444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Egypt oil and gas midstream market represents a critical component of the nation’s energy infrastructure, encompassing transportation, storage, and processing activities that bridge upstream production with downstream distribution. Egypt’s strategic position as a regional energy hub has positioned its midstream sector as a vital link connecting Mediterranean and Red Sea energy corridors. The market demonstrates robust growth potential driven by increasing domestic production, regional export opportunities, and substantial infrastructure investments.

Current market dynamics reflect Egypt’s ambitious energy expansion plans, with the government prioritizing midstream infrastructure development to support growing natural gas production and oil refining capabilities. The sector benefits from strategic geographic advantages, including proximity to major European and Asian markets, established pipeline networks, and expanding liquefied natural gas (LNG) facilities. Investment momentum continues to accelerate, with both domestic and international companies recognizing the market’s potential for sustainable growth at a projected CAGR of 6.2% through the forecast period.

Infrastructure modernization initiatives are transforming Egypt’s midstream landscape, with new pipeline projects, storage facilities, and processing plants enhancing the country’s energy handling capacity. The market encompasses various segments including pipeline transportation, storage terminals, processing facilities, and distribution networks, each contributing to the overall energy value chain optimization.

The Egypt oil and gas midstream market refers to the comprehensive network of infrastructure, services, and operations that facilitate the transportation, storage, processing, and distribution of crude oil and natural gas between production sites and end-user markets. This sector encompasses pipeline systems, storage terminals, processing facilities, compression stations, and distribution networks that ensure efficient energy flow throughout Egypt and neighboring regions.

Midstream operations serve as the crucial link connecting upstream exploration and production activities with downstream refining and marketing operations. The sector includes various specialized services such as pipeline transportation, terminal operations, gas processing, storage management, and logistics coordination. Egypt’s midstream infrastructure plays a particularly important role in regional energy security, supporting both domestic consumption needs and export capabilities to European and regional markets.

Egypt’s oil and gas midstream market stands at a pivotal juncture, characterized by significant infrastructure investments, technological modernization, and expanding regional connectivity. The sector benefits from the country’s strategic geographic position and growing energy production capacity, particularly in natural gas where Egypt has emerged as a major regional player. Government initiatives focusing on energy sector development have created favorable conditions for midstream expansion and modernization.

Key market drivers include increasing domestic energy demand, growing export opportunities, and substantial foreign direct investment in energy infrastructure. The market demonstrates strong fundamentals with pipeline capacity utilization rates reaching 78% and storage facility occupancy maintaining 85% average levels. Natural gas midstream operations particularly show promising growth prospects, supported by major discoveries in the Mediterranean and expanding LNG export capabilities.

Investment trends indicate sustained capital allocation toward infrastructure development, with particular emphasis on pipeline network expansion, storage capacity enhancement, and processing facility modernization. The market’s competitive landscape features a mix of state-owned enterprises, international energy companies, and specialized midstream operators, creating a dynamic environment for growth and innovation.

Strategic positioning emerges as Egypt’s primary competitive advantage in the regional midstream market, with the country serving as a critical energy transit hub connecting Africa, Europe, and Asia. Infrastructure development continues to accelerate, with new pipeline projects and storage facilities enhancing the country’s energy handling capacity and regional connectivity.

Domestic energy demand growth serves as a primary driver for Egypt’s midstream market expansion, with increasing industrial activity, population growth, and economic development creating sustained demand for reliable energy infrastructure. Natural gas consumption particularly shows strong growth trends, driven by power generation needs, industrial applications, and residential usage expansion.

Export market opportunities provide significant growth momentum, with Egypt’s strategic position enabling access to European, Asian, and regional markets. The development of LNG export facilities and pipeline connections to neighboring countries creates substantial revenue opportunities for midstream operators. Regional energy cooperation initiatives further enhance export potential through interconnected infrastructure networks.

Government policy support continues to drive market development through favorable regulatory frameworks, investment incentives, and infrastructure development programs. Energy sector reforms have created opportunities for private sector participation and foreign investment, stimulating competition and innovation in midstream operations. Strategic partnerships between government entities and international companies accelerate infrastructure development and technology transfer.

Technological advancement drives operational efficiency improvements and capacity optimization across midstream operations. Digital transformation initiatives including automation, monitoring systems, and data analytics enhance operational performance and reduce costs. Environmental compliance requirements also drive investment in cleaner technologies and more efficient infrastructure systems.

