444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The EMEA (Europe, Middle East, and Africa) blood glucose monitoring market is a rapidly growing sector in the healthcare industry. Blood glucose monitoring refers to the process of measuring and monitoring the blood glucose levels in individuals, especially those with diabetes. The market encompasses various devices, including glucose meters, continuous glucose monitoring (CGM) systems, and testing strips. These devices play a crucial role in diabetes management by providing real-time data on blood glucose levels.

Meaning

Blood glucose monitoring is vital for individuals with diabetes as it helps them manage their condition effectively. By regularly monitoring their blood glucose levels, patients can make informed decisions regarding their diet, exercise, and medication. This proactive approach can prevent complications and improve their overall quality of life. Blood glucose monitoring devices provide accurate and reliable data, allowing healthcare professionals to tailor treatment plans and adjust medications as necessary.

Executive Summary

The EMEA blood glucose monitoring market is experiencing substantial growth due to the rising prevalence of diabetes and the increasing awareness of the importance of blood glucose management. The market is driven by technological advancements in monitoring devices, the growing geriatric population, and the rising adoption of self-monitoring devices. However, the market also faces challenges such as high costs associated with devices and the lack of reimbursement policies in some regions. Despite these restraints, there are significant opportunities for market growth, including the development of non-invasive glucose monitoring technologies and increasing healthcare expenditure in emerging economies.

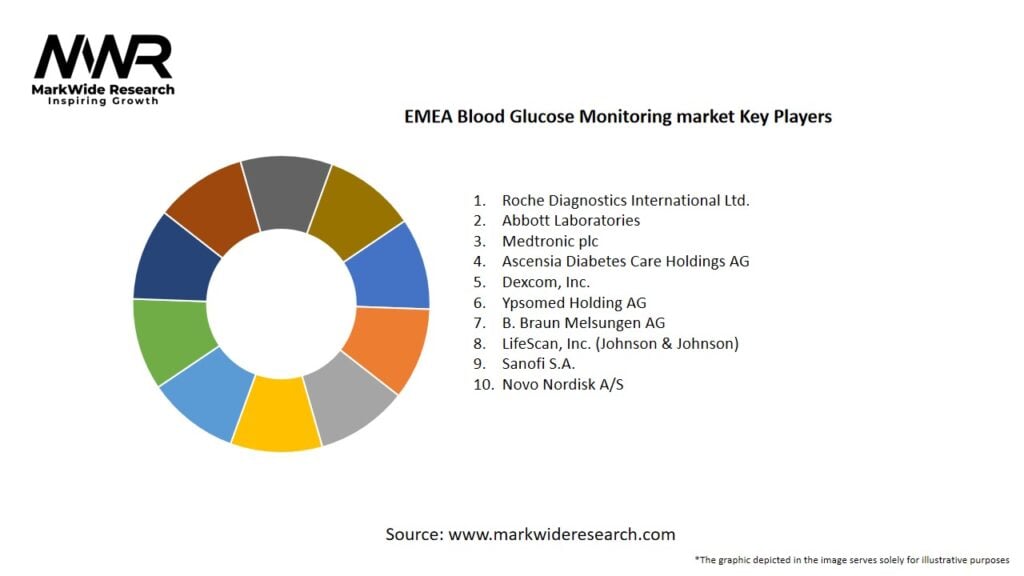

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The EMEA blood glucose monitoring market is driven by various dynamics, including the rising prevalence of diabetes, technological advancements, growing geriatric population, and increasing adoption of self-monitoring devices. These dynamics shape the market landscape and influence market players, healthcare professionals, and patients. The market dynamics also include challenges such as high device costs, lack of reimbursement policies, data privacy concerns, and limited awareness and access in developing countries. However, the market presents opportunities for innovation, non-invasive technologies, emerging economies, and AI integration.

Regional Analysis

The EMEA blood glucose monitoring market is divided into several key regions, including Europe, the Middle East, and Africa. Europe dominates the market due to its well-established healthcare infrastructure, high prevalence of diabetes, and advanced technological advancements. The Middle East and Africa regions are experiencing significant market growth due to the increasing adoption of blood glucose monitoring devices, growing healthcare expenditure, and rising awareness about diabetes management. These regions present untapped opportunities for market players to expand their presence and cater to the growing demand for blood glucose monitoring devices.

Competitive Landscape

Leading Companies in the EMEA Blood Glucose Monitoring Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The EMEA blood glucose monitoring market can be segmented based on product type, end-user, and distribution channel.

Segmentation allows market players to target specific customer segments and tailor their marketing strategies and product offerings accordingly. It also enables a deeper understanding of customer preferences and demands within each segment, facilitating effective market positioning and competitive advantage.

