444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The edible films and coating for fruits and vegetables market represents a revolutionary approach to food preservation and packaging that addresses growing consumer demands for sustainable, natural, and environmentally friendly solutions. This innovative technology utilizes biodegradable materials derived from natural sources to create protective barriers that extend shelf life, maintain nutritional quality, and reduce food waste across the global produce supply chain.

Market dynamics indicate robust growth driven by increasing awareness of environmental sustainability and the urgent need to reduce plastic packaging waste. The technology encompasses various natural polymers including chitosan, pectin, alginate, and protein-based materials that form transparent, edible barriers on fresh produce surfaces. These coatings provide moisture retention, gas barrier properties, and antimicrobial protection while maintaining the natural appearance and taste of fruits and vegetables.

Industry adoption has accelerated significantly, with major food retailers, packaging companies, and agricultural producers investing heavily in edible coating technologies. The market demonstrates particularly strong growth in developed regions where consumer environmental consciousness drives demand for sustainable packaging alternatives. Growth projections suggest the market will expand at a compound annual growth rate of 8.2% through the forecast period, reflecting increasing commercial viability and technological advancement.

Regional distribution shows North America and Europe leading market development, accounting for approximately 62% of global adoption, while Asia-Pacific emerges as the fastest-growing region due to expanding food processing industries and increasing export activities. The technology’s versatility in application across diverse produce categories, from delicate berries to robust root vegetables, positions it as a transformative solution for modern food preservation challenges.

The edible films and coating for fruits and vegetables market refers to the commercial sector focused on developing, manufacturing, and distributing biodegradable, consumable protective barriers applied to fresh produce to extend shelf life, maintain quality, and reduce environmental impact. These innovative solutions replace traditional plastic packaging with natural, edible alternatives that provide similar protective benefits while eliminating waste concerns.

Edible coatings are thin layers of edible materials applied directly to food surfaces through dipping, spraying, or brushing techniques. The coatings form invisible barriers that control moisture transfer, gas exchange, and microbial growth while maintaining the natural characteristics of fresh produce. Key materials include polysaccharides like chitosan and pectin, proteins such as whey and casein, and lipids including waxes and fatty acids.

Functional properties of these coatings encompass moisture barrier capabilities, oxygen permeability control, antimicrobial activity, and mechanical protection against physical damage during handling and transportation. The technology addresses critical challenges in food preservation, including water loss, oxidation, microbial contamination, and quality deterioration that occur during storage and distribution.

Commercial applications span the entire fresh produce value chain, from post-harvest treatment at processing facilities to retail display enhancement and consumer convenience. The coatings maintain produce freshness, reduce shrinkage losses, and provide sustainable packaging solutions that align with circular economy principles and environmental stewardship goals.

Market evolution in the edible films and coating sector reflects a paradigm shift toward sustainable food packaging solutions driven by environmental regulations, consumer preferences, and technological innovation. The industry has transitioned from experimental applications to commercial-scale implementation across major food supply chains, demonstrating significant potential for widespread adoption.

Technology advancement has enabled the development of sophisticated coating formulations that provide enhanced barrier properties, extended shelf life, and improved sensory characteristics. Recent innovations include nano-encapsulation techniques, active packaging components, and smart coatings that respond to environmental conditions. These developments have increased the effectiveness of edible coatings by 35% compared to earlier formulations.

Market drivers include stringent environmental regulations targeting plastic waste reduction, growing consumer demand for natural food products, and increasing focus on food security and waste minimization. The global food waste crisis, which affects approximately 30% of all food produced, has intensified interest in preservation technologies that can significantly extend produce shelf life.

Industry consolidation is occurring as major packaging companies acquire specialized coating technology firms and food processors integrate coating applications into their operations. Strategic partnerships between material suppliers, equipment manufacturers, and food companies are accelerating market development and commercial deployment.

Future prospects indicate continued expansion driven by regulatory support, technological improvements, and increasing cost-effectiveness. The market is positioned for substantial growth as coating technologies achieve price parity with traditional packaging methods while delivering superior environmental and functional benefits.

