444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The El Salvador construction market represents a dynamic and evolving sector that plays a crucial role in the nation’s economic development and infrastructure modernization. This Central American market has experienced significant transformation over the past decade, driven by government initiatives, foreign investment, and increasing urbanization demands. The construction industry encompasses residential, commercial, industrial, and infrastructure development projects that collectively contribute to the country’s GDP growth and employment generation.

Market dynamics indicate robust growth potential, with the sector experiencing a 6.2% annual growth rate in recent years. The industry benefits from strategic geographic positioning, improved political stability, and progressive construction regulations that attract both domestic and international investors. Key market segments include housing development, commercial construction, infrastructure projects, and industrial facilities, each contributing to the overall market expansion.

Infrastructure development remains a primary driver, with government investments in transportation networks, utilities, and public facilities creating substantial opportunities for construction companies. The market demonstrates resilience through diversified project portfolios and increasing adoption of modern construction technologies and sustainable building practices.

The El Salvador construction market refers to the comprehensive ecosystem of building and infrastructure development activities within the Republic of El Salvador, encompassing residential, commercial, industrial, and public sector construction projects that contribute to the nation’s physical and economic infrastructure development.

This market includes various construction activities such as new building construction, renovation and rehabilitation projects, infrastructure development, and specialty construction services. The sector involves multiple stakeholders including construction companies, contractors, suppliers, developers, government agencies, and financial institutions working collaboratively to deliver construction projects across different segments.

Construction activities span from small-scale residential projects to large infrastructure developments, incorporating traditional building methods alongside modern construction technologies. The market encompasses both formal and informal construction sectors, with increasing emphasis on regulatory compliance, quality standards, and sustainable construction practices that align with international best practices.

El Salvador’s construction market demonstrates strong growth momentum supported by government infrastructure investments, urban development initiatives, and increasing foreign direct investment in construction projects. The market benefits from strategic location advantages, improved business environment, and growing demand for modern housing and commercial facilities.

Key market drivers include population growth, urbanization trends, government infrastructure programs, and private sector investment in commercial and industrial facilities. The residential segment accounts for approximately 45% of total construction activity, while infrastructure projects represent 30% of market share, reflecting balanced growth across multiple segments.

Technological advancement and sustainable construction practices are gaining traction, with 25% of new projects incorporating green building standards and energy-efficient technologies. The market faces challenges including skilled labor shortages, material cost fluctuations, and regulatory compliance requirements, but demonstrates resilience through adaptive strategies and innovative solutions.

Future prospects remain positive with projected growth driven by continued infrastructure development, housing demand, and commercial construction expansion. The market’s strategic importance to national economic development ensures sustained government support and private sector engagement.

Market analysis reveals several critical insights that define the current state and future trajectory of El Salvador’s construction sector:

Government infrastructure investment serves as the primary catalyst for construction market growth, with substantial allocations for transportation networks, utilities, and public facilities. These investments create multiplier effects throughout the construction ecosystem, generating opportunities for contractors, suppliers, and service providers while improving national competitiveness.

Urbanization trends drive significant demand for residential and commercial construction projects. As rural populations migrate to urban centers seeking economic opportunities, the need for housing, commercial facilities, and supporting infrastructure increases substantially. This demographic shift creates sustained market demand across multiple construction segments.

Foreign direct investment contributes significantly to construction market expansion, particularly in industrial and commercial sectors. International companies establishing operations in El Salvador require modern facilities, creating opportunities for specialized construction services and advanced building technologies.

Economic diversification initiatives promote construction of manufacturing facilities, logistics centers, and technology parks. These projects require sophisticated construction capabilities and create long-term market opportunities for companies with specialized expertise in industrial construction.

Tourism development generates demand for hospitality infrastructure, recreational facilities, and supporting services. Construction projects related to tourism contribute to economic growth while creating employment opportunities in construction and related industries.

Skilled labor shortages present significant challenges for construction market growth, with 35% of companies reporting difficulty finding qualified workers. The construction industry requires specialized skills that take time to develop, creating bottlenecks in project execution and potentially impacting quality standards.

Material cost volatility affects project profitability and planning, particularly for imported construction materials subject to currency fluctuations and international market conditions. Construction companies must implement sophisticated cost management strategies to maintain competitive positioning while ensuring project viability.

