444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The embedded AI market represents a transformative sector where artificial intelligence capabilities are integrated directly into hardware devices, enabling real-time processing and decision-making at the edge. This rapidly expanding market encompasses a wide range of applications, from smart home devices and autonomous vehicles to industrial automation systems and healthcare monitoring equipment. The integration of AI processing capabilities into embedded systems is revolutionizing how devices interact with their environment, process data, and deliver intelligent responses without relying on cloud connectivity.

Market dynamics indicate substantial growth driven by increasing demand for real-time processing, reduced latency requirements, and enhanced privacy protection through local data processing. The sector is experiencing a compound annual growth rate of 18.2%, reflecting the accelerating adoption of AI-enabled devices across multiple industries. Key technological advancements in neural processing units, edge computing chips, and machine learning algorithms are enabling more sophisticated AI capabilities in resource-constrained embedded environments.

Industry adoption spans diverse sectors including automotive, consumer electronics, healthcare, industrial automation, and telecommunications. The market’s expansion is particularly notable in applications requiring low-power consumption, real-time decision making, and offline functionality. Major technology companies are investing heavily in developing specialized processors and software frameworks optimized for embedded AI applications, creating a competitive landscape focused on performance, efficiency, and integration capabilities.

The embedded AI market refers to the sector encompassing artificial intelligence technologies that are integrated directly into hardware devices, enabling intelligent processing and decision-making capabilities at the device level without requiring external connectivity or cloud-based processing. This market includes specialized processors, software frameworks, development tools, and complete system solutions designed to bring AI functionality to resource-constrained embedded systems.

Embedded AI systems combine traditional embedded computing with machine learning algorithms, neural networks, and intelligent processing capabilities. These systems are characterized by their ability to perform inference tasks, pattern recognition, and predictive analytics locally on the device, providing immediate responses and maintaining functionality even when disconnected from networks. The technology encompasses various implementation approaches, including dedicated AI accelerators, optimized software libraries, and hybrid processing architectures.

Key characteristics of embedded AI include low latency processing, energy efficiency, real-time performance, and the ability to operate in diverse environmental conditions. The market serves applications where traditional cloud-based AI solutions are impractical due to connectivity limitations, privacy requirements, or response time constraints. This technology enables devices to become more autonomous, adaptive, and intelligent while maintaining the reliability and efficiency expected from embedded systems.

The embedded AI market is experiencing unprecedented growth as organizations across industries recognize the value of bringing artificial intelligence capabilities directly to edge devices. This comprehensive market analysis reveals significant opportunities driven by technological advancements, changing consumer expectations, and evolving business requirements for intelligent, autonomous systems.

Market expansion is being fueled by several key factors, including the proliferation of Internet of Things devices, increasing demand for privacy-preserving AI solutions, and the need for real-time processing capabilities in critical applications. The automotive sector leads adoption with 42% market share, followed by consumer electronics and industrial automation segments. Technological innovations in neuromorphic computing, quantized neural networks, and specialized AI processors are enabling more sophisticated capabilities in power-constrained environments.

Regional analysis shows North America maintaining market leadership, while Asia-Pacific demonstrates the fastest growth trajectory due to manufacturing capabilities and technology adoption. The competitive landscape features both established semiconductor companies and emerging AI-focused startups, creating a dynamic ecosystem of innovation and collaboration. MarkWide Research analysis indicates that successful market participants are focusing on vertical-specific solutions, developer-friendly tools, and comprehensive ecosystem support to capture market opportunities.

Strategic insights reveal several critical trends shaping the embedded AI market landscape. The following key observations provide essential understanding for stakeholders:

Market maturation is evident in the increasing standardization of development tools, emergence of industry-specific reference designs, and growing availability of pre-trained models optimized for embedded deployment. These developments are reducing barriers to entry and accelerating adoption across various market segments.

Primary growth drivers for the embedded AI market stem from technological advancements, evolving user expectations, and changing business requirements across multiple industries. The convergence of these factors is creating substantial momentum for market expansion.

