444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Electronic Bill Presentment and Payment (EBPP) market is witnessing substantial growth and is expected to continue its upward trajectory in the coming years. This market is driven by the increasing adoption of digital payment solutions and the growing need for convenient and secure bill payment methods. EBPP refers to the process of electronically presenting bills to customers and facilitating their payment through various channels such as online platforms, mobile apps, and automated systems.

Meaning

Electronic Bill Presentment and Payment (EBPP) is a technology-driven process that enables businesses to generate and deliver electronic bills or invoices to their customers. This method eliminates the need for traditional paper-based billing and allows customers to receive and pay their bills electronically. EBPP streamlines the billing and payment process, improves efficiency, reduces costs, and enhances the overall customer experience.

Executive Summary

The Electronic Bill Presentment and Payment market is experiencing significant growth worldwide. The increasing adoption of digital payment solutions, the rise of mobile commerce, and the growing need for convenient and secure bill payment methods are driving the market’s expansion. The market players are focusing on offering innovative solutions that enhance customer experience and simplify the billing process. However, challenges such as security concerns and resistance from traditional billers hinder the market’s growth to some extent.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

The Electronic Bill Presentment and Payment market is driven by several key factors that contribute to its growth. Firstly, the increasing adoption of digital payment solutions is fueling the demand for EBPP services. Customers are increasingly embracing electronic bill payment methods due to their convenience and time-saving benefits. Secondly, the rise of mobile commerce and the widespread use of smartphones have accelerated the adoption of EBPP solutions. Mobile apps and online platforms provide users with a seamless experience, allowing them to pay their bills anytime and anywhere. Moreover, the growing emphasis on data security and fraud prevention measures is pushing organizations to adopt secure and reliable EBPP solutions. The integration of advanced security features ensures the protection of sensitive customer information, instilling trust among users.

Market Restraints

Despite the positive growth prospects, the Electronic Bill Presentment and Payment market faces certain challenges that impede its expansion. One significant restraint is the resistance from traditional billers who are reluctant to switch from paper-based billing to electronic methods. Some businesses may have established processes and systems that are not easily adaptable to digital transformation. Additionally, concerns over data security and privacy are barriers to the widespread adoption of EBPP solutions. Customers may hesitate to provide their financial information online due to the fear of unauthorized access or cyber-attacks. Overcoming these barriers requires effective education and awareness campaigns, highlighting the benefits and security measures associated with EBPP.

Market Opportunities

The Electronic Bill Presentment and Payment market presents numerous opportunities for growth and innovation. Integration with other financial systems and platforms can enhance the overall customer experience and streamline the billing process. For instance, integrating EBPP solutions with accounting software or payment gateways simplifies reconciliation and reduces manual efforts. Furthermore, expanding the scope of EBPP to emerging markets and industries provides significant growth opportunities. As more businesses and individuals adopt digital payment methods, the demand for efficient and secure EBPP solutions will continue to rise.

Market Dynamics

The Electronic Bill Presentment and Payment market operates in a dynamic environment influenced by various factors. Technological advancements, changing consumer preferences, government regulations, and industry collaborations play a crucial role in shaping the market dynamics. The market is characterized by intense competition, with key players striving to offer innovative solutions and gain a competitive edge. Partnerships and strategic alliances are common strategies employed by market players to expand their reach and enhance their service offerings.

The Electronic Bill Presentment and Payment (EBPP) Market is influenced by several factors:

Regional Analysis

Competitive Landscape

Leading Companies in the Electronic Bill Presentment And Payment Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

