444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Egypt plastic packaging films market represents a dynamic and rapidly evolving sector within the country’s packaging industry, driven by increasing consumer demand, industrial growth, and modernization of retail infrastructure. Plastic packaging films serve as essential components across multiple industries including food and beverage, pharmaceuticals, consumer goods, and industrial applications throughout Egypt’s expanding economy.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 6.8% driven by urbanization, changing consumer preferences, and increased adoption of flexible packaging solutions. The market encompasses various film types including polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), and specialized barrier films designed for specific applications.

Industrial expansion across Egypt’s manufacturing sector has significantly contributed to market growth, with pharmaceutical and food processing industries leading demand for high-quality packaging films. The market benefits from Egypt’s strategic geographic location, serving as a gateway between Africa, Asia, and Europe, facilitating both domestic consumption and export opportunities.

Technological advancement in film manufacturing has enabled local producers to offer increasingly sophisticated products, including multi-layer films, biodegradable options, and specialized barrier properties. This evolution reflects growing market maturity and alignment with international quality standards, positioning Egypt as a competitive player in the regional packaging films landscape.

The Egypt plastic packaging films market refers to the comprehensive ecosystem of manufacturing, distribution, and consumption of flexible plastic films used for packaging applications across various industries within Egypt’s economy. These films serve as protective barriers, preserving product quality, extending shelf life, and facilitating efficient distribution throughout the supply chain.

Plastic packaging films encompass a diverse range of materials and structures, from simple monolayer films to complex multi-layer constructions incorporating various polymers, additives, and functional coatings. The market includes both commodity films for general applications and specialized films engineered for specific performance requirements such as oxygen barriers, moisture protection, and temperature resistance.

Market scope extends beyond traditional packaging applications to include agricultural films, industrial wrapping, and emerging sustainable packaging solutions. This comprehensive definition reflects the market’s evolution from basic protective packaging to sophisticated material solutions supporting Egypt’s diverse industrial and consumer sectors.

Egypt’s plastic packaging films market demonstrates strong growth momentum, supported by expanding industrial base, increasing consumer spending, and modernization of retail and distribution networks. The market benefits from favorable demographic trends, with a growing population driving demand for packaged goods across multiple categories.

Key growth drivers include the food and beverage industry’s expansion, pharmaceutical sector development, and increasing adoption of flexible packaging solutions by manufacturers seeking cost-effective and efficient packaging alternatives. The market shows particular strength in polyethylene films, which account for approximately 45% of total market volume due to their versatility and cost-effectiveness.

Regional distribution centers around major industrial hubs including Greater Cairo, Alexandria, and emerging manufacturing zones, with Greater Cairo region representing approximately 38% of market demand. The market structure includes both large-scale manufacturers and smaller specialized producers, creating a competitive landscape that drives innovation and quality improvements.

Future prospects remain positive, with increasing focus on sustainable packaging solutions, technological advancement, and export market development. Government initiatives supporting industrial development and foreign investment continue to create favorable conditions for market expansion and modernization.

Market segmentation reveals distinct patterns across application areas, with food packaging representing the largest segment followed by industrial and pharmaceutical applications. The following key insights characterize the current market landscape:

Population growth and urbanization serve as fundamental drivers for Egypt’s plastic packaging films market, creating sustained demand for packaged goods across multiple consumer categories. The country’s young demographic profile supports continued consumption growth, particularly in food and beverage packaging applications.

Industrial diversification initiatives have expanded manufacturing capabilities across various sectors, generating increased demand for industrial packaging films. Government policies promoting local manufacturing and import substitution create favorable conditions for domestic packaging film producers while reducing dependency on imports.

Retail modernization throughout Egypt’s commercial landscape drives demand for attractive and functional packaging solutions. The growth of modern retail formats, including supermarkets and hypermarkets, requires sophisticated packaging that meets international standards for product presentation and preservation.

Food safety awareness among consumers and regulatory bodies emphasizes the importance of high-quality packaging films that maintain product integrity and extend shelf life. This trend particularly benefits manufacturers of barrier films and specialized food packaging solutions.

Export market development provides additional growth opportunities, with Egyptian manufacturers increasingly serving regional markets. The country’s competitive manufacturing costs and strategic location create advantages in serving African and Middle Eastern markets with growing packaging film demand.

