Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Regulatory Imperative: The Federal Motor Carrier Safety Administration (FMCSA) mandate in the U.S. and similar regulations worldwide are the primary drivers for ELD adoption.

-

Telematics Convergence: Integration of ELD data with telematics platforms enables advanced insights—route optimization, fuel use analysis, and driver behavior monitoring.

-

Cloud & Mobile Enablement: Cloud‑based dashboards and mobile apps facilitate real‑time alerts, compliance reporting, and fleet tracking from any device.

-

SME Penetration: Small and medium fleets increasingly adopt cost‑effective, subscription‑based ELD solutions, expanding the market beyond large carriers.

-

Value‑Added Services: Vendors are bundling ELDs with safety training, maintenance scheduling, and insurance telematics to differentiate offerings.

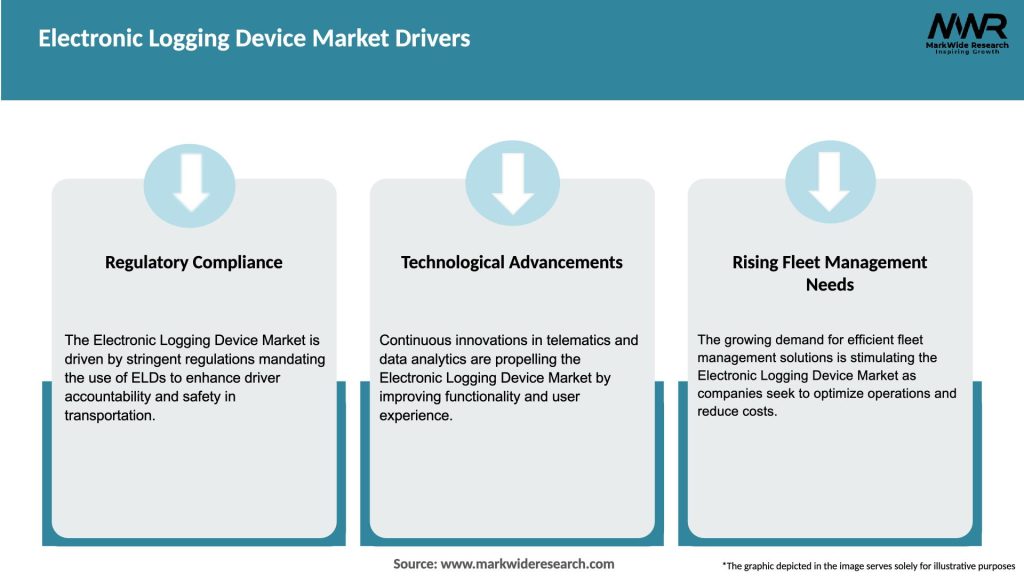

Market Drivers

-

Mandatory Compliance: ELD regulations in key markets (FMCSA in U.S., EU e‑log mandates, Canada’s CVOR rules) drive universal adoption.

-

Operational Efficiency: Automated logging reduces manual errors, driver paperwork, and audit risks—saving up to 1–2 hours daily per driver.

-

Safety & Risk Management: Continuous monitoring of driving patterns—hard braking, rapid acceleration—enables proactive safety interventions.

-

Cost Savings: Fuel optimization (up to 10%), reduced idle time, and lower insurance premiums from telematics data analytics.

-

Fleet Visibility: Real‑time vehicle location and status enhance dispatching, customer service, and supply‑chain transparency.

Market Restraints

-

High Initial Investment: Hardware procurement and installation costs can reach USD 200–300 per vehicle, posing barriers for small fleets.

-

Data Privacy & Security: Concerns over driver tracking, data ownership, and cybersecurity threaten user trust and regulatory acceptance.

-

Connectivity Challenges: In remote or cross‑border operations, inconsistent cellular coverage can disrupt real‑time data transmission.

-

Change Management: Driver resistance to new technology and the learning curve for ELD interface navigation can impede deployment.

-

Fragmented Regulations: Varying e‑logging requirements across regions complicate compliance for international carriers.

Market Opportunities

-

AI & Predictive Analytics: Leveraging machine learning to predict maintenance needs, identify at‑risk drivers, and optimize routes dynamically.

-

Integration with Autonomous Vehicles: ELD platforms can evolve to interface with automated driving systems for future‑ready fleets.

-

Value‑Added Services: Bundling fuel cards, compliance consulting, and insurance telematics with ELD subscriptions to increase revenue per vehicle.

-

SME‑Focused Solutions: Developing low‑cost, easy‑install “plug‑and‑play” devices and simplified software for small fleet operators.

-

Emerging Markets Expansion: Latin America, Middle East & Africa, and Southeast Asia present growth potential as local e‑log regulations emerge.

