Market Overview

The equity portfolio management and advisory services market is a dynamic and essential component of the financial industry. It encompasses a range of services provided by financial institutions, investment firms, and wealth management companies to help individuals and institutional investors manage their equity portfolios effectively. These services involve the strategic selection, allocation, and management of equity investments to achieve financial goals and maximize returns. Equity portfolio management and advisory services play a crucial role in helping investors navigate the complexities of the equity market and make informed investment decisions.

Meaning

Equity portfolio management and advisory services refer to the professional services provided by experts in the field of finance and investment to help investors manage their equity portfolios. These services involve a comprehensive analysis of the financial goals, risk appetite, and investment horizon of clients. Based on this information, portfolio managers and advisors develop customized investment strategies, select suitable equity investments, monitor portfolio performance, and provide regular reports and recommendations to clients. The goal is to optimize portfolio returns, manage risk, and ensure alignment with the client’s investment objectives.

Executive Summary

The equity portfolio management and advisory services market is witnessing significant growth due to several factors. Increasing individual and institutional wealth, rising demand for professional financial advice, and the complexity of the equity market are driving the demand for these services. Portfolio managers and advisors use their expertise, market insights, and advanced tools to identify investment opportunities, manage risks, and provide clients with tailored investment solutions. However, the market is also facing challenges such as regulatory changes, fee pressures, and increasing competition. To stay competitive, service providers are embracing technological advancements, expanding their service offerings, and adopting client-centric approaches.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

The equity portfolio management and advisory services market is influenced by various key market insights:

- Growing Investor Sophistication: Investors are becoming more sophisticated and seeking professional guidance to navigate the complexities of the equity market. They rely on portfolio managers and advisors to provide expert analysis, research, and investment recommendations.

- Increasing Wealth and Financial Literacy: Rising global wealth, particularly in emerging economies, is driving the demand for equity portfolio management and advisory services. Additionally, improved financial literacy is prompting individuals to seek professional assistance for their investment decisions.

- Shift Towards Fee-based Models: The industry is witnessing a shift from commission-based models to fee-based models, where portfolio managers and advisors charge a percentage of the assets under management. This trend aligns the interests of service providers with clients’ long-term investment goals.

- Technological Advancements: Technology is reshaping the equity portfolio management landscape. Robo-advisory platforms, artificial intelligence, and machine learning algorithms are being integrated into service offerings to enhance efficiency, automate processes, and provide personalized investment recommendations.

Market Drivers

- Increasing Demand for Professional Financial Advice: Investors recognize the value of expert guidance in managing their equity portfolios. The complexity of the equity market and the need to optimize returns while managing risk drive the demand for professional portfolio management and advisory services.

- Rising Wealth and Financial Market Participation: Growing individual and institutional wealth, along with increased participation in financial markets, fuel the demand for equity portfolio management and advisory services. Investors seek specialized knowledge and personalized strategies to achieve their financial goals.

- Regulatory Changes and Compliance Requirements: Evolving regulatory frameworks and compliance requirements compel investors to seek the assistance of portfolio managers and advisors who are well-versed in navigating these complexities. Service providers help clients adhere to regulatory guidelines and optimize their investment strategies accordingly.

- Technological Advancements: Technological advancements, such as data analytics, artificial intelligence, and digital platforms, enable portfolio managers and advisors to provide more sophisticated and personalized investment solutions. Automation and digitization streamline processes, enhance efficiency, and improve the client experience.

Market Restraints

- Fee Pressure and Cost Concerns: The industry faces increasing fee pressure as investors demand transparent and competitive fee structures. Service providers need to strike a balance between delivering value-added services and managing costs to remain profitable.

- Economic Uncertainty: Economic downturns, market volatility, and geopolitical risks can impact equity markets and investor sentiment. Uncertainty in the market environment poses challenges for portfolio managers and advisors in achieving consistent performance.

