444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe advanced building materials market represents a transformative sector driving innovation across the construction industry. This dynamic market encompasses cutting-edge materials that offer superior performance characteristics compared to traditional building components, including enhanced durability, energy efficiency, and environmental sustainability. European countries are experiencing unprecedented demand for these sophisticated materials as construction standards evolve and regulatory frameworks become increasingly stringent.

Market dynamics indicate robust growth potential, with the sector expanding at a compound annual growth rate (CAGR) of 8.2% through the forecast period. This growth trajectory reflects the region’s commitment to sustainable construction practices and the adoption of innovative building technologies. Germany, France, and the United Kingdom lead market development, accounting for approximately 62% of regional demand for advanced building materials.

Construction industry transformation across Europe has accelerated the integration of smart materials, high-performance composites, and eco-friendly alternatives. The market encompasses diverse material categories including advanced concrete formulations, innovative insulation systems, smart glass technologies, and sustainable composite materials. Energy efficiency regulations and green building certifications continue to drive adoption rates, with 45% of new construction projects now incorporating at least three categories of advanced building materials.

The Europe advanced building materials market refers to the comprehensive ecosystem of innovative construction materials that demonstrate superior performance characteristics compared to conventional building components. These materials incorporate cutting-edge technologies, sustainable manufacturing processes, and enhanced functionality to meet evolving construction demands across European markets.

Advanced building materials encompass a broad spectrum of products including high-performance concrete with self-healing properties, aerogel insulation systems, phase-change materials for thermal regulation, smart glass with variable opacity, and bio-based composite materials. These solutions address critical construction challenges including energy efficiency, structural durability, environmental impact reduction, and occupant comfort optimization.

Market definition extends beyond traditional material categories to include integrated building systems that combine multiple advanced components. The sector represents the convergence of materials science, digital technology, and sustainable engineering practices, creating solutions that transform how buildings are designed, constructed, and operated throughout their lifecycle.

Strategic market analysis reveals that the Europe advanced building materials sector is experiencing unprecedented growth driven by regulatory mandates, technological innovation, and shifting consumer preferences toward sustainable construction. The market demonstrates strong momentum across multiple material categories, with particular strength in energy-efficient solutions and smart building technologies.

Key growth drivers include stringent energy efficiency regulations, increasing adoption of green building certifications, and rising awareness of environmental sustainability. Construction industry digitization has accelerated the integration of smart materials and IoT-enabled building components, with 38% of construction companies now incorporating digital technologies into their material selection processes.

Regional leadership remains concentrated in Western European markets, though Eastern European countries are emerging as significant growth opportunities. The market benefits from strong research and development infrastructure, supportive government policies, and well-established supply chain networks. Innovation investment continues to drive product development, with European companies leading global advancement in sustainable building material technologies.

Market intelligence reveals several critical insights shaping the Europe advanced building materials landscape:

Regulatory frameworks serve as the primary catalyst for advanced building materials adoption across Europe. The European Union’s commitment to carbon neutrality by 2050 has established comprehensive building energy efficiency standards that mandate the use of high-performance materials. Energy Performance of Buildings Directive (EPBD) requirements continue to evolve, creating sustained demand for innovative insulation systems, smart glass technologies, and thermal management solutions.

Environmental consciousness among consumers and construction professionals drives preference for sustainable building materials. Growing awareness of embodied carbon, lifecycle environmental impact, and indoor air quality considerations influences material selection decisions. Green building certifications such as BREEAM and LEED provide market incentives for advanced material adoption, with certified projects demonstrating premium property values and enhanced marketability.

Technological advancement continues to expand the capabilities and applications of advanced building materials. Integration of nanotechnology, smart sensors, and responsive materials creates new possibilities for building performance optimization. Digital construction technologies including Building Information Modeling (BIM) and prefabrication methods facilitate the specification and installation of sophisticated material systems.

Economic factors increasingly favor advanced building materials as lifecycle cost analysis demonstrates long-term value propositions. Energy cost savings, reduced maintenance requirements, and extended service life offset higher initial material costs. Construction industry productivity improvements through advanced materials reduce labor costs and project timelines, enhancing overall project economics.

Cost considerations remain the most significant barrier to widespread advanced building materials adoption. Higher upfront costs compared to traditional materials create budget constraints, particularly for cost-sensitive construction projects. Economic uncertainty and fluctuating commodity prices can impact project feasibility and material selection decisions, slowing market growth in certain segments.