Technology segmentation reveals distinct categories of edible coating solutions, each addressing specific preservation challenges and application requirements:

Application diversity spans numerous produce categories, with citrus fruits, apples, and leafy greens representing the largest application segments. Coating effectiveness varies by produce type, with some applications achieving shelf life extensions of up to 50% compared to untreated produce.

Regional preferences influence coating material selection, with Asian markets favoring chitosan-based solutions due to abundant raw material availability, while European markets emphasize protein-based coatings aligned with clean label trends. North American adoption focuses on composite systems that provide comprehensive protection for long-distance transportation.

Commercial viability has improved significantly as production scales increase and raw material costs decline. Cost competitiveness with traditional packaging methods is achieved in applications where coating provides additional benefits beyond basic protection, such as enhanced appearance or nutritional fortification.

Environmental sustainability serves as the primary catalyst driving market growth, with increasing regulatory pressure to reduce plastic packaging waste and consumer demand for eco-friendly alternatives. Government initiatives worldwide are implementing plastic reduction targets and promoting biodegradable packaging solutions, creating favorable conditions for edible coating adoption.

Food waste reduction imperatives are accelerating market development as stakeholders across the food supply chain seek effective preservation technologies. The potential to reduce post-harvest losses through improved preservation directly addresses global food security concerns while providing economic benefits to producers, retailers, and consumers.

Consumer health consciousness is driving demand for natural, chemical-free preservation methods that maintain nutritional quality without synthetic additives. Edible coatings align with clean label trends and organic food preferences, offering preservation benefits without compromising consumer health or product integrity.

Technological advancement in coating formulation and application methods has improved performance characteristics and reduced implementation costs. Innovations in nano-technology, active packaging, and smart coatings are expanding application possibilities and enhancing commercial viability across diverse produce categories.

Supply chain optimization needs are promoting adoption of technologies that extend transportation windows and reduce handling requirements. Edible coatings enable longer distribution distances, reduced refrigeration needs, and improved product presentation at retail level, providing comprehensive supply chain benefits.

Regulatory support through favorable classification of edible coating materials and streamlined approval processes is facilitating market entry and expansion. Recognition of edible coatings as food ingredients rather than packaging materials simplifies regulatory compliance and accelerates commercial deployment.

High implementation costs represent a significant barrier to widespread adoption, particularly for small and medium-sized producers who may lack the capital investment required for coating equipment and facility modifications. The initial investment in application systems, quality control measures, and staff training can be substantial, limiting market penetration in cost-sensitive segments.

Technical complexity in coating formulation and application requires specialized knowledge and expertise that may not be readily available in all markets. Achieving consistent coating quality, optimizing formulations for specific produce types, and maintaining application parameters demand technical capabilities that can challenge implementation efforts.

Consumer acceptance varies across different markets and demographic segments, with some consumers expressing concerns about coating visibility, texture changes, or unfamiliarity with edible packaging concepts. Educational efforts and marketing initiatives are required to build consumer confidence and acceptance of coated produce.

Regulatory variations across different countries and regions create compliance challenges for companies operating in multiple markets. Differing approval requirements, labeling standards, and safety assessments can complicate international market expansion and increase regulatory compliance costs.

Performance limitations in certain applications or environmental conditions may restrict coating effectiveness and limit market adoption. Factors such as high humidity, temperature fluctuations, and extended storage periods can compromise coating integrity and reduce preservation benefits.

Supply chain integration challenges arise when implementing coating technologies across complex distribution networks involving multiple stakeholders with varying capabilities and requirements. Coordination between producers, processors, distributors, and retailers is essential for successful coating program implementation.

Emerging market expansion presents substantial growth opportunities as developing countries modernize their food processing and distribution systems. Rising disposable incomes, urbanization, and increasing food safety awareness in these markets create favorable conditions for edible coating adoption, particularly in regions with significant agricultural production.

