444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The EU fermentation ingredients market represents a dynamic and rapidly expanding sector within the European food and beverage industry. Fermentation ingredients encompass a diverse range of products including enzymes, cultures, organic acids, amino acids, and vitamins that are essential for various fermentation processes across multiple industries. The market has experienced substantial growth driven by increasing consumer demand for natural and organic food products, rising awareness of health benefits associated with fermented foods, and technological advancements in fermentation processes.

European manufacturers are increasingly adopting fermentation ingredients to enhance product quality, extend shelf life, and meet stringent regulatory requirements. The market demonstrates robust expansion with a projected compound annual growth rate of 6.2% CAGR through the forecast period. Key applications span across food and beverages, pharmaceuticals, animal feed, and industrial biotechnology sectors, with food and beverages accounting for approximately 68% market share of total consumption.

Regional dynamics within the EU show varying adoption patterns, with Western European countries leading in terms of technological advancement and market penetration. Germany, France, and the Netherlands emerge as primary markets, collectively representing over 45% of regional demand. The market benefits from strong regulatory frameworks, advanced research infrastructure, and increasing investments in biotechnology innovations.

The EU fermentation ingredients market refers to the comprehensive ecosystem of biological and chemical compounds utilized in fermentation processes across various industries within European Union member states. Fermentation ingredients serve as catalysts, nutrients, and enhancers that facilitate the conversion of organic compounds through microbial activity, enzymatic reactions, or controlled biochemical processes.

These ingredients encompass multiple categories including starter cultures for dairy and bakery applications, enzymes for beverage production, organic acids for preservation, amino acids for nutritional enhancement, and specialized vitamins for fermentation optimization. Market participants include ingredient manufacturers, distributors, end-user industries, and research institutions collaborating to develop innovative fermentation solutions.

The scope extends beyond traditional food applications to include pharmaceutical fermentation, biofuel production, and industrial biotechnology applications. European regulations governing food safety, organic certification, and biotechnology applications significantly influence market dynamics and product development strategies within this sector.

Market dynamics in the EU fermentation ingredients sector reflect a mature yet rapidly evolving landscape characterized by technological innovation and changing consumer preferences. Growth drivers include increasing demand for natural preservatives, rising popularity of probiotic products, and expanding applications in pharmaceutical manufacturing. The market demonstrates strong resilience with consistent growth patterns across multiple application segments.

Key market segments show varying growth trajectories, with enzyme-based ingredients experiencing the highest demand growth at approximately 8.1% annual increase. Competitive landscape features both established multinational corporations and innovative biotechnology startups, creating a dynamic environment for product development and market expansion.

Regional analysis reveals significant opportunities in Eastern European markets, where increasing industrialization and rising disposable incomes drive demand for processed foods and beverages. Technological advancements in fermentation processes, including precision fermentation and synthetic biology applications, are reshaping market opportunities and competitive positioning strategies.

Future prospects indicate continued market expansion driven by sustainability initiatives, regulatory support for biotechnology innovation, and increasing consumer awareness of health benefits associated with fermented products. Investment trends show growing focus on research and development activities, with particular emphasis on developing novel fermentation ingredients for emerging applications.

Strategic insights from comprehensive market analysis reveal several critical factors shaping the EU fermentation ingredients landscape:

Market intelligence indicates that successful companies are those investing in research and development while maintaining strong regulatory compliance and customer relationship management capabilities.

Primary growth drivers propelling the EU fermentation ingredients market include several interconnected factors that create sustained demand across multiple application segments. Consumer health consciousness represents the most significant driver, with increasing awareness of probiotic benefits and fermented food advantages driving market expansion.

Regulatory support for natural and organic food products creates favorable conditions for fermentation ingredient adoption. European food safety regulations increasingly favor natural preservation methods over synthetic alternatives, positioning fermentation ingredients as preferred solutions for manufacturers seeking regulatory compliance while meeting consumer expectations.

Technological advancement in fermentation processes enables more efficient production methods and higher-quality ingredient outputs. Precision fermentation technologies allow manufacturers to produce specific compounds with greater consistency and reduced environmental impact, driving adoption across various industries.

Industrial biotechnology growth creates new applications for fermentation ingredients beyond traditional food and beverage sectors. Pharmaceutical manufacturing increasingly relies on fermentation-derived ingredients for drug production, while biofuel and biochemical industries represent emerging growth opportunities.

