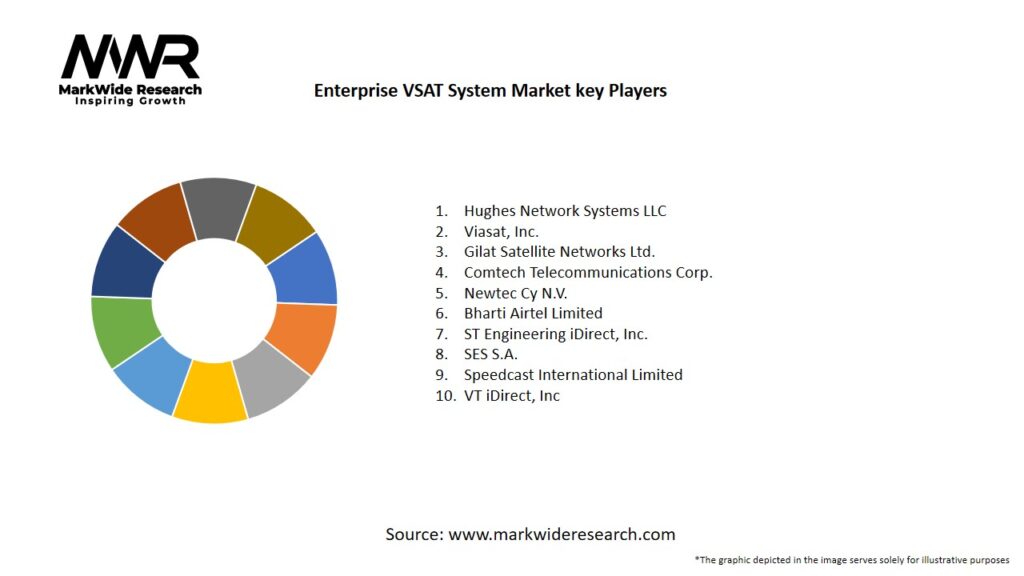

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

HTS Adoption: High-throughput satellites delivering 10× the capacity of traditional GEOs are driving down bandwidth costs and enabling new enterprise applications.

-

Hybrid Networks: Integration of VSAT with SD-WAN and terrestrial links ensures optimized path selection, enhanced security, and latency-aware routing.

-

Managed Services Growth: A shift toward fully managed VSAT services—with monitoring, SLAs, and remote provisioning—simplifies deployment and reduces OPEX.

-

Antenna Evolution: Electronically steered flat-panel and auto-pointing VSAT terminals facilitate rapid installation on moving platforms (vessels, vehicles) and sites without line-of-sight expertise.

-

Regulatory Environment: Liberalization of Ku-/Ka-band spectrum and regional licensing frameworks in Asia, Africa, and Latin America are expanding market access for VSAT providers.

Market Drivers

-

Digital Transformation Needs: Distributed enterprises require secure, high-bandwidth connectivity for cloud-based ERP, CRM, and collaboration tools across widely dispersed sites.

-

Business Continuity & Resilience: Natural disasters and fiber cuts highlight the importance of VSAT as a redundant or primary link for critical operations and public safety communications.

-

Remote & Mobile Applications: Mining, oil & gas exploration, maritime shipping, and military deployments rely on VSAT for real-time data, voice, and video in remote or high-mobility contexts.

-

IoT & M2M Connectivity: Agriculture, utilities, and logistics industries deploy IoT sensors and SCADA systems over VSAT networks to monitor assets where cellular coverage is sparse.

-

Emerging Market Expansion: Rapid economic development in Africa, Southeast Asia, and Latin America drives demand for VSAT connectivity in rural banking, telemedicine, and education.

Market Restraints

-

High Initial Investment: ODU hardware, installation, and hub infrastructure represent significant CAPEX, potentially deterring small and medium enterprises.

-

Latency Constraints: GEO VSAT links incur 500–700 ms round-trip latency, limiting real-time interactive applications without specialized acceleration techniques.

-

Regulatory Complexity: Satellite licensing, spectrum allocation, and import regulations vary by country, complicating global deployments.

-

Competition from Terrestrial Networks: Expanding 4G/5G coverage and fiber rollouts in many regions compete directly with VSAT for backhaul and last-mile access.

-

Operational Expertise: Effective VSAT management requires specialized skills in antenna alignment, RF engineering, and network optimization—resources that may be scarce.

Market Opportunities

-

LEO/MEO Integration: Partnerships with LEO/MEO constellations (e.g., OneWeb, Starlink) create hybrid solutions offering low-latency, high-capacity connectivity alongside GEO VSAT reliability.

-

Edge Computing & Caching: Deploying edge servers at remote sites reduces bandwidth usage and mitigates latency by caching frequently accessed data locally.

-

Vertical Solutions: Tailored VSAT packages for retail (POS backup), finance (ATM connectivity), healthcare (telemedicine), and education (e-learning) open new revenue streams.

-

Antenna-as-a-Service (AaaS): Subscription-based, plug-and-play VSAT terminals with integrated auto-alignment lower barriers to entry for non-technical users.