Technology integration with smart packaging concepts offers opportunities to develop advanced coating systems that provide real-time quality monitoring, traceability, and consumer information. Integration of sensors, indicators, and digital technologies with edible coatings can create value-added solutions that command premium pricing.

Organic and premium produce segments represent high-value opportunities where coating benefits align with consumer willingness to pay premium prices for enhanced quality and sustainability. The organic food market’s emphasis on natural preservation methods creates ideal conditions for edible coating adoption.

Export market facilitation through extended shelf life and improved quality maintenance during long-distance transportation can unlock new market opportunities for agricultural producers. Edible coatings enable access to distant markets that were previously economically unfeasible due to quality deterioration during transport.

Functional coating development incorporating nutrients, probiotics, or therapeutic compounds can create differentiated products that provide health benefits beyond preservation. These value-added coatings can command higher prices and appeal to health-conscious consumers seeking functional foods.

Circular economy initiatives are creating opportunities for coating materials derived from food processing waste streams, enabling sustainable raw material sourcing while addressing waste management challenges. This approach can reduce coating costs while enhancing environmental benefits.

Supply and demand dynamics in the edible films and coating market reflect the complex interplay between technological capability, cost considerations, and market acceptance. Demand growth is outpacing supply capacity in certain regions, creating opportunities for new market entrants and capacity expansion by existing players.

Raw material availability significantly influences market dynamics, with chitosan, pectin, and other natural polymers experiencing price volatility based on agricultural production cycles and competing applications. Material cost fluctuations can impact coating economics by 15-25% annually, requiring flexible pricing strategies and supply chain management.

Competitive intensity is increasing as traditional packaging companies, food processors, and specialized coating manufacturers compete for market share. Innovation cycles are accelerating, with new product introductions occurring more frequently and technological differentiation becoming increasingly important for market positioning.

Value chain integration is reshaping market dynamics as companies seek to control coating material supply, application processes, and end-market distribution. Vertical integration strategies are emerging to capture value across multiple market segments and ensure quality consistency.

Seasonal demand patterns reflect agricultural production cycles and seasonal consumption preferences, with peak demand occurring during harvest seasons and holiday periods. Capacity utilization varies seasonally, with some facilities operating at peak capacity of 85-90% during high-demand periods.

Technology adoption rates vary significantly across different produce categories and geographic regions, influenced by factors such as infrastructure availability, technical expertise, and economic conditions. Early adopters in developed markets are driving innovation and establishing best practices for broader market deployment.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research involves direct engagement with industry stakeholders including coating manufacturers, food processors, retailers, and technology providers through structured interviews, surveys, and focus groups.

Secondary research encompasses extensive analysis of industry publications, academic research, patent databases, regulatory filings, and company financial reports. This approach provides historical context, technological trends, and competitive landscape insights that inform market projections and strategic recommendations.

Data collection utilizes both quantitative and qualitative research methods to capture market dynamics from multiple perspectives. Quantitative analysis focuses on market sizing, growth rates, and statistical trends, while qualitative research explores market drivers, challenges, and future opportunities through expert opinions and stakeholder insights.

Market segmentation analysis examines the market across multiple dimensions including technology type, application category, geographic region, and end-user segment. This multi-dimensional approach enables identification of growth opportunities and market dynamics specific to different market segments.

Validation processes ensure data accuracy and reliability through triangulation of information sources, expert review, and statistical verification. Market projections are validated against historical trends, industry benchmarks, and economic indicators to ensure realistic and achievable forecasts.

Continuous monitoring of market developments, technological advances, and regulatory changes ensures research findings remain current and relevant. Regular updates incorporate new information and emerging trends to maintain the accuracy and usefulness of market intelligence.

North America leads global market development with advanced research capabilities, strong regulatory support, and high consumer environmental awareness. The region accounts for approximately 35% of global market adoption, driven by major food retailers implementing sustainability initiatives and government programs promoting plastic waste reduction.

United States market dominance reflects significant investment in coating technology development, extensive agricultural production, and sophisticated food distribution networks. California’s agricultural sector serves as a primary testing ground for new coating applications, while the Pacific Northwest focuses on organic produce applications.