- Regulatory and Compliance Challenges: Compliance with evolving regulatory requirements can be complex and resource-intensive for service providers. Meeting reporting, disclosure, and risk management obligations requires significant investment in systems, processes, and skilled professionals.

- Intense Competition: The equity portfolio management and advisory services market is highly competitive, with numerous players vying for clients’ business. Service providers need to differentiate themselves through their investment expertise, client service, technological capabilities, and innovative offerings.

Market Opportunities

- Expansion of Wealth Management Services: The integration of equity portfolio management and advisory services within broader wealth management offerings presents opportunities for service providers to cater to the holistic financial needs of clients. By offering a comprehensive suite of services, including financial planning, estate planning, and tax advisory, firms can enhance client relationships and capture a larger share of wallet.

- Focus on Sustainable and Impact Investing: The growing interest in sustainable and impact investing opens avenues for portfolio managers and advisors to develop specialized expertise in these areas. Investors increasingly seek to align their investments with environmental, social, and governance (ESG) principles, presenting opportunities for service providers to offer ESG-focused portfolios and advisory services.

- Expansion in Emerging Markets: Emerging economies are experiencing rapid wealth creation and increased investor participation in equity markets. Service providers can capitalize on these opportunities by expanding their presence in these markets, tailoring their services to local preferences, and leveraging partnerships with local financial institutions.

- Technology-driven Innovation: Technological advancements continue to drive innovation in the equity portfolio management and advisory services market. Service providers can leverage digital platforms, mobile applications, and robo-advisory solutions to reach a broader client base, improve operational efficiency, and deliver personalized investment solutions.

Market Dynamics

The equity portfolio management and advisory services market is influenced by various market dynamics:

- Client Expectations: Clients expect personalized investment strategies, transparency, and access to timely and accurate information. Service providers need to continuously adapt and innovate to meet these evolving client expectations.

- Regulatory Environment: The industry operates within a complex regulatory environment, with requirements related to licensing, registration, disclosure, and reporting. Service providers must remain compliant with regulatory guidelines and adapt to changes to ensure client trust and confidence.

- Shift in Investor Preferences: Investor preferences are shifting towards fee-based models, customized solutions, and sustainable investing. Service providers need to align their offerings with these changing preferences to attract and retain clients.

- Technological Disruption: Technology is disrupting the traditional portfolio management landscape, with robo-advisory platforms, artificial intelligence, and machine learning transforming the way investment advice is delivered. Service providers must embrace technology and leverage its capabilities to enhance their value proposition.

Regional Analysis

The equity portfolio management and advisory services market exhibits regional variations based on factors such as economic development, investor sophistication, regulatory frameworks, and cultural preferences. Here is a regional analysis of the market:

- North America: The North American market is characterized by a mature financial industry, high levels of investor sophistication, and a significant presence of wealth management firms. The United States, in particular, is a major market for equity portfolio management and advisory services, driven by its robust capital markets and large investor base.

- Europe: Europe is home to several prominent financial centers, including London, Zurich, and Frankfurt. The region has a strong regulatory framework and a history of wealth management expertise. European investors value personalized services, sustainability, and ESG-focused investing, creating opportunities for service providers in these areas.

- Asia Pacific: The Asia Pacific region is experiencing rapid economic growth, increasing wealth, and expanding capital markets. Countries like China, Japan, and Singapore are witnessing significant demand for equity portfolio management and advisory services as investors seek professional guidance to navigate these dynamic markets.

- Latin America: Latin America presents growth potential for equity portfolio management and advisory services, driven by increasing wealth and financial market development. Brazil and Mexico, in particular, are emerging as key markets for these services, fueled by a growing middle class and expanding investor base.

- Middle East and Africa: The Middle East and Africa region offers opportunities for equity portfolio management and advisory services, driven by sovereign wealth funds, family offices, and the development of financial centers such as Dubai and Abu Dhabi. However, the market is diverse, with variations in regulations, investor preferences, and economic conditions across countries.

