444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The electronics and electrical ceramics market represents a critical segment within the advanced materials industry, encompassing specialized ceramic materials designed for electronic and electrical applications. These high-performance materials demonstrate exceptional properties including superior dielectric strength, thermal stability, and electrical insulation capabilities. The market has experienced robust growth driven by increasing demand from telecommunications, automotive electronics, consumer electronics, and renewable energy sectors.

Market dynamics indicate substantial expansion opportunities as industries increasingly adopt miniaturized electronic components and advanced electrical systems. The growing emphasis on energy efficiency and sustainable technologies has positioned electrical ceramics as essential materials for next-generation electronic devices. Key applications span from capacitors and resistors to insulators and substrates in sophisticated electronic assemblies.

Regional distribution shows significant concentration in Asia-Pacific, particularly in countries with established electronics manufacturing ecosystems. The market demonstrates strong growth momentum with projected expansion at approximately 6.8% CAGR through the forecast period, reflecting increasing integration of ceramic materials in emerging technologies including 5G infrastructure, electric vehicles, and renewable energy systems.

The electronics and electrical ceramics market refers to the comprehensive ecosystem encompassing the production, distribution, and application of specialized ceramic materials engineered for electronic and electrical components. These advanced materials exhibit unique properties including high dielectric constants, low electrical conductivity, excellent thermal stability, and superior mechanical strength, making them indispensable for modern electronic applications.

Electronic ceramics encompass materials used in active electronic components such as capacitors, varistors, thermistors, and piezoelectric devices. Meanwhile, electrical ceramics primarily serve as insulating materials in power transmission systems, electrical equipment housings, and high-voltage applications. The market includes both traditional ceramic formulations and innovative compositions incorporating nanotechnology and advanced processing techniques.

Key characteristics defining this market include the integration of ceramic materials across diverse electronic applications, from consumer devices to industrial equipment. The sector encompasses raw material suppliers, ceramic manufacturers, component producers, and end-user industries, creating a complex value chain that supports global electronics manufacturing and electrical infrastructure development.

Market expansion in the electronics and electrical ceramics sector reflects the accelerating digitalization of global industries and increasing demand for high-performance electronic components. The market demonstrates strong fundamentals driven by technological advancement in telecommunications, automotive electronics, and renewable energy applications. Growth drivers include the proliferation of 5G networks, electric vehicle adoption, and smart grid infrastructure development.

Technological innovation continues to reshape market dynamics, with manufacturers developing advanced ceramic formulations offering enhanced performance characteristics. The integration of nanotechnology and precision manufacturing processes has enabled the production of ceramics with superior dielectric properties and improved reliability. Market participants are investing significantly in research and development to address evolving industry requirements.

Competitive landscape features established materials companies alongside specialized ceramic manufacturers, creating a diverse ecosystem of suppliers serving global electronics markets. The market benefits from increasing adoption rates of approximately 12% annually in emerging applications, particularly in automotive electronics and renewable energy systems. Future prospects remain positive, supported by continuous technological advancement and expanding application scope across multiple industries.

Strategic insights reveal several critical factors shaping the electronics and electrical ceramics market landscape:

Industry trends indicate increasing importance of ceramic materials in next-generation electronic systems, with particular emphasis on miniaturization and enhanced functionality. The market demonstrates resilience against economic fluctuations due to essential nature of electronic components across diverse industries.

Primary growth drivers propelling the electronics and electrical ceramics market include the rapid expansion of telecommunications infrastructure, particularly 5G network deployment requiring advanced ceramic components for base stations and communication equipment. The automotive industry’s transition toward electric vehicles has created substantial demand for ceramic materials in battery systems, power electronics, and charging infrastructure.

Consumer electronics proliferation continues driving market expansion as manufacturers seek materials offering superior performance in compact form factors. The increasing complexity of electronic devices requires ceramics with enhanced dielectric properties, thermal management capabilities, and reliability under demanding operating conditions. Smart device adoption has accelerated demand for miniaturized ceramic components supporting advanced functionality.

Renewable energy sector growth represents a significant market driver, with solar panels, wind turbines, and energy storage systems requiring specialized ceramic materials for power conversion and electrical insulation applications. The global push toward sustainable energy solutions has created new opportunities for ceramic manufacturers serving the clean technology sector. Industrial automation and Internet of Things (IoT) applications further contribute to market expansion through increased demand for sensor ceramics and electronic components.

Manufacturing complexity presents significant challenges for the electronics and electrical ceramics market, as production processes require precise control of material composition, sintering conditions, and quality parameters. The high-temperature processing requirements and specialized equipment needs create substantial capital investment barriers for new market entrants. Technical expertise requirements for ceramic formulation and processing limit the number of qualified suppliers in specialized application areas.