Raw material price volatility presents ongoing challenges for plastic packaging film manufacturers, with petroleum-based polymer costs subject to international market fluctuations. These price variations can impact profit margins and require careful supply chain management to maintain competitive pricing.

Environmental regulations and growing sustainability concerns create pressure for industry transformation toward more environmentally friendly alternatives. Compliance with evolving environmental standards requires investment in new technologies and materials, potentially increasing production costs.

Import competition from established international manufacturers poses challenges for local producers, particularly in specialized film segments requiring advanced technology and significant capital investment. Price competition from imports can pressure domestic manufacturers’ market share and profitability.

Infrastructure limitations in certain regions may constrain market expansion, particularly in rural areas where distribution networks and storage facilities require development. These limitations can affect market penetration and increase distribution costs for manufacturers.

Technical expertise requirements for advanced film manufacturing may limit some producers’ ability to compete in high-value segments. The need for skilled technical personnel and ongoing training represents an ongoing challenge for industry development.

Sustainable packaging solutions represent significant growth opportunities as environmental awareness increases among consumers and businesses. Development of biodegradable films, recyclable materials, and reduced-thickness films can capture growing demand for environmentally responsible packaging options.

Export market expansion offers substantial potential, with Egyptian manufacturers well-positioned to serve growing African markets and regional demand. The country’s competitive manufacturing costs and improving quality standards create opportunities for increased market share in neighboring countries.

Technology advancement in film manufacturing enables development of high-performance products with enhanced barrier properties, improved strength, and specialized functionality. Investment in advanced manufacturing equipment can open new market segments and premium applications.

Agricultural sector growth creates opportunities for specialized agricultural films, including mulch films, greenhouse covers, and crop protection materials. Egypt’s expanding agricultural modernization programs drive demand for these specialized applications.

E-commerce expansion generates new demand for packaging films suitable for online retail applications, including protective films, shipping materials, and consumer-friendly packaging solutions. This growing segment requires innovative packaging approaches and presents opportunities for specialized products.

Supply chain integration has become increasingly important as manufacturers seek to optimize costs and ensure consistent raw material supply. Vertical integration strategies enable better control over quality and pricing while reducing dependency on external suppliers for critical materials.

Competitive landscape evolution shows increasing consolidation among larger players while smaller specialized manufacturers focus on niche applications. This dynamic creates opportunities for both scale advantages and specialized expertise, depending on market positioning strategies.

Technology transfer from international partners has accelerated local capability development, with manufacturing efficiency improvements of approximately 25% achieved through modern equipment adoption. These improvements enhance competitiveness and enable production of higher-quality products.

Customer requirements continue evolving toward more sophisticated packaging solutions, driving innovation in film properties, printing capabilities, and functional performance. Manufacturers must balance cost considerations with advancing technical requirements to maintain market position.

Regulatory environment development includes both quality standards and environmental regulations, requiring ongoing adaptation by manufacturers. Compliance with evolving standards creates both challenges and opportunities for differentiation in the marketplace.

Primary research methodology encompasses comprehensive interviews with industry stakeholders including manufacturers, distributors, end-users, and regulatory authorities throughout Egypt’s packaging films ecosystem. This approach provides direct insights into market trends, challenges, and opportunities from multiple perspectives.

Secondary research incorporates analysis of industry reports, government statistics, trade publications, and company financial data to establish market size, growth trends, and competitive positioning. This data foundation supports quantitative analysis and market projections.

Market segmentation analysis examines demand patterns across application areas, geographic regions, and product types to identify growth opportunities and market dynamics. Segmentation provides detailed understanding of market structure and competitive positioning.

Supply chain analysis evaluates raw material sources, manufacturing capabilities, distribution networks, and end-user requirements to understand market flow and value creation. This analysis identifies potential bottlenecks and optimization opportunities.

Competitive intelligence gathering includes assessment of major market participants, their strategies, capabilities, and market positioning. This information supports understanding of competitive dynamics and market evolution trends.

Greater Cairo region dominates Egypt’s plastic packaging films market, accounting for approximately 38% of total demand due to its concentration of manufacturing facilities, consumer markets, and distribution infrastructure. The region benefits from proximity to major ports, transportation networks, and skilled workforce availability.

Alexandria and Delta region represents approximately 28% of market activity, driven by industrial development, port facilities, and agricultural processing activities. The region’s strategic location facilitates both domestic distribution and export operations, making it attractive for packaging film manufacturers.

