444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The EMEA satellite antenna market represents a dynamic and rapidly evolving sector within the broader telecommunications and aerospace industry. Spanning across Europe, the Middle East, and Africa, this market encompasses a diverse range of satellite communication technologies that serve critical functions in broadcasting, telecommunications, defense, and commercial applications. The region’s strategic geographic position and increasing demand for high-speed connectivity have positioned the EMEA satellite antenna market as a significant growth driver in the global satellite communications landscape.

Market dynamics in the EMEA region are characterized by substantial technological advancement and increasing adoption of next-generation satellite systems. The market is experiencing robust growth driven by the proliferation of satellite-based internet services, expanding defense communications requirements, and the growing need for reliable connectivity in remote and underserved areas. With a projected growth rate of 8.2% CAGR over the forecast period, the market demonstrates strong momentum across multiple application segments.

Regional diversity within EMEA creates unique market opportunities, with European markets leading in technological innovation, Middle Eastern countries investing heavily in satellite infrastructure for smart city initiatives, and African nations leveraging satellite technology to bridge digital divides. This geographical spread contributes to a 65% market concentration in developed European markets, while emerging markets in Africa and the Middle East represent the fastest-growing segments with adoption rates exceeding 12% annually.

The EMEA satellite antenna market refers to the comprehensive ecosystem of satellite communication equipment, systems, and services that facilitate the transmission and reception of satellite signals across Europe, the Middle East, and Africa. This market encompasses various types of antennas including parabolic dishes, phased array systems, flat panel antennas, and specialized military-grade communication equipment designed for satellite-based data, voice, and video transmission.

Satellite antennas serve as the critical interface between terrestrial communication networks and orbiting satellites, enabling seamless connectivity for applications ranging from direct-to-home broadcasting and maritime communications to emergency response systems and military operations. The market includes both ground-based fixed installations and mobile antenna systems that can be deployed in vehicles, aircraft, and maritime vessels.

Technology integration within this market spans traditional geostationary satellite systems, medium Earth orbit constellations, and emerging low Earth orbit satellite networks. The convergence of these technologies creates a comprehensive communication infrastructure that supports the growing demand for ubiquitous connectivity across the diverse EMEA region.

Strategic positioning of the EMEA satellite antenna market reflects a mature yet rapidly evolving industry landscape characterized by technological innovation and expanding application domains. The market benefits from strong regulatory support, increasing government investments in satellite infrastructure, and growing commercial demand for high-throughput satellite services. Key growth drivers include the digital transformation initiatives across EMEA countries, expanding IoT deployments, and the critical need for resilient communication networks.

Market segmentation reveals diverse opportunities across frequency bands, with Ku-band systems maintaining 42% market share due to their widespread adoption in broadcasting and commercial applications. Ka-band systems are experiencing rapid growth with 15% annual adoption increase, driven by high-throughput satellite deployments and next-generation broadband services. The emergence of multi-band and software-defined antenna systems is reshaping the competitive landscape.

Competitive dynamics feature a mix of established aerospace giants and innovative technology companies, with European manufacturers maintaining strong positions in high-end applications while emerging players focus on cost-effective solutions for developing markets. The market is witnessing increased consolidation as companies seek to expand their technological capabilities and geographic reach across the diverse EMEA region.

Technological evolution drives fundamental changes in the EMEA satellite antenna market, with several key insights shaping industry development:

Digital transformation initiatives across EMEA countries serve as primary catalysts for satellite antenna market growth. Government-led digitization programs, smart city developments, and Industry 4.0 implementations create substantial demand for reliable, high-capacity communication infrastructure. The increasing reliance on satellite connectivity for critical applications drives consistent market expansion across diverse industry verticals.

Connectivity requirements in remote and underserved regions represent significant growth drivers, particularly in African markets where terrestrial infrastructure limitations make satellite solutions essential. The digital divide bridging initiatives supported by international organizations and government programs fuel demand for cost-effective satellite antenna systems capable of delivering broadband services to previously unconnected populations.

Defense modernization programs across EMEA nations contribute substantially to market growth, with military organizations investing in advanced satellite communication capabilities for enhanced operational effectiveness. The growing emphasis on network-centric warfare, real-time intelligence sharing, and secure communications drives demand for sophisticated antenna systems with anti-jamming capabilities and enhanced security features.

Commercial aviation expansion and maritime industry growth create additional market opportunities, with airlines and shipping companies increasingly adopting satellite-based connectivity solutions to meet passenger expectations and operational requirements. The demand for in-flight entertainment, crew communications, and vessel tracking systems drives consistent antenna system deployments across transportation sectors.

High capital requirements for advanced satellite antenna systems pose significant barriers to market adoption, particularly for small and medium enterprises seeking to implement satellite connectivity solutions. The substantial upfront investments required for high-performance antenna systems, associated ground equipment, and ongoing service subscriptions can limit market penetration in price-sensitive segments.

Regulatory complexity across the diverse EMEA region creates challenges for market participants, with varying frequency allocations, licensing requirements, and technical standards complicating cross-border deployments. The need to navigate multiple regulatory frameworks increases compliance costs and can delay project implementations, particularly for multinational organizations.

Technical limitations of current satellite antenna technologies, including weather susceptibility, pointing accuracy requirements, and bandwidth constraints, can restrict adoption in certain applications. Rain fade effects in tropical regions, mechanical wear in mobile applications, and interference issues in dense urban environments present ongoing challenges for system designers and operators.

Competition from terrestrial alternatives such as fiber optic networks, 5G cellular systems, and microwave links can limit satellite antenna market growth in areas with robust terrestrial infrastructure. The improving performance and decreasing costs of terrestrial solutions create competitive pressure, particularly in urban markets with multiple connectivity options.

Emerging satellite constellations present substantial opportunities for antenna manufacturers and service providers, with new low Earth orbit and medium Earth orbit systems requiring specialized ground equipment and user terminals. The deployment of mega-constellations creates demand for innovative antenna designs capable of tracking multiple satellites and managing handovers between orbital platforms.

IoT and M2M applications represent rapidly expanding market segments, with satellite connectivity enabling remote monitoring, asset tracking, and data collection across industries including agriculture, energy, transportation, and environmental monitoring. The growing adoption of satellite-based IoT solutions creates opportunities for specialized antenna systems optimized for low-power, intermittent communication requirements.

5G network integration offers significant growth potential as satellite systems become integral components of next-generation cellular networks, providing backhaul connectivity and coverage extension capabilities. The convergence of satellite and terrestrial 5G technologies creates opportunities for hybrid antenna systems and integrated communication platforms.

Disaster recovery and emergency communications applications present consistent market opportunities, with government agencies and humanitarian organizations requiring rapidly deployable satellite communication systems. The increasing frequency of natural disasters and security incidents drives demand for portable, ruggedized antenna systems capable of providing immediate connectivity restoration.

Technological convergence shapes the fundamental dynamics of the EMEA satellite antenna market, with traditional boundaries between different communication technologies becoming increasingly blurred. The integration of satellite, cellular, and Wi-Fi technologies creates new market opportunities while challenging established business models and competitive positions.

Supply chain evolution reflects changing market dynamics, with manufacturers increasingly focusing on regional production capabilities to reduce costs and improve delivery times. The development of local supply chains across EMEA regions enhances market responsiveness while reducing dependencies on distant manufacturing centers.

Customer expectations continue to evolve, with end users demanding higher performance, lower costs, and greater flexibility from satellite antenna systems. The consumerization of satellite technology drives requirements for plug-and-play installation, automated configuration, and simplified maintenance procedures.

Partnership strategies between antenna manufacturers, satellite operators, and service providers create new market dynamics, with integrated solutions becoming increasingly important for competitive differentiation. Strategic alliances enable companies to offer comprehensive communication solutions while sharing development costs and market risks.

Comprehensive market analysis for the EMEA satellite antenna market employs a multi-faceted research approach combining primary and secondary data sources to ensure accuracy and completeness. The methodology incorporates quantitative analysis of market trends, competitive positioning, and technology adoption patterns alongside qualitative insights from industry experts and market participants.

Primary research activities include structured interviews with key stakeholders across the satellite antenna value chain, including manufacturers, system integrators, service providers, and end users. Survey methodologies capture market sentiment, technology preferences, and future investment intentions across different industry segments and geographic regions within EMEA.

Secondary research sources encompass industry reports, government publications, regulatory filings, and academic studies to provide comprehensive market context and historical trend analysis. Data validation processes ensure consistency and reliability across multiple information sources while identifying potential market gaps and opportunities.

Analytical frameworks applied in the research process include market sizing models, competitive analysis matrices, and technology adoption lifecycle assessments. These methodologies enable accurate market forecasting and strategic insight development while accounting for regional variations and market segment differences across the EMEA landscape.

European markets dominate the EMEA satellite antenna landscape, accounting for approximately 58% of regional market activity driven by advanced telecommunications infrastructure, strong regulatory frameworks, and significant defense spending. Countries including Germany, France, the United Kingdom, and Italy lead in technology adoption and manufacturing capabilities, with established aerospace industries supporting market development.

Middle Eastern countries represent rapidly growing market segments with 14% annual growth rates, fueled by smart city initiatives, oil and gas industry requirements, and government investments in satellite infrastructure. The UAE, Saudi Arabia, and Qatar lead regional adoption with ambitious connectivity projects and strategic satellite communication deployments supporting economic diversification efforts.

African markets demonstrate the highest growth potential within EMEA, with satellite antenna adoption increasing at 16% annually as countries leverage satellite technology to overcome terrestrial infrastructure limitations. South Africa, Nigeria, and Kenya serve as regional technology hubs, while emerging markets across the continent present significant opportunities for cost-effective satellite communication solutions.

Regional integration initiatives and cross-border collaboration projects create additional market dynamics, with pan-African connectivity programs and European Union digital agenda initiatives driving coordinated satellite antenna deployments. These regional approaches enable economies of scale while addressing diverse market requirements across different development levels and geographic challenges.

Market leadership in the EMEA satellite antenna sector features a diverse ecosystem of established aerospace companies, specialized antenna manufacturers, and emerging technology innovators. The competitive landscape reflects both global industry giants and regional players focused on specific market segments or geographic areas.

Competitive strategies focus on technology differentiation, regional market penetration, and strategic partnerships to address diverse customer requirements across EMEA markets. Companies increasingly emphasize software-defined capabilities, multi-band functionality, and integrated system solutions to maintain competitive advantages.

Technology-based segmentation reveals distinct market categories with varying growth trajectories and application focus areas:

Frequency band segmentation demonstrates market preferences and application-specific requirements:

Application-based segmentation highlights diverse market opportunities across industry verticals:

Fixed satellite antennas represent the largest market category, serving broadcasting, telecommunications, and enterprise applications with established technology platforms and proven operational reliability. This segment benefits from stable demand patterns and predictable replacement cycles, though growth rates are moderate compared to emerging mobile and specialized applications.

Mobile satellite antennas demonstrate the highest growth potential within the market, driven by increasing demand for connectivity in transportation, emergency response, and temporary deployment scenarios. The category encompasses vehicular, maritime, and aeronautical applications with specialized requirements for tracking accuracy, vibration resistance, and compact form factors.

Military and defense antennas constitute a high-value market category with stringent performance requirements and specialized security features. This segment demands advanced capabilities including anti-jamming protection, low probability of intercept characteristics, and ruggedized designs for harsh operational environments.

Consumer and SOHO antennas represent an emerging category driven by direct-to-consumer satellite broadband services and small office applications. This segment emphasizes cost-effectiveness, ease of installation, and automated configuration capabilities to serve non-technical users and price-sensitive markets.

Manufacturers benefit from expanding market opportunities across diverse application segments and geographic regions within EMEA. The growing demand for satellite connectivity creates consistent revenue streams while technological advancement enables premium pricing for innovative solutions. Regional manufacturing capabilities provide competitive advantages through reduced costs and improved customer proximity.

Service providers gain from comprehensive antenna solutions that enable new service offerings and market expansion opportunities. Integrated antenna and service packages create customer stickiness while reducing churn rates. The ability to offer turnkey solutions enhances competitive positioning and enables premium service pricing models.

End users receive significant value through improved connectivity options, enhanced operational capabilities, and reduced communication costs. Satellite antenna systems enable business expansion into remote areas, improve operational efficiency, and provide backup connectivity for critical applications. The technology offers independence from terrestrial infrastructure limitations.

Government stakeholders benefit from enhanced national security capabilities, improved emergency response systems, and expanded connectivity for underserved populations. Satellite antenna deployments support digital inclusion initiatives while providing resilient communication infrastructure for critical government operations and disaster response activities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Software-defined antennas represent a transformative trend reshaping the EMEA satellite antenna market, with programmable systems offering unprecedented flexibility and multi-mission capabilities. These advanced platforms enable rapid reconfiguration for different satellite systems, frequency bands, and communication protocols, providing significant operational advantages and future-proofing investments.

Miniaturization and integration trends drive development of compact, lightweight antenna systems suitable for diverse deployment scenarios. Advanced materials, innovative mechanical designs, and integrated electronics enable smaller form factors without compromising performance, opening new application opportunities in mobile and space-constrained environments.

Artificial intelligence integration enhances antenna system capabilities through automated pointing, interference mitigation, and performance optimization. AI-powered systems can adapt to changing conditions, predict maintenance requirements, and optimize communication parameters in real-time, improving overall system efficiency and reliability.

Sustainability focus influences antenna design and manufacturing processes, with companies emphasizing energy efficiency, recyclable materials, and reduced environmental impact. Green technology initiatives align with regional environmental regulations while appealing to environmentally conscious customers and stakeholders.

Strategic partnerships between antenna manufacturers and satellite operators are reshaping industry dynamics, with integrated solutions becoming increasingly important for market competitiveness. Recent collaborations focus on optimizing antenna designs for specific satellite constellations while reducing overall system costs and complexity.

Manufacturing expansion across EMEA regions reflects growing market demand and supply chain localization strategies. New production facilities in Eastern Europe and Africa enhance regional manufacturing capabilities while reducing costs and improving market responsiveness for local customers.

Technology acquisitions and mergers consolidate market expertise while accelerating innovation cycles. Recent industry consolidation activities focus on combining complementary technologies, expanding geographic reach, and achieving economies of scale in research and development activities.

Regulatory developments including spectrum harmonization initiatives and standardization efforts facilitate cross-border deployments and reduce compliance complexity. New regulatory frameworks support emerging applications while maintaining interference protection for existing services.

MarkWide Research analysis indicates that companies should prioritize software-defined antenna platforms to address evolving market requirements and maintain competitive differentiation. The flexibility offered by programmable systems provides significant advantages in rapidly changing satellite communication environments while enabling new revenue opportunities through software-based feature upgrades.

Market positioning strategies should emphasize regional expertise and local market knowledge to capitalize on diverse EMEA market opportunities. Companies that develop deep understanding of regional requirements, regulatory frameworks, and customer preferences will achieve superior market penetration and customer loyalty.

Technology investment priorities should focus on multi-band capabilities, AI integration, and sustainable design practices to align with market trends and customer expectations. Organizations that anticipate future requirements and invest in next-generation technologies will establish competitive advantages and capture premium market segments.

Partnership development represents a critical success factor for market participants, with strategic alliances enabling access to new technologies, markets, and customer bases. Collaborative approaches reduce development costs while accelerating time-to-market for innovative solutions and integrated system offerings.

Market evolution over the next decade will be characterized by continued technological advancement, expanding application domains, and increasing integration with terrestrial communication systems. The EMEA satellite antenna market is positioned for sustained growth driven by digital transformation initiatives, emerging satellite constellations, and expanding connectivity requirements across diverse industry sectors.

Technology convergence will create new market opportunities as satellite, cellular, and Wi-Fi technologies become increasingly integrated. Hybrid communication systems that seamlessly switch between different connectivity options will become standard, requiring sophisticated antenna platforms capable of supporting multiple technologies simultaneously.

Geographic expansion within EMEA regions will continue, with African markets representing the highest growth potential due to infrastructure development needs and digital inclusion initiatives. According to MWR projections, African satellite antenna adoption rates will exceed 18% annually as connectivity requirements expand across the continent.

Application diversification will drive market growth as satellite antennas become integral components of IoT networks, autonomous vehicle systems, and smart city infrastructure. The expanding scope of satellite-enabled applications creates multiple growth vectors while reducing market dependence on traditional broadcasting and telecommunications segments.

The EMEA satellite antenna market represents a dynamic and rapidly evolving sector with substantial growth potential across diverse application domains and geographic regions. Market fundamentals remain strong, supported by increasing connectivity demands, technological advancement, and favorable regulatory environments across Europe, the Middle East, and Africa.

Strategic opportunities abound for market participants willing to invest in next-generation technologies, develop regional expertise, and forge strategic partnerships. The convergence of satellite and terrestrial communication systems creates new market segments while traditional applications continue to provide stable revenue foundations.

Future success in the EMEA satellite antenna market will depend on companies’ ability to adapt to changing customer requirements, embrace technological innovation, and develop comprehensive solutions that address diverse regional needs. Organizations that prioritize flexibility, sustainability, and customer-centric approaches will achieve superior market positioning and long-term growth in this expanding and increasingly important market sector.

What is Satellite Antenna?

Satellite antennas are devices used to transmit and receive signals from satellites in orbit. They are essential for various applications, including telecommunications, broadcasting, and satellite internet services.

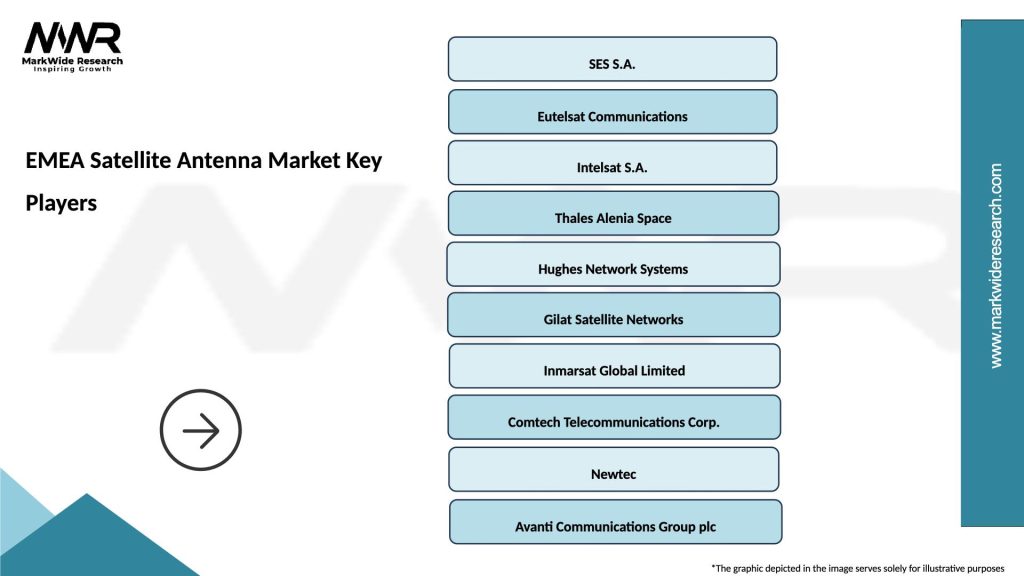

What are the key players in the EMEA Satellite Antenna Market?

Key players in the EMEA Satellite Antenna Market include companies like SES S.A., Eutelsat Communications, and Intelsat, among others. These companies are involved in the design, manufacturing, and deployment of satellite antennas for various applications.

What are the growth factors driving the EMEA Satellite Antenna Market?

The EMEA Satellite Antenna Market is driven by increasing demand for high-speed internet connectivity, the expansion of satellite communication services, and the growing need for reliable broadcasting solutions. Additionally, advancements in antenna technology are enhancing performance and efficiency.

What challenges does the EMEA Satellite Antenna Market face?

Challenges in the EMEA Satellite Antenna Market include regulatory hurdles, high manufacturing costs, and competition from alternative communication technologies such as fiber optics. These factors can impact market growth and innovation.

What opportunities exist in the EMEA Satellite Antenna Market?

The EMEA Satellite Antenna Market presents opportunities in emerging applications like IoT connectivity, remote sensing, and disaster recovery communications. The increasing adoption of satellite-based services in rural and underserved areas also offers significant growth potential.

What trends are shaping the EMEA Satellite Antenna Market?

Trends in the EMEA Satellite Antenna Market include the development of phased array antennas, the integration of artificial intelligence for signal processing, and the shift towards smaller, more efficient designs. These innovations are enhancing the capabilities and applications of satellite antennas.

EMEA Satellite Antenna Market

| Segmentation Details | Description |

|---|---|

| Product Type | Parabolic, Phased Array, Flat Panel, Cassegrain |

| Technology | Active, Passive, Hybrid, Digital |

| End User | Telecommunications, Broadcasting, Government, Maritime |

| Installation | Fixed, Portable, Mobile, Onshore |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the EMEA Satellite Antenna Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at