Competitive Landscape

Leading Companies in the Equity Portfolio Management and Advisory Services Market:

- BlackRock, Inc.

- JPMorgan Chase & Co.

- Goldman Sachs Group, Inc.

- Morgan Stanley

- Bank of America Corporation

- UBS Group AG

- Vanguard Group

- State Street Corporation

- Charles Schwab Corporation

- Fidelity Investments

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

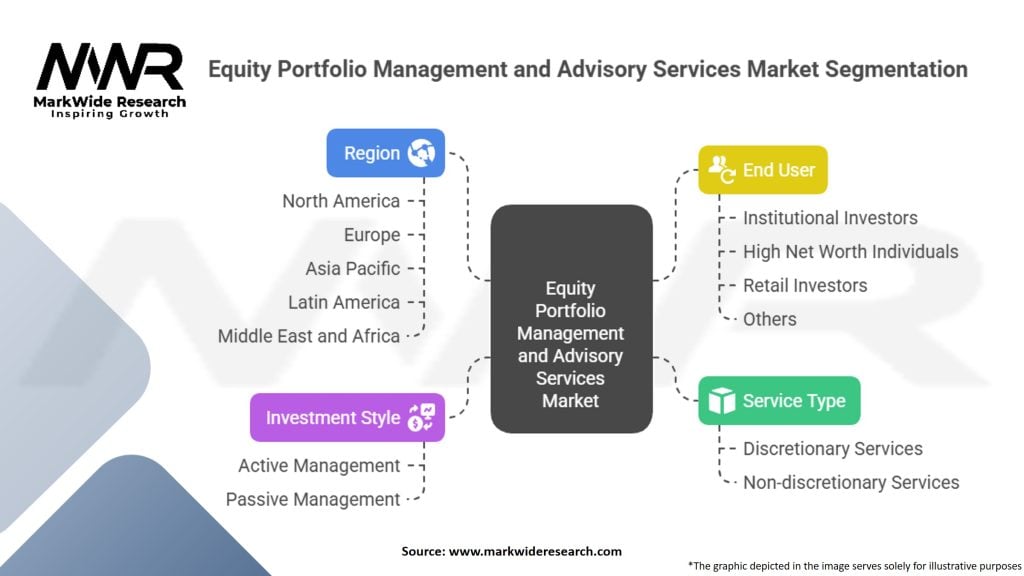

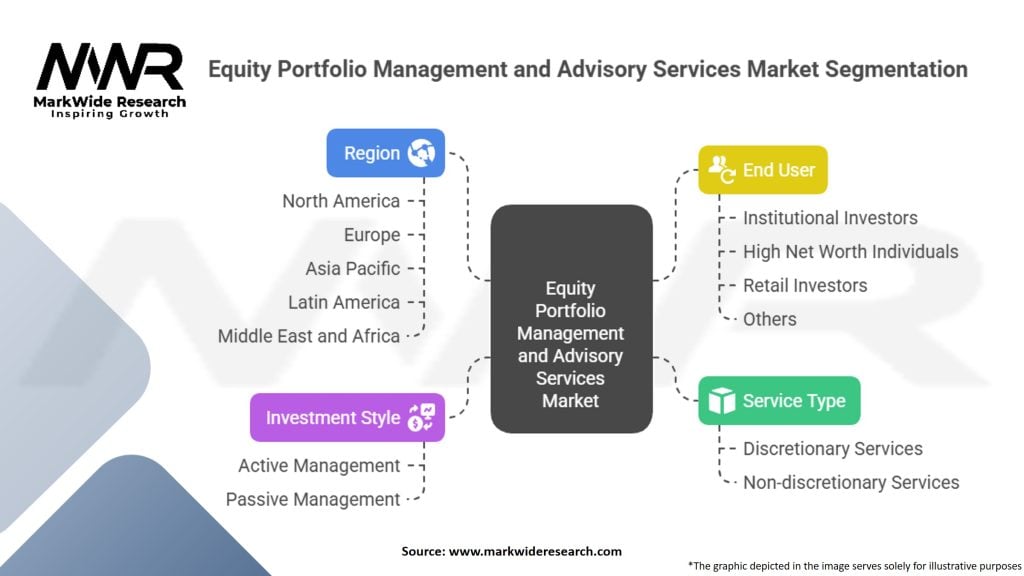

Segmentation

The equity portfolio management and advisory services market can be segmented based on various factors, including:

