444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Egypt diabetics drugs industry market represents a rapidly expanding healthcare sector driven by increasing diabetes prevalence and growing awareness of effective treatment options. Egypt’s pharmaceutical landscape has witnessed significant transformation as the country addresses one of the most pressing health challenges facing its population. The market encompasses a comprehensive range of therapeutic solutions including insulin preparations, oral antidiabetic medications, and innovative combination therapies designed to manage both Type 1 and Type 2 diabetes effectively.

Market dynamics indicate substantial growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% as healthcare infrastructure improvements and government initiatives drive accessibility to diabetes medications. The Egyptian healthcare system has prioritized diabetes management through enhanced distribution networks, subsidized medication programs, and increased healthcare provider training. Regional pharmaceutical companies are collaborating with international manufacturers to ensure consistent supply chains and competitive pricing structures that benefit Egyptian patients.

Healthcare accessibility improvements have contributed to a 35% increase in diabetes diagnosis rates over recent years, leading to expanded treatment demand across urban and rural populations. The market benefits from Egypt’s strategic geographic position, serving as a pharmaceutical hub for North African and Middle Eastern regions while maintaining focus on domestic healthcare needs.

The Egypt diabetics drugs industry market refers to the comprehensive pharmaceutical sector encompassing all therapeutic products, medications, and treatment solutions specifically designed for diabetes management within Egypt’s healthcare ecosystem. This market includes prescription medications, over-the-counter supplements, medical devices for drug delivery, and supportive healthcare services that collectively address the diabetes treatment needs of Egyptian patients across various demographic segments.

Market scope extends beyond traditional pharmaceutical products to include innovative drug delivery systems, continuous glucose monitoring integration, and personalized medicine approaches that enhance treatment effectiveness. The industry encompasses both imported international pharmaceutical products and locally manufactured medications that meet Egyptian regulatory standards while addressing specific population health requirements.

Egypt’s diabetics drugs market demonstrates robust growth trajectory supported by increasing disease prevalence, improved healthcare infrastructure, and enhanced government support for diabetes management programs. The market has evolved from basic insulin provision to comprehensive therapeutic ecosystems that include advanced drug formulations, combination therapies, and patient-centric treatment approaches designed for diverse socioeconomic populations.

Key market drivers include rising diabetes incidence rates, with Type 2 diabetes affecting approximately 17% of the adult population, alongside growing healthcare awareness and improved diagnostic capabilities. The pharmaceutical sector benefits from strategic government initiatives that prioritize non-communicable disease management while fostering local manufacturing capabilities and international pharmaceutical partnerships.

Market segmentation reveals strong demand across insulin products, oral antidiabetic medications, and combination therapies, with particular growth in long-acting insulin formulations and novel drug delivery systems. The competitive landscape features both established international pharmaceutical companies and emerging local manufacturers who contribute to market accessibility and affordability for Egyptian patients.

Strategic market analysis reveals several critical insights that define Egypt’s diabetics drugs industry landscape and future development potential:

Primary market drivers propelling Egypt’s diabetics drugs industry growth encompass demographic, healthcare, and socioeconomic factors that create sustained demand for diabetes therapeutic solutions. The convergence of these drivers establishes a foundation for long-term market expansion and pharmaceutical sector development.

Demographic transitions represent the most significant driver, with Egypt’s population experiencing lifestyle changes that increase diabetes risk factors. Urbanization patterns, dietary modifications, and reduced physical activity levels contribute to rising Type 2 diabetes incidence across age groups. Population aging further amplifies diabetes prevalence as metabolic disorders become more common in older demographics requiring comprehensive pharmaceutical interventions.

Healthcare system improvements drive market growth through enhanced diagnostic capabilities, expanded healthcare provider networks, and improved patient access to specialized diabetes care. Government initiatives focused on non-communicable disease management allocate resources for diabetes screening programs, medication subsidies, and healthcare infrastructure development that supports pharmaceutical market expansion.

Economic development enables increased healthcare spending by individuals and families, supporting demand for premium diabetes medications and innovative treatment options. Rising disposable income levels allow patients to access advanced therapeutic solutions while health insurance expansion provides financial protection for diabetes treatment costs.

Market constraints affecting Egypt’s diabetics drugs industry include economic, regulatory, and healthcare delivery challenges that may limit growth potential and market accessibility for certain population segments. Understanding these restraints enables stakeholders to develop targeted strategies for market development and patient access improvement.

Economic limitations pose significant challenges for diabetes medication accessibility, particularly among lower-income populations who may struggle with treatment costs despite government subsidies. Currency fluctuations affect imported medication pricing, creating affordability barriers for patients requiring consistent long-term therapy. Healthcare budget constraints may limit government support for comprehensive diabetes management programs.

