444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The electric scooter and motorcycle market represents one of the fastest-growing segments in the global transportation industry, driven by increasing environmental consciousness, urbanization trends, and technological advancements in battery technology. This dynamic market encompasses a wide range of electric two-wheelers, from lightweight electric scooters designed for urban commuting to high-performance electric motorcycles capable of highway speeds. The sector has experienced remarkable growth momentum, with adoption rates accelerating at 12.8% CAGR across major markets worldwide.

Market dynamics indicate that consumer preferences are shifting dramatically toward sustainable transportation solutions, particularly in densely populated urban areas where traffic congestion and air pollution concerns are paramount. The electric scooter and motorcycle market benefits from supportive government policies, including subsidies, tax incentives, and infrastructure development initiatives that promote electric vehicle adoption. Major manufacturers are investing heavily in research and development to enhance battery performance, reduce charging times, and improve overall vehicle efficiency.

Regional variations in market development reflect different stages of electric vehicle adoption, with Asia-Pacific leading in terms of volume while North America and Europe show strong growth in premium segments. The market encompasses various vehicle categories, from micro-mobility solutions for last-mile connectivity to full-sized motorcycles for recreational and commuting purposes, each addressing specific consumer needs and use cases.

The electric scooter and motorcycle market refers to the comprehensive ecosystem of battery-powered two-wheeled vehicles designed for personal transportation, encompassing manufacturing, sales, charging infrastructure, and related services. This market includes various vehicle types ranging from lightweight electric scooters with speeds up to 25 mph to high-performance electric motorcycles capable of exceeding 100 mph, all powered by rechargeable battery systems rather than traditional internal combustion engines.

Key characteristics of this market include the integration of advanced lithium-ion battery technology, electric motor systems, regenerative braking capabilities, and smart connectivity features. The market serves diverse consumer segments, from urban commuters seeking cost-effective transportation alternatives to motorcycle enthusiasts interested in high-performance electric alternatives to traditional gasoline-powered bikes.

Market scope extends beyond vehicle manufacturing to include charging infrastructure development, battery technology advancement, software integration for smart features, and comprehensive after-sales services. The ecosystem involves multiple stakeholders including vehicle manufacturers, battery suppliers, charging infrastructure providers, and technology companies developing connected vehicle solutions.

Strategic analysis reveals that the electric scooter and motorcycle market is experiencing unprecedented growth driven by converging factors including environmental regulations, technological breakthroughs, and changing consumer mobility preferences. The market demonstrates strong fundamentals with increasing penetration rates across both developed and emerging economies, supported by improving battery technology that addresses traditional concerns about range and charging time.

Key growth drivers include urbanization trends that favor compact, efficient transportation solutions, rising fuel costs that make electric alternatives more economically attractive, and government initiatives promoting clean transportation. The market benefits from technological convergence, with improvements in battery energy density reaching 15% annual improvement rates, making electric two-wheelers increasingly competitive with conventional alternatives.

Market segmentation reveals distinct opportunities across different vehicle categories, with electric scooters dominating urban mobility segments while electric motorcycles gain traction in recreational and long-distance commuting applications. The competitive landscape includes established motorcycle manufacturers expanding into electric segments alongside specialized electric vehicle startups bringing innovative approaches to market.

Future prospects indicate continued robust growth supported by expanding charging infrastructure, declining battery costs, and increasing consumer acceptance of electric mobility solutions. The market is positioned for sustained expansion as technology improvements address remaining barriers to adoption while regulatory support accelerates market development.

Market intelligence reveals several critical insights that define the current state and future trajectory of the electric scooter and motorcycle market:

Environmental consciousness serves as a primary market driver, with consumers increasingly seeking transportation alternatives that reduce carbon emissions and air pollution. Electric scooters and motorcycles produce zero direct emissions, making them attractive options for environmentally conscious consumers and cities implementing strict emission standards. This environmental imperative is reinforced by growing awareness of climate change impacts and the transportation sector’s contribution to greenhouse gas emissions.