European markets emphasize regulatory compliance and environmental sustainability, with the European Union’s circular economy initiatives driving coating adoption. Germany and Netherlands lead regional development through advanced food processing capabilities and strong export markets requiring extended shelf life solutions.

Asia-Pacific region represents the fastest-growing market segment, with annual growth rates exceeding 12% driven by expanding food processing industries, increasing export activities, and rising consumer income levels. China and India lead regional growth through large-scale agricultural production and modernizing food supply chains.

Latin America shows significant potential for market expansion, particularly in countries with substantial fruit and vegetable export industries. Brazil, Mexico, and Chile are implementing coating technologies to enhance export competitiveness and reduce post-harvest losses in international markets.

Middle East and Africa markets are emerging gradually, with adoption focused on high-value export crops and premium produce segments. Limited infrastructure and technical expertise constrain market development, but increasing investment in food processing capabilities is creating growth opportunities.

Market leadership is distributed among diverse company types including specialized coating manufacturers, food packaging companies, and agricultural technology providers. The competitive landscape reflects the multidisciplinary nature of edible coating technology, requiring expertise in materials science, food processing, and agricultural applications.

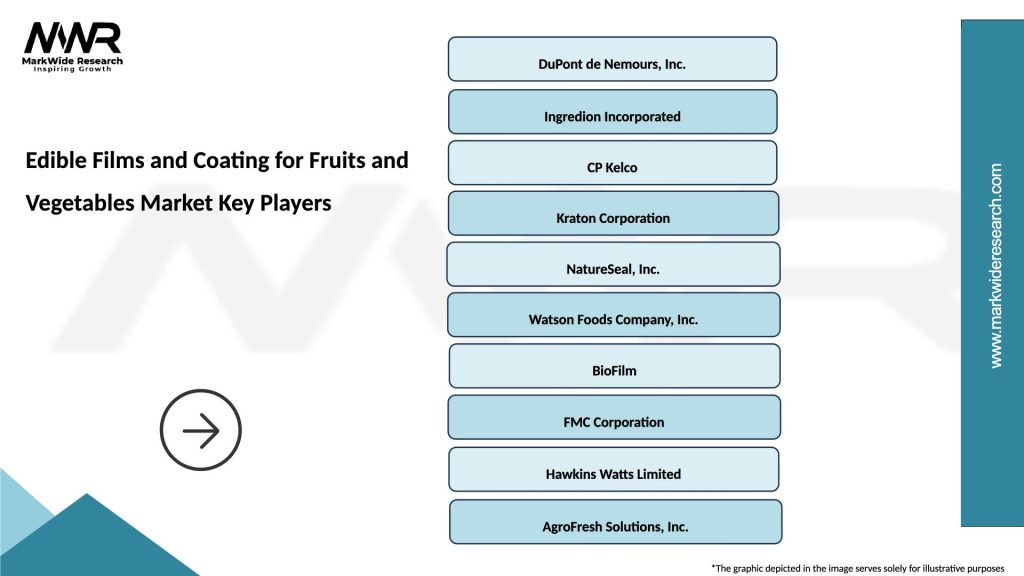

Key market participants include established companies and emerging technology firms:

Competitive strategies focus on technological differentiation, strategic partnerships, and market expansion through licensing agreements and joint ventures. Companies are investing heavily in research and development to improve coating performance, reduce costs, and expand application possibilities.

Market positioning varies among competitors, with some focusing on specific produce categories or geographic regions while others pursue broad market coverage. Innovation cycles are accelerating, with new product introductions and technological improvements occurring frequently to maintain competitive advantage.

By Material Type:

By Application Method:

By Produce Category:

By End-User:

Citrus fruit applications represent the most mature market segment, with established coating technologies providing proven benefits in moisture retention, appearance enhancement, and shelf life extension. Market penetration in this category reaches approximately 40% in developed markets, driven by consumer preference for glossy, fresh-appearing citrus fruits and retailer demands for extended display life.

