444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe 3D printing in healthcare market represents one of the most transformative technological sectors within the medical industry, revolutionizing patient care through innovative manufacturing solutions. This rapidly expanding market encompasses a diverse range of applications including medical device manufacturing, prosthetics production, surgical planning models, and bioprinting technologies. European healthcare institutions are increasingly adopting additive manufacturing technologies to enhance treatment outcomes and reduce operational costs.

Market dynamics indicate robust growth driven by advancing technology capabilities and increasing healthcare digitization across major European markets. The region’s strong regulatory framework, combined with substantial investments in medical research and development, positions Europe as a global leader in healthcare 3D printing adoption. Countries including Germany, United Kingdom, France, and Netherlands demonstrate particularly strong market penetration rates exceeding 35% adoption among major healthcare facilities.

Technological advancement continues accelerating market expansion, with biocompatible materials and precision manufacturing capabilities enabling increasingly sophisticated medical applications. The integration of artificial intelligence and machine learning technologies further enhances the precision and efficiency of 3D printing processes in healthcare settings.

The Europe 3D printing in healthcare market refers to the comprehensive ecosystem of additive manufacturing technologies, materials, services, and applications specifically designed for medical and healthcare purposes across European nations. This market encompasses the production of medical devices, surgical instruments, patient-specific implants, anatomical models, and emerging bioprinting applications that create living tissues and organs.

Healthcare 3D printing involves layer-by-layer construction of three-dimensional objects using digital design files, enabling unprecedented customization and precision in medical applications. The technology spans multiple printing methodologies including stereolithography, selective laser sintering, fused deposition modeling, and advanced bioprinting techniques. European healthcare providers leverage these technologies to improve patient outcomes while reducing treatment costs and procedural complexity.

Market participants include medical device manufacturers, healthcare institutions, research organizations, and specialized 3D printing service providers working collaboratively to advance medical care through innovative manufacturing solutions.

Europe’s 3D printing healthcare market demonstrates exceptional growth momentum, driven by increasing demand for personalized medical solutions and advancing manufacturing technologies. The market benefits from strong regulatory support, substantial research investments, and widespread adoption across diverse healthcare applications. Key growth drivers include aging population demographics, rising chronic disease prevalence, and growing emphasis on precision medicine approaches.

Market segmentation reveals diverse application areas with prosthetics and orthotics representing the largest segment, followed by surgical instruments and dental applications. The technology segment shows polymer-based printing maintaining dominant market share at approximately 68%, while metal printing technologies experience rapid growth in specialized applications.

Regional distribution indicates Western Europe leading market development, accounting for over 75% market share, with Eastern European markets showing accelerating adoption rates. Major healthcare institutions across the region report efficiency improvements of up to 40% in surgical planning and device manufacturing processes through 3D printing integration.

Future prospects remain highly favorable, with emerging bioprinting applications and regulatory approvals for advanced medical devices expected to drive continued market expansion throughout the forecast period.

Strategic market insights reveal several critical factors shaping the European 3D printing healthcare landscape:

Primary market drivers propelling European healthcare 3D printing adoption include demographic shifts, technological advancement, and evolving healthcare delivery models. The region’s aging population creates increasing demand for personalized medical devices, particularly in orthopedic applications and dental restoration procedures.

Technological innovation continues driving market expansion through improved printing precision, expanded material options, and reduced manufacturing costs. Healthcare institutions report production time reductions of up to 60% for certain medical devices compared to traditional manufacturing methods. Digital workflow integration enables seamless transition from medical imaging to physical device production.

Regulatory support from European health authorities facilitates market growth through clear certification pathways for 3D printed medical devices. The Medical Device Regulation (MDR) provides comprehensive guidelines supporting innovation while ensuring patient safety. Reimbursement policies increasingly recognize 3D printed medical devices, improving market accessibility.

Cost pressures within European healthcare systems drive adoption of efficient manufacturing solutions. Healthcare providers achieve significant inventory reduction and supply chain optimization through on-demand 3D printing capabilities, particularly valuable during supply disruptions.

Market restraints impacting European healthcare 3D printing development include regulatory complexity, technical limitations, and implementation challenges. Regulatory compliance requirements create substantial documentation and validation burdens, particularly for novel medical applications requiring extensive clinical testing.

