444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe accommodation market represents one of the most dynamic and resilient sectors within the continent’s tourism and hospitality industry. This comprehensive market encompasses a diverse range of lodging options, from traditional hotels and boutique establishments to vacation rentals, hostels, and emerging alternative accommodation formats. European accommodation providers have demonstrated remarkable adaptability in recent years, embracing digital transformation, sustainability initiatives, and evolving consumer preferences to maintain competitive positioning.

Market dynamics indicate substantial growth potential across multiple segments, with the sector experiencing a robust recovery trajectory following global disruptions. The integration of advanced booking technologies, personalized guest experiences, and eco-friendly practices has become increasingly critical for accommodation providers seeking to capture market share. Regional variations across European markets reflect diverse cultural preferences, economic conditions, and regulatory environments that shape accommodation demand patterns.

Digital transformation continues to drive significant changes in how accommodation services are marketed, booked, and delivered. The proliferation of online travel agencies, direct booking platforms, and mobile applications has fundamentally altered the competitive landscape. Consumer behavior increasingly favors flexible booking options, contactless services, and authentic local experiences, compelling accommodation providers to innovate their service offerings and operational models.

The Europe accommodation market refers to the comprehensive ecosystem of lodging facilities and services that provide temporary housing solutions for travelers, tourists, and business visitors across European destinations. This market encompasses traditional hospitality establishments, alternative lodging options, and emerging accommodation formats that cater to diverse consumer preferences and travel purposes.

Accommodation services within this market include hotels of various classifications, vacation rental properties, hostels, bed and breakfast establishments, serviced apartments, camping facilities, and innovative lodging concepts. The market operates through multiple distribution channels, including direct bookings, online travel platforms, travel agents, and corporate booking systems that facilitate seamless reservation processes for consumers.

Market participants range from international hotel chains and independent properties to individual property owners and specialized accommodation platforms. The sector’s complexity reflects the diverse needs of leisure travelers, business professionals, group tourists, and extended-stay guests who require different service levels, amenities, and pricing structures across various European destinations.

Strategic positioning within the Europe accommodation market requires understanding of evolving consumer expectations, technological advancement opportunities, and regulatory compliance requirements. The market demonstrates strong resilience and adaptation capabilities, with accommodation providers increasingly focusing on sustainability, digitalization, and personalized guest experiences to differentiate their offerings.

Growth drivers include recovering international travel demand, domestic tourism expansion, business travel resumption, and increasing preference for unique accommodation experiences. The market benefits from Europe’s established tourism infrastructure, cultural diversity, and strong transportation networks that facilitate visitor mobility across destinations. Innovation trends encompass contactless technologies, artificial intelligence applications, and sustainable operational practices that enhance guest satisfaction while improving operational efficiency.

Competitive dynamics reflect the ongoing evolution of traditional hospitality models alongside emerging accommodation concepts. Market participants are investing in technology upgrades, staff training, and facility improvements to meet changing consumer expectations. Regional opportunities vary significantly across European markets, with emerging destinations gaining popularity while established tourism hubs focus on premium positioning and service excellence.

Future prospects indicate continued market expansion driven by demographic shifts, changing travel patterns, and increasing emphasis on experiential tourism. The integration of smart technologies, sustainable practices, and flexible service models positions the market for sustained growth across multiple accommodation segments and geographic regions.

Consumer preferences have evolved significantly, with travelers increasingly seeking authentic, personalized accommodation experiences that reflect local culture and values. This shift has created opportunities for boutique properties, vacation rentals, and specialized lodging concepts that offer unique value propositions beyond traditional hotel services.

Tourism recovery serves as the primary catalyst for accommodation market expansion across European destinations. The gradual return of international visitors, combined with robust domestic travel demand, creates favorable conditions for accommodation providers to optimize occupancy rates and revenue performance. Business travel resumption contributes additional demand stability, particularly in major urban centers and commercial hubs.

