444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The edible film and coating market represents a revolutionary segment within the food packaging and preservation industry, experiencing unprecedented growth as manufacturers seek sustainable alternatives to conventional plastic packaging. Edible films and coatings are thin layers of edible materials applied to food surfaces or used as standalone packaging solutions, providing barrier properties while being completely consumable and biodegradable.

Market dynamics indicate robust expansion driven by increasing consumer awareness of environmental sustainability and food waste reduction. The industry is witnessing significant adoption across various food categories, from fresh produce to processed foods, with growth rates reaching 8.5% CAGR in key regional markets. Innovation in biopolymer technology continues to enhance the functionality and commercial viability of edible packaging solutions.

Regional distribution shows North America and Europe leading adoption rates at 35% and 28% respectively, while Asia-Pacific emerges as the fastest-growing region with increasing investment in sustainable packaging technologies. The market encompasses diverse applications including fruit and vegetable coatings, meat and seafood preservation, bakery product protection, and pharmaceutical capsule manufacturing.

The edible film and coating market refers to the commercial sector focused on developing, manufacturing, and distributing consumable packaging materials derived from natural biopolymers, proteins, lipids, and polysaccharides that can be safely ingested along with food products while providing protective barrier functions.

Edible films are standalone packaging materials that can be formed into pouches, wraps, or containers, while edible coatings are applied directly to food surfaces through dipping, spraying, or brushing techniques. These innovative solutions address multiple industry challenges simultaneously, including plastic waste reduction, food preservation enhancement, and consumer convenience improvement.

Functional properties of edible films and coatings include moisture barrier capabilities, oxygen permeability control, antimicrobial protection, and flavor encapsulation. The technology utilizes various base materials such as chitosan, alginate, pectin, gelatin, and plant-based proteins to create customized solutions for specific food applications and storage requirements.

Market transformation in the edible film and coating sector reflects a fundamental shift toward sustainable packaging solutions driven by environmental regulations and consumer preferences. The industry demonstrates strong momentum with technological advancements enabling improved barrier properties and cost-effective production methods.

Key growth drivers include stringent plastic waste regulations, increasing demand for organic and natural food products, and rising awareness of food safety concerns. The market benefits from continuous innovation in biopolymer science, with 65% of new product developments focusing on enhanced functionality and extended shelf life capabilities.

Competitive landscape features established food ingredient manufacturers expanding into edible packaging, alongside specialized biotechnology companies developing novel coating formulations. Strategic partnerships between material suppliers and food processors are accelerating market penetration across various application segments.

Future prospects indicate sustained growth potential with emerging applications in pharmaceutical delivery systems, nutraceutical encapsulation, and premium food packaging. Investment in research and development continues to drive innovation, with particular focus on improving mechanical properties and reducing production costs.

Strategic analysis reveals several critical factors shaping the edible film and coating market landscape:

Environmental sustainability concerns represent the primary catalyst driving edible film and coating market expansion. Increasing awareness of plastic pollution and its environmental impact motivates consumers and businesses to seek biodegradable alternatives. Government regulations restricting single-use plastics create mandatory demand for sustainable packaging solutions.

Food waste reduction initiatives significantly contribute to market growth as edible coatings extend product shelf life and maintain food quality during transportation and storage. The technology addresses global food security challenges by reducing spoilage rates and preserving nutritional content, particularly important for perishable produce and protein products.

Consumer health consciousness drives demand for natural and organic food packaging solutions free from synthetic chemicals and additives. Edible films and coatings align with clean label trends, offering transparency and safety assurance that resonates with health-focused consumers seeking minimally processed food options.

Technological innovation in biopolymer science enables development of high-performance edible packaging with enhanced barrier properties, mechanical strength, and functional capabilities. Advanced manufacturing techniques reduce production costs while improving product quality and consistency, making edible packaging commercially viable for mass market applications.

High production costs remain a significant barrier to widespread adoption of edible films and coatings, particularly when compared to conventional plastic packaging alternatives. Manufacturing processes require specialized equipment and quality-controlled environments, resulting in elevated operational expenses that impact price competitiveness in cost-sensitive market segments.

Limited shelf stability presents challenges for certain edible packaging applications, as moisture sensitivity and temperature variations can affect coating integrity and performance. Storage and transportation requirements may be more stringent than traditional packaging, potentially increasing supply chain complexity and costs.

Regulatory compliance complexities create hurdles for market entry, as edible packaging materials must meet both food safety and packaging performance standards. Approval processes for new formulations can be lengthy and expensive, particularly for applications involving direct food contact or pharmaceutical uses.

