444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Ethiopia container glass market represents a rapidly evolving sector within the country’s manufacturing landscape, driven by increasing industrialization and growing demand for sustainable packaging solutions. Container glass manufacturing in Ethiopia has experienced significant transformation over the past decade, with local production capabilities expanding to meet domestic demand while reducing import dependency. The market encompasses various glass container types including bottles for beverages, food jars, pharmaceutical containers, and cosmetic packaging.

Market dynamics indicate robust growth potential, with the sector benefiting from Ethiopia’s strategic position as a manufacturing hub in East Africa. The container glass industry has attracted substantial investment from both domestic and international players, leading to modernization of production facilities and adoption of advanced manufacturing technologies. Current market trends show increasing demand for eco-friendly packaging solutions, with glass containers gaining preference over plastic alternatives due to their recyclability and premium positioning.

Production capacity has expanded significantly, with several new manufacturing facilities coming online in recent years. The market demonstrates strong growth momentum, with industry analysts projecting continued expansion at a compound annual growth rate of 8.2% through the forecast period. This growth trajectory reflects Ethiopia’s broader economic development and the increasing sophistication of its consumer goods sector.

The Ethiopia container glass market refers to the domestic industry focused on manufacturing, distributing, and consuming glass containers for various packaging applications within Ethiopia’s borders. This market encompasses the entire value chain from raw material sourcing and glass production to final product distribution across multiple end-use industries including beverages, food processing, pharmaceuticals, and cosmetics.

Container glass specifically denotes hollow glass products designed for storing, protecting, and transporting liquid and solid goods. These products are manufactured through specialized processes involving melting silica sand, soda ash, and limestone at high temperatures, then forming the molten glass into desired container shapes through blow molding or press-and-blow techniques.

The market significance extends beyond mere packaging, representing Ethiopia’s industrial advancement and commitment to sustainable manufacturing practices. Glass containers offer superior product protection, maintain product integrity, and provide complete recyclability, making them increasingly valuable in Ethiopia’s evolving consumer market landscape.

Ethiopia’s container glass market demonstrates exceptional growth potential, driven by expanding industrial base, increasing consumer awareness of sustainable packaging, and government initiatives supporting local manufacturing. The market has evolved from heavy import dependence to developing substantial domestic production capabilities, with several major manufacturing facilities now operational across the country.

Key market drivers include rapid urbanization, growing middle-class population, expanding food and beverage industry, and increasing pharmaceutical sector development. The market benefits from 65% of demand now being met through domestic production, representing a significant shift from previous import-heavy patterns. This transformation has created employment opportunities and contributed to the country’s industrial diversification strategy.

Market challenges persist in areas of raw material availability, energy costs, and technical expertise development. However, ongoing investments in infrastructure, technology transfer programs, and skills development initiatives are addressing these constraints. The competitive landscape features both established international players and emerging local manufacturers, creating a dynamic market environment that benefits end-users through improved product quality and competitive pricing.

Future prospects remain highly positive, with anticipated market expansion driven by continued economic growth, increasing export opportunities to regional markets, and growing emphasis on sustainable packaging solutions across all industry sectors.

Strategic market analysis reveals several critical insights shaping Ethiopia’s container glass industry development. The market demonstrates strong fundamentals with increasing domestic demand, improving production capabilities, and favorable government policies supporting industrial growth.

These insights indicate a maturing market with strong growth fundamentals and increasing sophistication in both production capabilities and market demand patterns.

Primary market drivers propelling Ethiopia’s container glass industry growth stem from both demand-side factors and supply-side improvements. The convergence of economic development, industrial policy support, and changing consumer preferences creates a favorable environment for sustained market expansion.

Economic growth remains the fundamental driver, with Ethiopia’s expanding GDP supporting increased consumer spending and industrial development. Rising disposable incomes have led to greater demand for packaged goods, directly benefiting the container glass market. The growing middle-class population demonstrates increasing preference for premium packaging, with glass containers perceived as higher quality compared to alternative materials.