-

Software-defined Satellites: Virtualized VSAT network functions enable dynamic bandwidth allocation, real-time routing policy changes, and network slicing to meet diverse SLAs.

Market Dynamics

-

Consolidation & Alliances: Mergers between satellite operators and VSAT service providers (e.g., Viasat–Inmarsat alliance) create end-to-end connectivity portfolios.

-

Technology Evolution: Adoption of DVB-S2X, adaptive coding & modulation (ACM), and software-defined ground segment improves spectral efficiency and throughput.

-

Managed NaaS Models: Enterprises increasingly outsource connectivity management to VSAT operators offering pay-per-use, SLA-backed service bundles.

-

Cybersecurity Focus: Integration of end-to-end encryption, secure VPN tunneling, and network intrusion detection systems into VSAT offerings meets stringent enterprise security requirements.

-

Green Initiatives: Development of energy-efficient, low-power VSAT terminals and hubs aligns with corporate sustainability goals and reduces OPEX.

Regional Analysis

-

North America: Mature VSAT market with established service providers, high enterprise adoption of managed VSAT, and integration with cloud-based NaaS offerings.

-

Europe: Strong enterprise VSAT usage in oil & gas, maritime, and remote tourism; regulatory harmonization (SESAR) facilitates cross-border deployments.

-

Asia Pacific: Fastest-growing region, driven by rural broadband initiatives in India and China, plus demand from mining and agriculture sectors in Australia and Indonesia.

-

Latin America: Growing VSAT backhaul for cellular networks and rural banking applications in Brazil, Mexico, and Argentina; local regulatory reforms improving spectrum access.

-

Middle East & Africa: Expansion in energy, government communications, and humanitarian operations; challenges include import tariffs and limited local maintenance capabilities.

Competitive Landscape

Leading Companies in the Enterprise VSAT System Market:

- Hughes Network Systems LLC

- Viasat, Inc.

- Gilat Satellite Networks Ltd.

- Comtech Telecommunications Corp.

- Newtec Cy N.V.

- Bharti Airtel Limited

- ST Engineering iDirect, Inc.

- SES S.A.

- Speedcast International Limited

- VT iDirect, Inc

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

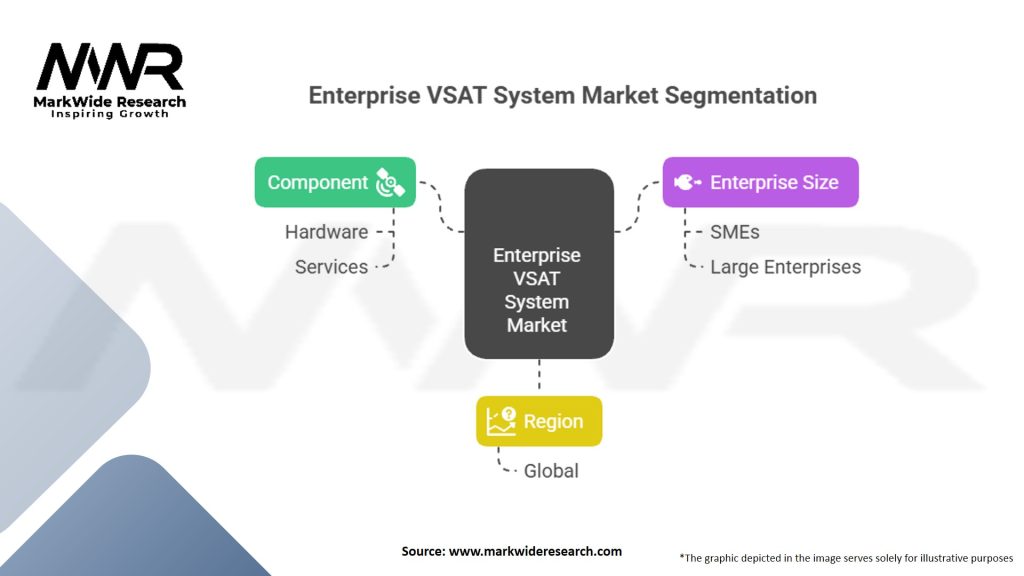

Segmentation

-

By Satellite Orbit: GEO VSAT, MEO-augmented VSAT, LEO-integrated VSAT

-

By Service Type: SCPC (dedicated), TDMA/MF-TDMA (shared), DAMA (dynamic), HTS-based VSAT

-

By Deployment Model: On-Premises Managed, Hosted Terminal (AaaS), Hybrid MPLS/VSAT

-

By End-Use Industry: Banking & Finance, Retail (POS/ATM), Oil & Gas, Maritime, Government & Defense, Healthcare, Education, Mining & Utilities

Category-wise Insights

-

Banking & Finance: VSAT ensures ATM uptime and secure branch connectivity, with transaction-level QoS and PCI-DSS–compliant encryption.

-

Retail: POS terminals rely on VSAT backup links to maintain sales operations during terrestrial outages; managed VSAT reduces onsite IT demands.

-

Oil & Gas: Onshore and offshore drilling sites use VSAT for SCADA telemetry, voice/video conferencing, and safety monitoring where no fiber exists.

