444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Egypt hospitality industry market represents a cornerstone of the nation’s economic development, encompassing hotels, resorts, restaurants, and tourism-related services that serve millions of domestic and international visitors annually. Egypt’s strategic location at the crossroads of Africa, Asia, and Europe, combined with its rich historical heritage and diverse tourist attractions, positions the hospitality sector as a vital contributor to national GDP and employment generation.

Market dynamics indicate robust growth potential driven by government initiatives to promote tourism, infrastructure development projects, and increasing international visitor arrivals. The sector demonstrates remarkable resilience, recovering from various challenges while adapting to evolving consumer preferences and technological advancements. Digital transformation initiatives and sustainable tourism practices are reshaping service delivery models across the industry.

Growth projections suggest the market will expand at a compound annual growth rate of 8.2% over the forecast period, supported by mega-tourism projects, improved aviation connectivity, and enhanced marketing campaigns targeting diverse international markets. The industry encompasses luxury resorts along the Red Sea coast, boutique hotels in historic Cairo, and eco-tourism facilities in desert regions, creating a comprehensive hospitality ecosystem.

The Egypt hospitality industry market refers to the comprehensive ecosystem of accommodation, food service, entertainment, and tourism-related businesses that cater to travelers and visitors within Egypt’s borders. This market encompasses traditional hotels, luxury resorts, budget accommodations, restaurants, tour operators, and ancillary services that collectively contribute to the visitor experience and economic value creation.

Industry scope extends beyond basic accommodation and dining services to include cultural tourism experiences, adventure tourism, medical tourism, and business travel services. The market integrates various stakeholders including international hotel chains, local hospitality providers, government tourism authorities, and supporting industries such as transportation, retail, and entertainment sectors.

Strategic importance of the hospitality industry lies in its role as a foreign currency generator, employment creator, and catalyst for regional development across Egypt’s diverse geographical regions. The sector serves as a bridge between Egypt’s rich cultural heritage and modern tourism infrastructure, facilitating economic growth while preserving historical and natural assets.

Egypt’s hospitality industry demonstrates exceptional growth momentum, driven by strategic government investments, international partnerships, and diversified tourism offerings that appeal to various market segments. The sector benefits from Egypt’s unique positioning as a year-round destination offering historical, cultural, leisure, and business tourism opportunities across multiple geographical regions.

Key performance indicators reveal increasing occupancy rates, with luxury segment properties achieving 72% average occupancy during peak seasons, while mid-scale accommodations maintain steady demand throughout the year. The industry’s recovery trajectory following global disruptions showcases remarkable resilience and adaptability to changing market conditions.

Investment flows into hospitality infrastructure continue expanding, with major international hotel brands establishing presence in key destinations including Cairo, Alexandria, Luxor, Aswan, and Red Sea coastal areas. Technology adoption accelerates across the sector, with 85% of major hotels implementing digital check-in systems and mobile service platforms to enhance guest experiences.

Market diversification strategies focus on developing niche tourism segments including wellness tourism, cultural heritage experiences, and sustainable eco-tourism initiatives. These developments position Egypt’s hospitality industry for sustained growth while addressing evolving consumer preferences for authentic and environmentally conscious travel experiences.

Strategic positioning of Egypt’s hospitality industry leverages the country’s unparalleled historical assets, including ancient monuments, archaeological sites, and cultural landmarks that attract millions of international visitors seeking authentic experiences. The market benefits from diverse geographical advantages spanning Mediterranean coastlines, Red Sea coral reefs, Nile River tourism, and desert adventure opportunities.

Government initiatives serve as primary catalysts for hospitality industry expansion, with comprehensive tourism development strategies, infrastructure investments, and promotional campaigns enhancing Egypt’s global tourism profile. Vision 2030 tourism strategy aims to position Egypt among the world’s top tourism destinations through systematic development of hospitality infrastructure and service capabilities.

