444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe activated alumina market represents a dynamic and rapidly expanding sector within the broader industrial materials landscape. Activated alumina, a highly porous form of aluminum oxide, serves as a critical component in various industrial applications including water treatment, gas purification, catalyst support, and desiccant systems. The European market demonstrates robust growth potential driven by stringent environmental regulations, increasing industrial automation, and growing demand for high-purity water treatment solutions.

Market dynamics in Europe reflect a sophisticated industrial ecosystem where activated alumina plays an essential role in meeting environmental compliance standards. The region’s commitment to sustainable manufacturing practices and circular economy principles has significantly boosted demand for advanced filtration and purification technologies. European manufacturers are increasingly adopting activated alumina solutions to achieve superior performance standards while maintaining cost-effectiveness in their operations.

Regional distribution across Europe shows concentrated demand in major industrial hubs including Germany, France, the United Kingdom, and Italy. These markets collectively account for approximately 68% of European consumption, with emerging markets in Eastern Europe contributing to accelerated growth rates. The market exhibits strong fundamentals supported by continuous technological advancement and increasing application diversity across multiple industry verticals.

The Europe activated alumina market refers to the comprehensive ecosystem encompassing production, distribution, and consumption of activated aluminum oxide products across European territories. Activated alumina is a highly porous, granular form of aluminum oxide created through controlled dehydration of aluminum hydroxide, resulting in a material with exceptional adsorption properties and thermal stability.

This specialized material functions as a versatile industrial solution capable of removing moisture, contaminants, and specific chemical compounds from various media. The European market encompasses diverse product grades, particle sizes, and specialized formulations designed to meet specific industrial requirements. Market participants include manufacturers, distributors, end-users, and technology providers who collectively contribute to the market’s growth and innovation trajectory.

Commercial applications span across water treatment facilities, petrochemical plants, pharmaceutical manufacturing, food processing, and environmental remediation projects. The market’s significance extends beyond simple material supply, encompassing technical support, application engineering, and customized solution development to address complex industrial challenges throughout Europe.

The European activated alumina market demonstrates exceptional growth momentum driven by increasing environmental awareness and stringent regulatory frameworks. Key market drivers include rising demand for water purification systems, expanding petrochemical industry, and growing emphasis on industrial process optimization. The market benefits from Europe’s advanced manufacturing infrastructure and strong commitment to environmental sustainability.

Technological advancement remains a cornerstone of market development, with manufacturers investing significantly in research and development to enhance product performance and application versatility. Innovation focus areas include improved adsorption capacity, enhanced thermal stability, and specialized surface modifications for targeted applications. These developments contribute to approximately 12% annual improvement in overall product efficiency across various applications.

Market segmentation reveals diverse application areas with water treatment representing the largest segment, followed by catalyst support and gas drying applications. Regional analysis indicates Western Europe maintains market leadership while Eastern European countries show accelerated adoption rates. The competitive landscape features both established global players and specialized regional manufacturers, creating a dynamic and innovative market environment.

Strategic market insights reveal several critical factors shaping the European activated alumina landscape. Primary insights demonstrate the market’s resilience and adaptability to changing industrial requirements and regulatory environments.

Environmental regulations serve as the primary catalyst for activated alumina market expansion across Europe. Stringent water quality standards mandated by European Union directives require industrial facilities to implement advanced treatment technologies, directly boosting demand for high-performance adsorbent materials. These regulatory frameworks create sustained market demand while encouraging continuous product innovation and application development.

Industrial growth in key sectors including petrochemicals, pharmaceuticals, and food processing generates substantial demand for activated alumina solutions. Process optimization initiatives across these industries focus on improving efficiency, reducing waste, and enhancing product quality, all of which benefit from activated alumina’s superior adsorption properties. The material’s versatility enables multiple application opportunities within single industrial facilities, maximizing market penetration potential.