Industrial diversification initiatives have created substantial demand for container glass across multiple sectors. The expanding food and beverage industry requires reliable packaging solutions, while the growing pharmaceutical sector demands high-quality containers meeting international standards. Beverage industry growth particularly drives demand, with local and international brands requiring consistent glass bottle supplies.

Government policy support through industrial development programs, investment incentives, and import substitution strategies has encouraged domestic container glass production. These policies include tax incentives for manufacturing investments, streamlined licensing procedures, and infrastructure development supporting industrial growth.

Sustainability trends increasingly favor glass packaging due to its complete recyclability and premium market positioning. Consumer awareness of environmental issues has grown significantly, with 42% of consumers expressing preference for glass over plastic packaging when available.

Market constraints continue to challenge Ethiopia’s container glass industry development, despite overall positive growth trends. These limitations require strategic attention to ensure sustained market expansion and competitiveness.

Raw material availability represents a significant constraint, with high-quality silica sand and other essential materials requiring careful sourcing and quality control. Local raw material deposits may not always meet the stringent quality requirements for premium glass production, necessitating imports that increase production costs and supply chain complexity.

Energy costs pose substantial challenges for glass manufacturing, which requires intensive energy consumption for melting and forming processes. Ethiopia’s energy infrastructure, while improving, still presents cost and reliability challenges that impact manufacturing competitiveness. Power supply interruptions can significantly affect production schedules and product quality consistency.

Technical expertise limitations constrain rapid industry expansion, with specialized skills in glass manufacturing, quality control, and equipment maintenance requiring ongoing development. The shortage of experienced technicians and engineers familiar with modern glass production technologies limits operational efficiency and product quality improvements.

Capital investment requirements for establishing modern glass manufacturing facilities are substantial, potentially limiting market entry for smaller players. High initial investment costs, combined with longer payback periods, may deter some potential investors despite favorable market conditions.

Competition from imports remains a concern, particularly for specialized container types where local production may not yet match international quality standards or cost competitiveness. Established international suppliers with economies of scale can sometimes offer competitive pricing that challenges domestic producers.

Significant opportunities exist within Ethiopia’s container glass market, driven by expanding industrial base, regional market access, and growing emphasis on sustainable packaging solutions. These opportunities present pathways for substantial market growth and development.

Export market potential represents a major opportunity, with Ethiopia’s strategic location providing access to growing East African markets. Regional demand for quality glass containers continues expanding, offering Ethiopian manufacturers opportunities to develop export-oriented production capabilities. Regional market integration through trade agreements facilitates cross-border commerce and market expansion.

Value-added products present opportunities for market differentiation and higher profit margins. Specialized containers for pharmaceuticals, cosmetics, and premium food products command higher prices and offer growth potential beyond traditional beverage bottles. Custom design capabilities and specialized coatings can create competitive advantages in niche market segments.

Technology partnerships with international glass manufacturers offer opportunities for knowledge transfer, equipment modernization, and quality improvement. These collaborations can accelerate capability development and market competitiveness while providing access to advanced manufacturing techniques.

Circular economy initiatives create opportunities for glass recycling and reuse programs, supporting sustainability goals while reducing raw material costs. Developing comprehensive recycling infrastructure can improve cost competitiveness and environmental performance simultaneously.

Industrial cluster development around glass manufacturing can create synergies with related industries, reducing costs and improving supply chain efficiency. Co-location with end-user industries can minimize transportation costs and improve customer relationships.

Market dynamics within Ethiopia’s container glass sector reflect the interplay of supply and demand factors, competitive pressures, and external influences shaping industry development. Understanding these dynamics is crucial for stakeholders navigating this evolving market landscape.

Supply-demand balance has shifted significantly over recent years, with domestic production capacity expanding to meet growing local demand. This transition from import-dependent to domestically-supplied market has created new competitive dynamics and pricing structures. Current market conditions show supply capacity utilization at 78%, indicating healthy demand levels while maintaining room for growth.

