444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Egypt telecom tower market represents a critical infrastructure segment driving the nation’s digital transformation and telecommunications expansion. Egypt’s strategic position as a gateway between Africa, Asia, and Europe has positioned it as a telecommunications hub, necessitating robust tower infrastructure to support growing connectivity demands. The market encompasses various tower types including monopole towers, lattice towers, guyed towers, and stealth towers, serving multiple telecommunications operators and emerging 5G networks.

Market dynamics indicate substantial growth driven by increasing mobile subscriber penetration, which has reached approximately 95% of the population. The Egyptian government’s commitment to digital infrastructure development, coupled with rising data consumption patterns, has created unprecedented demand for telecom tower installations and upgrades. Tower sharing initiatives have gained significant traction, with operators increasingly adopting shared infrastructure models to optimize costs and accelerate network deployment.

Infrastructure modernization efforts are transforming the landscape, with legacy 2G and 3G towers being upgraded to support 4G LTE and prepare for 5G deployment. The market benefits from Egypt’s Vision 2030 digital transformation strategy, which emphasizes telecommunications infrastructure as a cornerstone of economic development. Rural connectivity expansion represents a key growth driver, with government initiatives targeting underserved areas to bridge the digital divide.

The Egypt telecom tower market refers to the comprehensive ecosystem of telecommunications infrastructure including tower construction, installation, maintenance, and management services within Egypt’s borders. This market encompasses physical tower structures, supporting equipment, power systems, and associated technologies that enable wireless communication networks to function effectively across urban, suburban, and rural areas.

Telecom towers serve as the backbone of wireless communication networks, housing antennas, transmitters, receivers, and other critical equipment necessary for mobile voice and data services. The market includes various stakeholders such as tower companies, telecommunications operators, equipment manufacturers, construction firms, and maintenance service providers working collaboratively to ensure network coverage and capacity.

Market scope extends beyond traditional voice services to encompass data transmission, internet connectivity, IoT applications, and emerging technologies requiring robust wireless infrastructure. The definition includes both build-to-suit towers constructed for specific operators and multi-tenant towers designed to accommodate multiple service providers, reflecting the industry’s evolution toward shared infrastructure models.

Egypt’s telecom tower market demonstrates remarkable resilience and growth potential, driven by accelerating digitalization trends and government-backed infrastructure initiatives. The market has experienced consistent expansion, with tower installations growing at approximately 12% annually over recent years. Key market participants include major telecommunications operators, independent tower companies, and international infrastructure investors recognizing Egypt’s strategic importance in regional connectivity.

Market consolidation trends are evident as operators increasingly focus on core services while divesting tower assets to specialized infrastructure companies. This shift has created opportunities for tower companies to expand portfolios and optimize operational efficiencies through economies of scale. Technology evolution from 4G to 5G networks is driving substantial infrastructure investments, with operators requiring denser tower networks to support higher frequency bands and increased capacity demands.

Investment climate remains favorable, supported by stable regulatory frameworks and government commitment to telecommunications development. The market benefits from Egypt’s large population base, growing smartphone adoption rates of approximately 75%, and increasing data consumption patterns. Future prospects appear promising, with emerging applications such as smart cities, industrial IoT, and digital services creating sustained demand for enhanced tower infrastructure.

Strategic insights reveal several critical factors shaping the Egypt telecom tower market landscape:

Primary market drivers propelling the Egypt telecom tower market include accelerating digital transformation initiatives across government and private sectors. The Egyptian government’s commitment to becoming a regional digital hub has resulted in substantial infrastructure investments and supportive policy frameworks. Mobile data consumption continues growing exponentially, with average monthly usage per subscriber increasing by approximately 45% annually, necessitating network capacity expansions.

Population demographics present significant growth opportunities, with Egypt’s young, tech-savvy population driving smartphone adoption and digital service utilization. The country’s strategic geographic location makes it an attractive destination for international connectivity projects, including submarine cable landings and regional network hubs. Economic diversification efforts are creating demand for reliable telecommunications infrastructure to support emerging industries and digital services.

5G network deployment represents a transformative driver, requiring substantial tower infrastructure investments to support higher frequency bands and network densification. Government initiatives promoting financial inclusion through mobile banking and digital payment systems are driving rural connectivity expansion. Smart city projects in major urban centers are creating demand for advanced telecommunications infrastructure supporting IoT applications, traffic management systems, and public services digitalization.

