444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview The endowment insurances market is a significant segment within the insurance industry, offering long-term financial protection and investment opportunities to policyholders. Endowment insurance policies combine elements of life insurance coverage and savings/investment components, providing a lump sum payment at the end of the policy term or upon the insured individual’s death, whichever occurs first. This market serves individuals, families, and organizations seeking a combination of insurance protection and wealth accumulation over time.

Meaning Endowment insurance refers to a type of life insurance policy that offers both death benefits and a savings or investment component. Policyholders pay premiums to the insurer, which accumulates over time, and upon maturity of the policy or in the event of the insured’s death, the policy pays out a predetermined lump sum amount. Endowment policies provide financial security, asset accumulation, and potential tax advantages for policyholders and beneficiaries.

Executive Summary The endowment insurances market is characterized by its dual nature, offering life insurance coverage and a savings/investment vehicle. This market appeals to individuals and organizations seeking a disciplined savings strategy, long-term financial planning, tax-deferred growth, and guaranteed returns. Understanding key market insights, trends, regulatory frameworks, and customer preferences is crucial for insurers and financial institutions operating in this segment.

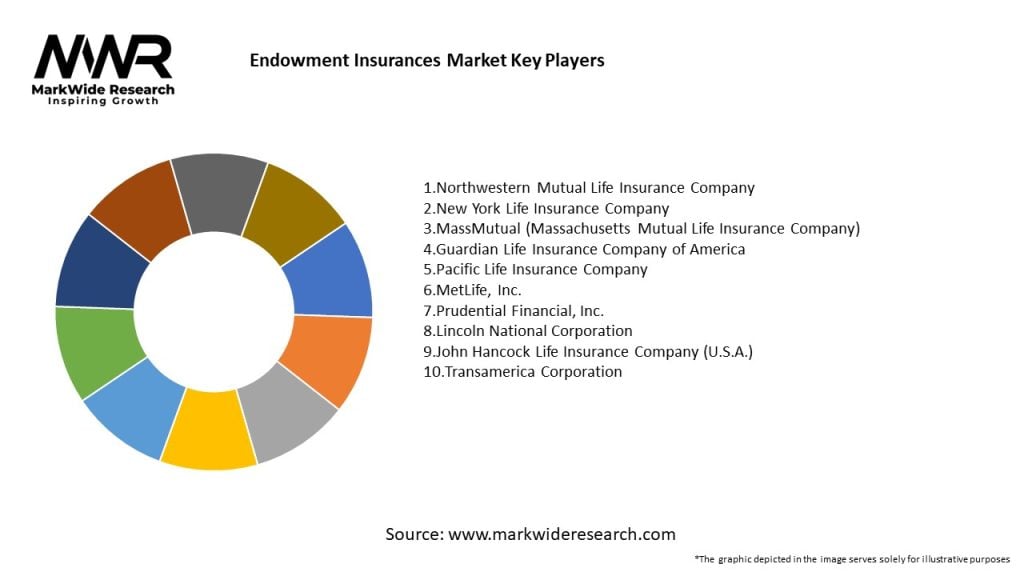

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics The endowment insurances market operates in a dynamic environment influenced by economic conditions, regulatory changes, market trends, consumer behaviors, and investment landscape. Insurers must adapt to market dynamics, customer preferences, and industry shifts to effectively serve policyholders and remain competitive.

Regional Analysis

Competitive Landscape

Leading Companies in the Endowment Insurances Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation The endowment insurances market can be segmented based on various factors, including:

Segmentation allows insurers to target specific market segments, customize product offerings, and address varying customer needs and preferences effectively.

Category-wise Insights

Key Benefits for Policyholders and Stakeholders

SWOT Analysis

Understanding these factors through a SWOT analysis helps insurers and stakeholders navigate market dynamics, capitalize on opportunities, address weaknesses, and mitigate potential threats.

Market Key Trends

Covid-19 Impact

Key Industry Developments

Analyst Suggestions

Future Outlook The endowment insurances market is poised for continued growth, innovation, and evolution, driven by digitalization, personalized solutions, ESG integration, regulatory compliance, and market trends. Insurers that embrace digital transformation, prioritize customer-centricity, offer flexible and sustainable endowment options, and adapt to changing consumer behaviors will thrive in a competitive and dynamic landscape. The future of endowment insurance will be shaped by advancements in technology, regulatory developments, customer engagement strategies, and industry collaborations.

Conclusion The endowment insurances market plays a vital role in the insurance industry, offering policyholders long-term financial protection, asset accumulation, tax advantages, and estate planning benefits. Endowment policies combine life insurance coverage with savings or investment components, providing a comprehensive solution for individuals, families, and organizations. As the market evolves, insurers must focus on digital innovation, product customization, ESG integration, regulatory compliance, and customer education to meet evolving customer needs and preferences. By leveraging technology, embracing sustainability, fostering partnerships, and delivering value-added services, insurers can navigate market dynamics, drive growth, and enhance customer outcomes in the endowment insurances market.

What is Endowment Insurances?

Endowment insurances are financial products that combine life insurance and savings components. They provide a lump sum payment either at the end of a specified term or upon the policyholder’s death, making them a popular choice for long-term financial planning.

What are the key players in the Endowment Insurances Market?

Key players in the Endowment Insurances Market include companies like Prudential, MetLife, and Aviva, which offer a range of endowment products tailored to different customer needs, among others.

What are the growth factors driving the Endowment Insurances Market?

The growth of the Endowment Insurances Market is driven by increasing awareness of financial planning, the rising demand for dual-benefit products, and the growing middle-class population seeking secure investment options.

What challenges does the Endowment Insurances Market face?

Challenges in the Endowment Insurances Market include regulatory changes that affect product offerings, competition from alternative investment vehicles, and consumer skepticism regarding the returns on such policies.

What opportunities exist in the Endowment Insurances Market?

Opportunities in the Endowment Insurances Market include the potential for product innovation, the introduction of digital platforms for easier access, and the growing trend of personalized insurance solutions to meet diverse customer needs.

What trends are shaping the Endowment Insurances Market?

Trends in the Endowment Insurances Market include the increasing integration of technology in policy management, a shift towards sustainable investment options, and a growing focus on customer-centric services that enhance user experience.

Endowment Insurances Market

| Segmentation Details | Description |

|---|---|

| Product Type | Traditional Endowment, Unit-Linked Endowment, Whole Life Endowment, Limited Pay Endowment |

| Customer Type | Individuals, Corporates, Financial Institutions, High Net Worth Individuals |

| Distribution Channel | Direct Sales, Insurance Brokers, Online Platforms, Banks |

| Policy Term | Short-Term, Medium-Term, Long-Term, Flexible Term |

Leading Companies in the Endowment Insurances Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at