Technical complexity associated with advanced building materials presents implementation challenges for construction professionals. Specialized installation requirements, compatibility considerations, and performance optimization demand enhanced technical expertise. Skills gaps in the construction workforce limit the effective deployment of sophisticated material systems, requiring ongoing training and education initiatives.

Regulatory variations across European markets create complexity for material manufacturers and construction companies operating in multiple jurisdictions. Differing building codes, certification requirements, and approval processes increase compliance costs and market entry barriers. Standardization challenges limit interoperability and create uncertainty regarding long-term material performance validation.

Supply chain constraints can impact material availability and project scheduling. Limited manufacturing capacity for specialized materials, raw material sourcing challenges, and logistics complexity affect market accessibility. Quality assurance requirements for advanced materials demand robust testing and certification processes that can extend product development timelines.

Renovation market expansion presents substantial opportunities for advanced building materials deployment. Europe’s aging building stock requires comprehensive energy efficiency upgrades, creating demand for retrofit-specific advanced materials. Deep renovation programs supported by government incentives drive market growth, with thermal insulation upgrades representing particularly strong opportunity areas.

Smart city initiatives across European urban centers create demand for intelligent building materials that support connected infrastructure. Integration of IoT sensors, energy management systems, and responsive materials enables buildings to participate in smart grid networks. Urban sustainability goals drive adoption of materials that contribute to air quality improvement, stormwater management, and urban heat island reduction.

Circular economy principles open new market segments for recycled content and bio-based building materials. European Union circular economy policies encourage material reuse, recycling, and sustainable sourcing practices. Innovation opportunities exist in developing materials from waste streams, agricultural byproducts, and renewable resources that meet performance requirements while reducing environmental impact.

Emerging technologies including 3D printing, robotics, and artificial intelligence create new applications for advanced building materials. Additive manufacturing enables customized material formulations and complex geometries that optimize building performance. Integration of AI-driven material selection and performance monitoring systems enhances value propositions for advanced materials.

Supply and demand equilibrium in the Europe advanced building materials market reflects the interplay between regulatory requirements, technological capabilities, and economic considerations. Demand growth consistently outpaces supply capacity in certain high-performance material categories, creating opportunities for capacity expansion and new market entrants.

Competitive dynamics are characterized by innovation-driven differentiation and strategic partnerships between material manufacturers, technology companies, and construction firms. Market consolidation through mergers and acquisitions enables companies to expand product portfolios and geographic reach while achieving economies of scale.

Price dynamics reflect the premium positioning of advanced materials while demonstrating gradual cost reduction as production scales increase. Value-based pricing strategies emphasize lifecycle benefits and performance advantages rather than direct cost comparisons with traditional materials. Market maturation drives increased price competition in established material categories.

Technology adoption cycles influence market dynamics as early adopters validate new material technologies and drive mainstream acceptance. Performance validation through real-world applications builds market confidence and accelerates adoption rates. Continuous innovation ensures sustained market dynamism and growth potential.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Europe advanced building materials market. Primary research includes extensive interviews with industry executives, construction professionals, material manufacturers, and regulatory officials across key European markets.

Secondary research encompasses analysis of industry reports, government publications, trade association data, and academic research. Market data validation involves cross-referencing multiple sources and conducting expert consultations to ensure accuracy and completeness of market intelligence.

Quantitative analysis utilizes statistical modeling techniques to project market trends, growth rates, and segment performance. Qualitative insights provide context for market dynamics, competitive positioning, and strategic implications. According to MarkWide Research analysis, this mixed-method approach delivers comprehensive market understanding.

Data collection spans multiple years to identify long-term trends and cyclical patterns. Geographic coverage includes all major European markets with detailed analysis of regional variations and local market conditions. Continuous monitoring ensures research findings remain current and relevant to market participants.

Western Europe maintains market leadership in advanced building materials adoption, driven by stringent environmental regulations and strong economic conditions. Germany represents the largest single market, accounting for approximately 28% of regional demand, supported by robust construction activity and advanced manufacturing capabilities. The country’s commitment to energy efficiency and sustainable construction drives consistent demand growth across multiple material categories.

France and the United Kingdom collectively represent 34% of market share, with both countries implementing comprehensive building energy efficiency programs. French market dynamics emphasize thermal performance and sustainable materials, while the UK focuses on retrofit applications and smart building technologies. Nordic countries including Sweden, Norway, and Denmark demonstrate high adoption rates for advanced insulation and energy management materials.

Southern Europe shows accelerating growth in advanced building materials adoption, with Italy and Spain leading regional development. Climate-specific requirements drive demand for thermal management materials and solar-responsive building components. Mediterranean markets increasingly adopt advanced materials for cooling efficiency and moisture management applications.

