444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

Employee retention tax credit services have gained significant attention in recent years, particularly amidst economic uncertainties and changes in government policies. These services aim to help businesses navigate complex tax regulations and maximize their eligibility for tax credits designed to incentivize employee retention. As companies strive to retain their workforce and recover from the impacts of the COVID-19 pandemic, employee retention tax credit services have become integral for optimizing tax savings and enhancing financial resilience.

Meaning

Employee retention tax credit services refer to specialized consulting and advisory services that assist businesses in identifying, applying for, and maximizing tax credits related to employee retention initiatives. These services encompass comprehensive analyses of tax regulations, eligibility criteria, and documentation requirements to ensure compliance and optimize tax savings. By leveraging expert guidance and industry insights, businesses can navigate the complexities of employee retention tax credits and capitalize on available incentives to strengthen their financial position.

Executive Summary

The employee retention tax credit service market has experienced rapid growth in response to evolving regulatory landscapes and economic challenges. As governments introduce measures to stimulate economic recovery and support businesses, the demand for expert guidance on employee retention tax credits has surged. Key players in this market provide tailored solutions to help businesses assess eligibility, calculate tax credits, and streamline the application process. By partnering with reputable service providers, businesses can unlock substantial tax savings and gain a competitive edge in uncertain times.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The employee retention tax credit service market operates in a dynamic environment shaped by regulatory changes, economic trends, technological advancements, and competitive pressures. Providers must adapt to evolving market dynamics, anticipate client needs, and innovate continuously to maintain relevance and sustain growth. Understanding the interplay of market forces and responding strategically enables providers to seize opportunities, overcome challenges, and thrive in a rapidly evolving landscape.

Regional Analysis

The employee retention tax credit service market exhibits regional variations influenced by factors such as regulatory frameworks, economic conditions, and industry landscapes. While certain regions may experience higher demand for employee retention tax credit services due to government policies or economic challenges, others may prioritize different tax incentives or face unique compliance requirements. A nuanced understanding of regional dynamics enables service providers to tailor their offerings, expand their market presence, and capitalize on opportunities across diverse geographic markets.

Competitive Landscape

Leading Companies in the Employee Retention Tax Credit Service Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

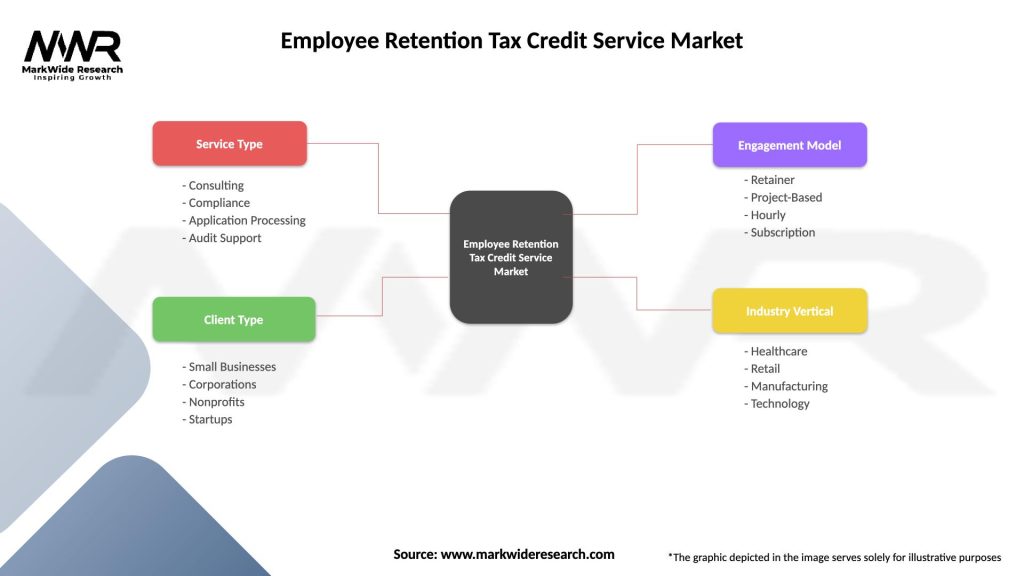

Segmentation

The employee retention tax credit service market can be segmented based on various factors, including:

Segmentation enhances providers’ ability to understand client needs, deliver targeted solutions, and capture opportunities in specific market segments.

Category-wise Insights

Category-wise insights provide a holistic view of the services offered by employee retention tax credit providers, highlighting the critical role they play in helping businesses navigate tax regulations, optimize savings, and mitigate risks effectively.