Cultural heritage assets provide sustainable competitive advantages, with UNESCO World Heritage sites, ancient monuments, and archaeological discoveries continuously attracting international visitors seeking authentic historical experiences. The Grand Egyptian Museum and other cultural projects create new tourism anchors supporting hospitality sector growth.

Geographical diversity enables year-round tourism operations, with Red Sea destinations offering beach and diving experiences, Nile Valley providing cultural tourism, and desert regions supporting adventure and eco-tourism activities. This diversification reduces seasonal dependency and creates multiple revenue streams for hospitality providers.

Economic reforms and currency adjustments improve Egypt’s cost competitiveness in international tourism markets, making destinations more attractive to price-sensitive travelers while maintaining value propositions for luxury segments. Investment incentives encourage private sector participation in hospitality infrastructure development and service expansion.

Security perceptions occasionally impact international visitor confidence, requiring continuous efforts to maintain and communicate safety standards across tourism destinations. Regional stability concerns can influence travel decisions and booking patterns, particularly for long-haul international markets sensitive to geopolitical developments.

Infrastructure limitations in certain regions constrain hospitality development potential, with transportation networks, utilities, and communication systems requiring ongoing investment to support tourism growth. Seasonal demand fluctuations create operational challenges for hospitality providers, particularly in destinations heavily dependent on specific tourism segments.

Skilled workforce shortages in specialized hospitality roles limit service quality improvements and expansion capabilities, necessitating enhanced training programs and professional development initiatives. Environmental challenges including water scarcity and waste management require sustainable solutions to support long-term hospitality industry growth.

Economic volatility and currency fluctuations can affect international visitor spending patterns and domestic tourism demand, requiring adaptive pricing strategies and flexible operational approaches. Regulatory complexities may slow investment processes and business development initiatives, particularly for international hospitality operators entering the market.

Emerging tourism segments present significant growth opportunities, with medical tourism, wellness tourism, and educational tourism showing strong potential for development. Medical tourism particularly benefits from Egypt’s advanced healthcare facilities, competitive pricing, and attractive recovery environments combining treatment with leisure experiences.

Digital transformation initiatives create opportunities for enhanced guest experiences, operational efficiency improvements, and new service delivery models. Smart hotel technologies, mobile applications, and data analytics enable personalized services and streamlined operations that differentiate Egyptian hospitality providers in competitive international markets.

Sustainable tourism development aligns with global trends toward environmentally conscious travel, creating opportunities for eco-lodges, renewable energy integration, and conservation-focused tourism experiences. Community-based tourism initiatives can generate local economic benefits while preserving cultural authenticity and natural environments.

Regional tourism integration through improved connectivity and joint marketing initiatives with neighboring countries can expand visitor flows and create multi-destination tourism packages. Business tourism development, supported by conference facilities and corporate travel services, provides stable revenue streams less dependent on leisure travel fluctuations.

Competitive landscape evolution reflects increasing participation of international hotel chains alongside established local hospitality providers, creating diverse accommodation options across price segments and service categories. Market consolidation trends indicate strategic partnerships and acquisitions aimed at expanding geographical coverage and service capabilities.

Consumer behavior shifts toward experiential travel, authentic cultural encounters, and sustainable tourism practices influence hospitality service development and marketing strategies. Digital booking platforms and social media marketing become increasingly important for market visibility and customer acquisition, with 78% of international visitors using online channels for travel planning.

Pricing dynamics reflect competitive pressures and value positioning strategies, with premium segments maintaining strong margins while mid-market providers focus on operational efficiency and service differentiation. Seasonal pricing optimization and dynamic revenue management systems help maximize occupancy rates and revenue per available room across different market conditions.

Supply chain integration improves operational efficiency and cost management, with hospitality providers developing local sourcing networks and supplier partnerships that support community development while reducing operational costs. Quality standards continue rising across all market segments, driven by international competition and evolving guest expectations.

Comprehensive market analysis employs multiple research methodologies including primary data collection through industry interviews, surveys, and field observations across key hospitality markets in Egypt. Secondary research incorporates government statistics, industry reports, and academic studies to provide comprehensive market understanding and trend analysis.

