444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Egypt real estate brokerage market represents a dynamic and rapidly evolving sector within the country’s broader real estate ecosystem. This market encompasses professional intermediaries who facilitate property transactions between buyers, sellers, landlords, and tenants across residential, commercial, and industrial segments. Market dynamics indicate substantial growth potential driven by urbanization, demographic shifts, and increasing demand for professional real estate services.

Egypt’s real estate brokerage sector has experienced significant transformation in recent years, with traditional practices evolving to incorporate modern technology and international best practices. The market demonstrates robust growth momentum with increasing professionalization of services and growing consumer awareness about the benefits of using licensed real estate professionals. Digital transformation has become a key driver, with online platforms and mobile applications revolutionizing how properties are marketed and transactions are conducted.

Regional distribution shows concentrated activity in major urban centers, particularly Cairo, Alexandria, and the New Administrative Capital, while emerging markets in coastal cities and new urban developments present significant opportunities. The market exhibits strong fundamentals supported by government initiatives to formalize the real estate sector and improve regulatory frameworks governing brokerage operations.

The Egypt real estate brokerage market refers to the comprehensive ecosystem of licensed professionals and companies that provide intermediary services for property transactions, including buying, selling, leasing, and property management services across all real estate segments in Egypt. This market encompasses traditional brokerage firms, independent agents, online platforms, and specialized service providers who facilitate real estate transactions while ensuring compliance with local regulations and industry standards.

Real estate brokerage services in Egypt include property valuation, market analysis, marketing and advertising, client representation, transaction coordination, legal documentation assistance, and post-transaction support. The market operates within a regulatory framework that requires licensing and certification of real estate professionals, ensuring consumer protection and service quality standards.

Market participants range from large established firms with extensive networks to boutique agencies specializing in specific property types or geographic areas. The sector increasingly incorporates technology-driven solutions, including virtual property tours, online transaction management, and data analytics tools to enhance service delivery and client experience.

Egypt’s real estate brokerage market demonstrates exceptional growth potential driven by urbanization trends, population growth, and increasing demand for professional real estate services. The market benefits from government initiatives to formalize the real estate sector and improve transparency in property transactions. Key growth drivers include rising disposable income, expanding middle class, and growing awareness of professional brokerage benefits.

Technology adoption represents a critical success factor, with approximately 68% of leading brokerage firms implementing digital platforms to enhance service delivery and client engagement. The market shows strong momentum in residential segments, while commercial real estate brokerage presents significant opportunities driven by business expansion and foreign investment initiatives.

Competitive landscape features a mix of established local players and emerging technology-driven platforms, creating a dynamic environment that benefits consumers through improved service quality and competitive pricing. The market demonstrates resilience and adaptability, with brokers increasingly focusing on value-added services and specialized expertise to differentiate their offerings.

Strategic market insights reveal several critical trends shaping Egypt’s real estate brokerage landscape:

Market maturation indicators include increasing transaction volumes, improving service standardization, and growing consumer confidence in professional brokerage services. These insights demonstrate the market’s evolution toward greater professionalism and efficiency.

Primary market drivers propelling Egypt’s real estate brokerage sector include demographic shifts, economic development, and changing consumer preferences. Population growth and urbanization create sustained demand for housing and commercial properties, directly benefiting brokerage services through increased transaction volumes and market activity.

Economic diversification initiatives and foreign investment promotion contribute significantly to market expansion. Government programs aimed at attracting international businesses and investors generate demand for commercial real estate services, while infrastructure development projects create new residential and mixed-use opportunities requiring professional brokerage expertise.

Technology advancement serves as a crucial driver, enabling brokers to reach wider audiences, streamline operations, and provide enhanced client services. Digital marketing capabilities, virtual property tours, and online transaction management systems improve efficiency and client satisfaction, driving market growth and professionalization.

Regulatory improvements including licensing requirements, consumer protection measures, and transaction transparency initiatives build market confidence and encourage the use of professional brokerage services. These regulatory enhancements create a more stable and trustworthy market environment that benefits all stakeholders.

Market challenges facing Egypt’s real estate brokerage sector include economic volatility, regulatory complexity, and traditional market practices that resist modernization. Currency fluctuations and economic uncertainty can impact property values and transaction volumes, affecting brokerage revenues and market stability.