Competitive intensity has increased as new market entrants challenge established players, leading to improved product quality, competitive pricing, and enhanced customer service. This competition benefits end-users through better value propositions and drives continuous improvement throughout the industry.

Technology adoption accelerates market evolution, with modern manufacturing equipment improving production efficiency and product quality. Advanced quality control systems and automated production processes enhance competitiveness while reducing operational costs. Production efficiency improvements of up to 35% have been achieved through technology upgrades.

Customer requirements continue evolving toward higher quality standards, customized solutions, and sustainable packaging options. These changing demands drive innovation and product development throughout the supply chain, encouraging manufacturers to invest in capability enhancement and market responsiveness.

Regulatory environment influences market dynamics through quality standards, environmental regulations, and trade policies. Compliance requirements drive investment in quality systems and environmental management, while trade policies affect competitive positioning relative to imported products.

Comprehensive research methodology employed for analyzing Ethiopia’s container glass market combines primary research, secondary data analysis, and expert consultations to provide accurate market insights and projections. This multi-faceted approach ensures data reliability and analytical depth.

Primary research involved extensive interviews with industry stakeholders including manufacturers, distributors, end-users, and government officials. These interviews provided firsthand insights into market conditions, challenges, opportunities, and future expectations. Survey data collection from key market participants supplemented interview findings with quantitative market information.

Secondary research encompassed analysis of government statistics, industry reports, trade data, and company financial information. This research provided historical market context, production data, import-export statistics, and competitive landscape information. MarkWide Research databases and analytical tools supported comprehensive data compilation and trend analysis.

Market modeling techniques were applied to develop growth projections and scenario analyses. Statistical analysis of historical data patterns, combined with forward-looking indicators, enabled development of realistic market forecasts and trend projections.

Expert validation through industry specialist consultations ensured research findings accuracy and relevance. Technical experts, market analysts, and industry veterans provided critical review and validation of research conclusions and market projections.

Data triangulation methods verified information consistency across multiple sources, enhancing research reliability and confidence in analytical conclusions. Cross-referencing primary and secondary data sources identified potential discrepancies and ensured analytical accuracy.

Regional market distribution within Ethiopia reveals concentrated industrial activity in key manufacturing zones, with Addis Ababa and surrounding areas dominating container glass production and consumption. This geographic concentration reflects infrastructure advantages, market access, and industrial development policies.

Addis Ababa region accounts for approximately 55% of national container glass demand, driven by concentrated beverage industry presence, pharmaceutical companies, and consumer goods manufacturers. The capital region benefits from superior infrastructure, logistics connectivity, and skilled workforce availability, making it the primary hub for glass container production and distribution.

Oromia region represents significant growth potential with expanding industrial development and agricultural processing activities. The region’s large population base and growing economic activity create substantial demand for packaged goods, supporting container glass market expansion. Industrial parks development in this region offers opportunities for manufacturing facility establishment.

Amhara region demonstrates increasing market importance through growing beverage production and food processing industries. The region’s agricultural base supports food packaging demand, while improving infrastructure connectivity enhances market access and distribution efficiency.

Southern regions show emerging market potential with developing industrial activities and increasing consumer goods demand. While currently representing smaller market shares, these regions offer growth opportunities as economic development continues and infrastructure improves.

Export corridors toward Djibouti and regional markets influence production location decisions, with manufacturers considering logistics costs and market access when establishing facilities. Proximity to transportation infrastructure becomes increasingly important as export opportunities develop.

Competitive environment within Ethiopia’s container glass market features a mix of established international players, emerging local manufacturers, and specialized niche providers. This diverse competitive landscape creates dynamic market conditions benefiting customers through improved products and competitive pricing.

Market competition intensifies as new entrants challenge established players through technological innovation, competitive pricing, and enhanced customer service. This competitive pressure drives continuous improvement throughout the industry, benefiting end-users through better product quality and value propositions.

Strategic partnerships between local and international companies facilitate technology transfer, market development, and capability enhancement. These collaborations combine local market knowledge with international expertise, creating competitive advantages and accelerating market development.