Eastern Europe represents the fastest-growing regional segment, with Poland, Czech Republic, and Hungary demonstrating strong market expansion. EU membership and infrastructure development programs drive adoption of advanced building materials. Regional growth rates exceed Western European averages as markets mature and regulatory frameworks align with EU standards.

Market leadership in the Europe advanced building materials sector is distributed among established multinational corporations, specialized technology companies, and innovative startups. Competitive positioning emphasizes technological innovation, product performance, and sustainable manufacturing practices.

Strategic partnerships between material manufacturers and technology companies accelerate innovation and market development. Collaboration initiatives focus on integrating digital technologies, IoT connectivity, and AI-driven performance optimization into advanced building materials.

Material type segmentation reveals diverse categories driving market growth across the Europe advanced building materials sector:

By Material Category:

By Application Sector:

By Performance Characteristic:

Advanced concrete technologies represent the largest market segment, driven by infrastructure development and high-performance building requirements. Self-healing concrete demonstrates particular growth potential, offering extended service life and reduced maintenance costs. Smart concrete with embedded sensors enables real-time structural monitoring and predictive maintenance capabilities.

High-performance insulation materials show consistent growth across all European markets, supported by energy efficiency regulations and building performance standards. Aerogel insulation gains market share in space-constrained applications where traditional insulation thickness is impractical. Vacuum insulated panels provide superior thermal performance for specialized applications including cold storage and passive house construction.

Smart glass technologies experience rapid adoption in commercial and high-end residential applications. Electrochromic glass enables dynamic solar control and glare management, reducing HVAC energy consumption while maintaining occupant comfort. Integration with building automation systems creates opportunities for optimized building performance and energy management.

Composite materials find increasing application in structural and architectural elements, offering design flexibility and performance advantages. Bio-based composites align with sustainability objectives while providing comparable performance to traditional materials. Fiber-reinforced polymers enable lightweight construction and seismic resistance in earthquake-prone regions.

Construction companies benefit from advanced building materials through improved project efficiency, enhanced building performance, and competitive differentiation. Productivity gains result from faster installation processes, reduced rework, and simplified construction sequences. Advanced materials enable construction firms to meet stringent performance requirements and achieve green building certifications.

Building owners and developers realize long-term value through reduced operating costs, enhanced property values, and improved tenant satisfaction. Energy cost savings from high-performance materials provide attractive return on investment over building lifecycles. Advanced materials contribute to building resilience, reducing maintenance requirements and extending service life.

Architects and engineers gain design flexibility and performance capabilities that enable innovative building solutions. Advanced materials expand design possibilities while ensuring compliance with increasingly stringent building codes and performance standards. Integration of smart materials enables responsive building systems that adapt to changing conditions.

Material manufacturers access growing market opportunities driven by regulatory requirements and performance demands. Innovation investment in advanced materials creates competitive advantages and premium pricing opportunities. Sustainable material development aligns with corporate responsibility objectives and market trends.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration represents the dominant trend shaping the Europe advanced building materials market. Circular economy principles drive development of materials with recycled content, bio-based components, and end-of-life recyclability. Carbon footprint reduction becomes a critical material selection criterion, with embodied carbon assessment increasingly influencing purchasing decisions.

Digitalization and connectivity transform traditional building materials into intelligent systems capable of data collection and performance optimization. IoT-enabled materials provide real-time monitoring of structural health, environmental conditions, and energy performance. Integration with building management systems enables predictive maintenance and automated performance optimization.

Prefabrication and modular construction methods drive demand for materials specifically designed for off-site manufacturing. Dimensional stability, quality consistency, and installation efficiency become critical material characteristics. Advanced materials enable complex prefabricated building systems that reduce construction time and improve quality control.

Health and wellness focus influences material selection toward products that improve indoor environmental quality. Low-emission materials, antimicrobial surfaces, and air-purifying technologies gain market acceptance. Biophilic design principles drive adoption of materials that connect occupants with natural environments.

Recent innovations in the Europe advanced building materials sector demonstrate accelerating technological advancement and market evolution. Breakthrough developments include self-healing concrete that extends infrastructure service life, aerogel insulation with unprecedented thermal performance, and smart glass that generates electricity while providing solar control.

Strategic partnerships between material manufacturers and technology companies accelerate innovation and market development. Collaboration initiatives focus on integrating artificial intelligence, machine learning, and IoT connectivity into building materials. Cross-industry partnerships enable development of integrated building systems that optimize performance across multiple building functions.