Category-wise Insights

Understanding the different categories within the blood glucose monitoring market provides insights into customer preferences, product usage patterns, and the potential for product innovation and development.

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

A SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis provides a comprehensive assessment of the EMEA blood glucose monitoring market.

Analyzing the market’s strengths, weaknesses, opportunities, and threats helps stakeholders understand the market’s current state, identify potential risks and challenges, and devise effective strategies for success.

Market Key Trends

Identifying and monitoring key market trends enables industry participants to stay ahead of the curve, adapt to changing customer needs, and capitalize on emerging opportunities.

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the EMEA blood glucose monitoring market. The pandemic disrupted healthcare systems, causing delays in routine diabetes care and reduced access to healthcare facilities. However, the pandemic also highlighted the importance of remote monitoring and self-management of chronic conditions, leading to increased adoption of blood glucose monitoring devices by individuals staying at home. The market witnessed a surge in demand for home-use devices and telehealth solutions. Additionally, the pandemic accelerated digital health transformation, with the integration of telemedicine platforms and remote monitoring technologies. As the healthcare system gradually recovers from the pandemic, the blood glucose monitoring market is expected to regain momentum with renewed focus on diabetes management and proactive healthcare measures.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the EMEA blood glucose monitoring market looks promising, driven by factors such as the rising prevalence of diabetes, technological advancements, and increasing adoption of self-monitoring devices. The market is expected to witness further growth with the development of non-invasive monitoring technologies, integration of artificial intelligence and data analytics, and the expansion of distribution networks in untapped regions. However, addressing affordability concerns, reimbursement policies, data privacy, and access challenges in developing countries will be crucial for sustainable market growth. The industry should also focus on educating healthcare professionals and patients, fostering collaborations, and embracing digital health solutions to enhance diabetes management and improve patient outcomes.

Conclusion

The EMEA blood glucose monitoring market is experiencing significant growth, driven by the increasing prevalence of diabetes and the growing importance of blood glucose management. Technological advancements, such as wireless connectivity, smartphone compatibility, and non-invasive monitoring techniques, are enhancing user experience and providing accurate data. Despite challenges related to affordability, reimbursement, data privacy, and limited access in developing countries, the market presents significant opportunities for industry participants. Collaboration, research and development, addressing affordability concerns, and embracing digital health solutions are key strategies for success in this rapidly evolving market. The future outlook remains promising, with a focus on improving diabetes management and empowering patients to take proactive control of their health.

What is Blood Glucose Monitoring?

Blood Glucose Monitoring refers to the methods and devices used to measure glucose levels in the blood, primarily for managing diabetes. This includes various technologies such as glucometers, continuous glucose monitors, and mobile health applications.

What are the key players in the EMEA Blood Glucose Monitoring market?

Key players in the EMEA Blood Glucose Monitoring market include Abbott Laboratories, Roche Diagnostics, and Medtronic, among others. These companies are known for their innovative products and extensive distribution networks in the healthcare sector.

What are the main drivers of the EMEA Blood Glucose Monitoring market?

The main drivers of the EMEA Blood Glucose Monitoring market include the rising prevalence of diabetes, increasing awareness about diabetes management, and advancements in monitoring technologies. Additionally, the growing demand for home healthcare solutions is contributing to market growth.

What challenges does the EMEA Blood Glucose Monitoring market face?

The EMEA Blood Glucose Monitoring market faces challenges such as regulatory hurdles, high costs of advanced monitoring devices, and the need for continuous innovation. Additionally, there is competition from alternative diabetes management solutions that may impact market dynamics.

What opportunities exist in the EMEA Blood Glucose Monitoring market?

Opportunities in the EMEA Blood Glucose Monitoring market include the development of smart glucose monitoring devices, integration of artificial intelligence for personalized diabetes management, and expansion into emerging markets. These innovations can enhance patient outcomes and drive market growth.

What trends are shaping the EMEA Blood Glucose Monitoring market?

Trends shaping the EMEA Blood Glucose Monitoring market include the increasing adoption of continuous glucose monitoring systems, the rise of telehealth services, and the integration of mobile applications for real-time data tracking. These trends are transforming how patients manage their diabetes.

EMEA Blood Glucose Monitoring market

| Segmentation Details | Description |

|---|---|

| Product Type | Continuous Glucose Monitors, Blood Glucose Meters, Test Strips, Lancets |

| End User | Hospitals, Homecare, Diagnostic Laboratories, Clinics |

| Technology | Enzymatic, Non-Enzymatic, Optical, Electrometric |

| Distribution Channel | Pharmacies, Online Retail, Hospitals, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the EMEA Blood Glucose Monitoring Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at