Competitive differentiation occurs through product quality, customer service, delivery reliability, and specialized capabilities. Companies invest in quality systems, customer relationship management, and technical capabilities to maintain competitive positioning in this growing market.

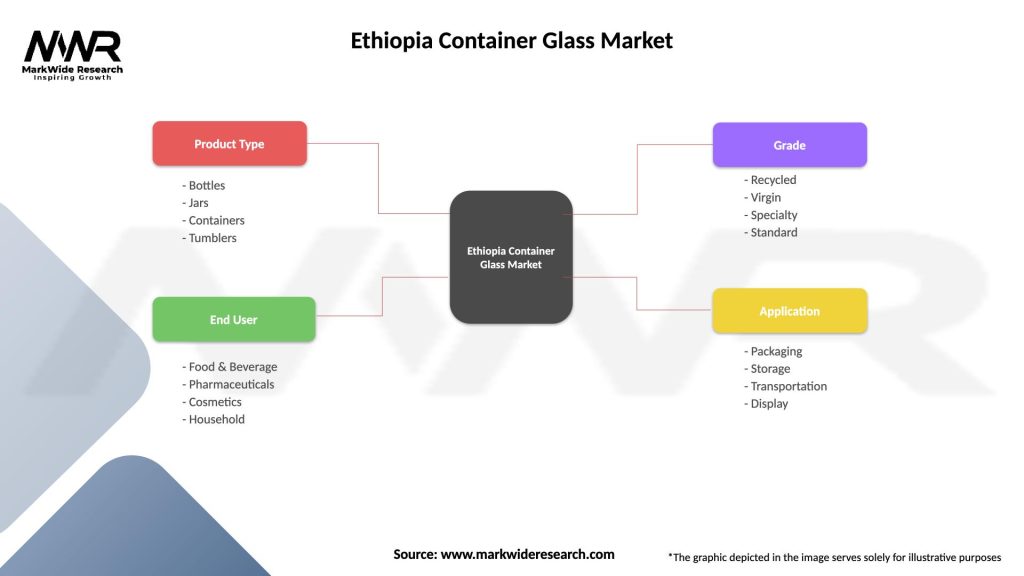

Market segmentation analysis reveals distinct container glass categories serving different end-use applications, each with unique characteristics, growth patterns, and competitive dynamics. Understanding these segments is essential for strategic market positioning and opportunity identification.

By Product Type:

By End-Use Industry:

By Capacity Range:

By Distribution Channel:

Beverage containers dominate Ethiopia’s container glass market, representing the largest volume and value segment. This category benefits from expanding local beverage production, including traditional drinks, soft drinks, and alcoholic beverages. Beer bottle production particularly drives demand, with local breweries requiring consistent supply of quality glass containers.

Food packaging applications show strong growth potential as food processing industry expands and consumer preferences shift toward packaged goods. Glass jars for honey, spices, sauces, and preserved foods create steady demand, while premium food products increasingly adopt glass packaging for quality positioning.

Pharmaceutical containers represent a high-value market segment with stringent quality requirements and regulatory compliance needs. This category offers attractive profit margins but requires specialized manufacturing capabilities and quality certifications. Growing pharmaceutical industry in Ethiopia drives increasing demand for various container types including vials, bottles, and ampoules.

Cosmetic packaging emerges as a promising growth segment with increasing consumer sophistication and beauty industry development. Glass containers for perfumes, skincare products, and premium cosmetics command higher prices and offer opportunities for value-added manufacturing.

Industrial applications including chemical storage and laboratory glassware represent specialized market niches requiring specific technical properties. While smaller in volume, these applications often provide stable, long-term customer relationships and specialized pricing structures.

Export-oriented production creates opportunities for market expansion beyond domestic demand, with regional markets showing increasing interest in Ethiopian-manufactured glass containers. Quality improvements and competitive pricing make Ethiopian products increasingly attractive for export markets.