Water scarcity concerns and increasing focus on water recycling drive significant investment in advanced water treatment infrastructure. Municipal and industrial water treatment facilities increasingly adopt activated alumina systems to achieve higher purification standards while maintaining operational cost-effectiveness. This trend supports long-term market stability and creates opportunities for specialized product development targeting specific contaminant removal applications.

High initial investment requirements for activated alumina systems present significant barriers for smaller industrial operations. Capital expenditure considerations often delay adoption decisions, particularly among cost-sensitive industries where immediate return on investment is prioritized. These financial constraints can limit market penetration in certain segments and geographic regions with less developed industrial infrastructure.

Alternative technologies including membrane filtration, ion exchange resins, and other adsorbent materials create competitive pressure on activated alumina applications. Technology competition requires continuous innovation and cost optimization to maintain market position. Some applications may favor alternative solutions based on specific performance requirements, operational conditions, or economic considerations.

Raw material availability and price volatility can impact production costs and market stability. Supply chain disruptions or fluctuations in aluminum oxide feedstock prices may affect manufacturer profitability and end-user adoption rates. These challenges require strategic supply chain management and long-term supplier relationships to ensure market continuity and competitive pricing structures.

Emerging applications in renewable energy systems, particularly hydrogen production and storage, present substantial growth opportunities for activated alumina manufacturers. Green hydrogen initiatives across Europe require advanced purification technologies to achieve the purity levels necessary for fuel cell applications. This emerging market segment offers significant revenue potential and aligns with Europe’s commitment to carbon neutrality objectives.

Pharmaceutical industry expansion creates specialized opportunities for high-purity activated alumina products designed for critical applications. Biopharmaceutical manufacturing requires stringent contamination control and precise purification processes, driving demand for premium-grade activated alumina solutions. The industry’s growth trajectory and quality requirements support premium pricing strategies and long-term customer relationships.

Digital transformation and smart manufacturing technologies enable new service models including predictive maintenance, performance optimization, and remote monitoring capabilities. Value-added services can differentiate suppliers and create additional revenue streams beyond traditional product sales. These technological capabilities enhance customer relationships and provide competitive advantages in increasingly sophisticated industrial markets.

Supply-demand dynamics in the European activated alumina market reflect a complex interplay of industrial growth, regulatory requirements, and technological advancement. Demand patterns show seasonal variations in certain applications while maintaining steady baseline consumption across core industrial segments. The market demonstrates resilient fundamentals with consistent growth drivers supporting long-term expansion prospects.

Competitive dynamics feature both price-based competition and differentiation through technical innovation and customer service excellence. Market leaders focus on developing specialized products and comprehensive solutions while smaller players often target niche applications or regional markets. This competitive environment encourages continuous improvement and innovation across the entire value chain.

Technology evolution drives market dynamics through improved product performance, new application development, and enhanced manufacturing efficiency. Research and development investments by major players contribute to approximately 8% annual productivity gains across manufacturing operations. These technological advances create opportunities for market expansion while potentially disrupting existing competitive positions through breakthrough innovations.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market intelligence. Primary research includes extensive interviews with industry executives, technical experts, and key stakeholders across the European activated alumina value chain. These discussions provide insights into market trends, competitive dynamics, and future growth prospects from experienced industry participants.

Secondary research encompasses analysis of industry publications, regulatory documents, company financial reports, and technical literature to establish market context and validate primary research findings. Data triangulation methods ensure consistency and accuracy across multiple information sources while identifying potential discrepancies or emerging trends that require further investigation.

Quantitative analysis utilizes statistical modeling and forecasting techniques to project market trends and growth patterns. Market sizing methodologies incorporate production capacity analysis, consumption pattern evaluation, and trade flow assessment to establish comprehensive market understanding. MarkWide Research analytical frameworks ensure robust methodology application and reliable market intelligence delivery for strategic decision-making purposes.