Investment activity in advanced building materials startups and established companies indicates strong market confidence and growth expectations. Venture capital funding supports development of next-generation materials including bio-based alternatives, smart responsive materials, and nanotechnology applications. Government research grants accelerate innovation in sustainable building technologies.

Regulatory developments continue to shape market requirements and opportunities. Updated building energy codes mandate higher performance standards that favor advanced materials. New sustainability reporting requirements increase transparency regarding material environmental impact and lifecycle performance.

Market participants should prioritize sustainability and circular economy principles in product development and marketing strategies. MWR analysis indicates that environmental performance increasingly influences material selection decisions across all market segments. Companies that demonstrate clear environmental benefits and lifecycle value propositions will achieve competitive advantages.

Technology integration represents a critical success factor for advanced building materials companies. Digital capabilities including IoT connectivity, data analytics, and AI-driven optimization create differentiation opportunities and premium pricing potential. Investment in digital technology development and partnerships with technology companies will drive long-term market success.

Geographic expansion into Eastern European markets offers significant growth opportunities for established companies. Market development strategies should emphasize local partnerships, regulatory compliance, and technical support capabilities. Early market entry in emerging regions can establish competitive advantages as markets mature.

Skills development and technical education initiatives will address workforce challenges and accelerate market adoption. Training programs for construction professionals, architects, and engineers will improve installation quality and expand market acceptance. Collaboration with educational institutions and trade organizations can build market expertise and demand.

Long-term market prospects for the Europe advanced building materials sector remain highly positive, supported by regulatory mandates, technological innovation, and sustainability imperatives. Growth acceleration is expected as material costs decline through scale economies and manufacturing optimization. The market is projected to maintain robust expansion with CAGR exceeding 7.5% through the next decade.

Technology evolution will continue driving market transformation through integration of artificial intelligence, nanotechnology, and biotechnology applications. Next-generation materials will offer unprecedented performance characteristics including self-repair capabilities, adaptive properties, and integrated energy generation. Smart building integration will become standard rather than premium features.

Market consolidation through strategic acquisitions and partnerships will create larger, more capable companies with comprehensive product portfolios. Vertical integration strategies will enable companies to control entire value chains from raw materials to installed systems. Global expansion will accelerate as European companies leverage technological leadership in international markets.

Regulatory evolution will continue driving market requirements toward higher performance and sustainability standards. Carbon neutrality objectives will mandate adoption of low-carbon materials and circular economy principles. Building performance standards will become increasingly stringent, creating sustained demand for advanced material solutions.

The Europe advanced building materials market stands at the forefront of construction industry transformation, driven by regulatory mandates, technological innovation, and sustainability imperatives. Market dynamics indicate sustained growth potential across multiple material categories and application sectors, with particular strength in energy efficiency and smart building technologies.

Strategic opportunities exist for companies that prioritize innovation, sustainability, and digital integration in their product development and market strategies. The convergence of environmental regulations, technological capabilities, and economic incentives creates favorable conditions for advanced building materials adoption across European markets.

Future success will depend on companies’ ability to deliver materials that demonstrate clear performance advantages, environmental benefits, and lifecycle value propositions. As the construction industry continues evolving toward sustainability and digitalization, advanced building materials will play an increasingly critical role in achieving building performance objectives and regulatory compliance requirements across Europe.

What is Advanced Building Materials?

Advanced Building Materials refer to innovative materials that enhance the performance, sustainability, and efficiency of construction projects. These materials include high-performance insulation, smart glass, and eco-friendly composites, which are increasingly used in modern architecture and construction practices.