- Client Type: Individual investors, high-net-worth individuals, institutional investors, and corporate clients have distinct needs and investment requirements. Service providers tailor their offerings accordingly.

- Service Model: Service models range from traditional human-advised portfolio management to robo-advisory platforms and hybrid models combining human expertise with digital capabilities.

- Investment Style: Different investment styles, such as value investing, growth investing, income-focused strategies, or active vs. passive management, cater to varying client preferences and risk-return objectives.

- Geographic Focus: Service providers may specialize in specific regions or offer global investment capabilities, allowing clients to diversify their portfolios across different markets and geographies.

- Asset Class Focus: Some firms specialize in equity investments, while others offer a broader range of asset classes, including fixed income, real estate, and alternative investments.

Category-wise Insights

- Traditional Portfolio Management: Traditional portfolio management services involve personalized investment advice, portfolio construction, and active management of client portfolios. These services typically cater to high-net-worth individuals and institutional investors who value customized investment strategies and active oversight.

- Robo-Advisory Platforms: Robo-advisory platforms leverage technology and algorithms to provide automated investment solutions. These platforms are gaining popularity among tech-savvy investors looking for cost-effective and convenient investment options. Robo-advisors offer diversified portfolios based on client risk profiles and investment goals.

- Sustainable and Impact Investing: The demand for sustainable and impact investing solutions is growing. Service providers specializing in ESG-focused investing integrate environmental, social, and governance factors into their investment processes. They identify companies with positive social and environmental impacts while seeking competitive financial returns.

- Alternative Investments: Some service providers focus on alternative investments, including private equity, venture capital, hedge funds, and real estate. These investments provide diversification and potential for higher returns but require specialized expertise and risk management.

Key Benefits for Industry Participants and Stakeholders

The equity portfolio management and advisory services market offers several benefits for industry participants and stakeholders:

- Expertise and Guidance: Investors can leverage the expertise of portfolio managers and advisors who have in-depth knowledge of equity markets, investment strategies, and risk management. They provide guidance based on individual financial goals, risk tolerance, and investment horizon.

- Diversification and Risk Management: Portfolio managers and advisors help investors achieve diversification by allocating assets across different sectors, regions, and asset classes. They aim to manage risk by employing sophisticated risk management techniques, such as asset allocation and portfolio rebalancing.

- Customized Investment Solutions: Service providers develop customized investment solutions based on clients’ unique financial circumstances and investment objectives. They consider factors such as income needs, tax considerations, and risk preferences to create tailored investment strategies.

- Access to Research and Insights: Portfolio managers and advisors provide clients with research reports, market insights, and investment recommendations. These resources help investors stay informed about market trends, company analysis, and potential investment opportunities.

- Monitoring and Reporting: Service providers continuously monitor portfolio performance, conduct regular performance reviews, and provide comprehensive reporting to clients. This allows investors to track the progress of their investments, evaluate performance, and make informed decisions.

- Regulatory Compliance: Equity portfolio management and advisory services are subject to regulatory oversight to protect investors’ interests. Service providers ensure compliance with applicable regulations, provide necessary disclosures, and follow industry best practices to maintain client trust and confidence.

SWOT Analysis

Strengths:

- Expertise and Knowledge: Equity portfolio management and advisory service providers possess deep knowledge and expertise in equity markets, investment analysis, and portfolio construction. This enables them to deliver value-added services and tailored investment solutions.

