444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Electronic Payslip Service Market serves as a pivotal component in the realm of payroll management, offering digital solutions for the generation, distribution, and management of electronic payslips. These services streamline the payroll process, replacing traditional paper-based systems with efficient, secure, and environmentally friendly electronic alternatives. The market caters to businesses of all sizes across various industries, providing a range of features such as automated payroll processing, electronic document delivery, employee self-service portals, and compliance management. As organizations increasingly embrace digital transformation and remote work arrangements, the demand for Electronic Payslip Services is witnessing steady growth.

Meaning

Electronic Payslip Services involve the digitization of payslip generation and distribution processes, enabling employers to deliver pay-related information to employees electronically. These services encompass the creation, storage, retrieval, and transmission of electronic payslips via secure online platforms or payroll software systems. Electronic payslips contain details such as employee wages, deductions, taxes, benefits, and other relevant information, providing transparency and accessibility for both employers and employees. By leveraging electronic payslip services, organizations can streamline payroll operations, reduce administrative burden, enhance data security, and improve employee satisfaction.

Executive Summary

The Electronic Payslip Service Market is experiencing increased adoption driven by factors such as the shift towards digitalization, regulatory compliance requirements, and the need for remote workforce management solutions. Electronic payslip service providers offer comprehensive solutions tailored to the evolving needs of businesses, enabling efficient payroll processing, compliance with labor regulations, and seamless employee communication. While challenges such as data privacy, cybersecurity, and integration complexities exist, the market presents significant opportunities for innovation, expansion, and value creation.

Key Market Insights

Key insights shaping the Electronic Payslip Service Market include:

Market Drivers

Drivers fueling the growth of the Electronic Payslip Service Market include:

Market Restraints

Challenges restraining market growth include:

Market Opportunities

Opportunities for growth and innovation in the Electronic Payslip Service Market include:

Market Dynamics

Dynamic factors shaping the Electronic Payslip Service Market include technological advancements, regulatory changes, market trends, and customer preferences. Electronic payslip service providers must continuously innovate, adapt, and differentiate their offerings to meet evolving customer needs, regulatory requirements, and industry standards.

Regional Analysis

Regional variations in labor regulations, data protection laws, and cultural norms influence the demand for Electronic Payslip Services. While developed economies have mature electronic payroll markets with stringent compliance requirements and advanced technology infrastructure, emerging markets offer growth opportunities driven by digitalization initiatives, regulatory reforms, and expanding workforce demographics.

Competitive Landscape

The Electronic Payslip Service Market features a competitive landscape comprising a mix of established payroll software vendors, HR technology providers, financial services companies, and specialized electronic payslip service providers. Competition centers around factors such as product features, pricing, scalability, customer support, and regulatory compliance. Differentiation through innovation, customer experience, and value-added services is critical for market success.

Segmentation

Segmentation of the Electronic Payslip Service Market can be based on factors such as:

Category-wise Insights

Electronic Payslip Services encompass a range of features and functionalities, including:

Key Benefits for Industry Participants and Stakeholders

Benefits of Electronic Payslip Services include:

SWOT Analysis

A SWOT analysis of the Electronic Payslip Service Market reveals:

Market Key Trends

Key trends shaping the Electronic Payslip Service Market include:

Covid-19 Impact

The Covid-19 pandemic has accelerated the adoption of Electronic Payslip Services, driven by remote work arrangements, social distancing measures, and the need for contactless payroll processing solutions. The pandemic has underscored the importance of digitalization, data security, and business continuity planning in payroll management, prompting organizations to invest in electronic payslip services for remote access, compliance management, and employee communication.

Key Industry Developments

Recent developments in the Electronic Payslip Service Market include:

Analyst Suggestions

Recommendations for stakeholders in the Electronic Payslip Service Market include:

Future Outlook

The Electronic Payslip Service Market is poised for continued growth and innovation as organizations seek to modernize payroll operations, enhance employee engagement, and comply with regulatory requirements. Key trends such as digital transformation, mobile access, AI-driven analytics, and blockchain technology will shape the future of electronic payslip services, driving demand for secure, scalable, and user-centric solutions.

Conclusion

Electronic Payslip Services play a pivotal role in modernizing payroll management, offering digital solutions for efficient, secure, and compliant generation, distribution, and management of payslips. Despite challenges such as data privacy, integration complexities, and security risks, the market presents significant opportunities for innovation, growth, and value creation. By prioritizing user experience, data security, and regulatory compliance, stakeholders can harness the transformative potential of electronic payslip services to streamline payroll operations, enhance employee satisfaction, and drive business success in the digital age.

Electronic Payslip Service Market

| Segmentation Details | Description |

|---|---|

| Service Type | Cloud-Based, On-Premise, Hybrid, Mobile |

| End User | Small Enterprises, Medium Enterprises, Large Corporations, Freelancers |

| Delivery Model | Subscription, Pay-Per-Use, One-Time Purchase, Freemium |

| Integration Level | API Integration, Manual Upload, Automated Sync, Others |

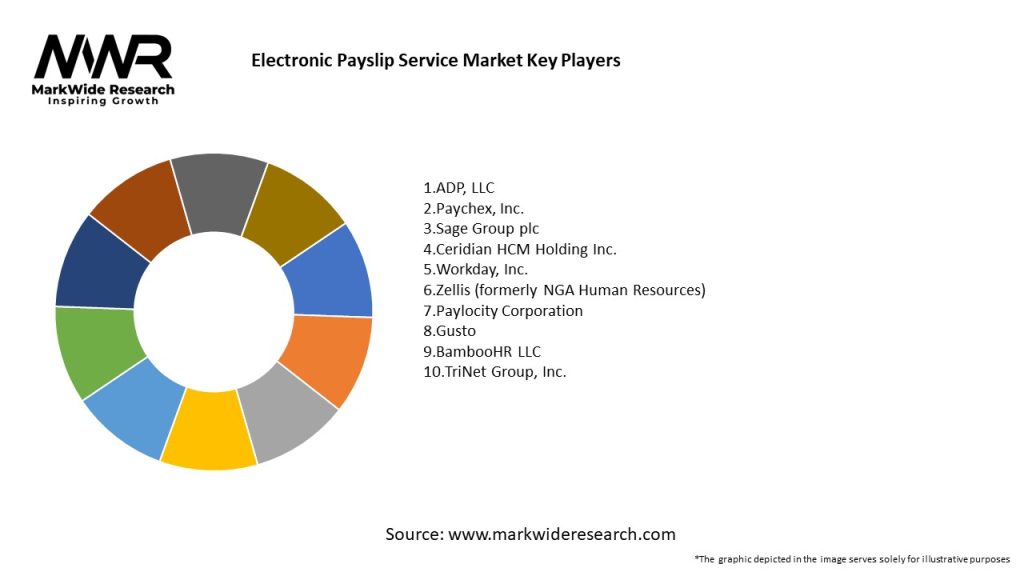

Leading companies in the Electronic Payslip Service Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at