Technological advancement represents the most significant driver, with breakthroughs in neural processing architectures, algorithm optimization, and semiconductor manufacturing enabling previously impossible AI capabilities in embedded systems. The development of specialized AI accelerators and neuromorphic processors is providing the computational power needed for complex machine learning tasks while maintaining energy efficiency requirements.

Privacy and data security concerns are driving organizations to adopt embedded AI solutions that process sensitive information locally rather than transmitting it to cloud services. This trend is particularly strong in healthcare, financial services, and personal device applications where data protection is paramount. Local processing eliminates many security vulnerabilities associated with data transmission and storage.

Real-time processing requirements in applications such as autonomous vehicles, industrial automation, and robotics are creating demand for AI systems that can make instantaneous decisions without network latency. The ability to process information and respond within milliseconds is becoming critical for safety-critical and time-sensitive applications.

Cost optimization is another key driver, as embedded AI solutions can reduce operational expenses by minimizing cloud computing costs, reducing bandwidth requirements, and enabling more efficient system architectures. Organizations are recognizing the long-term economic benefits of edge-based AI processing, particularly for high-volume applications.

Market constraints present significant challenges that organizations must address to successfully implement embedded AI solutions. Understanding these limitations is crucial for realistic market assessment and strategic planning.

Technical complexity represents a primary restraint, as embedded AI development requires specialized expertise in both artificial intelligence and embedded systems engineering. The intersection of these disciplines creates a skills gap that many organizations struggle to fill, limiting their ability to develop and deploy embedded AI solutions effectively.

Hardware limitations continue to constrain the types of AI workloads that can be efficiently executed on embedded devices. Despite advances in processor technology, memory bandwidth, storage capacity, and power consumption remain significant bottlenecks for complex AI applications. These constraints require careful optimization and often limit the sophistication of AI models that can be deployed.

Development costs associated with embedded AI projects can be substantial, particularly for custom hardware solutions and specialized software development. The need for specialized tools, extended development cycles, and rigorous testing procedures increases project costs and time-to-market, potentially limiting adoption among smaller organizations.

Standardization challenges create fragmentation in the embedded AI ecosystem, with multiple competing architectures, development frameworks, and deployment models. This lack of standardization increases development complexity, limits portability, and creates vendor lock-in concerns that may slow adoption in some market segments.

Regulatory uncertainty in emerging AI applications, particularly in safety-critical sectors such as automotive and healthcare, creates additional challenges for market participants. Evolving compliance requirements and certification processes can delay product launches and increase development costs.

Emerging opportunities in the embedded AI market present substantial potential for growth and innovation across multiple sectors. These opportunities are driven by technological convergence, evolving user needs, and expanding application domains.

Automotive transformation represents one of the most significant opportunities, with the transition to autonomous vehicles, advanced driver assistance systems, and connected car technologies creating massive demand for embedded AI capabilities. The automotive sector’s adoption rate of 38% annually demonstrates the substantial market potential in this vertical.

Healthcare digitization is creating opportunities for embedded AI in medical devices, wearable health monitors, and diagnostic equipment. The ability to perform real-time health monitoring, early disease detection, and personalized treatment recommendations at the point of care represents a transformative opportunity for healthcare delivery.

Smart city initiatives worldwide are driving demand for embedded AI in infrastructure monitoring, traffic management, environmental sensing, and public safety systems. These applications require distributed intelligence capable of operating reliably in diverse environmental conditions while providing real-time insights and automated responses.

Industrial automation evolution toward Industry 4.0 concepts is creating opportunities for embedded AI in predictive maintenance, quality control, process optimization, and autonomous manufacturing systems. The integration of AI capabilities into industrial equipment enables more efficient operations and reduced downtime.

Consumer electronics continue to evolve toward more intelligent and personalized experiences, creating opportunities for embedded AI in smartphones, smart home devices, wearables, and entertainment systems. The demand for voice recognition, computer vision, and personalization capabilities is driving innovation in consumer-focused embedded AI solutions.