Apple and pear coatings focus on preventing moisture loss and maintaining crispness during storage and transportation. Advanced formulations incorporate antioxidants to prevent browning and maintain nutritional quality. This segment shows strong growth potential as organic apple producers seek natural alternatives to synthetic wax coatings.

Berry preservation presents unique technical challenges due to the delicate nature of soft fruits and their susceptibility to mechanical damage and microbial contamination. Specialized coating formulations provide gentle protection while maintaining the natural texture and appearance that consumers expect from premium berry products.

Leafy green applications are emerging as a high-growth segment, with coatings designed to prevent wilting, maintain color, and extend freshness. The increasing popularity of pre-packaged salads and convenience vegetables is driving demand for coating solutions that can maintain quality throughout extended distribution chains.

Tropical fruit coatings address the specific challenges of fruits like avocados, mangoes, and bananas that require controlled ripening and protection during international transportation. These applications often incorporate ripening inhibitors or promoters to optimize fruit condition upon arrival at destination markets.

Root vegetable applications focus on preventing moisture loss and sprouting while maintaining the natural appearance and texture of products like potatoes, carrots, and onions. Coating formulations for this category emphasize long-term storage stability and compatibility with existing handling and packaging systems.

Producers and growers benefit from reduced post-harvest losses, extended marketing windows, and improved product quality that commands premium pricing. Edible coatings enable access to distant markets previously economically unfeasible due to quality deterioration during transportation. Waste reduction can decrease post-harvest losses by 20-30%, directly improving profitability and resource utilization efficiency.

Food processors gain operational advantages through simplified handling, reduced packaging requirements, and enhanced product differentiation. Coating applications can be integrated into existing processing lines with minimal infrastructure modification, providing cost-effective quality enhancement solutions that improve competitive positioning.

Retailers and distributors achieve improved inventory management through extended shelf life, reduced shrinkage, and enhanced product presentation. Coated produce maintains visual appeal longer, reducing markdown requirements and improving customer satisfaction. Inventory turnover improvements can increase profitability while reducing waste disposal costs.

Consumers receive enhanced value through longer-lasting produce, maintained nutritional quality, and reduced environmental impact. Edible coatings eliminate concerns about plastic packaging waste while providing superior preservation benefits that extend home storage life and reduce household food waste.

Environmental stakeholders benefit from significant plastic waste reduction, decreased food waste, and more sustainable packaging solutions. The biodegradable nature of edible coatings supports circular economy principles and reduces environmental impact throughout the food supply chain.

Technology providers and equipment manufacturers gain access to expanding market opportunities driven by increasing adoption rates and technological advancement requirements. The growing market creates demand for specialized application equipment, quality control systems, and technical services that support coating implementation.

Strengths:

Weaknesses:

Opportunities:

Threats:

Nano-technology integration is revolutionizing coating performance through enhanced barrier properties, controlled release mechanisms, and improved application characteristics. Nano-encapsulation techniques enable incorporation of active compounds while maintaining coating transparency and consumer acceptance. This trend is driving performance improvements of 25-40% in key preservation metrics.

Smart coating development incorporates sensors, indicators, and responsive materials that provide real-time quality monitoring and consumer information. These advanced systems can change color to indicate ripeness, display temperature exposure, or provide traceability information through digital integration.

Circular economy applications are gaining momentum as companies develop coating materials from food processing waste streams, creating sustainable raw material sources while addressing waste management challenges. This approach reduces material costs while enhancing environmental benefits and supporting zero-waste initiatives.

Personalized nutrition trends are driving development of functional coatings that deliver targeted nutrients, probiotics, or therapeutic compounds. These value-added solutions appeal to health-conscious consumers seeking functional foods that provide benefits beyond basic nutrition.

Automation advancement in coating application systems is improving consistency, reducing labor requirements, and enabling high-volume processing. Robotic application systems and automated quality control are making coating technology more accessible to smaller operations and improving overall cost-effectiveness.

