444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Empty capsules are a type of pharmaceutical dosage form that consist of a shell made from gelatin or other materials, which is filled with a drug or combination of drugs. They are used to encapsulate both solid and liquid medications, and are available in a range of sizes and colors. The global empty capsules market has been growing steadily in recent years, driven by factors such as increasing demand for dietary supplements, growing preference for capsules over tablets, and rising demand for customized medicines.

Empty capsules are an integral part of the pharmaceutical and nutraceutical industries. They provide a convenient and effective means of delivering drugs and supplements to patients and consumers. The capsules can be customized to meet specific dosage requirements, and can be filled with a wide range of active ingredients, including vitamins, minerals, herbal extracts, and pharmaceutical drugs. They are available in a range of sizes, colors, and materials, and can be used to encapsulate both solid and liquid formulations.

Executive Summary

The global empty capsules market is expected to grow at a steady pace over the next few years, driven by factors such as increasing demand for dietary supplements, growing preference for capsules over tablets, and rising demand for customized medicines. Gelatin capsules account for the majority of the market share, due to their widespread availability and low cost. However, non-gelatin capsules are gaining popularity, particularly among vegetarian and vegan consumers. The market is characterized by intense competition among key players, with companies focused on developing innovative products to cater to evolving customer needs.

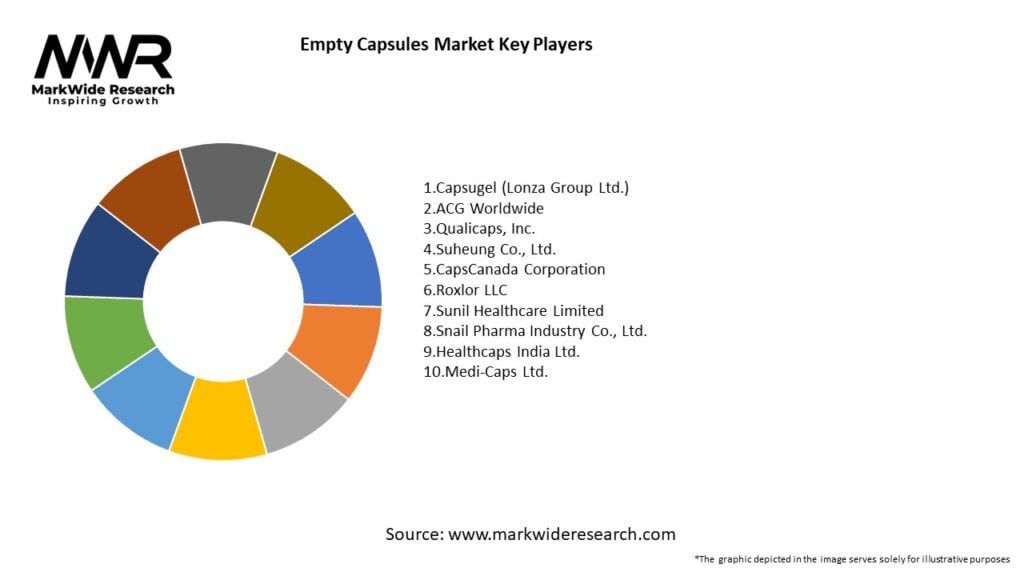

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

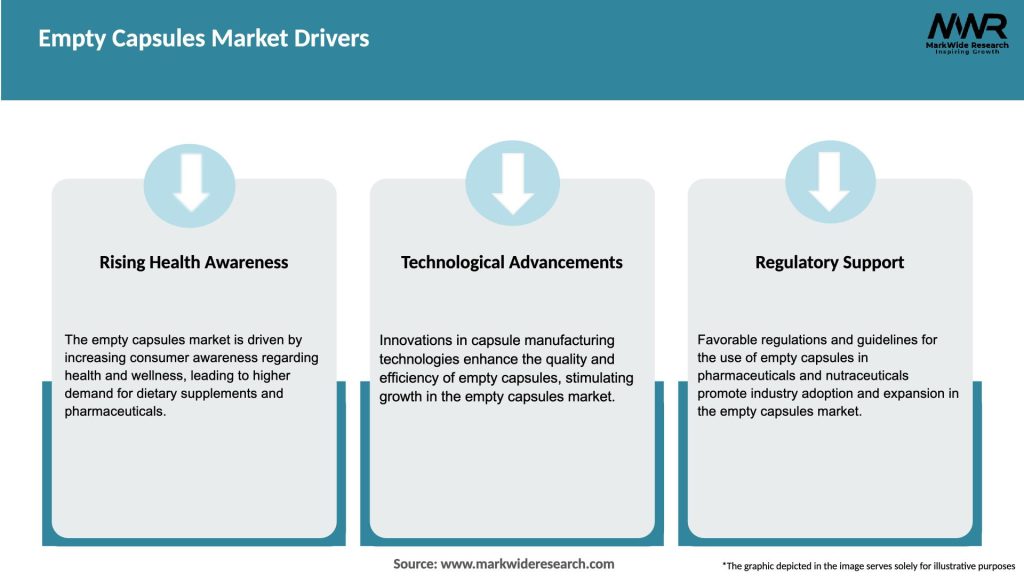

Market Drivers

Market Restraints

Market Dynamics

The global empty capsules market is characterized by intense competition among key players, with companies focused on developing innovative products to cater to evolving customer needs. The market is also subject to stringent regulatory requirements, which can increase the cost of production and limit the entry of new players into the market. However, increasing demand for customized medicines, growing preference for capsules over tablets, and rising demand for dietary supplements are expected to drive the growth of the market over the next few years.