Market dynamics in the embedded AI sector reflect the complex interplay between technological innovation, competitive pressures, and evolving customer requirements. These dynamics are shaping market structure and influencing strategic decisions across the value chain.

Competitive intensity is increasing as traditional semiconductor companies, AI software providers, and system integrators compete for market share. This competition is driving rapid innovation in processor architectures, development tools, and complete solution offerings. Companies are differentiating through specialized vertical solutions, comprehensive developer support, and ecosystem partnerships.

Technology evolution continues at an accelerated pace, with new processor architectures, algorithm optimizations, and development methodologies emerging regularly. The rapid pace of change creates both opportunities for innovation and challenges for organizations trying to maintain competitive positioning. Companies must balance investment in current technologies with preparation for future developments.

Partnership strategies are becoming increasingly important as the complexity of embedded AI solutions requires collaboration between hardware providers, software developers, and system integrators. Strategic alliances enable companies to offer comprehensive solutions while focusing on their core competencies. These partnerships are particularly critical for addressing vertical market requirements and accelerating time-to-market.

Customer adoption patterns show increasing sophistication in embedded AI requirements, with organizations demanding more comprehensive solutions, better development tools, and stronger ecosystem support. Early adopters are moving beyond proof-of-concept implementations to production deployments, creating demand for enterprise-grade solutions with robust support and long-term roadmaps.

Comprehensive research methodology employed in this market analysis combines multiple data collection and analysis techniques to ensure accuracy, reliability, and depth of insights. The methodology encompasses both primary and secondary research approaches to provide a complete market perspective.

Primary research involved extensive interviews with industry executives, technology leaders, and market participants across the embedded AI value chain. These interviews provided insights into market trends, competitive dynamics, technology developments, and future outlook from key stakeholders. Survey data from embedded AI developers, system integrators, and end-users contributed additional quantitative insights into adoption patterns and requirements.

Secondary research encompassed analysis of industry reports, patent filings, academic publications, and company financial disclosures to understand technology trends, competitive positioning, and market developments. This research provided historical context and validated primary research findings through independent sources.

Market modeling techniques were employed to analyze market size, growth projections, and segmentation patterns. Statistical analysis of adoption rates, technology penetration, and regional variations provided quantitative foundation for market insights. Scenario analysis explored potential market developments under different technological and economic conditions.

Expert validation processes ensured research accuracy through review by industry experts, academic researchers, and technology specialists. This validation process confirmed findings, identified potential biases, and enhanced the reliability of conclusions and projections.

Regional market dynamics reveal significant variations in embedded AI adoption, technology development, and growth patterns across major geographic markets. These regional differences reflect varying technological capabilities, market maturity, and industry focus areas.

North America maintains market leadership with 45% regional market share, driven by strong technology innovation, substantial R&D investment, and early adoption across multiple industries. The region benefits from a robust ecosystem of semiconductor companies, AI software providers, and system integrators. Key growth drivers include automotive innovation, healthcare digitization, and defense applications requiring advanced embedded AI capabilities.

Asia-Pacific demonstrates the fastest growth trajectory with 22% annual expansion rate, fueled by manufacturing capabilities, technology adoption, and government initiatives supporting AI development. China, Japan, and South Korea lead regional development through substantial investments in AI research, semiconductor manufacturing, and smart city initiatives. The region’s strength in consumer electronics manufacturing provides significant opportunities for embedded AI integration.

Europe focuses on industrial applications and automotive innovation, with 28% regional market presence concentrated in Germany, France, and the United Kingdom. European market development emphasizes privacy protection, regulatory compliance, and sustainable technology solutions. The region’s automotive industry leadership drives significant embedded AI adoption in autonomous vehicle development and advanced driver assistance systems.

Emerging markets in Latin America, Middle East, and Africa show increasing interest in embedded AI solutions, particularly for infrastructure development, healthcare applications, and industrial automation. While currently representing smaller market shares, these regions present significant long-term growth potential as technology costs decrease and local capabilities develop.