Quantitative analysis utilizes statistical modeling and forecasting techniques to project market growth, demand patterns, and performance indicators across different hospitality segments and geographical regions. Qualitative insights from industry experts, government officials, and hospitality professionals provide contextual understanding of market dynamics and strategic implications.

Data validation processes ensure accuracy and reliability through cross-referencing multiple sources, expert review, and consistency checks across different market indicators. Market segmentation analysis examines performance variations across accommodation types, price categories, geographical regions, and customer segments to identify specific growth opportunities and challenges.

Trend analysis incorporates historical performance data, current market conditions, and forward-looking indicators to develop comprehensive market projections and strategic recommendations. Stakeholder consultation with industry participants, government agencies, and tourism organizations provides insights into policy developments and market evolution expectations.

Greater Cairo region dominates Egypt’s hospitality market, accounting for approximately 35% of total accommodation capacity and serving as the primary gateway for international visitors. The region benefits from proximity to major attractions including the Pyramids of Giza, extensive business travel demand, and comprehensive transportation connectivity supporting both leisure and corporate tourism segments.

Red Sea destinations including Hurghada, Sharm El Sheikh, and Marsa Alam represent the fastest-growing hospitality markets, with beach and diving tourism driving resort development and international visitor arrivals. These destinations achieve some of the highest occupancy rates and average daily rates in Egypt’s hospitality sector, particularly during European winter months.

Upper Egypt regions encompassing Luxor and Aswan capitalize on cultural heritage tourism, with boutique hotels and Nile cruise operations serving visitors to ancient temples and archaeological sites. Cultural tourism in these regions shows steady growth supported by ongoing archaeological discoveries and heritage site development projects.

Mediterranean coastal areas including Alexandria and North Coast destinations develop as domestic tourism markets while attracting regional visitors seeking beach experiences and historical attractions. Seasonal demand patterns in these regions complement Red Sea destinations, helping balance national tourism flows throughout the year.

Desert and oasis regions emerge as niche tourism destinations supporting eco-tourism and adventure travel segments, with specialized accommodations and tour services catering to travelers seeking unique desert experiences and cultural encounters with local communities.

Market leadership reflects a diverse ecosystem of international hotel chains, regional hospitality groups, and local independent operators serving different market segments and geographical areas. Strategic positioning varies from luxury resort operations to budget accommodation providers, creating comprehensive market coverage across price points and service categories.

Competitive strategies emphasize service differentiation, technology integration, and sustainability initiatives to attract environmentally conscious travelers and enhance operational efficiency. Market expansion continues through new property development, brand extensions, and strategic partnerships with local developers and tourism authorities.

By Accommodation Type: The market encompasses luxury hotels and resorts, mid-scale business hotels, budget accommodations, boutique properties, and alternative lodging options including vacation rentals and eco-lodges. Luxury segment commands premium pricing and maintains strong performance in key destinations, while budget accommodations serve price-sensitive domestic and international travelers.

By Customer Segment: International leisure travelers represent the largest market segment, followed by domestic tourists, business travelers, and specialized groups including medical tourists and cultural heritage visitors. Leisure tourism shows seasonal variations while business travel provides more consistent demand patterns throughout the year.

By Geographical Region: Market segmentation reflects distinct regional characteristics, with coastal destinations focusing on resort tourism, urban centers serving business and cultural tourism, and emerging regions developing niche tourism offerings. Regional specialization enables targeted marketing and service development strategies.

By Service Category: Full-service hotels, limited-service properties, all-inclusive resorts, and specialized accommodation types serve different market needs and price points. Service differentiation becomes increasingly important as competition intensifies across all market segments.

Luxury Hotels and Resorts: Premium segment properties achieve the highest revenue per available room and maintain strong brand recognition among international travelers. Luxury positioning emphasizes exclusive experiences, personalized services, and prime locations near major attractions or pristine natural environments. These properties typically achieve occupancy rates exceeding 65% during peak seasons.

