthcare systems to serve more patients effectively with existing infrastructure.

Manufacturers benefit from growing market demand, premium pricing opportunities, and expanding geographic markets. Innovation leadership creates competitive advantages and supports long-term business growth. Strategic partnerships with healthcare providers enable continuous product improvement and market expansion opportunities.

SWOT analysis provides comprehensive assessment of internal strengths and weaknesses alongside external opportunities and threats affecting the Europe advanced wound therapy devices market. This strategic framework enables stakeholders to develop informed strategies and risk mitigation approaches.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the Europe advanced wound therapy devices landscape reflect technological innovations, healthcare delivery evolution, and changing patient expectations. These trends create both opportunities and challenges for market participants while driving continuous market transformation.

Digital Health Integration emerges as the dominant trend, with manufacturers incorporating connectivity features, mobile applications, and cloud-based data management into wound therapy devices. This integration enables remote patient monitoring, treatment optimization, and healthcare provider communication. Artificial intelligence applications analyze wound healing patterns and predict treatment outcomes, supporting clinical decision-making.

Personalized Medicine approaches gain traction as genetic testing and biomarker analysis enable customized treatment protocols. Advanced wound therapy devices increasingly adapt to individual patient characteristics and healing responses. Precision medicine applications optimize device settings and treatment duration based on patient-specific factors.

Home Healthcare Expansion accelerates as healthcare systems seek cost-effective alternatives to hospital-based care. Portable advanced wound therapy devices enable patients to receive sophisticated treatments in comfortable home environments. Caregiver training programs support safe and effective home-based device utilization.

Sustainability Focus influences product development as manufacturers address environmental concerns through recyclable materials, energy-efficient designs, and reduced packaging waste. Circular economy principles guide device lifecycle management and disposal processes.

Value-Based Care models reshape purchasing decisions as healthcare providers prioritize devices demonstrating measurable outcome improvements and cost-effectiveness. Outcome-based contracts align manufacturer incentives with patient results and healthcare system objectives.

Recent industry developments demonstrate the dynamic nature of the Europe advanced wound therapy devices market, with continuous innovation, strategic partnerships, and regulatory evolution shaping competitive landscapes and market opportunities. These developments reflect industry commitment to improving patient outcomes and addressing evolving healthcare needs.

Product Innovation activities intensify across major manufacturers, with recent launches including next-generation negative pressure wound therapy systems featuring enhanced portability, extended battery life, and integrated monitoring capabilities. Smart wound dressings incorporating sensors and wireless communication enable real-time wound assessment and treatment optimization.

Strategic Acquisitions reshape competitive dynamics as established companies acquire innovative startups and specialized technologies. Recent transactions focus on digital health capabilities, bioactive materials, and novel therapeutic approaches. Market consolidation creates larger, more comprehensive wound care companies with enhanced research capabilities and global reach.

Regulatory Approvals for innovative wound therapy devices accelerate market access and expand treatment options. European regulatory authorities increasingly recognize the clinical and economic benefits of advanced wound care technologies. Clinical trial results continue demonstrating superior outcomes for advanced wound therapy devices compared to conventional treatments.

Partnership Agreements between device manufacturers and healthcare providers create collaborative relationships supporting product development, clinical evidence generation, and market adoption. Research collaborations with academic institutions advance understanding of wound healing mechanisms and optimize device technologies.

Reimbursement Expansions across European countries improve patient access to advanced wound therapy devices, with several countries recently adding coverage for home-based negative pressure wound therapy and bioactive wound care products.

Strategic recommendations for stakeholders in the Europe advanced wound therapy devices market emphasize leveraging current opportunities while addressing market challenges and preparing for future developments. MarkWide Research analysis indicates that successful market participants must balance innovation investments with operational efficiency and customer-centric strategies.

For Manufacturers: Focus on developing integrated solutions combining advanced wound therapy devices with digital health platforms and patient support services. Invest in clinical evidence generation demonstrating cost-effectiveness and improved outcomes. Geographic expansion into Eastern European markets offers significant growth potential, while home healthcare segment development addresses evolving care delivery models.

For Healthcare Providers: Develop comprehensive wound care programs integrating advanced therapy devices with clinical protocols and staff training initiatives. Establish partnerships with device manufacturers for ongoing support and technology updates. Outcome measurement systems should track healing rates, cost savings, and patient satisfaction to demonstrate value-based care benefits.

For Investors: Consider companies with strong innovation pipelines, established clinical evidence, and expanding market presence. Digital health integration capabilities and home healthcare focus represent key investment criteria. Evaluate companies’ ability to navigate regulatory requirements and establish reimbursement coverage.

For Policymakers: Support evidence-based reimbursement policies recognizing the long-term cost-effectiveness of advanced wound therapy devices. Encourage innovation through favorable regulatory frameworks while maintaining safety standards. Healthcare infrastructure investments should include advanced wound care capabilities to address demographic challenges.

Future outlook for the Europe advanced wound therapy devices market indicates sustained growth driven by demographic trends, technological innovations, and healthcare system evolution. Market projections suggest continued expansion with growth rates maintaining momentum above 6% annually through the forecast period, reflecting strong underlying demand and expanding applications.

Technology evolution will focus on artificial intelligence integration, personalized treatment protocols, and enhanced patient monitoring capabilities. Next-generation devices will feature predictive analytics, automated treatment adjustments, and seamless integration with electronic health records. Nanotechnology applications may revolutionize wound healing through targeted drug delivery and enhanced tissue regeneration.

Market expansion into Eastern European countries will accelerate as healthcare infrastructure modernization continues and economic conditions improve. Home healthcare adoption will reach approximately 55% of suitable cases by 2030, driven by patient preferences, cost considerations, and device portability improvements.