Digital transformation enables accommodation providers to reach broader audiences through online marketing channels, optimize pricing strategies through revenue management systems, and enhance guest experiences through technology-enabled services. The proliferation of mobile booking applications and social media marketing creates new opportunities for direct customer engagement and brand building.

Infrastructure development across European regions improves accessibility to previously underserved destinations, creating new accommodation opportunities in emerging tourism markets. Transportation improvements, including expanded airline routes and enhanced rail connectivity, facilitate visitor access to diverse accommodation options throughout the continent.

Demographic trends support sustained accommodation demand growth, with millennials and Generation Z travelers demonstrating strong preferences for unique lodging experiences and authentic cultural immersion. These consumer segments prioritize value, convenience, and social responsibility in their accommodation choices, driving innovation in service delivery and operational practices.

Regulatory complexity presents ongoing challenges for accommodation providers operating across multiple European jurisdictions. Varying taxation policies, licensing requirements, and operational standards create compliance burdens that particularly impact smaller operators and alternative accommodation providers seeking to expand their market presence.

Labor shortages affect service quality and operational capacity across many European accommodation markets. The hospitality sector faces difficulties recruiting and retaining qualified staff, leading to increased labor costs and potential service disruptions during peak demand periods. Skills gaps in technology adoption and customer service delivery compound these workforce challenges.

Economic uncertainty influences consumer spending patterns and travel behavior, creating demand volatility that complicates revenue forecasting and investment planning for accommodation providers. Currency fluctuations and inflation pressures affect operational costs and pricing strategies, particularly for international hotel chains and vacation rental operators.

Oversupply concerns in certain mature tourism destinations create competitive pressure on accommodation rates and occupancy levels. Market saturation in popular urban centers and resort areas limits growth opportunities for new entrants while pressuring existing operators to differentiate their offerings through enhanced services or specialized positioning.

Sustainable tourism trends create significant opportunities for accommodation providers that embrace environmental responsibility and social impact initiatives. Properties with strong sustainability credentials attract environmentally conscious travelers and benefit from positive brand differentiation in competitive markets. Green building certifications and renewable energy adoption enhance long-term operational efficiency while appealing to eco-minded consumers.

Technology innovation enables accommodation providers to develop new service models, optimize operational efficiency, and create personalized guest experiences that command premium pricing. Artificial intelligence applications, IoT integration, and data analytics capabilities offer competitive advantages for forward-thinking operators willing to invest in technological advancement.

Emerging destinations across Eastern and Southern Europe present growth opportunities for accommodation development as these regions gain recognition among international travelers. Infrastructure improvements and marketing initiatives by national tourism boards create favorable conditions for accommodation investment and expansion in previously underexplored markets.

Niche market segments offer specialized accommodation opportunities, including wellness retreats, adventure tourism lodges, cultural immersion properties, and business-focused extended-stay facilities. These specialized concepts can achieve higher margins and guest loyalty through targeted service delivery and unique value propositions.

Supply and demand equilibrium varies significantly across European accommodation markets, with popular destinations experiencing seasonal fluctuations and emerging markets showing more consistent growth patterns. The dynamic nature of accommodation demand requires flexible operational strategies and adaptive pricing models to optimize revenue performance throughout different market cycles.

Competitive intensity continues to increase as traditional accommodation providers compete with alternative lodging options, including vacation rentals, boutique properties, and innovative hospitality concepts. This competition drives service innovation, pricing optimization, and marketing creativity as providers seek to capture and retain market share in evolving consumer segments.

Technology adoption accelerates across all accommodation categories, with providers investing in digital infrastructure to enhance guest experiences, streamline operations, and improve revenue management capabilities. The integration of artificial intelligence, mobile applications, and data analytics transforms how accommodation services are delivered and optimized.

Consumer behavior evolution reflects changing lifestyle preferences, work patterns, and travel motivations that influence accommodation selection criteria. The growing importance of authentic experiences, local connections, and flexible booking terms shapes how accommodation providers design their service offerings and marketing strategies.