Consumer acceptance barriers persist in some market segments where traditional packaging preferences remain strong. Educational initiatives and gradual market introduction strategies are necessary to overcome resistance and build confidence in edible packaging solutions among conservative consumer groups.

Emerging market penetration offers substantial growth opportunities as developing economies implement environmental protection measures and modernize food processing infrastructure. Rising disposable incomes and urbanization trends create demand for premium packaging solutions that align with sustainability objectives.

Pharmaceutical applications represent a high-value opportunity segment where edible films can replace traditional capsule materials and provide controlled-release drug delivery systems. The pharmaceutical industry’s focus on patient compliance and safety creates demand for innovative delivery mechanisms that edible packaging can address.

E-commerce expansion drives demand for protective packaging solutions that maintain product integrity during shipping while minimizing environmental impact. Edible films and coatings can provide tamper-evident features and freshness preservation for online food retail applications.

Functional ingredient integration enables development of value-added packaging solutions that deliver nutritional benefits, antimicrobial protection, or flavor enhancement. This convergence of packaging and functional food technologies creates premium market opportunities with higher profit margins.

Supply chain evolution reflects increasing collaboration between raw material suppliers, packaging manufacturers, and food processors to develop integrated solutions. Vertical integration strategies enable better quality control and cost optimization while ensuring consistent supply of specialized ingredients required for edible packaging production.

Innovation cycles accelerate as research institutions and private companies invest heavily in next-generation edible packaging technologies. Patent activity increases significantly, with 40% growth in intellectual property filings related to edible coating formulations and application methods over recent years.

Market consolidation trends emerge as larger food packaging companies acquire specialized edible film manufacturers to expand their sustainable packaging portfolios. Strategic partnerships between biotechnology firms and established packaging companies facilitate technology transfer and market access.

Competitive positioning shifts toward differentiation through specialized applications and enhanced functionality rather than price competition alone. Companies focus on developing niche solutions for specific food categories or addressing unique performance requirements to establish market leadership positions.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of market insights. Primary research includes extensive interviews with industry stakeholders, including manufacturers, suppliers, distributors, and end-users across various geographic regions and application segments.

Secondary research encompasses analysis of industry publications, regulatory documents, patent databases, and financial reports from publicly traded companies operating in the edible packaging sector. Academic research papers and conference proceedings provide insights into emerging technologies and future development directions.

Data validation processes involve cross-referencing information from multiple sources and conducting follow-up interviews to verify key findings. Statistical analysis techniques ensure data consistency and identify significant trends and patterns within the market landscape.

Market modeling utilizes advanced analytical frameworks to project future growth scenarios and assess the impact of various market drivers and restraints. Sensitivity analysis examines how changes in key variables affect overall market dynamics and growth projections.

North American markets demonstrate strong adoption of edible film and coating technologies, driven by stringent environmental regulations and consumer demand for sustainable packaging solutions. The United States leads regional growth with 42% market share, supported by significant investment in research and development activities and favorable regulatory frameworks.

European markets show robust expansion driven by the European Union’s circular economy initiatives and plastic waste reduction targets. Germany, France, and the United Kingdom represent key growth markets, with increasing adoption in organic food packaging and premium product segments showing 12% annual growth rates.

Asia-Pacific region emerges as the fastest-growing market segment, with China, Japan, and India leading adoption rates. Rapid industrialization, growing environmental awareness, and expanding food processing industries contribute to strong market momentum, with regional growth rates exceeding 15% annually.

Latin American markets demonstrate increasing interest in sustainable packaging solutions, particularly in Brazil and Mexico where agricultural export industries seek value-added packaging technologies. Government support for environmental protection initiatives creates favorable conditions for market development.

Market leadership is distributed among several key players specializing in different aspects of edible film and coating technology:

By Material Type:

By Application:

By End-User:

Protein-based segment dominates the edible film market due to excellent film-forming properties and widespread availability of raw materials. Gelatin-based films show particular strength in confectionery applications, while plant protein films gain traction in vegan and vegetarian product segments with 25% growth in adoption rates.

Polysaccharide coatings demonstrate superior performance in fresh produce applications, with chitosan-based formulations showing exceptional antimicrobial properties. Starch-based films offer cost-effective solutions for high-volume applications, while pectin coatings provide excellent clarity and consumer appeal.

Fresh produce applications represent the largest market segment, driven by increasing demand for organic produce and extended shelf life requirements. MarkWide Research analysis indicates that produce coatings can extend shelf life by 30-50% while maintaining nutritional quality and visual appearance.