Supply chain resilience considerations following recent global disruptions have prompted manufacturers to diversify ingredient sources and invest in local fermentation capabilities, supporting regional market growth and development.

Significant challenges facing the EU fermentation ingredients market include complex regulatory requirements that can delay product approvals and increase development costs. Regulatory compliance across multiple EU member states requires substantial investment in documentation, testing, and certification processes, particularly for novel fermentation ingredients.

High capital requirements for establishing fermentation facilities and maintaining quality control systems present barriers to entry for smaller companies. Equipment costs and ongoing operational expenses associated with maintaining sterile production environments can limit market participation and innovation capacity.

Technical complexity in fermentation processes requires specialized expertise and continuous monitoring, creating operational challenges for manufacturers. Quality consistency issues can arise from variations in raw materials, environmental conditions, or process parameters, potentially affecting product reliability and customer satisfaction.

Market volatility in raw material prices, particularly for agricultural inputs used in fermentation processes, can impact profitability and pricing strategies. Supply chain disruptions affecting key ingredients or packaging materials can create production delays and inventory management challenges.

Competition from synthetic alternatives in certain applications may limit market growth potential, particularly where cost considerations outweigh natural product benefits. Consumer price sensitivity in some market segments can constrain premium pricing strategies for advanced fermentation ingredients.

Emerging opportunities in the EU fermentation ingredients market present substantial growth potential across multiple dimensions. Precision fermentation technologies offer possibilities for producing high-value compounds with improved efficiency and reduced environmental impact, creating competitive advantages for early adopters.

Pharmaceutical applications represent significant expansion opportunities, with increasing demand for fermentation-derived active pharmaceutical ingredients and excipients. Biotechnology advancement enables production of complex molecules through fermentation processes, opening new revenue streams for ingredient manufacturers.

Sustainability initiatives across European industries create demand for eco-friendly fermentation ingredients that support circular economy principles. Waste valorization through fermentation processes offers opportunities to convert agricultural byproducts into valuable ingredients while addressing environmental concerns.

Personalized nutrition trends drive demand for specialized fermentation ingredients tailored to specific health benefits or dietary requirements. Functional food development creates opportunities for innovative fermentation ingredients that deliver targeted nutritional or therapeutic benefits.

Digital transformation in fermentation processes, including artificial intelligence and machine learning applications, enables optimization of production parameters and quality control systems. Smart manufacturing technologies offer opportunities for improved efficiency and reduced production costs.

Complex interactions between supply and demand factors create dynamic market conditions that influence pricing, innovation, and competitive strategies within the EU fermentation ingredients sector. Demand fluctuations across different application segments require manufacturers to maintain flexible production capabilities and diversified product portfolios.

Seasonal variations in certain food and beverage applications affect ingredient demand patterns, requiring strategic inventory management and production planning. Economic conditions within EU member states influence consumer spending patterns and industrial investment decisions, impacting overall market growth trajectories.

Technological disruption continues to reshape market dynamics, with new fermentation methods and ingredient types creating both opportunities and competitive pressures. Innovation cycles are accelerating, requiring companies to invest continuously in research and development to maintain market position.

Regulatory evolution affects market dynamics through changing approval processes, safety requirements, and labeling regulations. Policy changes related to sustainability, biotechnology, and food safety can significantly impact market conditions and competitive landscapes.

Global supply chain considerations influence regional market dynamics, with geopolitical factors and trade policies affecting ingredient availability and pricing structures. Market consolidation trends through mergers and acquisitions continue to reshape competitive dynamics and market structure.

Comprehensive research approach employed in analyzing the EU fermentation ingredients market combines multiple data collection and analysis methodologies to ensure accuracy and reliability of findings. Primary research involves direct engagement with industry stakeholders including manufacturers, distributors, end-users, and regulatory bodies across EU member states.

Secondary research encompasses analysis of industry reports, regulatory documents, patent filings, and academic publications related to fermentation technologies and ingredient applications. Market intelligence gathering includes monitoring of industry publications, conference proceedings, and expert interviews to capture emerging trends and technological developments.