Comprehensive analysis of the Europe accommodation market incorporates multiple research approaches to ensure accurate and actionable insights for industry stakeholders. Primary research methodologies include structured interviews with accommodation providers, consumer surveys, and expert consultations with industry professionals across various market segments and geographic regions.

Secondary research encompasses analysis of industry reports, government tourism statistics, trade association publications, and academic studies that provide contextual understanding of market trends, regulatory developments, and competitive dynamics. Financial performance data from publicly traded accommodation companies offers additional insights into market conditions and growth trajectories.

Market segmentation analysis examines accommodation categories, price points, geographic markets, and consumer demographics to identify growth opportunities and competitive positioning strategies. This segmentation approach enables detailed understanding of market dynamics across different accommodation types and regional markets throughout Europe.

Trend analysis incorporates historical data review, current market assessment, and forward-looking projections to identify emerging opportunities and potential challenges facing accommodation providers. This temporal perspective provides strategic context for investment decisions and operational planning across various market segments.

Western Europe maintains its position as the largest accommodation market segment, with established tourism destinations in France, Germany, Italy, and the United Kingdom driving consistent demand across multiple accommodation categories. These mature markets demonstrate 65% market share of total European accommodation capacity, benefiting from strong infrastructure, international accessibility, and diverse tourism offerings.

Southern Europe experiences robust growth in accommodation demand, particularly in Spain, Portugal, and Greece, where favorable climate conditions and cultural attractions support year-round tourism activity. The region shows strong recovery momentum with accommodation occupancy rates reaching pre-pandemic levels in many destinations, driven by both domestic and international visitor growth.

Northern Europe accommodation markets, including Scandinavia and the Baltic states, demonstrate resilience and innovation in sustainable tourism practices. These markets command premium pricing for eco-friendly accommodation options and unique cultural experiences, with sustainability-focused properties achieving occupancy rates that exceed traditional accommodation by approximately 12%.

Eastern Europe represents the fastest-growing accommodation market segment, with countries like Poland, Czech Republic, and Hungary experiencing significant increases in tourism infrastructure investment. MarkWide Research analysis indicates that emerging Eastern European destinations show accommodation demand growth rates exceeding 15% annually as these markets gain international recognition and accessibility improvements.

Central Europe accommodation markets benefit from their strategic location and strong business travel demand, with cities like Vienna, Zurich, and Amsterdam maintaining high accommodation occupancy rates throughout the year. The region’s focus on premium positioning and service excellence supports higher average daily rates compared to other European markets.

Market leadership in the Europe accommodation sector reflects a diverse ecosystem of international hotel chains, regional operators, independent properties, and alternative accommodation platforms that compete across multiple service segments and price points.

Competitive strategies emphasize brand differentiation, technology integration, and customer experience enhancement to capture market share in increasingly competitive accommodation markets. Companies invest in loyalty programs, mobile applications, and personalized services to build customer retention and direct booking relationships.

By Accommodation Type: The market encompasses hotels, vacation rentals, hostels, bed and breakfast establishments, serviced apartments, camping facilities, and alternative lodging concepts that serve different consumer preferences and budget requirements.

By Price Segment: Accommodation options span luxury, upscale, midscale, economy, and budget categories, with each segment targeting specific consumer demographics and travel purposes through tailored service offerings and amenities.

By Booking Channel: Reservations occur through direct booking websites, online travel agencies, mobile applications, travel agents, and corporate booking platforms that provide different levels of service and pricing transparency.

By Guest Type: Market segments include leisure travelers, business professionals, group tourists, extended-stay guests, and specialized travel categories such as medical tourism and educational travel that require specific accommodation features.

By Geographic Region: European accommodation markets vary by country and destination type, including major cities, resort areas, cultural destinations, business centers, and emerging tourism markets with different demand patterns and competitive dynamics.