Significant challenges facing the Egypt telecom tower market include complex regulatory approval processes that can delay tower deployment projects. Despite improvements, obtaining necessary permits and clearances for tower construction remains time-consuming, particularly in densely populated urban areas. Land acquisition difficulties present ongoing obstacles, with suitable sites becoming increasingly scarce and expensive in prime locations.

Environmental concerns and community resistance to tower installations create deployment challenges, requiring extensive stakeholder engagement and environmental impact assessments. Power infrastructure limitations in remote areas complicate tower operations, necessitating expensive backup power solutions and increasing operational costs. Security considerations in certain regions may restrict tower deployment and maintenance activities, affecting network coverage expansion plans.

Economic volatility and currency fluctuations can impact infrastructure investment decisions and equipment procurement costs. Competition for skilled technical personnel creates workforce challenges, with specialized tower construction and maintenance expertise in high demand. Technology obsolescence risks require careful planning to ensure infrastructure investments remain viable as wireless technologies continue evolving rapidly.

Substantial opportunities exist in rural and underserved market segments where telecommunications infrastructure remains underdeveloped. Government initiatives targeting universal connectivity create favorable conditions for tower deployment in previously uneconomical locations. Tower sharing models present significant opportunities for cost optimization and accelerated network deployment, with potential efficiency gains of 35-50% compared to single-tenant approaches.

5G network rollout represents the most significant near-term opportunity, requiring extensive infrastructure investments and creating demand for specialized tower solutions supporting millimeter-wave frequencies. Smart city initiatives across major Egyptian cities are creating opportunities for integrated telecommunications infrastructure supporting multiple applications and services. Industrial digitalization trends are driving demand for private network solutions and dedicated tower infrastructure serving manufacturing and logistics sectors.

International connectivity projects position Egypt as a regional telecommunications hub, creating opportunities for specialized tower infrastructure supporting submarine cable systems and satellite ground stations. Renewable energy integration presents opportunities for sustainable tower solutions, reducing operational costs and supporting environmental objectives. Edge computing deployment is creating demand for tower-based data centers and enhanced infrastructure supporting low-latency applications.

Market dynamics in Egypt’s telecom tower sector reflect complex interactions between technological advancement, regulatory evolution, and economic development priorities. The transition from operator-owned tower models to independent tower companies is reshaping competitive dynamics and operational efficiencies. Consolidation trends are evident as smaller players seek partnerships or acquisition opportunities to achieve scale advantages.

Technology convergence is influencing tower design and deployment strategies, with infrastructure increasingly required to support multiple wireless technologies simultaneously. The shift toward software-defined networks and network function virtualization is changing equipment requirements and tower specifications. Sustainability considerations are becoming increasingly important, with operators and tower companies prioritizing energy-efficient solutions and renewable power integration.

Competitive pressures are driving innovation in tower design, construction methodologies, and operational practices. According to MarkWide Research analysis, market participants are increasingly focusing on differentiation through service quality, deployment speed, and cost optimization. Customer expectations for network reliability and coverage quality continue rising, requiring ongoing infrastructure investments and performance improvements.

Comprehensive research methodology employed for analyzing the Egypt telecom tower market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability. Primary research involves extensive interviews with key industry stakeholders including telecommunications operators, tower companies, equipment manufacturers, and regulatory officials. Secondary research encompasses analysis of government publications, industry reports, financial statements, and regulatory filings.

Data triangulation methods are utilized to validate findings across multiple sources and ensure consistency in market assessments. Quantitative analysis includes statistical modeling of market trends, growth projections, and competitive positioning metrics. Qualitative assessment incorporates expert opinions, industry insights, and strategic analysis of market dynamics and future developments.

Market segmentation analysis employs detailed categorization by tower type, technology, application, and geographic region to provide comprehensive market understanding. Field research includes site visits, infrastructure assessments, and operational analysis to validate market assumptions and identify emerging trends. Regulatory analysis encompasses detailed review of policy frameworks, licensing requirements, and compliance obligations affecting market participants.