Technical limitations persist in areas including printing resolution, material properties, and production scalability. Current technologies face constraints in producing certain complex geometries and achieving consistent quality across large production volumes. Material certification processes remain lengthy and expensive, limiting innovation speed.

Implementation costs represent significant barriers for smaller healthcare institutions, including equipment acquisition, staff training, and facility modifications. Quality assurance requirements necessitate substantial investments in testing equipment and validation processes. Intellectual property concerns create uncertainty around design ownership and liability issues.

Skills shortage in specialized 3D printing technologies limits market expansion, with healthcare institutions struggling to recruit qualified personnel. Integration challenges with existing healthcare IT systems create additional implementation complexity and costs.

Emerging opportunities within the European healthcare 3D printing market span multiple high-growth segments and technological frontiers. Bioprinting applications represent the most significant long-term opportunity, with potential for creating functional tissues and organs addressing critical shortage issues across European healthcare systems.

Personalized medicine trends create substantial opportunities for customized medical device manufacturing, particularly in oncology, cardiology, and orthopedics. Healthcare providers increasingly demand patient-specific solutions that improve treatment outcomes while reducing procedural complexity.

Point-of-care manufacturing presents opportunities for distributed production models, enabling healthcare facilities to produce medical devices on-demand. This approach reduces supply chain dependencies while improving response times for urgent medical needs. Remote healthcare delivery models benefit significantly from local 3D printing capabilities.

Pharmaceutical applications offer emerging opportunities in drug delivery systems, personalized dosing, and complex drug formulations. European pharmaceutical companies explore 3D printing for creating customized medications and novel delivery mechanisms. Medical education applications continue expanding through realistic anatomical models and surgical training tools.

Market dynamics within European healthcare 3D printing reflect complex interactions between technological advancement, regulatory evolution, and healthcare transformation. Supply chain disruptions experienced during recent global events accelerated adoption of distributed manufacturing models, highlighting the strategic value of in-house 3D printing capabilities.

Competitive dynamics intensify as traditional medical device manufacturers integrate 3D printing technologies while specialized additive manufacturing companies expand into healthcare applications. This convergence creates opportunities for innovative partnerships and collaborative development models. Technology democratization enables smaller healthcare institutions to access advanced manufacturing capabilities previously limited to large organizations.

Investment flows into European healthcare 3D printing companies remain robust, with venture capital and strategic investors supporting innovation development. Government initiatives across multiple European countries provide funding and policy support for healthcare digitization, including 3D printing adoption.

Market maturation drives standardization efforts and quality improvement initiatives. Industry associations work collaboratively to establish best practices, quality standards, and certification processes supporting market development while ensuring patient safety.

Research methodology for analyzing the European healthcare 3D printing market employs comprehensive primary and secondary research approaches, ensuring accurate market assessment and reliable forecasting. Primary research includes extensive interviews with healthcare professionals, technology providers, regulatory experts, and industry stakeholders across major European markets.

Data collection encompasses quantitative surveys of healthcare institutions, technology adoption assessments, and detailed case studies of successful 3D printing implementations. Secondary research incorporates analysis of regulatory filings, patent databases, clinical trial registrations, and published academic research.

Market sizing methodology utilizes bottom-up and top-down approaches, validating findings through multiple data sources and expert consultations. Forecasting models incorporate technology adoption curves, demographic trends, and regulatory timeline assessments to project market development.

Quality assurance processes include data triangulation, expert validation, and continuous monitoring of market developments. Research findings undergo rigorous review processes ensuring accuracy and reliability for strategic decision-making purposes.

Regional analysis reveals significant variations in 3D printing adoption across European healthcare markets, with Western European countries leading development while Eastern European markets demonstrate accelerating growth trajectories. Germany maintains the largest market presence, accounting for approximately 28% regional market share, driven by strong manufacturing capabilities and healthcare infrastructure.

United Kingdom represents a major innovation hub with extensive research activities and early adoption of advanced 3D printing technologies. Brexit implications create both challenges and opportunities, with UK companies seeking new European partnerships while maintaining technological leadership. France demonstrates strong growth in dental applications and surgical planning, supported by comprehensive healthcare digitization initiatives.