Hotel Segment: Traditional hotels continue to dominate accommodation capacity across European markets, with properties investing in technology upgrades, service enhancements, and sustainability initiatives to maintain competitive positioning. Full-service hotels focus on comprehensive amenity offerings while limited-service properties emphasize efficiency and value pricing to attract cost-conscious travelers.

Vacation Rental Segment: Alternative accommodation options experience rapid growth as travelers seek authentic local experiences and flexible lodging arrangements. Short-term rental platforms facilitate property discovery and booking while enabling property owners to monetize unused space and generate additional income streams.

Hostel Segment: Budget accommodation options serve price-sensitive travelers, particularly younger demographics and backpackers seeking affordable lodging with social interaction opportunities. Modern hostels upgrade facilities and services to appeal to broader consumer segments while maintaining competitive pricing structures.

Serviced Apartment Segment: Extended-stay accommodation options cater to business travelers, relocating professionals, and long-term visitors who require residential-style amenities and flexible lease terms. This segment benefits from changing work patterns and increased demand for temporary housing solutions.

Boutique Hotel Segment: Unique, design-focused properties attract travelers seeking distinctive experiences and personalized service delivery. Independent boutique hotels leverage local character and specialized amenities to command premium pricing and build strong guest loyalty.

Accommodation Providers benefit from diverse revenue opportunities, brand building potential, and operational flexibility that enables adaptation to changing market conditions. Technology integration enhances operational efficiency while improving guest satisfaction and loyalty development.

Investors and Developers gain access to stable income-generating assets with potential for capital appreciation and portfolio diversification. The accommodation sector offers various investment structures and risk profiles suitable for different investment strategies and return expectations.

Technology Partners find expanding opportunities to provide innovative solutions that enhance guest experiences, optimize operations, and improve revenue performance for accommodation providers across various market segments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration becomes increasingly important as accommodation providers implement environmental management systems, renewable energy solutions, and waste reduction programs to meet consumer expectations and regulatory requirements. Green certifications and sustainable operational practices enhance brand reputation while reducing long-term operational costs.

Contactless Technology adoption accelerates across accommodation categories, with providers implementing mobile check-in systems, digital room keys, and automated service delivery to enhance guest convenience while reducing operational labor requirements. These technologies improve operational efficiency while meeting evolving consumer preferences for minimal-contact experiences.

Personalization Enhancement through data analytics and artificial intelligence enables accommodation providers to deliver customized experiences, targeted marketing, and individualized service offerings that increase guest satisfaction and loyalty. Predictive analytics help optimize pricing strategies and inventory management across different market segments.

Flexible Booking Policies become standard practice as accommodation providers adapt to changing travel patterns and consumer preferences for reservation flexibility. Enhanced cancellation terms, rate transparency, and booking modification options attract travelers while reducing booking abandonment rates.

Local Experience Integration transforms accommodation offerings from simple lodging to comprehensive destination experiences that include cultural activities, culinary programs, and authentic local connections. This trend enables accommodation providers to differentiate their offerings while supporting local communities and economies.

Digital Transformation Acceleration continues across the accommodation sector, with providers investing in cloud-based property management systems, mobile applications, and integrated booking platforms that streamline operations while enhancing guest experiences. These technological investments improve operational efficiency and enable better data-driven decision making.

Sustainability Initiatives gain momentum as accommodation providers implement comprehensive environmental programs, including renewable energy adoption, waste reduction systems, and sustainable sourcing practices. MWR analysis indicates that properties with strong sustainability credentials achieve higher guest satisfaction scores and improved financial performance compared to conventional operations.

Partnership Development between accommodation providers and technology companies creates innovative service delivery models and operational optimization solutions. These collaborations enable smaller accommodation providers to access advanced technologies while allowing technology companies to expand their market reach and application development.