Capital intensity requirements present significant challenges for midstream infrastructure development, with large-scale projects requiring substantial upfront investments and long payback periods. Financing constraints can limit the pace of infrastructure expansion, particularly for smaller operators and domestic companies with limited access to international capital markets.

Regulatory complexity and bureaucratic processes can create delays in project approvals and implementation timelines. Environmental regulations and compliance requirements add complexity and costs to midstream operations, requiring specialized expertise and additional investment in environmental protection measures. Land acquisition challenges for pipeline and facility development can create project delays and increased costs.

Technical challenges related to aging infrastructure and integration of new systems with existing networks require careful planning and substantial investment. Security concerns in certain regions can impact infrastructure development and operational continuity, requiring additional security measures and risk management strategies.

Market volatility in oil and gas prices can affect investment decisions and project economics, creating uncertainty for long-term infrastructure planning. Competition from alternative energy sources and changing energy policies may impact long-term demand projections for traditional oil and gas midstream services.

Regional hub development presents substantial opportunities for Egypt to expand its role as a central energy distribution point for Africa, Europe, and the Middle East. Strategic infrastructure investments can position Egypt as a preferred transit route for regional energy flows, creating long-term revenue streams and economic benefits.

LNG market expansion offers significant growth potential, with increasing global demand for natural gas and Egypt’s growing production capacity creating opportunities for export-oriented infrastructure development. Floating LNG facilities and expanded terminal capacity can capture growing Asian and European market demand.

Technology integration opportunities include implementation of advanced monitoring systems, predictive maintenance technologies, and digital optimization platforms that can improve operational efficiency and reduce costs. Smart infrastructure development incorporating IoT sensors, automation systems, and data analytics can enhance competitive positioning.

Public-private partnerships create opportunities for risk sharing, technology transfer, and accelerated infrastructure development. International collaboration with experienced midstream operators can bring expertise, financing, and market access to Egyptian projects. Cross-border infrastructure projects with neighboring countries can expand market reach and create new revenue opportunities.

Supply and demand dynamics in Egypt’s midstream market reflect the country’s evolving energy landscape, with increasing domestic production capacity requiring enhanced transportation and processing infrastructure. Natural gas discoveries in the Mediterranean have created substantial midstream investment opportunities, with new pipeline projects and processing facilities needed to handle increased production volumes.

Competitive dynamics feature a mix of established state-owned enterprises and emerging private sector players, creating a balanced market environment that promotes innovation and efficiency. International partnerships bring advanced technology and operational expertise, while domestic companies provide local market knowledge and regulatory familiarity. Market consolidation trends are creating larger, more efficient operators capable of handling complex infrastructure projects.

Pricing dynamics reflect regional energy market conditions, infrastructure capacity constraints, and transportation costs. Capacity utilization rates averaging 82% across major pipeline systems indicate strong market demand and potential for additional infrastructure investment. Seasonal demand variations create opportunities for storage operators and flexible transportation services.

Investment dynamics show sustained capital allocation toward infrastructure modernization and expansion, with foreign direct investment accounting for approximately 45% of total midstream investments. MarkWide Research analysis indicates that technological advancement initiatives represent 15% of total capital expenditure in the sector, reflecting the industry’s focus on operational efficiency and competitiveness.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Egypt’s oil and gas midstream market. Primary research activities include extensive interviews with industry executives, government officials, and market participants to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research components encompass analysis of government publications, industry reports, regulatory documents, and financial statements from key market participants. Data triangulation methods ensure accuracy and reliability by cross-referencing information from multiple sources and validating findings through expert consultations.

Market modeling techniques incorporate quantitative analysis of infrastructure capacity, utilization rates, investment flows, and operational metrics to develop comprehensive market projections. Scenario analysis examines various market conditions and their potential impact on midstream operations and investment decisions.

Expert validation processes involve consultation with industry specialists, regulatory experts, and market analysts to ensure research findings accurately reflect market realities and future prospects. Continuous monitoring of market developments and regulatory changes ensures research remains current and relevant to market participants.