Market Dynamics

-

Supply Side: Rising competition among hardware vendors, emergence of Bluetooth/Wi‑Fi ELD dongles, and standardization of telematics protocols (SAE J1939).

-

Demand Side: Fleet operators demand turnkey solutions that integrate compliance, safety, and operations—driving consolidation of ELD with TMS and ERP systems.

-

Economic Factors: Fuel price volatility and driver shortage pressures make ELD‑enabled efficiency gains a strategic imperative.

-

Regulatory Evolution: Upcoming EU Mobility Package 1 and India’s e‑waybill mandates indicate further global regulatory expansion.

Regional Analysis

-

North America:

-

Market Share: > 60% of global market due to FMCSA ELD mandate.

-

Key Trends: Consolidation among telematics providers, robust aftermarket ecosystem.

-

-

Europe:

-

Growth: 15% CAGR, driven by AETR compliance and upcoming EU mandates.

-

Challenges: Diverse national regulations (Germany, France, Poland).

-

-

Asia‑Pacific:

-

Dynamics: Rapid modernization of logistics in China, India, Australia; pilot e‑log programs underway.

-

Opportunities: Partnerships with local telcos for connectivity.

-

-

Latin America:

-

Penetration: Early stage; Mexico exploring e‑log pilot projects; Brazil considering nationwide mandate.

-

Drivers: Trade route optimization, border cross‑compliance.

-

-

Middle East & Africa:

-

Adoption: Slow but increasing, led by petrochemical and construction logistics in GCC.

-

Barriers: Infrastructure and regulatory uncertainty.

-

Competitive Landscape

Leading companies in the Electronic Logging Device Market:

- Omnitracs LLC

- Trimble Inc.

- Verizon Communications Inc.

- Geotab Inc.

- Garmin Ltd.

- Teletrac Navman Group

- EROAD

- KeepTruckin, Inc.

- Stoneridge, Inc.

- Samsara Networks, Inc.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

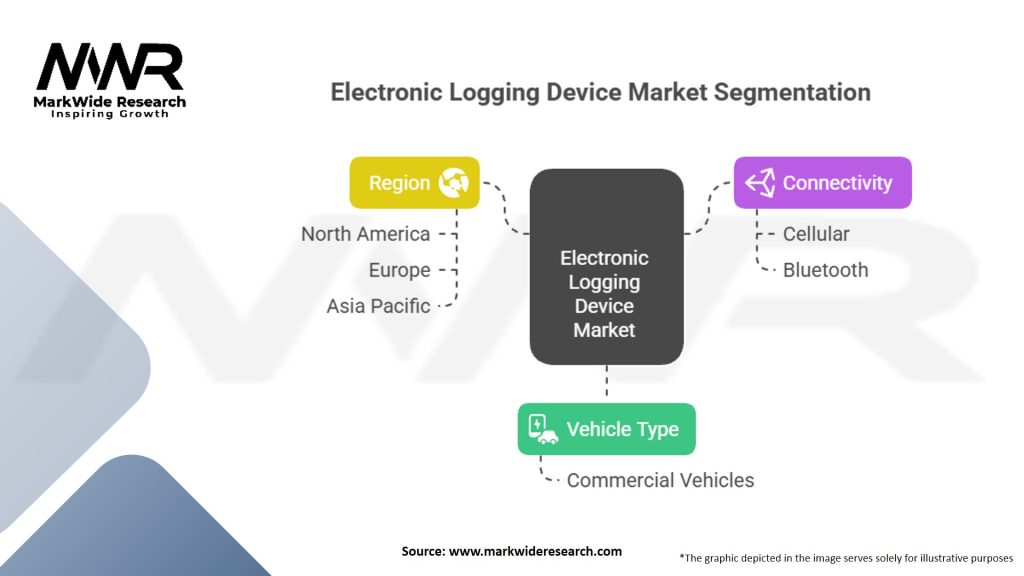

Segmentation

-

By Deployment:

-

Integrated Fleet Management Suites

-

Stand‑Alone ELD Devices

-

-

By Connectivity:

-

Cellular (4G/5G)

-

Bluetooth/Wi‑Fi Dongles

-

-

By Fleet Size:

-

Small Fleets (<50 vehicles)

-

Medium Fleets (50–500 vehicles)

-

Large Fleets (>500 vehicles)

-

-

By End‑User Industry:

-

Trucking & Logistics

-

Field Services

-

Construction

-

Waste Management

-

Public Safety & Transit

-

Category-wise Insights

-

Integrated Suites: Preferred by large fleets for end‑to‑end visibility—HOS, maintenance, dispatch.

-

Standalone ELDs: Attractive to SMEs for low cost and ease of use.