The competitive landscape in the embedded AI market features diverse participants ranging from established semiconductor giants to innovative AI-focused startups. This dynamic ecosystem creates opportunities for collaboration while driving intense competition for market leadership.

Competitive strategies focus on vertical market specialization, comprehensive developer ecosystems, and strategic partnerships to address complex customer requirements. Companies are investing heavily in AI-specific processor architectures, optimized software frameworks, and industry-specific solutions to differentiate their offerings.

Market consolidation trends include strategic acquisitions, technology licensing agreements, and joint development partnerships as companies seek to expand capabilities and market reach. These activities are creating more comprehensive solution offerings while potentially reducing the number of independent competitors in specific market segments.

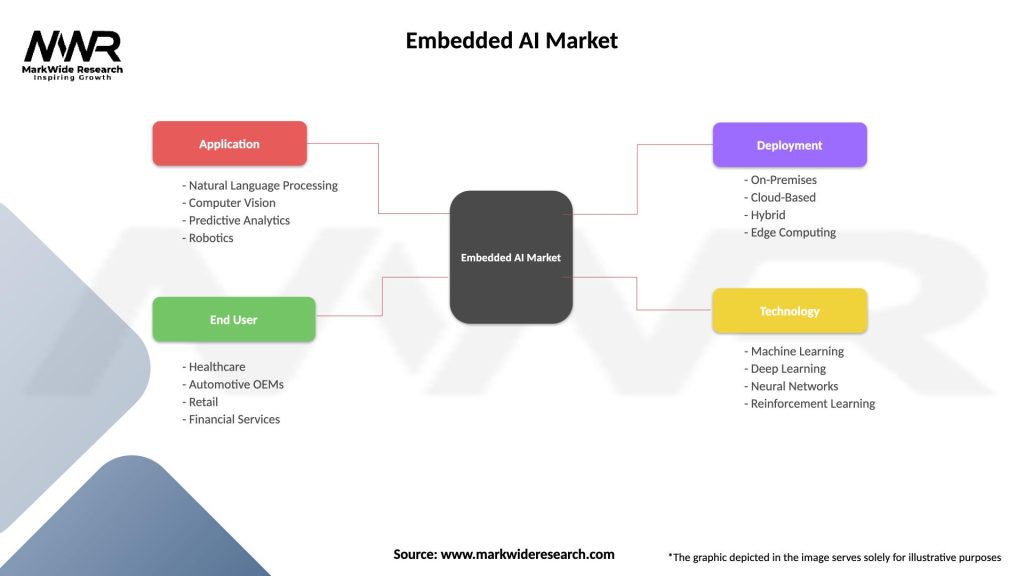

Market segmentation analysis reveals distinct categories based on technology approach, application domain, and deployment characteristics. Understanding these segments is crucial for identifying specific opportunities and developing targeted strategies.

By Technology:

By Application:

By Deployment Model:

Automotive category represents the largest and fastest-growing segment, driven by the transition toward autonomous vehicles and advanced driver assistance systems. This category demonstrates 35% adoption acceleration as automotive manufacturers integrate AI capabilities for safety, navigation, and user experience enhancement. Key applications include object detection, path planning, driver monitoring, and predictive maintenance systems.

Consumer electronics category shows strong growth in AI-enabled devices, with smartphones leading adoption followed by smart home products and wearables. The integration of voice recognition, computer vision, and personalization capabilities is becoming standard in premium consumer devices. This category benefits from high-volume production and rapid technology refresh cycles.

Industrial automation category focuses on predictive maintenance, quality control, and process optimization applications. The adoption of Industry 4.0 concepts is driving demand for embedded AI in manufacturing equipment, with 28% efficiency improvements reported in early implementations. This category emphasizes reliability, real-time performance, and integration with existing industrial systems.

Healthcare category demonstrates significant potential for embedded AI in medical devices, diagnostic equipment, and patient monitoring systems. Applications include real-time vital sign analysis, early disease detection, and personalized treatment recommendations. Regulatory requirements and safety considerations create longer development cycles but also provide competitive barriers for established solutions.