Cost considerations impact market growth, particularly in price-sensitive consumer electronics applications where manufacturers seek cost-effective alternatives to advanced ceramic materials. The premium pricing of high-performance ceramics compared to conventional materials can limit adoption in certain market segments. Supply chain vulnerabilities related to raw material availability and geopolitical factors affecting key producing regions create uncertainty for manufacturers and end users.

Competition from alternative materials poses ongoing challenges, as polymer-based and composite materials continue improving performance characteristics while offering cost advantages. The lengthy qualification processes required for ceramic materials in critical applications can delay market penetration and limit growth opportunities. Environmental regulations regarding ceramic manufacturing processes and material disposal create compliance costs and operational constraints for industry participants.

Emerging applications in electric vehicle technology present substantial growth opportunities for electronics and electrical ceramics manufacturers. The transition to electric mobility requires advanced ceramic materials for battery management systems, power electronics, and charging infrastructure, creating new revenue streams for industry participants. 5G infrastructure deployment offers significant expansion potential as telecommunications companies invest in network upgrades requiring specialized ceramic components.

Healthcare technology advancement creates opportunities for biocompatible ceramic materials in medical devices, diagnostic equipment, and implantable electronics. The aging global population and increasing healthcare spending drive demand for sophisticated medical technologies incorporating ceramic components. Aerospace and defense applications offer premium market opportunities for high-performance ceramics meeting stringent reliability and performance requirements.

Smart city initiatives worldwide create demand for ceramic materials in intelligent infrastructure systems, including smart lighting, traffic management, and environmental monitoring applications. The integration of IoT technologies across urban environments requires reliable electronic components incorporating advanced ceramic materials. Energy storage systems represent a rapidly growing opportunity as grid-scale battery installations and residential energy storage solutions require specialized ceramic components for safety and performance optimization.

Supply-demand dynamics in the electronics and electrical ceramics market reflect the complex interplay between technological advancement and manufacturing capacity. The market experiences cyclical patterns aligned with electronics industry trends, with demand fluctuations corresponding to consumer electronics product cycles and industrial investment patterns. Capacity utilization rates among ceramic manufacturers typically range around 75-85%, indicating healthy market conditions with room for expansion.

Pricing mechanisms vary significantly across different ceramic types and applications, with premium segments commanding higher margins due to specialized performance requirements. The market demonstrates price elasticity in commodity applications while maintaining stable pricing for high-performance specialty ceramics. Innovation cycles drive market dynamics as new ceramic formulations and manufacturing processes create competitive advantages and market differentiation opportunities.

Regulatory influences shape market dynamics through environmental standards, safety requirements, and quality certifications affecting ceramic materials used in critical applications. According to MarkWide Research analysis, regulatory compliance costs represent approximately 8-12% of total manufacturing expenses for ceramic producers serving regulated industries. Global trade patterns impact market dynamics through tariffs, trade agreements, and supply chain considerations affecting international ceramic materials commerce.

Comprehensive research approach employed in analyzing the electronics and electrical ceramics market combines primary and secondary research methodologies to ensure accuracy and completeness of market insights. The methodology encompasses extensive industry interviews with key stakeholders including ceramic manufacturers, component suppliers, and end-user companies across diverse application sectors.

Data collection processes include structured surveys of industry participants, analysis of company financial reports, patent filings review, and examination of trade statistics from relevant government agencies. The research incorporates both quantitative and qualitative analysis techniques to provide comprehensive market understanding. Market modeling utilizes statistical analysis and forecasting methodologies to project future market trends and growth patterns.

Validation procedures ensure research accuracy through cross-referencing multiple data sources, expert consultation, and industry feedback mechanisms. The methodology includes continuous monitoring of market developments and regular updates to maintain current and relevant market intelligence. Quality assurance protocols verify data integrity and analytical consistency throughout the research process, ensuring reliable market insights for strategic decision-making.

Asia-Pacific dominance characterizes the global electronics and electrical ceramics market, with the region accounting for approximately 58% market share driven by extensive electronics manufacturing infrastructure in China, Japan, South Korea, and Taiwan. The region benefits from integrated supply chains, skilled workforce, and proximity to major electronics brands. Manufacturing concentration in Asia-Pacific creates cost advantages and enables rapid scaling of production capacity to meet global demand.

North American market demonstrates strong demand for high-performance ceramic materials in aerospace, defense, and automotive applications, with particular strength in advanced technology segments. The region’s focus on innovation and premium applications supports higher-margin ceramic products. European markets emphasize sustainability and environmental compliance, driving demand for eco-friendly ceramic materials and manufacturing processes.