Western Europe maintains market leadership with Germany representing the largest single country market, accounting for approximately 28% of regional consumption. German industrial strength in chemicals, automotive, and manufacturing drives substantial activated alumina demand across multiple application areas. The country’s commitment to environmental excellence and advanced manufacturing technologies creates favorable market conditions for premium product segments.

France and the United Kingdom constitute significant markets with strong demand from pharmaceutical, food processing, and water treatment sectors. French market dynamics benefit from robust chemical industry presence and stringent environmental regulations. The UK market demonstrates steady growth patterns despite economic uncertainties, supported by ongoing industrial investment and infrastructure modernization projects.

Eastern European markets including Poland, Czech Republic, and Hungary show accelerated growth rates exceeding 15% annually in certain segments. Industrial development and EU integration drive infrastructure investment and environmental compliance initiatives, creating substantial opportunities for activated alumina suppliers. These markets offer attractive growth potential while requiring adapted strategies for local market conditions and customer requirements.

Market leadership is distributed among several key players with distinct competitive advantages and market positioning strategies. Leading companies focus on different aspects of the value chain including raw material integration, specialized product development, and comprehensive customer service capabilities.

Competitive strategies emphasize technical innovation, customer relationship management, and operational excellence to maintain market position. Market consolidation trends include strategic partnerships, technology licensing agreements, and targeted acquisitions to enhance capabilities and market reach.

Product segmentation reveals diverse activated alumina grades designed for specific applications and performance requirements. Standard grades serve general-purpose applications while specialized products target high-performance requirements in critical industrial processes.

By Product Type:

By Application:

Water treatment applications dominate the European activated alumina market with consistent growth driven by regulatory requirements and infrastructure investment. Municipal water treatment facilities increasingly adopt activated alumina systems for fluoride removal and general purification, while industrial applications focus on process water treatment and wastewater management. This segment benefits from stable demand patterns and long-term customer relationships.

Catalyst support applications represent a technically sophisticated market segment requiring specialized products with precise specifications. Petrochemical refineries and chemical manufacturing facilities utilize activated alumina as catalyst carriers, requiring products with specific surface area, pore structure, and thermal stability characteristics. This segment commands premium pricing due to technical requirements and critical application importance.

Gas drying applications serve diverse industrial sectors including compressed air systems, natural gas processing, and specialty gas purification. Industrial automation and quality control requirements drive demand for reliable moisture removal solutions. This segment shows steady growth potential aligned with industrial production expansion and process optimization initiatives across European manufacturing sectors.

Manufacturers benefit from diverse application opportunities and growing market demand across multiple industrial sectors. Product diversification enables risk mitigation while specialized grades command premium pricing in high-value applications. The European market’s emphasis on quality and performance creates opportunities for differentiation strategies and long-term customer partnerships.

End-users gain access to advanced purification technologies that improve process efficiency, product quality, and environmental compliance. Activated alumina solutions provide cost-effective alternatives to more expensive treatment technologies while delivering reliable performance across diverse operating conditions. Users benefit from technical support services and customized solutions addressing specific application requirements.

Distributors and suppliers participate in a growing market with stable demand patterns and opportunities for value-added services. Technical expertise and customer service capabilities create competitive advantages while regional distribution networks ensure market coverage and customer accessibility. The market’s growth trajectory supports sustainable business development and expansion opportunities across European territories.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as a dominant trend shaping product development and market strategies across the European activated alumina sector. Circular economy principles drive innovation in recycling technologies and sustainable production methods, with manufacturers investing in closed-loop systems and waste reduction initiatives. This trend aligns with European environmental policies and creates competitive advantages for companies demonstrating environmental leadership.

Digitalization and automation transform manufacturing processes and customer service delivery throughout the activated alumina value chain. Industry 4.0 technologies enable predictive maintenance, quality optimization, and remote monitoring capabilities that enhance operational efficiency and customer satisfaction. These digital capabilities contribute to approximately 18% improvement in overall system reliability and performance monitoring.