Security and surveillance category leverages embedded AI for intelligent video analysis, threat detection, and automated response systems. The ability to process video streams locally while maintaining privacy and reducing bandwidth requirements drives adoption in this category. Smart city initiatives and enterprise security applications represent major growth opportunities.

Technology providers benefit from expanding market opportunities as embedded AI creates demand for specialized processors, development tools, and software frameworks. The growing market enables companies to justify substantial R&D investments while building sustainable competitive advantages through technology leadership and ecosystem development.

System integrators gain opportunities to provide higher-value solutions by incorporating AI capabilities into traditional embedded systems. The complexity of embedded AI implementation creates demand for specialized expertise and comprehensive integration services, enabling premium pricing and stronger customer relationships.

End-user organizations realize significant operational benefits through embedded AI adoption, including improved efficiency, enhanced user experiences, and new product capabilities. Local AI processing reduces operational costs, improves response times, and enables new business models that were previously impractical.

Developers and engineers benefit from expanding career opportunities and access to advanced development tools and frameworks. The growing embedded AI ecosystem provides resources for skill development, community support, and career advancement in this high-demand technical area.

Investors and stakeholders gain exposure to a rapidly growing technology sector with substantial long-term potential. The embedded AI market offers opportunities for both established technology companies and innovative startups, creating diverse investment options across the value chain.

Society and consumers benefit from more intelligent, responsive, and efficient devices and systems. Embedded AI enables improved safety in transportation, better healthcare outcomes, enhanced security, and more personalized experiences across various applications.

Strengths:

Weaknesses:

Opportunities:

Threats:

Edge-first AI architecture is becoming the dominant trend as organizations prioritize local processing capabilities over cloud-dependent solutions. This shift reflects growing concerns about data privacy, network reliability, and response time requirements. Companies are designing AI systems with embedded processing as the primary capability, using cloud connectivity for model updates and advanced analytics rather than core functionality.

Neuromorphic computing emergence represents a significant technological trend, with brain-inspired processor architectures offering potential breakthroughs in energy efficiency and learning capabilities. These processors mimic neural network structures in hardware, enabling more efficient AI processing and adaptive learning capabilities that could revolutionize embedded AI applications.

Model compression and optimization techniques are advancing rapidly, enabling deployment of sophisticated AI models on resource-constrained devices. Techniques such as quantization, pruning, and knowledge distillation are making it possible to run complex neural networks on embedded processors while maintaining acceptable accuracy levels.

Vertical market specialization is intensifying as companies develop industry-specific embedded AI solutions optimized for particular use cases and requirements. This trend toward specialization enables better performance, easier integration, and stronger competitive positioning in targeted market segments.

Development tool sophistication continues improving with more comprehensive frameworks, automated optimization tools, and integrated development environments specifically designed for embedded AI applications. These tools are reducing development complexity and accelerating time-to-market for embedded AI solutions.

Security integration is becoming a standard requirement rather than an optional feature, with embedded AI systems incorporating hardware-based security, encrypted model storage, and secure execution environments to protect against various threat vectors.

Recent industry developments demonstrate the rapid pace of innovation and market evolution in the embedded AI sector. These developments reflect both technological advances and changing market dynamics that are shaping the industry’s future direction.

Processor architecture innovations include the introduction of specialized AI accelerators optimized for embedded applications, with major semiconductor companies releasing new processor families designed specifically for edge AI workloads. These processors feature improved energy efficiency, enhanced parallel processing capabilities, and integrated security features.

Software framework evolution has produced more sophisticated development tools and runtime environments optimized for embedded deployment. Major technology companies have released updated versions of their AI frameworks with better support for resource-constrained environments, automated optimization capabilities, and improved debugging tools.

Strategic partnerships between hardware providers, software companies, and system integrators are creating comprehensive ecosystem solutions. These partnerships enable companies to offer complete embedded AI solutions while focusing on their core competencies, accelerating market development and customer adoption.

