444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Enterprise Merger and Acquisition (M&A) Advisory Service market is a critical component of the global financial industry, facilitating mergers, acquisitions, divestitures, and strategic partnerships for businesses across various sectors. M&A advisory services provide expertise, guidance, and support to companies seeking to navigate complex transactions, optimize value, and achieve their strategic objectives. With globalization, technological advancements, and evolving market dynamics, the demand for M&A advisory services continues to grow, driving innovation and competition within the industry.

Meaning

Enterprise Merger and Acquisition Advisory Services encompass a range of financial advisory and consulting services designed to assist companies throughout the M&A process. These services may include strategic planning, target identification, valuation analysis, deal structuring, due diligence, negotiation support, and post-merger integration. M&A advisors act as trusted partners to clients, leveraging their industry expertise, market insights, and transaction experience to guide them through each stage of the M&A lifecycle.

Executive Summary

The Enterprise Merger and Acquisition Advisory Service market is experiencing robust growth, fueled by factors such as increasing globalization, industry consolidation, technological disruption, and shifting market dynamics. Companies across sectors are increasingly turning to M&A transactions as a strategic tool to drive growth, expand market presence, gain competitive advantages, and unlock synergies. M&A advisory firms play a pivotal role in facilitating these transactions, providing strategic counsel, financial expertise, and transaction execution capabilities to clients worldwide.

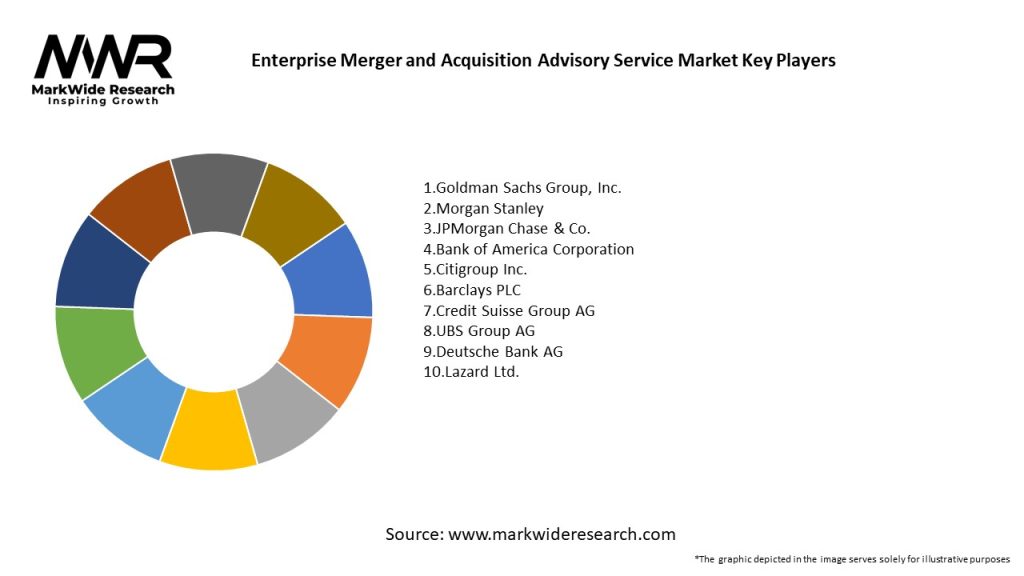

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Enterprise Merger and Acquisition Advisory Service market operates in a dynamic environment shaped by factors such as economic conditions, market trends, regulatory changes, technological advancements, and geopolitical developments. These dynamics influence M&A activity levels, deal structures, valuation trends, and market competition, requiring M&A advisory firms to stay agile, innovative, and responsive to market shifts.

Regional Analysis

The Enterprise Merger and Acquisition Advisory Service market exhibits regional variations influenced by factors such as economic growth, market maturity, regulatory frameworks, and cultural norms. Regional analysis enables M&A advisory firms to identify market opportunities, assess competitive dynamics, and tailor their service offerings to meet the unique needs of clients in different regions.