-

Maritime: Cruise ships, cargo vessels, and fishing fleets deploy stabilized VSAT antennas for crew welfare, operational data exchange, and ISR support.

-

Government & Defense: VSAT supports secure, survivable communications in disaster zones, remote outposts, and mobile command centers.

Key Benefits for Industry Participants and Stakeholders

-

Ubiquitous Connectivity: VSAT delivers high-availability links where cellular and fiber are absent or unreliable, ensuring business continuity.

-

Rapid Deployment: Satellite terminals can be installed within hours, enabling fast setup of temporary sites and disaster relief operations.

-

Scalable Bandwidth: HTS platforms allow enterprises to scale bandwidth on-demand, aligning costs with usage and seasonal needs.

-

Centralized Management: Managed VSAT services provide single-pane-of-glass visibility, SLA reporting, and automated fault resolution.

-

Security & Compliance: End-to-end encryption, network segmentation, and compliance with industry standards (ISO 27001, GDPR) protect critical data.

SWOT Analysis

Strengths

-

Resilient, global coverage independent of terrestrial infrastructure.

-

Mature ecosystem of service providers and hardware vendors.

Weaknesses

-

Higher latency compared to fiber, impacting real-time interactive applications.

-

Significant upfront hardware and installation costs for enterprise sites.

Opportunities

-

Integration with 5G backhaul and cloud-edge architectures for IoT and AI workloads.

-

Expansion of LEO/MEO networks to offer low-latency, high-capacity enterprise services.

Threats

-

Competition from expanding terrestrial broadband and 5G networks in urban and suburban areas.

-

Regulatory changes and spectrum reallocation impacting satellite service economics.

Market Key Trends

-

SD-WAN Integration: VSAT providers bundle managed SD-WAN appliances to optimize traffic routing across satellite and terrestrial links.

-

Edge Caching & CDN: Deploying local caches and CDN nodes at VSAT hubs reduces latency for frequently accessed cloud services.

-

AI-Driven Network Management: Machine learning algorithms predict link degradations and automatically adjust modulation, coding, and routing.

-

Compact & Auto-Align Antennas: Next-gen flat-panel VSAT terminals simplify installation on vehicles, boats, and rooftops without manual pointing.

-

Sustainability Initiatives: Development of solar-powered VSAT terminals and green data center practices at hub sites aligns with corporate ESG goals.

Covid-19 Impact

The pandemic underscored the importance of reliable connectivity for remote work, telemedicine, and supply chain resilience. Demand for enterprise VSAT surged in rural healthcare clinics, mobile testing labs, and field hospitals. Concurrently, supply chain disruptions prompted VSAT providers to expand local warehousing and accelerate adoption of plug-and-play terminals requiring minimal onsite expertise.

Key Industry Developments

-

OneWeb–Arianespace Partnership: Accelerating LEO constellation deployments to supplement enterprise VSAT services with low-latency links.

-

Hughes SD-WAN Launch: Integration of JUPITER™ VSAT with routing and security functions in a single managed CPE appliance.

-

Inmarsat OneSat Terminals: Innovative multi-orbit terminals automatically switch between GEO, MEO, and LEO services for seamless connectivity.

-

Edge Cloud Integration: Collaborations between VSAT operators and cloud providers (AWS Ground Station, Azure Orbital) enable direct satellite-to-cloud data paths.

Analyst Suggestions

-

Adopt Hybrid Architectures: Combine GEO VSAT with emerging LEO/MEO services and terrestrial links under unified NMS for optimal performance and cost balance.

-

Leverage Managed Services: Shift capital expenditure to OPEX through fully managed VSAT offerings, freeing internal IT teams to focus on core business.

-

Invest in Edge & Caching: Deploy edge compute nodes and CDN caches at remote sites to mitigate satellite latency and improve user experience.

-

Pursue Verticalization: Develop industry-specific VSAT solutions—complete with specialized hardware, optimized bandwidth packages, and tailored SLAs—to deepen market penetration.

Future Outlook

The Enterprise VSAT Systems market is poised for sustained growth as digitalization accelerates in every industry vertical. The convergence of high-throughput GEO satellites, burgeoning LEO/MEO constellations, and advanced ground segment technologies will yield ubiquitous, low-latency, and secure connectivity. Managed NaaS models, powered by AI-driven network orchestration and hybrid SD-WAN integration, will simplify adoption and expand use cases—from remote office connectivity to AI-powered edge analytics. As enterprises prioritize resilience, agility, and seamless cloud access, VSAT will cement its role as a foundational component of global enterprise networks.

Conclusion

Enterprise VSAT Systems uniquely address the connectivity challenges of remote, mobile, and distributed operations, delivering resilient broadband where terrestrial options fall short. With rapid technological evolution—spanning HTS capacity gains, LEO/MEO latency reduction, and software-defined ground segments—VSAT’s value proposition is stronger than ever. Stakeholders who embrace hybrid architectures, managed service models, and verticalized solutions will harness the full potential of satellite connectivity, ensuring robust, secure, and cost-effective networks that underpin tomorrow’s digital enterprises.