Nordic countries including Sweden, Denmark, and Norway show exceptional adoption rates relative to population size, with healthcare systems embracing innovative technologies. These markets achieve penetration rates exceeding 45% among major healthcare facilities.

Eastern European markets including Poland, Czech Republic, and Hungary experience rapid growth as healthcare modernization programs incorporate advanced manufacturing technologies. Southern European countries focus primarily on dental applications and orthopedic devices, with growing interest in surgical planning applications.

Competitive landscape within the European healthcare 3D printing market features diverse participants ranging from established medical device manufacturers to specialized additive manufacturing companies. Market leaders demonstrate strong technological capabilities and comprehensive product portfolios.

Strategic partnerships and collaborative relationships characterize competitive dynamics, with companies forming alliances to combine technological capabilities and market access. Innovation focus remains critical for competitive differentiation, particularly in emerging applications like bioprinting and personalized medicine.

Market segmentation analysis reveals diverse application areas and technology categories within European healthcare 3D printing. By Technology: The market segments into stereolithography, selective laser sintering, fused deposition modeling, polyjet printing, and emerging bioprinting technologies.

By Application:

By Material: Market segments include polymers, metals, ceramics, and biological materials. Polymer materials dominate current applications while metal printing grows rapidly in implant manufacturing.

By End User: Healthcare institutions, medical device manufacturers, research organizations, and specialized service providers represent primary market segments.

Category-wise analysis provides detailed insights into specific market segments and their unique characteristics. Prosthetics and Orthotics represent the most mature application category, with established manufacturing processes and regulatory pathways. This segment benefits from strong patient demand for customized solutions and improving insurance coverage.

Dental Applications demonstrate exceptional growth potential, with digital dentistry adoption accelerating across European markets. Clear aligners and dental implants show particularly strong demand, supported by patient preferences for aesthetic solutions. Same-day dentistry models leverage 3D printing for immediate treatment completion.

Surgical Instruments category focuses on patient-specific tools and complex geometries impossible through traditional manufacturing. Healthcare institutions report surgical time reductions of up to 25% using customized instruments. Sterilization compatibility and biocompatibility remain critical requirements.

Bioprinting Applications represent the most innovative category, with research institutions exploring tissue engineering, drug testing, and organ printing possibilities. While commercial applications remain limited, research progress indicates significant future potential.

Healthcare Providers benefit significantly from 3D printing adoption through improved patient outcomes, reduced treatment costs, and enhanced operational efficiency. Customization capabilities enable personalized treatment approaches while on-demand manufacturing reduces inventory requirements and supply chain dependencies.

Patients experience improved treatment outcomes through personalized medical devices, reduced recovery times, and enhanced comfort. Aesthetic improvements in prosthetics and dental applications significantly impact patient satisfaction and quality of life. Faster treatment delivery reduces waiting times for critical medical devices.

Medical Device Manufacturers gain competitive advantages through rapid prototyping, mass customization, and reduced time-to-market for new products. Design freedom enables innovative product development while distributed manufacturing models reduce logistics costs.

Research Institutions leverage 3D printing for advancing medical research, developing new treatment approaches, and creating realistic models for education and training. Collaboration opportunities with industry partners accelerate innovation development and commercialization.

Technology Providers benefit from expanding market opportunities, recurring revenue streams through materials and services, and strategic partnerships with healthcare organizations. Market growth creates opportunities for specialized solution development and geographic expansion.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend shaping European healthcare 3D printing, with integration of artificial intelligence, machine learning, and advanced imaging technologies enhancing design and manufacturing capabilities. Workflow automation reduces manual intervention while improving consistency and quality.

Sustainability focus drives development of recyclable materials and energy-efficient manufacturing processes. Healthcare institutions increasingly prioritize environmental considerations in technology adoption decisions. Circular economy principles influence material selection and waste reduction strategies.

Point-of-care manufacturing trends toward distributed production models, enabling healthcare facilities to produce medical devices on-demand. This approach reduces supply chain vulnerabilities while improving response times for urgent medical needs. Mobile 3D printing units extend capabilities to remote healthcare settings.

Collaborative ecosystems emerge as healthcare providers, technology companies, and research institutions form strategic partnerships. Open innovation models accelerate development while sharing risks and costs. Data sharing initiatives improve design optimization and quality assurance processes.