Automotive industry adoption has accelerated significantly, with major automotive manufacturers announcing embedded AI integration plans for next-generation vehicles. These developments include advanced driver assistance systems, autonomous driving capabilities, and intelligent user interfaces powered by embedded AI processing.

Healthcare applications are expanding rapidly, with regulatory approvals for AI-enabled medical devices and diagnostic equipment incorporating embedded AI capabilities. These developments demonstrate growing acceptance of AI technology in safety-critical healthcare applications.

Strategic recommendations for market participants focus on positioning for long-term success in the rapidly evolving embedded AI landscape. MarkWide Research analysis suggests several key strategies for different types of market participants.

Technology providers should prioritize vertical market specialization while maintaining platform flexibility to address diverse customer requirements. Investment in comprehensive developer ecosystems, including tools, documentation, and community support, will be critical for market success. Companies should also consider strategic partnerships to provide complete solutions rather than competing solely on individual components.

System integrators should develop deep expertise in specific vertical markets while building capabilities across the embedded AI technology stack. Focus on providing end-to-end solutions that address customer business objectives rather than just technical requirements. Investment in training and certification programs will be essential for building the necessary expertise.

End-user organizations should develop clear embedded AI strategies that align with business objectives and technical capabilities. Start with pilot projects in well-defined use cases before expanding to more complex applications. Build internal expertise through training and strategic hiring while leveraging external partners for specialized capabilities.

Investors should focus on companies with strong technology differentiation, comprehensive market strategies, and experienced management teams. Consider both established technology companies expanding into embedded AI and innovative startups developing breakthrough technologies. Evaluate companies based on their ability to execute in specific vertical markets rather than just general technology capabilities.

Future market evolution indicates continued strong growth driven by technological advancement, expanding applications, and increasing adoption across multiple industries. The embedded AI market is expected to maintain robust expansion with compound annual growth rates exceeding 20% over the next five years.

Technology development will focus on improving energy efficiency, processing performance, and ease of development. Advances in neuromorphic computing, quantum-inspired algorithms, and specialized processor architectures will enable new categories of embedded AI applications. Integration with emerging technologies such as 5G networks and advanced sensors will create additional opportunities for innovation.

Application expansion will continue across existing market segments while emerging in new areas such as augmented reality, environmental monitoring, and space exploration. The automotive sector will remain a primary growth driver as autonomous vehicle development accelerates. Healthcare applications will expand significantly as regulatory frameworks mature and technology capabilities improve.

Market maturation will bring increased standardization, improved interoperability, and more comprehensive ecosystem support. Development tools will become more sophisticated and user-friendly, reducing barriers to entry for new market participants. Industry consolidation may occur as successful companies acquire complementary capabilities and market access.

Geographic expansion will see increased adoption in emerging markets as technology costs decrease and local capabilities develop. Asia-Pacific will continue demonstrating the fastest growth, while established markets in North America and Europe will focus on advanced applications and vertical specialization.

The embedded AI market represents a transformative technology sector with substantial growth potential and significant implications for multiple industries. The convergence of advancing AI algorithms, specialized processor architectures, and growing demand for intelligent edge devices is creating unprecedented opportunities for innovation and market expansion.

Market dynamics indicate strong fundamentals supporting continued growth, with technological advancement, privacy requirements, and real-time processing needs driving adoption across diverse applications. While challenges exist in terms of technical complexity and skills availability, the overall market trajectory remains highly positive with expanding opportunities in automotive, healthcare, industrial automation, and consumer electronics sectors.

Success factors for market participants include focus on vertical specialization, comprehensive ecosystem development, and strategic partnerships to address complex customer requirements. Organizations that can effectively combine AI expertise with embedded systems knowledge while providing complete solutions will be best positioned for long-term success in this dynamic market.

The future outlook for embedded AI remains exceptionally promising, with continued technological advancement, expanding applications, and growing market acceptance creating a foundation for sustained growth and innovation in the years ahead.