Mid-Scale Business Hotels: Properties serving corporate travelers and mid-market leisure visitors focus on operational efficiency, technology integration, and consistent service quality. Business hotel segment benefits from stable demand patterns and repeat customer relationships, particularly in major urban centers and commercial districts.

Budget Accommodations: Economy segment properties emphasize value pricing and basic amenities while maintaining acceptable service standards. Budget market growth reflects increasing price sensitivity among certain traveler segments and growing domestic tourism participation across income levels.

Boutique and Heritage Properties: Specialized accommodations capitalize on unique architectural features, cultural significance, and authentic local experiences. Boutique hotel segment attracts travelers seeking distinctive experiences and cultural immersion, often achieving premium pricing despite smaller property sizes.

Alternative Accommodations: Vacation rentals, eco-lodges, and specialized properties serve niche markets and provide unique value propositions. Alternative lodging growth reflects changing consumer preferences and demand for authentic, personalized travel experiences.

Hotel Operators benefit from Egypt’s diverse tourism assets, growing international visitor arrivals, and government support for hospitality sector development. Revenue diversification opportunities across multiple tourism segments and geographical regions reduce business risks and enhance profitability potential.

Investors gain access to a hospitality market with strong growth fundamentals, attractive returns on investment, and government incentives supporting tourism infrastructure development. Investment opportunities span various property types, market segments, and geographical locations, enabling portfolio diversification and risk management.

Tourism Authorities leverage hospitality sector growth to achieve economic development objectives, employment generation, and foreign currency earnings. Sector contribution to national GDP and regional development creates positive economic impacts across multiple industries and communities.

Local Communities benefit from employment opportunities, skills development programs, and economic activities generated by hospitality operations. Community engagement initiatives and local sourcing practices create sustainable economic benefits while preserving cultural heritage and environmental resources.

Travelers and Guests enjoy expanding accommodation options, improved service quality, and enhanced experiences across Egypt’s diverse tourism destinations. Service innovation and technology integration provide greater convenience, personalization, and value for money across different market segments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainable Tourism Development emerges as a dominant trend, with hospitality providers implementing eco-friendly practices, renewable energy systems, and conservation initiatives. Environmental consciousness among travelers drives demand for sustainable accommodation options and responsible tourism experiences that minimize environmental impact while supporting local communities.

Digital Integration and Smart Technologies transform guest experiences and operational efficiency through mobile applications, contactless services, and data analytics. Technology adoption accelerates across all market segments, with properties investing in digital infrastructure to meet evolving guest expectations and improve service delivery.

Experiential Tourism Focus shifts emphasis from traditional sightseeing to immersive cultural experiences, adventure activities, and authentic local encounters. Experience design becomes a key differentiator as travelers seek meaningful connections with destinations and local cultures rather than standardized tourism products.

Health and Wellness Tourism gains momentum with specialized facilities, wellness programs, and medical tourism services attracting visitors seeking health-focused travel experiences. Wellness integration extends beyond spa services to comprehensive health and lifestyle programs that combine treatment with leisure activities.

Personalization and Customization drive service innovation as hospitality providers leverage data analytics and guest preferences to create tailored experiences. Personalized services enhance guest satisfaction and loyalty while enabling premium pricing for customized offerings and exclusive experiences.

Major Infrastructure Projects including the New Administrative Capital, Grand Egyptian Museum, and expanded airport facilities create new tourism anchors and improve accessibility to key destinations. Infrastructure investments support hospitality sector growth while enhancing Egypt’s competitiveness in international tourism markets.

International Hotel Chain Expansions continue with new property openings, brand introductions, and strategic partnerships with local developers. Brand diversification provides travelers with expanded accommodation options while raising service standards across the hospitality sector through competitive pressures and best practice sharing.

Technology Platform Implementations revolutionize booking systems, guest services, and operational management across hospitality properties. Digital transformation initiatives enable enhanced guest experiences, improved operational efficiency, and data-driven decision making that optimize revenue and service quality.

