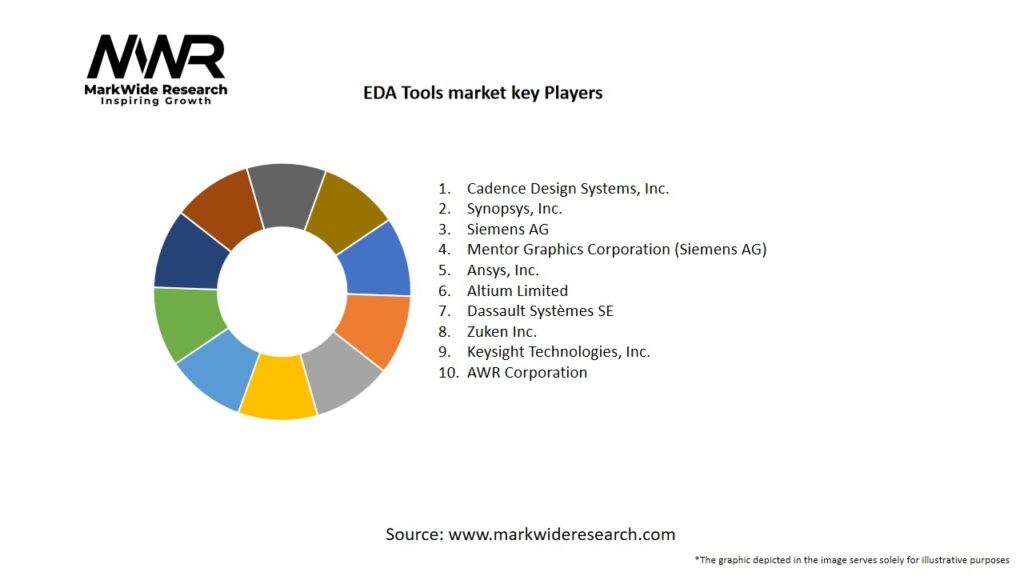

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Cloud-Based EDA: On-demand compute resources and collaboration environments accelerate design iterations and reduce CAPEX on in-house compute farms.

-

AI/ML Integration: Machine-learning algorithms optimize synthesis, placement, and routing, improving performance-per-watt and reducing manual tuning.

-

System-Level Verification: Transaction-level modeling and virtual platforms address functional safety and reliability requirements in automotive and aerospace.

-

Heterogeneous Integration: Chiplet and 2.5D/3D packaging trends drive demand for advanced floorplanning and thermal-electrical co-design tools.

-

Open-Source Movement: Companies are embracing open-source flows (e.g., RISC-V) and collaborating on tool interoperability to lower barriers to entry.

Market Drivers

-

Complexity of Modern ICs: Growing transistor counts and mixed-signal content necessitate powerful EDA solutions to ensure first-silicon success.

-

Shortened Design Cycles: Time-to-market pressures for consumer electronics, automotive safety, and 5G rollout accelerate EDA adoption.

-

Advanced Process Nodes: As foundries move to 5nm, 3nm, and beyond, the need for accurate modeling and analysis tools intensifies.

-

Emergence of AI Workloads: Custom AI accelerators and neuromorphic designs require specialized synthesis and verification flows.

-

Regulatory & Safety Requirements: Functional safety standards (ISO 26262, DO-254) in automotive and aerospace drive verification investment.

Market Restraints

-

High Cost of EDA Licenses: Premium pricing of leading EDA suites can be prohibitive for smaller design houses and startups.

-

Steep Learning Curve: Complex tools require specialized training, lengthening onboarding and reducing productivity during ramp-up.

-

Fragmented Tool Ecosystem: Integration challenges among disparate tools and vendors can disrupt design flows.

-

Compute Resource Demands: Advanced simulations and AI-driven flows require significant on-premises or cloud compute investments.

-

Intellectual Property (IP) Concerns: Managing proprietary design data on shared or cloud platforms raises security and IP protection issues.

Market Opportunities

-

EDA-as-a-Service: Subscription and cloud-hosted models democratize access to high-end tools for SMEs and academic institutions.

-

Vertical-Specific Flows: Tailored EDA solutions for automotive, IoT, and AI edge accelerate adoption in these high-growth verticals.

-

Open-Source Collaboration: Participation in initiatives like the CHIPS Alliance fosters innovation and broadens market reach.

-

AI-First Toolchains: Continued development of self-optimizing design engines can further reduce manual intervention.