What is Embedded AI?

Embedded AI refers to the integration of artificial intelligence capabilities into hardware devices, enabling them to perform tasks such as data processing, decision-making, and automation without needing constant connectivity to the cloud. This technology is commonly used in applications like smart appliances, automotive systems, and industrial automation.

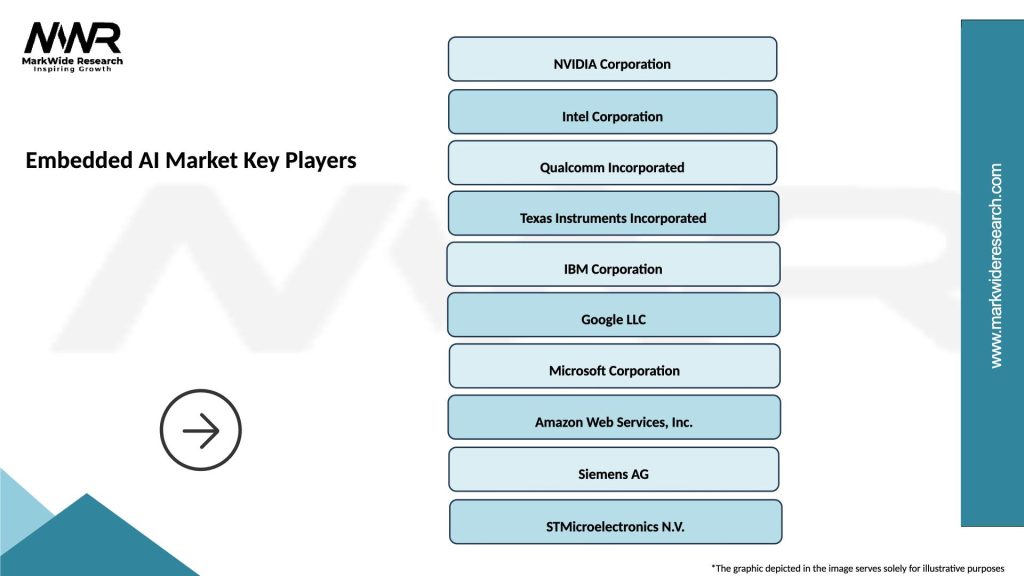

What are the key players in the Embedded AI Market?

Key players in the Embedded AI Market include NVIDIA, Intel, and Google, which provide advanced hardware and software solutions for AI integration. These companies focus on developing powerful processors and frameworks that facilitate the deployment of AI in various devices, among others.

What are the main drivers of growth in the Embedded AI Market?

The growth of the Embedded AI Market is driven by the increasing demand for smart devices, advancements in machine learning algorithms, and the need for real-time data processing in applications such as autonomous vehicles and smart manufacturing.

What challenges does the Embedded AI Market face?

Challenges in the Embedded AI Market include the complexity of integrating AI into existing systems, concerns over data privacy and security, and the need for specialized skills to develop and maintain AI solutions.

What opportunities exist in the Embedded AI Market?

The Embedded AI Market presents opportunities in sectors like healthcare, where AI can enhance diagnostic tools, and in smart home technology, where it can improve energy efficiency and user experience. Additionally, the rise of edge computing is creating new avenues for AI deployment.

What trends are shaping the Embedded AI Market?

Trends in the Embedded AI Market include the growing adoption of edge AI, which allows for processing data closer to the source, and the increasing use of AI in Internet of Things (IoT) devices. These trends are enhancing the capabilities of devices across various industries, including automotive and consumer electronics.

Embedded AI Market

| Segmentation Details | Description |

|---|---|

| Application | Natural Language Processing, Computer Vision, Predictive Analytics, Robotics |

| End User | Healthcare, Automotive OEMs, Retail, Financial Services |

| Deployment | On-Premises, Cloud-Based, Hybrid, Edge Computing |

| Technology | Machine Learning, Deep Learning, Neural Networks, Reinforcement Learning |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Embedded AI Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at