Market Consolidation activities include strategic acquisitions, brand portfolio expansion, and operational efficiency initiatives that enable accommodation companies to achieve economies of scale and competitive positioning advantages. These developments reshape competitive dynamics while creating opportunities for specialized market participants.

Regulatory Evolution across European markets includes updated taxation policies, licensing requirements, and operational standards that affect accommodation providers’ compliance obligations and operational costs. Industry participants actively engage with regulatory authorities to influence policy development and ensure sustainable market growth.

Technology Investment should prioritize solutions that enhance guest experiences while improving operational efficiency and revenue optimization capabilities. Accommodation providers should focus on integrated platforms that provide comprehensive functionality rather than disparate point solutions that create operational complexity.

Sustainability Programs require comprehensive implementation that addresses environmental impact, social responsibility, and economic sustainability to meet evolving consumer expectations and regulatory requirements. Authentic sustainability initiatives create competitive differentiation while reducing long-term operational costs and regulatory compliance risks.

Market Diversification strategies should consider geographic expansion into emerging European destinations and service diversification into specialized accommodation segments that offer higher margins and reduced competitive intensity. This approach reduces market concentration risk while capturing growth opportunities in developing markets.

Partnership Development with local service providers, technology companies, and tourism organizations creates value-added service offerings while reducing operational costs and market entry barriers. Strategic partnerships enable accommodation providers to enhance their service capabilities without significant capital investment.

Data Analytics Utilization should focus on customer behavior analysis, revenue optimization, and operational efficiency improvement to support strategic decision making and competitive positioning. Advanced analytics capabilities enable personalized marketing, dynamic pricing, and predictive maintenance that improve financial performance.

Growth trajectory for the Europe accommodation market remains positive, supported by recovering international travel demand, domestic tourism expansion, and evolving consumer preferences for unique lodging experiences. The market demonstrates resilience and adaptability that positions it for sustained expansion across multiple accommodation segments and geographic regions.

Technology integration will continue transforming accommodation operations, guest experiences, and revenue management practices. Artificial intelligence, Internet of Things connectivity, and advanced data analytics will become standard operational tools that enable accommodation providers to optimize performance while delivering personalized guest services.

Sustainability requirements will increasingly influence accommodation selection criteria, operational practices, and investment decisions. Properties that embrace comprehensive environmental and social responsibility programs will achieve competitive advantages while meeting regulatory requirements and consumer expectations for responsible tourism.

Market segmentation will become more sophisticated as accommodation providers develop specialized offerings for niche consumer segments, including wellness tourism, adventure travel, cultural immersion, and extended-stay requirements. This specialization enables premium pricing while building strong customer loyalty and brand differentiation.

Regional development opportunities will emerge in previously underexplored European destinations as infrastructure improvements and marketing initiatives increase international awareness and accessibility. MarkWide Research projects that emerging Eastern and Southern European markets will experience accommodation demand growth rates exceeding 18% annually over the next five years, creating significant investment and expansion opportunities for forward-thinking accommodation providers.

The Europe accommodation market presents compelling opportunities for growth, innovation, and strategic positioning across diverse market segments and geographic regions. The sector’s demonstrated resilience, combined with evolving consumer preferences and technological advancement, creates favorable conditions for accommodation providers that embrace change and invest in sustainable competitive advantages.

Strategic success in this dynamic market requires comprehensive understanding of consumer behavior trends, technology integration opportunities, and regulatory compliance requirements. Accommodation providers that prioritize guest experience enhancement, operational efficiency improvement, and sustainability implementation will achieve superior performance while building long-term competitive positioning.

Future market development will be shaped by continued digital transformation, sustainability requirements, and evolving travel patterns that create both challenges and opportunities for industry participants. The accommodation sector’s ability to adapt to changing conditions while maintaining service excellence positions it for sustained growth and profitability across European markets, making it an attractive sector for investors, operators, and technology partners seeking exposure to the dynamic European tourism and hospitality industry.

What is Accommodation?