Regulatory compliance costs and licensing requirements may present barriers for smaller brokerage firms and independent agents, potentially limiting market participation and competition. Complex bureaucratic processes for property transactions can slow deal completion and reduce client satisfaction with brokerage services.

Market fragmentation and lack of standardization in some segments create challenges for brokers seeking to provide consistent service quality. Informal market practices and direct transactions between parties can bypass professional brokerage services, limiting market growth potential.

Technology adoption barriers including infrastructure limitations and resistance to digital transformation among traditional market participants may slow the implementation of modern brokerage tools and services. Training and development costs for technology integration can strain resources for smaller firms.

Significant opportunities exist within Egypt’s real estate brokerage market, particularly in emerging segments and underserved geographic areas. New urban developments and planned cities present substantial opportunities for brokers to establish early market presence and build client relationships in high-growth areas.

Commercial real estate expansion driven by business growth and foreign investment creates demand for specialized brokerage services including office leasing, retail space management, and industrial property transactions. These segments typically offer higher commission rates and longer-term client relationships.

Property management services represent a growing opportunity as property owners seek professional management for rental properties and commercial assets. This recurring revenue stream provides stability and growth potential for brokerage firms willing to expand their service offerings.

International client services present opportunities for brokers with multilingual capabilities and international market knowledge. Serving expatriate communities, foreign investors, and international businesses can command premium pricing and create sustainable competitive advantages.

Market dynamics in Egypt’s real estate brokerage sector reflect the interplay between supply and demand factors, regulatory changes, and technological advancement. Supply-side dynamics include the increasing number of licensed brokers, expansion of service offerings, and geographic market coverage improvements.

Demand-side factors encompass growing consumer awareness of professional brokerage benefits, increasing transaction complexity requiring expert assistance, and rising expectations for service quality and transparency. Market research indicates that approximately 72% of property buyers now prefer using professional brokerage services compared to direct transactions.

Competitive dynamics feature increasing differentiation through specialization, technology adoption, and value-added services. Firms compete on service quality, market expertise, and client relationship management rather than solely on commission rates, indicating market maturation and professionalization.

Regulatory dynamics continue evolving with government initiatives to improve market transparency, consumer protection, and professional standards. These changes create both challenges and opportunities for market participants, requiring ongoing adaptation and compliance investments.

Comprehensive research methodology employed for analyzing Egypt’s real estate brokerage market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research includes structured interviews with industry professionals, brokerage firm executives, and market participants to gather firsthand insights about market trends and challenges.

Secondary research encompasses analysis of government statistics, industry reports, regulatory filings, and market publications to establish baseline data and historical trends. Market surveys conducted among consumers and industry stakeholders provide insights into preferences, satisfaction levels, and future expectations.

Data validation processes include cross-referencing multiple sources, expert review panels, and statistical analysis to ensure information accuracy and relevance. Quantitative analysis focuses on market metrics, growth rates, and performance indicators, while qualitative assessment examines market dynamics, competitive positioning, and strategic implications.

Research scope covers all major market segments, geographic regions, and participant categories to provide comprehensive market understanding. Regular updates and monitoring ensure research findings remain current and actionable for market participants and stakeholders.

Regional market distribution across Egypt shows significant concentration in major metropolitan areas, with Greater Cairo accounting for approximately 45% of total brokerage activity. This dominance reflects the capital’s economic importance, population density, and concentration of commercial and residential development projects.

Alexandria region represents the second-largest market with approximately 18% market share, driven by its status as a major commercial center and tourist destination. The coastal city benefits from both residential and vacation property markets, creating diverse opportunities for brokerage services.

New Administrative Capital emerges as a high-growth region with rapidly expanding brokerage activity. This planned city attracts significant investment and development, creating opportunities for early-market-entry brokers to establish strong positions in government, commercial, and residential segments.

Red Sea coastal areas including Hurghada and Sharm El Sheikh present specialized opportunities in tourism and vacation property markets. These regions require brokers with expertise in international client services and vacation rental management.

Upper Egypt regions remain underserved markets with significant growth potential as economic development initiatives expand beyond traditional centers. Regional expansion strategies focus on establishing local partnerships and developing market-specific expertise.