Emerging markets in Latin America, Middle East, and Africa show increasing adoption of electronic devices and infrastructure development creating new opportunities for ceramic materials suppliers. These regions demonstrate growth potential with expanding telecommunications networks and industrial modernization programs. Regional trade patterns reflect the global nature of electronics supply chains, with ceramic materials flowing between manufacturing hubs and consumption centers worldwide.

Market leadership in the electronics and electrical ceramics sector features established materials companies with comprehensive product portfolios and global manufacturing capabilities:

Competitive strategies emphasize technological innovation, manufacturing excellence, and customer relationship development. Companies invest significantly in R&D to develop next-generation ceramic materials meeting evolving industry requirements. Market positioning varies from broad-based materials suppliers to specialized niche players focusing on specific applications or technologies.

Product-based segmentation of the electronics and electrical ceramics market encompasses several key categories:

Application-based segmentation reflects diverse end-use markets:

Dielectric ceramics represent the largest market segment, driven by extensive use in capacitors for electronic devices. This category demonstrates steady growth with increasing demand for high-capacitance, miniaturized components supporting advanced electronic functionality. Performance requirements continue evolving toward higher dielectric constants and improved temperature stability.

Piezoelectric ceramics show strong growth potential in sensor applications, actuators, and energy harvesting systems. The automotive industry’s adoption of advanced driver assistance systems (ADAS) creates significant demand for piezoelectric sensors. Innovation focus centers on lead-free formulations addressing environmental concerns while maintaining performance characteristics.

Ferrite ceramics benefit from increasing demand in power electronics, renewable energy systems, and electric vehicle applications. The segment demonstrates resilience due to essential role in electromagnetic interference (EMI) suppression and power conversion systems. Market trends favor soft ferrites for high-frequency applications and hard ferrites for permanent magnet applications.

Conductive ceramics represent a specialized but growing segment serving applications requiring controlled electrical properties. The category includes materials for heating elements, electrodes, and electromagnetic shielding applications. Development efforts focus on improving conductivity while maintaining ceramic advantages such as thermal stability and corrosion resistance.

Manufacturers benefit from the electronics and electrical ceramics market through access to high-performance materials enabling product differentiation and competitive advantages. Ceramic materials offer superior reliability and performance characteristics compared to alternative materials, supporting premium product positioning. Cost optimization opportunities exist through improved manufacturing efficiency and reduced warranty claims due to enhanced component reliability.

End-user industries gain significant advantages from ceramic materials including extended product lifecycles, improved performance under demanding conditions, and enhanced safety characteristics. The miniaturization capabilities of ceramic components enable compact product designs meeting consumer preferences for portable devices. Operational benefits include reduced maintenance requirements and improved system efficiency.

Supply chain participants benefit from stable demand patterns and long-term customer relationships characteristic of the ceramics industry. The technical complexity of ceramic materials creates barriers to entry, supporting sustainable competitive positions for established suppliers. Innovation opportunities enable value-added services and premium pricing for advanced ceramic solutions meeting specific customer requirements.

Investors and stakeholders benefit from market stability and growth potential driven by fundamental technology trends including electrification, digitalization, and sustainable energy adoption. The essential nature of ceramic materials in critical applications provides defensive characteristics during economic downturns. Long-term prospects remain positive due to increasing electronics content across diverse industries and continuous technological advancement.

Strengths:

Weaknesses:

Opportunities:

Threats:

Miniaturization trend continues driving innovation in electronics and electrical ceramics, with manufacturers developing materials enabling smaller component sizes while maintaining or improving performance characteristics. This trend supports the consumer electronics industry’s push toward thinner, lighter devices with enhanced functionality. Advanced processing techniques including additive manufacturing and precision machining enable production of complex ceramic geometries previously impossible to achieve.

Sustainability focus influences market trends as manufacturers develop environmentally friendly ceramic formulations and manufacturing processes. The elimination of hazardous materials such as lead from ceramic compositions addresses regulatory requirements and environmental concerns. Circular economy principles drive development of recyclable ceramic materials and waste reduction initiatives throughout the supply chain.

Smart materials integration represents an emerging trend with ceramics incorporating sensing, actuation, and communication capabilities. These intelligent ceramic materials enable self-monitoring systems and adaptive performance characteristics. Nanotechnology adoption continues advancing ceramic material properties through precise control of microstructure and composition at the nanoscale level.

Customization demand increases as end-user industries seek ceramic materials tailored to specific application requirements. This trend drives development of specialized formulations and manufacturing processes supporting unique customer needs. Digital transformation in manufacturing enables improved quality control, process optimization, and customer service capabilities throughout the ceramics industry.