Greater Cairo region dominates the Egypt telecom tower market, accounting for approximately 35% of total installations due to high population density and concentrated economic activity. The region benefits from advanced infrastructure, favorable regulatory environment, and strong demand for high-capacity telecommunications services. Alexandria and Delta region represents the second-largest market segment, with significant industrial and commercial activity driving tower deployment requirements.

Upper Egypt region presents substantial growth opportunities, with government initiatives targeting improved connectivity in historically underserved areas. Rural tower deployment in this region faces unique challenges including power infrastructure limitations and difficult terrain conditions. Red Sea and Sinai regions are experiencing increased tower deployment driven by tourism development and strategic economic projects.

New Administrative Capital and surrounding areas represent emerging high-growth segments, with smart city initiatives driving demand for advanced telecommunications infrastructure. The region benefits from planned infrastructure development and government support for digital services. Canal Zone areas are experiencing growth driven by logistics and industrial development, requiring specialized tower solutions supporting commercial and industrial applications.

Competitive landscape in Egypt’s telecom tower market features a mix of international tower companies, domestic operators, and specialized infrastructure providers:

Market competition is intensifying as operators seek to optimize infrastructure costs while maintaining service quality and coverage standards. Strategic partnerships and joint ventures are becoming increasingly common as market participants seek to leverage complementary capabilities and share investment risks.

Market segmentation analysis reveals distinct categories based on multiple classification criteria:

By Tower Type:

By Technology:

By Application:

Monopole tower segment demonstrates strongest growth momentum, with installations increasing by approximately 18% annually driven by urban densification requirements and aesthetic considerations. These towers offer optimal solutions for space-constrained urban environments while supporting multiple operators and technologies. Installation efficiency and reduced site preparation requirements make monopole towers increasingly attractive for rapid deployment scenarios.

4G LTE infrastructure represents the largest technology segment, accounting for the majority of new tower installations and upgrades. The segment benefits from ongoing network modernization efforts and increasing data consumption patterns. 5G-ready installations are gaining traction as operators prepare for next-generation network deployment, with approximately 20% of new towers incorporating 5G-compatible features.

Rural deployment category shows accelerating growth driven by government connectivity initiatives and operator expansion strategies. These installations often require specialized solutions including renewable power systems and enhanced structural designs for challenging environmental conditions. Tower sharing adoption in rural areas is particularly strong, with multi-tenancy rates reaching 60% in some regions to optimize deployment economics.

Telecommunications operators benefit from improved network coverage, enhanced service quality, and reduced infrastructure costs through tower sharing arrangements. Operators can focus on core competencies while leveraging specialized tower companies for infrastructure management and optimization. Cost savings of up to 30% are achievable through shared infrastructure models compared to individual tower ownership.

Tower companies enjoy stable revenue streams through long-term lease agreements and opportunities for portfolio expansion through acquisition and new construction. The business model provides predictable cash flows and potential for operational efficiency improvements through economies of scale. Investment returns are enhanced through multi-tenant tower utilization and value-added services.

Government stakeholders benefit from improved telecommunications infrastructure supporting economic development, digital inclusion, and public service delivery. Enhanced connectivity facilitates e-government initiatives, digital education, and healthcare services. Economic impact includes job creation, technology transfer, and improved business competitiveness through better communications infrastructure.

End users experience improved service quality, expanded coverage areas, and access to advanced mobile services and applications. Rural communities particularly benefit from enhanced connectivity enabling access to digital services, online education, and economic opportunities. Service reliability improvements and faster data speeds enhance user experience and productivity.

Strengths:

Weaknesses:

Opportunities:

Threats:

Infrastructure sharing emerges as the dominant trend, with operators increasingly adopting collaborative approaches to reduce costs and accelerate deployment. This trend is driving consolidation in the tower industry and creating opportunities for specialized infrastructure companies. Sharing rates have improved significantly, with new installations achieving multi-tenancy levels of 70% or higher.

Green tower initiatives are gaining momentum as environmental sustainability becomes a priority for operators and regulators. Solar-powered towers, energy-efficient equipment, and sustainable construction materials are becoming standard features in new installations. Carbon footprint reduction efforts are driving adoption of renewable energy solutions and efficient cooling systems.

Smart tower technology integration is transforming traditional infrastructure into intelligent platforms supporting multiple applications beyond basic telecommunications. These installations incorporate IoT sensors, edge computing capabilities, and advanced monitoring systems. Operational efficiency improvements of 25% are achievable through smart tower implementations.