Pharmaceutical applications show the highest growth potential with specialized requirements for controlled release and biocompatibility. Regulatory approval processes create barriers to entry but offer significant opportunities for companies with appropriate expertise and resources.

Food manufacturers benefit from enhanced product differentiation and alignment with sustainability objectives while potentially reducing packaging costs through material optimization. Edible packaging enables innovative product presentations and can incorporate functional ingredients that add value beyond basic protection.

Retailers gain competitive advantages through sustainable packaging offerings that appeal to environmentally conscious consumers. Reduced packaging waste and improved product presentation contribute to enhanced brand image and customer loyalty, while extended shelf life reduces inventory losses.

Consumers enjoy convenience benefits from edible packaging that eliminates waste disposal requirements while potentially providing nutritional or functional benefits. Improved food safety and quality preservation enhance overall product experience and value perception.

Environmental stakeholders benefit from significant reductions in plastic waste and improved biodegradability of packaging materials. Edible films and coatings contribute to circular economy objectives and support sustainable development goals related to waste reduction and environmental protection.

Strengths:

Weaknesses:

Opportunities:

Threats:

Nanotechnology integration represents a transformative trend enabling development of edible films with enhanced barrier properties and antimicrobial functionality. Nanocellulose and nano-chitosan incorporation improves mechanical strength while maintaining biodegradability and safety characteristics.

Smart packaging convergence involves integration of sensors and indicators within edible films to provide real-time information about food quality and safety. These intelligent packaging solutions offer enhanced traceability and consumer communication capabilities while maintaining sustainability benefits.

Personalized nutrition packaging emerges as edible films become vehicles for delivering customized nutritional supplements and functional ingredients. This trend aligns with growing interest in personalized health solutions and precision nutrition approaches.

Circular economy integration drives development of edible packaging systems that utilize food waste streams as raw materials, creating closed-loop production cycles. Agricultural residues and food processing byproducts become valuable inputs for sustainable packaging production.

Strategic partnerships between food companies and packaging manufacturers accelerate technology development and market adoption. Recent collaborations focus on developing application-specific solutions that address unique performance requirements while maintaining cost competitiveness.

Investment in production capacity increases significantly as companies respond to growing market demand. New manufacturing facilities incorporate advanced processing technologies that improve efficiency and reduce production costs while maintaining quality standards.

Regulatory approvals for new edible packaging formulations expand application possibilities and market access. Recent approvals in pharmaceutical applications demonstrate growing regulatory acceptance and confidence in edible packaging safety and efficacy.

Research breakthroughs in biopolymer science enable development of next-generation edible films with improved performance characteristics. Academic and industrial research collaborations drive innovation in material science and processing technologies.

Investment priorities should focus on research and development activities that address current performance limitations while reducing production costs. Companies should prioritize development of scalable manufacturing processes and strategic partnerships that enable market access and technology sharing.

Market entry strategies should emphasize niche applications where edible packaging provides clear value propositions and competitive advantages. Gradual market introduction through premium product segments can build consumer acceptance and demonstrate commercial viability.

Technology development should concentrate on improving barrier properties, mechanical strength, and shelf stability while maintaining safety and biodegradability characteristics. MWR analysis suggests that companies achieving 20% improvement in barrier properties can capture significant market share.

Regulatory compliance requires proactive engagement with regulatory authorities and investment in safety testing and documentation. Companies should establish comprehensive quality management systems that ensure consistent product performance and regulatory compliance.

Market evolution indicates continued strong growth driven by increasing environmental awareness and technological advancement. The industry is expected to achieve mainstream adoption in several key application segments within the next decade, supported by improving cost competitiveness and performance characteristics.

Technology roadmap suggests significant improvements in edible packaging performance through advanced materials science and processing innovations. Integration of nanotechnology and biotechnology approaches will enable development of high-performance solutions that compete directly with conventional packaging materials.

Application expansion beyond traditional food packaging into pharmaceutical, cosmetic, and industrial applications will drive market diversification and growth. Specialized high-value applications offer opportunities for premium pricing and improved profitability.

Global adoption patterns indicate accelerating market penetration in developing economies as environmental awareness increases and regulatory frameworks evolve. MarkWide Research projects that emerging markets will account for 45% of global demand growth over the next five years.

The edible film and coating market represents a transformative opportunity within the broader packaging industry, driven by compelling environmental and functional benefits that address critical market needs. Strong growth momentum reflects increasing consumer awareness, regulatory support, and technological advancement that collectively create favorable conditions for sustained market expansion.