Regulatory harmonization efforts across European markets simplify compliance requirements and accelerate market access for innovative products. Standardization initiatives improve interoperability and quality consistency.

Recent industry developments demonstrate accelerating innovation and market maturation within European healthcare 3D printing. Major healthcare institutions across the region establish dedicated 3D printing centers, integrating manufacturing capabilities directly into clinical workflows.

Regulatory milestones include expanded approvals for 3D printed medical devices and streamlined certification processes for established applications. European Medicines Agency guidance documents provide clarity for pharmaceutical 3D printing applications, supporting market development.

Technology breakthroughs in bioprinting achieve significant milestones, with research institutions successfully printing functional tissue constructs. Material innovations expand application possibilities while improving biocompatibility and performance characteristics.

Strategic partnerships between technology providers and healthcare institutions create integrated solution offerings. Acquisition activities consolidate market participants while expanding technological capabilities and geographic reach.

Investment activities remain robust, with European venture capital firms and strategic investors supporting innovative healthcare 3D printing companies. Government funding programs provide additional support for research and development initiatives.

Strategic recommendations for market participants focus on leveraging emerging opportunities while addressing current market challenges. Healthcare providers should prioritize staff training and quality assurance systems to maximize 3D printing benefits while ensuring patient safety.

Technology companies should focus on user-friendly solutions and comprehensive support services to accelerate adoption among healthcare institutions. Integration capabilities with existing healthcare IT systems represent critical success factors. MarkWide Research analysis indicates that companies offering end-to-end solutions achieve higher market penetration rates.

Investment strategies should prioritize companies with strong regulatory expertise, proven clinical outcomes, and scalable business models. Bioprinting technologies represent high-risk, high-reward opportunities requiring careful evaluation of technical capabilities and regulatory pathways.

Policy makers should continue supporting regulatory harmonization efforts while maintaining rigorous safety standards. Funding programs for healthcare digitization should include specific provisions for 3D printing adoption and training.

Research institutions should focus on translational research that bridges laboratory innovations with clinical applications. Industry collaboration accelerates commercialization while ensuring practical relevance.

Future market prospects for European healthcare 3D printing remain exceptionally positive, with multiple growth drivers supporting continued expansion. Technological advancement will continue improving capabilities while reducing costs, making 3D printing accessible to broader healthcare segments. Market growth projections indicate sustained expansion at compound annual growth rates exceeding 18% through the forecast period.

Bioprinting applications represent the most transformative future opportunity, with potential for creating functional organs and tissues addressing critical healthcare needs. Clinical trials for bioprinted tissues show promising results, indicating commercial viability within the next decade. Regenerative medicine integration will create entirely new market segments.

Artificial intelligence integration will enhance design optimization, quality control, and predictive maintenance capabilities. Machine learning algorithms will improve printing precision while reducing material waste and production time. Automated workflows will minimize manual intervention requirements.

Market consolidation trends will continue as successful companies expand through acquisitions and strategic partnerships. Vertical integration strategies will create comprehensive solution providers offering hardware, software, materials, and services. MWR forecasts indicate that market concentration will increase while maintaining competitive dynamics.

Geographic expansion into Eastern European markets will accelerate as healthcare modernization programs incorporate advanced manufacturing technologies. Emerging applications in pharmaceutical manufacturing and personalized medicine will create additional growth opportunities.

Europe’s 3D printing in healthcare market represents a dynamic and rapidly evolving sector with exceptional growth potential and transformative impact on medical care delivery. The market benefits from strong technological foundations, supportive regulatory frameworks, and increasing healthcare digitization across the region. Key success factors include continued innovation, quality assurance, and strategic partnerships between technology providers and healthcare institutions.

Market opportunities span diverse applications from established segments like prosthetics and dental devices to emerging areas including bioprinting and personalized medicine. Regional variations create opportunities for targeted market development strategies, with Western European markets leading adoption while Eastern European countries demonstrate accelerating growth potential.

Strategic implications for market participants emphasize the importance of comprehensive solution offerings, regulatory expertise, and clinical outcome validation. Investment priorities should focus on companies with proven technologies, strong market positions, and scalable business models. The Europe 3D printing in healthcare market will continue evolving as a critical component of modern medical care, delivering improved patient outcomes while enhancing healthcare system efficiency and sustainability.