Recent technological breakthroughs in the electronics and electrical ceramics industry include development of ultra-high dielectric constant materials for advanced capacitor applications and breakthrough achievements in lead-free piezoelectric ceramics matching traditional lead-based material performance. These innovations address both performance requirements and environmental sustainability concerns.

Strategic partnerships between ceramic manufacturers and electronics companies have accelerated product development cycles and market penetration. Collaborative research initiatives focus on next-generation materials for emerging applications including flexible electronics and wearable devices. Investment activities include significant capacity expansion projects in Asia-Pacific and technology acquisition programs by major industry participants.

Manufacturing innovations incorporate advanced automation, artificial intelligence, and quality control systems improving production efficiency and product consistency. The adoption of Industry 4.0 principles enables real-time monitoring and optimization of ceramic manufacturing processes. MWR analysis indicates that approximately 23% of ceramic manufacturers have implemented advanced digital manufacturing systems within the past two years.

Regulatory developments include updated environmental standards affecting ceramic manufacturing processes and new safety requirements for ceramic materials used in critical applications. Industry participants continue adapting operations to meet evolving regulatory requirements while maintaining competitive positioning and profitability.

Strategic recommendations for electronics and electrical ceramics market participants emphasize the importance of continued investment in research and development to maintain technological leadership and address evolving customer requirements. Companies should focus on developing specialized ceramic formulations for emerging applications while maintaining cost competitiveness in established market segments.

Market positioning strategies should emphasize value proposition communication highlighting ceramic material advantages including reliability, performance, and lifecycle benefits. Manufacturers should develop comprehensive customer support capabilities including technical consulting and application engineering services to differentiate from commodity suppliers. Partnership development with key customers and technology companies can accelerate market penetration and product development initiatives.

Operational excellence remains critical for success in the competitive ceramics market, requiring continuous improvement in manufacturing efficiency, quality control, and supply chain management. Companies should invest in advanced manufacturing technologies and automation systems to reduce costs and improve product consistency. Sustainability initiatives should be integrated into business strategies to address environmental concerns and regulatory requirements.

Geographic expansion opportunities exist in emerging markets with growing electronics industries and infrastructure development programs. Companies should evaluate market entry strategies including local partnerships, joint ventures, and direct investment approaches. Portfolio optimization should focus on high-growth, high-margin applications while maintaining presence in stable, established market segments.

Long-term prospects for the electronics and electrical ceramics market remain highly positive, driven by fundamental technology trends including electrification, digitalization, and sustainable energy adoption. The market is projected to maintain robust growth momentum with expansion rates of approximately 6.8% CAGR through the next decade. Technology evolution will continue creating new application opportunities and driving demand for advanced ceramic materials.

Emerging applications in quantum computing, advanced sensors, and next-generation communication systems will create premium market opportunities for specialized ceramic materials. The automotive industry’s transition to electric and autonomous vehicles will significantly expand demand for ceramic components in power electronics, sensors, and safety systems. Healthcare technology advancement will drive growth in biocompatible ceramic materials for medical devices and implants.

Manufacturing evolution will incorporate advanced technologies including artificial intelligence, machine learning, and additive manufacturing to improve production efficiency and enable new product capabilities. MarkWide Research projects that digital manufacturing adoption will reach approximately 65% of ceramic manufacturers within five years, significantly improving operational performance and customer responsiveness.

Market consolidation may accelerate as companies seek scale advantages and technology synergies through strategic acquisitions and partnerships. The industry will likely see continued investment in research and development to address evolving performance requirements and environmental regulations. Global expansion will continue as electronics manufacturing spreads to new geographic regions and emerging markets develop local electronics industries.

The electronics and electrical ceramics market represents a dynamic and essential segment of the advanced materials industry, characterized by continuous innovation, expanding applications, and strong growth fundamentals. The market benefits from increasing electronics content across diverse industries, technological advancement driving new application opportunities, and the superior performance characteristics of ceramic materials compared to alternatives.

Key success factors for market participants include maintaining technological leadership through sustained R&D investment, developing strong customer relationships and technical support capabilities, and achieving operational excellence in manufacturing and quality control. The market rewards companies that can balance innovation with cost competitiveness while addressing evolving customer requirements and regulatory standards.

Future growth prospects remain compelling, supported by fundamental technology trends including electric vehicle adoption, 5G network deployment, renewable energy expansion, and IoT proliferation. The market’s essential role in enabling advanced electronic systems positions it well for continued expansion despite potential economic uncertainties and competitive pressures from alternative materials.