Northern Egypt dominates midstream infrastructure concentration, with major pipeline networks, processing facilities, and export terminals located in the Mediterranean coastal region. Alexandria and Port Said serve as critical hubs for LNG exports and petroleum product distribution, accounting for approximately 60% of total export capacity. Infrastructure density in this region reflects proximity to major production areas and international shipping routes.

Western Desert regions feature extensive pipeline networks connecting oil and gas production sites to processing facilities and distribution centers. Transportation infrastructure in these areas focuses primarily on gathering systems and trunk pipelines that move hydrocarbons to coastal processing and export facilities. Storage capacity in western regions represents approximately 25% of national total.

Eastern regions including the Suez Canal area serve as strategic transit points for regional energy flows and domestic distribution networks. Suez Canal proximity provides unique advantages for energy transit operations and regional hub development. Red Sea coastal areas offer potential for expanded export infrastructure targeting Asian markets.

Upper Egypt regions primarily focus on domestic distribution networks and local storage facilities serving southern population centers and industrial areas. Infrastructure development in these regions emphasizes reliability and accessibility for domestic energy security. Regional connectivity projects aim to integrate southern regions more effectively with national energy networks.

Market leadership in Egypt’s oil and gas midstream sector features a diverse mix of state-owned enterprises, international energy companies, and specialized midstream operators. Competitive positioning reflects companies’ infrastructure assets, operational capabilities, and strategic partnerships within the Egyptian energy market.

Strategic partnerships between international companies and domestic operators create synergies that combine global expertise with local market knowledge. Joint venture arrangements facilitate risk sharing and accelerate infrastructure development timelines. Technology transfer through international partnerships enhances operational capabilities and competitive positioning.

By Infrastructure Type:

By Energy Type:

By Application:

Pipeline Transportation segment represents the largest component of Egypt’s midstream infrastructure, with extensive networks connecting production areas to processing facilities and export terminals. Natural gas pipelines show particularly strong growth potential, driven by increasing domestic production and export opportunities. Capacity expansion projects focus on enhancing throughput capabilities and improving system reliability.

Storage Infrastructure category demonstrates growing importance as Egypt develops strategic petroleum reserves and commercial storage capabilities. Underground storage facilities offer advantages in terms of security and capacity, while surface terminals provide flexibility for import and export operations. Storage utilization rates averaging 88% indicate strong market demand and potential for additional capacity development.

LNG Infrastructure segment emerges as a high-growth category, with Egypt’s expanding natural gas production creating opportunities for liquefaction and export facilities. Floating LNG units provide flexible solutions for accessing international markets, while permanent facilities offer long-term capacity and cost advantages. Regasification capabilities also support import flexibility and energy security.

Processing Facilities category focuses on gas processing plants, compression stations, and fractionation units that add value to raw hydrocarbon streams. Technology upgrades in processing facilities improve efficiency and product quality, while capacity expansions support growing production volumes. Environmental compliance drives investment in cleaner processing technologies and emission control systems.

Energy Security Enhancement provides fundamental benefits for Egypt’s economic development and national security objectives. Reliable energy infrastructure supports industrial growth, residential needs, and export capabilities that contribute to economic stability and growth. Strategic reserves and diverse supply sources reduce vulnerability to supply disruptions and market volatility.

Economic Development Impact creates substantial benefits through job creation, technology transfer, and industrial development opportunities. Midstream investments generate direct employment in construction, operations, and maintenance activities, while supporting indirect economic activity throughout the supply chain. Export revenues from energy sales contribute to foreign exchange earnings and economic growth.

Regional Integration Benefits position Egypt as a strategic energy hub connecting multiple regional markets and creating opportunities for transit revenues and strategic partnerships. Cross-border infrastructure enhances regional energy security and creates mutual dependencies that support political and economic stability.

Technology Advancement Opportunities through international partnerships and investment bring cutting-edge technologies and operational expertise to Egyptian operations. Knowledge transfer builds local capabilities and creates opportunities for technology adaptation and innovation. Operational efficiency improvements reduce costs and enhance competitive positioning in regional markets.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Transformation emerges as a dominant trend, with midstream operators implementing advanced monitoring systems, predictive maintenance technologies, and data analytics platforms to optimize operations. IoT integration enables real-time monitoring of pipeline conditions, storage levels, and equipment performance, improving safety and efficiency. Artificial intelligence applications support predictive maintenance and operational optimization.