Upper Egypt regions show growing market potential, with increasing industrial development and agricultural modernization driving demand for packaging films. Government initiatives promoting regional development create opportunities for market expansion in these areas.

Suez Canal zone benefits from industrial development initiatives and strategic location advantages, attracting investment in manufacturing facilities including packaging film production. The zone’s special economic status provides additional incentives for industry development.

Regional distribution patterns reflect transportation infrastructure, with major highways and rail connections influencing market accessibility. Manufacturers strategically locate facilities to optimize distribution costs and market reach across Egypt’s diverse geographic regions.

Market leadership includes both international companies with local operations and domestic manufacturers with significant market presence. The competitive environment encourages innovation, quality improvement, and cost optimization across the industry.

Competitive strategies vary across market segments, with commodity film producers focusing on cost leadership while specialized manufacturers emphasize technical performance and customer service. Innovation in product development and manufacturing processes provides competitive advantages in premium segments.

Market consolidation trends show increasing cooperation between manufacturers through joint ventures, technology partnerships, and supply agreements. These collaborations enable resource sharing and market expansion while maintaining competitive independence.

By Material Type:

By Application:

By End-User Industry:

Food packaging films demonstrate the strongest growth trajectory, with flexible packaging adoption increasing by approximately 15% annually as manufacturers seek cost-effective alternatives to rigid packaging. This category benefits from consumer preference for convenient, portable packaging formats.

Barrier films represent a high-value segment with specialized applications in food preservation and pharmaceutical packaging. These films command premium pricing due to their technical complexity and performance requirements, making them attractive for manufacturers with advanced capabilities.

Industrial films show steady demand growth driven by manufacturing sector expansion and increasing adoption of automated packaging systems. This category includes stretch films, shrink films, and protective packaging materials serving diverse industrial applications.

Agricultural films present emerging opportunities as Egypt’s agricultural sector modernizes and adopts advanced farming techniques. Greenhouse films, mulch films, and crop protection materials support agricultural productivity improvements and sustainable farming practices.

Sustainable films represent a developing category with growing market interest, though current adoption remains limited by cost considerations and performance requirements. This category shows potential for future growth as environmental awareness increases and technology improves.

Manufacturers benefit from Egypt’s strategic location, competitive labor costs, and growing domestic market demand. Access to regional export markets provides additional growth opportunities while government support for industrial development creates favorable operating conditions.

Raw material suppliers gain from increasing local demand and opportunities to establish long-term supply relationships with growing manufacturers. Market expansion creates stable demand for polymer resins, additives, and other production materials.

End-users benefit from improving product quality, competitive pricing, and better supply chain reliability as the local industry develops. Proximity to manufacturers reduces transportation costs and delivery times while enabling better customer service.

Distributors and converters find opportunities in market expansion and increasing demand for specialized packaging solutions. The growing market supports business development and investment in enhanced distribution capabilities.

Technology providers benefit from increasing investment in modern manufacturing equipment and process improvements. Market growth drives demand for advanced machinery, automation systems, and technical services.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as a dominant trend, with manufacturers increasingly developing recyclable and biodegradable film options. This trend reflects growing environmental consciousness among consumers and regulatory pressure for sustainable packaging solutions.

Technology advancement in manufacturing processes enables production of thinner, stronger films with enhanced performance characteristics. Advanced manufacturing adoption has improved production efficiency by approximately 22% while reducing material consumption and waste generation.

Customization demand increases as end-users seek specialized packaging solutions tailored to specific product requirements. This trend drives development of application-specific films with unique properties and performance characteristics.

Digital printing integration enables high-quality graphics and branding on packaging films, supporting marketing objectives while maintaining functional performance. This capability becomes increasingly important in consumer-facing applications.

Supply chain optimization focuses on reducing costs and improving reliability through better inventory management, logistics efficiency, and supplier relationships. These improvements enhance competitiveness and customer satisfaction.

Manufacturing capacity expansion continues across the industry, with several major producers investing in new production lines and facility upgrades. These investments reflect confidence in market growth prospects and commitment to serving increasing demand.

Technology partnerships between local manufacturers and international technology providers accelerate capability development and quality improvement. These collaborations enable access to advanced manufacturing processes and technical expertise.