Strategic positioning for long-term success requires focus on high-growth applications, geographic expansion into emerging markets, and development of sustainable manufacturing practices addressing environmental concerns. Companies that successfully navigate these opportunities while maintaining operational excellence and customer focus will be well-positioned to capitalize on the significant growth potential in the electronics and electrical ceramics market throughout the coming decade.

What is Electronics and Electrical Ceramics?

Electronics and Electrical Ceramics refer to a category of materials that exhibit electrical properties and are used in various electronic applications, including capacitors, insulators, and semiconductors. These ceramics are essential in the manufacturing of electronic devices due to their ability to withstand high temperatures and electrical stress.

What are the key players in the Electronics and Electrical Ceramics Market?

Key players in the Electronics and Electrical Ceramics Market include companies like Murata Manufacturing Co., Ltd., Kyocera Corporation, and Saint-Gobain, which are known for their innovative ceramic materials and components. These companies focus on developing advanced ceramics for applications in telecommunications, automotive, and consumer electronics, among others.

What are the main drivers of growth in the Electronics and Electrical Ceramics Market?

The growth of the Electronics and Electrical Ceramics Market is driven by the increasing demand for miniaturized electronic components, advancements in technology, and the rising adoption of electric vehicles. Additionally, the expansion of the telecommunications sector and the need for high-performance materials in consumer electronics contribute to market growth.

What challenges does the Electronics and Electrical Ceramics Market face?

The Electronics and Electrical Ceramics Market faces challenges such as the high cost of raw materials and the complexity of manufacturing processes. Additionally, competition from alternative materials and the need for continuous innovation to meet evolving consumer demands pose significant challenges.

What opportunities exist in the Electronics and Electrical Ceramics Market?

Opportunities in the Electronics and Electrical Ceramics Market include the development of new materials with enhanced properties and the growing demand for smart devices. Furthermore, the increasing focus on sustainability and eco-friendly materials presents avenues for innovation and market expansion.

What trends are shaping the Electronics and Electrical Ceramics Market?

Trends in the Electronics and Electrical Ceramics Market include the integration of nanotechnology to improve material performance and the shift towards more sustainable manufacturing practices. Additionally, the rise of Internet of Things (IoT) devices is driving demand for advanced ceramics that can support high-frequency applications.

Electronics and Electrical Ceramics Market

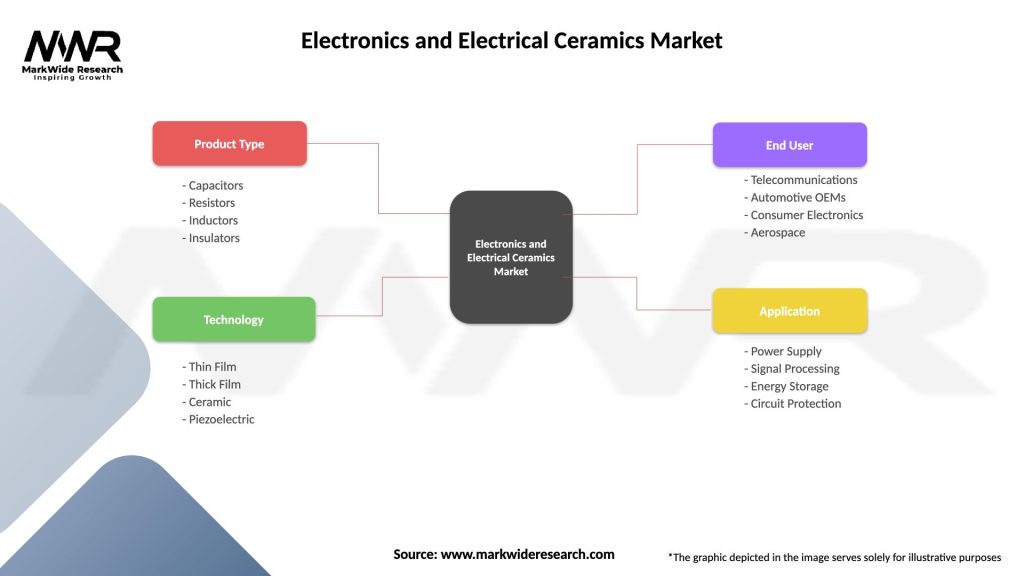

| Segmentation Details | Description |

|---|---|

| Product Type | Capacitors, Resistors, Inductors, Insulators |

| Technology | Thin Film, Thick Film, Ceramic, Piezoelectric |

| End User | Telecommunications, Automotive OEMs, Consumer Electronics, Aerospace |

| Application | Power Supply, Signal Processing, Energy Storage, Circuit Protection |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Electronics and Electrical Ceramics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at