-

Geographic Expansion: Rising semiconductor design capacity in India, Southeast Asia, and Eastern Europe offers new markets.

Market Dynamics

-

Strategic Acquisitions: Major EDA vendors acquire niche startups to fill gaps—in analog verification, reliability analysis, and power integrity.

-

Partnership Ecosystems: Collaborations among IP providers, foundries, and cloud service providers ensure seamless end-to-end flows.

-

Standardization Efforts: Initiatives around data exchange formats (e.g., OpenAccess, IEEE 1685) and API frameworks promote interoperability.

-

Academic Engagement: Universities partnering with EDA companies to train the next generation of design engineers and evolve tools.

-

Sustainability Focus: Power-aware design and carbon reporting features in EDA tools align with corporate ESG goals.

Regional Analysis

-

North America: Leading region, home to major EDA vendors and top-tier semiconductor companies; strong R&D and early technology adoption.

-

Asia Pacific: Fastest-growing market, driven by China, Taiwan, South Korea design houses and foundry services; increasing local EDA development.

-

Europe: Focus on automotive and aerospace-specific EDA tools; collaboration on safety-critical design flows.

-

Latin America: Emerging academic and startup ecosystem exploring open-source EDA; potential cost-sensitive market.

-

Middle East & Africa: Nascent semiconductor initiatives and academic programs gradually stimulating EDA tool uptake.

Competitive Landscape

Leading Companies in the EDA Tools Market:

- Cadence Design Systems, Inc.

- Synopsys, Inc.

- Siemens AG

- Mentor Graphics Corporation (Siemens AG)

- Ansys, Inc.

- Altium Limited

- Dassault Systèmes SE

- Zuken Inc.

- Keysight Technologies, Inc.

- AWR Corporation

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

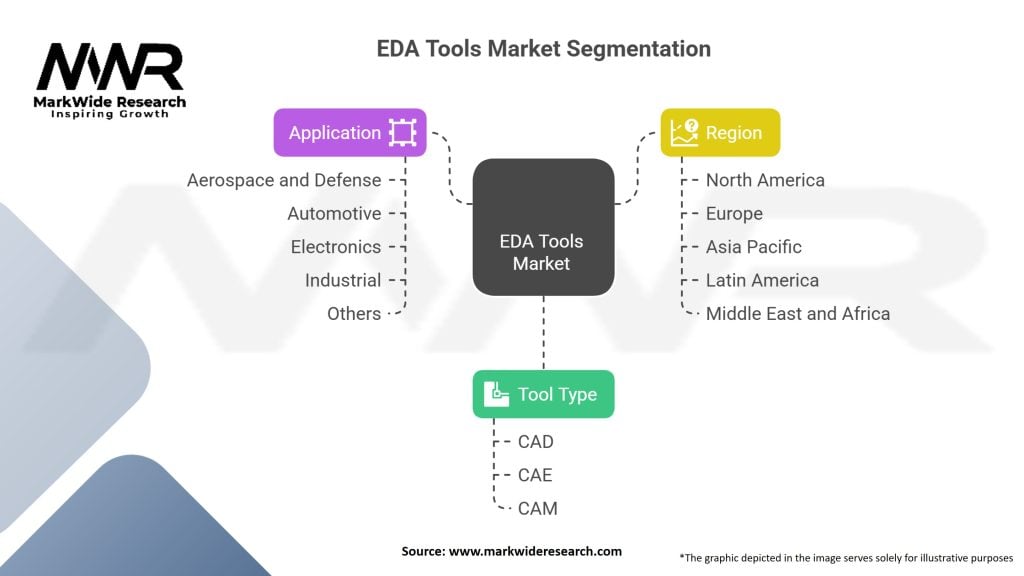

Segmentation

-

By Tool Type: Front-End (HDL synthesis, simulation), Back-End (Physical design, signoff), Verification (Formal, emulation, power analysis), PCB Design, System-Level Design.

-

By Deployment: On-Premises, Cloud-Hosted, Hybrid.

-

By End-Use Vertical: Consumer Electronics, Automotive, Telecommunication, Aerospace & Defense, Industrial & IoT, Healthcare.

-

By Region: North America, Europe, Asia Pacific, Latin America, Middle East & Africa.

Category-Wise Insights

-

Front-End Tools: Growth fueled by AI-optimized synthesis and UVM-based verification.