Environmental Sustainability drives investment in cleaner technologies and more efficient infrastructure systems. Emission reduction initiatives focus on methane leak detection and repair programs, while energy efficiency improvements reduce operational carbon footprints. Renewable energy integration in midstream operations supports sustainability objectives.

Infrastructure Modernization continues as a key trend, with operators upgrading aging facilities and implementing new technologies to improve capacity and reliability. Smart pipeline systems incorporate advanced monitoring and control capabilities, while automated storage facilities improve operational efficiency and safety.

Regional Integration accelerates through cross-border pipeline projects and energy cooperation agreements. Interconnected infrastructure enhances energy security and creates opportunities for regional energy trading. Standardization efforts facilitate interoperability and reduce operational complexity.

Major infrastructure projects currently under development include pipeline expansions, new LNG facilities, and storage capacity additions that will significantly enhance Egypt’s midstream capabilities. International partnerships are driving technology transfer and operational expertise development, while regulatory reforms create favorable conditions for private sector investment.

Technology implementations include advanced pipeline monitoring systems, automated storage management platforms, and digital optimization tools that improve operational efficiency and safety. MarkWide Research indicates that technology adoption rates in Egyptian midstream operations have increased by 35% over the past three years, reflecting the industry’s commitment to modernization.

Strategic acquisitions and joint ventures are reshaping the competitive landscape, with international companies partnering with domestic operators to access local markets and expertise. Capacity expansion projects focus on bottleneck elimination and system optimization to support growing energy flows.

Environmental initiatives include implementation of leak detection and repair programs, energy efficiency improvements, and emission reduction technologies. Safety enhancements incorporate advanced monitoring systems and emergency response capabilities that improve operational reliability and environmental protection.

Strategic positioning recommendations emphasize leveraging Egypt’s geographic advantages to develop comprehensive regional energy hub capabilities. Infrastructure investment priorities should focus on bottleneck elimination, capacity expansion, and technology modernization to support growing energy flows and export opportunities.

Partnership development strategies should emphasize collaboration with international operators to access technology, financing, and market expertise. Joint venture arrangements can facilitate risk sharing and accelerate infrastructure development timelines while building local capabilities.

Technology adoption initiatives should prioritize digital transformation opportunities that improve operational efficiency, safety, and environmental performance. Predictive maintenance systems and automated monitoring capabilities offer significant potential for cost reduction and reliability improvement.

Regulatory engagement efforts should focus on streamlining approval processes and creating favorable conditions for private sector investment. Policy advocacy for infrastructure development incentives and regulatory clarity can accelerate market growth and investment attraction.

Long-term growth prospects for Egypt’s oil and gas midstream market remain highly positive, supported by increasing domestic production, expanding export opportunities, and strategic infrastructure investments. Natural gas midstream operations particularly show strong potential, with Mediterranean discoveries creating substantial infrastructure requirements and export opportunities.

Infrastructure development is expected to accelerate over the next decade, with major pipeline projects, LNG facilities, and storage expansions enhancing Egypt’s energy handling capacity. Investment projections indicate sustained capital allocation toward midstream infrastructure, with annual growth rates expected to maintain 7.5% through 2030.

Technology integration will continue transforming operational capabilities, with digital solutions, automation systems, and advanced monitoring technologies becoming standard across midstream operations. Environmental compliance requirements will drive additional investment in cleaner technologies and more efficient systems.

Regional hub development positions Egypt to capture growing energy transit opportunities and establish itself as a central distribution point for African, European, and Middle Eastern energy flows. MWR analysis suggests that Egypt’s midstream sector could achieve regional market leadership within the next decade through strategic infrastructure investments and international partnerships.

Egypt’s oil and gas midstream market represents a dynamic and rapidly evolving sector with substantial growth potential driven by strategic geographic advantages, increasing energy production, and expanding regional connectivity. The market’s fundamental strengths include established infrastructure networks, government policy support, and growing international investment interest that create favorable conditions for sustained expansion.

Key success factors for market participants include strategic positioning, technology adoption, operational efficiency, and effective partnership development. The sector’s growth trajectory reflects Egypt’s broader energy sector transformation and its emerging role as a regional energy hub connecting multiple international markets.