Data validation processes involve cross-referencing information from multiple sources and conducting follow-up interviews with industry experts to verify findings. Statistical analysis employs advanced modeling techniques to project market trends and identify growth opportunities across different segments and regions.

Regional analysis methodology includes country-specific research to understand local market conditions, regulatory environments, and competitive landscapes. Segmentation analysis examines market dynamics across different ingredient types, applications, and end-user industries to provide comprehensive market insights.

Quality assurance measures ensure research accuracy through peer review processes and validation against established industry benchmarks and historical market performance data.

Western Europe dominates the EU fermentation ingredients market, with Germany, France, and the Netherlands representing the largest consumption centers. German market leadership stems from strong industrial biotechnology sector and advanced food processing capabilities, accounting for approximately 22% of regional market share.

French market demonstrates particular strength in dairy and wine fermentation applications, supported by traditional fermentation expertise and premium product positioning. Netherlands serves as a key distribution hub and innovation center, with significant investments in biotechnology research and development facilities.

Nordic countries including Sweden, Denmark, and Finland show growing adoption of fermentation ingredients, driven by sustainability initiatives and advanced food technology sectors. Market penetration in these regions reaches approximately 15% of total EU consumption, with strong growth potential in functional food applications.

Eastern European markets present significant growth opportunities, with Poland, Czech Republic, and Hungary experiencing rapid industrialization and increasing consumer demand for processed foods. Market expansion in these regions shows growth rates exceeding 9.5% annually, driven by rising disposable incomes and modernization of food processing infrastructure.

Southern European countries including Italy, Spain, and Portugal demonstrate strong demand for fermentation ingredients in traditional food applications, with particular emphasis on wine, cheese, and preserved food production. Regional specialization creates opportunities for targeted ingredient solutions and premium product positioning.

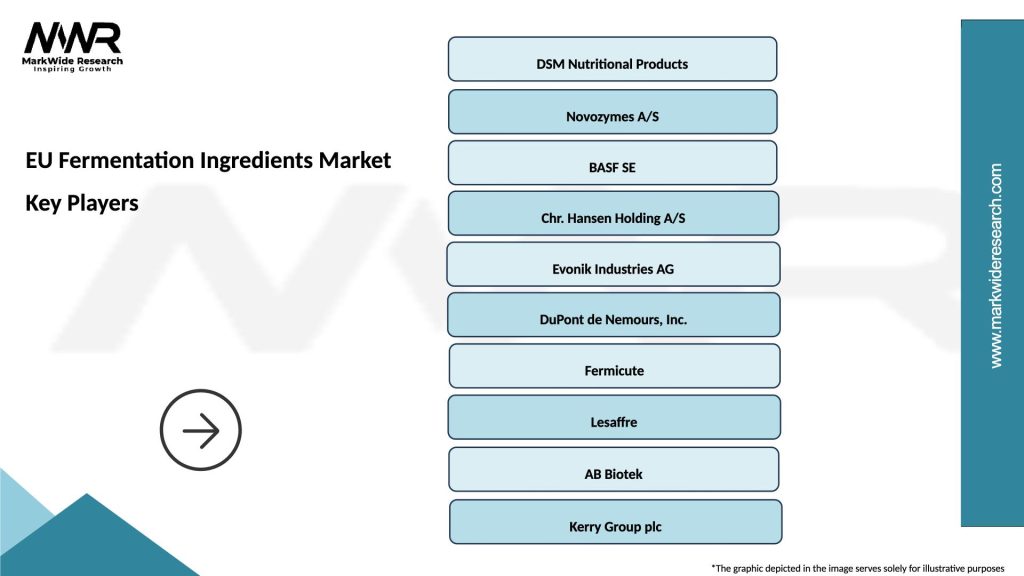

Market leadership in the EU fermentation ingredients sector is characterized by a mix of established multinational corporations and innovative biotechnology companies. Competitive dynamics reflect ongoing consolidation trends alongside emerging market entrants bringing novel technologies and specialized solutions.

Leading market participants include:

Competitive strategies focus on research and development investments, strategic partnerships, and geographic expansion to capture emerging market opportunities. Innovation leadership remains crucial for maintaining market position and developing next-generation fermentation ingredients.