-

Physical Design & Signoff: High investment in advanced node flows (FinFET, GAA) ensures timing, power, and yield.

-

System-Level & Virtual Prototyping: Virtual platforms shorten software-hardware integration cycles in automotive and IoT.

-

PCB Design Solutions: 5G and Wi-Fi 6/6E demand advanced RF-capable PCB tools with signal integrity analysis.

-

Cloud-Hosted EDA: Adoption driven by burst compute for large regressions and global team collaboration.

Key Benefits for Industry Participants and Stakeholders

-

First-Silicon Success: Robust verification and analysis reduce re-spins, saving hundreds of millions in mask costs.

-

Accelerated Time-to-Market: Automated flows and parallel compute shorten lengthy design cycles.

-

Design Quality: AI-guided optimizations improve performance, power, and area metrics.

-

Scalability: Cloud-based EDA enables elastic compute to handle peak workloads without capital investment.

-

Collaboration: Integrated data management and version control streamline geographically distributed design teams.

SWOT Analysis

Strengths

-

Mature, feature-rich toolsets established over decades.

-

Deep partnerships with IP providers and foundries ensure tight process support.

Weaknesses

-

High total cost of ownership limits entry for smaller players.

-

Complex user interfaces and steep learning curve hamper productivity.

Opportunities

-

Expansion of EDA-as-a-Service to democratize access.

-

AI/ML innovations to further automate design and verification tasks.

Threats

-

Emergence of in-house or open-source alternatives disrupting traditional licensing.

-

Geopolitical tensions affecting cross-border tool availability and support.

Market Key Trends

-

AI-Enhanced Optimization: Use of reinforcement learning and genetic algorithms to refine placement, routing, and power planning.

-

Chiplet & Heterogeneous Design: New EDA flows for 2.5D/3D integration, interposer co-design, and thermal-electrical co-optimization.

-

Continuous Verification: Shift from sign-off to continuous verification throughout the design cycle, leveraging cloud CI/CD pipelines.

-

Virtual Hardware Platforms: Transaction-level models and emulation accelerate early software development and system validation.

-

Eco-Design Metrics: Incorporation of carbon footprint estimation and power-proportional design features into tool dashboards.

Covid-19 Impact

The pandemic accelerated remote work adoption and highlighted the need for cloud-based EDA environments. Vendors rapidly enhanced secure remote-access capabilities and expanded cloud partnerships (AWS, Azure, Google Cloud). Design centers invested in virtual collaboration platforms, ensuring uninterrupted chip development despite global lockdowns.

Key Industry Developments

-

Synopsys AI Acquisitions: Integration of AI-synthesis startup OptimoRoute to bolster AI-based design flows.

-

Cadence Cloud Launches: Expansion of Cadence Cloud for real-time collaboration and on-demand compute.

-

Siemens-AMD Alliance: Collaboration on system-level emulation platforms for heterogeneous compute.

-

Open-Source Momentum: Growth of projects like OpenROAD and Yosys for academic and SMB use cases.

Analyst Suggestions

-

Adopt Hybrid Models: Combine on-premises licensing with cloud bursts to optimize cost and productivity.

-

Invest in Training: Develop continuous learning programs to upskill engineers on AI-driven and system-level EDA tools.

-

Forge Strategic Alliances: Partner with IP, foundry, and cloud providers to deliver turnkey, differentiated flows.

-

Explore Open-Source Integration: Leverage open formats and tools for non-critical workloads to reduce costs.

Future Outlook

The EDA tools market will continue evolving toward fully autonomous, AI-optimized design flows that abstract complexity from engineers. As chip heterogeneity and system integration intensify, EDA platforms will converge hardware and software design, offering unified environments from high-level architecture to sign-off. Cloud-native and subscription-based delivery models will democratize access, fueling innovation among startups and academic labs. Ultimately, the fusion of AI, cloud scalability, and open interoperability will redefine how electronic systems are conceived, verified, and brought to market.

Conclusion

EDA tools underpin every modern semiconductor product, enabling the complex, high-performance, and energy-efficient designs that drive today’s digital economy. Facing mounting design challenges—from extreme transistor scaling to system-level validation—EDA vendors and users must embrace AI, cloud, and collaborative ecosystems to maintain pace. Stakeholders who invest in integrated, automated, and scalable EDA platforms will secure the agility and quality needed for first-time success and sustained competitive advantage in the fast-moving world of electronics design.