Regulatory complexities can delay new medication approvals and market entry for innovative diabetes treatments, potentially limiting patient access to advanced therapeutic options. Quality control requirements for pharmaceutical manufacturing may increase production costs, affecting medication pricing and market competitiveness for local manufacturers.

Healthcare infrastructure gaps in rural areas limit medication distribution and patient monitoring capabilities, creating disparities in diabetes care quality and treatment outcomes. Healthcare provider shortages in specialized diabetes care may restrict patient access to optimal medication management and therapeutic guidance.

Emerging opportunities within Egypt’s diabetics drugs market present significant potential for pharmaceutical companies, healthcare providers, and technology innovators seeking to address unmet medical needs while expanding market presence. These opportunities align with evolving healthcare demands and technological advancement possibilities.

Digital health integration offers substantial opportunities for medication management enhancement through mobile applications, remote monitoring systems, and telemedicine platforms that improve patient compliance and treatment outcomes. Artificial intelligence applications in diabetes management can optimize medication dosing, predict complications, and personalize treatment approaches for individual patients.

Biosimilar development presents opportunities for cost-effective insulin and diabetes medication alternatives that increase treatment accessibility while maintaining therapeutic efficacy. Local manufacturing expansion can reduce import dependency, improve supply chain reliability, and create employment opportunities within Egypt’s pharmaceutical sector.

Public-private partnerships enable collaborative approaches to diabetes care that combine government resources with private sector innovation and efficiency. Regional market expansion allows Egyptian pharmaceutical companies to leverage their market expertise for growth in neighboring countries with similar healthcare challenges and demographic profiles.

Market dynamics within Egypt’s diabetics drugs industry reflect complex interactions between supply and demand factors, regulatory environments, and competitive pressures that shape market evolution and strategic decision-making for industry participants. These dynamics create both challenges and opportunities for sustainable market growth.

Supply chain dynamics involve balancing imported pharmaceutical products with domestic manufacturing capabilities to ensure consistent medication availability while managing cost pressures. Distribution networks must accommodate both urban concentration and rural dispersion of patient populations, requiring flexible logistics solutions and strategic partnership arrangements with healthcare providers.

Competitive dynamics feature established international pharmaceutical companies competing with emerging local manufacturers who offer cost advantages and market knowledge. Innovation cycles drive continuous product development as companies seek to differentiate their offerings through improved efficacy, convenience, and patient compliance features.

Regulatory dynamics influence market entry strategies, product approval timelines, and quality standards that affect competitive positioning and market access. Pricing dynamics reflect negotiations between pharmaceutical companies, government agencies, and insurance providers to balance medication accessibility with sustainable business models for continued innovation and market development.

Comprehensive research methodology employed for analyzing Egypt’s diabetics drugs industry market incorporates multiple data sources, analytical techniques, and validation processes to ensure accurate market assessment and reliable insights for stakeholder decision-making. The methodology combines quantitative analysis with qualitative insights from industry experts and healthcare professionals.

Primary research activities include structured interviews with pharmaceutical company executives, healthcare providers, regulatory officials, and patient advocacy groups to gather firsthand insights about market conditions, challenges, and opportunities. Survey methodologies capture patient perspectives on medication accessibility, treatment satisfaction, and healthcare service quality across diverse demographic segments.

Secondary research analysis examines government healthcare statistics, pharmaceutical industry reports, academic studies, and international diabetes management guidelines to establish market context and benchmark Egypt’s market against regional and global standards. Data triangulation ensures research findings accuracy through cross-validation of information sources and analytical approaches.

Market modeling techniques incorporate demographic projections, healthcare spending trends, and pharmaceutical consumption patterns to develop realistic market forecasts and scenario analyses that support strategic planning for industry participants and healthcare policymakers.

Regional market analysis reveals significant variations in diabetes medication demand, healthcare infrastructure, and market penetration across Egypt’s diverse geographic regions. Understanding these regional differences enables targeted market strategies and resource allocation for optimal healthcare delivery and pharmaceutical market development.

Greater Cairo region dominates the diabetics drugs market with 38% of total medication consumption, reflecting high population density, advanced healthcare infrastructure, and superior access to specialized diabetes care services. The region benefits from concentrated pharmaceutical distribution networks, major hospital systems, and higher healthcare spending capacity among urban populations.

Alexandria and Delta regions represent significant market opportunities with growing diabetes prevalence and improving healthcare access. These areas demonstrate increasing medication adoption rates of 12% annually as healthcare infrastructure development and government health programs expand treatment accessibility for diverse population segments.