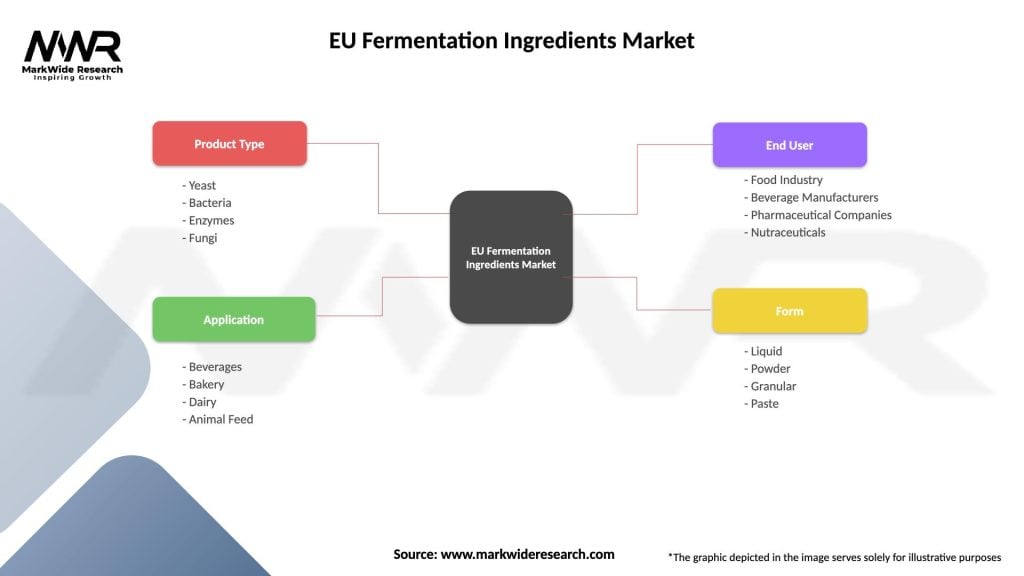

Market segmentation analysis reveals distinct patterns across multiple dimensions, providing insights into growth opportunities and competitive dynamics within specific market niches.

By Ingredient Type:

By Application:

By End-User Industry:

Enzyme category demonstrates the strongest growth momentum within the EU fermentation ingredients market, driven by expanding applications in food processing and industrial biotechnology. Proteases and carbohydrases represent the largest enzyme subcategories, with particular strength in bakery and beverage applications where they improve product quality and processing efficiency.

Culture category shows steady growth supported by increasing consumer demand for probiotic products and traditional fermented foods. Lactic acid bacteria dominate this segment, with specialized strains developed for specific applications including yogurt, cheese, and functional food production. Innovation focus centers on developing cultures with enhanced stability, flavor profiles, and health benefits.

Organic acid category benefits from growing demand for natural preservation solutions and clean-label products. Citric acid and lactic acid represent the primary products in this category, with applications spanning food preservation, flavor enhancement, and pH regulation. Market growth is driven by regulatory pressure to reduce synthetic preservative usage.

Amino acid category serves specialized applications in nutritional supplementation and pharmaceutical manufacturing. Essential amino acids produced through fermentation processes command premium pricing due to their high purity and bioavailability. Growth opportunities exist in personalized nutrition and therapeutic applications.

Vitamin category focuses on fermentation-derived vitamins used in food fortification and nutritional supplementation. B-complex vitamins produced through fermentation processes offer advantages in terms of bioavailability and consumer acceptance compared to synthetic alternatives.

Manufacturers in the EU fermentation ingredients market benefit from multiple value propositions that enhance their competitive positioning and operational efficiency. Product differentiation opportunities arise from developing specialized fermentation ingredients that meet specific customer requirements and regulatory standards.

Cost optimization benefits include reduced raw material costs through efficient fermentation processes and waste valorization initiatives. Quality improvements achieved through controlled fermentation conditions result in more consistent product characteristics and enhanced customer satisfaction.

Distributors and suppliers benefit from growing market demand and expanding application areas that create new business opportunities. Portfolio diversification through fermentation ingredients reduces dependency on traditional chemical ingredients and provides access to higher-margin products.

End-user industries gain advantages through improved product quality, extended shelf life, and enhanced nutritional profiles. Regulatory compliance becomes easier with natural fermentation ingredients that meet clean-label requirements and consumer preferences for natural products.