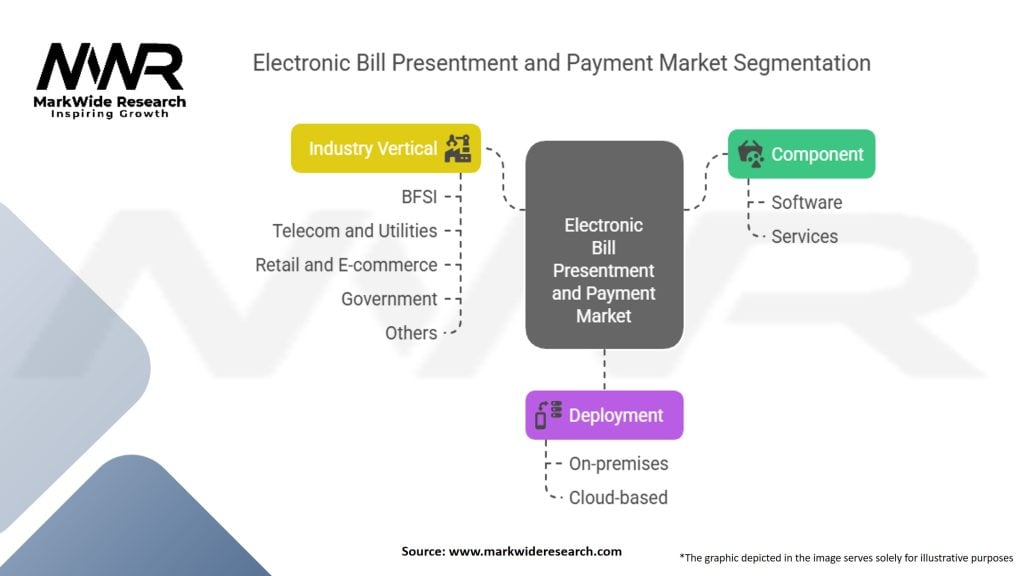

Segmentation

The market can be segmented based on type, application, and region:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The adoption of Electronic Bill Presentment and Payment solutions offers numerous benefits for industry participants and stakeholders. For businesses, implementing EBPP streamlines the billing process, reduces operational costs, and enhances customer satisfaction. By leveraging digital payment methods, organizations can improve cash flow, eliminate paper-based processes, and reduce the risk of errors. Customers also benefit from EBPP solutions, as they offer convenience, flexibility, and real-time access to billing information. Additionally, EBPP enhances transparency and enables customers to track their payment history easily.

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has accelerated the adoption of digital payment solutions, including Electronic Bill Presentment and Payment. With lockdowns and social distancing measures in place, businesses and individuals increasingly turned to online platforms for bill payment. This shift in consumer behavior drove the demand for efficient and contactless payment methods, boosting the EBPP market. Additionally, the pandemic highlighted the importance of digital transformation and compelled businesses to embrace electronic billing and payment solutions to ensure business continuity and minimize physical contact.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the Electronic Bill Presentment and Payment market looks promising, with sustained growth expected in the coming years. The continued digital transformation across industries, the rising adoption of mobile commerce, and the increasing demand for secure payment methods will drive the market’s expansion. Technological advancements such as AI, blockchain, and IoT will further enhance the capabilities of EBPP solutions, providing opportunities for innovation and differentiation. To capitalize on these opportunities, market players need to stay agile, focus on customer needs, and adapt to the evolving landscape of digital payments.

Conclusion

The Electronic Bill Presentment and Payment market is witnessing significant growth driven by the increasing adoption of digital payment solutions and the need for convenient and secure billing and payment methods. Despite challenges such as resistance from traditional billers and security concerns, the market offers substantial opportunities for innovation, expansion, and collaboration. By focusing on customer-centric approaches, integrating with emerging technologies, and prioritizing data security, businesses can position themselves for success in the evolving landscape of electronic bill presentment and payment.

What is Electronic Bill Presentment and Payment?

Electronic Bill Presentment and Payment refers to the process of delivering bills electronically and allowing customers to make payments online. This system enhances efficiency, reduces paper usage, and improves customer convenience in managing their bills.

What are the key companies in the Electronic Bill Presentment and Payment Market?

Key companies in the Electronic Bill Presentment and Payment Market include PayPal, Square, Bill.com, and Stripe, among others.

What are the main drivers of growth in the Electronic Bill Presentment and Payment Market?

The main drivers of growth in the Electronic Bill Presentment and Payment Market include the increasing adoption of digital payment solutions, the demand for faster transaction processing, and the growing need for cost-effective billing solutions across various industries.

What challenges does the Electronic Bill Presentment and Payment Market face?

Challenges in the Electronic Bill Presentment and Payment Market include concerns over data security, the need for regulatory compliance, and the potential resistance from consumers who prefer traditional billing methods.

What opportunities exist in the Electronic Bill Presentment and Payment Market?

Opportunities in the Electronic Bill Presentment and Payment Market include the expansion of mobile payment technologies, the integration of artificial intelligence for personalized billing experiences, and the potential for partnerships with utility companies and service providers.

What trends are shaping the Electronic Bill Presentment and Payment Market?

Trends shaping the Electronic Bill Presentment and Payment Market include the rise of subscription-based billing models, increased focus on user experience design, and the growing importance of sustainability in reducing paper waste.

Electronic Bill Presentment And Payment Market

| Segmentation | Details |

|---|---|

| Component | Software, Services |

| Deployment | On-premises, Cloud-based |

| Industry Vertical | BFSI, Telecom and Utilities, Retail and E-commerce, Government, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Electronic Bill Presentment And Payment Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at