Future opportunities encompass LNG market expansion, digital transformation initiatives, regional integration projects, and environmental sustainability programs that will shape the sector’s long-term development. Strategic investments in infrastructure modernization and capacity expansion will be critical for capturing these opportunities and maintaining competitive positioning in the evolving regional energy landscape.

What is Egypt Oil & Gas Midstream?

Egypt Oil & Gas Midstream refers to the sector involved in the transportation, storage, and processing of oil and gas products. This includes pipelines, storage facilities, and processing plants that facilitate the movement of hydrocarbons from production sites to refineries and distribution points.

What are the key players in the Egypt Oil & Gas Midstream Market?

Key players in the Egypt Oil & Gas Midstream Market include the Egyptian Natural Gas Holding Company (EGAS), the Egyptian General Petroleum Corporation (EGPC), and international companies like BP and Eni, among others.

What are the growth factors driving the Egypt Oil & Gas Midstream Market?

The growth of the Egypt Oil & Gas Midstream Market is driven by increasing energy demand, investments in infrastructure, and the discovery of new oil and gas reserves. Additionally, government initiatives to enhance energy security and attract foreign investment play a significant role.

What challenges does the Egypt Oil & Gas Midstream Market face?

The Egypt Oil & Gas Midstream Market faces challenges such as regulatory hurdles, geopolitical instability, and the need for significant capital investment in infrastructure. These factors can hinder the development and expansion of midstream operations.

What opportunities exist in the Egypt Oil & Gas Midstream Market?

Opportunities in the Egypt Oil & Gas Midstream Market include the potential for new pipeline projects, the expansion of liquefied natural gas (LNG) facilities, and partnerships with international firms to enhance technology and operational efficiency.

What trends are shaping the Egypt Oil & Gas Midstream Market?

Trends in the Egypt Oil & Gas Midstream Market include the increasing adoption of digital technologies for monitoring and management, a focus on sustainability practices, and the shift towards cleaner energy sources. These trends are influencing how companies operate and invest in midstream infrastructure.

Egypt Oil & Gas Midstream Market

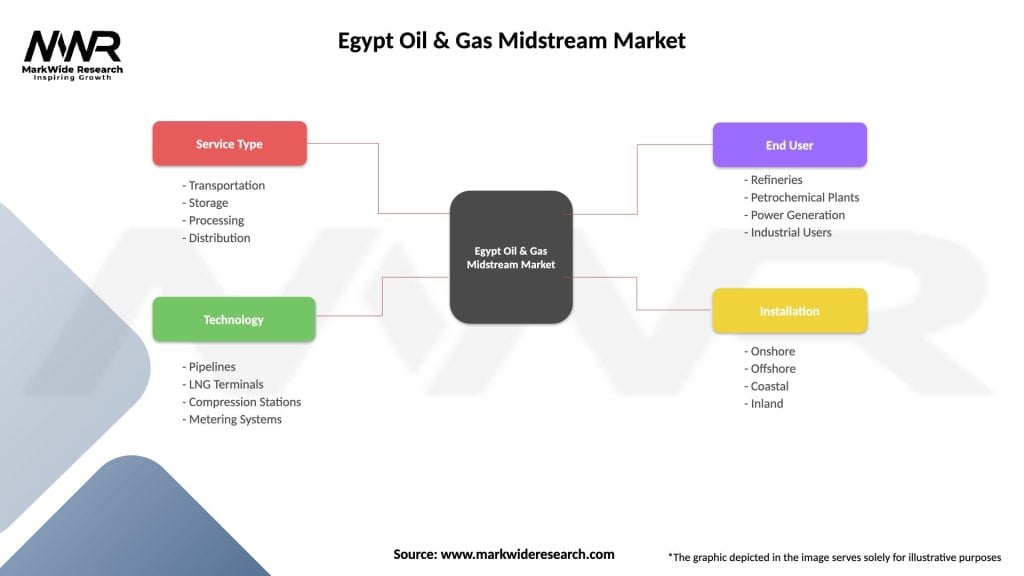

| Segmentation Details | Description |

|---|---|

| Service Type | Transportation, Storage, Processing, Distribution |

| Technology | Pipelines, LNG Terminals, Compression Stations, Metering Systems |

| End User | Refineries, Petrochemical Plants, Power Generation, Industrial Users |

| Installation | Onshore, Offshore, Coastal, Inland |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Egypt Oil & Gas Midstream Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at