Industry participants in Ethiopia’s container glass market enjoy numerous benefits from the sector’s growth and development, creating value for manufacturers, suppliers, customers, and supporting industries. These benefits extend beyond immediate commercial gains to include broader economic and social impacts.

Manufacturers benefit from expanding market demand, improving profit margins, and opportunities for capacity expansion. Growing domestic demand reduces market risk while export opportunities provide additional revenue streams. Production efficiency improvements through modern equipment and processes enhance competitiveness and profitability.

Raw material suppliers gain from increased demand for silica sand, soda ash, limestone, and other glass manufacturing inputs. Local sourcing opportunities reduce import dependence while creating employment and economic activity in mining and processing sectors.

End-user industries benefit from improved product availability, competitive pricing, and enhanced supply chain reliability. Domestic production reduces import risks, delivery times, and currency exposure while providing opportunities for customized solutions and closer supplier relationships.

Employment creation throughout the value chain supports economic development goals, with glass manufacturing providing skilled and semi-skilled job opportunities. Technical training programs develop local expertise while supporting career advancement and skills development.

Government stakeholders benefit from increased tax revenue, foreign exchange savings through import substitution, and industrial development supporting broader economic diversification goals. The sector contributes to manufacturing competitiveness and export potential.

Environmental benefits include reduced packaging waste through glass recycling, lower carbon footprint compared to imported products, and support for circular economy initiatives. Glass containers’ complete recyclability supports sustainability goals and environmental protection efforts.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability focus emerges as the dominant trend shaping Ethiopia’s container glass market, with increasing consumer and industry emphasis on environmentally responsible packaging solutions. This trend drives preference for glass containers due to their complete recyclability and premium environmental positioning compared to plastic alternatives.

Technology modernization accelerates throughout the industry, with manufacturers investing in advanced production equipment, quality control systems, and automation technologies. These investments improve production efficiency, product quality consistency, and operational competitiveness while reducing labor dependency and production costs.

Customization demand increases as end-user industries seek differentiated packaging solutions for brand positioning and market differentiation. Custom bottle designs, specialized coatings, and unique container shapes create opportunities for value-added manufacturing and higher profit margins.

Regional market integration develops through improved trade relationships and infrastructure connectivity, creating opportunities for Ethiopian manufacturers to access growing East African markets. Cross-border trade facilitation and regional economic integration support export market development.

Quality standardization becomes increasingly important as domestic manufacturers strive to meet international quality standards for both domestic and export markets. Investment in quality systems, testing equipment, and certification processes supports market competitiveness and customer confidence.

Circular economy initiatives gain momentum with development of glass recycling infrastructure and reuse programs. These initiatives support cost reduction through recycled content utilization while addressing environmental concerns and sustainability goals.

Digital transformation begins impacting market operations through online ordering platforms, digital customer service, and data-driven production planning. Technology adoption improves customer relationships and operational efficiency while supporting market expansion efforts.

Major capacity expansions have transformed Ethiopia’s container glass manufacturing landscape, with several new production facilities commissioned over recent years. These investments bring modern technology, increased production capacity, and improved product quality capabilities to the domestic market.

Technology transfer agreements between Ethiopian manufacturers and international glass companies facilitate knowledge sharing, equipment modernization, and quality improvement. These partnerships accelerate capability development while providing access to advanced manufacturing techniques and global best practices.

Quality certification achievements by leading manufacturers demonstrate industry maturation and commitment to international standards. ISO certifications, pharmaceutical compliance approvals, and export quality certifications enhance market credibility and customer confidence.

Raw material supply chain development includes investments in local silica sand processing, limestone quarrying, and other input material production. These developments reduce import dependence while improving supply chain reliability and cost competitiveness.

Skills development programs launched in partnership with educational institutions and international organizations address technical expertise gaps. Training programs in glass manufacturing, quality control, and equipment maintenance develop local capabilities supporting industry growth.

Export market penetration achievements by Ethiopian manufacturers demonstrate growing competitiveness in regional markets. Successful export contracts validate product quality and competitive positioning while providing growth opportunities beyond domestic demand.