Blockchain integration for traceability and supply chain transparency is becoming increasingly important as consumers demand information about food origins, processing methods, and environmental impact. Edible coatings can incorporate digital markers that enable comprehensive product tracking throughout the supply chain.

Strategic partnerships between coating technology companies and major food retailers are accelerating market adoption through large-scale implementation programs. MarkWide Research analysis indicates that retail partnerships have increased coating adoption rates by 60% over the past two years, demonstrating the importance of end-market collaboration in technology deployment.

Investment activity in coating technology startups has intensified, with venture capital and corporate investors recognizing the market potential for sustainable packaging solutions. Recent funding rounds have enabled technology companies to scale production capabilities and expand market reach through enhanced research and development programs.

Regulatory approvals for new coating materials and applications are expanding market opportunities, with recent approvals enabling coating use on previously restricted produce categories. Streamlined approval processes in key markets are reducing time-to-market for new coating formulations and applications.

Technology licensing agreements are facilitating global market expansion as established companies license coating technologies to regional partners with local market expertise and distribution capabilities. This approach enables rapid market penetration while leveraging existing infrastructure and relationships.

Research collaborations between universities, government agencies, and industry participants are advancing coating science and developing next-generation solutions. These partnerships are addressing fundamental challenges in coating performance, application methods, and cost reduction through coordinated research efforts.

Sustainability certifications and environmental standards are being developed specifically for edible coating applications, providing frameworks for measuring and communicating environmental benefits. These standards support market development by establishing credible metrics for sustainability claims and competitive differentiation.

Market entry strategies should focus on specific produce categories and geographic regions where coating benefits are most pronounced and market acceptance is highest. Companies entering the market should prioritize applications with proven commercial viability and established customer demand rather than attempting broad market coverage initially.

Technology investment priorities should emphasize application consistency, cost reduction, and performance enhancement rather than entirely new coating materials. Incremental improvements in existing technologies often provide better return on investment than revolutionary approaches that require extensive market education and acceptance building.

Partnership development with established food industry participants is essential for successful market penetration. Coating technology companies should seek strategic alliances with processors, distributors, and retailers who can provide market access, application expertise, and customer relationships necessary for commercial success.

Regulatory compliance should be addressed proactively through early engagement with regulatory agencies and comprehensive safety testing programs. Companies should invest in regulatory expertise and documentation to ensure smooth approval processes and avoid delays in market introduction.

Consumer education initiatives are critical for building market acceptance and addressing concerns about coating visibility, safety, and effectiveness. Educational programs should emphasize environmental benefits, safety assurance, and quality improvements rather than technical complexity or manufacturing processes.

Supply chain integration requires careful planning and stakeholder coordination to ensure successful coating implementation across complex distribution networks. Companies should develop comprehensive implementation guides, training programs, and support services to facilitate adoption by supply chain partners.

Market expansion is projected to accelerate significantly over the next decade, driven by increasing environmental regulations, consumer sustainability awareness, and technological advancement. MWR projections indicate the market will experience sustained growth rates exceeding 9% annually as coating technologies achieve broader commercial adoption and cost competitiveness with traditional packaging methods.

Technology evolution will focus on enhanced functionality, improved application methods, and integration with digital technologies. Next-generation coatings will incorporate smart features, active preservation compounds, and responsive materials that adapt to environmental conditions and provide real-time quality information.

Geographic expansion into emerging markets will drive significant growth as developing countries modernize their food processing and distribution systems. Asia-Pacific and Latin American markets are expected to lead growth, supported by expanding agricultural production, increasing export activities, and rising consumer income levels.

Application diversification will extend coating use beyond traditional produce categories into processed foods, prepared meals, and specialty applications. This expansion will create new market opportunities and drive technology development to address diverse preservation requirements and consumer preferences.

Industry consolidation is expected to continue as successful coating companies attract acquisition interest from larger food industry participants seeking to integrate sustainable packaging capabilities. Strategic acquisitions will accelerate technology development and market expansion while providing resources for scaling operations.

Regulatory evolution will likely support market growth through continued recognition of edible coatings as beneficial food technologies and potential incentives for sustainable packaging adoption. Environmental regulations targeting plastic waste reduction will create additional market drivers and competitive advantages for coating technologies.

The edible films and coating for fruits and vegetables market represents a transformative opportunity in sustainable food packaging and preservation technology. Market analysis reveals strong growth potential driven by environmental sustainability imperatives, consumer health consciousness, and technological advancement that addresses critical challenges in food waste reduction and supply chain optimization.

Market dynamics indicate favorable conditions for continued expansion, with increasing adoption rates across diverse produce categories and geographic regions. The technology’s proven effectiveness in extending shelf life, maintaining quality, and reducing environmental impact positions it as a viable alternative to traditional packaging methods that aligns with circular economy principles and consumer preferences.

Industry development is accelerating through strategic partnerships, investment activity, and regulatory support that facilitate market adoption and technology advancement. The competitive landscape reflects healthy innovation cycles and diverse market approaches that are driving performance improvements and cost reductions necessary for widespread commercial deployment.

Future prospects remain highly positive, with projected growth rates reflecting increasing market acceptance, technological sophistication, and expanding application possibilities. The convergence of environmental regulations, consumer demand, and economic viability creates a compelling value proposition for industry participants and stakeholders across the food supply chain.

Strategic considerations for market participants emphasize the importance of focused market entry, technology partnerships, and comprehensive implementation support to achieve successful adoption. The market’s evolution toward smart, functional coatings with enhanced capabilities will create additional opportunities for differentiation and value creation in this dynamic and rapidly expanding sector.

What is Edible Films and Coating for Fruits and Vegetables?

Edible films and coatings for fruits and vegetables are thin layers made from natural or synthetic materials that are applied to the surface of produce. They serve to enhance shelf life, maintain freshness, and reduce spoilage by providing a barrier against moisture and gases.

What are the key players in the Edible Films and Coating for Fruits and Vegetables Market?

Key players in the Edible Films and Coating for Fruits and Vegetables Market include companies like DuPont, BASF, and Tate & Lyle, which are known for their innovative solutions in food preservation and packaging technologies, among others.

What are the growth factors driving the Edible Films and Coating for Fruits and Vegetables Market?

The growth of the Edible Films and Coating for Fruits and Vegetables Market is driven by increasing consumer demand for fresh produce, rising awareness of food waste reduction, and the shift towards sustainable packaging solutions. Additionally, advancements in material science are enhancing the effectiveness of these coatings.

What challenges does the Edible Films and Coating for Fruits and Vegetables Market face?

Challenges in the Edible Films and Coating for Fruits and Vegetables Market include the variability in the effectiveness of coatings based on different fruit and vegetable types, potential regulatory hurdles, and consumer acceptance of edible coatings. These factors can impact market growth and product development.

What opportunities exist in the Edible Films and Coating for Fruits and Vegetables Market?

Opportunities in the Edible Films and Coating for Fruits and Vegetables Market include the development of biodegradable and edible materials that align with sustainability trends. Additionally, expanding applications in the organic produce sector present significant growth potential.

What trends are shaping the Edible Films and Coating for Fruits and Vegetables Market?

Trends in the Edible Films and Coating for Fruits and Vegetables Market include the increasing use of plant-based materials, innovations in nanotechnology for enhanced barrier properties, and a growing focus on clean label products. These trends reflect consumer preferences for healthier and more sustainable food options.

Edible Films and Coating for Fruits and Vegetables Market

| Segmentation Details | Description |

|---|---|

| Product Type | Biodegradable Films, Edible Coatings, Natural Polymers, Synthetic Polymers |

| Application | Fresh Produce, Processed Fruits, Vegetables, Organic Products |

| End User | Food Manufacturers, Retailers, Distributors, Exporters |

| Packaging Type | Flexible Packaging, Rigid Packaging, Vacuum Packaging, Modified Atmosphere Packaging |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Edible Films and Coating for Fruits and Vegetables Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at