Strategic positioning requires careful balance between innovation investment and market development activities, with successful companies likely to be those that can achieve cost-competitive production while maintaining superior performance characteristics. The convergence of sustainability imperatives and technological capability creates unprecedented opportunities for market participants willing to invest in long-term development strategies.

Future success in the edible packaging market will depend on continued innovation, strategic partnerships, and effective market education initiatives that build consumer confidence and regulatory acceptance. Companies that can successfully navigate the complex landscape of technical requirements, regulatory compliance, and market development will be well-positioned to capture significant value in this emerging and rapidly evolving market segment.

What is Edible Film and Coating?

Edible Film and Coating refers to thin layers of edible materials applied to food products to enhance their shelf life, maintain freshness, and improve appearance. These films can be made from various biopolymers and are used in applications such as fruits, vegetables, and processed foods.

What are the key companies in the Edible Film and Coating Market?

Key companies in the Edible Film and Coating Market include DuPont, BASF, and InnovoPro, which are known for their innovative solutions in food preservation and packaging. These companies focus on developing sustainable and functional edible coatings to meet consumer demands, among others.

What are the main drivers of the Edible Film and Coating Market?

The main drivers of the Edible Film and Coating Market include the increasing demand for natural and organic food products, the need for sustainable packaging solutions, and the growing awareness of food waste reduction. These factors are pushing manufacturers to adopt edible coatings as a viable alternative.

What challenges does the Edible Film and Coating Market face?

Challenges in the Edible Film and Coating Market include the limited shelf life of certain edible films, potential regulatory hurdles, and consumer acceptance of new food technologies. These factors can hinder market growth and innovation.

What opportunities exist in the Edible Film and Coating Market?

Opportunities in the Edible Film and Coating Market include the development of new biopolymer materials, expansion into emerging markets, and increasing applications in the pharmaceutical and nutraceutical industries. These trends indicate a promising future for edible coatings.

What trends are shaping the Edible Film and Coating Market?

Trends shaping the Edible Film and Coating Market include the rise of plant-based and biodegradable materials, advancements in nanotechnology for improved barrier properties, and the growing consumer preference for clean label products. These trends are driving innovation and market growth.

Edible Film and Coating Market

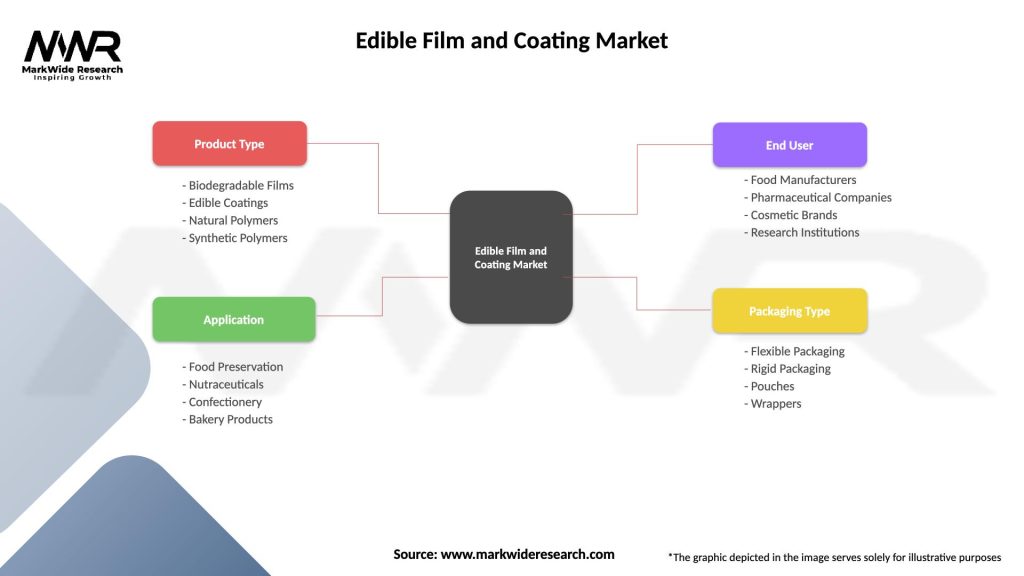

| Segmentation Details | Description |

|---|---|

| Product Type | Biodegradable Films, Edible Coatings, Natural Polymers, Synthetic Polymers |

| Application | Food Preservation, Nutraceuticals, Confectionery, Bakery Products |

| End User | Food Manufacturers, Pharmaceutical Companies, Cosmetic Brands, Research Institutions |

| Packaging Type | Flexible Packaging, Rigid Packaging, Pouches, Wrappers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Edible Film and Coating Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at