Quality certification achievements by Egyptian manufacturers enhance market credibility and export potential. International quality standards compliance opens new market opportunities and supports premium pricing strategies.

Sustainable product development initiatives focus on creating environmentally friendly alternatives to traditional plastic films. These developments respond to growing environmental concerns and regulatory requirements.

Market consolidation activities include mergers, acquisitions, and strategic partnerships aimed at achieving scale advantages and market expansion. These developments reshape competitive dynamics and market structure.

Investment priorities should focus on technology upgrade and capacity expansion to meet growing demand while improving product quality and cost competitiveness. MarkWide Research analysis indicates that manufacturers investing in modern equipment achieve productivity improvements of 18-25% within two years of implementation.

Market positioning strategies should emphasize quality differentiation and customer service excellence to compete effectively against low-cost imports. Developing strong customer relationships and technical support capabilities creates sustainable competitive advantages.

Export development represents significant growth opportunity, requiring investment in quality systems, marketing capabilities, and distribution networks. Regional market expansion can provide substantial revenue growth and risk diversification.

Sustainability initiatives should be integrated into long-term strategic planning, as environmental considerations become increasingly important for market success. Early adoption of sustainable technologies can provide competitive advantages as regulations evolve.

Talent development programs should address technical skill requirements and management capabilities needed for industry growth. Investment in human resources supports quality improvement and operational excellence initiatives.

Market growth prospects remain positive, supported by continued economic development, population growth, and industrial expansion. MWR projections indicate sustained growth momentum with annual growth rates of 6-8% expected over the next five years across key market segments.

Technology evolution will continue driving product innovation and manufacturing efficiency improvements. Advanced materials, smart packaging features, and sustainable alternatives will shape future market development and competitive positioning.

Regional market integration offers substantial opportunities as trade relationships strengthen and market access improves. Egyptian manufacturers are well-positioned to serve growing African markets and expand their regional presence.

Regulatory development will influence market evolution, particularly regarding environmental standards and product safety requirements. Proactive compliance and sustainable product development will become increasingly important for market success.

Investment climate improvements and government support for industrial development create favorable conditions for continued market expansion and modernization. These factors support both domestic and international investment in the sector.

Egypt’s plastic packaging films market demonstrates strong fundamentals and promising growth prospects, driven by expanding industrial base, growing consumer demand, and strategic geographic advantages. The market benefits from favorable demographic trends, government support for industrial development, and increasing integration with regional markets.

Key success factors include technology advancement, quality improvement, and strategic positioning to serve both domestic and export markets effectively. Manufacturers who invest in modern capabilities while developing sustainable product alternatives will be best positioned for long-term success in this evolving market landscape.

Future development will be shaped by sustainability requirements, technological innovation, and regional market expansion opportunities. The industry’s ability to adapt to changing market conditions while maintaining cost competitiveness will determine its continued growth and success in serving Egypt’s packaging needs and regional export opportunities.

What is Plastic Packaging Films?

Plastic packaging films are thin layers of plastic used for wrapping and protecting products. They are commonly used in various applications, including food packaging, medical supplies, and consumer goods.