-

Hardware Form Factors: From hardwired units to simple OBD‑II plug‑and‑play dongles.

-

Software Models: Subscription‑based SaaS vs. perpetual license with on‑premise servers.

Key Benefits for Industry Participants and Stakeholders

-

Compliance Assurance: Automated HOS recording reduces violations and fines.

-

Operational Efficiency: Insights into idle time, route optimization, and driver behavior cut fuel and maintenance costs.

-

Safety Improvement: Monitoring harsh events (braking, cornering) enables targeted coaching.

-

Data‑Driven Decision Making: Real‑time analytics drive proactive fleet management.

-

Competitive Advantage: Early adopters gain productivity and branding benefits by marketing safe, compliant services.

SWOT Analysis

-

Strengths: Regulatory mandate ensures universal base demand; continuous tech innovation.

-

Weaknesses: High initial costs; fragmented provider landscape complicates procurement.

-

Opportunities: AI‑powered predictive analytics; integration with autonomous vehicle platforms; SME market penetration.

-

Threats: Data privacy regulations (GDPR, CCPA); cybersecurity risks; competitive pressure driving price erosion.

Market Key Trends

-

AI & Machine Learning: Advanced algorithms for predictive maintenance and driver risk scoring.

-

Edge Computing: On‑device processing for low‑latency compliance and safety alerts in connectivity‑sparse regions.

-

Blockchain for E‑Logs: Immutable log storage to prevent tampering and simplify cross‑border audits.

-

Unified Platforms: Convergence of ELD, TMS, EAM (enterprise asset management) and ERP systems.

-

Green Logistics: ELD data used to reduce CO₂ emissions through eco‑driving coaching and optimized routing.

Covid-19 Impact

-

Accelerated Digital Adoption: Fleets invested in contactless ELD solutions to minimize driver‑clerk interactions.

-

Supply Chain Disruptions: Highlighted need for real‑time fleet visibility, boosting telematics and ELD demand.

-

Regulatory Flexibility: FMCSA granted temporary HOS exemptions, but long‑term compliance needs remained, reinforcing automated logging benefits.

-

Driver Shortages: ELDs helped optimize limited driver resources through improved dispatch and route planning.

Key Industry Developments

-

5G Rollout: Enhanced connectivity enables real‑time video telematics and advanced fleet analytics.

-

Partnerships: Telematics vendors collaborating with OEMs (Volvo, Daimler) for factory‑installed ELDs.

-

Mergers & Acquisitions: Consolidation among telematics providers to broaden services and customer base.

-

Open APIs: Push for standardized data exchange to integrate ELD data into multi‑vendor TMS and ERP ecosystems.

-

Driver‑Centric Innovations: Voice‑activated controls and in‑cab coaching apps to improve user adoption.

Analyst Suggestions

-

Invest in AI/ML Capabilities: Build or partner to offer predictive analytics that go beyond compliance—maintenance, safety, and productivity insights.

-

Enhance Cybersecurity & Privacy: Implement end‑to‑end encryption, zero‑trust networking, and clear data‑use policies to build user trust.

-

Offer Flexible Deployment Models: Provide both hardware‑based and BYOD (bring‑your‑own‑device) ELD options to cater to SMEs and large fleets alike.

-

Focus on Integration: Develop robust APIs and middleware to seamlessly connect ELD data with TMS, ERP, and maintenance management systems.

-

Expand Services Portfolio: Bundle compliance with fuel cards, insurance telematics, and driver training to increase wallet share and stickiness.

Future Outlook

The ELD market’s trajectory is upward:

-

Continued Regulatory Expansion: Anticipated mandates in Europe, Asia, and Latin America will drive new adoption waves.

-

Autonomous & Electric Vehicles: ELD platforms will evolve to monitor battery health, autonomy engagement, and virtual HOS for robot‑axis fleets.

-

Sustainability Mandates: Governments and shippers will leverage ELD data to meet decarbonization targets and ESG reporting requirements.

-

Platform Ecosystems: ELD software will become part of wider mobility‑as‑a‑service (MaaS) and supply chain visibility ecosystems.

-

Technology Convergence: Edge AI, 5G, blockchain, and IoT will unify to deliver predictive, secure, and autonomous fleet management solutions.

Conclusion

The Electronic Logging Device Market stands at the intersection of regulatory compliance and digital transformation in transportation. Mandated adoption in developed markets has laid the foundation, while global expansion, AI‑driven insights, and integration with emerging mobility trends promise sustained growth. By addressing cost, privacy, and interoperability challenges—and by innovating around AI, edge computing, and green logistics—ELD providers can unlock new value for fleets of all sizes. For carriers, shippers, and technology investors alike, the ELD market offers a pathway toward safer roads, more efficient operations, and a decarbonized future for commercial transport.