Economic advantages provide compelling reasons for consumer adoption, including significantly lower operating costs compared to gasoline-powered vehicles. Electric two-wheelers offer reduced fuel costs, minimal maintenance requirements, and often benefit from government incentives and tax breaks. The total cost of ownership advantage becomes more pronounced as battery costs decline and electricity remains cheaper than gasoline in most markets.

Technological improvements continue driving market growth through enhanced battery performance, faster charging capabilities, and improved vehicle reliability. Modern electric scooters and motorcycles feature sophisticated battery management systems, regenerative braking, and smart connectivity options that enhance the user experience. These technological advances address traditional concerns about electric vehicle limitations while introducing new capabilities not available in conventional vehicles.

Urbanization trends create favorable conditions for electric two-wheeler adoption, as cities become increasingly congested and parking becomes more challenging and expensive. Electric scooters offer excellent maneuverability in urban environments, require minimal parking space, and often benefit from preferential treatment in city planning initiatives. The rise of shared mobility services also drives demand for durable, efficient electric scooters suitable for fleet operations.

Initial purchase costs remain a significant barrier to adoption, as electric scooters and motorcycles typically require higher upfront investment compared to conventional alternatives. While operating costs are lower, the initial price premium can deter price-sensitive consumers, particularly in emerging markets where disposable income levels may limit premium product adoption. This cost barrier is gradually diminishing as production scales increase and battery costs decline.

Charging infrastructure limitations continue to constrain market growth, particularly in suburban and rural areas where charging station density remains low. Range anxiety persists among potential buyers concerned about finding convenient charging locations during longer trips. The infrastructure challenge is compounded by varying charging standards and the need for significant investment in electrical grid upgrades to support widespread electric vehicle adoption.

Battery performance concerns include issues related to battery degradation over time, temperature sensitivity, and charging time requirements. Cold weather performance can be significantly reduced, limiting usability in certain climates. Battery replacement costs, while decreasing, still represent a substantial expense that consumers must consider when evaluating long-term ownership costs.

Regulatory uncertainties in some markets create hesitation among both manufacturers and consumers. Varying safety standards, licensing requirements, and infrastructure regulations across different jurisdictions complicate market development and product standardization efforts. Some regions lack clear regulatory frameworks for electric two-wheelers, creating uncertainty about future compliance requirements.

Emerging market expansion presents substantial growth opportunities as developing economies experience rapid urbanization and rising middle-class populations. Countries in Southeast Asia, Latin America, and Africa show strong potential for electric scooter adoption, particularly as local manufacturing capabilities develop and prices become more accessible. These markets often have favorable conditions for two-wheeler adoption due to traffic patterns and infrastructure characteristics.

Commercial applications offer significant market expansion potential, including last-mile delivery services, food delivery, and urban logistics applications. E-commerce growth drives demand for efficient, cost-effective delivery vehicles, and electric scooters provide ideal solutions for urban delivery operations. Fleet operators benefit from lower operating costs and reduced maintenance requirements while meeting corporate sustainability objectives.

Technology integration opportunities include advanced connectivity features, autonomous capabilities, and integration with smart city infrastructure. Vehicle-to-grid technology could enable electric scooters and motorcycles to serve as mobile energy storage units, providing additional value to owners and supporting grid stability. Artificial intelligence and IoT integration can enhance vehicle performance, predictive maintenance, and user experience.

Battery technology advancement continues creating new market opportunities through improved energy density, faster charging, and longer lifespan batteries. Solid-state battery technology promises to address many current limitations while wireless charging technology could eliminate range anxiety concerns. These technological developments will expand addressable markets and enable new use cases.

Supply chain evolution reflects the market’s rapid maturation, with established automotive suppliers expanding into electric two-wheeler components while new specialized suppliers emerge to serve this growing segment. Battery supply chains are becoming more sophisticated and geographically diversified, reducing dependency on single-source suppliers and improving cost competitiveness. Manufacturing capabilities are scaling rapidly to meet growing demand while maintaining quality standards.

Competitive dynamics show increasing intensity as traditional motorcycle manufacturers compete with electric vehicle startups and technology companies entering the mobility space. Competition drives innovation in battery technology, vehicle design, and smart features while putting pressure on pricing. Strategic partnerships between manufacturers, technology companies, and charging infrastructure providers are becoming common as companies seek to create comprehensive mobility ecosystems.