Customization and specialization trends reflect increasing customer demands for tailored solutions addressing specific application requirements. Application engineering services and customized product development create differentiation opportunities while strengthening customer relationships. This trend supports premium pricing strategies and long-term market positioning in high-value segments requiring specialized technical expertise and performance characteristics.

Recent technological breakthroughs in activated alumina manufacturing include advanced surface modification techniques and enhanced pore structure control methods. Innovation initiatives focus on improving adsorption capacity, selectivity, and regeneration characteristics to address evolving industrial requirements. These developments enable performance improvements of up to 25% in specific applications while maintaining cost-effectiveness and operational reliability.

Strategic partnerships between activated alumina manufacturers and technology providers accelerate product development and market expansion initiatives. Collaboration agreements enable access to complementary technologies, expanded distribution networks, and enhanced customer service capabilities. MarkWide Research analysis indicates these partnerships contribute significantly to market growth and competitive positioning across European territories.

Regulatory developments including updated environmental standards and quality requirements drive continuous product improvement and compliance initiatives. Industry adaptation to new regulations creates opportunities for advanced products while potentially challenging existing market participants. These regulatory changes support market evolution toward higher performance standards and enhanced environmental responsibility throughout the activated alumina value chain.

Market participants should prioritize investment in research and development to maintain competitive positioning in an increasingly sophisticated market environment. Innovation focus should emphasize sustainability, performance enhancement, and application diversification to capture emerging opportunities while defending existing market positions. Companies should develop comprehensive strategies addressing both current market needs and future growth segments.

Geographic expansion strategies should target high-growth Eastern European markets while maintaining strong positions in established Western European territories. Market entry approaches should consider local partnerships, regulatory requirements, and customer preferences to ensure successful market penetration. Regional strategies should balance growth objectives with risk management and resource allocation considerations.

Digital transformation initiatives should integrate advanced technologies throughout operations, from manufacturing processes to customer service delivery. Technology investments should focus on areas providing measurable value creation including operational efficiency, quality improvement, and customer satisfaction enhancement. Companies should develop digital capabilities that differentiate their offerings and strengthen competitive advantages in evolving market conditions.

Long-term market prospects for European activated alumina remain highly favorable, supported by sustained industrial growth, environmental regulations, and technological advancement. Growth projections indicate continued expansion across multiple application segments with particular strength in emerging areas including renewable energy and advanced manufacturing. The market’s fundamental drivers suggest resilient growth patterns capable of withstanding economic uncertainties and competitive pressures.

Technology evolution will continue shaping market dynamics through improved product performance, new application development, and enhanced manufacturing efficiency. Innovation trends suggest significant opportunities in specialized applications requiring advanced purification capabilities and customized solutions. MWR forecasts indicate technology-driven growth will contribute approximately 35% of market expansion over the next decade.

Market structure evolution may include increased consolidation among suppliers, enhanced customer-supplier partnerships, and expanded service offerings beyond traditional product sales. Value chain integration and strategic alliances will likely play important roles in competitive positioning and market development. These structural changes should create enhanced value creation opportunities for market participants while improving customer service and technical support capabilities across European territories.

The European activated alumina market presents compelling opportunities for growth and development across diverse industrial applications and geographic regions. Market fundamentals remain strong, supported by regulatory requirements, technological advancement, and expanding application portfolios that create multiple avenues for sustainable business development. The market’s resilience and adaptability position it favorably for continued expansion despite potential economic uncertainties and competitive challenges.

Strategic success in this market requires comprehensive understanding of customer needs, technological capabilities, and regulatory environments across different European territories. Companies positioning themselves for long-term success should emphasize innovation, sustainability, and customer service excellence while maintaining operational efficiency and cost competitiveness. The market rewards participants who can deliver superior value propositions through technical expertise, product quality, and comprehensive support services.