Upper Egypt regions present both challenges and opportunities, with lower current market penetration but substantial growth potential as healthcare infrastructure improvements and government initiatives address rural healthcare gaps. Rural market penetration currently reaches 23% of diagnosed diabetes patients, indicating significant expansion opportunities through targeted distribution strategies and healthcare provider training programs.

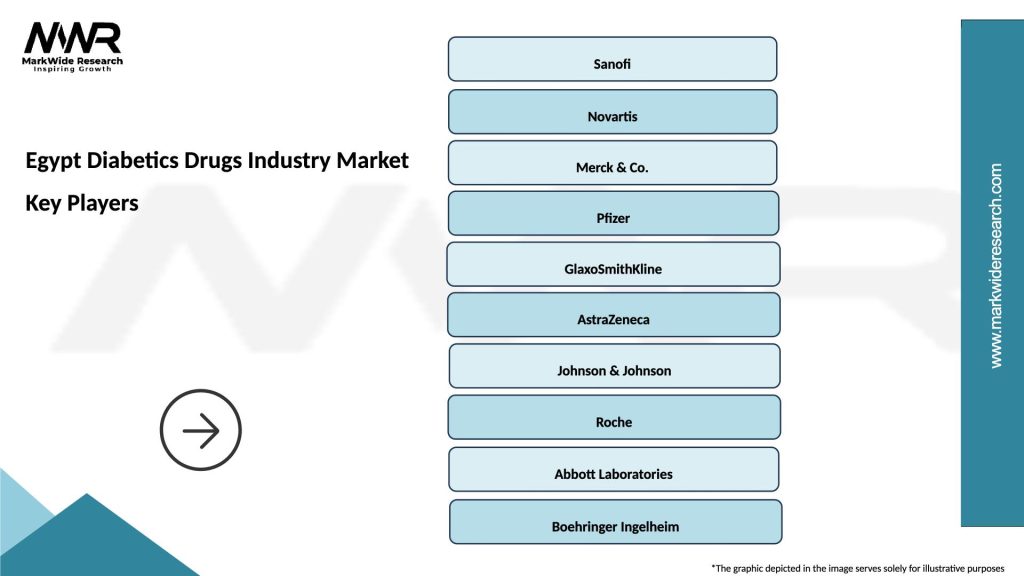

Competitive landscape analysis reveals a dynamic market environment featuring established international pharmaceutical companies, emerging local manufacturers, and strategic partnerships that collectively serve Egypt’s diverse diabetes treatment needs. The competitive structure balances innovation, accessibility, and affordability to address varied patient requirements.

Leading market participants include:

Competitive strategies emphasize product differentiation through improved efficacy, patient convenience, and cost-effectiveness while maintaining high quality standards and regulatory compliance requirements for sustainable market positioning.

Market segmentation analysis provides detailed insights into Egypt’s diabetics drugs industry structure, revealing distinct market segments with unique characteristics, growth patterns, and strategic opportunities for pharmaceutical companies and healthcare providers.

By Product Type:

By Diabetes Type:

By Distribution Channel:

Category-specific analysis reveals distinct performance patterns and growth opportunities within Egypt’s diabetics drugs market segments, providing strategic insights for pharmaceutical companies seeking to optimize their market approach and resource allocation strategies.

Insulin category demonstrates steady growth with long-acting insulin formulations showing particular strength due to improved patient compliance and reduced injection frequency requirements. Biosimilar insulin products gain market acceptance as cost-effective alternatives that maintain therapeutic efficacy while improving treatment accessibility for price-sensitive patient populations.

Oral antidiabetic medications represent the largest market segment by volume, with metformin-based products maintaining dominant market position due to established efficacy profiles and favorable cost structures. Combination therapies experience accelerated adoption as healthcare providers seek simplified treatment regimens that enhance patient adherence and clinical outcomes.

Advanced injectable therapies show promising growth potential despite higher costs, as healthcare providers and patients recognize superior efficacy and reduced complication risks. Patient education programs support adoption of advanced therapies by addressing concerns about injection techniques and treatment complexity.

Digital health integration across all medication categories enhances treatment monitoring and patient engagement, with smart insulin pens and mobile health applications providing valuable data for treatment optimization and healthcare provider communication.

Industry participants and stakeholders within Egypt’s diabetics drugs market realize substantial benefits through strategic engagement with this growing healthcare sector. These benefits extend beyond immediate commercial returns to include long-term value creation and positive healthcare impact contributions.