Consumer behavior patterns indicate growing acceptance of electric mobility solutions, with early adopters demonstrating high satisfaction rates that encourage broader market adoption. Social media and word-of-mouth marketing play significant roles in market development, as satisfied customers share their experiences and help overcome skepticism among potential buyers. Demographic shifts favor electric vehicle adoption, with younger consumers showing strong preference for sustainable transportation options.

Regulatory landscape evolution continues shaping market development through emissions standards, safety requirements, and infrastructure mandates. Government policies increasingly favor electric vehicle adoption through incentives, infrastructure investment, and restrictions on conventional vehicles in urban areas. International coordination on standards and regulations is improving, facilitating global market development and reducing compliance complexity for manufacturers.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes extensive surveys of consumers, manufacturers, dealers, and industry experts to gather firsthand perspectives on market trends, challenges, and opportunities. In-depth interviews with key industry stakeholders provide qualitative insights into market dynamics and future developments.

Secondary research methodology involves systematic analysis of industry reports, government publications, company financial statements, and regulatory documents to establish market baselines and identify trends. Patent analysis reveals technological development directions while trade publication monitoring tracks industry news and developments. Academic research provides theoretical frameworks and long-term trend analysis.

Data validation processes ensure research accuracy through triangulation of multiple data sources and cross-verification of key findings. Statistical analysis techniques identify correlations and causation relationships while scenario modeling explores potential future market developments. Regular data updates maintain research currency and relevance in this rapidly evolving market.

Market modeling approaches combine quantitative and qualitative analysis to develop comprehensive market forecasts and trend projections. Economic modeling considers macroeconomic factors, while technology adoption curves help predict market penetration rates. Regional analysis accounts for local market conditions and regulatory environments that influence market development patterns.

Asia-Pacific dominance characterizes the global electric scooter and motorcycle market, with the region accounting for 75% of global sales volume. China leads in manufacturing and adoption, benefiting from government support, established supply chains, and consumer acceptance of electric mobility. India shows rapid growth potential driven by urbanization, air pollution concerns, and government initiatives promoting electric vehicle adoption. Southeast Asian markets demonstrate increasing adoption rates supported by favorable demographics and traffic conditions.

European market development focuses on premium segments and regulatory compliance, with strong growth in countries implementing strict emission standards and urban mobility restrictions. The region emphasizes high-quality, technologically advanced products with superior performance characteristics. Government incentives and charging infrastructure development support market growth while environmental consciousness drives consumer adoption.

North American expansion shows accelerating momentum, particularly in urban areas where electric scooters address last-mile transportation needs. The market benefits from strong consumer purchasing power, growing environmental awareness, and increasing traffic congestion in major metropolitan areas. Shared mobility services drive significant demand while individual ownership grows among environmentally conscious consumers.

Emerging markets potential includes Latin America, Africa, and parts of Asia where rapid urbanization and growing middle classes create favorable conditions for electric two-wheeler adoption. These markets often have high two-wheeler penetration rates and favorable traffic conditions for electric scooter use. Local manufacturing development and declining battery costs are making electric options more accessible to price-sensitive consumers.

Market leadership includes both established motorcycle manufacturers and innovative electric vehicle startups, creating a diverse competitive environment that drives innovation and market development:

Competitive strategies vary significantly across market segments, with premium manufacturers focusing on performance and technology leadership while mass-market players emphasize affordability and practicality. Strategic partnerships are common, particularly between vehicle manufacturers and battery suppliers or charging infrastructure providers.