Future market development will likely favor companies capable of adapting to evolving customer requirements while maintaining strong technical capabilities and market presence. The European activated alumina market offers substantial opportunities for growth, innovation, and value creation for participants committed to excellence and strategic market development across this dynamic and expanding industrial sector.

What is Activated Alumina?

Activated Alumina is a highly porous form of aluminum oxide that is used as an adsorbent for various applications, including water treatment, air purification, and as a catalyst support in chemical processes.

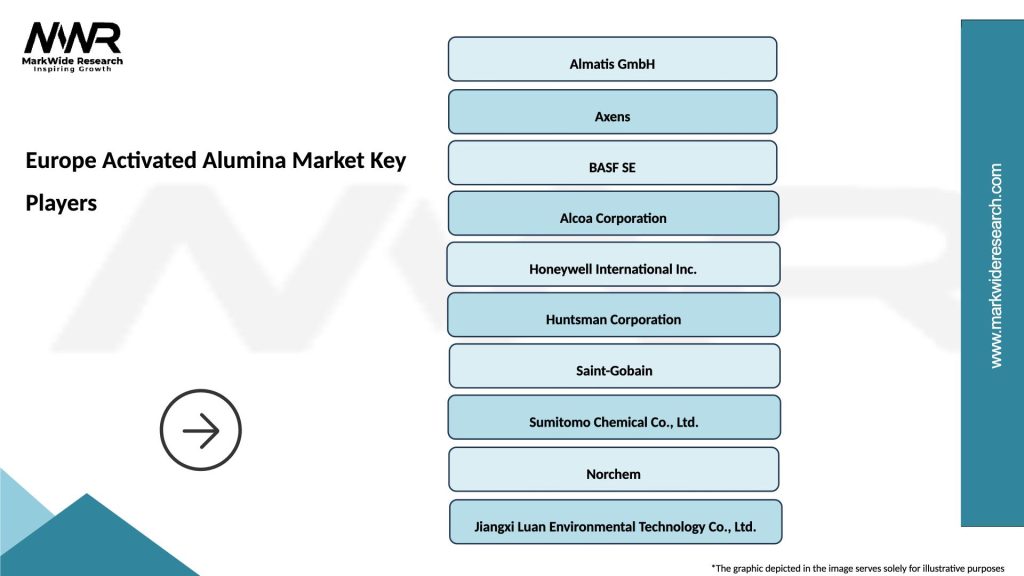

What are the key players in the Europe Activated Alumina Market?

Key players in the Europe Activated Alumina Market include BASF SE, Sorbead Europe, and Axens, among others.

What are the main drivers of the Europe Activated Alumina Market?

The main drivers of the Europe Activated Alumina Market include the increasing demand for water treatment solutions, the growing need for air purification systems, and the rising industrial applications in catalysis.

What challenges does the Europe Activated Alumina Market face?

Challenges in the Europe Activated Alumina Market include the availability of alternative adsorbents, fluctuating raw material prices, and stringent environmental regulations affecting production processes.

What opportunities exist in the Europe Activated Alumina Market?

Opportunities in the Europe Activated Alumina Market include the expansion of wastewater treatment facilities, advancements in adsorption technology, and increasing investments in sustainable industrial practices.

What trends are shaping the Europe Activated Alumina Market?

Trends shaping the Europe Activated Alumina Market include the development of high-performance activated alumina products, the integration of smart technologies in water treatment, and a growing focus on eco-friendly manufacturing processes.

Europe Activated Alumina Market

| Segmentation Details | Description |

|---|---|

| Product Type | Granular, Powder, Beads, Pellets |

| Grade | High Purity, Low Purity, Activated, Super Activated |

| Application | Water Treatment, Oil & Gas, Desiccant, Catalyst Support |

| End User | Chemical Industry, Pharmaceutical, Food & Beverage, Environmental Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Activated Alumina Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at