Pharmaceutical companies benefit from sustained market demand driven by chronic disease characteristics requiring continuous medication therapy. Market expansion opportunities enable revenue growth through product portfolio diversification, geographic market penetration, and strategic partnerships with local healthcare providers and distribution networks.

Healthcare providers gain access to comprehensive treatment options that improve patient outcomes while enhancing clinical practice efficiency. Advanced pharmaceutical products enable personalized treatment approaches that address individual patient needs and preferences, supporting improved therapeutic relationships and patient satisfaction levels.

Patients and families benefit from expanded medication access, improved treatment options, and enhanced healthcare support systems that collectively contribute to better diabetes management and quality of life improvements. Government health programs provide financial protection and medication subsidies that reduce treatment burden for diverse socioeconomic populations.

Healthcare system stakeholders realize benefits through improved population health outcomes, reduced diabetes-related complications, and enhanced healthcare delivery efficiency that supports sustainable healthcare system development and resource optimization strategies.

Comprehensive SWOT analysis provides strategic assessment of Egypt’s diabetics drugs industry market, identifying internal strengths and weaknesses alongside external opportunities and threats that influence market development and competitive positioning.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging market trends within Egypt’s diabetics drugs industry reflect evolving healthcare needs, technological advancement, and changing patient expectations that collectively shape market development and strategic opportunities for industry participants.

Personalized medicine approaches gain prominence as healthcare providers seek individualized treatment strategies based on patient genetics, lifestyle factors, and treatment response patterns. Pharmacogenomic testing enables optimized medication selection and dosing strategies that improve therapeutic outcomes while reducing adverse effects and treatment costs.

Digital therapeutics integration transforms diabetes management through mobile health applications, continuous glucose monitoring systems, and artificial intelligence-powered treatment optimization platforms. Telemedicine adoption expands healthcare access for rural populations while providing convenient monitoring and consultation services for urban patients with busy lifestyles.

Biosimilar market expansion accelerates as regulatory frameworks mature and healthcare providers gain confidence in therapeutic equivalence. Cost-effective alternatives improve treatment accessibility while maintaining clinical efficacy standards that support sustainable healthcare system development.

Patient-centric care models emphasize comprehensive diabetes management that extends beyond medication therapy to include lifestyle counseling, nutritional guidance, and psychological support services. Integrated care approaches coordinate multiple healthcare providers and services to optimize patient outcomes and treatment satisfaction levels.

Recent industry developments demonstrate dynamic market evolution within Egypt’s diabetics drugs sector, reflecting innovation, strategic partnerships, and regulatory advancement that collectively enhance market competitiveness and patient care quality.

Pharmaceutical manufacturing expansion includes new production facilities and technology upgrades that increase domestic medication production capacity while meeting international quality standards. Local companies invest in research and development capabilities to develop innovative diabetes treatments tailored for Egyptian patient populations and regional market requirements.

Strategic partnerships between international pharmaceutical companies and Egyptian healthcare organizations facilitate technology transfer, market access improvement, and healthcare provider training programs. MarkWide Research analysis indicates these collaborations contribute to enhanced treatment accessibility and improved patient outcomes across diverse geographic regions.

Regulatory framework improvements streamline medication approval processes while maintaining rigorous safety and efficacy standards that protect patient welfare. Digital health regulations enable innovative diabetes management solutions while ensuring data privacy and security protection for patient information.

Healthcare infrastructure investments include specialized diabetes care centers, diagnostic equipment upgrades, and healthcare provider training programs that collectively enhance treatment quality and accessibility. Government initiatives support medication subsidy programs and health insurance expansion that improve treatment affordability for diverse socioeconomic populations.

Strategic recommendations for Egypt’s diabetics drugs industry stakeholders emphasize sustainable market development, patient access improvement, and innovation advancement that collectively support long-term sector growth and healthcare system enhancement.

Pharmaceutical companies should prioritize local manufacturing capabilities and biosimilar development to improve cost competitiveness while maintaining therapeutic quality standards. Market access strategies should emphasize affordability programs, patient assistance initiatives, and healthcare provider education that support treatment adoption across diverse population segments.

Healthcare providers should invest in diabetes care specialization and digital health technology adoption that enhances patient monitoring and treatment optimization capabilities. Integrated care models combining medication management with lifestyle counseling and patient education provide comprehensive treatment approaches that improve long-term outcomes.

Government agencies should continue healthcare infrastructure development and regulatory framework optimization that supports innovation while ensuring patient safety and treatment accessibility. Public-private partnerships enable efficient resource utilization and accelerated healthcare system improvement through collaborative approaches.

Technology companies should focus on diabetes-specific digital health solutions that integrate with existing healthcare systems while providing user-friendly interfaces for patients and healthcare providers. Data analytics capabilities enable treatment optimization and population health management that support evidence-based healthcare decision-making.

Future market outlook for Egypt’s diabetics drugs industry indicates sustained growth potential driven by demographic trends, healthcare system development, and technological innovation that collectively create favorable conditions for market expansion and patient care improvement.

Market growth projections suggest continued expansion with projected CAGR of 9.1% over the next five years, supported by increasing diabetes prevalence, improved healthcare access, and enhanced treatment options. Population aging and lifestyle changes contribute to sustained medication demand while government health initiatives support market accessibility and affordability.

Innovation trends indicate accelerated development of personalized medicine approaches, digital therapeutics integration, and advanced drug delivery systems that enhance treatment effectiveness and patient convenience. Artificial intelligence applications in diabetes management promise improved treatment optimization and complication prevention through predictive analytics and personalized care recommendations.

Market consolidation may occur as smaller pharmaceutical companies seek strategic partnerships or acquisitions to compete effectively with established market leaders. Regional expansion opportunities enable Egyptian pharmaceutical companies to leverage their market expertise for growth in neighboring countries with similar healthcare challenges and demographic profiles.

Regulatory evolution will likely emphasize patient safety, treatment accessibility, and innovation support through streamlined approval processes and digital health framework development. MWR projections indicate healthcare digitization adoption rates reaching 75% within the next decade, transforming diabetes care delivery and patient engagement approaches across Egypt’s healthcare system.

Egypt’s diabetics drugs industry market represents a dynamic and rapidly evolving healthcare sector with substantial growth potential driven by increasing disease prevalence, improving healthcare infrastructure, and advancing treatment technologies. The market demonstrates resilience and adaptability as stakeholders address challenges while capitalizing on emerging opportunities for sustainable development.

Strategic market positioning requires balanced approaches that address patient accessibility, treatment innovation, and cost-effectiveness while maintaining high quality standards and regulatory compliance. Collaborative partnerships between pharmaceutical companies, healthcare providers, government agencies, and technology innovators create synergistic benefits that enhance market competitiveness and patient care quality.

Long-term success in Egypt’s diabetics drugs market depends on continued investment in healthcare infrastructure, regulatory framework optimization, and innovation development that collectively support comprehensive diabetes management solutions. Patient-centric approaches that prioritize treatment accessibility, clinical effectiveness, and quality of life improvements will drive sustainable market growth while contributing to Egypt’s overall healthcare system advancement and population health improvement objectives.

What is Egypt Diabetics Drugs?

Egypt Diabetics Drugs refer to pharmaceutical products specifically designed to manage diabetes, including insulin, oral hypoglycemics, and other related medications used to control blood sugar levels in patients.

What are the key players in the Egypt Diabetics Drugs Industry Market?

Key players in the Egypt Diabetics Drugs Industry Market include companies like Novo Nordisk, Sanofi, and Merck, which are known for their innovative diabetes treatments and extensive market presence, among others.

What are the growth factors driving the Egypt Diabetics Drugs Industry Market?

The growth of the Egypt Diabetics Drugs Industry Market is driven by increasing diabetes prevalence, rising awareness about diabetes management, and advancements in drug formulations and delivery systems.

What challenges does the Egypt Diabetics Drugs Industry Market face?

Challenges in the Egypt Diabetics Drugs Industry Market include regulatory hurdles, high costs of innovative treatments, and the need for better healthcare infrastructure to support diabetes care.

What opportunities exist in the Egypt Diabetics Drugs Industry Market?

Opportunities in the Egypt Diabetics Drugs Industry Market include the potential for developing new therapies, increasing investment in healthcare, and expanding access to diabetes education and management programs.

What trends are shaping the Egypt Diabetics Drugs Industry Market?

Trends in the Egypt Diabetics Drugs Industry Market include the rise of personalized medicine, the integration of digital health technologies, and a growing focus on preventive care and lifestyle management for diabetes patients.

Egypt Diabetics Drugs Industry Market

| Segmentation Details | Description |

|---|---|

| Product Type | Insulin, Oral Hypoglycemics, GLP-1 Agonists, DPP-4 Inhibitors |

| Delivery Mode | Subcutaneous Injection, Oral Tablet, Inhalation, Continuous Infusion |

| End User | Hospitals, Clinics, Home Care, Pharmacies |

| Therapy Area | Type 1 Diabetes, Type 2 Diabetes, Gestational Diabetes, Prediabetes |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Egypt Diabetics Drugs Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at