Environmental compliance initiatives include investment in emission control systems, waste management programs, and energy efficiency improvements. These developments support regulatory compliance while reducing environmental impact and operational costs.

Strategic recommendations for Ethiopia’s container glass market stakeholders focus on capability development, market expansion, and competitive positioning to capitalize on growth opportunities while addressing industry challenges.

Investment in technology should prioritize modern manufacturing equipment, quality control systems, and automation technologies to improve production efficiency and product quality. These investments are essential for maintaining competitiveness and meeting evolving customer requirements.

Skills development initiatives require sustained attention through training programs, technical education partnerships, and knowledge transfer arrangements. Building local expertise in glass manufacturing, quality control, and equipment maintenance is crucial for long-term industry success.

Market diversification strategies should explore export opportunities, value-added products, and new application segments to reduce dependence on domestic beverage market demand. Regional market development offers significant growth potential for competitive manufacturers.

Supply chain optimization through local raw material development, logistics improvement, and supplier relationship management can reduce costs and improve reliability. Vertical integration opportunities should be evaluated for strategic input materials.

Quality system implementation including international certifications, testing capabilities, and continuous improvement programs is essential for market credibility and export market access. MWR analysis indicates that quality leadership provides sustainable competitive advantages.

Sustainability initiatives including recycling programs, energy efficiency improvements, and environmental management systems support market positioning and regulatory compliance while reducing operational costs.

Customer relationship development through technical support, customization capabilities, and service excellence creates competitive differentiation and customer loyalty in increasingly competitive market conditions.

Future prospects for Ethiopia’s container glass market remain highly positive, with multiple growth drivers supporting sustained expansion over the medium to long term. The market is positioned to benefit from continued economic development, industrial diversification, and increasing regional market integration.

Production capacity is expected to continue expanding as demand growth justifies additional investment in manufacturing facilities. New capacity additions will likely incorporate advanced technology and automation, improving efficiency and quality while reducing production costs. Capacity utilization rates are projected to reach 85% by 2028, indicating healthy demand growth.

Export market development offers significant growth potential as Ethiopian manufacturers achieve quality standards and cost competitiveness required for regional market penetration. East African market integration and infrastructure improvements support export opportunity realization.

Technology advancement will continue transforming the industry through automation, quality control improvements, and production efficiency gains. Digital technologies including IoT, data analytics, and automated systems will increasingly support operational excellence and customer service.

Market sophistication will increase as customer requirements evolve toward higher quality standards, customized solutions, and sustainable packaging options. This evolution creates opportunities for value-added manufacturing and premium product positioning.

Sustainability integration will become increasingly important as environmental regulations strengthen and consumer awareness grows. Circular economy initiatives, recycling programs, and energy efficiency improvements will support long-term competitiveness.

Regional leadership potential exists for Ethiopian manufacturers to become significant suppliers to East African markets, leveraging cost advantages, strategic location, and improving quality capabilities. This regional expansion could substantially increase market size and growth opportunities.

The Ethiopia container glass market represents a dynamic and rapidly evolving industry with substantial growth potential driven by expanding domestic demand, improving production capabilities, and increasing export opportunities. The market has successfully transitioned from import dependence to developing significant domestic manufacturing capacity, creating a foundation for sustained growth and regional competitiveness.

Key success factors include continued investment in modern technology, skills development, quality improvement, and market diversification. The industry benefits from favorable government policies, growing end-user demand, and strategic geographic positioning for regional market access. MarkWide Research projections indicate continued robust growth supported by these fundamental strengths.

Market challenges including technical expertise development, energy infrastructure, and quality standardization require ongoing attention but are being addressed through strategic investments and partnerships. The competitive landscape continues evolving with new entrants and capacity expansions creating dynamic market conditions that ultimately benefit customers through improved products and competitive pricing.