Key Benefits for Industry Participants and Stakeholders

Key benefits for industry participants and stakeholders underscore the value proposition of employee retention tax credit services and their impact on business operations, financial health, and compliance assurance.

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

A SWOT analysis provides insights into the internal strengths and weaknesses, as well as external opportunities and threats, facing employee retention tax credit service providers. Understanding these factors enables providers to capitalize on opportunities, address challenges, and mitigate risks effectively.

Market Key Trends

Market key trends reflect the evolving dynamics and emerging opportunities in the employee retention tax credit service market, guiding providers in their strategic planning and investment decisions.

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the employee retention tax credit service market, influencing demand dynamics, regulatory landscapes, and client priorities. Some key impacts of COVID-19 on the market include:

The COVID-19 pandemic reshapes market dynamics and client priorities in the employee retention tax credit service market, highlighting the importance of agility, resilience, and innovation in navigating uncertain times.

Key Industry Developments

Key industry developments reflect ongoing trends and initiatives shaping the employee retention tax credit service market, driving innovation, collaboration, and advocacy to support businesses’ tax optimization and compliance efforts.

Analyst Suggestions

Analyst suggestions provide actionable recommendations for service providers to navigate market dynamics, capitalize on opportunities, and drive sustainable growth in the employee retention tax credit service market.

Future Outlook

The future outlook for the employee retention tax credit service market is characterized by continued growth, innovation, and regulatory evolution. As businesses navigate economic uncertainties, talent shortages, and regulatory complexities, the demand for expert guidance on tax optimization and compliance will remain strong. Service providers that embrace technology, foster strategic partnerships, and prioritize client value will be well-positioned to thrive in a dynamic and competitive market landscape. By staying agile, proactive, and client-focused, employee retention tax credit service providers can drive value for businesses, support workforce retention, and contribute to economic recovery and resilience.

Conclusion

Employee retention tax credit services play a critical role in helping businesses optimize tax savings, navigate regulatory complexities, and support workforce retention initiatives. As businesses strive to adapt to changing economic conditions, regulatory landscapes, and talent dynamics, the demand for expert guidance and strategic advice on tax optimization will continue to grow. By leveraging technology, fostering strategic partnerships, and prioritizing client value, service providers can address evolving client needs, drive innovation, and drive sustainable growth in the employee retention tax credit service market. By staying agile, proactive, and client-focused, employee retention tax credit service providers can drive value for businesses, support workforce retention, and contribute to economic recovery and resilience.

What is Employee Retention Tax Credit Service?

Employee Retention Tax Credit Service refers to specialized services that assist businesses in claiming tax credits designed to encourage employee retention during economic downturns. These services often include consulting, documentation preparation, and compliance support to maximize eligible credits.

What are the key players in the Employee Retention Tax Credit Service Market?

Key players in the Employee Retention Tax Credit Service Market include companies like ADP, Paychex, and H&R Block, which provide comprehensive payroll and tax services. These firms help businesses navigate the complexities of tax credits and ensure compliance with regulations, among others.

What are the growth factors driving the Employee Retention Tax Credit Service Market?

The Employee Retention Tax Credit Service Market is driven by factors such as increased awareness of tax incentives among businesses, the ongoing economic impact of global events, and the need for financial relief strategies. Additionally, the complexity of tax regulations encourages companies to seek expert assistance.

What challenges does the Employee Retention Tax Credit Service Market face?

Challenges in the Employee Retention Tax Credit Service Market include frequent changes in tax legislation, which can create confusion for businesses. Additionally, the competition among service providers can lead to varying levels of service quality and expertise.

What opportunities exist in the Employee Retention Tax Credit Service Market?

Opportunities in the Employee Retention Tax Credit Service Market include the potential for expanding services to small and medium-sized enterprises that may not be fully aware of available credits. Furthermore, as economic conditions evolve, there may be increased demand for tailored consulting services.

What trends are shaping the Employee Retention Tax Credit Service Market?

Trends in the Employee Retention Tax Credit Service Market include the growing use of technology to streamline the application process and enhance compliance tracking. Additionally, there is an increasing focus on personalized service offerings to meet the unique needs of different industries.

Employee Retention Tax Credit Service Market

| Segmentation Details | Description |

|---|---|

| Service Type | Consulting, Compliance, Application Processing, Audit Support |

| Client Type | Small Businesses, Corporations, Nonprofits, Startups |

| Engagement Model | Retainer, Project-Based, Hourly, Subscription |

| Industry Vertical | Healthcare, Retail, Manufacturing, Technology |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Employee Retention Tax Credit Service Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at