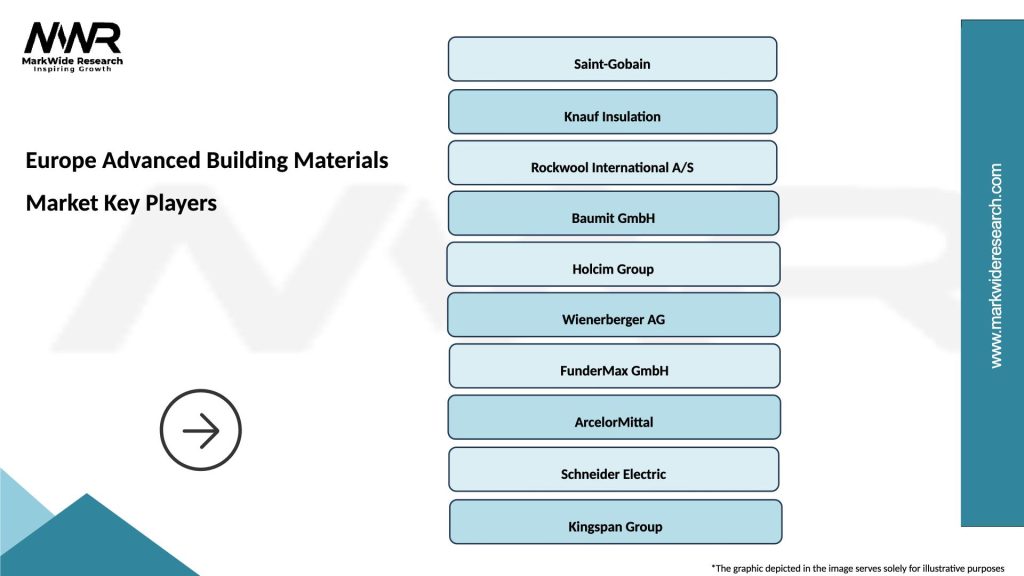

What are the key players in the Europe Advanced Building Materials Market?

Key players in the Europe Advanced Building Materials Market include BASF SE, Saint-Gobain, and Knauf Insulation, among others. These companies are known for their innovative products and solutions that cater to the evolving needs of the construction industry.

What are the growth factors driving the Europe Advanced Building Materials Market?

The Europe Advanced Building Materials Market is driven by factors such as the increasing demand for energy-efficient buildings, the rise in construction activities, and the growing emphasis on sustainable building practices. Additionally, advancements in technology and materials science are contributing to market growth.

What challenges does the Europe Advanced Building Materials Market face?

Challenges in the Europe Advanced Building Materials Market include high initial costs of advanced materials and the need for skilled labor to implement these technologies. Additionally, regulatory hurdles and varying standards across countries can impede market growth.

What opportunities exist in the Europe Advanced Building Materials Market?

The Europe Advanced Building Materials Market presents opportunities in the development of smart materials and sustainable construction solutions. As the demand for green buildings increases, companies can innovate in areas such as energy-efficient insulation and renewable materials.

What trends are shaping the Europe Advanced Building Materials Market?

Trends in the Europe Advanced Building Materials Market include the integration of smart technologies in building materials, the use of recycled materials, and a focus on reducing carbon footprints. These trends reflect a broader shift towards sustainability and efficiency in the construction sector.

Europe Advanced Building Materials Market

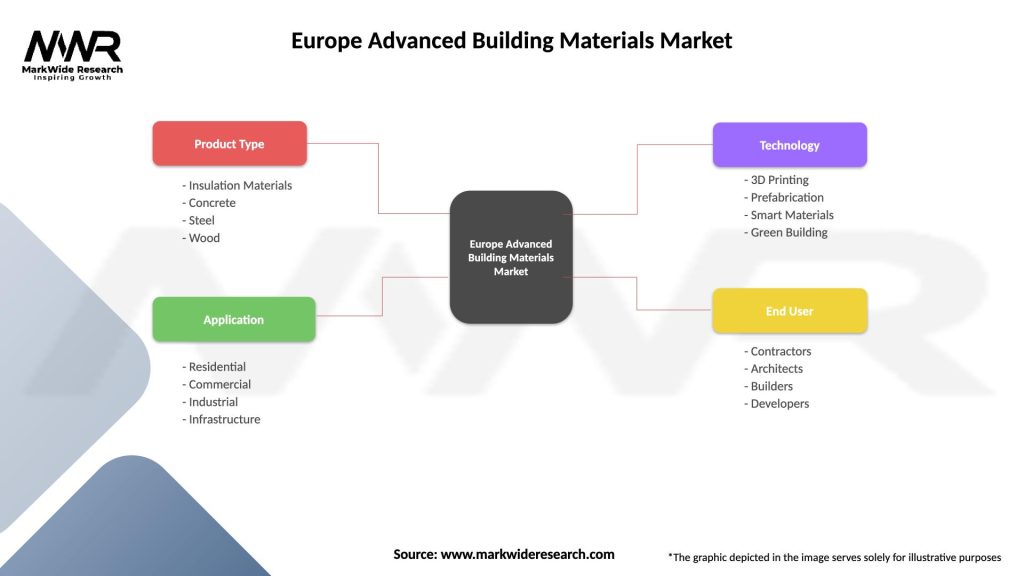

| Segmentation Details | Description |

|---|---|

| Product Type | Insulation Materials, Concrete, Steel, Wood |

| Application | Residential, Commercial, Industrial, Infrastructure |

| Technology | 3D Printing, Prefabrication, Smart Materials, Green Building |

| End User | Contractors, Architects, Builders, Developers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Advanced Building Materials Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at