Regional Analysis

The global empty capsules market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. Asia-Pacific is the fastest-growing region in the market, driven by factors such as growing population, rising disposable income, and increasing demand for healthcare services. North America and Europe are the largest markets for empty capsules, due to the presence of a large pharmaceutical and nutraceutical industry in these regions.

Competitive Landscape

Leading companies in the Empty Capsules Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

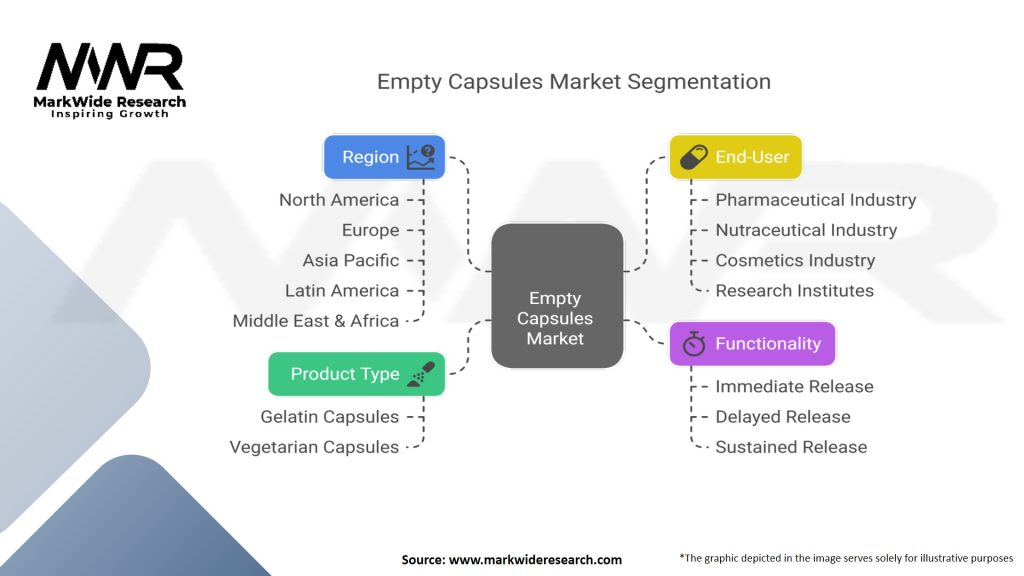

The global empty capsules market is segmented based on product type, application, end user, and geography.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a mixed impact on the empty capsules market. On the one hand, there has been an increase in demand for supplements and vitamins, as consumers seek to boost their immune systems and protect their health. This has driven demand for empty capsules as a delivery system for these products. On the other hand, the pandemic has disrupted global supply chains and led to a decline in manufacturing activity, which has had a negative impact on the market.

Key Industry Developments

Analyst Suggestions

Future Outlook

The global empty capsules market is expected to grow at a steady pace over the next few years, driven by factors such as increasing demand for dietary supplements, growing preference for capsules over tablets, and rising demand for customized medicines. Non-gelatin capsules are expected to gain popularity, particularly among vegetarian and vegan consumers, and emerging markets such as Asia-Pacific, Latin America, and the Middle East are expected to offer significant growth opportunities for the market.

Conclusion

The global empty capsules market is a well-established and growing industry, driven by increasing demand for dietary supplements, growing preference for capsules over tablets, and rising demand for customized medicines. The market is characterized by intense competition among key players, with manufacturers focused on developing innovative products and expanding their geographic presence to capitalize on growth opportunities in emerging markets. The growing focus on sustainability and the increasing demand for non-gelatin capsules are expected to shape the future of the industry, and collaboration and partnerships among players in the market are likely to drive innovation in the industry. Overall, the future of the global empty capsules market looks promising, with significant growth potential in the years to come.

What are empty capsules?

Empty capsules are pharmaceutical dosage forms that consist of a shell made from gelatin or other materials, designed to encapsulate powders, granules, or liquids for oral administration. They are widely used in the pharmaceutical and nutraceutical industries for delivering medications and dietary supplements.

What are the key companies in the Empty Capsules Market?

Key companies in the Empty Capsules Market include Capsugel, Qualicaps, and Suheung Co., Ltd., which are known for their innovative capsule technologies and extensive product offerings in various segments, among others.

What are the growth factors driving the Empty Capsules Market?

The growth of the Empty Capsules Market is driven by the increasing demand for dietary supplements, the rise in chronic diseases requiring medication, and advancements in capsule technology that enhance bioavailability and patient compliance.

What challenges does the Empty Capsules Market face?

The Empty Capsules Market faces challenges such as stringent regulatory requirements, the rising cost of raw materials, and competition from alternative drug delivery systems that may limit market growth.

What opportunities exist in the Empty Capsules Market?

Opportunities in the Empty Capsules Market include the growing trend of personalized medicine, the expansion of the nutraceutical sector, and the development of plant-based capsules that cater to vegan and vegetarian consumers.

What trends are shaping the Empty Capsules Market?

Trends shaping the Empty Capsules Market include the increasing preference for vegetarian capsules, innovations in capsule manufacturing processes, and the rising popularity of customized formulations to meet specific health needs.

Empty Capsules Market

| Segmentation | Details |

|---|---|

| Product Type | Gelatin Capsules, Vegetarian Capsules |

| Functionality | Immediate Release, Delayed Release, Sustained Release |

| End-User | Pharmaceutical Industry, Nutraceutical Industry, Cosmetics Industry, Research Institutes |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Empty Capsules Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at