Accommodation refers to the provision of lodging or housing for travelers and tourists, including hotels, hostels, vacation rentals, and serviced apartments. It plays a crucial role in the tourism and hospitality sectors, catering to various consumer needs and preferences.

What are the key players in the Europe Accommodation Market?

Key players in the Europe Accommodation Market include major hotel chains like Accor, Marriott International, and Hilton Worldwide, as well as online travel agencies such as Booking.com and Expedia. These companies significantly influence market trends and consumer choices, among others.

What are the growth factors driving the Europe Accommodation Market?

The Europe Accommodation Market is driven by factors such as increasing tourism, a rise in disposable incomes, and the growing popularity of short-term rentals. Additionally, the expansion of digital platforms for booking accommodations has made travel more accessible.

What challenges does the Europe Accommodation Market face?

Challenges in the Europe Accommodation Market include regulatory hurdles, competition from alternative lodging options like Airbnb, and fluctuating demand due to economic uncertainties. These factors can impact occupancy rates and profitability for accommodation providers.

What opportunities exist in the Europe Accommodation Market?

Opportunities in the Europe Accommodation Market include the potential for growth in eco-friendly accommodations, the rise of experiential travel, and the increasing demand for personalized services. These trends can lead to innovative offerings that attract diverse traveler segments.

What trends are shaping the Europe Accommodation Market?

Trends in the Europe Accommodation Market include the integration of technology for enhanced guest experiences, a focus on sustainability, and the rise of remote work leading to longer stays. These trends are reshaping how accommodations are designed and marketed.

Europe Accommodation Market

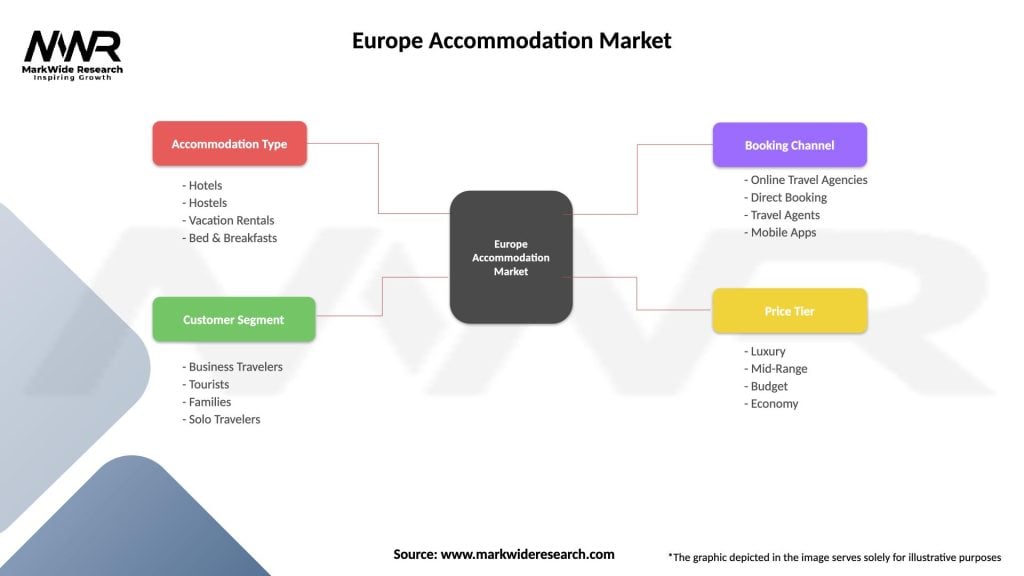

| Segmentation Details | Description |

|---|---|

| Accommodation Type | Hotels, Hostels, Vacation Rentals, Bed & Breakfasts |

| Customer Segment | Business Travelers, Tourists, Families, Solo Travelers |

| Booking Channel | Online Travel Agencies, Direct Booking, Travel Agents, Mobile Apps |

| Price Tier | Luxury, Mid-Range, Budget, Economy |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Accommodation Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at