Research institutions benefit from increased industry collaboration and funding opportunities for fermentation technology development. Innovation partnerships with commercial entities accelerate technology transfer and practical application of research findings.

Consumers ultimately benefit from improved product quality, enhanced nutritional value, and greater availability of natural and organic food options. Health benefits associated with fermented products contribute to overall wellness and dietary satisfaction.

Strengths:

Weaknesses:

Opportunities:

Threats:

Precision fermentation emerges as a transformative trend reshaping the EU fermentation ingredients landscape. Advanced biotechnology enables production of specific compounds with unprecedented precision and efficiency, creating opportunities for novel ingredient development and cost optimization.

Sustainability integration drives development of eco-friendly fermentation processes and circular economy solutions. Waste valorization through fermentation technologies converts agricultural byproducts into valuable ingredients, addressing environmental concerns while creating new revenue streams.

Digital transformation in fermentation processes includes artificial intelligence applications for process optimization and quality control. Smart manufacturing technologies enable real-time monitoring and automated adjustment of fermentation parameters, improving efficiency and product consistency.

Clean-label movement continues to influence product development strategies, with consumers demanding natural and minimally processed ingredients. Transparency requirements drive adoption of fermentation ingredients that support clean-label claims and consumer trust.

Personalized nutrition trends create demand for specialized fermentation ingredients tailored to specific health benefits and dietary requirements. Functional food development focuses on fermentation ingredients that deliver targeted nutritional or therapeutic benefits.

Regulatory harmonization efforts across EU member states aim to streamline approval processes and reduce compliance complexity. Policy support for biotechnology innovation creates favorable conditions for fermentation ingredient development and commercialization.

Recent industry developments highlight the dynamic nature of the EU fermentation ingredients market and emerging opportunities for growth and innovation. Strategic partnerships between ingredient manufacturers and technology companies are accelerating development of next-generation fermentation solutions.

Investment activities show increased funding for biotechnology startups developing novel fermentation ingredients and processes. Venture capital and corporate investment in precision fermentation technologies reached record levels, indicating strong confidence in market potential.

Regulatory approvals for new fermentation ingredients continue to expand market opportunities, with recent approvals for novel enzymes and culture strains opening new application areas. MarkWide Research analysis indicates that regulatory approval timelines are improving, supporting faster market entry for innovative products.

Facility expansions by major manufacturers demonstrate commitment to meeting growing demand and expanding production capabilities. New production facilities incorporating advanced fermentation technologies are being established across multiple EU countries.

Acquisition activities continue to reshape the competitive landscape, with established companies acquiring specialized biotechnology firms to enhance their fermentation ingredient portfolios. Market consolidation trends create opportunities for improved operational efficiency and expanded market reach.

Research collaborations between industry and academic institutions are yielding breakthrough developments in fermentation technology and ingredient applications. Innovation partnerships accelerate technology transfer and commercial application of research findings.

Strategic recommendations for market participants focus on leveraging emerging opportunities while addressing key challenges in the EU fermentation ingredients market. Investment priorities should emphasize research and development capabilities, particularly in precision fermentation and sustainable production technologies.

Market entry strategies for new participants should focus on niche applications and specialized ingredient categories where established players have limited presence. Partnership approaches with local distributors and end-users can accelerate market penetration and reduce entry barriers.

Product development initiatives should prioritize clean-label solutions and functional ingredients that address specific consumer health concerns. Innovation focus on sustainability and circular economy applications can create competitive advantages and support premium pricing strategies.

Geographic expansion opportunities exist primarily in Eastern European markets where industrial development and consumer spending growth create favorable conditions. Market development strategies should consider local preferences and regulatory requirements in target markets.

Technology investments in digital transformation and automation can improve operational efficiency and product quality while reducing production costs. Smart manufacturing capabilities become increasingly important for maintaining competitiveness in evolving market conditions.

Regulatory compliance strategies should anticipate future regulatory changes and invest in capabilities that ensure continued market access. Quality assurance systems must meet the highest standards to maintain customer confidence and regulatory approval.

Long-term prospects for the EU fermentation ingredients market remain highly positive, with multiple growth drivers supporting sustained expansion across various application segments. Market evolution will be characterized by increasing sophistication in fermentation technologies and expanding application areas beyond traditional food and beverage sectors.