- Client Relationships: Strong client relationships are a key strength of service providers. They build trust by understanding clients’ financial goals, communicating effectively, and delivering personalized investment strategies.

- Research Capabilities: Service providers invest in robust research capabilities to analyze market trends, identify investment opportunities, and evaluate potential risks. In-house research teams and access to external research sources contribute to their competitive advantage.

Weaknesses:

- Fee Pressure: The industry faces increasing fee pressure as investors demand competitive and transparent fee structures. Service providers need to carefully balance fee structures to remain profitable while delivering value-added services.

- Regulatory Compliance: Compliance with evolving regulatory requirements can be challenging, requiring ongoing investment in systems, processes, and skilled professionals. Non-compliance can result in reputational damage and legal consequences.

- Talent Retention: Retaining talented portfolio managers and advisors is crucial for service providers. Competition for skilled professionals is intense, and attracting and retaining top talent can be a challenge.

Opportunities:

- Technological Advancements: Technology continues to reshape the equity portfolio management and advisory services market. Advancements in artificial intelligence, data analytics, and digital platforms present opportunities to enhance efficiency, personalize services, and reach new client segments.

- ESG and Sustainable Investing: The growing demand for sustainable and impact investing creates opportunities for service providers to develop specialized ESG-focused portfolios and advisory services. Integrating environmental, social, and governance factors into investment processes can attract a new generation of investors.

- Emerging Markets: Emerging economies, particularly in Asia and Latin America, offer significant growth opportunities. Rising wealth, increasing investor participation, and expanding capital markets present avenues for service providers to expand their presence and cater to the unique needs of these markets.

Threats:

- Market Volatility: Equity markets are subject to volatility, influenced by economic factors, geopolitical events, and investor sentiment. Market downturns can impact portfolio performance and investor confidence, posing a threat to the equity portfolio management and advisory services market.

- Regulatory Changes: Evolving regulatory frameworks and changes in tax policies can create compliance challenges and operational complexities for service providers. Adapting to new regulations and ensuring compliance can be resource-intensive.

- Competition from Fintech: Fintech companies and online investment platforms offering robo-advisory services pose a threat to traditional service providers. These platforms attract tech-savvy investors seeking low-cost, automated investment solutions.

Market Key Trends

- Technological Advancements: Technology continues to drive key trends in the equity portfolio management and advisory services market. Robo-advisory platforms, artificial intelligence, machine learning, and data analytics are increasingly integrated into service offerings to enhance efficiency, deliver personalized investment solutions, and improve client experiences.

- Sustainable Investing: The focus on environmental, social, and governance factors is gaining momentum. Investors are increasingly considering sustainability and impact factors in their investment decisions. Service providers are developing ESG-focused portfolios and incorporating sustainable investing principles into their investment processes.

- Customization and Personalization: Investors expect customized investment solutions that align with their financial goals, risk appetite, and values. Service providers are leveraging technology and data-driven insights to deliver personalized investment strategies, tailored advice, and customized portfolio construction.

- Fee Transparency and Value Proposition: Fee transparency is becoming increasingly important to investors. Service providers are aligning their fee structures with client interests, emphasizing value-added services, and demonstrating the impact of their investment strategies to justify their fees.

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the equity portfolio management and advisory services market. Some key effects include:

- Market Volatility: The pandemic led to heightened market volatility, impacting portfolio performance and investor confidence. Service providers had to navigate rapidly changing market conditions, reevaluate investment strategies, and provide reassurance to clients.

- Digital Transformation: The pandemic accelerated the digital transformation of the industry. Remote work arrangements, virtual client meetings, and increased reliance on digital platforms became the new norm. Service providers had to adapt their operations and leverage technology to continue delivering services effectively.

- Heightened Risk Management: The pandemic highlighted the importance of robust risk management. Service providers had to assess and manage the risks associated with market volatility, economic uncertainty, and changing investor behavior. They needed to proactively communicate with clients, address their concerns, and provide guidance during turbulent times.