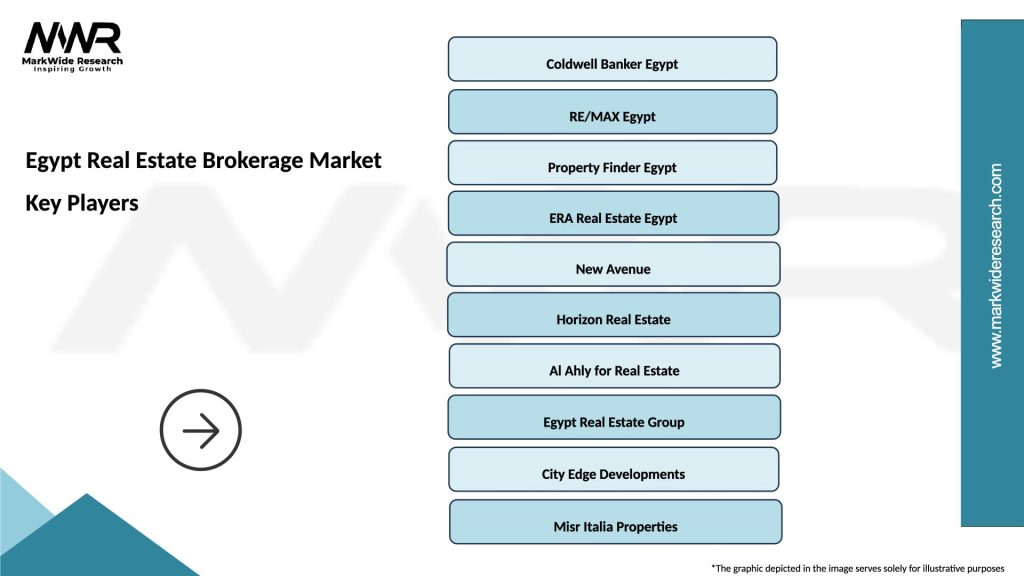

Competitive landscape in Egypt’s real estate brokerage market features diverse participants ranging from large established firms to innovative technology-driven platforms. Market leaders include:

Competitive strategies emphasize service differentiation, technology adoption, and market specialization. Leading firms invest heavily in agent training, digital platforms, and customer relationship management systems to maintain competitive advantages.

Market consolidation trends include strategic partnerships, acquisitions, and franchise expansion as firms seek to achieve scale economies and geographic coverage. Innovation focus centers on digital transformation, data analytics, and enhanced client experience delivery.

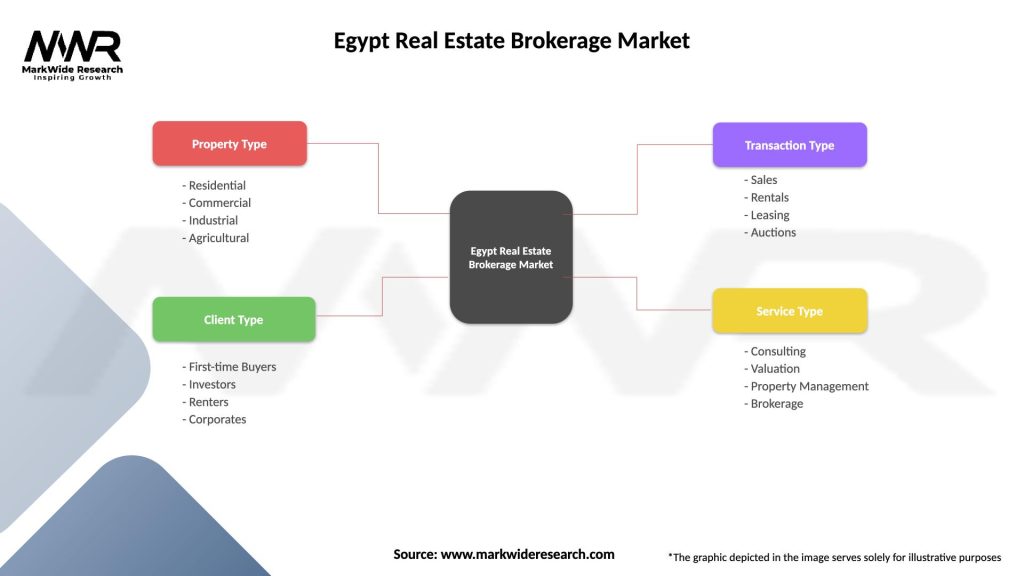

Market segmentation analysis reveals distinct categories based on property type, service offering, and client demographics. By Property Type:

By Service Type:

By Client Segment:

Residential brokerage dominates the market with approximately 65% of total transaction volume, driven by sustained housing demand and population growth. This segment benefits from government housing initiatives and mortgage financing improvements that increase market accessibility for middle-income buyers.

Commercial brokerage shows strong growth potential with increasing business expansion and foreign investment. Office space demand particularly benefits from the New Administrative Capital development and business district expansion in major cities. Retail brokerage grows with shopping center development and international brand expansion.

Luxury property segment represents a high-value niche with premium commission rates and specialized service requirements. This category requires brokers with international experience, multilingual capabilities, and extensive high-net-worth client networks.

Vacation property brokerage in coastal areas presents seasonal opportunities with international client focus. This segment requires specialized marketing approaches and understanding of vacation rental market dynamics.

Investment property services grow as real estate becomes an increasingly popular investment vehicle. Brokers providing comprehensive investment analysis, market research, and portfolio management services command premium pricing and develop long-term client relationships.

Industry participants benefit from Egypt’s real estate brokerage market through multiple value creation opportunities. For Brokerage Firms:

For Real Estate Agents:

For Property Owners:

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping Egypt’s real estate brokerage market. Technology integration includes virtual property tours, online transaction management, and mobile applications that enhance client experience and operational efficiency. Approximately 78% of leading firms have implemented comprehensive digital platforms to remain competitive.

Specialization trend shows brokers increasingly focusing on specific property types, geographic areas, or client segments to develop expertise and competitive advantages. Luxury property specialists, commercial real estate experts, and international client service providers command premium pricing and build sustainable market positions.

Service integration involves expanding beyond traditional brokerage to include property management, investment advisory, and comprehensive real estate services. This trend creates recurring revenue streams and deeper client relationships while improving market positioning against competitors.

Regulatory compliance becomes increasingly important as government initiatives strengthen licensing requirements and consumer protection measures. Firms investing in compliance systems and professional development gain competitive advantages through enhanced credibility and client trust.

International standards adoption includes implementing global best practices in client service, transaction management, and professional development. This trend particularly benefits firms serving international clients and seeking franchise opportunities with global brands.

Recent industry developments demonstrate the dynamic nature of Egypt’s real estate brokerage market. Regulatory enhancements include new licensing requirements for real estate professionals and improved consumer protection measures that strengthen market credibility and professionalism.

Technology partnerships between traditional brokerage firms and technology companies create innovative service delivery platforms. MarkWide Research analysis indicates these collaborations improve operational efficiency and client satisfaction while reducing transaction costs.

International expansion includes global franchise brands entering the Egyptian market and local firms seeking international partnerships. These developments bring advanced training programs, technology systems, and global best practices to the local market.

Market consolidation activities include strategic acquisitions and mergers as firms seek scale economies and expanded geographic coverage. Large firms acquire smaller regional players to strengthen market presence and service capabilities.

Professional development initiatives include new certification programs, continuing education requirements, and industry associations that promote service quality and ethical standards. These developments enhance the overall professionalism and credibility of the brokerage industry.

Strategic recommendations for Egypt’s real estate brokerage market participants focus on technology adoption, service differentiation, and market expansion opportunities. Technology investment should prioritize client-facing platforms, data analytics capabilities, and operational efficiency tools that provide measurable competitive advantages.

Market positioning strategies should emphasize specialization in high-growth segments such as commercial real estate, luxury properties, or international client services. Firms developing deep expertise in specific niches can command premium pricing and build sustainable competitive moats.

Geographic expansion opportunities exist in underserved regions and emerging urban developments. Early market entry in planned cities and growing regions can establish strong market positions before competition intensifies.

Service diversification into property management, investment advisory, and comprehensive real estate services creates recurring revenue streams and deeper client relationships. These expanded offerings improve financial stability and growth potential.

Partnership development with developers, financial institutions, and international firms can provide access to new clients, markets, and capabilities. Strategic alliances enable smaller firms to compete effectively against larger competitors while maintaining independence.

Future market prospects for Egypt’s real estate brokerage sector appear highly favorable, driven by sustained demographic growth, economic development, and increasing market professionalization. Growth projections indicate continued expansion with the market expected to grow at a compound annual growth rate of 8.5% over the next five years.

Technology evolution will continue reshaping service delivery with artificial intelligence, virtual reality, and blockchain technologies creating new opportunities for innovation and differentiation. Firms embracing these technologies early will gain significant competitive advantages in client acquisition and retention.

Market maturation trends include increasing standardization, professional development, and regulatory compliance that will benefit consumers through improved service quality and transparency. MWR projections suggest that professional brokerage services will capture an increasing share of total real estate transactions.

International integration will accelerate as global brands expand their presence and local firms seek international partnerships. This trend will bring advanced practices, training programs, and technology systems that elevate overall market standards.

Sustainable growth factors include government support for sector formalization, infrastructure development creating new markets, and rising consumer awareness of professional brokerage benefits. These fundamentals support long-term market expansion and profitability for well-positioned participants.

Egypt’s real estate brokerage market presents exceptional opportunities for growth and development, driven by strong demographic trends, economic expansion, and increasing market professionalization. The sector demonstrates remarkable resilience and adaptability, with participants successfully navigating challenges while capitalizing on emerging opportunities.

Key success factors include technology adoption, service specialization, and commitment to professional development that enhances client satisfaction and market credibility. Firms investing in these areas position themselves for sustained growth and competitive advantage in an evolving market landscape.

Market fundamentals remain strong with government support, regulatory improvements, and growing consumer awareness creating a favorable environment for continued expansion. The combination of traditional market knowledge and modern technology platforms enables brokers to deliver superior value to clients while building profitable, sustainable businesses.

Strategic positioning for future success requires balancing innovation with proven practices, embracing technology while maintaining personal service excellence, and developing specialized expertise while serving diverse client needs. The Egypt real estate brokerage market offers substantial rewards for participants who adapt to changing conditions while maintaining focus on client service and professional excellence.

What is Egypt Real Estate Brokerage?

Egypt Real Estate Brokerage refers to the services provided by agents and firms that facilitate the buying, selling, and leasing of properties in Egypt. This sector plays a crucial role in connecting buyers and sellers, offering market insights, and assisting with legal documentation.

What are the key players in the Egypt Real Estate Brokerage Market?

Key players in the Egypt Real Estate Brokerage Market include firms like Coldwell Banker Egypt, RE/MAX Egypt, and Al Ahly for Real Estate among others. These companies provide a range of services from residential to commercial property transactions.

What are the growth factors driving the Egypt Real Estate Brokerage Market?

The Egypt Real Estate Brokerage Market is driven by factors such as urbanization, increasing foreign investment, and a growing middle class seeking housing. Additionally, government initiatives to improve infrastructure and housing availability contribute to market growth.

What challenges does the Egypt Real Estate Brokerage Market face?

Challenges in the Egypt Real Estate Brokerage Market include regulatory hurdles, fluctuating property prices, and economic instability. These factors can create uncertainty for both buyers and brokers, impacting transaction volumes.

What opportunities exist in the Egypt Real Estate Brokerage Market?

Opportunities in the Egypt Real Estate Brokerage Market include the expansion of digital platforms for property listings and virtual tours, as well as the potential for growth in luxury and commercial real estate sectors. The increasing demand for rental properties also presents a significant opportunity.

What trends are shaping the Egypt Real Estate Brokerage Market?

Trends in the Egypt Real Estate Brokerage Market include the rise of online property platforms, increased focus on sustainability in building practices, and a shift towards integrated community developments. These trends are influencing how properties are marketed and sold.

Egypt Real Estate Brokerage Market

| Segmentation Details | Description |

|---|---|

| Property Type | Residential, Commercial, Industrial, Agricultural |

| Client Type | First-time Buyers, Investors, Renters, Corporates |

| Transaction Type | Sales, Rentals, Leasing, Auctions |

| Service Type | Consulting, Valuation, Property Management, Brokerage |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Egypt Real Estate Brokerage Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at