Network densification trends are driving demand for small cell deployments and distributed antenna systems to support 5G networks and capacity requirements. Urban areas particularly require denser infrastructure to support higher frequency bands and increased user density. MWR data indicates small cell deployments are expected to complement traditional macro tower infrastructure significantly.

Recent industry developments highlight the dynamic nature of Egypt’s telecom tower market. Major operators have announced significant infrastructure investment programs targeting network modernization and coverage expansion. Partnership agreements between international tower companies and local operators are facilitating technology transfer and operational expertise sharing.

Regulatory reforms have streamlined tower deployment processes, reducing approval timelines and simplifying compliance requirements. The government has introduced incentives for rural tower deployment and renewable energy integration in telecommunications infrastructure. Spectrum allocation decisions are driving network upgrade requirements and creating demand for enhanced tower infrastructure.

Technology partnerships between equipment manufacturers and tower companies are accelerating innovation in tower design and functionality. Advanced materials, modular construction techniques, and integrated power solutions are improving deployment efficiency and operational performance. Digital transformation initiatives are creating demand for edge computing capabilities and enhanced connectivity solutions.

Investment announcements from international infrastructure funds and development finance institutions are providing capital for market expansion. These investments are supporting both greenfield tower construction and acquisition of existing infrastructure assets. Market consolidation activities continue as operators divest tower assets to focus on core telecommunications services.

Strategic recommendations for market participants emphasize the importance of embracing infrastructure sharing models to optimize costs and accelerate deployment timelines. Operators should consider divesting non-core tower assets to specialized infrastructure companies while maintaining focus on service delivery and customer experience. Partnership strategies with international tower companies can provide access to best practices and operational expertise.

Technology investment priorities should focus on 5G-ready infrastructure and multi-technology platforms supporting current and future wireless standards. Early preparation for 5G deployment will provide competitive advantages and reduce future upgrade costs. Rural expansion strategies should leverage government incentives and shared infrastructure models to improve deployment economics.

Sustainability initiatives should be integrated into tower deployment and operational strategies to meet environmental objectives and regulatory requirements. Renewable energy integration and energy-efficient equipment selection will reduce operational costs and support corporate sustainability goals. Stakeholder engagement programs should address community concerns and facilitate smoother deployment processes.

Risk management strategies should address regulatory, environmental, and technology obsolescence risks through diversified approaches and flexible infrastructure designs. According to MarkWide Research analysis, successful market participants will be those who can adapt quickly to changing technology requirements and market conditions.

Future prospects for Egypt’s telecom tower market appear highly promising, with sustained growth expected driven by 5G network deployment, rural connectivity expansion, and smart city initiatives. The market is projected to experience robust expansion with tower installations growing at approximately 15% annually over the next five years. Technology evolution will continue driving infrastructure upgrade requirements and creating opportunities for specialized tower solutions.

5G network rollout represents the most significant growth driver, requiring substantial infrastructure investments and network densification. Early 5G deployment is expected to begin in major urban centers before expanding to suburban and rural areas. Infrastructure sharing will become increasingly important as operators seek to optimize 5G deployment costs and accelerate coverage expansion.

Digital transformation initiatives across government and private sectors will create sustained demand for enhanced telecommunications infrastructure. Smart city projects, industrial digitalization, and e-government services will require robust connectivity solutions supported by advanced tower infrastructure. Edge computing integration will transform towers into distributed data processing centers supporting low-latency applications.

Market consolidation trends are expected to continue as the industry matures and operators focus on core competencies. Independent tower companies will play increasingly important roles in infrastructure provision and management. International investment flows will support market expansion and technology advancement, positioning Egypt as a regional telecommunications hub.

Egypt’s telecom tower market stands at a transformative juncture, driven by technological advancement, government support, and growing connectivity demands. The market demonstrates strong fundamentals with substantial growth opportunities in 5G deployment, rural expansion, and smart city initiatives. Infrastructure sharing models are reshaping competitive dynamics and creating opportunities for specialized tower companies to optimize operational efficiencies.

Strategic positioning will be critical for market participants as the industry evolves toward more sophisticated infrastructure requirements and collaborative business models. Success will depend on adaptability to changing technology standards, effective stakeholder engagement, and sustainable operational practices. Investment opportunities remain attractive for both domestic and international players seeking exposure to Egypt’s growing telecommunications infrastructure market.

The market’s future trajectory appears positive, supported by favorable demographics, government initiatives, and accelerating digital transformation trends. Continued growth is expected as Egypt positions itself as a regional connectivity hub and advances toward comprehensive 5G network coverage. Market participants who embrace innovation, sustainability, and collaborative approaches will be best positioned to capitalize on emerging opportunities in this dynamic and evolving sector.

What is Telecom Tower?

Telecom towers are structures that support antennas and other equipment for telecommunications, enabling wireless communication for mobile networks, broadcasting, and data transmission.

What are the key players in the Egypt Telecom Tower Market?

Key players in the Egypt Telecom Tower Market include companies like Vodafone Egypt, Orange Egypt, and Etisalat Misr, which are involved in the deployment and management of telecom infrastructure, among others.

What are the growth factors driving the Egypt Telecom Tower Market?

The growth of the Egypt Telecom Tower Market is driven by increasing mobile data consumption, the expansion of 5G networks, and the rising demand for improved connectivity in urban areas.

What challenges does the Egypt Telecom Tower Market face?

Challenges in the Egypt Telecom Tower Market include regulatory hurdles, high infrastructure costs, and the need for land acquisition, which can delay tower deployment.

What opportunities exist in the Egypt Telecom Tower Market?

Opportunities in the Egypt Telecom Tower Market include the potential for partnerships with local governments for infrastructure development and the growing demand for smart city solutions that require enhanced telecom services.

What trends are shaping the Egypt Telecom Tower Market?

Trends in the Egypt Telecom Tower Market include the shift towards small cell technology for urban areas, increased investment in renewable energy solutions for tower operations, and the integration of IoT devices to enhance network capabilities.

Egypt Telecom Tower Market

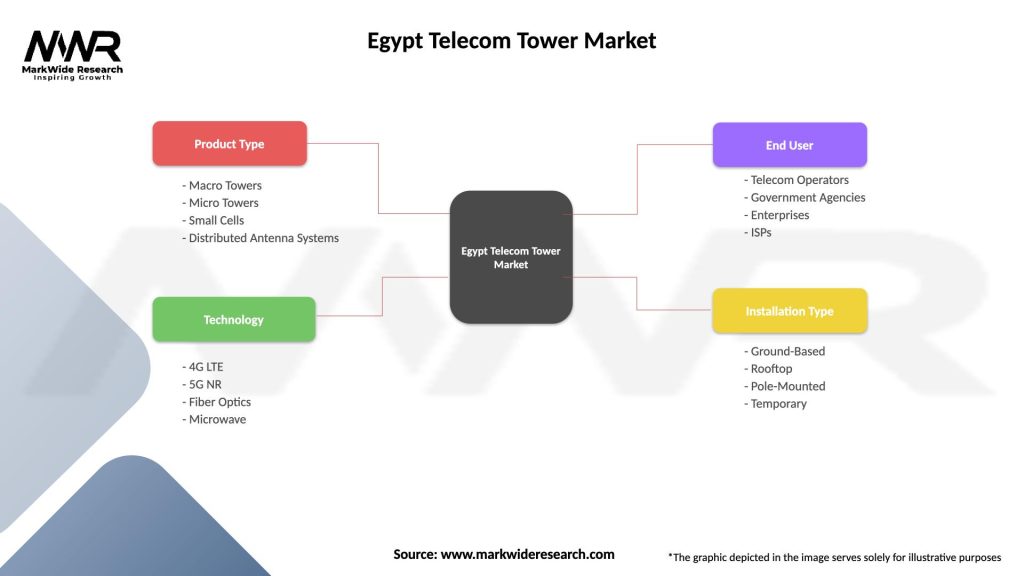

| Segmentation Details | Description |

|---|---|

| Product Type | Macro Towers, Micro Towers, Small Cells, Distributed Antenna Systems |

| Technology | 4G LTE, 5G NR, Fiber Optics, Microwave |

| End User | Telecom Operators, Government Agencies, Enterprises, ISPs |

| Installation Type | Ground-Based, Rooftop, Pole-Mounted, Temporary |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Egypt Telecom Tower Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at