Regulatory harmonization across European countries will simplify market access and reduce compliance costs for manufacturers. Reimbursement coverage will expand to include innovative therapies as clinical evidence demonstrates cost-effectiveness and improved patient outcomes.

Competitive landscape will continue evolving through strategic partnerships, technology acquisitions, and new market entrants from adjacent industries. MWR analysis suggests that companies successfully combining clinical efficacy, cost-effectiveness, and digital health integration will achieve market leadership positions in the evolving healthcare landscape.

The Europe advanced wound therapy devices market represents a dynamic and rapidly evolving healthcare sector positioned for sustained growth and innovation. Market fundamentals remain strong, supported by demographic trends, technological advancement, and healthcare system recognition of advanced wound care benefits. The combination of aging populations, rising chronic disease prevalence, and healthcare cost containment pressures creates favorable conditions for continued market expansion.

Key success factors for market participants include maintaining innovation leadership, developing comprehensive clinical evidence, and adapting to evolving healthcare delivery models. The shift toward home-based care, digital health integration, and value-based healthcare creates both opportunities and challenges requiring strategic adaptation and investment. Market leaders will distinguish themselves through superior clinical outcomes, cost-effectiveness demonstration, and comprehensive customer support services.

Future market development will be characterized by continued technological innovation, geographic expansion into emerging European markets, and integration with broader healthcare digitization initiatives. The market’s resilience and growth potential make it an attractive sector for manufacturers, investors, and healthcare providers committed to improving patient outcomes while managing healthcare costs effectively. Strategic positioning in this evolving market requires balancing innovation investments with operational excellence and customer-centric approaches that address the diverse needs of European healthcare systems and patient populations.

What is Advanced Wound Therapy Devices?

Advanced Wound Therapy Devices refer to specialized medical equipment designed to promote healing in complex wounds. These devices include negative pressure wound therapy systems, bioengineered skin substitutes, and advanced dressings that enhance the healing process.

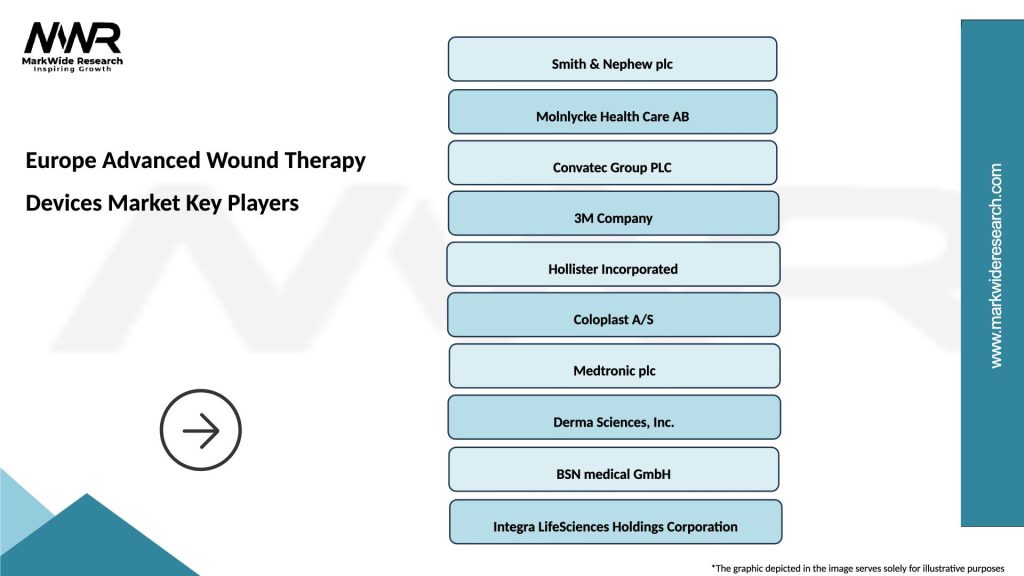

What are the key players in the Europe Advanced Wound Therapy Devices Market?

Key players in the Europe Advanced Wound Therapy Devices Market include Smith & Nephew, Mölnlycke Health Care, and ConvaTec, among others. These companies are known for their innovative products and significant market presence.

What are the main drivers of the Europe Advanced Wound Therapy Devices Market?

The main drivers of the Europe Advanced Wound Therapy Devices Market include the rising incidence of chronic wounds, an aging population, and advancements in wound care technologies. These factors contribute to increased demand for effective wound management solutions.

What challenges does the Europe Advanced Wound Therapy Devices Market face?

The Europe Advanced Wound Therapy Devices Market faces challenges such as high costs of advanced therapies and regulatory hurdles. Additionally, the need for skilled professionals to operate these devices can limit their widespread adoption.

What opportunities exist in the Europe Advanced Wound Therapy Devices Market?

Opportunities in the Europe Advanced Wound Therapy Devices Market include the development of innovative products and the expansion of telemedicine in wound care. There is also potential for growth in home healthcare settings as patients seek more convenient treatment options.

What trends are shaping the Europe Advanced Wound Therapy Devices Market?

Trends shaping the Europe Advanced Wound Therapy Devices Market include the increasing use of digital health technologies and personalized wound care solutions. Additionally, there is a growing focus on sustainability and eco-friendly materials in wound care products.

Europe Advanced Wound Therapy Devices Market

| Segmentation Details | Description |

|---|---|

| Product Type | Hydrocolloid Dressings, Foam Dressings, Alginate Dressings, Negative Pressure Wound Therapy |

| End User | Hospitals, Home Care, Long-term Care Facilities, Outpatient Clinics |

| Technology | Electroceutical Devices, Biologics, Advanced Dressings, Smart Wound Care |

| Application | Diabetic Ulcers, Surgical Wounds, Pressure Ulcers, Burn Injuries |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Advanced Wound Therapy Devices Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at