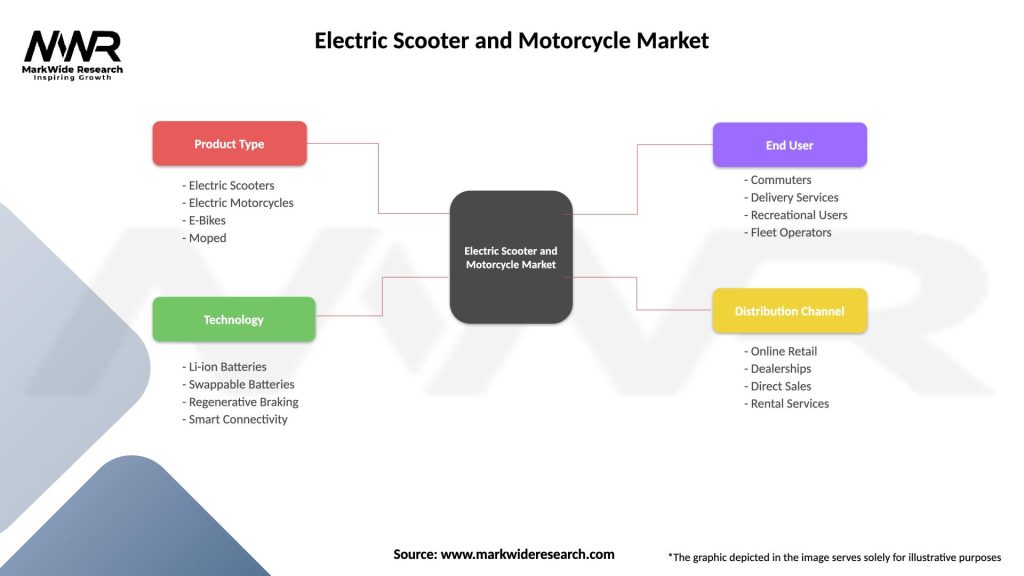

By Vehicle Type: The market divides into distinct categories serving different consumer needs and use cases. Electric scooters dominate volume sales due to lower costs and urban suitability, while electric motorcycles command premium pricing and serve performance-oriented consumers.

By Battery Type: Battery technology significantly influences vehicle performance, cost, and consumer acceptance, with lithium-ion technology dominating current market offerings.

By End User: Market segmentation reflects diverse consumer needs and use patterns, from individual consumers to commercial fleet operators.

Electric Scooter Segment demonstrates the strongest growth momentum, driven by urban mobility needs and cost-effectiveness. This category benefits from lower entry barriers, simplified maintenance requirements, and broad consumer appeal. Technological improvements focus on battery life, charging speed, and smart connectivity features that enhance user experience. The segment shows particular strength in Asia-Pacific markets where two-wheeler adoption rates are traditionally high.

Electric Motorcycle Category targets performance-oriented consumers and long-distance commuters, emphasizing power, range, and advanced features. This premium segment commands higher margins while serving as a technology showcase for manufacturers. Recent developments include motorcycles achieving 300+ mile ranges and performance levels matching or exceeding conventional motorcycles. The category benefits from growing environmental consciousness among motorcycle enthusiasts.

Commercial Fleet Applications represent a rapidly expanding market segment driven by e-commerce growth and last-mile delivery needs. Fleet operators appreciate lower operating costs, reduced maintenance requirements, and environmental benefits that support corporate sustainability goals. This segment drives demand for durable, high-utilization vehicles with fast-charging capabilities and comprehensive service support.

Shared Mobility Services create substantial demand for electric scooters designed for high-frequency use and minimal maintenance. This category requires robust vehicles capable of withstanding intensive use while maintaining reliability and safety standards. Operators focus on total cost of ownership optimization and user experience enhancement to maximize utilization rates and customer satisfaction.

Manufacturers benefit from expanding market opportunities, technological innovation drivers, and potential for premium pricing in emerging segments. The electric transition enables new entrants to compete with established players while creating opportunities for vertical integration and ecosystem development. Manufacturing scale economies improve as market volumes increase, reducing unit costs and improving profitability.

Consumers gain from lower operating costs, reduced environmental impact, and improved urban mobility options. Electric scooters and motorcycles offer quiet operation, instant torque delivery, and minimal maintenance requirements that enhance the ownership experience. Smart features and connectivity options provide additional value through navigation, security, and performance monitoring capabilities.

Infrastructure providers benefit from growing demand for charging solutions, creating new revenue streams and business opportunities. The expanding electric vehicle market drives investment in charging networks, grid upgrades, and energy management systems. Partnerships with vehicle manufacturers and fleet operators create stable demand for infrastructure services.

Government stakeholders achieve environmental and urban planning objectives through electric vehicle adoption, including reduced air pollution, lower noise levels, and decreased petroleum dependence. Electric two-wheelers support smart city initiatives and sustainable transportation goals while creating economic development opportunities in manufacturing and technology sectors.

Strengths:

Weaknesses:

Opportunities:

Threats:

Battery technology evolution continues driving market transformation through improved energy density, faster charging capabilities, and extended lifespan. Solid-state battery development promises to address current limitations while reducing costs and improving safety. Wireless charging technology development could eliminate range anxiety and simplify user experience, making electric vehicles more attractive to mainstream consumers.

Smart connectivity integration transforms electric scooters and motorcycles into connected devices with advanced features including GPS navigation, theft protection, performance monitoring, and predictive maintenance. Mobile app integration enables remote vehicle management while over-the-air updates provide continuous feature enhancement. Vehicle-to-infrastructure communication capabilities support smart city initiatives and traffic optimization.

Shared mobility expansion drives demand for durable, high-utilization electric scooters designed for fleet operations. Micromobility services are expanding globally, creating substantial market opportunities for specialized vehicles and supporting infrastructure. Integration with public transportation systems enhances urban mobility options while reducing private vehicle dependence.

Sustainability focus influences entire product lifecycles, from sustainable manufacturing processes to battery recycling programs. Manufacturers increasingly emphasize circular economy principles and environmental responsibility throughout their operations. Consumer awareness of environmental issues drives preference for sustainable transportation options, supporting market growth.

Manufacturing capacity expansion reflects growing market confidence, with major manufacturers investing in new production facilities and capacity increases. MarkWide Research analysis indicates that global production capacity has increased by 35% annually over recent years to meet growing demand. Localization strategies reduce costs and improve supply chain resilience while supporting regional market development.

Technology partnerships between vehicle manufacturers, battery suppliers, and technology companies accelerate innovation and market development. Strategic alliances enable companies to leverage complementary capabilities while sharing development costs and risks. Cross-industry collaboration brings automotive, technology, and energy sector expertise together to address market challenges.

Infrastructure investment by governments and private companies expands charging networks and supporting infrastructure. Major cities are implementing comprehensive electric vehicle charging strategies while utility companies develop smart grid capabilities to support increased electric vehicle adoption. Public-private partnerships accelerate infrastructure development while ensuring sustainable financing models.

Regulatory framework development provides clearer guidelines for electric vehicle safety, performance, and infrastructure standards. International coordination on standards reduces compliance complexity while ensuring consumer safety and market interoperability. Emission regulations increasingly favor electric vehicles while restricting conventional vehicle access in urban areas.

Market entry strategies should focus on specific consumer segments and geographic markets where competitive advantages can be established and sustained. New entrants should consider partnerships with established players to leverage distribution networks and market knowledge while developing differentiated product offerings. Technology specialization in areas like battery management, smart features, or specific use cases can provide competitive advantages.

Investment priorities should emphasize battery technology development, charging infrastructure, and manufacturing scale optimization. Companies should balance current market opportunities with long-term technology trends to ensure sustainable competitive positions. Supply chain resilience and vertical integration opportunities deserve careful consideration given market growth projections and potential supply constraints.

Product development focus should address remaining consumer concerns about range, charging time, and total cost of ownership while enhancing user experience through smart features and connectivity. Manufacturers should consider modular design approaches that enable product customization and upgrade capabilities. Safety and reliability improvements remain critical for building consumer confidence and regulatory acceptance.

Market positioning strategies should clearly differentiate products based on target consumer needs, whether emphasizing cost-effectiveness, performance, sustainability, or convenience. Brand building and customer education are essential for overcoming skepticism and building market acceptance. After-sales service capabilities and charging infrastructure partnerships can provide competitive advantages in customer acquisition and retention.

Market trajectory indicates continued robust growth driven by technological improvements, expanding infrastructure, and increasing consumer acceptance. MWR projections suggest the market will maintain strong momentum with growth rates of 18-22% annually over the next five years. Battery cost reductions and performance improvements will make electric options increasingly competitive with conventional alternatives across all market segments.