Sustainability Certification Programs gain adoption as properties seek environmental credentials and respond to growing traveler demand for responsible tourism options. Green certification becomes a competitive advantage while supporting Egypt’s sustainable tourism development objectives and environmental conservation goals.

Workforce Development Initiatives expand through partnerships between hospitality providers, educational institutions, and government agencies to address skills shortages and enhance service quality. Training programs focus on technical skills, language capabilities, and customer service excellence to support industry growth and competitiveness.

MarkWide Research recommends that hospitality operators prioritize digital transformation initiatives to enhance guest experiences and operational efficiency while maintaining cost competitiveness. Technology investments should focus on mobile platforms, data analytics, and automation systems that improve service delivery and enable personalized guest interactions.

Market diversification strategies should emphasize emerging tourism segments including medical tourism, wellness travel, and sustainable tourism to reduce dependency on traditional leisure markets. Segment development requires specialized facilities, trained personnel, and targeted marketing approaches that address specific traveler needs and preferences.

Sustainability integration becomes essential for long-term competitiveness, with properties implementing environmental management systems, renewable energy solutions, and community engagement programs. Sustainable practices not only reduce operational costs but also appeal to environmentally conscious travelers and support destination preservation.

Partnership development with local suppliers, tour operators, and community organizations can enhance service offerings while supporting local economic development. Collaborative approaches create authentic experiences for guests while building sustainable business relationships that benefit all stakeholders in the tourism ecosystem.

Quality enhancement initiatives should focus on staff training, service standardization, and facility upgrades to maintain competitiveness with international destinations. Service excellence becomes increasingly important as travelers have access to global accommodation options and expect consistent quality standards regardless of location.

Long-term growth prospects for Egypt’s hospitality industry remain positive, supported by ongoing infrastructure development, tourism promotion initiatives, and diversification strategies that reduce market vulnerabilities. Market expansion is expected to continue at a steady growth rate of 8.2% annually over the next five years, driven by increasing international visitor arrivals and domestic tourism development.

Investment opportunities will likely concentrate in emerging destinations, sustainable tourism projects, and technology-enhanced properties that meet evolving traveler expectations. MWR analysis indicates particular potential in medical tourism facilities, eco-resorts, and boutique properties that offer unique cultural experiences and authentic local encounters.

Market evolution will be characterized by increased competition, service innovation, and sustainability integration as the industry matures and adapts to global tourism trends. Competitive differentiation will increasingly depend on experience quality, environmental responsibility, and technological sophistication rather than price competition alone.

Regional development patterns suggest expansion beyond traditional tourism centers to emerging destinations that offer specialized attractions and unique value propositions. Geographical diversification will help distribute tourism benefits more broadly while reducing pressure on established destinations and creating new economic opportunities.

Technology integration will accelerate across all market segments, with artificial intelligence, Internet of Things, and mobile platforms becoming standard features rather than competitive advantages. Digital transformation will enable new service models and operational efficiencies that reshape industry dynamics and guest expectations.

Egypt’s hospitality industry market demonstrates remarkable resilience and growth potential, positioned to capitalize on the country’s unique cultural heritage, geographical diversity, and strategic location. The sector’s comprehensive development across multiple tourism segments and geographical regions creates a robust foundation for sustained expansion and economic contribution.

Strategic advantages including world-renowned historical attractions, diverse natural environments, and government support for tourism development provide sustainable competitive positioning in global hospitality markets. The industry’s evolution toward sustainability, technology integration, and experiential tourism aligns with international trends while preserving Egypt’s distinctive cultural identity.

Future success will depend on continued investment in infrastructure, workforce development, and service innovation that maintains Egypt’s competitiveness while addressing evolving traveler expectations. The hospitality sector’s role as an economic catalyst and employment generator positions it as a critical component of Egypt’s broader development strategy and international positioning as a premier tourism destination.

What is Egypt Hospitality?

Egypt Hospitality refers to the services and facilities provided to travelers and tourists in Egypt, including hotels, restaurants, and entertainment venues. This sector plays a crucial role in the country’s economy by attracting international visitors and supporting local businesses.

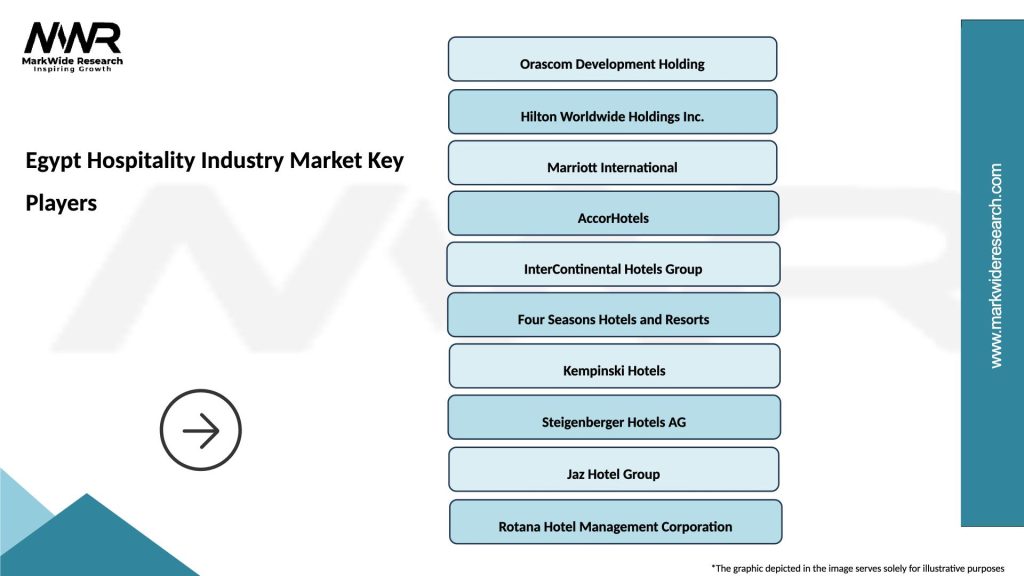

What are the key players in the Egypt Hospitality Industry Market?

Key players in the Egypt Hospitality Industry Market include major hotel chains like Hilton, Marriott, and Accor, which offer a range of accommodations and services. Additionally, local companies such as Steigenberger Hotels and Orascom Hotels contribute significantly to the market, among others.

What are the growth factors driving the Egypt Hospitality Industry Market?

The growth of the Egypt Hospitality Industry Market is driven by increasing tourist arrivals, government initiatives to promote tourism, and the development of new attractions. Additionally, the rise in domestic travel and investment in infrastructure are also contributing to market expansion.

What challenges does the Egypt Hospitality Industry Market face?

The Egypt Hospitality Industry Market faces challenges such as political instability, fluctuating economic conditions, and competition from neighboring countries. These factors can impact tourist confidence and overall market performance.

What opportunities exist in the Egypt Hospitality Industry Market?

Opportunities in the Egypt Hospitality Industry Market include the potential for eco-tourism, the development of luxury resorts, and the growth of niche markets such as wellness tourism. Additionally, leveraging technology for enhanced customer experiences presents significant prospects.

What trends are shaping the Egypt Hospitality Industry Market?

Trends shaping the Egypt Hospitality Industry Market include a focus on sustainability, the integration of digital technologies in service delivery, and the rise of experiential travel. These trends are influencing how businesses operate and cater to evolving consumer preferences.

Egypt Hospitality Industry Market

| Segmentation Details | Description |

|---|---|

| Service Type | Luxury Hotels, Budget Hotels, Resorts, Hostels |

| Customer Type | Business Travelers, Tourists, Families, Solo Travelers |

| Booking Channel | Online Travel Agencies, Direct Booking, Travel Agents, Mobile Apps |

| Location Type | Urban, Coastal, Rural, Suburban |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Egypt Hospitality Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at