Technology advancement will continue to drive market transformation, with precision fermentation and synthetic biology applications creating new possibilities for ingredient production. Innovation cycles are expected to accelerate, requiring companies to maintain strong research and development capabilities to remain competitive.

Regulatory environment is anticipated to become more supportive of biotechnology innovation while maintaining strict safety standards. Policy initiatives promoting sustainability and circular economy principles will create additional opportunities for fermentation ingredient applications.

Market growth projections indicate continued expansion at a compound annual growth rate of 6.2% through the forecast period, with particular strength in pharmaceutical and industrial biotechnology applications. MWR analysis suggests that market dynamics will favor companies with strong innovation capabilities and diversified product portfolios.

Consumer trends toward natural and functional foods will continue to drive demand for fermentation ingredients, while growing awareness of environmental sustainability will support adoption of eco-friendly production methods. Market maturation in Western Europe will be balanced by growth opportunities in Eastern European markets.

Competitive landscape evolution will likely feature continued consolidation alongside emergence of specialized biotechnology companies bringing innovative solutions to market. Success factors will include technological leadership, regulatory compliance, and ability to adapt to changing market conditions and consumer preferences.

The EU fermentation ingredients market represents a dynamic and rapidly evolving sector with substantial growth potential across multiple application areas. Market fundamentals remain strong, supported by increasing consumer demand for natural products, regulatory support for biotechnology innovation, and expanding applications in pharmaceutical and industrial sectors.

Key success factors for market participants include maintaining strong research and development capabilities, ensuring regulatory compliance, and developing sustainable production methods that address environmental concerns. Strategic positioning in high-growth segments such as precision fermentation and functional ingredients will be crucial for long-term competitiveness.

Regional opportunities vary significantly across EU member states, with Western European markets offering stability and innovation leadership while Eastern European markets provide substantial growth potential. Market development strategies must consider local market conditions and regulatory requirements to achieve success.

Future market evolution will be driven by technological advancement, changing consumer preferences, and regulatory developments that support sustainable and innovative fermentation solutions. Companies positioned to leverage these trends while maintaining operational excellence and customer focus are expected to achieve superior market performance and sustainable competitive advantages in the expanding EU fermentation ingredients market.

What is Fermentation Ingredients?

Fermentation ingredients are substances used in the fermentation process to produce various products, including food, beverages, and biofuels. These ingredients can include yeasts, bacteria, enzymes, and nutrients that facilitate the fermentation process.

What are the key players in the EU Fermentation Ingredients Market?

Key players in the EU Fermentation Ingredients Market include companies like DSM, BASF, and Novozymes, which are known for their innovative fermentation technologies and ingredient solutions. These companies focus on various applications, including food and beverage production, pharmaceuticals, and bio-based products, among others.

What are the growth factors driving the EU Fermentation Ingredients Market?

The EU Fermentation Ingredients Market is driven by increasing consumer demand for natural and organic products, the rise of plant-based diets, and advancements in fermentation technology. Additionally, the growing interest in sustainable production methods contributes to market growth.

What challenges does the EU Fermentation Ingredients Market face?

Challenges in the EU Fermentation Ingredients Market include regulatory hurdles related to food safety and labeling, competition from synthetic alternatives, and the need for continuous innovation to meet changing consumer preferences. These factors can impact market dynamics and growth potential.

What opportunities exist in the EU Fermentation Ingredients Market?

Opportunities in the EU Fermentation Ingredients Market include the development of new fermentation processes for alternative proteins and the expansion of applications in the pharmaceutical industry. Additionally, increasing investments in research and development can lead to innovative products and solutions.

What trends are shaping the EU Fermentation Ingredients Market?

Trends in the EU Fermentation Ingredients Market include a growing focus on sustainability, the use of biotechnology for ingredient development, and the rise of functional foods. These trends reflect changing consumer preferences and the industry’s response to environmental concerns.

EU Fermentation Ingredients Market

| Segmentation Details | Description |

|---|---|

| Product Type | Yeast, Bacteria, Enzymes, Fungi |

| Application | Beverages, Bakery, Dairy, Animal Feed |

| End User | Food Industry, Beverage Manufacturers, Pharmaceutical Companies, Nutraceuticals |

| Form | Liquid, Powder, Granular, Paste |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the EU Fermentation Ingredients Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at