Technology evolution will address current limitations while introducing new capabilities that expand market opportunities. Next-generation battery technologies promise to eliminate range anxiety while autonomous capabilities could transform urban mobility patterns. Integration with smart city infrastructure and renewable energy systems will create additional value propositions for consumers and fleet operators.

Market maturation will bring increased competition, standardization, and consolidation as the industry evolves from early-stage growth to mainstream adoption. Successful companies will be those that establish strong brand positions, achieve manufacturing scale, and develop comprehensive ecosystem capabilities. Market leaders will likely emerge through combination of technological innovation, operational excellence, and strategic partnerships.

Global expansion will accelerate as technology costs decline and infrastructure develops in emerging markets. Regional market characteristics will drive product adaptation and localization strategies while international standards facilitate global trade and technology transfer. The market will increasingly integrate with broader transportation and energy systems, creating new opportunities and challenges for industry participants.

The electric scooter and motorcycle market represents a transformative force in global transportation, driven by converging trends in environmental consciousness, urbanization, and technological advancement. Market fundamentals remain strong with accelerating adoption rates, improving technology, and expanding infrastructure support creating favorable conditions for sustained growth. The industry has successfully addressed many early concerns about electric vehicle viability while continuing to innovate in areas that enhance consumer value and market appeal.

Strategic opportunities abound for companies that can effectively navigate the evolving competitive landscape while delivering products that meet diverse consumer needs. Success factors include technological innovation, manufacturing efficiency, brand building, and ecosystem development that creates comprehensive solutions for electric mobility. The market rewards companies that balance current opportunities with long-term vision while building sustainable competitive advantages.

Future prospects indicate that electric scooters and motorcycles will become increasingly mainstream as technology improvements eliminate remaining barriers to adoption. The convergence of electric propulsion, smart connectivity, and sustainable transportation policies creates a powerful foundation for continued market expansion. Industry participants who invest wisely in technology, infrastructure, and market development will be well-positioned to capitalize on the significant opportunities ahead in this dynamic and rapidly evolving market.

What is Electric Scooter and Motorcycle?

Electric scooters and motorcycles are two-wheeled vehicles powered by electric motors, designed for personal transportation. They offer an eco-friendly alternative to traditional gasoline-powered vehicles, often featuring rechargeable batteries and various designs for urban commuting and leisure riding.

What are the key companies in the Electric Scooter and Motorcycle Market?

Key companies in the Electric Scooter and Motorcycle Market include Tesla, Zero Motorcycles, Gogoro, and NIU Technologies, among others.

What are the main drivers of growth in the Electric Scooter and Motorcycle Market?

The growth of the Electric Scooter and Motorcycle Market is driven by increasing environmental awareness, advancements in battery technology, and rising urban congestion. Additionally, government incentives for electric vehicles are encouraging consumer adoption.

What challenges does the Electric Scooter and Motorcycle Market face?

The Electric Scooter and Motorcycle Market faces challenges such as limited charging infrastructure, high initial costs, and regulatory hurdles. Safety concerns and the need for consumer education also pose significant barriers to widespread adoption.

What opportunities exist in the Electric Scooter and Motorcycle Market?

Opportunities in the Electric Scooter and Motorcycle Market include the development of smart technologies, expansion into emerging markets, and partnerships with ride-sharing services. The growing trend of sustainable urban mobility presents further avenues for innovation.

What trends are shaping the Electric Scooter and Motorcycle Market?

Trends in the Electric Scooter and Motorcycle Market include the rise of shared mobility solutions, integration of IoT technology for enhanced user experience, and a focus on design and customization. Additionally, the shift towards sustainability is influencing product development and consumer preferences.

Electric Scooter and Motorcycle Market

| Segmentation Details | Description |

|---|---|

| Product Type | Electric Scooters, Electric Motorcycles, E-Bikes, Moped |

| Technology | Li-ion Batteries, Swappable Batteries, Regenerative Braking, Smart Connectivity |

| End User | Commuters, Delivery Services, Recreational Users, Fleet Operators |

| Distribution Channel | Online Retail, Dealerships, Direct Sales, Rental Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Electric Scooter and Motorcycle Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at