Future opportunities in export markets, value-added products, and sustainability initiatives provide pathways for substantial market expansion beyond current domestic focus. The Ethiopia container glass market is well-positioned to capitalize on these opportunities while contributing to the country’s broader industrial development and economic diversification objectives.

What is Container Glass?

Container glass refers to glass products designed for packaging and storing various goods, including beverages, food, and pharmaceuticals. It is known for its durability, recyclability, and ability to preserve the quality of its contents.

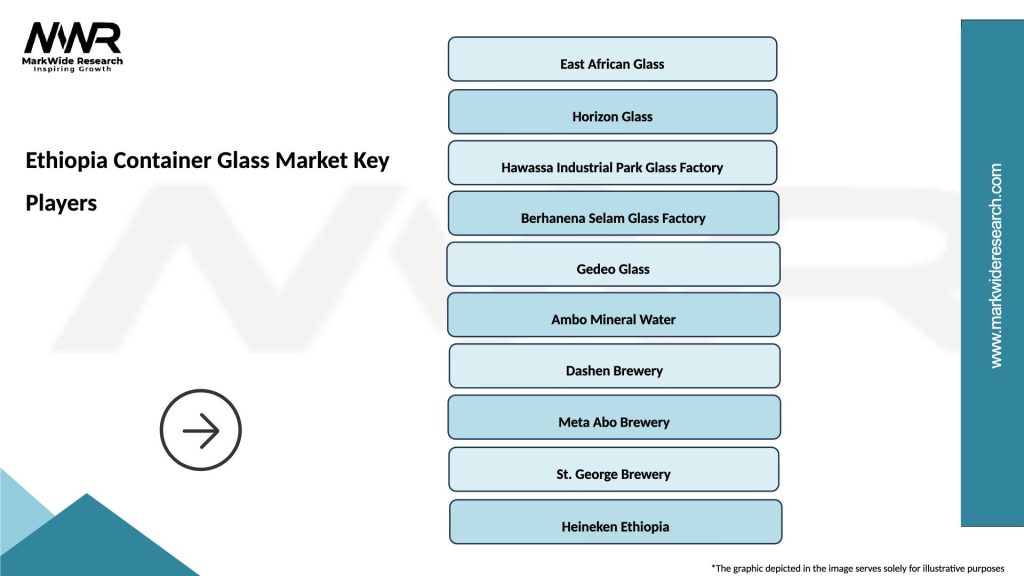

What are the key players in the Ethiopia Container Glass Market?

Key players in the Ethiopia Container Glass Market include East African Glass, Addis Ababa Glass Factory, and Ethiopian Glass Industry, among others. These companies are involved in the production and distribution of various glass containers for different industries.

What are the growth factors driving the Ethiopia Container Glass Market?

The growth of the Ethiopia Container Glass Market is driven by increasing demand for packaged beverages, a rise in the food processing industry, and a growing emphasis on sustainable packaging solutions. Additionally, urbanization and changing consumer preferences contribute to market expansion.

What challenges does the Ethiopia Container Glass Market face?

The Ethiopia Container Glass Market faces challenges such as high production costs, competition from alternative packaging materials, and limited recycling infrastructure. These factors can hinder the growth and sustainability of the market.

What opportunities exist in the Ethiopia Container Glass Market?

Opportunities in the Ethiopia Container Glass Market include the potential for innovation in eco-friendly glass products, expansion into new markets, and partnerships with local beverage and food companies. The increasing focus on sustainability also opens avenues for growth.

What trends are shaping the Ethiopia Container Glass Market?

Trends in the Ethiopia Container Glass Market include a shift towards lightweight glass packaging, advancements in manufacturing technologies, and a growing preference for recyclable materials. These trends reflect the industry’s response to environmental concerns and consumer demands.

Ethiopia Container Glass Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bottles, Jars, Containers, Tumblers |

| End User | Food & Beverage, Pharmaceuticals, Cosmetics, Household |

| Grade | Recycled, Virgin, Specialty, Standard |

| Application | Packaging, Storage, Transportation, Display |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Ethiopia Container Glass Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at