Regulatory complexity can slow project approvals and increase compliance costs, particularly for companies unfamiliar with local requirements. While regulations ensure quality and safety standards, complex approval processes may discourage some potential investors or delay project implementation.

Access to financing remains challenging for smaller construction companies and residential developers. Limited availability of long-term construction financing at competitive rates constrains market participation and project scale, particularly affecting small and medium-sized enterprises.

Environmental considerations require additional planning and compliance measures that may increase project costs and timelines. While environmental protection is essential, balancing development needs with environmental requirements presents ongoing challenges for construction companies.

Infrastructure modernization presents substantial opportunities for construction companies with expertise in transportation, utilities, and telecommunications infrastructure. Government commitments to infrastructure development create long-term project pipelines that support sustained business growth and market expansion.

Sustainable construction represents an emerging opportunity as environmental awareness increases and green building standards gain acceptance. Companies developing expertise in sustainable construction technologies and practices position themselves for future market leadership in this growing segment.

Public-private partnerships offer innovative financing and project delivery mechanisms that create opportunities for construction companies to participate in large-scale infrastructure projects. These partnerships leverage private sector efficiency with public sector resources to deliver complex projects.

Regional integration projects create opportunities for construction companies to participate in cross-border infrastructure development. These projects enhance regional connectivity while providing access to broader markets and diverse project types.

Technology adoption enables construction companies to improve efficiency, quality, and competitiveness through digital project management, building information modeling, and advanced construction techniques. Early adopters gain competitive advantages in project delivery and client satisfaction.

Supply and demand dynamics in El Salvador’s construction market reflect complex interactions between economic growth, government policy, and private sector investment. The market demonstrates cyclical patterns influenced by political stability, economic conditions, and international market factors that affect material costs and financing availability.

Competitive dynamics involve both domestic and international construction companies competing across different market segments. Local companies possess advantages in market knowledge and regulatory familiarity, while international firms bring advanced technologies and financial resources. This competition drives innovation and quality improvements throughout the industry.

Technology adoption increasingly influences market dynamics, with companies investing in digital tools, advanced equipment, and modern construction methods to improve efficiency and competitiveness. MarkWide Research indicates that technology integration improves project delivery times by approximately 20% on average.

Regulatory evolution shapes market dynamics through updated building codes, environmental requirements, and safety standards. These changes create opportunities for companies that adapt quickly while potentially challenging those slower to embrace new requirements.

Economic integration with regional and global markets influences construction demand through trade relationships, investment flows, and economic cooperation agreements. These connections create opportunities while also exposing the market to external economic fluctuations.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into El Salvador’s construction market. Primary research includes surveys and interviews with industry participants, government officials, and market stakeholders to gather firsthand information about market conditions, trends, and challenges.

Secondary research incorporates analysis of government statistics, industry reports, economic data, and regulatory documents to provide quantitative foundations for market assessment. This approach ensures comprehensive coverage of market segments, geographic regions, and time periods relevant to construction market analysis.

Data validation processes include cross-referencing multiple sources, statistical analysis, and expert review to ensure accuracy and reliability of market insights. Quantitative data undergoes statistical testing while qualitative insights receive expert validation to maintain research integrity.

Market segmentation analysis examines construction market components including residential, commercial, industrial, and infrastructure segments. This detailed segmentation provides insights into specific market dynamics, growth patterns, and opportunity areas within the broader construction market.

Trend analysis incorporates historical data, current market conditions, and forward-looking indicators to identify market trends and project future developments. This temporal analysis provides context for understanding market evolution and anticipating future changes.

San Salvador Metropolitan Area dominates construction activity, accounting for approximately 55% of total market activity. This region benefits from economic concentration, government presence, and infrastructure advantages that attract residential, commercial, and industrial construction projects. The metropolitan area demonstrates the highest construction values and most sophisticated project types.

Western regions including Santa Ana and surrounding areas represent 20% of construction market share, driven by agricultural processing facilities, manufacturing plants, and residential development. These areas benefit from proximity to Guatemala border and established transportation networks that support economic activity and construction demand.

Eastern regions encompassing San Miguel and coastal areas account for 15% of market activity, with construction focused on port facilities, tourism infrastructure, and agricultural support facilities. The eastern region demonstrates growth potential through strategic location advantages and natural resource development opportunities.

Central regions contribute 10% of construction activity, primarily through infrastructure projects, rural development initiatives, and small-scale residential construction. These areas benefit from government rural development programs and infrastructure connectivity improvements that support construction market growth.

Coastal areas show increasing construction activity related to tourism development, port facilities, and residential projects. These regions benefit from natural attractions and strategic location advantages that create opportunities for specialized construction projects and infrastructure development.

Market competition involves diverse participants ranging from large international construction companies to local contractors specializing in specific market segments. The competitive environment encourages innovation, quality improvement, and cost efficiency while providing clients with various options for construction services.

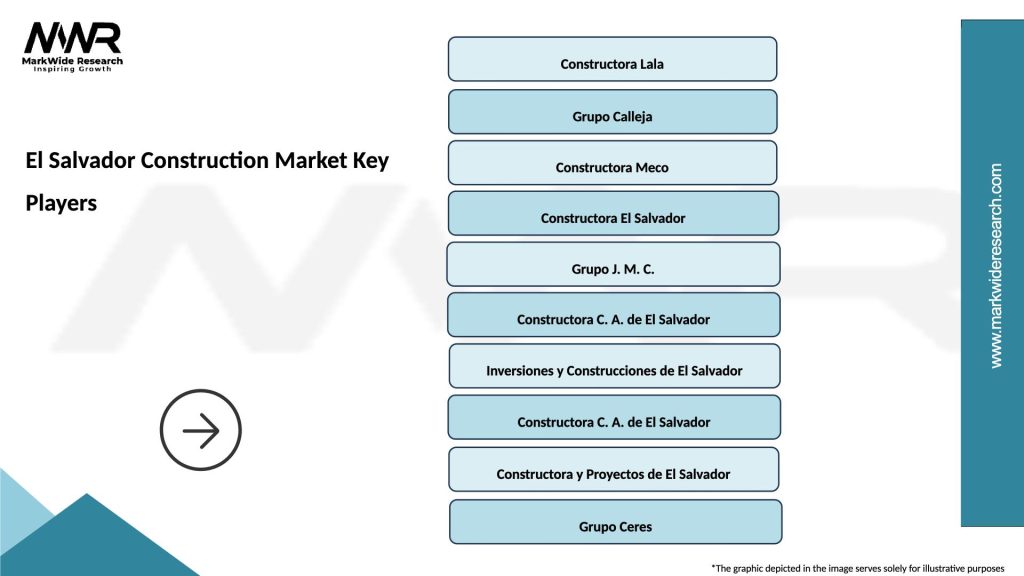

Leading market participants include:

Competitive strategies include specialization in specific market segments, technology adoption, strategic partnerships, and geographic expansion. Companies differentiate through service quality, project delivery capabilities, and client relationships while competing on cost-effectiveness and technical expertise.

Market consolidation trends show larger companies acquiring smaller firms to expand capabilities and market reach. This consolidation creates more capable organizations while potentially reducing competition in some market segments.

By Construction Type:

By Project Scale:

By Geographic Region:

Residential Construction demonstrates consistent demand driven by population growth and urbanization trends. This segment benefits from government housing programs, private development initiatives, and increasing household formation rates. Quality standards continue improving while affordability remains a key consideration for market development.

Commercial Construction reflects economic diversification efforts and business expansion needs. Office buildings, retail centers, and hospitality facilities create opportunities for specialized construction services while contributing to urban development and economic growth. This segment shows sensitivity to economic cycles and business confidence levels.

Industrial Construction supports manufacturing expansion and logistics development essential for economic competitiveness. These projects require specialized expertise and often involve international companies bringing advanced construction standards and technologies. Industrial construction contributes significantly to employment generation and economic development.

Infrastructure Construction represents government priorities for national development and competitiveness improvement. Transportation networks, utilities, and public facilities create foundation for economic growth while providing substantial opportunities for construction companies. This segment demonstrates stability through government commitment and international development assistance.

Specialty Construction includes renovation, restoration, and specialized building types serving unique market needs. This segment provides opportunities for companies with specific expertise while contributing to market diversity and resilience.

Construction Companies benefit from diverse market opportunities, government support for infrastructure development, and improving business environment that supports growth and profitability. The market provides opportunities for specialization, technology adoption, and regional expansion while contributing to national development objectives.

Suppliers and Vendors gain from sustained construction activity that creates demand for materials, equipment, and services. The market supports supply chain development while encouraging quality improvement and competitive pricing that benefits all market participants.

Financial Institutions find opportunities in construction financing, project funding, and related financial services. The construction market creates demand for various financial products while contributing to economic growth and employment generation that supports broader financial sector development.

Government Agencies achieve development objectives through construction market activity that improves infrastructure, housing availability, and economic competitiveness. Construction projects contribute to employment generation, tax revenue, and national development goals while supporting political stability and social progress.

Local Communities benefit from improved infrastructure, housing availability, and employment opportunities created by construction activity. These projects enhance quality of life while supporting economic development and social progress in communities throughout El Salvador.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainable construction practices gain momentum as environmental awareness increases and green building standards become more prevalent. Construction companies increasingly adopt environmentally responsible methods, energy-efficient technologies, and sustainable materials to meet client expectations and regulatory requirements.

Technology integration transforms construction project management, design processes, and building methods. Digital tools, building information modeling, and advanced construction equipment improve efficiency, quality, and safety while reducing costs and project timelines. MWR analysis indicates that 40% of construction companies now utilize digital project management systems.

Modular and prefabricated construction methods gain acceptance as solutions for faster project delivery and cost control. These approaches reduce construction time, improve quality consistency, and provide flexibility in project design while addressing skilled labor shortages through factory-based production methods.

Public-private partnerships become increasingly important for large infrastructure projects, combining public sector resources with private sector efficiency. These partnerships enable complex project financing while transferring appropriate risks to parties best equipped to manage them.

Regional integration creates opportunities for cross-border construction projects and market expansion. Construction companies increasingly participate in regional infrastructure development while accessing broader markets and diverse project opportunities.

Infrastructure modernization programs represent major industry developments with government investments in transportation networks, utilities, and public facilities. These programs create substantial opportunities for construction companies while improving national competitiveness and economic development prospects.

Regulatory framework improvements streamline construction approvals and enhance industry standards. Updated building codes, environmental regulations, and safety requirements create clearer guidelines for construction companies while ensuring quality and safety standards that protect public interests.

International partnerships bring advanced construction technologies, financing mechanisms, and expertise to El Salvador’s construction market. These partnerships facilitate knowledge transfer while providing access to international markets and best practices that enhance industry capabilities.

Skills development initiatives address workforce needs through training programs, technical education, and certification systems. These programs improve construction industry capabilities while creating career opportunities for workers and supporting industry growth and competitiveness.

Technology adoption programs promote modern construction methods, digital tools, and advanced equipment utilization. Government and industry initiatives support technology integration while improving construction efficiency, quality, and safety standards throughout the market.

Market participants should focus on developing specialized capabilities in high-growth segments such as infrastructure construction and sustainable building practices. Companies that invest in technology adoption, workforce development, and quality improvement position themselves for long-term success in the evolving construction market.

Strategic partnerships with international firms, suppliers, and financial institutions can provide access to advanced technologies, financing, and market opportunities. These partnerships enable knowledge transfer while expanding capabilities and market reach for local construction companies.

Technology investment in digital project management, building information modeling, and advanced construction equipment improves competitiveness and project delivery capabilities. Early adopters gain advantages in efficiency, quality, and client satisfaction that translate into market leadership positions.

Workforce development through training programs, skills certification, and career development initiatives addresses labor shortages while improving construction quality and safety. Companies investing in human capital development create competitive advantages while contributing to industry advancement.

Market diversification across construction segments, geographic regions, and client types reduces risk while creating growth opportunities. Companies with diversified portfolios demonstrate greater resilience during economic cycles while capturing opportunities across different market segments.

Long-term growth prospects for El Salvador’s construction market remain positive, supported by continued infrastructure investment, urban development needs, and economic diversification initiatives. The market demonstrates resilience and adaptability while benefiting from government support and private sector engagement.

Infrastructure development will continue driving market growth with substantial government commitments to transportation networks, utilities, and public facilities. These investments create sustained demand for construction services while improving national competitiveness and economic development prospects.

Technology adoption will accelerate as construction companies recognize competitive advantages from digital tools, advanced equipment, and modern construction methods. This technological evolution improves efficiency, quality, and safety while creating new opportunities for innovation and market differentiation.

Sustainable construction practices will become increasingly important as environmental awareness grows and green building standards gain acceptance. Companies developing expertise in sustainable construction position themselves for future market leadership in this expanding segment.

Regional integration will create additional opportunities through cross-border projects and market expansion. MarkWide Research projects that regional construction activity will grow by approximately 8.5% annually over the next five years, creating opportunities for companies with regional capabilities and strategic partnerships.

El Salvador’s construction market presents significant opportunities for growth and development, supported by government infrastructure investments, urbanization trends, and economic diversification initiatives. The market demonstrates resilience and adaptability while facing challenges including skilled labor shortages, material cost volatility, and regulatory complexity.

Key success factors include technology adoption, workforce development, strategic partnerships, and market diversification that enable construction companies to capitalize on growth opportunities while managing market risks. Companies that invest in capabilities development and quality improvement position themselves for long-term success in the evolving construction market.

Future prospects remain positive with continued government support for infrastructure development, private sector investment in construction projects, and regional integration opportunities that expand market potential. The construction market’s strategic importance to national development ensures sustained growth and opportunity creation for industry participants and stakeholders throughout El Salvador.

What is El Salvador Construction?

El Salvador Construction refers to the activities involved in the building and infrastructure development within the country, including residential, commercial, and public works projects.

What are the key players in the El Salvador Construction Market?

Key players in the El Salvador Construction Market include Constructora Lala, Grupo Calleja, and CEMEX El Salvador, among others.

What are the main drivers of growth in the El Salvador Construction Market?

The main drivers of growth in the El Salvador Construction Market include urbanization, government investment in infrastructure, and increasing demand for housing.

What challenges does the El Salvador Construction Market face?

Challenges in the El Salvador Construction Market include regulatory hurdles, limited access to financing, and issues related to labor shortages.

What opportunities exist in the El Salvador Construction Market?

Opportunities in the El Salvador Construction Market include the potential for public-private partnerships, growth in renewable energy projects, and advancements in construction technology.

What trends are shaping the El Salvador Construction Market?

Trends shaping the El Salvador Construction Market include the increasing use of sustainable building materials, the adoption of smart construction technologies, and a focus on resilient infrastructure.

El Salvador Construction Market

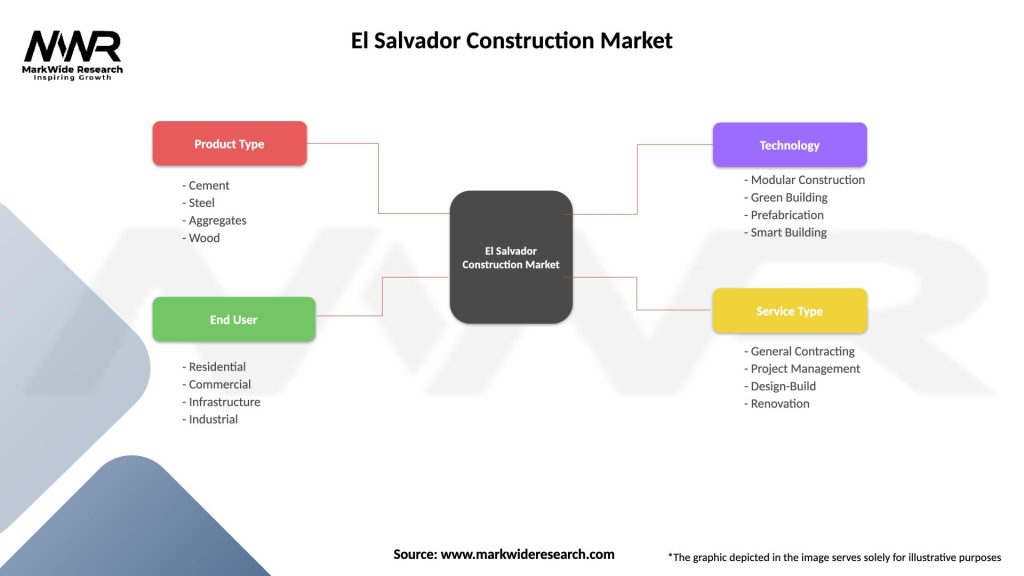

| Segmentation Details | Description |

|---|---|

| Product Type | Cement, Steel, Aggregates, Wood |

| End User | Residential, Commercial, Infrastructure, Industrial |

| Technology | Modular Construction, Green Building, Prefabrication, Smart Building |

| Service Type | General Contracting, Project Management, Design-Build, Renovation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the El Salvador Construction Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at