Competitive Landscape

Leading Companies in the Enterprise Merger and Acquisition Advisory Service Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Enterprise Merger and Acquisition Advisory Service market can be segmented based on various factors including:

Segmentation enables M&A advisory firms to target specific market segments, tailor their service offerings, and address the unique needs of clients in different industries and regions.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

A SWOT analysis provides an overview of the Enterprise Merger and Acquisition Advisory Service market’s strengths, weaknesses, opportunities, and threats:

Strengths:

Weaknesses:

Opportunities:

Threats:

Understanding these factors through a SWOT analysis helps M&A advisory firms identify their competitive advantages, address weaknesses, capitalize on opportunities, and mitigate potential threats.

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a profound impact on the Enterprise Merger and Acquisition Advisory Service market, disrupting M&A activity, altering deal dynamics, and reshaping market trends. Some key impacts of COVID-19 on the M&A advisory market include:

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Enterprise Merger and Acquisition Advisory Service market remains positive, with continued growth opportunities driven by factors such as increasing M&A activity, technological innovation, globalization, and industry consolidation. While challenges such as regulatory complexity, economic uncertainty, and geopolitical risks may impact the market in the short term, the long-term outlook for the M&A advisory industry remains favorable. M&A advisory firms that can adapt to evolving market dynamics, embrace technology, deliver value-added services, and build strong client relationships will be well-positioned to capitalize on growth opportunities and drive success in the future.

Conclusion

The Enterprise Merger and Acquisition Advisory Service market is a dynamic and evolving industry that plays a crucial role in facilitating M&A transactions, driving strategic growth, and unlocking value for businesses worldwide. Despite challenges such as regulatory complexity, economic uncertainty, and market volatility, the M&A advisory industry continues to thrive, driven by increasing M&A activity, technological innovation, and globalization. M&A advisory firms that can adapt to changing market dynamics, deliver superior client value, and provide innovative solutions will be well-positioned to succeed in the future and contribute to the growth and prosperity of the global economy.

What is Enterprise Merger and Acquisition Advisory Service?

Enterprise Merger and Acquisition Advisory Service refers to professional services that assist companies in the process of merging with or acquiring other businesses. These services typically include strategic advice, valuation, due diligence, and negotiation support.

What are the key players in the Enterprise Merger and Acquisition Advisory Service Market?

Key players in the Enterprise Merger and Acquisition Advisory Service Market include firms like Goldman Sachs, Morgan Stanley, and Deloitte, which provide comprehensive advisory services to clients involved in mergers and acquisitions, among others.

What are the growth factors driving the Enterprise Merger and Acquisition Advisory Service Market?

The growth of the Enterprise Merger and Acquisition Advisory Service Market is driven by factors such as increasing globalization, the need for companies to enhance competitive advantage, and the rising trend of consolidation across various industries.

What challenges does the Enterprise Merger and Acquisition Advisory Service Market face?

Challenges in the Enterprise Merger and Acquisition Advisory Service Market include regulatory complexities, cultural integration issues post-merger, and the potential for market volatility that can affect deal-making.

What opportunities exist in the Enterprise Merger and Acquisition Advisory Service Market?

Opportunities in the Enterprise Merger and Acquisition Advisory Service Market include the increasing demand for digital transformation advisory, the rise of private equity investments, and the growing interest in cross-border transactions.

What trends are shaping the Enterprise Merger and Acquisition Advisory Service Market?

Trends shaping the Enterprise Merger and Acquisition Advisory Service Market include the use of advanced analytics for deal evaluation, a focus on sustainability in mergers, and the growing importance of technology integration in acquisition strategies.

Enterprise Merger and Acquisition Advisory Service Market

| Segmentation Details | Description |

|---|---|

| Service Type | Due Diligence, Valuation, Integration Planning, Market Analysis |

| Client Type | Corporations, Private Equity Firms, Investment Banks, Startups |

| Transaction Size | Small Cap, Mid Cap, Large Cap, Mega Deals |

| Industry Vertical | Technology, Healthcare, Financial Services, Consumer Goods |

Leading Companies in the Enterprise Merger and Acquisition Advisory Service Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at