- Increased Demand for Financial Advice: The pandemic emphasized the need for professional financial advice. Investors sought guidance from portfolio managers and advisors to navigate the uncertainties and protect their investments. The crisis underscored the value of expertise, risk management, and long-term financial planning.

Key Industry Developments

- Integration of Artificial Intelligence: Artificial intelligence is increasingly used in equity portfolio management and advisory services. AI-powered algorithms and machine learning techniques enhance investment analysis, risk management, and portfolio optimization.

- Growth of Sustainable and Impact Investing: Sustainable and impact investing is gaining traction. Service providers are incorporating ESG factors into their investment processes, launching ESG-focused funds, and integrating sustainability metrics into their performance evaluation.

- Expansion of Digital Platforms: Online investment platforms and robo-advisory services continue to expand. These platforms provide low-cost, automated investment solutions to tech-savvy investors, leveraging algorithms and data-driven insights.

- Regulatory Focus on Investor Protection: Regulators are placing increased emphasis on investor protection, transparency, and risk management. Compliance with regulatory requirements, including fiduciary duties and disclosure obligations, is a key focus for service providers.

Analyst Suggestions

- Embrace Technological Advancements: Service providers should invest in technology infrastructure, data analytics capabilities, and digital platforms to enhance operational efficiency, deliver personalized services, and stay competitive in a rapidly evolving landscape.

- Focus on Sustainable Investing: Incorporating ESG factors and sustainable investing principles into investment processes can attract a growing segment of socially conscious investors. Service providers should develop expertise in sustainable investing and offer ESG-focused investment solutions.

- Enhance Client Experience: Client-centric approaches are essential for success. Service providers should focus on building strong client relationships, delivering personalized advice, providing transparent reporting, and offering exceptional customer service to differentiate themselves from competitors.

- Strengthen Risk Management: Robust risk management practices are crucial in volatile market conditions. Service providers should continuously monitor risks, conduct stress tests, and communicate risk profiles effectively to clients.

Future Outlook

The future of the equity portfolio management and advisory services market appears promising. The market is expected to grow, driven by increasing investor demand for professional financial advice, the growing complexity of the equity market, and the need for customized investment solutions. Technological advancements, including artificial intelligence, data analytics, and digital platforms, will continue to reshape the industry and drive innovation. Sustainable investing and ESG considerations will become increasingly integrated into investment strategies. Regulatory compliance will remain a priority, with service providers adapting to evolving regulatory frameworks. The industry will continue to evolve, focusing on delivering value-added services, enhancing client experiences, and providing tailored investment solutions to meet the changing needs and preferences of investors.

Conclusion

The equity portfolio management and advisory services market plays a vital role in helping investors navigate the complexities of the equity market and achieve their financial goals. The market is driven by increasing wealth, investor demand for professional financial advice, and the need for customized investment solutions.

However, the industry faces challenges such as fee pressure, regulatory changes, and intense competition. Service providers must embrace technological advancements, focus on sustainable investing, enhance the client experience, and strengthen risk management practices to thrive in a rapidly evolving landscape.

With the growing demand for personalized investment strategies and the integration of technology, the equity portfolio management and advisory services market is poised for growth and innovation in the years to come.

Equity Portfolio Management and Advisory Services Market

| Segmentation |

Details |

| Service Type |

Discretionary Services, Non-discretionary Services |

| Investment Style |

Active Management, Passive Management |

| End User |

Institutional Investors, High Net Worth Individuals, Retail Investors, Others |

| Region |

North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Equity Portfolio Management and Advisory Services Market:

- BlackRock, Inc.

- JPMorgan Chase & Co.

- Goldman Sachs Group, Inc.

- Morgan Stanley

- Bank of America Corporation

- UBS Group AG

- Vanguard Group

- State Street Corporation

- Charles Schwab Corporation

- Fidelity Investments

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA