444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The EMEA frequency control and timing devices market represents a critical segment of the global electronics industry, encompassing sophisticated components that ensure precise timing and frequency stability across diverse applications. This market spans across Europe, Middle East, and Africa, serving industries ranging from telecommunications and automotive to aerospace and consumer electronics. Frequency control devices including crystal oscillators, resonators, and timing modules form the backbone of modern electronic systems, enabling synchronized operations and reliable performance.

Market dynamics in the EMEA region reflect strong demand driven by digital transformation initiatives, 5G network deployments, and increasing adoption of Internet of Things (IoT) technologies. The region demonstrates robust growth potential with compound annual growth rate (CAGR) projections indicating sustained expansion through the forecast period. European markets lead in terms of technological advancement and manufacturing capabilities, while Middle Eastern and African regions show accelerating adoption rates driven by infrastructure development and modernization efforts.

Industry participants benefit from diverse application segments including telecommunications infrastructure, automotive electronics, industrial automation, and consumer devices. The market’s resilience stems from the fundamental requirement for precise timing in virtually all electronic applications, creating consistent demand across economic cycles. Regional variations in market maturity and growth rates provide opportunities for strategic market positioning and expansion initiatives.

The EMEA frequency control and timing devices market refers to the comprehensive ecosystem of electronic components designed to generate, control, and maintain precise frequencies and timing signals across the Europe, Middle East, and Africa regions. These devices include crystal oscillators, ceramic resonators, surface acoustic wave (SAW) devices, voltage-controlled oscillators (VCOs), and phase-locked loops (PLLs) that serve as timing references for electronic circuits and systems.

Frequency control devices function as the heartbeat of electronic systems, providing stable reference signals that synchronize operations, enable data transmission, and ensure system reliability. The market encompasses both discrete timing components and integrated timing solutions that combine multiple functions within single packages. Applications span from simple clock generation in consumer electronics to ultra-precise timing requirements in telecommunications infrastructure and satellite communications.

Market scope includes design, manufacturing, distribution, and support services for timing devices across diverse industry verticals. The EMEA designation reflects the geographic focus on European, Middle Eastern, and African markets, each presenting unique characteristics in terms of technology adoption, regulatory requirements, and growth trajectories.

Strategic analysis of the EMEA frequency control and timing devices market reveals a dynamic landscape characterized by technological innovation, expanding application domains, and evolving customer requirements. The market demonstrates resilient growth fundamentals supported by increasing digitalization across industries and growing demand for high-performance timing solutions. Key growth drivers include 5G network rollouts, automotive electronics advancement, and industrial IoT implementations.

Market segmentation analysis indicates strong performance across multiple product categories, with crystal oscillators maintaining dominant market position while emerging technologies like MEMS-based timing devices gain traction. Regional distribution shows European markets leading in terms of technological sophistication and manufacturing excellence, while Middle Eastern and African regions present significant growth opportunities driven by infrastructure development initiatives.

Competitive dynamics feature established global players alongside regional specialists, creating a diverse ecosystem that serves varied customer needs. Innovation focus areas include miniaturization, power efficiency, temperature stability, and integration capabilities. Future outlook remains positive with sustained demand growth expected across key application segments, supported by ongoing digital transformation trends and emerging technology adoption.

Digital transformation initiatives across EMEA regions serve as primary market drivers, creating substantial demand for precise timing solutions in emerging applications. The accelerating deployment of 5G networks requires sophisticated frequency control devices capable of supporting higher frequencies and stricter timing requirements. Telecommunications infrastructure modernization projects throughout the region drive consistent demand for high-performance timing solutions.

Automotive industry evolution toward electric and autonomous vehicles creates new opportunities for timing device manufacturers. Advanced driver assistance systems (ADAS), infotainment systems, and electric powertrain components require reliable timing references for optimal performance. Industrial automation trends including Industry 4.0 implementations drive demand for precise timing in manufacturing equipment and control systems.

Consumer electronics proliferation continues driving volume demand for cost-effective timing solutions. Smart devices, wearables, and IoT applications require compact, power-efficient timing components. Data center expansion across EMEA regions creates demand for high-performance timing solutions supporting cloud computing and edge processing applications. Aerospace and defense applications maintain steady demand for ultra-reliable timing devices meeting stringent performance specifications.

Supply chain complexities present significant challenges for market participants, particularly regarding raw material availability and manufacturing capacity constraints. The specialized nature of frequency control devices requires sophisticated manufacturing processes and quality control measures, creating barriers to entry for new participants. Cost pressures from customers seeking lower-priced solutions while maintaining performance requirements challenge manufacturers to optimize production efficiency.

Technical complexity associated with advanced timing solutions requires substantial research and development investments, limiting the ability of smaller companies to compete effectively. Regulatory compliance requirements across different EMEA countries create additional costs and complexity for market participants. Economic uncertainties in certain regions may impact infrastructure investment and technology adoption rates.

Technology transition challenges arise as customers evaluate migration from traditional quartz-based solutions to newer technologies like MEMS oscillators. Design-in cycles for timing devices can be lengthy, creating delays between product development and revenue realization. Competitive pricing pressures from low-cost manufacturers in other regions challenge EMEA-based companies to maintain market position while preserving profitability.

Emerging applications in artificial intelligence, machine learning, and edge computing create new market opportunities for specialized timing solutions. The growing Internet of Things ecosystem requires billions of connected devices, each needing reliable timing components. Smart city initiatives across EMEA regions drive demand for timing devices in traffic management, utility monitoring, and public safety systems.

Renewable energy infrastructure development presents opportunities for timing devices in solar inverters, wind turbine controllers, and energy storage systems. Healthcare technology advancement creates demand for precise timing in medical devices, diagnostic equipment, and telemedicine applications. Space technology development in Europe opens opportunities for radiation-hardened timing solutions for satellite and space exploration applications.

Regional expansion opportunities exist in developing markets within Africa and the Middle East as infrastructure investment accelerates. Vertical integration strategies allow companies to capture additional value by offering complete timing solutions rather than discrete components. Partnership opportunities with system integrators and OEMs enable market participants to access new customer segments and application areas.

Technological convergence drives market dynamics as timing devices integrate with other electronic functions to create comprehensive solutions. The shift toward software-defined systems requires programmable timing solutions that can adapt to changing requirements. Market consolidation trends see larger companies acquiring specialized timing device manufacturers to expand product portfolios and market reach.

Customer behavior evolution shows increasing preference for suppliers offering complete solutions rather than individual components. Time-to-market pressures drive demand for reference designs and development tools that accelerate product development cycles. Quality requirements continue increasing as timing devices become critical components in safety-critical applications.

Competitive dynamics intensify as traditional timing device manufacturers face competition from semiconductor companies offering integrated solutions. Innovation cycles accelerate with shorter product lifecycles requiring continuous research and development investment. Market access strategies evolve as companies leverage digital channels and direct customer engagement to reach new markets and applications.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the EMEA frequency control and timing devices market. Primary research includes extensive interviews with industry executives, technical specialists, and key decision-makers across the value chain. Survey methodologies capture quantitative data on market trends, customer preferences, and technology adoption patterns.

Secondary research encompasses analysis of industry reports, company financial statements, patent filings, and regulatory documents. Market modeling techniques incorporate statistical analysis and forecasting methods to project market trends and growth trajectories. Competitive intelligence gathering includes monitoring of company announcements, product launches, and strategic initiatives.

Data validation processes ensure accuracy through cross-referencing multiple sources and expert review. Regional analysis methodology accounts for local market conditions, regulatory environments, and cultural factors affecting technology adoption. Technology assessment includes evaluation of emerging trends and their potential market impact through expert consultation and technical analysis.

European markets dominate the EMEA frequency control and timing devices landscape, accounting for approximately 75% of regional market share. Germany, United Kingdom, France, and Italy represent the largest national markets, driven by strong automotive, industrial, and telecommunications sectors. Nordic countries show particular strength in telecommunications and IoT applications, while Eastern European markets demonstrate rapid growth in manufacturing and infrastructure development.

Middle Eastern markets exhibit strong growth potential with infrastructure investment driving demand for timing devices in telecommunications, energy, and transportation applications. The UAE and Saudi Arabia lead regional adoption, supported by smart city initiatives and economic diversification programs. African markets represent emerging opportunities with mobile telecommunications expansion and infrastructure development creating demand for cost-effective timing solutions.

Regional manufacturing capabilities vary significantly, with Europe maintaining advanced production facilities while Middle Eastern and African regions rely primarily on imports. Technology adoption rates differ across regions, with European markets embracing advanced solutions while developing regions focus on proven, cost-effective technologies. Regulatory environments create regional variations in product requirements and certification processes.

Market leadership in the EMEA frequency control and timing devices sector features a combination of global technology companies and specialized regional players. The competitive environment demonstrates strong innovation focus with companies investing heavily in research and development to maintain technological advantages.

Competitive strategies focus on technological differentiation, customer service excellence, and market-specific solutions. Strategic partnerships and acquisitions enable companies to expand capabilities and market reach while maintaining competitive positioning.

Product segmentation of the EMEA frequency control and timing devices market reveals diverse categories serving different application requirements and performance specifications. Crystal oscillators maintain the largest market segment, offering reliable performance across wide frequency ranges. Ceramic resonators provide cost-effective solutions for consumer electronics and automotive applications.

By Technology:

By Application:

Crystal oscillator segment demonstrates consistent growth driven by telecommunications infrastructure expansion and automotive electronics advancement. Temperature-compensated oscillators show particular strength in applications requiring precise timing across wide temperature ranges. Voltage-controlled oscillators benefit from increasing demand in phase-locked loop applications and frequency synthesis.

MEMS timing devices represent the fastest-growing category with adoption rates increasing by 15% annually as customers recognize benefits including improved reliability and integration capabilities. Programmable oscillators gain traction in applications requiring flexibility and reduced inventory complexity. Ultra-low power timing devices serve growing IoT and wearable device markets.

Frequency range analysis shows strong demand across the spectrum from low-frequency real-time clock applications to high-frequency RF timing requirements. Package innovations including smaller form factors and improved thermal performance drive adoption in space-constrained applications. Custom timing solutions represent growing market segment as customers seek differentiation through specialized performance characteristics.

Manufacturers benefit from diverse market opportunities across multiple application segments and geographic regions. Revenue diversification reduces dependence on single markets or technologies while providing stability during economic fluctuations. Technology leadership positions enable premium pricing and customer loyalty through superior performance and reliability.

Customers gain access to comprehensive timing solutions that improve system performance and reduce design complexity. Supply chain partnerships with established manufacturers ensure consistent product availability and technical support. Innovation collaboration enables customers to access latest technologies and custom solutions for specific applications.

Distributors benefit from growing market demand and expanding product portfolios that serve diverse customer bases. Technical expertise development enables value-added services including design support and application guidance. Regional market knowledge provides competitive advantages in serving local customers and understanding market requirements.

End users benefit from improved system reliability, reduced power consumption, and enhanced performance through advanced timing solutions. Cost optimization opportunities arise through standardization and volume purchasing arrangements. Technology roadmaps provide visibility into future capabilities and migration paths for evolving applications.

Strengths:

Weaknesses:

Opportunities:

Threats:

Miniaturization trend continues driving development of smaller timing devices without compromising performance characteristics. System integration approaches combine timing functions with other electronic components to reduce board space and improve reliability. Power efficiency becomes increasingly important as battery-powered applications proliferate across consumer and industrial segments.

Programmability features gain importance as customers seek flexibility in frequency selection and output characteristics. Temperature stability improvements enable timing devices to operate reliably in harsh environmental conditions. Frequency accuracy requirements increase as applications demand more precise timing references for optimal performance.

Digital interfaces replace traditional analog controls, enabling software configuration and monitoring capabilities. Reliability enhancement through improved packaging and manufacturing processes addresses demands from automotive and industrial applications. Cost optimization efforts focus on manufacturing efficiency and material selection while maintaining quality standards.

Customization services expand as customers seek differentiated solutions for specific applications and performance requirements. Environmental compliance drives development of lead-free and RoHS-compliant products. Supply chain localization trends see companies establishing regional manufacturing and distribution capabilities.

Technology partnerships between timing device manufacturers and semiconductor companies accelerate development of integrated solutions. Acquisition activities consolidate market participants and expand product portfolios to serve broader customer bases. Manufacturing investments in advanced production facilities improve quality and capacity while reducing costs.

Product launches focus on next-generation timing devices offering improved performance, smaller packages, and enhanced features. Standards development activities establish new specifications for emerging applications and technologies. Research collaborations with universities and research institutions advance fundamental timing technology understanding.

Market expansion initiatives target growing regions and application segments through strategic partnerships and direct investment. Sustainability programs address environmental concerns through improved manufacturing processes and recyclable materials. Digital transformation efforts modernize operations and customer engagement through advanced technologies and data analytics.

Quality certifications demonstrate compliance with automotive, aerospace, and industrial standards. Customer support enhancements include expanded technical services and design assistance capabilities. Supply chain resilience improvements diversify sourcing and manufacturing locations to ensure consistent product availability.

Strategic positioning recommendations emphasize focus on high-growth application segments including automotive electronics, 5G infrastructure, and IoT devices. MarkWide Research analysis suggests companies should invest in MEMS timing technology development to capture emerging market opportunities. Regional expansion strategies should prioritize Middle Eastern and African markets where infrastructure development creates substantial demand.

Product development efforts should concentrate on integration capabilities, power efficiency, and miniaturization to meet evolving customer requirements. Partnership strategies with system integrators and OEMs can accelerate market penetration and customer acquisition. Manufacturing optimization through automation and process improvement can enhance competitiveness while maintaining quality standards.

Customer engagement approaches should emphasize technical support and design assistance to differentiate from commodity suppliers. Innovation investment in emerging technologies like silicon-based timing and programmable solutions positions companies for future growth. Supply chain diversification reduces risks and improves resilience against disruptions.

Market intelligence capabilities should monitor emerging applications and technology trends to identify new opportunities. Sustainability initiatives address growing customer and regulatory requirements while potentially reducing costs. Digital transformation investments improve operational efficiency and customer experience through modern technologies and processes.

Long-term growth prospects for the EMEA frequency control and timing devices market remain positive, supported by continued digitalization and emerging technology adoption. 5G network deployment will drive sustained demand for high-performance timing solutions throughout the forecast period. Automotive industry transformation toward electric and autonomous vehicles creates substantial opportunities for specialized timing devices.

Technology evolution will see increased adoption of MEMS-based solutions and silicon timing devices, with market penetration expected to reach 25% within the next five years. Integration trends will continue as customers seek comprehensive solutions rather than discrete components. Regional growth patterns indicate accelerating adoption in developing markets while mature regions focus on advanced applications.

Market consolidation may continue as larger companies acquire specialized manufacturers to expand capabilities and market reach. Innovation focus will emphasize power efficiency, miniaturization, and programmability to serve evolving application requirements. MWR projections indicate sustained growth across key market segments with particular strength in telecommunications and automotive applications.

Competitive dynamics will intensify as traditional timing device manufacturers face increasing competition from integrated circuit companies offering comprehensive solutions. Customer requirements will continue evolving toward higher performance, greater reliability, and improved cost-effectiveness. Regulatory environment changes may create new opportunities and challenges for market participants across different regions.

The EMEA frequency control and timing devices market presents a dynamic and evolving landscape characterized by strong growth fundamentals, technological innovation, and expanding application opportunities. Market analysis reveals robust demand drivers including 5G deployment, automotive electronics advancement, and IoT proliferation that support sustained growth across the forecast period.

Regional diversity within EMEA provides multiple growth vectors, with European markets leading in technological sophistication while Middle Eastern and African regions offer substantial expansion opportunities. Technology trends toward integration, miniaturization, and enhanced performance create competitive advantages for innovative companies while challenging traditional approaches.

Strategic success in this market requires balanced focus on technological innovation, customer service excellence, and operational efficiency. Companies that effectively navigate the evolving competitive landscape while addressing changing customer requirements will be well-positioned to capture growth opportunities and maintain market leadership. Future prospects remain positive as the fundamental requirement for precise timing in electronic systems ensures continued market relevance and expansion potential across diverse application segments and geographic regions.

What is Frequency Control And Timing Devices?

Frequency Control And Timing Devices are essential components used in various electronic systems to maintain accurate timing and frequency stability. They are widely utilized in telecommunications, consumer electronics, and industrial applications.

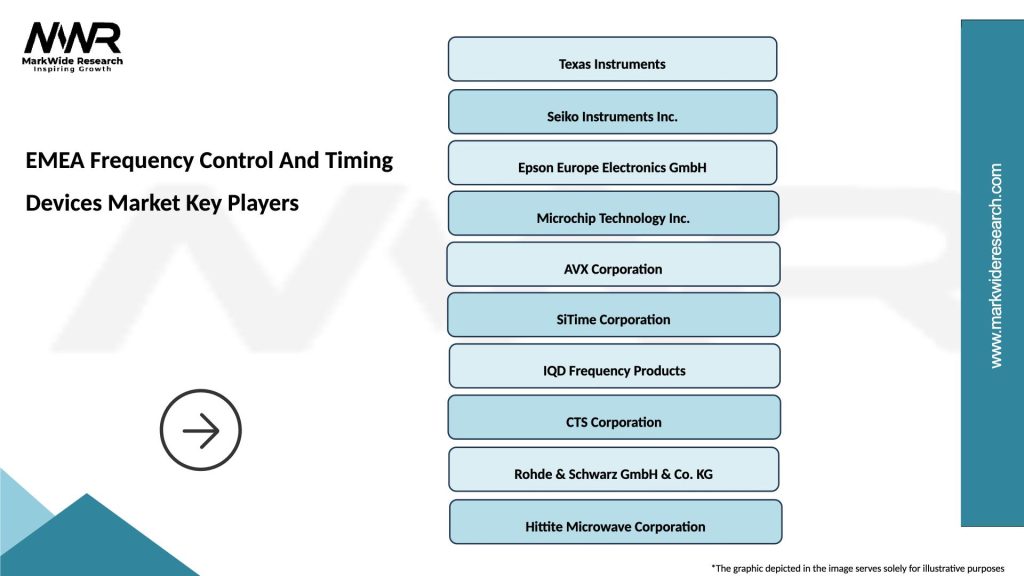

What are the key players in the EMEA Frequency Control And Timing Devices Market?

Key players in the EMEA Frequency Control And Timing Devices Market include Texas Instruments, Seiko Instruments, and NXP Semiconductors, among others. These companies are known for their innovative solutions and extensive product portfolios in frequency control technologies.

What are the growth factors driving the EMEA Frequency Control And Timing Devices Market?

The EMEA Frequency Control And Timing Devices Market is driven by the increasing demand for high-performance electronic devices, advancements in telecommunications infrastructure, and the growing adoption of IoT applications. These factors contribute to the rising need for precise timing solutions.

What challenges does the EMEA Frequency Control And Timing Devices Market face?

The EMEA Frequency Control And Timing Devices Market faces challenges such as the rapid pace of technological change and the need for continuous innovation. Additionally, competition from alternative technologies can impact market growth and profitability.

What opportunities exist in the EMEA Frequency Control And Timing Devices Market?

Opportunities in the EMEA Frequency Control And Timing Devices Market include the expansion of 5G networks and the increasing integration of frequency control devices in automotive applications. These trends are expected to create new avenues for growth and innovation.

What trends are shaping the EMEA Frequency Control And Timing Devices Market?

Trends shaping the EMEA Frequency Control And Timing Devices Market include the miniaturization of devices, the rise of smart technologies, and the growing emphasis on energy efficiency. These trends are influencing product development and market dynamics.

EMEA Frequency Control And Timing Devices Market

| Segmentation Details | Description |

|---|---|

| Product Type | Quartz Oscillators, MEMS Oscillators, Atomic Clocks, TCXO |

| Technology | Frequency Synthesis, Phase-Locked Loop, Direct Digital Synthesis, Time Code Generators |

| End User | Telecommunications, Aerospace, Automotive Electronics, Consumer Electronics |

| Application | Network Synchronization, Signal Processing, Timekeeping, Test Equipment |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the EMEA Frequency Control And Timing Devices Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at