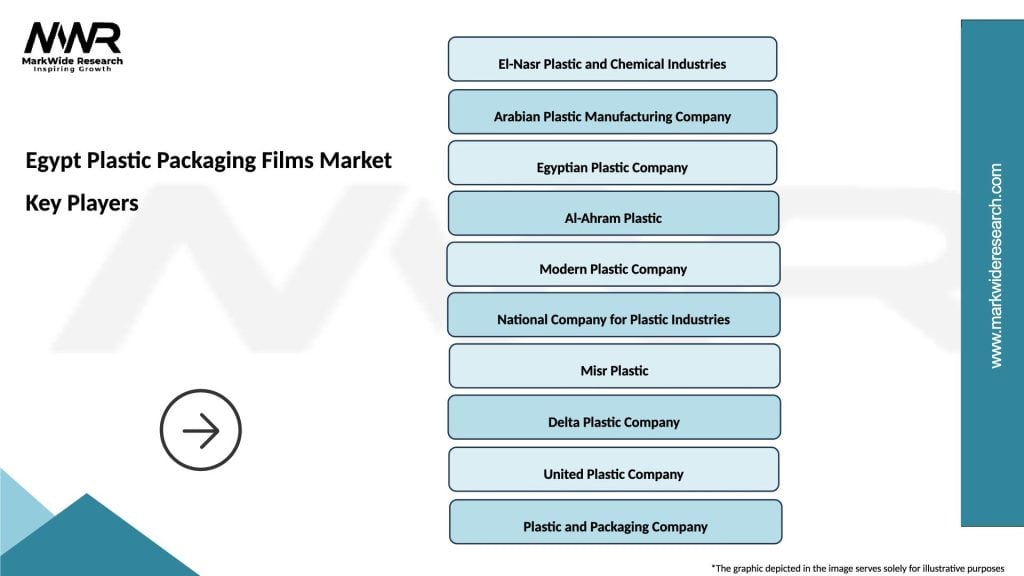

What are the key players in the Egypt Plastic Packaging Films Market?

Key players in the Egypt Plastic Packaging Films Market include companies like Jindal Poly Films, Amcor, and Constantia Flexibles, among others. These companies are known for their innovative packaging solutions and extensive product ranges.

What are the growth factors driving the Egypt Plastic Packaging Films Market?

The Egypt Plastic Packaging Films Market is driven by factors such as the increasing demand for packaged food, the growth of the e-commerce sector, and the rising awareness of hygiene and safety in packaging.

What challenges does the Egypt Plastic Packaging Films Market face?

Challenges in the Egypt Plastic Packaging Films Market include environmental concerns regarding plastic waste, regulatory pressures for sustainable packaging, and competition from alternative materials.

What opportunities exist in the Egypt Plastic Packaging Films Market?

Opportunities in the Egypt Plastic Packaging Films Market include the development of biodegradable films, advancements in recycling technologies, and the expansion of the food and beverage industry.

What trends are shaping the Egypt Plastic Packaging Films Market?

Trends in the Egypt Plastic Packaging Films Market include the increasing use of smart packaging technologies, the shift towards sustainable materials, and the growing demand for customized packaging solutions.

Egypt Plastic Packaging Films Market

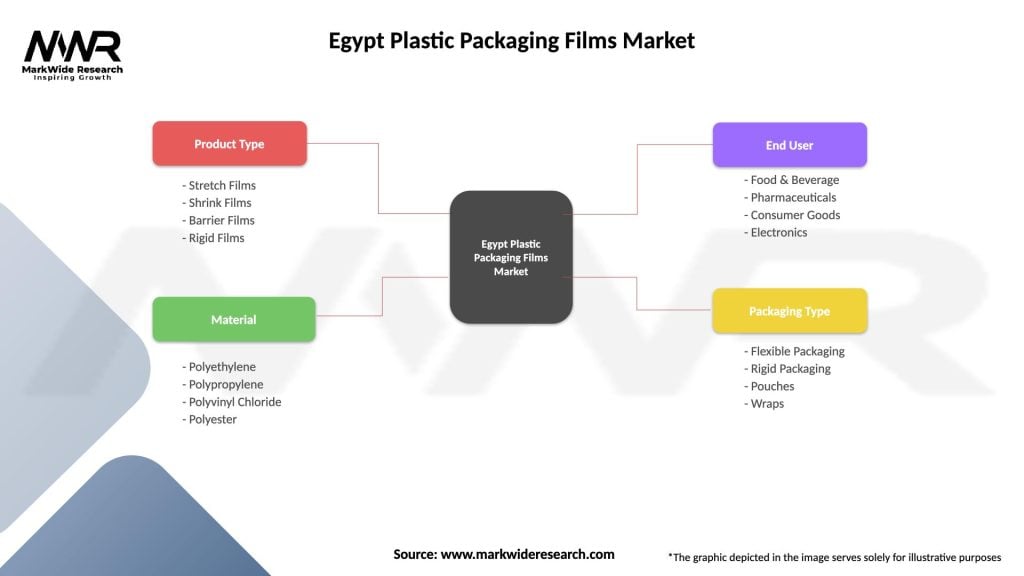

| Segmentation Details | Description |

|---|---|

| Product Type | Stretch Films, Shrink Films, Barrier Films, Rigid Films |

| Material | Polyethylene, Polypropylene, Polyvinyl Chloride, Polyester |

| End User | Food & Beverage, Pharmaceuticals, Consumer Goods, Electronics |

| Packaging Type | Flexible Packaging, Rigid Packaging, Pouches, Wraps |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Egypt Plastic Packaging Films Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at