What is 3D Printing in Healthcare?

3D Printing in Healthcare refers to the use of additive manufacturing technologies to create medical devices, prosthetics, implants, and anatomical models. This innovative approach allows for customization and rapid prototyping, enhancing patient care and surgical planning.

What are the key players in the Europe 3D Printing in Healthcare Market?

Key players in the Europe 3D Printing in Healthcare Market include Stratasys, 3D Systems, Materialise, and Siemens Healthineers, among others. These companies are at the forefront of developing advanced 3D printing technologies tailored for medical applications.

What are the growth factors driving the Europe 3D Printing in Healthcare Market?

The growth of the Europe 3D Printing in Healthcare Market is driven by the increasing demand for personalized medicine, advancements in 3D printing technologies, and the rising prevalence of chronic diseases. Additionally, the need for cost-effective manufacturing solutions in healthcare is contributing to market expansion.

What challenges does the Europe 3D Printing in Healthcare Market face?

The Europe 3D Printing in Healthcare Market faces challenges such as regulatory hurdles, high initial investment costs, and the need for skilled professionals. These factors can hinder the widespread adoption of 3D printing technologies in healthcare settings.

What future opportunities exist in the Europe 3D Printing in Healthcare Market?

Future opportunities in the Europe 3D Printing in Healthcare Market include the development of bioprinting technologies, expansion into new medical applications, and collaborations between healthcare providers and technology companies. These advancements could significantly enhance patient outcomes and treatment options.

What trends are shaping the Europe 3D Printing in Healthcare Market?

Trends shaping the Europe 3D Printing in Healthcare Market include the increasing use of 3D printing for surgical planning and education, the rise of on-demand manufacturing, and the integration of artificial intelligence in design processes. These trends are transforming how healthcare professionals approach treatment and device creation.

Europe 3D Printing in Healthcare Market

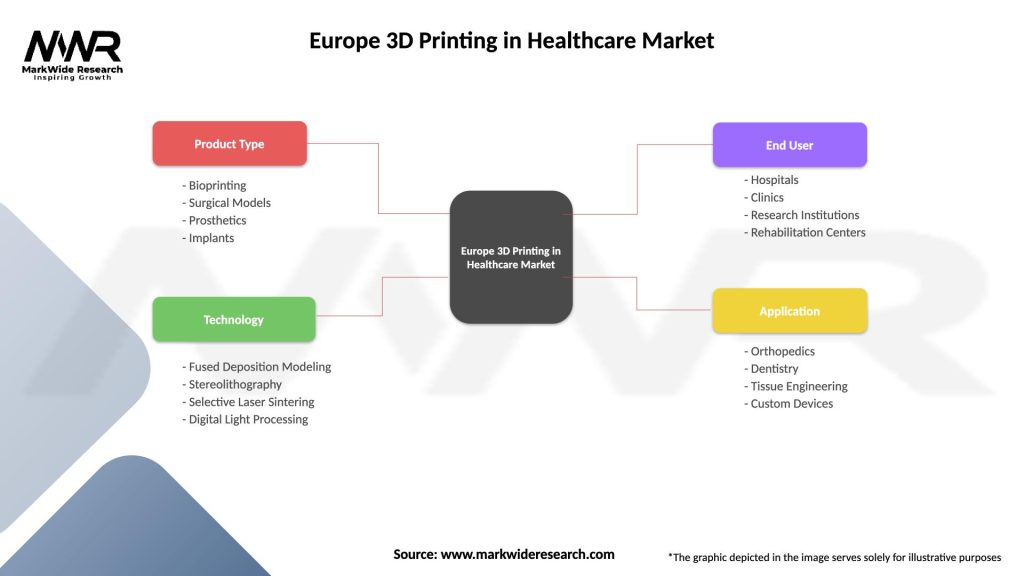

| Segmentation Details | Description |

|---|---|

| Product Type | Bioprinting, Surgical Models, Prosthetics, Implants |

| Technology | Fused Deposition Modeling, Stereolithography, Selective Laser Sintering, Digital Light Processing |

| End User | Hospitals, Clinics, Research Institutions, Rehabilitation Centers |

| Application | Orthopedics, Dentistry, Tissue Engineering, Custom Devices |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe 3D Printing in Healthcare Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at